TIDMHRN

RNS Number : 3572U

Hornby PLC

23 November 2023

23 November 2023

HORNBY ANNOUNCES INTERIM RESULTS

Hornby Plc ("Hornby"), the international hobby products Group,

today announces its unaudited interim results for the six months

ended 30 September 2023.

Interim Results Highlights

Financial

- Group revenue of GBP23.8 million (2022: GBP22.4 million) an increase of 6% on prior year

- Underlying Operating Group loss before tax* of GBP4.2 million (2022: loss of GBP1.5 million)

- Statutory loss before taxation for the period of GBP5.1

million (2022: loss of GBP2.9 million)

- Net debt GBP14.6 million (September 2022: Net debt GBP4.9 million)

* Stated before exceptional items, FX, share based payment and

amortisation of intangibles.

Operational

- New senior team in place, including a Chief Marketing Officer

(ex Lego) and a Group Sales Director (ex Mattel)

- Launch of our first retail experience under the name The

WonderWorks ( www.wonderworksmargate.co.uk )

- Continued revenue growth in the digital channel, up +30% YOY

- Further progress made on driving price down on select products, through further supply chain diversification into India.

Olly Raeburn, Hornby Chief Executive, commented:

"In a year of structural, strategic and operational change, we

are starting to see critical improvements in many areas of the

business. Whilst topline revenue is growing, and remains in line

with management guidance for the full year, there is a cost

increase associated with what's being implemented. We head into the

key Christmas trading period with a strong order book, a full

calendar of promotional activity and a strong team in place. Whilst

we do not expect the full benefits of this year's initiatives to

take effect until the next financial year, I remain excited about

the progress being made and look forward to seeing the impact of

these changes over the next 12 months."

-ends-

23 November 2023

Enquiries:

Hornby plc

Olly Raeburn, CEO 01843 233 500

Kirstie Gould, CFO

Liberum

Andrew Godber 020 3100 2222

Edward Thomas

Miquela Bezuidenhoudt

Hornby Plc ("Hornby" or "the Group")

INTERIM REPORT FOR THE SIX MONTHSED 30 SEPTEMBER 2023

CEO Statement

In my letter to shareholders as part of the Annual Report that

was released in June, I highlighted a number of key areas of focus

for the remainder of this financial year. To accompany these half

year results, I shall talk to progress made in some of those areas,

as well as referencing the changes we have made from a key

personnel perspective.

Brand and Strategy

I shared details of the Brand Positioning work we had undertaken

in the early part of the year, identifying 'Building Happiness' as

the core proposition for Hornby, with our Mission being 'To build a

happier world for all of us'. These two organising thoughts have

become integrated into our product and communications planning this

year and, more importantly, are a fundamental component of the FY24

strategy and planning process.

Beyond the proposition work, a key part of my vision for the

future sees the Group being organised to give greater individuality

to the brands, and that process is already underway. It's an

evolutionary transformation that should see the brands, which have

different audiences, develop in different ways and at different

rates.

Ultimately, we will see the structure of the Group evolve from a

traditional corporate hierarchy, towards a confederation of

semi-autonomous, brand-focused, business units. This approach will

give those at the coal face greater autonomy, accountability and

capacity to obsess about the brands and how to drive growth in

distinctive ways.

Significant progress has been made during the last quarter, and

we expect to start implementing change before the end of the

current financial year, allowing us to see the associated benefits

come through from the start of the next one.

Product Development and Merchandising

One of the challenges we were facing as we exited the last

financial year was a significant stock holding on account of a

combination of over-commitment and under performance in the second

half of last year. We committed to improving our analysis of stock

performance and inventory management, and to reduce the volume of

aged stock in the business, whilst protecting brand value by

avoiding aggressive discounting.

Our approach to inventory management is evolving, but we will

not see the impact and benefit of that until the second half of the

next financial year when the decisions made in the last 6 months

flow through.

Whilst we materially reduced forward inventory orders at the

start of the year, the lead times in our supply chain mean we are

still receiving product from the orders placed between 12 and 18

months ago. This unavoidable reality, combined with the normal

stock build for forthcoming peak trading, means that our overall

stock holding in the business at the half year, remains at similar

levels to the start of the year. That said, we have reduced the

amount of stock aged more than 12 months, that we held at 31(st)

March, by 18%, through effective promotional activity and close

management of key existing retailer relationships.

Additionally, we have opened up new channels through rekindling

some lapsed relationships with valuable National retailers, and

adding additional, sector specific, independent retailers to our

portfolio. That said, as we hit the half year, our inventory

position still remains high on account of the natural stock build

ahead of peak trading.

Entry Level Product and Pricing

Having identified a clear opportunity to present some of our

product at more accessible prices, we have undertaken a number of

workstreams in this area. We have developed some prototype

entry-level priced Hornby train sets and Scalextric sets that were

well received when presented to potential buyers at the New York

Toy Fair at the end of September. We are continuing to develop this

initiative through gleaning end-consumer feedback and further buyer

input.

Additionally, we have now moved production of the majority of

our Quickbuild product from the UK to India where we will see

significant savings, enabling us to present this high-potential

range at a much more attractive price point from the end of the

current financial year.

Data, Loyalty and CRM

In the Annual Report I talked about our desire to use

pre-existing data to start to build better relationships with our

customers, based on their preferences and their behaviours. Since

then, through our Customer Loyalty Lead, we have been able to build

a view of previous browsing and transaction history to create a

series of automated CRM / email journeys to drive consideration and

purchase.

Launched in August, these programmes are running in the

background and created cGBP100K of incremental revenue in their

first six weeks. This is just the beginning and we are increasing

the number of 'live' journeys to ensure this revenue stream

continues to grow, adding value and contribution on an ongoing

basis.

As our understanding of customer behaviour deepens, so too will

the volume and impact of the automated CRM journeys that will

continue to run in the background, supporting our BAU customer

development activities.

Customer Experience and Retail

One of the first outward manifestations of the new strategy at

Hornby is the opening of The

WonderWorks in Margate ( www.wonderworksmargate.co.uk ) on the

site of the old Hornby Visitors' Centre. Our first experiential

site is set over 11,000 sq ft of engaging and immersive space,

comprising an exhibit, a large retail space and a café.

This is our first experiential site that hosts all the hobbies

and products of the Group, including Warlord Games. Many new

concepts are being trialled for the first time, and once we have

learned lessons from this site, and assuming it is successful, we

aim to develop more sites in the future.

We opened the doors to The WonderWorks in Margate on 30(th)

October and, whilst it's early days, we have

consistently seen close to 100% increases in revenues from the

site, versus the same period last year through the Hornby Visitors'

Centre.

As evidenced in the progress we're making with Data, Loyalty and

CRM, we want to develop deeper, more

insight driven, direct relationships with our existing and

potential customers; The WonderWorks is another way in which we can

begin do that, and early reactions give us high hopes for its

success.

People Changes

Much of what I have described above represents a new direction

for Hornby, and a critical contributing factor to our future

success relies on us having the right people in key roles. With the

departures of Simon Kohler (Marketing and Development Director) and

Tim Mulhall (COO) earlier in the year, we have invested in a

handful of high calibre, senior, individuals to help drive the new

strategy forward, including;

-- Chief Marketing Officer (ex Lego)

-- Group Sales Director (ex Mattel)

-- Head of Export Sales (ex WHSmith)

-- Head of Research and Insight (ex Lego)

With a stronger and more diverse senior team in place we are

already starting to see the impact of new strategies for improving

performance, albeit the benefits will accelerate and truly start to

flow through into the next financial year.

Digital Update

Direct sales via our website continue to increase, with a

year-on-year uplift of more than 30% in the first two quarters of

2023/24. I expect this increase to continue to accelerate into the

second half of our financial year.

Q1 Q2 Q3 Q4

2018/19 GBP301,100 GBP479,767 GBP582,434 GBP362,688

------------------- ------------------- ------------------- -------------------

2019/20 GBP426,382 GBP497,494 GBP731,252 GBP638,260

------------------- ------------------- ------------------- -------------------

2020/21 GBP1,222,578 GBP1,169,936 GBP1,574,834 GBP976,711

------------------- ------------------- ------------------- -------------------

2021/22 GBP849,782 GBP1,038,172 GBP2,128,918 GBP1,687,916

------------------- ------------------- ------------------- -------------------

2022/23 GBP1,389,736 GBP1,519,917 GBP2,834,467 GBP2,863,283

------------------- ------------------- ------------------- -------------------

2023/24 GBP1,787,510 GBP1,981,956

------------------- ------------------- ------------------- -------------------

In addition to a general improvement in performance, we are also

seeing the benefits of bringing more digital capability in-house

and relying less on external agency support. This not only allows

us to be more agile and responsive but also upskills the

organisation, making us better fit for future growth.

Outlook

As with the 2022/2023 financial year, we expect profitability to

be depressed in 2023/2024 as we restructure the business and make

necessary investments in people and processes. We certainly expect

2023/2024 to show improvement at the topline, and our guidance of

'high single digit / low double digit revenue growth' remains

unchanged. It is from next year onwards that we are targeting a

return to profitability as the restructuring improves efficiencies

and margins on continued increasing revenues.

As far as current trading and the outlook for the second half of

the year are concerned, our order book is strong and although, like

everyone, we are seeing the ramp up into Christmas trade coming

later than in previous years, we are starting to see some

encouraging increases in performance. We have a stronger calendar

of seasonal promotional activities than in previous years and are

operating in a far more joined up way in execution, so remain

positive about the potential for the coming months.

A more comprehensive analysis of the year will be given in the

January 2024 trading update.

Financial review

Performance

Group revenue for the six months to September 2023 of GBP23.8

million was 6% higher than the prior year (2022: GBP22.4 million).

The gross margin for the period was 44% (2022: 48%), a slight

decrease reflecting the product/channel mix in the first half of

2023 compared to prior year and increased tooling amortisation

costs.

Underlying overheads increased year-on-year from GBP12.5 million

to GBP14.6 million, or by 17%, reflecting an increase in minimum

wages, general inflationary increases and increased focus on direct

selling routes and e-commerce costs including personnel.

The operating loss before exceptional costs (including IFRS 16)

for the six months to September 2023 was GBP4.3 million compared to

a loss of GBP2.6 million for the same period last year. This is due

to the increased overheads as mentioned above and changes to senior

staff within sales and marketing and associated costs.

Exceptional costs during the first half year were GBP0.05

million (2022: GBP0.2 million) and these comprised of one-off costs

relating to the departure of 2 senior executives.

Group loss before tax was GBP5.1 million (2022: loss of GBP2.9

million). The basic loss per share was 3.00p (2022: loss per share

of 1.29p).

Segmental analysis

Third party revenue for the UK business increased by 4% in the

period and generated a loss before taxation of GBP5.0 million

compared to GBP2.3 million loss last year. Revenue for the first

half of 2023 has increased slightly compared with the same period

last year due to the increase in sales direct to consumers.

The International segment revenue decreased by 17% in the period

and generated an underlying loss of GBP0.1 million (2022: GBP0.6

million loss). The decrease in revenue is a result of the global

cost of living crisis impacting European markets..

Balance sheet

Group inventories increased during the period by 13% from

GBP21.3 million at March 2023 to GBP24.1 million at September 2023,

due to a seasonal build-up of stocks in the lead-up to the busy

Christmas trading period.

Trade & other receivables and Trade & other payables are

higher than the start of the year due to seasonality of the

business.

Investment in new tooling, new computer software and other

capital expenditure was GBP2.9 million (2022: GBP1.9 million).

Capital structure

There was an increase in net debt compared to 31 March 2023. The

September period end net debt balance stood at GBP14.8 million,

from GBP5.5 million of net debt at the end of the last financial

year. This is due to the operational cash outflow in the business,

purchase of 25% stake in Warlord Games Limited which was announced

on 7 July 2023, spending on stocks and tooling ahead of Christmas

trading as budgeted and increased overheads as we continue to

invest in people and technology. Headroom at 30 September 2023 was

GBP5 million.

Going concern

The Group has in place a GBP12.0 million Asset Based Lending

(ABL) facility with Secure Trust Bank Limited (STB) through to

October 2024. The STB Covenants are customary operational covenants

applied on a monthly basis. In addition, the Group has a committed

GBP11.25 million loan facility with Phoenix Asset Management

Partners Limited (the Group's largest shareholder) which runs

through to December 2024. The Group also carries a Covid Business

Interruption Loan (CBIL) liability as a result of the acquisition

of LCD Enterprises Limited on 30 July 2021. Balance at 30 September

2023 is GBP142,000.

The Group has prepared trading and cash flow forecasts for a

period of three years, which have been reviewed and approved by the

Board. On the basis of these forecasts, and after a detailed review

of trading, financial position and cash flow models the Directors

have a reasonable expectation that the Group and Company have

adequate resources to continue in operational existence for the

foreseeable future. For these reasons, they continue to adopt the

going concern basis of accounting in preparing the financial

statements.

STATEMENT OF COMPREHENSIVE INCOME

for the six months ended 30 September 2023

Six months Six months Year

to to to

30 September 30 September 31 March

2023 2022 2023

(unaudited) (unaudited) (audited)

Notes GBP'000 GBP'000 GBP'000

REVENUE 4 23,794 22,410 55,105

Cost of Sales (13,368) (11,683) (28,166)

------------- ------------- ------------

GROSS PROFIT 10,426 10,727 26,939

Distribution costs (3,988) (3,833) (8,196)

Selling and marketing

costs (6,487) (5,003) (11,448)

Administrative expenses (4,109) (4,183) (7,712)

Other operating expenses (157) (328) (653)

------------- ------------- ------------

OPERATING PROFIT/(LOSS)

BEFORE EXCEPTIONAL (4,315) (2,620) (1,070)

Exceptional Items 5 (47) (148) (3,974)

------------- ------------- ------------

OPERATING PROFIT/(LOSS) (4,362) (2,768) (5,044)

Finance income 11 4 11

Finance costs (725) (122) (843)

------------- ------------- ------------

Net finance costs (714) (118) (832)

Share of profit of investments (2) - -

accounted for using the

equity method

PROFIT/(LOSS) BEFORE

TAXATION 4 (5,078) (2,886) (5,876)

Taxation 13 (14) 87 (46)

------------- ------------- ------------

PROFIT/(LOSS) FOR THE

PERIOD AFTER TAXATION (5,092) (2,799) (5,922)

OTHER COMPREHENSIVE INCOME/(LOSS)

(Items that may be classified

subsequently to profit

and loss)

Cash flow hedges 794 793 (932)

Currency translation

differences 48 441 161

------------- ------------- ------------

OTHER COMPREHENSIVE INCOME/(LOSS)

FOR THE PERIOD, NET OF

TAX 842 1,234 (771)

------------- ------------- ------------

TOTAL COMPREHENSIVE LOSS

FOR THE PERIOD (4,250) (1,565) (6,693)

============= ============= ============

Comprehensive income

attributable to:

Equity holders of the

Company (4,234) (1,544) (6,676)

Non-controlling interests (16) (21) (17)

(LOSS)/PROFIT PER ORDINARY

SHARE

Basic (3.00)p (1.29)p (3.50)p

Diluted (3.00)p (1.29)p (3.50)p

============= ============== ============

All of the activities of the Group are continuing. The notes

form an integral part of this condensed consolidated half-yearly

financial information.

BALANCE SHEET

As at 30 September 2023

Six months Six months Year to

to to

30 September 30 September 31 March

2023 2022 2023

(unaudited) (unaudited) (audited)

Notes GBP'000 GBP'000 GBP'000

ASSETS

NON-CURRENT ASSETS

Goodwill 6 1,731 4,647 1,732

Intangible assets 6 2,724 3,097 2,986

Investment 7 1,437 - -

Property, plant and equipment 6 13,786 10,477 12,041

Right of Use Lease Asset 8 2,144 2,484 2,087

Deferred income tax assets 3,571 3,423 3,571

------------- ------------- ----------

25,393 24,128 22,417

CURRENT ASSETS

Inventories 24,112 22,548 21,282

Trade and other receivables 9,115 9,154 9,181

Derivative financial instruments 12 256 1,808 2

Cash and cash equivalents 1,014 1,874 1,337

------------- ------------- ----------

34,497 35,384 31,802

------------- ------------- ----------

LIABILITIES

CURRENT LIABILITIES

Borrowings 11 (6,219) (5,558) (6,750)

Derivative financial instruments 12 (17) - (557)

Trade and other payables (9,509) (8,454) (8,067)

Lease liabilities (403) (450) (409)

------------- ------------- ----------

(16,148) (14,462) (15,783)

------------- ------------- ----------

NET CURRENT ASSETS 18,349 20,922 16,019

------------- ------------- ----------

NON-CURRENT LIABILITIES

Borrowings 11 (9,595) (1,252) (117)

Lease liabilities 9 (2,125) (2,213) (2,047)

Deferred tax liabilities (233) (233) (233)

------------- ------------- ----------

(11,953) (3,698) (2,397)

------------- ------------- ----------

. .

NET ASSETS 31,789 41,352 36,039

------------- ------------- ----------

SHAREHOLDERS' EQUITY

Share capital 10 1,699 1,698 1,699

Share premium 52,857 52,857 52,857

Capital redemption reserve 55 55 55

Translation reserve (1,605) (1,373) (1,653)

Hedging reserve 239 1,356 (555)

Other reserves 1,688 1,688 1,688

Retained earnings (23,123) (14,920) (18,047)

------------- ------------- ----------

Equity attibutable to PLC

shareholders 31,810 41,361 36,044

Non-controlling interests (21) (9) (5)

Total equity 31,789 41,352 36,039

------------- ------------- ----------

STATEMENT OF CHANGES IN EQUITY

for the six months ended 30 September 2023

Capital

Share Share redemption Translation Hedging Other Non-controlling Retained Total

capital premium reserve reserve reserve reserves interests earnings equity

(unaudited) (unaudited) (unaudited) (unaudited) (unaudited) (unaudited) (unaudited) (unaudited) (unaudited)

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at

1 April 2023 1,699 52,857 55 (1,653) (555) 1,688 (5) (18,047) 36,039

Profit for the

period - - - - - - (16) (5,076) (5,092)

Other

comprehensive

income/(loss)

for the

period - - - 48 794 - - - 842

------------ ------------ ------------ ------------ ------------ ------------ ---------------- ------------ ------------

Total

comprehensive

loss for the

period - - - 48 794 - (16) (5,076) (4,250)

------------ ------------ ------------ ------------ ------------ ------------ ---------------- ------------ ------------

Balance at

30 September

2023 1,699 52,857 55 (1,605) 239 1,688 (21) (23,123) 31,789

============ ============ ============ ============ ============ ============ ================ ============ ============

Balance at

1 April 2022 1,669 52,857 55 (1,814) 377 1,688 12 (11,734) 43,110

Profit for the

period - - - - - - (21) (2,778) (2,799)

Other

comprehensive

income/(loss)

for the

period - - - 441 979 - - - 1,420

------------ ------------ ------------ ------------ ------------ ------------ ---------------- ------------ ------------

Total

comprehensive

loss for the

period - - - 441 979 - (21) (2,778) (1,379)

------------ ------------ ------------ ------------ ------------ ------------ ---------------- ------------ ------------

Transactions -

with owners

Share based

payments 29 - - - - - - (408) (379)

------------ ------------ ------------ ------------ ------------ ------------ ---------------- ------------ ------------

Total

transactions

with owners 29 (408) (379)

------------ ------------ ------------ ------------ ------------ ------------ ---------------- ------------ ------------

Balance at

30 September

2022 1,698 52,857 55 (1,373) 1,356 1,688 (9) (14,920) 41,352

============ ============ ============ ============ ============ ============ ================ ============ ============

The notes form an integral part of this condensed consolidated

half-yearly financial information.

STATEMENT OF CASH FLOWS

for the six months ended 30 September 2023

Six months Six months Year to

to to

30 September 30 September 31 March

Note 2023 2022 2023

-------------------------------------------- -----

GBP'000 GBP'000 GBP'000

-------------------------------------------- ----- ------------- ------------- ---------

Loss before taxation (5,078) (2,886) (5,875)

-------------------------------------------- ----- ------------- ------------- ---------

Interest payable 653 43 322

-------------------------------------------- ----- ------------- ------------- ---------

Interest paid on Lease liabilities 9 72 79 153

-------------------------------------------- ----- ------------- ------------- ---------

Interest receivable (11) (4) (11)

-------------------------------------------- ----- ------------- ------------- ---------

Share of profit of Minority Interest 2 - -

-------------------------------------------- ----- ------------- ------------- ---------

Amortisation of intangible assets 288 259 553

-------------------------------------------- ----- ------------- ------------- ---------

Impairment of Goodwill - - 2,915

-------------------------------------------- ----- ------------- ------------- ---------

Depreciation 1,819 1,311 2,762

-------------------------------------------- ----- ------------- ------------- ---------

Depreciation on right of use assets 8 243 267 528

-------------------------------------------- ----- ------------- ------------- ---------

Share-based payments (non cash) - 532 532

-------------------------------------------- ----- ------------- ------------- ---------

Share-based payments (cash) - (919) (940)

-------------------------------------------- ----- ------------- ------------- ---------

Decrease / (increase) in inventories (2,799) (5,700) (4,680)

-------------------------------------------- ----- ------------- ------------- ---------

Decrease / (increase) in trade and

other receivables 225 (199) (373)

-------------------------------------------- ----- ------------- ------------- ---------

(Decrease) / increase in trade and

other payables 1,301 634 733

-------------------------------------------- ----- ------------- ------------- ---------

Cash flows from operating activities (3,285) (6,583) (3,381)

-------------------------------------------- ----- ------------- ------------- ---------

Interest paid (653) (43) (322)

-------------------------------------------- ----- ------------- ------------- ---------

Interest element of ROU lease payments (72) (79) (153)

-------------------------------------------- ----- ------------- ------------- ---------

Net cash (used in)/generated from

operating activities (4,010) (6,705) (3,856)

-------------------------------------------- ----- ------------- ------------- ---------

Cash flows from investing activities

-------------------------------------------- ----- ------------- ------------- ---------

Purchase of business 7 (1,439) - -

-------------------------------------------- ----- ------------- ------------- ---------

Purchase of property, plant and equipment 6 (3,562) (1,720) (4,744)

-------------------------------------------- ----- ------------- ------------- ---------

Purchase of intangible assets 6 (25) (168) (351)

-------------------------------------------- ----- ------------- ------------- ---------

Interest received 11 4 11

-------------------------------------------- ----- ------------- ------------- ---------

Net cash (used in)/generated from

investing activities (5,015) (1,884) (5,084)

-------------------------------------------- ----- ------------- ------------- ---------

Cash flows from financing activities

-------------------------------------------- ----- ------------- ------------- ---------

Proceeds from issuance of ordinary

shares - 30 30

-------------------------------------------- ----- ------------- ------------- ---------

Repayment of CBIL loan (50) (25) (50)

-------------------------------------------- ----- ------------- ------------- ---------

Proceeds from Asset Based Lending

Facility 1,579 5,508 4,590

-------------------------------------------- ----- ------------- ------------- ---------

Shareholder Loan 7,418 1,000 2,000

-------------------------------------------- ----- ------------- ------------- ---------

Payment of lease liabilities (228) (248) (460)

-------------------------------------------- ----- ------------- ------------- ---------

Net cash generated from/(used in)

financing activities 8,719 6,265 6,110

-------------------------------------------- ----- ------------- ------------- ---------

Net (decrease)/increase in cash

and cash equivalents (306) (2,324) (2,830)

-------------------------------------------- ----- ------------- ------------- ---------

Cash, cash equivalents and bank overdrafts

at beginning of the year 1,337 4,139 4,139

-------------------------------------------- ----- ------------- ------------- ---------

Effect of exchange rate movements (17) 59 28

-------------------------------------------- ----- ------------- ------------- ---------

Cash, cash equivalents and bank

overdrafts at end of year 1,014 1,874 1,337

-------------------------------------------- ----- ------------- ------------- ---------

Cash, cash equivalents and bank

overdrafts consist of:

-------------------------------------------- ----- ------------- ------------- ---------

Cash and cash equivalents 1,014 1,874 1,337

-------------------------------------------- ----- ------------- ------------- ---------

Cash, cash equivalents and bank

overdrafts at end of year 1,014 1,874 1,337

-------------------------------------------- ----- ------------- ------------- ---------

The notes form an integral part of this condensed consolidated

half-yearly financial information.

NOTES TO CONDENSED CONSOLIDATED HALF-YEARLY FINANCIAL REPORT

1. 1. GENERAL INFORMATION

The Company is a public limited liability company incorporated

and domiciled in the UK. The address of the registered office is

Enterprise Road, Westwood Industrial Estate, Margate, CT9 4JX. The

Group is principally engaged in the development, design, sourcing

and distribution of hobby and interactive home entertainment

products.

The Company has its primary listing on the Alternative

Investment Market and is registered in England No. 01547390.

This condensed consolidated half-yearly financial information

was approved for issue on 22 November 2023.

This condensed consolidated half-yearly financial information

does not comprise statutory accounts within the meaning of Section

434 of the Companies Act 2006 and is unaudited. Statutory accounts

for the year ended 31 March 2023 were approved by the Board of

Directors on 21 June 2023 and delivered to the Registrar of

Companies. The Report of the Auditors on those accounts was

unqualified and did not contain any statement under Section 498 of

the Companies Act 2006.

Forward Looking Statements

Certain statements in this half-yearly report are

forward-looking. Although the Group believes that the expectations

reflected in these forward-looking statements are reasonable, we

can give no assurance that these expectations will prove to be

correct. Because these statements involve risks and uncertainties,

actual results may differ materially from those expressed or

implied by these forward-looking statements.

We undertake no obligation to update any forward-looking

statements whether as a result of new information, future events or

otherwise.

2. BASIS OF PREPARATION

The financial statements are presented in sterling, which is the

Parent's functional currency and the Group's presentation currency.

The figures shown in the financial statements are rounded to the

nearest thousand pounds.

This condensed consolidated half-yearly financial information

for the half-year ended 30 September 2023 has been prepared in

accordance with IAS 34 'Interim Financial Reporting'. The

half-yearly condensed consolidated financial report should be read

in conjunction with the annual financial statements for the year

ended 31 March 2023 which have been prepared in accordance with

UK-adopted international accounting standards. The consolidated

Group financial statements have been prepared on a going concern

basis and under the historical cost convention, as modified by the

revaluation of certain financial assets and liabilities (including

derivative instruments) at fair value through profit or loss.

The preparation of financial statements in conformity with IFRS

requires the use of estimates and assumptions that affect the

reported amounts of assets and liabilities at the date of the

financial statements and the reported amounts of revenues and

expenses during the reporting period. Although these estimates are

based on management's best knowledge of the amount, event or

actions, actual results ultimately may differ from those

estimates.

3. ACCOUNTING POLICIES

The accounting policies adopted are consistent with those of the

annual financial statements for the year ended 31 March 2023, as

described in those annual financial statements with the exception

of tax which is accrued using the tax rate that would be applicable

to expected total annual earnings.

Judgements and Estimates

The preparation of interim financial statements requires

management to make judgements, estimates and assumptions that

affect the application of accounting policies and the reported

amounts of assets and liabilities, income and expense. Actual

results may differ from these estimates.

In preparing this condensed consolidated half-yearly financial

report, the significant judgements made by management in applying

the Group's accounting policies and the key sources of estimation

uncertainty were the same as those that applied to the consolidated

financial statements for the year ended 31 March 2023.

Financial Instruments

The Group's activities expose it to a variety of financial

risks: market risk (including currency risk, cash flow interest

rate risk and price risk), credit risk and liquidity risk.

The condensed consolidated half-yearly financial report does not

include all financial risk management information and disclosures

required in the annual financial statements and should be read in

conjunction with the Group's annual financial statements as at 31

March 2023.

There have been no changes in the risk management policies since

year end.

The Group's financial instruments, measured at fair value, are

all classed as level 2 in the fair value hierarchy, which is

unchanged from 31 March 2023. Further details of the Group's

financial instruments are set out within note 12 of this

half-yearly report as required by IFRS 13.

4. SEGMENT INFORMATION

Operating segments are reported in a manner consistent with the

internal reporting provided to the chief operating decision-maker.

The chief operating decision-maker, who is responsible for

allocating resources and assessing performance of the operating

segments, has been identified as the Board of the Company that

makes strategic decisions.

Operating profit of each reporting segment includes revenue and

expenses directly attributable to or able to be allocated on a

reasonable basis. Segment assets and liabilities are those

operating assets and liabilities directly attributable to or that

can be allocated on a reasonable basis.

Management has determined the operating segments based on the

reports reviewed by the Board (chief operating decision-maker) that

are used to make strategic decisions.

The Board considers the business from a geographic perspective.

Geographically, management considers the performance in the UK,

USA, Spain, Italy and rest of Europe. Although these segments do

not meet the quantitative thresholds required by IFRS 8, management

has concluded that these segments should be reported, as it is

closely monitored by the chief operating decision-maker.

Total

UK USA Spain Italy Rest Intra Reportable

of Europe Group Segments

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Six months ended 30 September

2023 (unaudited)

Revenue - External 16,932 1,788 978 1,504 2,592 - 23,794

Inter-segment revenue 1,502 - - - - (1,502) -

Operating (Loss)/Profit (4,441) (248) 36 130 161 - (4,362)

Finance income - external 11 - - - - - 11

Finance income - other segments 230 - - - - - 230

Finance costs - external (719) (4) (1) (1) - - (725)

Finance costs - other segments (87) 0 (107) 0 (36) - (230)

Share of profit of investments

accounted for using the equity

method (2) - - - - - ( 2)

(Loss)/Profit before taxation (5,008) (252) (72) 129 125 - (5,078)

Taxation - - - - (14) - (14)

Profit/(Loss) after taxation (5,008) (252) (72) 129 111 - (5,092)

-------- -------- -------- -------- ----------- -------- -----------

5. EXCEPTIONAL ITEMS

Six months Six months Year to

to to

30 September 30 September 31 March

2023 2022 2023

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Exceptional items - - -

comprise:

- Refinancing costs - 149 149

- Hornby World Experience - - 910

- Goodwill impairment - - 2,915

- Restructuring costs 47 - -

47 149 3,974

------------- ------------- ----------

The exceptional items totalling GBP47,000 (2022: GBP148,000)

include restructuring costs within senior management within sales

and marketing.

6. TANGIBLE AND INTANGIBLE ASSETS AND GOODWILL

The additions comprise new product tooling (GBP2,783,000), property,

plant and equipment (GBP60,000) and intangible assets - computer

software (GBP25,000).

The Group has again performed impairment reviews as at 30 September

2023 and consider the carrying value of the assets held to be recoverable.

The discount rates and key assumptions used within the updated models

at 30 September 2023 have remained constant with the impairment reviews

conducted in March 2023.

====================================================================================

Tangible and intangible assets and goodwill Six months Six months

(unaudited) ended ended

30 September 30 September

2023 2022

GBP'000 GBP'000

Opening net book amount 1 April 2023 and

1 April 2023 16,759 17,888

Exchange adjustment 2 14

Additions 2,868 1,888

Depreciation, amortisation and impairment (2,107) (1,569)

--------------- ---------------

Closing net book amount 30 September 2023

and 30 September 2022 17,522 18,221

=============== ===============

2023 2022

CAPITAL COMMITMENTS (unaudited) (unaudited)

GBP'000 GBP'000

At 30 September commitments were:

Contracted for but not provided for 2,175 3,033

============ ============

The commitments relate to the acquisition of tooling as part of

property, plant and equipment.

7. INVESTMENTS

Interests

in associate

undertakings

at cost

GBP'000

-------------------------------------------------------- --------------

At 1 April 2023 -

Acquisition of 25% of Warlord Games Limited including

costs 1,439

Share of profit of investments accounted for using the

equity method (2)

-------------------------------------------------------- --------------

At 30 September 2023 1,437

-------------------------------------------------------- --------------

On 7 July 2023 Hornby Plc acquired a 25% share in Warlord Games

Limited for cash consideration of GBP1.25 million. Hornby has the

option to acquire a majority stake in Warlord on or around the

second anniversary of this initial acquisition and then to acquire

any remaining shares in Warlord on future anniversaries.

Warlord will continue to be managed by its existing Directors

and the Company believes that this transaction creates a number of

opportunities to accelerate growth of the business further

still.

8. RIGHT OF USE ASSETS

GROUP Property Motor Fixtures, Total

Vehicles Fittings

and Equipment

GBP'000

--------------------------------- ---------

GBP'000 GBP'000 GBP'000

--------------------------------- --------- ---------- --------------- --------

COST

--------------------------------- --------- ---------- --------------- --------

At 1 April 2023 3,757 310 22 4,089

---------------------------------- --------- ---------- --------------- --------

Additions at cost 297 3 - 300

---------------------------------- --------- ---------- --------------- --------

At 30 September 2023 4,054 313 22 4,389

---------------------------------- --------- ---------- --------------- --------

ACCUMULATED DEPRECIATION

--------------------------------- --------- ---------- --------------- --------

At 1 April 2023 1,697 287 18 2,002

---------------------------------- --------- ---------- --------------- --------

Charge 220 23 - 243

---------------------------------- --------- ---------- --------------- --------

At 30 September 2023 1 ,917 310 18 2,245

---------------------------------- --------- ---------- --------------- --------

Net book amount at 30 September

2023 2,137 3 4 2,144

---------------------------------- --------- ---------- --------------- --------

9. RIGHT OF USE LEASE LIABILITIES

The movement in the right of use lease liabilities over the

period was as follows:

2023 2022

GBP'000 GBP'000

--------------------------------------------------------- -------- --------

As at 1 April 2023 2,456 2,746

--------------------------------------------------------- -------- --------

New leases 300 166

--------------------------------------------------------- -------- --------

Interest payable 72 79

--------------------------------------------------------- -------- --------

Repayment of lease liabilities (300) (328)

--------------------------------------------------------- -------- --------

As at 30 September 2023 2,528 2,663

--------------------------------------------------------- -------- --------

Lease liability less than one year 403 450

--------------------------------------------------------- -------- --------

Lease liability greater than one year and less than five

years 677 613

--------------------------------------------------------- -------- --------

Lease liability greater than five years 1,448 1,600

--------------------------------------------------------- -------- --------

Total Liability 2,528 2,663

--------------------------------------------------------- -------- --------

Maturity analysis of contracted undiscounted cashflows is as

follows:

30 September 30 September

2023 2022

GBP'000 GBP'000

--------------------------------------------------------- ------------ ------------

Lease liability less than one year 549 601

--------------------------------------------------------- ------------ ------------

Lease liability greater than one year and less than five

years 1,143 1,048

--------------------------------------------------------- ------------ ------------

Lease liability greater than five years 1,911 2,200

--------------------------------------------------------- ------------ ------------

Total Liability 3,603 3,849

--------------------------------------------------------- ------------ ------------

Finance charges included above (1,075) (1,186)

--------------------------------------------------------- ------------ ------------

2,528 2,663

--------------------------------------------------------- ------------ ------------

10. SHARE CAPITAL

At 30 September 2023 the Group had 169,853,770 ordinary 1p

shares in issue with nominal value GBP1,698,538 (2022:

GBP1,698,538).

11. BORROWINGS

30 September 30 September 31 March

2023 2022 2023

(unaudited) (unaudited) (unaudited)

GBP'000 GBP'000 GBP'000

SECURED BORROWING AT AMORTISED

COST

CBIL Bank Loan (146) (192) (167)

Shareholder Loan (9,499) (1,110) (2,110)

ABL Facility (6,169) (5,508) (4,590)

============= ============= ============

(15,814) (6,810) (6,867)

============= ============= ============

Total borrowings

Amounts due for settlement within

12 months (6,219) (5,558) (6,750)

Amounts due for settlement after

12 months (9,595) (1,252) (117)

------------- ------------- ------------

(15,814) (6,810) (6,867)

============= ============= ============

At 30 September 2023 t he Group has in place a GBP12.0 million

Asset Based Lending (ABL) facility with Secure Trust Bank PLC

through to October 2024. The Covenants are customary operational

covenants applied on a monthly basis. The Group also has a CBIL

loan with Barclays, acquired as part of the LCD acquisition. The

CBIL payback commenced in August 2021 and finishes July 2026. In

addition, the Group has a committed GBP11.25 million loan facility

with Phoenix Asset Management Partners Limited (the Group's largest

shareholder) if it should be required. The facility currently

expires December 2024.

In the period to 30 September 2023 loan repayments were

GBP25,000 (2022: GBP25,000).

12. FINANCIAL INSTRUMENTS

The following tables present the Group's assets and liabilities

that are measured at fair value at 30 September 2023 and 31 March

2023. The table analyses financial instruments carried at fair

value, by valuation method. The different levels have been defined

as follows:

- Quoted prices (unadjusted) in active markets for identical assets or liabilities (Level 1).

- Inputs other than quoted prices included within level 1 that

are observable for the asset or liability, either directly (that

is, as prices) or indirectly (that is, derived from prices) (Level

2).

- Inputs for the asset or liability that are not based on

observable market data (that is, unobservable inputs) (Level

3).

There were no transfers or reclassifications between levels

within the period. Level 2 hedging derivatives comprise forward

foreign exchange contracts and an interest rate swap and have been

fair valued using forward exchange rates that are quoted in an

active market. The fair value of the following financial assets and

liabilities approximate their carrying amount: Trade and other

receivables, other current financial assets, cash and cash

equivalents, trade and other payables and bank overdrafts and

borrowings.

Fair values are determined by a process involving discussions

between the Group finance team and the Audit Committee which occur

at least once every 6 months in line with the Group's reporting

dates.

Level Level Level Total

1 2 3

GBP'000 GBP'000 GBP'000 GBP'000

Assets

Derivatives used for hedging - 256 - 256

---------- -------- -------- --------

Total assets as at 30

September 2023 - 256 - 256

---------- -------- -------- --------

Liabilities

Derivatives used for hedging - (17) - (17)

---------- -------- -------- --------

Total liabilities at 30

September 2023 - (17) - (17)

---------- -------- -------- --------

Level Level Level Total

1 2 3

GBP'000 GBP'000 GBP'000 GBP'000

Assets

Derivatives used for hedging - 2 - 2

---------- -------- -------- --------

Total assets at 31 March

2023 - 2 - 2

---------- -------- -------- --------

Liabilities

Derivatives used for hedging - (557) - (557)

---------- -------- -------- --------

Total liabilities at 31

March 2023 - (557) - (557)

---------- -------- -------- --------

13. TAXATION

The Group has elected not to recognise a deferred tax movement

on the half year losses at this time and there is no tax credit

associated with this in the profit and loss. There is a small

credit associated with a prior year adjustment on current taxation.

The Group has significant brought forward trading losses which can

be utilised.

14. EARNINGS/(LOSS) PER SHARE

Earnings/(loss) per share attributable to equity holders of the

Company arises from continuing operations as follows:

30 September 30 September 31 March

2023 2022 2023

(unaudited) (unaudited) (audited)

Earnings/(loss) per share from

continuing operations

attributable to the equity of the

Company

- basic (3.00)p (1.29)p (3.50)p

- diluted (3.00)p (1.29)p (3.50)p

============= ============= ==========

15. DIVIDENDS

No interim dividend has been declared for the interim period

ended 30 September 2023 (2022: GBPnil).

16. CONTINGENT LIABILITIES

The Company and its subsidiary undertakings are, from time to

time, parties to legal proceedings and claims, which arise in the

ordinary course of business. The Directors do not anticipate that

the outcome of these proceedings and claims, either individually or

in aggregate, will have a material adverse effect upon the Group's

financial position.

17. PERFORMANCE SHARE PLANS AWARDS

At 30 September 2023, there are no outstanding awards to

Directors under any PSP schemes:

18. RELATED-PARTY TRANSACTIONS

Key management compensation amounted to GBP769,000 for the six

months to 30 September 2023 (2022: GBP1,083,000). Key management

include directors and senior management. For the period to 30

September 2023:

30 September 30 September 31 March

2023 2022 2023

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Salaries and other short-term benefits 692 528 1,022

Other pension costs 32 23 47

Compensation for loss of office 45 - -

Share-based payments - 532 532

-------------------- ---------------------- -----------------

769 1,083 1,601

==================== ====================== =================

Phoenix Asset Management Partners who own the majority

shareholding in Hornby PLC have also provided a funding facility to

the Group. During the period interest fees of GBP396,426 were

accrued and remain unpaid at 30 September 2023.

Hornby Hobbies Limited purchased services totalling GBP471,808

from Rawnet Limited which is 100% owned by Phoenix Asset

Management, the controlling party of the Group. At 30 September

2023 GBP96,790 was owing to Rawnet Limited for services

rendered.

There were no other contracts with the Company or any of its

subsidiaries existing during or at the end of the financial year in

which a Director of the Company or any of its subsidiaries was

interested. There are no other related-party transactions.

19. RISKS AND UNCERTAINTIES

The Board has reviewed the principal risks and uncertainties and

have concluded that the key risks continue to be UK market

dependence, market conditions, exchange rates, supply chain,

product compliance and liquidity. The disclosures on pages 11 and

12 of the Group's Annual report for the year ended 31 March 2023

provide a description of each risk along with the associated impact

and mitigating actions. The Board will continue to focus on risk

mitigation plans to address these areas.

20. SEASONALITY

Sales are subject to seasonal fluctuations, with peak demand in

the October - December quarter. For the six months ended 30

September 2023 sales represented 43 per cent of the annual sales

for the year ended 31 March 2023 (2022: 42 per cent of the annual

sales for the year ended 31 March 2022).

21. SUBSEQUENT EVENTS

No other significant events have occurred between the end of the

reporting period and the date of signature of the Annual Report and

Accounts.

By order of the Board

Oliver Raeburn Kirstie Gould

Chief Executive Chief Finance Officer

22 November 2023

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BDBDBCSDDGXD

(END) Dow Jones Newswires

November 23, 2023 02:00 ET (07:00 GMT)

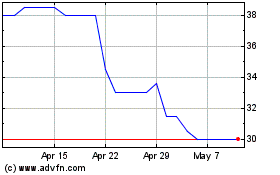

Hornby (LSE:HRN)

Historical Stock Chart

From Jan 2025 to Feb 2025

Hornby (LSE:HRN)

Historical Stock Chart

From Feb 2024 to Feb 2025