TIDMFUTR

RNS Number : 3552Y

Future PLC

21 August 2018

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY IN, INTO OR FROM THE UNITED STATES OF

AMERICA, AUSTRALIA, CANADA, JAPAN, SOUTH AFRICA OR ANY JURISDICTION

WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF

SUCH JURISDICTION

THIS ANNOUNCEMENT IS AN ADVERTISEMENT AND NOT A PROSPECTUS AND

THIS ANNOUNCEMENT DOES NOT CONSTITUTE OR FORM PART OF, AND SHOULD

NOT BE CONSTRUED AS, ANY OFFER, INVITATION OR RECOMMATION TO

PURCHASE, SELL OR SUBSCRIBE FOR ANY SECURITIES IN ANY JURISDICTION.

NOTHING IN THIS ANNOUNCEMENT SHOULD BE INTERPRETED AS A TERM OR

CONDITION OF THE RIGHTS ISSUE AND NEITHER THE ISSUE OF THE

INFORMATION NOR ANYTHING CONTAINED HEREIN SHALL FORM THE BASIS OF

OR BE RELIED UPON IN CONNECTION WITH, OR ACT AS AN INDUCEMENT TO

ENTER INTO, ANY INVESTMENT ACTIVITY. ANY DECISION TO PURCHASE,

SUBSCRIBE FOR, OTHERWISE ACQUIRE, SELL OR OTHERWISE DISPOSE OF ANY

SECURITIES MUST BE MADE ONLY ON THE BASIS OF THE INFORMATION

CONTAINED IN AND INCORPORATED BY REFERENCE INTO THE PROSPECTUS.

COPIES OF THE PROSPECTUS ARE AVAILABLE FOR INSPECTION ON THE

COMPANY'S WESBITE AT WWW.FUTUREPLC.COM/INVEST-IN-FUTURE/, AND AT

THE COMPANY'S REGISTERED OFFICE AT QUAY HOUSE, THE AMBURY, BATH BA1

1UA

PLEASE SEE THE IMPORTANT NOTICE AT THE OF THIS ANNOUNCEMENT

21 August 2018

Future plc

Results of Rights Issue

Future plc ("Future" or the "Company") today announces that the

3 for 4 Rights Issue at 303 pence per New Ordinary Share announced

on 18 July 2018 closed for acceptances at 11.00 a.m. (London time)

on 20 August 2018. The Company received valid acceptances in

respect of 31,809,864 New Ordinary Shares, representing

approximately 91.2 per cent of the total number of New Ordinary

Shares offered to Qualifying Shareholders pursuant to the fully

underwritten Rights Issue.

It is expected that the New Ordinary Shares will commence

trading, fully paid, on the London Stock Exchange's main market for

listed securities at 8.00 a.m. today, 21 August 2018.

It is also expected that the New Ordinary Shares in

uncertificated form will be credited to CREST accounts as soon as

practicable after 8.00 a.m. on 21 August 2018 and that definitive

share certificates in respect of the New Ordinary Shares in

certificated form will be despatched to Qualifying Shareholders by

no later than 28 August 2018.

In accordance with their obligations under the Underwriting

Agreement, Numis Securities Limited ("Numis") and Nplus1 Singer

Capital Markets Limited ("N+1 Singer") will use reasonable

endeavours to procure, by no later than 5.00 p.m. on 23 August

2018, subscribers for the remaining 3,070,908 New Ordinary Shares

not taken up in the Rights Issue, failing which Numis and N+1

Singer have agreed to subscribe, on a several basis, for any

remaining New Ordinary Shares.

The net proceeds from the placing of such New Ordinary Shares

(after the deduction of the Issue Price of 303 pence per New

Ordinary Share and the expenses of procuring subscribers including

any applicable brokerage and commissions and amounts in respect of

VAT), if any, will be paid (without interest) to Qualifying

Shareholders that have not taken up their entitlements pro rata to

their lapsed provisional allotments, save that individual amounts

of less than GBP5.00 will not be paid to such persons, but will be

paid to the Company. Cheques and credits to CREST accounts in

respect of any amounts payable to Qualifying Shareholders are

expected to be despatched by no later than 28 August 2018.

A further announcement as to the number of New Ordinary Shares

for which subscribers have been procured will be made in due

course.

Except where the context requires otherwise, defined terms

herein shall have the meanings given to them in the Prospectus

published by the Company on 18 July 2018.

Enquiries:

Future plc via Instinctif

Partners

Zillah Byng-Thorne, Chief Executive Officer

Penny Ladkin-Brand, Chief Financial Officer

Dom Del Mar, Investor Relations

Numis Securities Limited (Financial Adviser, Joint

Bookrunner

and Joint Broker to Future) 020 7260 1000

Nick Westlake, Mark Lander, Hugo Rubinstein, Toby

Adcock

Nplus1 Singer Capital Markets Limited (Joint Bookrunner

and Joint Broker to Future) 020 7496 3000

Mark Taylor, James White

Instinctif Partners 020 7457 2077

Kay Larsen, Chris Birt

IMPORTANT NOTICE

The contents of this announcement have been prepared by and are

the sole responsibility of Future plc.

This announcement is not a prospectus but an advertisement and

investors should not acquire any Nil Paid Rights, Fully Paid Rights

or New Ordinary Shares referred to in this announcement except on

the basis of the information contained in the Prospectus. The

information contained in this announcement is for background

purposes only and does not purport to be full or complete. No

reliance may be placed by any person for any purpose on the

information contained in this announcement or its accuracy,

fairness or completeness. The information in this announcement is

subject to change.

A copy of the Prospectus is available from the registered office

of Future plc and on Future plc's website at

www.futureplc.com/invest-in-future/ provided that the Prospectus is

not, subject to certain exceptions, available to Shareholders in

certain excluded jurisdictions. Neither the content of Future plc's

website nor any website accessible by hyperlinks on Future plc's

website is incorporated in, or forms part of, this

announcement.

This announcement is not for publication or distribution,

directly or indirectly, in or into the United States. The

distribution of this announcement may be restricted by law in

certain jurisdictions and persons into whose possession any

announcement, or other information referred to herein, comes should

inform themselves about and observe any such restriction. Any

failure to comply with these restrictions may constitute a

violation of the securities laws of any such jurisdiction. In

particular, subject to certain exceptions, this announcement, the

Prospectus and the Provisional Allotment Letter should not be

distributed, forwarded to or transmitted in or into the United

States or any of the other Excluded Territories.

This announcement does not contain or constitute an offer of, or

the solicitation of an offer to buy, securities to any person in

the United States, Australia, Canada, Japan or South Africa or in

any jurisdiction to whom or in which such offer or solicitation is

unlawful. The Nil Paid Rights, the Fully Paid Rights and the New

Ordinary Shares have not been and will not be registered under the

US Securities Act of 1933, as amended (the "Securities Act") or

under any securities laws of any state or other jurisdiction of the

United States, and may not be offered, sold, taken up, exercised,

resold, renounced, or otherwise transferred, directly or

indirectly, in or into the United States except pursuant to an

exemption from, or in a transaction not subject to, the

registration requirements of the Securities Act and in compliance

with any applicable securities laws of any state or other

jurisdiction of the United States. There will be no public offering

of the Provisional Allotment Letters, the Nil Paid Rights, the

Fully Paid Rights or the New Ordinary Shares in the United

States.

The offer and sale of the Nil Paid Rights, the Fully Paid Rights

and the New Ordinary Shares have not been and will not be

registered under the applicable securities laws of Australia,

Canada, Japan or South Africa. Subject to certain exceptions, the

Nil Paid Rights, the Fully Paid Rights and the New Ordinary Shares

may not be offered or sold in Australia, Canada, Japan or South

Africa or to, or for the account or benefit of, any national,

resident or citizen of Australia, Canada, Japan or South Africa.

There will be no public offer of the Provisional Allotment Letters,

the Nil Paid Rights, the Fully Paid Rights or the New Ordinary

Shares in Australia, Canada, Japan or South Africa.

Recipients of this announcement and/or the Prospectus should

conduct their own investigation, evaluation and analysis of the

business, data and information described in this announcement

and/or the Prospectus. This announcement does not constitute a

recommendation concerning the Rights Issue. The price and value of

securities can go down as well as up. Past performance is not a

guide to future performance. The contents of this announcement are

not to be construed as legal, business, financial or tax advice.

Each Shareholder or prospective investor should consult his, her or

its own legal adviser, business adviser, financial adviser or tax

adviser for legal, financial, business or tax advice.

Numis Securities Limited ("Numis") and Nplus1 Singer Capital

Markets Limited ("N+1 Singer") are each authorised and regulated in

the United Kingdom by the FCA and are acting exclusively for the

Company and no one else in relation with the Rights Issue (whether

or not a recipient of this announcement) and will not regard any

other person as a client in relation to the Rights Issue and will

not be responsible to anyone other than the Company for providing

the protections afforded to their respective clients, nor for

providing advice in connection with the Rights Issue or any other

matter, transaction or arrangement referred to in this

announcement.

Apart from the responsibilities and liabilities, if any, which

may be imposed on Numis and N+1 Singer under FSMA or the regulatory

regime established thereunder, none of Numis, N+1 Singer or any of

their respective affiliates, directors, officers, employees, agents

or advisers accepts any responsibility or liability whatsoever for,

or makes any representation or warranty, express or implied, as to,

the contents of this announcement, including its accuracy,

fairness, sufficiency, completeness or verification, or for any

other statement made or purported to be made by it, or on its

behalf, in connection with the Company, the Acquisition or the

Rights Issue, whether written, oral or in a visual or electronic

form, and howsoever transmitted or made available, and nothing in

this announcement is, or shall be relied upon as, a promise or

representation in this respect, whether as to the past or future.

Each of Numis, N+1 Singer and their respective affiliates,

directors, officers, employees, agents and advisers accordingly

disclaims to the fullest extent permitted by law all and any

responsibility and liability whether arising in tort, contract or

otherwise (save as referred to above) which it might otherwise have

in respect of this announcement or any such statement.

Numis, N+1 Singer and any of their respective affiliates may,

acting as investors for their own account, in accordance with

applicable legal and regulatory provisions, engage in transactions

in relation to the Nil Paid Rights, the Fully Paid Rights, the New

Ordinary Shares and/or related instruments for the purpose of

hedging their underwriting exposure or otherwise. Accordingly,

references in the Prospectus to Nil Paid Rights, Fully Paid Rights

and New Ordinary Shares being issued, offered, subscribed, placed

or otherwise dealt in, should be read as including any issue or

offer to, or subscription, placing or dealing by, either of Numis

or N+1 Singer or any of their respective affiliates acting in such

capacity. In addition, either of Numis or N+1 Singer or their

affiliates may enter into financing arrangements (including swaps

or contracts for differences) with investors in connection with

which Numis or N+1 Singer (or its affiliates) may from time to time

acquire, hold or dispose New Ordinary Shares. Except as required by

applicable law or regulation, the Numis and N+1 Singer do not

propose to make any public disclosure in relation to such

transactions.

Information to Distributors

Solely for the purposes of the product governance requirements

contained within: (a) EU Directive 2014/65/EU on markets in

financial instruments, as amended ("MiFID II"); (b) Articles 9 and

10 of Commission Delegated Directive (EU) 2017/593 supplementing

MiFID II; and (c) local implementing measures (together, the "MiFID

II Product Governance Requirements"), and disclaiming all and any

liability, whether arising in tort, contract or otherwise, which

any "manufacturer" (for the purposes of the Product Governance

Requirements) may otherwise have with respect thereto, the Nil Paid

Rights, the Fully Paid Rights and the New Ordinary Shares have been

subject to a product approval process, which has determined that

the Nil Paid Rights, the Fully Paid Rights and the New Ordinary

Shares are: (i) compatible with an end target market of retail

investors and investors who meet the criteria of professional

clients and eligible counterparties, each as defined in MiFID II;

and (ii) eligible for distribution through all distribution

channels as are permitted by MiFID II (the "Target Market

Assessment"). Notwithstanding the Target Market Assessment,

Distributors should note that: the price of the Nil Paid Rights,

the Fully Paid Rights and the New Ordinary Shares may decline and

investors could lose all or part of their investment; the Nil Paid

Rights, the Fully Paid Rights and the New Ordinary Shares offer no

guaranteed income and no capital protection; and an investment in

the Nil Paid Rights, the Fully Paid Rights and the New Ordinary

Shares is compatible only with investors who do not need a

guaranteed income or capital protection, who (either alone or in

conjunction with an appropriate financial or other adviser) are

capable of evaluating the merits and risks of such an investment

and who have sufficient resources to be able to bear any losses

that may result therefrom. The Target Market Assessment is without

prejudice to the requirements of any contractual, legal or

regulatory selling restrictions in relation to the Rights Issue.

Furthermore, it is noted that, notwithstanding the Target Market

Assessment, Numis and N+1 Singer will only procure investors who

meet the criteria of professional clients and eligible

counterparties.

For the avoidance of doubt, the Target Market Assessment does

not constitute: (a) an assessment of suitability or appropriateness

for the purposes of MiFID II; or (b) a recommendation to any

investor or group of investors to invest in, or purchase, or take

any other action whatsoever with respect to the Nil Paid Rights,

the Fully Paid Rights and the New Ordinary Shares.

Each distributor is responsible for undertaking its own target

market assessment in respect of the Nil Paid Rights, the Fully Paid

Rights and the New Ordinary Shares and determining appropriate

distribution channels.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ROIDBLFLVVFZBBZ

(END) Dow Jones Newswires

August 21, 2018 02:00 ET (06:00 GMT)

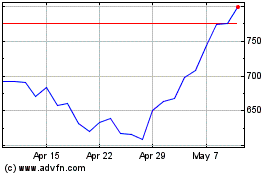

Future (LSE:FUTR)

Historical Stock Chart

From Jan 2025 to Feb 2025

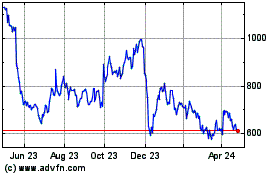

Future (LSE:FUTR)

Historical Stock Chart

From Feb 2024 to Feb 2025