Open Letter to Shareholders RE: Tender Offer

November 04 2008 - 1:00AM

UK Regulatory

RNS Number : 3485H

Tanzanite One Limited

04 November 2008

TanzaniteOne Limited

Clarendon House

2 Church Street

Hamilton

HM 11

Bermuda

LETTER FROM CHAIRMAN

4 November 2008

Dear Shareholder,

TanzaniteOne Limited ("TanzaniteOne" or the "Company")

As you are aware, there have been considerable developments in relation to your Company in recent weeks. Since the announcement by

Gemfields Resources plc ("Gemfields") on 12 September 2008 that it was considering an offer for TanzaniteOne, Gemfields has made a series of

statements to the markets that seek to undermine the position of your Company. The Board believes that Shareholders should be aware of the

facts surrounding these statements so as to enable them to understand fully the actions taken by the Board to protect the interests of all

Shareholders.

The announcement by Gemfields on 12 September contemplated a possible offer in cash or in shares for the entire issued share capital of

the Company and which valued TanzaniteOne shares at 45 pence each. However, no formal offer was made.

Instead, Gemfields announced on 21 October a Tender Offer to purchase up to 30,754,970 TanzaniteOne shares for 42.75 pence in cash on a

"first-come, first-served" basis. Together with shares held by Gemfields and its associates, full acceptance of the Tender Offer would have

resulted in Gemfields being interested in shares representing approximately 57 per cent. of the issued share capital of the Company (or 52

per cent. of the share capital of the Company following the proposed issue of Common Shares in connection with the acquisition of the

tsavorite projects, which was announced on 22 October 2007 but which, contrary to statements made by Gemfields, have not yet been issued).

The Tender Offer is an attempt to take control of TanzaniteOne without making an offer to all Shareholders. Moreover, no commitments or

undertakings have been offered by Gemfields in relation to the ongoing governance of the Company, despite the fact that the Tender Offer

related only to a minority of the shares not already owned by Gemfields or its associates.

In these circumstances, the Board felt it appropriate to announce on 25 October 2008 the issue of 83,739,976 nil paid unlisted B Shares

to a wholly owned subsidiary of the Company in order to protect the position of all Shareholders. The Board has made the following

commitments to Shareholders in relation to the B Share issue:

* The B Shares, which carry voting rights but have no economic rights, will convert into deferred non-voting shares within 6 months

from the date of issue;

* The Board intends to introduce appropriate takeover protections into its Bye-laws as soon as practicable, subject to Shareholder

approval in the normal course; and

* The Board will continue to consider on its merits any proposal from Gemfields or a third party that treats all Shareholders

equally.

The B Share issue is designed to ensure that Gemfields is not able to take control of your Company unless it makes an appropriate offer

to all Shareholders. The Board has taken legal advice, on behalf of the Company, in connection with the B Share issue and, as a result, is

satisfied that the issue was valid and was carried out for a proper purpose, being to preserve equality of treatment for Shareholders as a

whole. This cannot be said to be in violation of the principles of good corporate governance, since its purpose is to benefit Shareholders

as a whole. This contrasts with Gemfields' Tender Offer which (if concluded) will prejudice the interests of the minority. The Board is also

satisfied that, as announced on 29 October 2008, the issue of the B Shares does not contravene the Exchange Control Regulations of South

Africa.

In addition, the Board considers that the conditions attaching to the Tender Offer are unclear. The Tender Offer released on 21 October

2008 prescribed that the offer would close on Gemfields receiving acceptances for 30,754,970 Tanzanite One shares. On 28 October 2008,

Gemfields released an open letter to TanzaniteOne Shareholders disclosing that acceptances had been received for 36,203,219 TanzaniteOne

shares. Gemfields also announced that the Tender Offer was conditional upon acceptances of 50.1% of the enlarged share capital. The Board

does not consider the minimum acceptance requirement under the Tender Offer, and in what circumstances it will become unconditional, to be

clear. Moreover, as a "first-come, first-served" proposal the Tender Offer is presumably no longer available to Shareholders who have not

already accepted.

Your Board has concerns about the conduct of Gemfields in relation to the events described above. It is also concerned about the

underlying value of Gemfields itself, particularly in current difficult markets. This is relevant because if the Tender Offer is concluded,

TanzaniteOne will become a subsidiary of Gemfields whose profits may be required to support Gemfields' wider business operations instead of

being reinvested in the TanzaniteOne business or distributed to Shareholders. Shareholders should therefore take careful note of the

following considerations:

* Financial Performance: Gemfields is a loss making business that has not reported a profit or paid a dividend since its listing on

AIM in 2005. In Gemfields' 2008 re-admission document Gemfields stated the intention not to commence payment of dividends in the immediate

future;

* Share Price Performance: The Gemfields share price has fallen by one third since the announcement of its possible offer on 12

September 2008;

* Corporate Strategy: Gemfields strategy of seeking to manage the entire supply chain from extraction to polishing and distribution

involves Gemfields in multiple disciplines. TanzaniteOne has had direct experience of this strategy and does not endorse a return to it;

* Commercial Strategy: Gemfields' worldwide and exclusive 15 year licence to use the Faberge brand name in respect of coloured

gemstones is granted by Faberge Limited, also a Pallinghurst portfolio company. The license agreement requires Gemfields to pay Faberge a

royalty on a sliding scale of sales. In the event that such a royalty agreement is extended to TanzaniteOne, it could have a material impact

on the Company's profitability; and

* Shareholding Structure: Gemfields, through Rox Limited's 61 per cent. holding, is a company controlled by Pallinghurst Resources,

an investment holding company with a look through interest in Gemfields of approximately 28 per cent.

In contrast to Gemfields, the Company has consistently delivered profits since its listing on AIM in 2004, which has enabled the Company

to pursue an increasing dividend policy over the same period. In addition, the Company's strategy to continue to improve its mining methods

is delivering tangible results, as evidenced by the recent production record of 1.8 million carats for the nine months ended September 2008.

This growth will be complemented by the completion of the tsavorite transaction, which was announced on 22 October 2007.

As mentioned above, it is the intention of the Board to issue new Common Shares once the tsavorite transaction is completed. It is

anticipated that the transaction will complete shortly and Shareholders will be updated following any further developments.

The Board continues to recommend Shareholders take no action in relation to the Tender Offer.

Yours sincerely,

Ami Mpungwe

For more information, please visit www.tanzaniteone.com or contact:

Willi Boehm, Company Secretary Alex Buck, Public Relations

+61 8 9367 5211 +44 (0)7932 740 452

Nick Bias, Investor Relations Laurence Read, Public Relations

+44 (0)7887 920 530 +44 (0)7979 955923

Nominated Advisor and Joint Broker Joint Broker

Evolution Securities Ambrian Partners

Simon Edwards or Neil Elliot Richard Chase

+44 (0)20 7071 4300 +44 (0)20 7634 4700

Financial Adviser

Lazard & Co

Spiro Youakim or Chris Seherr-Thoss

+44 (0)20 7187 2000

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCUOSWRWKRARAA

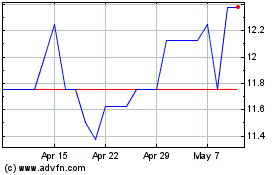

Gemfields (LSE:GEM)

Historical Stock Chart

From Jan 2025 to Feb 2025

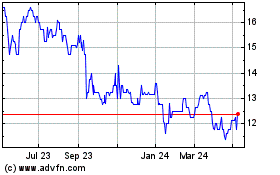

Gemfields (LSE:GEM)

Historical Stock Chart

From Feb 2024 to Feb 2025