TIDMVENN

RNS Number : 7352I

Venn Life Sciences Holdings PLC

11 December 2015

The Enterprise Securities Market ("ESM") is a market designed

primarily for emerging or smaller companies to which a higher

investment risk tends to be attached than to larger or more

established companies. ESM securities are not admitted to the

Official List of the Irish Stock Exchange ("ISE"). A prospective

investor should be aware of the risks of investing in such

companies and should make the decision to invest only after careful

consideration and, if appropriate, consultation with an independent

financial adviser. Each ESM company is required pursuant to the ESM

Rules for Companies to have an ESM Adviser. The ESM Adviser is

required to make a declaration to the Irish Stock Exchange on

admission in the form set out in Schedule Two to the Rules for

Enterprise Securities Market Advisers. The Irish Stock Exchange has

not itself examined or approved the contents of this document.

VENN LIFE SCIENCES HOLDINGS PLC

ISIN GB00B9275X97

APPENDIX TO SCHEDULE ONE ANNOUNCEMENT

FURTHER INFORMATION ON VENN LIFE SCIENCES HOLDINGS PLC (THE

"COMPANY" OR "VENN") IN CONNECTION WITH ITS PROPOSED ADMISSION TO

TRADING ON ESM

This Appendix is prepared in accordance with section (k) of the

supplement to Schedule One of the ESM Rules for Companies ("ESM

Rules") published by the Irish Stock Exchange. It includes

information equivalent to that required for an admission document,

which is not currently public. The Company's Public Record can be

accessed freely on the Company's website www.vennlifesciences.com

and via RNS (the "Public Record"). This Appendix should be read in

conjunction with the Schedule One pre-admission announcement (the

"Schedule One") made by the Company at least 20 days prior to ESM

Admission and the Public Record. (This Appendix and Schedule One

together constitute "the Announcement").

The Company and the Directors of the Company (whose name appear

on page 2 of this document) (the "Directors") accept

responsibility, both collectively and individually, for all the

information contained in this document and compliance with the ESM

Rules for Companies. To the best of the knowledge and belief of the

Company and the Directors (who have taken all reasonable care to

ensure that such is the case), the information contained in this

document is in accordance with the facts and does not omit anything

likely to affect the import of such information.

Davy, who is regulated in Ireland by the Central Bank of

Ireland, has been appointed as Nominated Adviser, ESM Adviser and

Joint Broker to the Company effective from ESM Admission. Davy is

acting exclusively for the Company in connection with the ESM

Admission and is not acting for any other person and will not be

responsible to any person for providing the protections afforded to

customers of Davy or for advising any other person in connection

with the arrangements described in the Announcement. In accordance

with the ESM Rules, Davy confirms to the Irish Stock Exchange that

it has satisfied itself that the Directors have received advice and

guidance as to the nature of their responsibilities and obligations

to ensure compliance by the Company with the ESM Rules, and that,

in its opinion and to the best of its knowledge and belief, all

relevant requirements of the ESM Rules have been complied with.

Davy accepts no liability whatsoever for the accuracy of any

information or opinions contained in this document or for the

omission of any material information, for which it is not

responsible.

Copies of this document will be freely available to the public

on the Company's website from the date of this document for the

period of at least one month from ESM Admission.

1. DIRECTOR INFORMATION

1.1 Details of the Directors are set out in the table below:

Name of Director Age Position

David Evans 55 (Non-Executive

Chairman)

Anthony Richardson 51 (Chief Executive

Officer)

Jonathan Hartshorn 45 (Chief Financial

Officer)

Gracielle Anna Maria 49 (Chief Operations

Beijerbacht-Schutjens Officer)

Kees Groen 54 (Executive Director)

Michael Ryan 58 (Non-Executive

Director)

Paul Kennedy 70 (Non-Executive

Director)

1.2 Mr Groen was a member of the Advisory Board of InPEC B.V. a

Phase 1 CRO invested in by Kinesis. InPEC B.V. was liquidated on 20

April 2010.

1.3 Save as disclosed above or in the Company's Public Record, none of the Directors has:

(i) any unspent convictions in relation to indictable offences;

(ii) been made bankrupt or has made an individual voluntary

arrangement with creditors or suffered the appointment of a

receiver over any of his assets;

(iii) been a director of any company which, whilst he was such a

director or within 12 months after his ceasing to be such a

director, was put into receivership, compulsory liquidation,

creditors' voluntary liquidation, administration, company voluntary

arrangement or any composition or arrangement with the company's

creditors generally or with any class of creditors of any company

or had an administrator or an administrative or other receiver

appointed;

(iv) been a partner in any partnership which, whilst he was a

partner, or within 12 months after his ceasing to be a partner, was

put into compulsory liquidation or had an administrator or an

administrative or other receiver appointed or entered into any

partnership voluntary arrangement;

(v) had an administrative or other receiver appointed in respect

of any asset belonging either to him or to a partnership of which

he was a partner at the time of such appointment or within the 12

months preceding such appointment; or

(vi) received any public criticisms by statutory or regulatory

authorities (including recognised professional bodies) or has ever

been disqualified by a court from acting as a director of a company

or from acting in the management or conduct of the affairs of the

company.

1.4 Save as disclosed in the Company's Public Record, no

Director, nor any connected person (being any person connected with

a Director within the meaning of sections 252 to 255 of the UK

Companies Act 2006 (the "2006 Act") has at the date of this

document, or will have immediately following Admission, any

interest, whether beneficial or non--beneficial, in the share or

loan capital of the Company or any of its subsidiaries or any

related financial product referenced to the Company's ordinary

shares.

2. BOARD PRACTICES

2.1 Service agreements

2.2 Service agreement with Jonathan Hartshorn

Mr Hartshorn was appointed Chief Financial Officer and Executive

Board member on 15 June 2015. The terms of his appointment are set

out in a service agreement dated 1 May 2015. The terms provide:

2.2.1 a commencement date of 15 June 2015;

2.2.2 no fixed term and a notice period of two months' is

required in the event of the termination or resignation of

employment;

2.2.3 a fee of EUR120,000 gross per annum, subject to annual review.

2.3 Service agreement with Kees Groen

Mr Groen was appointed as an Executive Director on 19 October

2015 following the acquisition of Kinesis Pharma B.V. ("Kinesis")

by the Company. Mr Groen was the founder and managing director of

Kinesis, and is a regulatory expert with significant experience in

pharmaceutical research and development, both with regulatory

authorities and in industry. The terms of his appointment are set

out in a letter dated 16 October 2015. The terms provide:

2.3.1 a commencement date of 19 October 2015;

2.3.3 no fixed term and a notice period of six months' is

required in the event of the termination or

resignation of employment; and

2.3.3 a fee of EUR215,000 gross per annum, subject to annual review.

Mr Groen is beneficially interested in 4,780,320 ordinary shares

in the Company, amounting to 7.94% of the issued share capital of

the Company. These ordinary shares were received as part

consideration for the sale of Kinesis and are subject to a lock up

period of 12 months from 16 October 2015.

2.4 Service agreement with Gracielle Anna Maria

Beijerbacht-Schutjens

Mrs Beijerbacht-Schutjens became an employee of the Company in

March 2010, when her business Uptoyou B.V. was acquired by Venn.

She was appointed as an Executive Director, Chief Operations

Officer, on 6 January 2015. The terms of her employment are:

2.4.1 no fixed term and a notice period of six months' is

required in the event of the termination or

resignation of employment;

2.4.2 a fee of EUR130,000 gross per annum, subject to annual review; and

2.4.3 a fee of EUR12,000 per annum for her services as a Board member.

3. RISK FACTORS

Venn may not be able to successfully integrate entities or

assets it has acquired or may acquire in the future

(MORE TO FOLLOW) Dow Jones Newswires

December 11, 2015 02:00 ET (07:00 GMT)

There can be no assurance that Venn will be able to fully or

effectively integrate entities or assets it has acquired or which

it may acquire in the future. Venn strives to achieve revenue and

cost synergies, operating efficiencies and business growth

opportunities, as well as other benefits from any acquisition. The

integration of any such acquisition into Venn, however, may be

complex and expensive and may present a number of challenges for

management. In addition, expected business growth opportunities,

revenue and cost synergies, operational efficiencies and other

benefits may not materialise, in part because the assumptions upon

which Venn determined to proceed with any such acquisition may

prove to be incorrect. It is the policy of Venn to undertake due

diligence in relation to any potential acquisition, but there can

be no guarantee that such diligence has been or would be sufficient

to uncover all material issues or that the quality of assets

acquired will not negatively impact upon Venn's overall business.

As a result, if anticipated synergies or other benefits of an

acquisition are not achieved, or those achieved are materially

different from those that were expected to be achieved prior to the

acquisition, then this could have a material adverse effect on

Venn's business, results of operations, financial condition and

prospects.

Following the acquisition of Kinesis, Venn developed and is

implementing an integration plan to improve the performance of the

two companies. The process of integration of Kinesis is underway

but there can be no assurance that Venn will be able to fully

realise the expected revenue or cost synergies, operating

efficiencies or business growth opportunities as well as other

benefits from the business combination. Furthermore, any

re-branding of the businesses could result in reduced demand for

services.

4. ORGANISATIONAL STRUCTURE

A list of Venn's principal subsidiaries as at 10 December 2015

are set out below:

Name Country of incorporation Proportion

of ownership

interest

--------------------- -------------------------- --------------

Venn Life Sciences

Limited Ireland 100%

--------------------- -------------------------- --------------

Venn Life Sciences

(Ireland) Limited Ireland 100%

--------------------- -------------------------- --------------

Venn Life Sciences

B.V. Netherlands 100%

--------------------- -------------------------- --------------

Venn Synergie

S.A.S. France 100%

--------------------- -------------------------- --------------

Venn Life Sciences England and

UK Limited Wales 100%

--------------------- -------------------------- --------------

Venn Life Sciences

(NI) Limited Northern Ireland 100%

--------------------- -------------------------- --------------

Venn Life Sciences

(Germany) GmbH Germany 100%

--------------------- -------------------------- --------------

Venn Life Science

(France) S.A.S France 85.2%

--------------------- -------------------------- --------------

England and

Innovenn UK Limited Wales 55.6%

--------------------- -------------------------- --------------

Innovenn Limited Ireland 55.6%

--------------------- -------------------------- --------------

Kinesis Pharma

B.V. Netherlands 100%

--------------------- -------------------------- --------------

Kinesis Pharma

Singapore Pte.

Limited. Singapore 100%

--------------------- -------------------------- --------------

5. EMPLOYEES

As at 10 December 2015, Venn had 144 employees (including the

Executive Directors). The breakdown of the employees for each of

the financial years ended 31 December 2012, 31 December 2013, 31

December 2014 and on 10 December 2015 was as follows:

Average Number of Employees

2012 2013 2014 10 December

2015

Employees 55 43 62 144

----- ----- ----- ------------

6. MAJOR SHAREHOLDERS

6.1 A list of those shareholders who, directly or indirectly,

are interested in three per cent. or more of the current issued

ordinary share capital of the Company is set out in the table below

and represent the holdings last notified by those shareholders to

the Company.

Name No. of ordinary % of existing share

shares capital

Livingbridge

VC LLP 5,263,157 8.7%

Calculus Capital

Limited 5,106,117 8.5%

Kees Groen 4,780,320 7.9%

David Newton 2,200,000 3.7%

6.2 As at the date of this document, no major shareholder has

any different voting rights to the other holders of ordinary shares

in the capital of the Company.

7. ARTICLES OF ASSOCIATION

A copy of the Articles may be accessed at

www.vennlifesciences.com/company-information/.

8. MATERIAL CONTRACTS

In addition to the agreements summarised in the Public Record,

the following contracts, not being contracts entered into in the

ordinary course of business, have been entered into by the Company

or its subsidiaries during the two years immediately preceding the

date of the Announcement and are, or may be, material as of the

date of the Announcement:

8.1 Appointment of Davy as Nominated Adviser, ESM Adviser and

Joint Broker to Venn Life Sciences Holdings plc

The Company has entered into a Nominated Adviser, ESM Adviser

and Joint Broker agreement dated 9 December 2015 with Davy pursuant

to which the Company has appointed Davy to act as Nominated

Adviser, ESM Adviser and Joint Broker to the Company effective from

ESM Admission. The Company has agreed to pay to Davy a fee of

EUR50,000 per annum (plus applicable VAT). The appointment of Davy

as Nominated Adviser, ESM Adviser and Broker shall continue unless

and until terminated by either party on 60 days' notice. Davy has

reserved the right to terminate the agreement forthwith in certain

circumstances. Under the agreement, the Company has given certain

customary indemnities to Davy in connection with its engagement as

the Company's Nominated Adviser, ESM Adviser and Joint Broker. The

agreement is governed by English law.

8.2 Appointment of Hybridan LLP as Joint Broker to Venn Life Sciences Holdings plc

The Company has entered into a Joint Broker agreement dated 24

August 2015 with Hybridan LLP ("Hybridan") pursuant to which the

Company has appointed Hybridan to act as Joint Broker to the

Company effective from 24 August 2015. The Company has agreed to

pay Hybridan a fee of GBP28,000 per annum (plus applicable VAT).

The appointment of Hybridan as Joint Broker shall continue unless

and until terminated by either party on three months written

notice. The agreement is governed by English Law.

8.3 Appointment of Walbrook PR Limited as Public Relations

Consultant to Venn Life Sciences Holdings plc

The Company has an annual consultancy agreement with Walbrook PR

Ltd for the provision of PR and investor relations services at a

monthly fee of GBP2,500 plus VAT. The appointment may be terminated

by either party serving at least 1 month's written notice on the

other.

9. DIVIDEND POLICY

The Company has not paid a dividend and the Board do not propose

to pay a dividend for the foreseeable future. However, the Board,

once it is commercially prudent to do so, intends to implement a

progressive dividend policy.

10. CORPORATE GOVERNANCE

The Directors acknowledge the importance of the principles set

out in the UK Corporate Governance Code. Although the UK Corporate

Governance Code is not compulsory for AIM or ESM quoted companies,

the Directors have a policy of applying the principles as far as

practicable and appropriate for a company of its size.

11. LITIGATION AND ARBITRATION

Neither the Company nor any subsidiary of Venn is, nor has at

any time in the 12 months immediately preceding the date of this

document been, involved in any governmental, legal or arbitration

proceedings, and the Company is not aware of any governmental,

legal or arbitration proceedings pending or threatened by or

against the Company or any subsidiary of Venn, nor of any such

proceedings having been pending or threatened at any time in the 12

months immediately preceding the date of this document, in each

case which may have, or have had in the recent past, a significant

effect on the Company's financial position or profitability.

12. GENERAL

12.1 Davy has given and has not withdrawn its written consent to

the issue of this document with the inclusion herein of its name in

the form and context in which it is included.

12.2 On an ad hoc basis the Company engages Amrita Corporate

Advisory Limited ("Amrita") for the provision of M&A advisory

services. In the 12 months preceding the Company's application for

Admission Amrita invoiced the company for GBP98,968 (inclusive of

VAT).

(MORE TO FOLLOW) Dow Jones Newswires

December 11, 2015 02:00 ET (07:00 GMT)

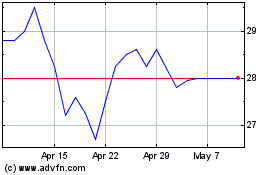

Hvivo (LSE:HVO)

Historical Stock Chart

From Jun 2024 to Jul 2024

Hvivo (LSE:HVO)

Historical Stock Chart

From Jul 2023 to Jul 2024