TIDMGPL

RNS Number : 6947X

Graft Polymer (UK) PLC

22 December 2023

THIS ANNOUNCEMENT AND THE INFORMATION HEREIN (THE

"ANNOUNCEMENT") IS RESTRICTED AND IS NOT FOR PUBLICATION, RELEASE,

TRANSMISSION, DISTRIBUTION OR FORWARDING DIRECTLY OR INDIRECTLY, IN

WHOLE OR IN PART, IN OR INTO THE UNITED STATES, AUSTRALIA, CANADA,

RUSSIA, THE REPUBLIC OF SOUTH AFRICA, JAPAN OR ANY OTHER

JURISDICTION IN WHICH SUCH PUBLICATION, TRANSMISSION, RELEASE,

DISTRIBUTION OR FORWARDING WOULD BE UNLAWFUL. THIS ANNOUNCEMENT

SHOULD BE READ IN ITS ENTIRETY. IN PARTICULAR, PERSONS RECEIVING

THIS ANNOUNCEMENT SHOULD READ AND UNDERSTAND THE INFORMATION

PROVIDED IN THE "IMPORTANT NOTICES" SECTION OF THIS

ANNOUNCEMENT.

FURTHER, THIS ANNOUNCEMENT IS MADE FOR INFORMATION PURPOSES ONLY

AND DOES NOT CONSTITUTE AN OFFER TO SELL OR ISSUE OR SOLICITATION

TO BUY, SUBSCRIBE FOR OR OTHERWISE ACQUIRE SHARES IN GRAFT POLYMER

(UK) PLC IN ANY JURISDICTION IN WHICH ANY SUCH OFFER OR

SOLICITATION WOULD BE UNLAWFUL.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF EU REGULATION 596/2014 AS IT FORMS PART OF DOMESTIC

LAW IN THE UNITED KINGDOM BY VIRTUE OF THE EUROPEAN UNION

(WITHDRAWAL) ACT 2018. UPON THE PUBLICATION OF THIS ANNOUNCEMENT

VIA A REGULATORY INFORMATION SERVICE, THIS INSIDE INFORMATION WILL

BE CONSIDERED TO BE IN THE PUBLIC DOMAIN.

22 December 2023

Graft Polymer (UK) Plc

(the "Company")

Placing of New Ordinary Shares

Graft Polymer Plc (LSE:GPL), the multi-sector specialist

chemical company offering modified and alloyed polymer and

bio-polymer solutions for refiners, compounders and processors,

today announces that it has conditionally placed 20,666,667 new

ordinary shares ("Ordinary Shares") of 0.1 pence each in the

capital of the Company ("New Ordinary Shares") (the "Placing

Shares") with a new cornerstone investor at a price of 0.6 pence

per Placing Share (the "Placing Price") ("Placing") in addition to

receiving conditional subscriptions for 51,916,667 New Ordinary

Shares at the Placing Price (" Subscription "), and agreements

being entered into for 10,750,000 existing Ordinary Shares of 0.1

pence each in the capital of the Company ("Existing Shares") to be

transferred by an existing shareholder at the Placing Price,

raising gross proceeds of GBP500,000 (together, the "Fundraising").

In addition, one warrant is being issued by the Company for every

two Placing Shares allotted, being in aggregate warrants over

10,333,333 Ordinary Shares, exercisable at 1 penny per Ordinary

Share for a period of two years ("Placing Warrants"). The Placing

Warrants will not be admitted to trading on London Stock Exchange

or any other stock exchange.

The net proceeds of the Fundraising will be used to fund the

Company's general working capital requirements. The Placing Price

represents a discount of 45 per cent. to the closing price of the

Ordinary Shares on 21 December 2023, being the trading day

immediately prior to the release of this announcement.

CMC Markets Plc ( " CMC ") acted as Bookrunner and placing agent

in connection with the Placing.

Commenting on the placing, Graft Polymer CEO / CTO Victor

Bolduev, said: "This placing follows a year where we have made

significant progress including the completion of our new commercial

production facility in June 2023 and momentum with new contracts

reflecting our competitive advantage based on strong innovation. We

now have core infrastructure in place with established industry

networks and the commitment of cornerstone investors. We look

forward to delivering the next stage of growth".

Appointment of CMC

CMC has been appointed as the Company's joint UK broker with

immediate effect. CMC is headquartered in London, with hubs in

Sydney and Singapore. CMC is listed on the London Stock Exchange

and was admitted to the FTSE 250 on 20 June 2016. Investors and

Brokers wishing to gain access to future CMC Markets transactions,

should register their interest at:

https://www.cmcmarkets.com/en-gb/capx .

Further Details of the Fundraising

The Placing is conditional on, inter alia, (i) the placing

agreement entered into between the Company and CMC becoming

unconditional in all respects in relation to the Placing and not

having been terminated in accordance with its terms; and (ii)

Admission (as defined below). The Placing Shares will be allotted

and issued under the Company's existing authorities obtained at the

Company's last annual general meeting held on 27 July 2023.

The Company will not be able to satisfy its obligations in full

under the Fundraising by the issue and admission to the Official

List (standard listing segment) of the London Stock Exchange's main

market for listed securities (" Official List ") of all the New

Ordinary Shares pursuant to the Fundraising without producing of an

FCA approved prospectus. The Company is proposing to issue and

admit 20,666,667 Placing Shares (available under the Company's

existing headroom under the UK Prospectus Regulation as at the date

of this announcement) on or around 4 January 2024

("Admission").

On the same date, Victor Bolduev, a Director and shareholder of

the Company, will transfer 10,750,000 Existing Shares held by him

to settle the Fundraising in a timely manner, and certain

individuals shall conditionally subscribe for 51,916,667 New

Ordinary Shares . Further detail in respect of the agreements being

entered into between (among others) the Company and Mr Bolduev is

set out below.

Share Purchase and Subscription Agreements

Mr Bolduev will transfer 10,750,000 Existing Shares pursuant to

the terms of a Share Purchase Agreement to be entered into between

Mr Bolduev and the transferees.

In addition, an aggregate of 51,916,667 New Ordinary Shares will

be issued to subscribers (which includes certain Directors of the

Company or their connected persons) ("Subscribers") pursuant to a

Subscription Agreement between the Company and the Subscribers as

soon as reasonably practicable subject to compliance by the Company

with the Companies Act 2006, UK Prospectus Regulation, the Listing

Rules and the Company's dealing policy. The Company undertakes to

make the necessary listing and admission hearing applications to

have those New Ordinary Shares admitted to trading at the

appropriate time.

The Company is undertaking a material related party transaction

with Victor Bolduev and his associates for the purpose of rule 7.3

of the FCA's Disclosure Guidance and Transparency Rules. Mr Bolduev

is a Director of the Company. Pursuant to the Subscription

Agreement, Mr Bolduev and his associates will pay to the Company

cash consideration (as defined in section 583 of the Companies Act

2006) of GBP153,175. Mr Bolduev and his associates will be issued,

in aggregate and subject to various conditions as set out in the

paragraph above, 25,529,117 Ordinary Shares at the Placing Price.

This material related party transaction has been approved by the

board of Directors of the Company. Mr Bolduev did not take part in

the board of Directors' consideration of the transaction with him

and his associates and he did not vote on the relevant board

decision.

On Admission, the Concert Party (as referred to in the Company's

prospectus published on 21 December 2021) shall hold Ordinary

Shares carrying 50.81 per cent. of the voting rights of the

Company.

S

For further information, visit www.graftpolymer.com , follow on

Twitter @PolymerLtd or contact:

Graft Polymer (UK) Plc

Roby Zomer, Non-Executive Chairman Via Flagstaff

Yifat Steuer, CFO and Executive Director

CMC Markets

Douglas Crippen Tel 02030038632

Flagstaff Strategic and Investor Communications Tel + 44 (0) 207

129 1474

Tim Thompson graftpolymer@flagstaffcomms.com

Mark Edwards

Alison Allfrey

Anna Probert

Placing Agreement and issue of warrants

The Company and CMC have entered into a Placing Agreement

pursuant to which CMC has agreed, subject to certain conditions, to

use its reasonable endeavours to procure subscribers for the

Placing Shares at the Placing Price. The Company has given

warranties and undertakings to CMC in relation to, inter alia, its

business and the performance of its duties. In addition, the

Company has agreed to indemnify CMC in relation to certain

liabilities that they may incur in undertaking the Placing. CMC has

the right to terminate the Placing Agreement in certain

circumstances prior to Admission (as defined below) and, in

particular, in the event that there has been, inter alia, a

material breach of any of the warranties. No part of the Placing is

being underwritten.

Under the terms of the Placing Agreement, CMC will receive a

commission relating to the Placing Shares and warrants to subscribe

for 1,500,000 New Ordinary Shares ("Broker Warrants"). The Broker

Warrants are exercisable at 0.6p for a period of two years from the

date of Admission (as defined below). The Broker Warrants will not

be admitted to trading on the LSE or any other stock exchange. The

issue of New Ordinary Shares upon exercise of the Placing Warrants

and the Broker Warrants will be conditional on compliance with all

applicable laws and regulations, including the UK Prospectus

Regulation.

Total voting rights

On Admission, the Company will have 124,763,966 ordinary shares

of 0.1p each in issue, each with one voting right. There are no

shares held in treasury. Therefore, the Company's total number of

ordinary shares in issue and voting rights will be 124,763,966 and

this figure may be used by shareholders from Admission as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change to their

interest in, the Company under the FCA's Disclosure Guidance and

Transparency Rules.

About Graft Polymer

Graft Polymer is a London Stock Exchange listed company (GPL)

with a cutting-edge research and development (R&D) and

manufacturing facility based in Slovenia which has already

introduced more than 50 products to the market. The core business

of the Group comprises polymer modification and drug delivery

system developments. The Group has developed a proprietary set of

polymer modification technologies, including using recycled raw

materials and a closed loop system to reduce waste. Graft Polymer's

technology can improve existing products and processing

methodologies by enhancing performance, simplifying manufacturing,

reducing material consumption, widening the choice of feedstocks,

and reducing costs.

Graft Polymer has three divisions: the first division focusses

on polymer modification; the second is GraftBio which develops IP

for Bio/Pharma applications (including a drug delivery system to

support and provide solutions to the market, which had been heavily

impacted by the COVID-19 pandemic); and the third is the Group's

food supplement division. A significant milestone was reached in

May 2022 when the Slovenian manufacturing facility was granted a

Hazard Analysis and Critical Control Point (HACCP) Certificate. The

HACCP Certificate allows it to enter the lucrative

Business-to-Consumer market and commercialise its IP for bio/pharma

applications, developing active pharmaceutical ingredients and drug

delivery platforms for use in the food supplement market, thereby

introducing a further revenue stream to its business.

ESG is at the forefront of the Group's strategy and the facility

in Slovenia has been granted ISO 14001 accreditation in recognition

of the environmental management systems in place to reduce waste.

Graft Polymer only uses REACH and ROHS certificated raw materials

instead of toxic raw materials, and its extensive R&D programme

has also developed specialised recycling polymer additives which

increases the strength of recycled blends and plastic products

whilst also reducing plastic waste by between 40 and 50 per

cent.

Forward Looking Statements

This announcement includes statements that are, or may be deemed

to be, "forward-looking statements". These forward-looking

statements can be identified by the use of forward-looking

terminology, including the terms "believes", "estimates", "plans",

"anticipates", "targets", "aims", "continues", "expects",

"intends", "hopes", "may", "will", "would", "could" or "should" or,

in each case, their negative or other variations or comparable

terminology. These forward-looking statements include matters that

are not facts. They appear in a number of places throughout this

announcement and include statements regarding the Directors'

beliefs or current expectations. By their nature, forward-looking

statements involve risk and uncertainty because they relate to

future events and circumstances. Investors should not place undue

reliance on forward-looking statements, which speak only as of the

date of this announcement.

Notice to overseas persons

This announcement does not constitute, or form part of, a

prospectus relating to the Company, nor does it constitute or

contain any invitation or offer to any person, or any public offer,

to subscribe for, purchase or otherwise acquire any shares in the

Company or advise persons to do so in any jurisdiction, nor shall

it, or any part of it form the basis of or be relied on in

connection with any contract or as an inducement to enter into any

contract or commitment with the Company.

This announcement is not for release, publication or

distribution, in whole or in part, directly or indirectly, in or

into Australia, Canada, Japan or the Republic of South Africa,

Russia or any jurisdiction into which the publication or

distribution would be unlawful. This announcement is for

information purposes only and does not constitute an offer to sell

or issue or the solicitation of an offer to buy or acquire shares

in the capital of the Company in Australia, Canada, Japan, New

Zealand, the Republic of South Africa, Russia or any jurisdiction

in which such offer or solicitation would be unlawful or require

preparation of any prospectus or other offer documentation or would

be unlawful prior to registration, exemption from registration or

qualification under the securities laws of any such jurisdiction.

Persons into whose possession this announcement comes are required

by the Company to inform themselves about, and to observe, such

restrictions.

This announcement is not for publication or distribution,

directly or indirectly, in or into the United States of America.

This announcement is not an offer of securities for sale into the

United States. The securities referred to herein have not been and

will not be registered under the U.S. Securities Act of 1933, as

amended, and may not be offered or sold in the United States,

except pursuant to an applicable exemption from registration. No

public offering of securities is being made in the United

States.

ENDS

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEEANAFAEKDFFA

(END) Dow Jones Newswires

December 22, 2023 02:00 ET (07:00 GMT)

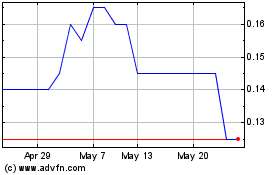

Graft Polymer (uk) (LSE:GPL)

Historical Stock Chart

From Dec 2024 to Jan 2025

Graft Polymer (uk) (LSE:GPL)

Historical Stock Chart

From Jan 2024 to Jan 2025