Harbour Energy PLC Trading and Operations Update (8593Y)

May 10 2023 - 1:00AM

UK Regulatory

TIDMHBR

RNS Number : 8593Y

Harbour Energy PLC

10 May 2023

Harbour Energy plc

("Harbour" or the "Company")

Trading and Operations Update

10 May 2023

Harbour Energy plc today provides the following unaudited

Trading and Operations Update for the first quarter of 2023. This

is issued ahead of the Company's Annual General Meeting (AGM) which

is being held today at 10.00 BST.

Operational highlights

* Production averaged 202 kboepd (Q1 2022: 215 kboepd),

split broadly 50 per cent liquids, 50 per cent gas.

This reflects new wells on-stream, including at

Tolmount, J-Area and Clair, partially offsetting

natural decline. On track to meet full year guidance

of 185-200 kboepd.

* Estimated operating costs of c.$15/boe (Q1 2022:

$14/boe). Full year forecast is unchanged at

c.$16/boe [1] .

* Strong safety record with total recordable injury

rate of 0.82 per million hours worked.

* High return, infrastructure-led UK development

opportunities progressed, including start of drilling

at Talbot.

* Growing portfolio of international development

opportunities with the potential for material reserve

replacement and diversification:

* Mexico: Submission of Zama Unit Development Plan for

approval to the regulator; oil discovery at Kan-1.

* Indonesia: Following the 2022 Timpan gas discovery,

high impact three well Andaman exploration drilling

campaign to start in the second half of the year;

partner and government discussions underway at Tuna

to enable the project to progress.

* Significant progress on our UK CCS projects with the

Harbour-operated Viking and non-operated Acorn

projects recognised as best placed to meet the UK

Government's objectives for the Track 2 regulatory

approval process. Confirmation of Track 2 status

would allow negotiation with the Government over the

terms of the economic licences to commence and the

projects to move to FEED ahead of a potential final

investment decision.

Financial highlights

* Estimated revenue of $1.1 billion with realised,

post-hedging, oil and UK gas prices of $76/bbl and 71

pence/therm. This compares to average Brent and NBP

prices of $81/bbl and 133 pence/therm for the period.

* Total capital expenditure (including decommissioning

spend) of c.$0.2 billion. Full year guidance of

c.$1.1 billion(1) reiterated, reflecting:

* Increased activity post first quarter including

drilling in the UK, and exploration campaigns in

Indonesia and Norway.

* Reduced UK activity in certain areas due to the EPL,

including partner cancelled programmes at Elgin

Franklin and Beryl and rephasing of certain

decommissioning activities.

* Review of UK organisation on track to complete in the

second half of 2023 and expected to result in a

reduction of c.350 onshore positions. This is

forecast to deliver annual savings of c.$50 million

from 2024, following an estimated c.$15 million one

off charge to be taken in Harbour's 2023 interim

financial statements.

* Free cash flow for the period was $0.7 billion.

Forecast full year free cash flow (after c.$450

million of tax payments and pre-distributions) is

unchanged at c.$1.0 billion [2] and is first quarter

weighted due to summer maintenance campaigns and

phasing of capital expenditure and tax payments.

* Net debt reduced from $0.8 billion at year end to

c.$0.2 billion at the end of March. The potential to

be net debt free in 2024(2) is unchanged.

* Significant liquidity of $3.1 billion, as at quarter

end, although our debt capacity is expected to be

impacted by the EPL at the upcoming annual

re-determination of our borrowing base.

Capital allocation

* Proposed final dividend of $100 million (12 cents per

share) for 2022 to be paid on 24 May, subject to

shareholder approval and in line with $200 million

annual dividend policy. This represents dividend per

share growth of nine per cent, driven by the

significant share repurchases made over the last 12

months.

* New $200 million buyback programme initiated in March

2023. As at 9 May 2023, c.$50 million of the

programme had been completed with over 10 per cent of

our issued share capital repurchased since Harbour's

2022 AGM.

* Ongoing evaluation of M&A opportunities to grow and

diversify internationally, in line with Harbour's

stated strategy.

Linda Z Cook, Chief Executive Officer, commented:

"We delivered a strong first quarter. Continuing to invest in

our portfolio while actively managing our cost base has enabled us

to further deleverage our balance sheet and return additional

capital to shareholders. At the same time, we've built good

momentum in our international development opportunities in Mexico

and Indonesia which have the potential to add materially to our

reserves and future production, and in our CCS projects, all of

which will lead to future diversification of our business."

Enquiries

Harbour Energy plc

Elizabeth Brooks, Head of Investor Relations

020 3833 2421

Brunswick

Patrick Handley, Will Medvei

020 7404 5959

Appendix 1: Group production

Q1 2023 Q1 2022

(net, kboepd) (net, kboepd)

Greater Britannia

Area 28 34

--------------- ----------------

J-Area 36 34

--------------- ----------------

AELE hub 26 27

--------------- ----------------

Catcher 20 22

--------------- ----------------

Tolmount 16 -

--------------- ----------------

Elgin Franklin 21 26

--------------- ----------------

Buzzard 12 16

--------------- ----------------

Beryl 11 13

--------------- ----------------

West of Shetlands(3) 15 15

--------------- ----------------

Other North Sea 7 12

--------------- ----------------

North Sea 192 199

--------------- ----------------

International 10 16

--------------- ----------------

Total Group 202 215

--------------- ----------------

(3) West of Shetlands includes Clair, Schiehallion and Solan

Appendix 2: Hedging schedule as per 30 April 2023

During the first quarter, Harbour incrementally added to its UK

gas hedging position for summer and winter 2024 and summer 2025,

securing zero cost collars at attractive pricing.

2023 2024 2025

Volume Price Volume Price Volume Price

(p/th (p/th,

(mmboe) $/bbl) (mmboe) $/bbl) (mmboe) (p/th $/bbl)

UK

gas

Swaps 21.5 40 9.9 52 1.6 45

Collars 1.6 55 - 69 2.4 119 - 269 1.1 108 - 270

Options 0.0 - 0.0 - 0.0 -

========= ======== ======== ======== ========== ======== =============

Oil

Swaps 11.0 74 7.3 84 2.4 81

========= ======== ======== ======== ========== ======== =============

[1] Assumes a US dollar to GBP sterling exchange rate of

$1.2/GBP

[2] Assumes for 2023 that Brent and NBP averages $85/bbl and 150

pence/therm respectively and a US dollar to GBP sterling exchange

rate of $1.2/GBP. For 2024, the 9(th) May 2023 forward curve for

Brent and NBP is assumed and a $1.25/GBP US dollar to GBP sterling

exchange rate.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTKZGGKRLLGFZM

(END) Dow Jones Newswires

May 10, 2023 02:00 ET (06:00 GMT)

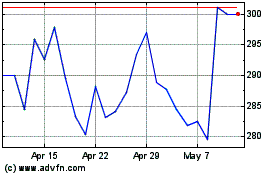

Harbour Energy (LSE:HBR)

Historical Stock Chart

From Jun 2024 to Jul 2024

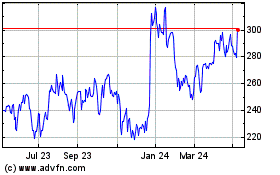

Harbour Energy (LSE:HBR)

Historical Stock Chart

From Jul 2023 to Jul 2024