TIDMHCFT

RNS Number : 6800Y

Highcroft Investments PLC

04 January 2024

4 January 2024

Highcroft Investments PLC

("Highcroft" or the "Company")

Proposed Cancellation of Listing of Ordinary Shares from the

Official List

and

Proposed Admission of the Ordinary Shares to the TISE Official

List

The Company announces the proposed cancellation of listing of

the Ordinary Shares on the premium listing segment of the Official

List (the "Cancellation"), and the proposed admission of the

Ordinary Shares to the TISE Official List (the "Admission",

together the "Proposal").

The Directors have undertaken a review to evaluate the benefits

and drawbacks to the Company and Shareholders of retaining the

listing of the Ordinary Shares on the premium listing segment of

the Official List. In parallel, the Directors have conducted a

review of the proposed admission of the Ordinary Shares to the TISE

Official List. This review has included, among other matters, the

impact on Shareholders, the lack of trading liquidity in the

Ordinary Shares, the requirement, as a REIT, for the Company to be

publicly listed, and the regulatory and financial burden of

maintaining a public listing on the Main Market. Given the matters

referred to above and following careful consideration, the

Directors believe that the Proposal is in the best interests of the

Company and its Shareholders as a whole. A detailed explanation of

the reasons outlined above is set out in the Appendix to this

announcement.

Pursuant to Listing Rule 5.2.5, the Cancellation is subject to

Shareholder approval and accordingly, a circular will be sent to

Shareholders and made available on the Company's website later

today, setting out the background to and reasons for the Proposal

(the "Circular"). The Circular will contain a notice convening a

general meeting (the "General Meeting") at which Shareholders will

be invited to consider and, if thought fit, pass the requisite

shareholder resolution to approve the Proposal (the "Resolution").

Extracts of the Circular can be found in the Appendix to this

announcement.

The Resolution will be proposed as a special resolution to

approve the Cancellation and to authorise the Directors to apply

for TISE Admission and must be approved by: (i) a majority of at

least 75 per cent. of votes cast by Shareholders (in person or by

proxy) at the General Meeting (the "First Voting Threshold"); and

(ii) as a company with a "controlling shareholder" (as defined in

the Listing Rules), more than 50 per cent. of votes cast by

Independent Shareholders (in person or by proxy) at the General

Meeting (the "Second Voting Threshold"). As at today's date, the

Company has received irrevocable undertakings from certain

shareholders representing approximately 50.0 per cent. of the

Company's voting rights and issued share capital, to vote in favour

of the Resolution (with approximately 33.5 per cent. of such votes

counting only towards the First Voting Threshold and remainder

counting both towards the First Voting Threshold and the Second

Voting Threshold).

The General Meeting will be held at held at 2.00 p.m. on Monday

22 January 2024 at the offices of Singer Capital Markets at 1

Bartholomew Lane, London, EC2N 2AX.

A copy of the Circular will be made available later today on the

Company's website at https://www.highcroftplc.com/

Capitalised terms in this announcement (including in the

Appendix to this announcement) shall have the meanings given to

them in the Circular, unless otherwise defined in this announcement

or the context otherwise requires).

Expected timetable of principal events(1)

Event 2024

Publication of the Circular 4 January

Latest time and date for receipt of completed 2.00p.m. on 18 January

proxy appointments

Record time and date for entitlement to 8.00p.m. on 18 January

vote at the General Meeting

Time and date of General Meeting 2.00p.m. on 22 January

Last day of dealings in the Ordinary Shares 19 February

on the Main Market

Admission of, and commencement of dealings 8.00a.m. on 19 February

in, the Ordinary Shares on TISE

Cancellation of the listing of the Ordinary 8.00a.m. on 20 February

Shares from the Official List becomes

effective

(1) All times referred to are London times. Each of the above

dates and times is based on the Company's expectations as at the

date of this announcement. If any of the above times and/or dates

change, the revised times and/or dates will be posted to

Shareholders by an announcement through the Regulatory Information

Service.

For further information, please contact:

Highcroft Investments PLC

Paul Leaf-Wright/Roberta Miles +44 (0)1869 352766

Singer Capital Markets Advisory LLP

Peter Steel / Asha Chotai / Finn Gordon - Corporate +44 (0)20 7496

Finance 3000

Appendix - Extracts from the Circular

1. INFORMATION ON HIGHCROFT

Highcroft is an internally managed UK REIT with a focus on

commercial property in England and Wales. The Company has a diverse

portfolio of 22 properties generating rental income from 28

tenancies spread across the warehouse, retail warehouse, leisure,

office and retail sectors.

Highcroft's purpose is to provide its tenants with quality

properties, in good locations, enabling them to succeed, and for

stakeholders to benefit on a long-term, sustainable basis. The

Company aims to deliver sustainable long-term income and capital

growth through accretive asset management initiatives and recycling

of capital in its regionally based property portfolio.

A REIT is exempt from corporation tax on qualifying income and

gains of its property rental business provided that various

conditions are met. A REIT remains subject to corporation tax on

non-exempt income and gains. REITs must distribute at least 90 per

cent. of their income profits from their tax-exempt property

rentals business by way of dividend, known as "Property Income

Distribution".

2. BACKGROUND TO AND REASONS FOR THE DELISTING AND TISE ADMISSION

The Directors have undertaken a review to evaluate the benefits

and drawbacks to the Company and Shareholders of retaining the

listing of the Ordinary Shares on the premium listing segment of

the Official List. In parallel, the Directors have conducted a

review of the proposed admission of the Ordinary Shares to the TISE

Official List. This review has included, among other matters, the

impact on Shareholders, the lack of trading liquidity in the

Ordinary Shares, the requirement, as a REIT, for the Company to be

publicly listed, and the regulatory and financial burden of

maintaining a public listing on the Main Market. Specifically, the

Directors have considered the following points in relation to the

Company's current listing of the Ordinary Shares on the Official

List:

(a) the Company has two separate Concert Parties which, when

combined, account for approximately 65 per cent. of its current

issued share capital. The Kingerlee Concert Party and the Conn

Concert Party hold approximately 41 per cent. and 24 per cent. of

the Company's current issued share capital, respectively. The major

shareholdings of the Concert Parties have contributed to the

limited trading liquidity in the Ordinary Shares for some time. As

a result, the Directors do not believe that the Company's issued

share capital and small market capitalisation provides sufficient

liquidity and opportunity to trade in meaningful volumes or with

sufficient frequency to create an active market in the Ordinary

Shares on the Main Market. The Company does not have any

institutional Shareholders, which the Directors believe further

compounds the limited trading liquidity. The Company believes it is

unlikely to attract new institutional shareholders by remaining on

the Official List and there is no negative impact in this regard of

moving to TISE; and

(b) the Directors believe that the considerable current, and

likely future increased, cost, management time and the legal and

regulatory burden associated with maintaining the Ordinary Shares

admission to listing on the Official List and to trading on the

Main Market significantly outweighs the benefits of continued

admission. Given the lower costs and less onerous regulatory

environment associated with trading on TISE, the Directors believe

that the Delisting and TISE Admission will materially reduce the

Company's recurring administrative and adviser expenses, whilst

allowing an enhanced focus on achieving operational and strategic

goals.

Given the matters referred to above and following careful

consideration, the Directors believe that the Delisting and TISE

Admission are appropriate for the following reasons:

(a) the Company will continue to be a UK-registered and UK-based company;

(b) the Company will continue to be a UK REIT paying Property

Income Distributions in accordance with all applicable laws

relating to REIT Property Income Distributions;

(c) TISE is a global exchange, internationally recognised and a

regulated market which is located conveniently in the British

Isles;

(d) TISE is the second largest market for all listed UK REITs; and

(e) the regulatory environment of TISE is such that it would

allow the Company, if appropriate, to issue new shares to new

investors to raise capital for growth or to implement a share

buyback programme to improve the trading liquidity of the Company's

issued share capital more cost effectively than on the Main Market,

where the costs of such activities outweigh the benefits.

Future strategy

The Board's strategy will remain to:

(a) protect the capital base of the Company by investing in good

quality real estate assets that generate long term income;

(b) increase Property Income Distributions to Shareholders;

(c) keep the Company's cost base to a minimum; and

(d) maintain high standards of ethics and governance.

Summary

For the reasons set out above, the Directors have concluded that

TISE is a more appropriate market for the Company at this point in

time and that the Delisting and TISE Admission is in the best

interests of the Company and its Shareholders.

Accordingly, if the Resolution is passed by Shareholders (on the

date on which the General Meeting is originally convened), TISE

Admission is expected to take place on 19 February 2024 and the

Delisting on 20 February 2024.

The Board has consulted with certain of the Company's largest

Shareholders in connection with the Delisting and TISE Admission

and has received certain irrevocable undertakings to vote in favour

of the Resolution (please see paragraph 5 below for further

details).

Further information on the Delisting and TISE Admission is set

out in Part II of the Circular.

3. CONSEQUENCES AND RISKS ASSOCIATED WITH DELISTING FROM THE OFFICIAL LIST AND TISE ADMISSION

Following TISE Admission, the Company will be subject to the

TISE Listing Rules. Shareholders should note that the protections

afforded to investors in TISE companies are in some respects less

rigorous than those afforded to investors in companies whose shares

are listed on the premium segment of the Official List. The

regulatory and financial reporting regime applicable to companies

whose shares are listed on the Official List will no longer apply

and the levels of disclosure and corporate governance within the

Company may not be as stringent as for a company listed on the

Official List. This paragraph sets out further detailed information

on the consequences and risks associated with the Delisting.

While for the most part the obligations of a company whose

shares are traded on TISE are similar to those of companies whose

shares are listed on the premium segment of the Official List,

there are certain exceptions. Examples of these areas of similarity

and difference are provided below:

-- Under the Listing Rules, a company is required to appoint a

'sponsor' for the purposes of certain corporate transactions. The

responsibilities of the sponsor include providing assurance to the

FCA, when required, that the responsibilities of the listed company

have been met. The TISE Listing Rules require that a company

retains a TISE sponsor at all times. The TISE sponsor is

responsible to TISEA for advising and guiding a TISE company on its

responsibilities under the TISE Listing Rules, must be approved by

TISEA to act in that capacity and has ongoing responsibilities to

both the Company and TISEA. The TISE Listing Rules require a TISE

listed company to seek advice from its TISE sponsor regarding its

compliance with the TISE Listing Rules and to take that advice into

account. Conditional on TISE Admission, the Company has appointed

Appleby as its TISE sponsor.

-- Under the TISE Listing Rules (and similar to the Listing

Rules), prior shareholder approval is required for: (i) reverse

takeovers (being an acquisition or acquisitions in a 12 month

period which would exceed 100 per cent. in various class tests;

(ii) acquisitions, which would exceed 15 per cent. in various class

tests, that are not already approved in advance by all shareholders

in accordance with the issuer's constitutional documents; (iii)

disposals which, when aggregated with any other disposals over the

previous 12 months, would result in a material change of business

(being disposals that exceed 75 per cent. in various class tests);

or (iv) transactions with a related party, which would exceed five

per cent. in various class tests, that are not already approved in

advance by all shareholders in accordance with the issuer's

constitutional documents. The TISE Listing Rules require a circular

to be sent to shareholders in relation to the transactions

described in (i) to (iv) above, albeit the content requirements for

such circulars under the TISE Listing Rules are less detailed than

under the Listing Rules and do not require the approval of TISEA

prior to publication (certain circulars published under the Listing

Rules require prior approval by the FCA).

-- There is no requirement under the TISE Listing Rules for a

prospectus or a listing document to be published for further issues

of a class of listed securities, except when seeking admission for

a new class of securities, or in connection with a reverse takeover

(as defined above), or as otherwise required by law.

-- Unlike the Listing Rules, the TISE Listing Rules do not

specify any required structures or discount limits in relation to

further issues of securities.

-- The Company has a controlling shareholder (as defined in the

Listing Rules and under the TISE Listing Rules) but will no longer

be required to enter into: (i) a relationship agreement with the

Kingerlee Concert Party as a controlling shareholder (or, for that

matter, any other such shareholder); or (ii) comply with the

independence provisions required by the Listing Rules. The Company

and the Kingerlee Concert Party have agreed to maintain the

existing relationship agreement in place from admission to

TISE.

-- In common with a company whose shares are admitted to trading

on the premium segment of the Official List, a company listed on

TISE has to maintain a minimum of 25 per cent. of its issued

ordinary share capital in public hands (except in certain limited

circumstances).

-- The regime in relation to dealing in own securities and

treasury shares on TISE has similarities to the Listing Rules,

including restrictions on the timing of dealings and requirements

relating to notification, price, shareholder approval or tender

offers. It is highlighted that the levels of disclosure may not be

as stringent under the TISE Listing Rules as for a company whose

shares are admitted to trading on the premium segment of the

Official List.

-- Companies with a listing on the premium segment of the

Official List may only cancel their listing with the approval of 75

per cent. of the voted shares and, if the company has a controlling

shareholder, must also secure the approval of a majority of the

voting independent shareholders (other than in certain limited

circumstances). Under the TISE Listing Rules, a TISE company does

not require shareholder consent to cancel admission of its

securities to TISE.

-- The Company is currently required to comply with the UK

Corporate Governance Code or explain areas of non-compliance. It is

not mandatory for companies whose shares are admitted to trading on

TISE to comply with this code. The Board recognises, however, the

importance of high standards of corporate governance and, if TISE

Admission becomes effective, intends to comply, insofar as possible

for a company of its size and nature, with the provisions of the

QCA Code as described in paragraph 8 of this document.

-- The Disclosure Guidance and Transparency Rules will no longer

apply to the Company following TISE Admission. This is because TISE

is not a regulated market for the purposes of the EU's securities

directives. The Company will, however, be required to notify TISEA

and publish an announcement on the website of TISE relating to

changes to the person(s) who, directly or indirectly, hold or

control three per cent. or more of the Ordinary Shares (excluding

treasury shares) or of the votes to be cast on all matters at

general meetings of the Company.

-- Investor guidelines (such as those issued by the Investment

Association, the Pensions and Lifetime Savings Association and the

Pre-Emption Group), which provide guidance on issues such as

executive compensation and share-based remuneration, corporate

governance, share capital management and the issue and allotment of

shares on a pre-emptive or non-pre-emptive basis, do not directly

apply to companies whose shares are admitted to trading on

TISE.

-- The requirement under section 439A of the Companies Act to

submit a remuneration policy for a binding vote by shareholders is

only applicable to quoted companies listed on the Main Market. A

company whose shares are traded on TISE is not subject to the same

obligation to submit its remuneration policy to a binding vote of

shareholders.

-- There can be no assurance that an active or liquid trading

market for the Ordinary Shares will develop or, if developed, will

be maintained following TISE Admission. Additionally, the future

success of TISE and liquidity in the market for the Company's

shares cannot be guaranteed. Potential investors and Shareholders

should be aware that the value and any income from the Ordinary

Shares can go down as well as up and that investment in securities

which are traded on TISE might be less realisable and might carry a

higher risk than a security listed on the Official List.

-- Singer Capital Markets will cease to be financial adviser and

broker to the Company at the point the Company of Delisting.

It is emphasised that the Delisting and TISE Admission will have

no impact on the assets and liabilities of the Company (save in

respect of the fees for the production of this document and TISE

Admission) and it will continue to have the same business and

operations following TISE Admission.

4. IRREVOCABLE UNDERTAKINGS TO VOTE

The Company has received irrevocable undertakings to vote (or

procure a vote) in favour of the Resolution from:

(a) Shareholders who are beneficially interested, in aggregate,

1,744,390 Ordinary Shares (representing approximately 33.5 per

cent. of the Ordinary Shares as at 29 December 2023, being the

latest practicable date prior to the publication of this document)

to vote in favour of the Resolution. All such Shareholders' votes

will count only towards the First Voting Threshold; and

(b) Shareholders (in addition to those under paragraph (a)) who

are beneficially interested, in aggregate, 859,426 Ordinary Shares

(representing approximately 16.5 per cent. of the Ordinary Shares

as at 29 December 2023, being the latest practicable date prior to

the publication of this document) to vote in favour of the

Resolution. All such Shareholders' votes will count both towards

the First Voting Threshold and the Second Voting Threshold.

5. DELISTING AND TISE ADMISSION

Conditional on the Resolution being approved by the requisite

majorities of Shareholders at the General Meeting, the Company will

apply to cancel the listing of the Ordinary Shares on the Official

List and their admission to trading on the Main Market and give 20

Business Days' notice to the London Stock Exchange of its intention

to delist. It is currently anticipated that, subject to the passing

of the Resolution by the requisite majorities:

(a) TISE Admission will take place at 8.00 a.m. on 19 February 2024;

(b) the last day of dealings in the Ordinary Shares on the Main

Market will be 19 February 2024; and

(c) the Delisting will take effect at 8.00 a.m. on 20 February

2024, being not less than 20 Business Days from the date of the

General Meeting.

Although TISE Admission is planned to take place at 8.00 a.m. on

19 February 2024, TISE Admission is subject to final approval of

TISEA, and there is no guarantee that TISEA will approve TISE

Admission on the intended date, and there is no assurance that TISE

Admission will occur or that such TISE listing will be

maintained.

6. APPLICATION OF THE TAKEOVER CODE

The Takeover Code applies to all companies which have registered

offices in the United Kingdom, the Channel Islands, or the Isle of

Man, if any of their equity share capital or other transferable

securities carrying voting rights are admitted to trading on a

regulated market or multilateral trading facility in the United

Kingdom or on any exchange in the Channel Islands or the Isle of

Man.

If the Delisting and TISE Admission is approved by Shareholders

at the General Meeting, the Company will remain subject to the

Takeover Code as it will remain a public company incorporated and

registered in England and Wales with its registered offices in the

UK and, its securities admitted to and trading on an exchange in

the Channel Islands. As a result, the protections that are afforded

to Shareholders under the Takeover Code will remain applicable to

the Company.

Under the Takeover Code, if an acquisition of an interest in

Ordinary Shares were to increase the aggregate interests of the

acquirer and its concert parties to 30 per cent. or more of the

voting rights in the Company, the acquirer and its concert parties

would be required to make a cash offer for the outstanding Ordinary

Shares at a price not less than the highest price paid for

interests in Ordinary Shares by the acquirer or its concert parties

during the previous 12 months. This requirement would also be

triggered when, except with the consent of the Panel, any person

(together with persons acting in concert with that person) who is

interested in Ordinary Shares which carry not less than 30 per

cent. of the voting rights of the Company but does not hold

Ordinary Shares carrying more than 50 per cent. of such voting

rights, and such person (or person acting in concert with that

person) acquires any other Ordinary Shares which increases the

percentage of Ordinary Shares carrying voting rights in which he is

interested.

The Kingerlee Concert Party has an interest in approximately 41

per cent. of the Company's current issued share capital. If members

of the Kingerlee Concert Party acquire any further interest in

Ordinary Shares, such acquisition will, subject to Panel consent,

result in an obligation under Rule 9 of the Takeover Code upon the

Kingerlee Concert Party to make a general offer for the remaining

Ordinary Shares not already held by the Kingerlee Concert Party, at

a price not less than the highest price paid by any member of the

Kingerlee Concert Party for any Ordinary Shares in the previous 12

months.

7. CORPORATE GOVERNANCE

The Board recognises the value of good corporate governance and

envisages no significant alteration in the standards of governance

which the Group has always achieved. It will maintain its existing

governance framework which includes the key mechanisms through

which the Company sets strategy, plans its objectives and monitors

performance and risk management. As the Company will no longer be

listed on the premium listing segment of the Official List, it will

no longer need to comply with the UK Corporate Governance Code.

The TISE Listing Rules require issuers to adhere to certain

principles, including being responsible for following any

applicable recognised code of corporate governance. Following TISE

Admission, the Company intends to comply, insofar as possible for a

company of its size and nature, with the provisions of the QCA

Code. The Board believes the QCA Code offers a flexible, yet

rigorous approach to support the Company as the business

evolves.

8. TAXATION

The Company has taken tax advice to confirm the proposed

Delisting and TISE Admission would not affect the Company's REIT

status and has disclosed the proposed Delisting and TISE Admission

to HMRC.

The Company will therefore remain a UK REIT for tax purposes and

will continue to comply with all applicable laws. As such,

distributions to shareholders will be made, as in the past, as

Property Income Distributions.

Shareholders are urged to consult their own independent

professional adviser regarding the tax consequences of Delisting

and TISE Admission.

9. GENERAL MEETING

The Delisting is conditional on the passing of the Resolution at

the General Meeting by the requisite majorities. A notice convening

a general meeting of the Company to be held at 2.00 p.m. on Monday

22 January 2024 at the offices of Singer Capital Markets at 1

Bartholomew Lane, London EC2N 2AX is set out at the end of this

document.

The Resolution will be proposed as a special resolution to

approve the Delisting and to authorise the Directors to apply for

TISE Admission.

The Resolution will be voted on by way of a poll (and not on a

show of hands). The Board believes a poll is more representative of

Shareholders' voting intentions because Shareholders' votes are

counted according to the number of Ordinary Shares held and all

votes tendered are taken into account. This will also assist in

ensuring that only those votes cast (in person or by proxy) by

Independent Shareholders are counted towards the Second Voting

Threshold. The results of the poll vote held at the General Meeting

will be published on the Company's website and will be released via

a Regulatory Information Service as soon as practicable following

the close of the General Meeting.

Shareholders are encouraged to take the recommended action

before the General Meeting (as set out below), which includes

appointing a proxy whether online, via a CREST Proxy Instruction or

by a hard copy form of proxy in accordance with the instructions in

this document.

The Board strongly urges all Shareholders to vote by proxy on

the Resolution as early as possible and recommends that

Shareholders appoint the chair of the General Meeting as their

proxy.

10. RECOMMENDATION

The Board considers that cancelling the listing of the Ordinary

Shares on the Official List and trading on the Main Market and

applying for admission to listing on the TISE Official List and

trading on TISE is, in the Board's opinion, in the best interests

of the Shareholders as a whole.

Accordingly, the Board unanimously recommends that you vote in

favour of the Resolution to be proposed at the General Meeting.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCUPUQGGUPCGGC

(END) Dow Jones Newswires

January 04, 2024 06:20 ET (11:20 GMT)

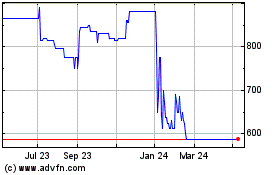

Highcroft Investments (LSE:HCFT)

Historical Stock Chart

From Nov 2024 to Dec 2024

Highcroft Investments (LSE:HCFT)

Historical Stock Chart

From Dec 2023 to Dec 2024