Herald Investment Trust PLC Statistics and Performance Report (8466Q)

June 08 2018 - 10:53AM

UK Regulatory

TIDMHRI

RNS Number : 8466Q

Herald Investment Trust PLC

08 June 2018

HERALD INVESTMENT TRUST

STATISTICS AND PERFORMANCE REPORT

Performance

At inception At since Performance Performance

31

16 February May 30 April YTD (%) since inception

1994 2018 2018 (%) (%)

------------------------- ------------- ------ ------- ------------ ------------ ---------------- ---

NAV (p) excl accrued

income 98.7 p* 1490.5 p +5.9% +8.5% +1410.2%

------------- ------ ------- ------------ ------------ ---------------- ---

NAV (p) incl accrued

income 98.7 p* 1490.4 p +5.9% +8.4% +1505.8% **

------------------------- ------------- ------ ------- ------------ ------------ ---------------- ---

Numis SC + AIM

(capital gains ex

I.T.) 1750.0 5929.8 +0.8% -1.2% +238.8%

------------- ------ ------- ------------ ------------ ---------------- ---

Russell 2000 Technology

Index (capital gains

in Sterling terms) 673.8 *** 2866.4 +12.0% +15.6% +325.4%

------------------------- ------------- ------ ------- ------------ ------------ ---------------- ---

Share price 90.9 p**** 1305.0 p +5.7% +11.4% +1335.6%

------------------------- ------------- ------ ------- ------------ ------------ ---------------- ---

Premium/(Discount) to NAV (excl accrued income)/share

as at 31st May 2018 (12.4)%

---

UK Equity Portfolio as a % of Net Asset

Value at 31st May 2018***** 56.9%

--------------------------------------------------------- ------------ ------------ ---------------- ---

Overseas Equity Portfolio as a % of

Net Asset Value at 31st May 2018 33.6%

---------------- ---

(Gearing)/Cash as a % of Net Asset

Value at 31st May 2018****** 9.5%

--------------------------------------------------------- ------------ ------------ ---------------- ---

Number of Equity Holdings

at 31st May 2018 283

---------------------------------------- ------ ------- ------------ ------------ ---------------- ---

*100p was the subscription

price before launch costs

of 1.3p

** Total return (in percentage terms)

on 100p invested at inception excluding

warrant.

***Value shown is from 31/03/1996 the

date funds were first available for

international investment.

****90.9p is CGT base subscription price for shareholders

adjusting for warrants which were issued on a 1

for 5 basis.

*****Includes 4 convertible bonds

and 1 convertible preference share.

****** Gearing is total assets (including all debt used for investment

purposes) less all cash and fixed interest securities (excluding

convertibles and corporate bonds) divided by shareholders' funds.

These figures are not audited

At 31/05/2018 the Net Asset Value including current year income

was GBP1035.6m (GBP1035.7m excluding current year income). Income

is shown net of expenses.

There are 69,485,583

shares currently in

issue.

This Report has been issued on behalf of Herald Investment Trust

plc, and has been approved by Herald Investment Management Limited,

its investment manager. Herald Investment Management Limited is

authorised and regulated by the Financial Conduct Authority. You

should remember that past performance is not necessarily a guide

to the future. Markets and currency movements may cause the value

of shares, and the income from them, to fall as well as rise,

and you may get back less than you invested when you decide to

sell your shares.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCSSFFIAFASEIM

(END) Dow Jones Newswires

June 08, 2018 11:53 ET (15:53 GMT)

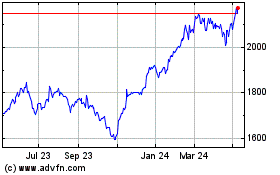

Herald Investment (LSE:HRI)

Historical Stock Chart

From Apr 2024 to May 2024

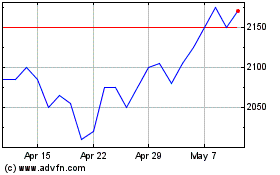

Herald Investment (LSE:HRI)

Historical Stock Chart

From May 2023 to May 2024