Genel Energy PLC Report on payments to governments (4783D)

April 27 2017 - 4:00AM

UK Regulatory

TIDMGENL

RNS Number : 4783D

Genel Energy PLC

27 April 2017

Report on payments to governments for the year 2016

Introduction and basis for preparation

This report sets out details of the payments made to governments

by Genel Energy plc and its subsidiary undertakings ('Genel') for

the year ended 31 December 2016 as required under the Disclosure

and Transparency Rules of the UK Financial Conduct Authority (the

'DTRs') and in accordance with our interpretation of the draft

Industry Guidance issued for the UK's Report on Payments to

Governments Regulations 2014, as amended in December 2015 ('the

Regulations'). The DTRs require companies in the UK and operating

in the extractives sector to publically disclose payments made to

governments in the countries where they undertake exploration,

prospection, development and extraction of oil and natural gas

deposits or other materials.

This report is available to download at

www.genelenergy.com/investor-relations/results-reports-presentations.

Governments

All of the payments made in relation to licences in the

Kurdistan Region of Iraq ('KRI') have been made to the Ministry of

Natural Resources of the Kurdistan Regional Government ('KRG'). All

other payments have been made to the national governments of the

relevant country where the licence is based.

Production entitlements

Production entitlements are the host government's share of

production during the reporting period from projects operated by

Genel. Production entitlements from projects that are not operated

by Genel are not covered by this report. The figures reported have

been produced on an entitlement basis rather than on a liftings

basis. Production entitlements are paid in-kind and the monetary

value disclosed is derived from management's calculation of revenue

from the field.

Royalties

Royalties represent royalties paid in-kind to governments during

the year for the extraction of oil. The terms of the Royalties are

described within our Production Sharing Contracts and can vary from

project to project. Royalties have been calculated on the same

barrels of oil equivalent basis as production entitlements.

Licence fees

These are fees and other sums paid as consideration for

acquiring a licence for gaining access to an area where extractives

are performed.

Materiality threshold

Total payments below GBP86,000 made to a government are excluded

from this report as permitted under the Regulations.

payments to governments - 2016

Kurdistan

Total Taq Taq Tawke Morocco Mir Somaliland

Country/Licence (1) (2) (3) Total Left Total Odewayne SL-10B/SL-13

------------------ -------------- -------------- ------- -------- ------ ----------- --------- -------------

Payments in bbls

-------------------------------------------------------------------------------------------------------------------

Production

entitlement

(bbls) 13,799,444.39 13,799,444.39 - - - - -

------------------ -------------- -------------- ------- -------- ------ ----------- --------- -------------

Royalties in kind

(bbls) 2,201,957.06 2,201,957.06 - - - - -

------------------ -------------- -------------- ------- -------- ------ ----------- --------- -------------

Total (bbls) 16,001,401.45 16,001,401.45 - - - - -

------------------ -------------- -------------- ------- -------- ------ ----------- --------- -------------

*Estimated value in $millions (this amount is not paid to the

KRG, and is calculated to meet the reporting requirements under

the Regulations)

-------------------------------------------------------------------------------------------------------------------

Value of

production

entitlements

($million) 522.94* 522.94 - - - - -

------------------ -------------- -------------- ------- -------- ------ ----------- --------- -------------

Value of

royalties

($million) 83.17 83.17 - - - - -

------------------ -------------- -------------- ------- -------- ------ ----------- --------- -------------

Licence fees

($million) - - 0.15 0.15 0.49 0.15 0.34

------------------ -------------- -------------- ------- -------- ------ ----------- --------- -------------

Capacity building

payments(4) 24.5 13.6 10.9

------------------ -------------- -------------- ------- -------- ------ ----------- --------- -------------

Total ($million) 630.61 619.71 10.9 0.15 0.15 0.49 0.15 0.34

------------------ -------------- -------------- ------- -------- ------ ----------- --------- -------------

(1) Under the lifting arrangements implemented by the KRG, the

KRG takes title to crude at the wellhead and then transports it to

Ceyhan in Turkey by pipeline. The crude is then sold by the KRG

into the international market. All proceeds of sale are received by

or on behalf of the KRG, out of which the KRG then makes payment

for cost and profit oil in accordance with the PSC to Genel, in

exchange for the crude delivered to the KRG. Under these

arrangements, payments are in fact made by or on behalf of the KRG

to Genel, rather than by Genel to the KRG. For the purposes of the

reporting requirements under the Regulations however, we are

required to characterise the value of the KRG's entitlement under

the PSC (for which they receive payment directly from the market)

as a payment made to the KRG.

(2) The amount reported for Taq Taq, with the exception of

Capacity Building Payments, is the gross payment made to the KRI by

the operating company (TTOPCO), Genel's share of these payments is

equal to 55%.

(3) Payments in relation to Tawke are made by the Operator with

the exception of capacity building payments which are made directly

by Genel in relation to our interest in the Tawke Production

Sharing Contract.

(4) Capacity building payments reported are payments made by

Genel directly to the KRI in cash as required by the Production

Sharing Contract.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCEAFLKAANXEAF

(END) Dow Jones Newswires

April 27, 2017 05:00 ET (09:00 GMT)

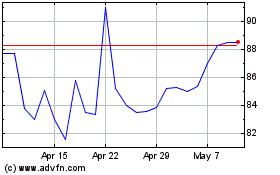

Genel Energy (LSE:GENL)

Historical Stock Chart

From Jan 2025 to Feb 2025

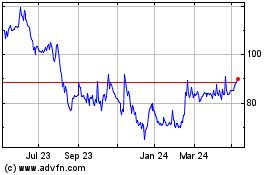

Genel Energy (LSE:GENL)

Historical Stock Chart

From Feb 2024 to Feb 2025