TIDMHE1

RNS Number : 6967L

Helium One Global Ltd

07 September 2023

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN

WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM THE

UNITED STATES, AUSTRALIA, CANADA, THE REPUBLIC OF SOUTH AFRICA,

JAPAN OR ANY OTHER JURISDICTION IN WHICH SUCH RELEASE, PUBLICATION

OR DISTRIBUTION WOULD BE UNLAWFUL. PLEASE SEE THE IMPORTANT

INFORMATION SECTION AT THE OF THIS ANNOUNCEMENT.

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND DOES NOT

CONSTITUTE OR CONTAIN ANY INVITATION, SOLICITATION, RECOMMATION,

OFFER OR ADVICE TO ANY PERSON TO SUBSCRIBE FOR, OTHERWISE ACQUIRE

OR DISPOSE OF ANY SECURITIES IN HELIUM ONE GLOBAL LTD OR ANY OTHER

ENTITY IN ANY JURISDICTION WHERE TO DO SO WOULD BREACH ANY

APPLICABLE LAW OR REGULATION. NEITHER THIS ANNOUNCEMENT NOR THE

FACT OF ITS DISTRIBUTION SHALL FORM THE BASIS OF, OR BE RELIED ON

IN CONNECTION WITH, ANY INVESTMENT DECISION IN RESPECT OF HELIUM

ONE GLOBAL LTD.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF THE MARKET ABUSE REGULATION (EU) 596/2014 WHICH FORMS PART OF UK

LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT 2018 ("UK

MAR"). IN ADDITION, MARKET SOUNDINGS (AS DEFINED IN UK MAR) WERE

TAKEN IN RESPECT OF CERTAIN OF THE MATTERS CONTAINED IN THIS

ANNOUNCEMENT, WITH THE RESULT THAT CERTAIN PERSONS BECAME AWARE OF

SUCH INSIDE INFORMATION, AS PERMITTED BY UK MAR. UPON THE

PUBLICATION OF THIS ANNOUNCEMENT, THIS INSIDE INFORMATION IS NOW

CONSIDERED TO BE IN THE PUBLIC DOMAIN AND SUCH PERSONS SHALL

THEREFORE CEASE TO BE IN POSSESSION OF INSIDE INFORMATION.

7 September 2023

Helium One Global Ltd

("Helium One" or the "Company")

Result of Placing, Subscription and Retail Offer

Helium One Global (AIM: HE1), the primary helium explorer in

Tanzania, is pleased to announce that, following the announcement

on 6 September 2023 (the "Launch Announcement") regarding the

launch of a proposed placing (the "Placing") and a direct

subscription (the "Subscription") (together, the "Fundraise"), the

Company has raised gross proceeds of GBP6.3 million (approximately

US$7.9 million) through the issue of an aggregate of 105,000,000

new ordinary shares of no par value in the capital of the Company

("Ordinary Shares") at a price of 6.0 pence per Ordinary Share (the

"Issue Price"). The Fundraise was oversubscribed.

The Placing was conducted through an accelerated bookbuild

process (the "Bookbuild") undertaken by Liberum Capital Limited and

Peterhouse Capital Limited acting as joint bookrunners ("Joint

Bookrunners").

The Fundraise comprised of a Placing of 104,383,335 new Ordinary

Shares ("Placing Shares") to raise approximately GBP6.26 million

(approximately US$7.86 million) and a Subscription of 616,665 new

Ordinary Shares ("Subscription Shares") to raise approximately

GBP0.04 million (approximately US$0.05 million) (together and in

aggregate the "Fundraise Shares").

In addition to the Fundraise, the Company is also pleased to

announce that gross proceeds of GBP0.5 million (approximately

US$0.6 million) have been raised by the Retail Offer via PrimaryBid

through the issue of 8,333,333 new Ordinary Shares at the Issue

Price (the "Retail Offer Shares").

In aggregate the Fundraise and the Retail Offer have raised

gross proceeds of GBP6.8 million (approximately US$8.5

million).

The Issue Price represents a discount of approximately 10.4 per

cent. to the closing price of 6.7 pence per Ordinary Share on 5

September 2023, being the last business day prior to the

announcement of the Fundraise.

In addition to the Fundraise Shares and the Retail Offer Shares

the Company will also issue 750,000 Ordinary Shares at the Issue

Price in in lieu of certain advisory fees (the "Fee Shares").

Lorna Blaisse, Chief Executive Officer, commented:

""We are delighted with the response that we have received

during our oversubscribed Placing and Retail Offer and are pleased

to have been able to include our existing investors. The funds

raised now enable us to drill a further prospect immediately after

the planned drill at Tai-C. Itumbula has always ranked highly in

our portfolio and to be able to drill it this side of the wet

season, offers an excellent opportunity to utilise personnel and

equipment and make a significant cost saving in the long term.

"The next few months promise to be an incredibly exciting time

for the Company as we commence spud this month and complete these

two wells. We look forward to providing further updates as

appropriate as we deliver our Phase II drilling campaign.

"This has been a tremendous effort from the team at an already

busy period leading up to Operations and I'd like to thank

everybody involved."

Admission and Total Voting Rights

Application has been made for the Fundraise Shares, the Retail

Offer Shares and the Fee Shares to be admitted to trading on AIM

("Admission"). It is anticipated that trading in the new shares

will commence on AIM at or around 8.00 a.m. on 15 September 2023.

The Fundraise Shares, the Retail Offer Shares and the Fee Shares

will rank pari passu with the existing Ordinary Shares in

issue.

Following Admission, the Company's issued and fully paid share

capital will consist of 941,456,430 Ordinary Shares, all of which

carry one voting right per share. The Company does not hold any

Ordinary Shares in treasury. Following Admission, the figure of

941,456,430 Ordinary Shares may be used by shareholders as the

denominator for the calculation by which they will determine if

they are required to notify their interest in, or a change to their

interest in, the Company, under the Disclosure Guidance and

Transparency Rules.

The Fundraise Shares and the Retail Offer Shares will represent

approximately 11.2 per cent. and 0.9 per cent. respectively of the

Company's enlarged issued share capital on Admission (assuming no

other issuance of Ordinary Shares prior to Admission).

Director Participation in the Subscription

The Directors of the Company have subscribed for a total of

483,332 Subscription Shares in aggregate. The beneficial holdings

of the Directors before and after Admission of the new shares are

set out below:

Director Subscription Total Ordinary % of Issued

Shares Shares held on Share Capital

Admission on Admission

Lorna Blaisse 133,333 173,333 0.02%

------------- ---------------- ---------------

James Smith 83,333 223,333 0.02%

------------- ---------------- ---------------

Sarah Cope 83,333 295,857 0.03%

------------- ---------------- ---------------

Russel Swarts 100,000 200,000 0.02%

------------- ---------------- ---------------

Nigel Friend 83,333 183,333 0.02%

------------- ---------------- ---------------

Capitalised terms not defined in this announcement have the

meaning given to them in the Launch Announcement.

For more information please contact:

Helium One Global Ltd +44 20 7920

Lorna Blaisse, CEO 3150

Liberum Capital Limited (Nominated

Adviser and Joint Broker)

Scott Mathieson

Ed Thomas

Nikhil Varghese +44 20 3100

Anake Singh 2000

Peterhouse Capital Limited (Joint

Broker)

Lucy Williams

Charles Goodfellow +44 20 7220

Duncan Vasey 9792

Tavistock (Financial PR)

Nick Elwes +44 20 7920

Tara Vivian - Neal 3150

Notes to Editors

Helium One Global, the AIM-traded Tanzanian explorer, holds

prospecting licences totalling 2,965km(2) across three distinct

project areas, with the potential to become a strategic player in

resolving a supply-constrained helium market.

The Rukwa, Balangida, and Eyasi projects are located within rift

basins on the margin of the Tanzanian Craton in the north and

southwest of the country. The assets lie near surface seeps with

helium concentrations ranging up to 10.6% He by volume. All Helium

One's licences are held on a 100% equity basis and are in close

proximity to the required infrastructure.

The Company's flagship Rukwa Project is located within the Rukwa

Rift Basin covering 1,899km(2) in south-west Tanzania. The project

is considered to be an advanced exploration project with leads and

prospects defined by a subsurface database including multispectral

satellite spectroscopy, airborne gravity gradiometry, 2D seismic

data, and QEMSCAN analysis. The Rukwa Project has been de-risked by

the 2021 drilling campaign, which identified reservoir and seal

with multiple prospective intervals from basin to near surface

within a working helium system.

In July 2023, Helium One acquired their own exploration drill

rig, an Epiroc Predator 220 oil and gas type rig, capable of

drilling to depths of 2,400m. The rig was shipped to Tanzania in

order to commence Phase II drilling operations.

Helium One is traded on the AIM market of the London Stock

Exchange with the ticker of HE1 and on the OTCQB in the United

States with the ticker HLOGF.

IMPORTANT NOTICES

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN

WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN OR INTO OR FROM THE

UNITED STATES, AUSTRALIA, CANADA, THE REPUBLIC OF SOUTH AFRICA OR

JAPAN OR ANY OTHER JURISDICTION IN WHICH SUCH RELEASE, PUBLICATION

OR DISTRIBUTION WOULD BE UNLAWFUL.MEMBERS OF THE PUBLIC ARE NOT

ELIGIBLE TO TAKE PART IN THE PLACING. THIS ANNOUNCEMENT IS FOR

INFORMATION PURPOSES AND IS DIRECTED ONLY AT PERSONS WHOSE ORDINARY

ACTIVITIES INVOLVE THEM IN ACQUIRING, HOLDING, MANAGING AND

DISPOSING OF INVESTMENTS (AS PRINCIPAL OR AGENT) FOR THE PURPOSES

OF THEIR BUSINESS AND WHO HAVE PROFESSIONAL EXPERIENCE IN MATTERS

RELATING TO INVESTMENTS AND ARE: (1) IF IN A MEMBER STATE OF THE

EUROPEAN ECONOMIC AREA ("EEA"), QUALIFIED INVESTORS AS DEFINED IN

ARTICLE 2(e) OF REGULATION (EU) 2017/1129 (THE "EU PROSPECTUS

REGULATION"); (2) IF IN THE UNITED KINGDOM, ARE QUALIFIED INVESTORS

WITHIN THE MEANING OF ARTICLE 2(e) OF REGULATION (EU) 2017/1129 AS

AMED, AS IT FORMS PART OF UK LAW AS RETAINED EU LAW AS DEFINED IN,

AND BY VIRTUE OF, THE EUROPEAN UNION (WITHDRAWAL) ACT 2018 (AS

AMED) (THE "UK PROSPECTUS REGULATION") ("UK QUALIFIED INVESTORS")

AND WHO ALSO (A) FALL WITHIN ARTICLE 19(5) OF THE FINANCIAL

SERVICES AND MARKETS ACT 2000 (FINANCIAL PROMOTION) ORDER 2005, AS

AMED (THE "ORDER") (INVESTMENT PROFESSIONALS) OR (B) FALL WITHIN

ARTICLE 49(2)(a) TO (d) (HIGH NET WORTH COMPANIES, UNINCORPORATED

ASSOCIATIONS, ETC.) OF THE ORDER; OR (3) PERSONS TO WHOM IT MAY BE

OTHERWISE LAWFULLY COMMUNICATED (ALL SUCH PERSONS TOGETHER BEING

REFERRED TO AS "RELEVANT PERSONS").

THIS ANNOUNCEMENT AND THE INFORMATION IN IT MUST NOT BE ACTED ON

OR RELIED ON BY PERSONS WHO ARE NOT RELEVANT PERSONS. PERSONS

DISTRIBUTING THIS ANNOUNCEMENT MUST SATISFY THEMSELVES THAT IT IS

LAWFUL TO DO SO. ANY INVESTMENT OR INVESTMENT ACTIVITY TO WHICH

THIS ANNOUNCEMENT RELATES IS AVAILABLE ONLY TO RELEVANT PERSONS AND

WILL BE ENGAGED IN ONLY WITH RELEVANT PERSONS. THIS ANNOUNCEMENT

DOES NOT ITSELF CONSTITUTE AN OFFER FOR SALE OR SUBSCRIPTION OF ANY

SECURITIES IN HELIUM ONE GLOBAL LTD.

THE FUNDRAISE SHARES AND THE RETAIL OFFER SHARES HAVE NOT BEEN

AND WILL NOT BE REGISTERED UNDER THE UNITED STATES SECURITIES ACT

OF 1933, AS AMED (THE "SECURITIES ACT") OR UNDER THE SECURITIES

LAWS OF ANY STATE OR OTHER JURISDICTION OF THE UNITED STATES, AND

MAY NOT BE OFFERED, SOLD, RESOLD OR DELIVERED, DIRECTLY OR

INDIRECTLY, IN OR INTO THE UNITED STATES EXCEPT PURSUANT TO AN

EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE

REGISTRATION REQUIREMENTS OF THE SECURITIES ACT. THE FUNDRAISE AND

RETIAL OFFER WERE MADE SOLELY OUTSIDE THE UNITED STATES TO PERSONS

IN OFFSHORE TRANSACTIONS (AS DEFINED IN REGULATION S UNDER THE

SECURITIES ACT ("REGULATION S")) MEETING THE REQUIREMENTS OF

REGULATION S. PERSONS RECEIVING THIS ANNOUNCEMENT (INCLUDING

CUSTODIANS, NOMINEES AND TRUSTEES) MUST NOT FORWARD, DISTRIBUTE,

MAIL OR OTHERWISE TRANSMIT IT IN OR INTO THE UNITED STATES OR USE

THE UNITED STATES MAILS, DIRECTLY OR INDIRECTLY, IN CONNECTION WITH

THE FUNDRAISE AND/OR RETAIL OFFER.

The distribution or transmission of this Announcement and/or the

Fundraise and/or the Retail Offer and/or issue of the Fundraise

Shares and the Retail Offer Shares in certain jurisdictions may be

restricted or prohibited by law or regulation. Persons distributing

this Announcement must satisfy themselves that it is lawful to do

so. Any failure to comply with these restrictions may constitute a

violation of the securities laws of any such jurisdiction. No

action has been taken by the Company, the Joint Bookrunners or any

of their respective affiliates, agents, directors, officers or

employees that would permit an offer of the Fundraise Shares or

Retail Offer Shares or possession or distribution of this

Announcement or any other offering or publicity material relating

to such shares in any jurisdiction where action for that purpose is

required. Persons into whose possession this Announcement comes are

required by the Company and the Joint Bookrunners to inform

themselves about and to observe any such restrictions.

This Announcement or any part of it does not constitute or form

part of any offer to issue or sell, or the solicitation of an offer

to acquire, purchase or subscribe for, any securities in the United

States (including its territories and possessions, any state of the

United States and the District of Columbia (the "United States" or

the "US")), Australia, Canada, the Republic of South Africa or

Japan or any other jurisdiction in which the same would be

unlawful. No public offering of the Fundraise Shares is being made

in any such jurisdiction.

All offers of the Fundraise Shares and Retail Offer Shares will

be made pursuant to an exemption under the UK Prospectus Regulation

and the EU Prospectus Regulation from the requirement to produce a

prospectus. In the United Kingdom, this Announcement is being

directed solely at persons in circumstances in which section 21(1)

of the Financial Services and Markets Act 2000 (as amended) does

not apply.

The Fundraise Shares and Retail Offer Shares have not been

approved or disapproved by the US Securities and Exchange

Commission, any state securities commission or other regulatory

authority in the United States, nor have any of the foregoing

authorities passed upon or endorsed the merits of the Fundraise or

Retail Offer or the accuracy or adequacy of this Announcement. Any

representation to the contrary is a criminal offence in the United

States. The relevant clearances have not been, nor will they be,

obtained from the securities commission of any province or

territory of Canada, no prospectus has been lodged with, or

registered by, the Australian Securities and Investments Commission

or the Japanese Ministry of Finance; the relevant clearances have

not been, and will not be, obtained for the South Africa Reserve

Bank or any other applicable body in the Republic of South Africa

in relation to the Fundraise Shares and Retail Offer Shares and the

Fundraise Shares and Retail Offer Shares have not been, nor will

they be, registered under or offered in compliance with the

securities laws of any state, province or territory of Australia,

Canada, the Republic of South Africa or Japan. Accordingly, the

Fundraise Shares and Retail Offer Shares may not (unless an

exemption under the relevant securities laws is applicable) be

offered, sold, resold or delivered, directly or indirectly, in or

into Australia, Canada, the Republic of South Africa or Japan or

any other jurisdiction outside the United Kingdom.

Persons (including, without limitation, nominees and trustees)

who have a contractual right or other legal obligations to forward

a copy of this Announcement should seek appropriate advice before

taking any action.

This Announcement includes "forward-looking statements" which

includes all statements other than statements of historical fact,

including, without limitation, those regarding the Company's

financial position, business strategy, plans and objectives of

management for future operations, or any statements preceded by,

followed by or that include the words "targets", "believes",

"expects", "aims", "intends", "will", "may", "anticipates",

"would", "could" or similar expressions or negatives thereof. Such

forward-looking statements involve known and unknown risks,

uncertainties and other important factors beyond the Company's

control that could cause the actual results, performance or

achievements of the Company and its subsidiary undertakings to be

materially different from future results, performance or

achievements expressed or implied by such forward-looking

statements. Such forward-looking statements are based on numerous

assumptions regarding the Company's present and future business

strategies and the environment in which the Company will operate in

the future. These forward-looking statements speak only as at the

date of this Announcement. The Company expressly disclaims any

obligation or undertaking to disseminate any updates or revisions

to any forward-looking statements contained herein to reflect any

change in the Company's expectations with regard thereto or any

change in events, conditions or circumstances on which any such

statements are based unless required to do so by applicable law or

the AIM Rules for Companies governing the admission to and

operation of AIM published by the London Stock Exchange as amended

from time to time.

The Joint Bookrunners are authorised and regulated by the

Financial Conduct Authority ("FCA") in the United Kingdom, are

acting as joint bookrunners and brokers in connection with the

Placing and no one else in connection with the Placing, the Joint

Bookrunners will not be responsible to anyone (including any

Placees) other than the Company for providing the protections

afforded to its clients or for providing advice in relation to the

Placing or any other matters referred to in this Announcement.

Liberum is also acting as nominated adviser to the Company.

No representation or warranty, express or implied, is or will be

made as to, or in relation to, and no responsibility or liability

is or will be accepted by the Joint Bookrunners or by any of the

Joint Bookrunners' affiliates or agents as to, or in relation to,

the accuracy or completeness of this Announcement or any other

written or oral information made available to or publicly available

to any interested party or its advisers, and any liability therefor

is expressly disclaimed.

Any indication in this Announcement of the price at which the

existing ordinary shares in the capital of the Company have been

bought or sold in the past cannot be relied upon as a guide to

future performance. Persons needing advice should consult an

independent financial adviser. The Fundraise Shares and Retail

Offer Shares to be issued pursuant to the Fundraise and Retail

Offer respectively will not be admitted to trading on any stock

exchange other than the AIM Market of the London Stock

Exchange.

No statement in this Announcement is intended to be a profit

forecast, and no statement in this Announcement should be

interpreted to mean that earnings per share of the Company for the

current or future financial years would necessarily match or exceed

the historical published earnings per share of the Company.

Neither the content of the Company's website (or any other

website) nor any website accessible by hyperlinks on the Company's

website (or any other website) is incorporated in, or forms part

of, this Announcement.

Information to Distributors

Solely for the purposes of the product governance requirements

contained within the FCA Handbook Product Intervention and Product

Governance Sourcebook (the "UK Product Governance Rules"), and

disclaiming all and any liability, whether arising in tort,

contract or otherwise, which any "manufacturer" (for the purposes

of the UK Product Governance Rules) may otherwise have with respect

thereto, the Placing Shares have been subject to a product approval

process, which has determined that the Placing Shares are: (i)

compatible with an end target market of (a) retail clients, as

defined in point (8) of Article 2 of the UK Prospectus Regulation

(EU) No 2017/565 as it forms part of domestic law by virtue of the

European Union (Withdrawal) Act 2018 ("EUWA"), (b) investors who

meet the criteria of professional clients as defined in Regulation

(EU) No 600/2014 as it forms part of domestic law by virtue of the

EUWA and (c) eligible counterparties as defined in the FCA Handbook

Conduct of Business Sourcebook ("COBS"); and (ii) eligible for

distribution through all distribution channels as are permitted by

EU Directive 2014/65/EU on markets in financial instruments, as

amended ("MiFID II") (the "UK Target Market Assessment").

Solely for the purposes of the product governance requirements

contained within: (a) MiFID II; (b) Articles 9 and 10 of Commission

Delegated Directive EU 2017/593 supplementing MiFID II; and (c)

local implementing measures (together, the "MiFID II Product

Governance Requirements"), and disclaiming all and any liability,

whether arising in tort, contract or otherwise, which any

"manufacturer" (for the purposes of the MiFID II Product Governance

Requirements) may otherwise have with respect thereto, the Placing

Shares have been subject to a product approval process, which has

determined that the Placing Shares are: (i) compatible with an end

target market of (a) retail investors, (b) investors who meet the

criteria of professional clients and (c) eligible counterparties,

each as defined in MiFID II; and (ii) eligible for distribution

through all distribution channels as are permitted by MiFID II (the

"EU Target Market Assessment" and, together with the UK Target

Market Assessment, the "Target Market Assessments").

Notwithstanding the Target Market Assessments, distributors

should note that: the price of the Placing Shares may decline and

investors could lose all or part of their investment; the Placing

Shares offer no guaranteed income and no capital protection; and an

investment in the Placing Shares is compatible only with investors

who do not need a guaranteed income or capital protection, who

(either alone or in conjunction with an appropriate financial or

other adviser) are capable of evaluating the merits and risks of

such an investment and who have sufficient resources to be able to

bear any losses that may result therefrom. The Target Market

Assessments are without prejudice to the requirements of any

contractual, legal or regulatory selling restrictions to the

Placing. Furthermore, it is noted that, notwithstanding the Target

Market Assessments, the Joint Bookrunners will only procure

investors who meet the criteria of professional clients or eligible

counterparties.

For the avoidance of doubt, the Target Market Assessments do not

constitute: (a) an assessment of suitability or appropriateness for

the purposes of COBS (for the purposes of the UK Target Market

Assessment) or MiFID II (for the purposes of the EU Target Market

Assessment); or (b) a recommendation to any investor or group of

investors to invest in, or purchase, or take any other action

whatsoever with respect to the Placing Shares.

Each distributor is responsible for undertaking its own target

market assessment in respect of the Placing Shares and determining

appropriate distribution channels.

Notification and public disclosure of transactions by persons

discharging managerial responsibilities and persons closely

associated with them.

Details of the person discharging managerial responsibilities/person

1 closely associated

a. Name Lorna Blaisse

------------------------------------------------------

Reason for notification

2

----------------------------- ------------------------------------------------------

a. Position/Status Chief Executive Officer

----------------------------- ------------------------------------------------------

b. Initial notification/ Initial

Amendment

----------------------------- ------------------------------------------------------

Details of the issuer, emission allowance market participant,

3 auction platform, auctioneer or auction monitor

-------------------------------------------------------------------------------------

a. Name Helium One Global Limited

-----------------------------

b. LEI 213800J96OQKNQZ60

----------------------------- ------------------------------------------------------

Details of the transaction(s): section to be repeated for

4 (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions have

been conducted

---- -------------------------------------------------------------------------------------

a. Description of Ordinary Shares of nil par value each

the financial instrument,

type of instrument

ISIN: VGG4392T1075

Identification

Code

----------------------------- ------------------------------------------------------

b. Nature of the transaction Subscription for ordinary shares

----------------------------- ------------------------------------------------------

c. Price(s) and volume(s) Price(s) Volume(s)

----------------------------- ------------

6p 133,333

------------ ------------

d. Aggregated information N/A

- Aggregated Volume

- Price

----------------------------- ------------------------------------------------------

e. Date of the transaction 7 September 2023

----------------------------- ------------------------------------------------------

f. Place of the transaction AIMX

----------------------------- ------------------------------------------------------

Details of the person discharging managerial responsibilities/person

1 closely associated

a. Name Sarah Cope

------------------------------------------------------

Reason for notification

2

----------------------------- ------------------------------------------------------

a. Position/Status Non-Executive Director

----------------------------- ------------------------------------------------------

b. Initial notification/ Initial

Amendment

----------------------------- ------------------------------------------------------

Details of the issuer, emission allowance market participant,

3 auction platform, auctioneer or auction monitor

-------------------------------------------------------------------------------------

a. Name Helium One Global Limited

-----------------------------

b. LEI 213800J96OQKNQZ60

----------------------------- ------------------------------------------------------

Details of the transaction(s): section to be repeated for

4 (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions have

been conducted

---- -------------------------------------------------------------------------------------

a. Description of Ordinary Shares of nil par value each

the financial instrument,

type of instrument

ISIN: VGG4392T1075

Identification

Code

----------------------------- ------------------------------------------------------

b. Nature of the transaction Subscription for ordinary shares

----------------------------- ------------------------------------------------------

c. Price(s) and volume(s) Price(s) Volume(s)

----------------------------- ------------ ------------

6p 83,333

------------ ------------

d. Aggregated information N/A

- Aggregated Volume

- Price

----------------------------- ------------------------------------------------------

e. Date of the transaction 7 September 2023

----------------------------- ------------------------------------------------------

f. Place of the transaction AIMX

----------------------------- ------------------------------------------------------

Details of the person discharging managerial responsibilities/person

1 closely associated

a. Name James Smith

------------------------------------------------------

Reason for notification

2

----------------------------- ------------------------------------------------------

a. Position/Status Non-Executive Director

----------------------------- ------------------------------------------------------

b. Initial notification/ Initial

Amendment

----------------------------- ------------------------------------------------------

Details of the issuer, emission allowance market participant,

3 auction platform, auctioneer or auction monitor

-------------------------------------------------------------------------------------

a. Name Helium One Global Limited

-----------------------------

b. LEI 213800J96OQKNQZ60

----------------------------- ------------------------------------------------------

Details of the transaction(s): section to be repeated for

4 (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions have

been conducted

---- -------------------------------------------------------------------------------------

a. Description of Ordinary Shares of nil par value each

the financial instrument,

type of instrument

ISIN: VGG4392T1075

Identification

Code

----------------------------- ------------------------------------------------------

b. Nature of the transaction Subscription for ordinary shares

----------------------------- ------------------------------------------------------

c. Price(s) and volume(s) Price(s) Volume(s)

----------------------------- ------------

6p 83,333

------------ ------------

d. Aggregated information N/A

- Aggregated Volume

- Price

----------------------------- ------------------------------------------------------

e. Date of the transaction 7 September 2023

----------------------------- ------------------------------------------------------

f. Place of the transaction AIMX

----------------------------- ------------------------------------------------------

Details of the person discharging managerial responsibilities/person

1 closely associated

a. Name Russel Swarts

------------------------------------------------------

Reason for notification

2

----------------------------- ------------------------------------------------------

a. Position/Status Non-Executive Director

----------------------------- ------------------------------------------------------

b. Initial notification/ Initial

Amendment

----------------------------- ------------------------------------------------------

Details of the issuer, emission allowance market participant,

3 auction platform, auctioneer or auction monitor

-------------------------------------------------------------------------------------

a. Name Helium One Global Limited

-----------------------------

b. LEI 213800J96OQKNQZ60

----------------------------- ------------------------------------------------------

Details of the transaction(s): section to be repeated for

4 (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions have

been conducted

---- -------------------------------------------------------------------------------------

a. Description of Ordinary Shares of nil par value each

the financial instrument,

type of instrument

ISIN: VGG4392T1075

Identification

Code

----------------------------- ------------------------------------------------------

b. Nature of the transaction Subscription for ordinary shares

----------------------------- ------------------------------------------------------

c. Price(s) and volume(s) Price(s) Volume(s)

----------------------------- ------------

6p 100,000

------------ ------------

d. Aggregated information N/A

- Aggregated Volume

- Price

----------------------------- ------------------------------------------------------

e. Date of the transaction 7 September 2023

----------------------------- ------------------------------------------------------

f. Place of the transaction AIMX

----------------------------- ------------------------------------------------------

Details of the person discharging managerial responsibilities/person

1 closely associated

a. Name Nigel Friend

------------------------------------------------------

Reason for notification

2

----------------------------- ------------------------------------------------------

a. Position/Status Non-Executive Director

----------------------------- ------------------------------------------------------

b. Initial notification/ Initial

Amendment

----------------------------- ------------------------------------------------------

Details of the issuer, emission allowance market participant,

3 auction platform, auctioneer or auction monitor

-------------------------------------------------------------------------------------

a. Name Helium One Global Limited

-----------------------------

b. LEI 213800J96OQKNQZ60

----------------------------- ------------------------------------------------------

Details of the transaction(s): section to be repeated for

4 (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions have

been conducted

---- -------------------------------------------------------------------------------------

a. Description of Ordinary Shares of nil par value each

the financial instrument,

type of instrument

ISIN: VGG4392T1075

Identification

Code

----------------------------- ------------------------------------------------------

b. Nature of the transaction Subscription for ordinary shares

----------------------------- ------------------------------------------------------

c. Price(s) and volume(s) Price(s) Volume(s)

----------------------------- ------------

6p 83,333

------------ ------------

d. Aggregated information N/A

- Aggregated Volume

- Price

----------------------------- ------------------------------------------------------

e. Date of the transaction 7 September 2023

----------------------------- ------------------------------------------------------

f. Place of the transaction AIMX

----------------------------- ------------------------------------------------------

Details of the person discharging managerial responsibilities/person

1 closely associated

a. Name Graham Jacobs

------------------------------------------------------

Reason for notification

2

----------------------------- ------------------------------------------------------

a. Position/Status Finance and Commercial Director

----------------------------- ------------------------------------------------------

b. Initial notification/ Initial

Amendment

----------------------------- ------------------------------------------------------

Details of the issuer, emission allowance market participant,

3 auction platform, auctioneer or auction monitor

-------------------------------------------------------------------------------------

a. Name Helium One Global Limited

-----------------------------

b. LEI 213800J96OQKNQZ60

----------------------------- ------------------------------------------------------

Details of the transaction(s): section to be repeated for

4 (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions have

been conducted

---- -------------------------------------------------------------------------------------

a. Description of Ordinary Shares of nil par value each

the financial instrument,

type of instrument

ISIN: VGG4392T1075

Identification

Code

----------------------------- ------------------------------------------------------

b. Nature of the transaction Subscription for ordinary shares

----------------------------- ------------------------------------------------------

c. Price(s) and volume(s) Price(s) Volume(s)

----------------------------- ------------

6p 133,333

------------ ------------

d. Aggregated information N/A

- Aggregated Volume

- Price

----------------------------- ------------------------------------------------------

e. Date of the transaction 7 September 2023

----------------------------- ------------------------------------------------------

f. Place of the transaction AIMX

----------------------------- ------------------------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCEASNXEDSDEEA

(END) Dow Jones Newswires

September 07, 2023 02:00 ET (06:00 GMT)

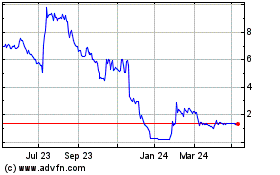

Helium One Global (LSE:HE1)

Historical Stock Chart

From Nov 2024 to Dec 2024

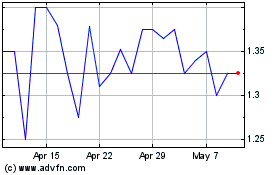

Helium One Global (LSE:HE1)

Historical Stock Chart

From Dec 2023 to Dec 2024