TIDMGENL

RNS Number : 0056U

Genel Energy PLC

19 October 2017

19 October 2017

Genel Energy plc

Trading and operations update

Genel Energy plc ('Genel' or 'the Company') issues the following

trading and operations update in respect of Q3 2017. The

information contained herein has not been audited and may be

subject to further review.

Murat Özgül, Chief Executive of Genel, said:

"During the quarter Genel executed a landmark settlement

agreement with the KRG over historical receivables, which we expect

to materially enhance our cash flows going forward. Ahead of those

payments commencing we continued to generate meaningful free cash

flow, resulting in a further 13% reduction in net debt during the

period.

Our operations in the Kurdistan Region of Iraq are progressing

as normal - exports are continuing from Taq Taq and Tawke, payments

are being received on time, and operations are proceeding at both

fields, with testing now underway on the TT-29w well."

Q3 2017 OPERATING PERFORMANCE

-- Q3 2017 net production averaged 33,810 bopd, with production

for the nine months ending September 2017 averaging 36,030 bopd

-- Production and sales by field during Q3 2017 were as follows:

(bopd) Export Domestic Refinery Total Total Genel

via sales sales sales production net production

pipeline

--------- ---------- --------- --------- -------- ------------ ----------------

Taq Taq 13,230 - 950 14,180 14,080 6,200

--------- ---------- --------- --------- -------- ------------ ----------------

Tawke

PSC 109,760 - 30 109,790 110,460 27,610

========= ========== ========= ========= ======== ============ ================

Total 122,990 - 980 123,970 124,540 33,810

Note: Difference between production and sales relates to

inventory movements at both fields

-- Tawke PSC (Genel 25% working interest)

o Tawke PSC production in Q3 averaged 110,460 bopd, including

long-term test production from the Peshkabir-2 well of 4,670

bopd.

o In 2017 to date, the Tawke partners have drilled ten wells,

including the Peshkabir-2 and 3 wells, four Cretaceous producers,

three Jeribe producers and a Jeribe water injector

o A further four development wells are planned on the Tawke PSC

by year-end 2017 - two Cretaceous producers, one Jeribe producer

and a Jeribe water disposal well

o Peshkabir-3 well operations are ongoing, with results expected

later in Q4. The Peshkabir early production facility remains on

track to be installed by the end of 2017

-- Taq Taq PSC (Genel 44% working interest)

o Taq Taq field production in Q3 averaged 14,080 bopd, and

production has averaged 13,570 bopd during October 2017 to date

o The TT-29w well, which is appraising the northern end of the

Taq Taq field, reached target depth of 3,100 metres in early

September 2017. A testing programme is now underway. Further

development of the Cretaceous reservoir has been deferred pending

results of the TT-29w testing programme

o The EDC-24 rig has moved to the TT-30 well location, with two

shallow horizontal wells set to be drilled in the Pilaspi reservoir

before the end of the year

FINANCIAL PERFORMANCE AND GUIDANCE

-- $191 million of total cash proceeds were received in the nine

months ending September 2017, of which $52 million was received in

Q3

o Post-period, payments have been received for July sales from

Tawke and Taq Taq and the first Tawke override payment under the

Receivable Settlement Agreement ('RSA') for August 2017, totalling

$22.6 million net to Genel

-- Positive free cash flow generation continued in the third

quarter, leading to a further reduction in net debt. Unrestricted

cash balances at 30 September 2017 stood at $268 million ($246

million at 30 June 2017). IFRS net debt at 30 September 2017 stood

at $138 million ($158 million at 30 June 2017), a reduction of 13%

in the quarter and 43% on the end 2016 figure of $241 million

-- The RSA, effective 1 August 2017, resulted in the Company

cancelling and waiving its rights to outstanding receivables,

principally in return for enhanced future cash flows from the Tawke

PSC

o The August 2017 Genel Tawke override invoice was submitted in

September, with $6.0 million being received on 16 October

o The September 2017 Genel Tawke override invoice, totalling

$6.4 million, was submitted in October with payment due in

November

o The elimination of Tawke CBP in the RSA is expected to

positively impact August and September 2017 net proceeds for Tawke

current sales by $5 million, with the corresponding cash flow

impact due in Q4 2017

-- Capital expenditure for Q3 2017 totalled $27 million, with

the majority of spend on the development programmes at Taq Taq and

Tawke. Capex for the nine months ending 30 September 2017 totalled

$68 million, including spend on the KRI gas assets and Somaliland

seismic acquisition

-- 2017 guidance remains unchanged:

o Capex:

- Tawke and Taq Taq net to Genel $60-75 million

- KRI gas business capex of $10-15 million

- Somaliland 2D seismic capex budget expected at c.$15 million

o Opex: $30-35 million

o G&A: income statement $20-25 million and cash cost $15-20

million

KRI GAS BUSINESS

-- During the period the Company continued its efforts to

maximise the value of its KRI gas assets, which included

negotiations with potential farm-in partners for the upstream

development of the Miran and Bina Bawi gas fields

-- The prospect of enhanced future cash flows under the RSA has

created an opportunity for further appraisal and development

activity at the Miran and Bina Bawi fields, which may include an

extended well test and 3D seismic on Bina Bawi, and early

development of the Miran oil resource. The Company believes this

activity, which has yet to be finalised and is dependent on a

number of factors including continuity of payments, can be

implemented while maintaining financial flexibility and a strong

balance sheet, and will deliver the best possible shareholder value

and backdrop for the farm-out process

-- The updated competent person's reports for Miran and Bina

Bawi are on track to complete by the end of 2017. During Q3, it was

announced that the KRG had negotiated Rosneft's participation in

the funding of the construction of the KRI natural gas pipeline

infrastructure

AFRICA EXPLORATION UPDATE

-- Onshore Somaliland, the acquisition of 2D seismic data on the

SL-10B/13 (Genel 75%, operator) and Odewayne (Genel 50%, operator)

blocks continues, with over 2,000 km obtained to date. Initial

results have offered sufficient encouragement for a number of high

graded areas to be targeted with infill 2D seismic acquisition.

Processing of the data, commencing Q4 2017 and continuing into

2018, will facilitate seismic interpretation and the associated

development of an inventory of drillable prospects

-- The Company is in the final stages of discussions with the

Moroccan government over the nature, scope and timing of the

activity related to the remaining exploration commitment on the

Sidi Moussa offshore licensed acreage

-ends-

For further information, please contact:

Genel Energy

Phil Corbett, Head of Investor

Relations

Andrew Benbow, Head of Public

Relations +44 20 7659 5100

Vigo Communications

Patrick d'Ancona +44 20 7830 9700

This announcement includes inside information.

Notes to editors:

Genel Energy is an independent oil and gas exploration and

production company listed on the main market of the London Stock

Exchange (LSE: GENL, LEI: 549300IVCJDWC3LR8F94). The Company, with

headquarters in London and offices in Ankara and Erbil, is one of

the largest London-listed independent oil producers, and is the

largest holder of reserves and resources in the Kurdistan Region of

Iraq. Through its Miran and Bina Bawi gas fields, the Company is

positioned to be a cornerstone provider of KRI gas to Turkey under

the KRI-Turkey Gas Sales Agreement. Genel also continues to pursue

further growth opportunities within the Middle East and Africa. For

further information, please refer to www.genelenergy.com.

Disclaimer

This announcement contains certain forward-looking statements

that are subject to the usual risk factors and uncertainties

associated with the oil & gas exploration and production

business. Whilst the Company believes the expectations reflected

herein to be reasonable in light of the information available to

them at this time, the actual outcome may be materially different

owing to factors beyond the Company's control or within the

Company's control where, for example, the Company decides on a

change of plan or strategy. Accordingly no reliance may be placed

on the figures contained in such forward looking statements.

This information is provided by RNS

The company news service from the London Stock Exchange

END

DRLQVLFFDBFLFBL

(END) Dow Jones Newswires

October 19, 2017 02:00 ET (06:00 GMT)

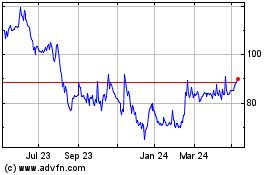

Genel Energy (LSE:GENL)

Historical Stock Chart

From Dec 2024 to Jan 2025

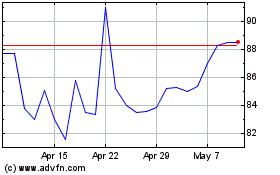

Genel Energy (LSE:GENL)

Historical Stock Chart

From Jan 2024 to Jan 2025