Horizonte Minerals PLC Operations Director Appointed for Araguaia Project

August 24 2023 - 1:00AM

RNS Non-Regulatory

TIDMHZM

Horizonte Minerals PLC

24 August 2023

REACH

24 August 2023

HORIZONTE MINERALS PLC APPOINTS OPERATIONS DIRECTOR FOR THE

ARAGUAIA NICKEL PROJECT

Horizonte Minerals Plc (AIM/TSX: HZM) ("Horizonte" or the

"Company") a nickel company developing two Tier-1 assets in Brazil,

is pleased to strengthen its management team with the appointment

of Mr. Fernando Marino as its Operations Director for the Araguaia

Nickel Project ("Araguaia" or "the Project").

Jeremy Martin, CEO of Horizonte, commented : "We are pleased to

welcome Fernando as Operations Director for the Araguaia Nickel

Project, which marks an important milestone for Horizonte as we

prepare to bring Araguaia into production given that construction

is now around 65% complete. Fernando's extensive experience in

commissioning, production ramp-up, and operating Brazilian nickel

operations, coupled with over 20 years of stakeholder engagement

experience in the Para state, will be invaluable at Araguaia and we

look forward to working with him."

Fernando has over 35 years of experience in the resources

industry, with a strong track record of ramping up and operating

mining operations in Brazil. He worked across a range of mining

operations for Vale in Brazil, including as Director of Operations

at Onça Puma, a ferronickel operation in Para state located

approximately 250 km from Araguaia. During his time at Onça Puma,

he managed the initial ramp-up phase and subsequently implemented

improvements to the original furnace design in conjunction with

Hatch (Araguaia's furnace vendor). Additionally, he led a

comprehensive review of the operational, maintenance and safety

procedures, resulting in a record annual production of 25,000

tonnes of nickel, without any lost-time accidents. Prior to joining

Horizonte, Fernando was Executive Manager at Vale's Base Metals

South Atlantic operations, and previously managed the Salobo copper

mine and plant.

For further information, visit www.horizonteminerals.com or

contact:

Horizonte Minerals plc info@horizonteminerals.com

Jeremy Martin (CEO) +44 (0) 203 356 2901

Simon Retter (CFO)

Patrick Chambers (Head of IR)

Peel Hunt LLP (Nominated Adviser & Joint

Broker)

Ross Allister

David McKeown +44 (0)20 7418 8900

---------------------------

BMO (Joint Broker)

Thomas Rider

Pascal Lussier Duquette

Andrew Cameron +44 (0) 20 7236 1010

---------------------------

Barclays (Joint Broker)

Philip Lindop

Richard Bassingthwaighte +44 (0)20 7623 2323

---------------------------

Tavistock (Financial PR)

Emily Moss

Cath Drummond +44 (0) 20 7920 3150

---------------------------

ABOUT HORIZONTE MINERALS

Horizonte Minerals Plc (AIM/TSX: HZM) is developing two

100%-owned, Tier 1 projects in Pará state, Brazil - the Araguaia

Nickel Project and the Vermelho Nickel-Cobalt Project. Both

projects are large scale, high-grade, low-cost, have low carbon

emission intensities and are scalable. Araguaia is under

construction with first metal scheduled for 1Q 2024. When fully

ramped up with Line 1 and Line 2, Araguaia is forecast to produce

29,000 tonnes of nickel per year. Vermelho is at feasibility study

stage and is expected to supply nickel to the critical metals

market. Horizonte's combined production profile of over 60,000

tonnes of nickel per year positions the Company as a globally

significant nickel producer. Horizonte's top three shareholders are

La Mancha Investments S.à r.l., Glencore Plc and Orion Resource

Partners LLP.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

Except for statements of historical fact relating to the

Company, certain information contained in this press release

constitutes "forward-looking information" under Canadian securities

legislation. Forward-looking information includes, but is not

limited to, the ability of the Company to complete any planned

acquisition of equipment, statements with respect to the potential

of the Company's current or future property mineral projects; the

ability of the Company to complete a positive feasibility study

regarding the second RKEF line at Araguaia on time, or at all, the

ability of the Company to complete a positive feasibility study

regarding the Vermelho Project on time, or at all, the success of

exploration and mining activities; cost and timing of future

exploration, production and development; the costs and timing for

delivery of the equipment to be purchased, the estimation of

mineral resources and reserves and the ability of the Company to

achieve its goals in respect of growing its mineral resources; the

realization of mineral resource and reserve estimates and achieving

production in accordance with the Company's potential production

profile or at all. Generally, forward-looking information can be

identified by the use of forward-looking terminology such as

"plans", "expects" or "does not expect", "is expected", "budget",

"scheduled", "estimates", "forecasts", "intends", "anticipates" or

"does not anticipate", or "believes", or variations of such words

and phrases or statements that certain actions, events or results

"may", "could", "would", "might" or "will be taken", "occur" or "be

achieved". Forward-looking information is based on the reasonable

assumptions, estimates, analysis and opinions of management made in

light of its experience and its perception of trends, current

conditions and expected developments, as well as other factors that

management believes to be relevant and reasonable in the

circumstances at the date that such statements are made, and are

inherently subject to known and unknown risks, uncertainties and

other factors that may cause the actual results, level of activity,

performance or achievements of the Company to be materially

different from those expressed or implied by such forward-looking

information, including but not limited to risks related to: the

inability of the Company to complete any planned acquisition of

equipment on time or at all, the ability of the Company to complete

a positive feasibility study regarding the implementation of a

second RKEF line at Araguaia on the timeline contemplated or at

all, the ability of the Company to complete a positive feasibility

study regarding the Vermelho Project on the timeline contemplated

or at all, exploration and mining risks, competition from

competitors with greater capital; the Company's lack of experience

with respect to development-stage mining operations; fluctuations

in metal prices; uninsured risks; environmental and other

regulatory requirements; exploration, mining and other licences;

the Company's future payment obligations; potential disputes with

respect to the Company's title to, and the area of, its mining

concessions; the Company's dependence on its ability to obtain

sufficient financing in the future; the Company's dependence on its

relationships with third parties; the Company's joint ventures; the

potential of currency fluctuations and political or economic

instability in countries in which the Company operates; currency

exchange fluctuations; the Company's ability to manage its growth

effectively; the trading market for the ordinary shares of the

Company; uncertainty with respect to the Company's plans to

continue to develop its operations and new projects; the Company's

dependence on key personnel; possible conflicts of interest of

directors and officers of the Company, and various risks associated

with the legal and regulatory framework within which the Company

operates, together with the risks identified and disclosed in the

Company's disclosure record available on the Company's profile on

SEDAR at www.sedar.com, including without limitation, the annual

information form of the Company for the year ended December 31,

2022, and the Araguaia and Vermelho Technical Reports available on

the Company's website https://horizonteminerals.com/. Although

management of the Company has attempted to identify important

factors that could cause actual results to differ materially from

those contained in forward-looking information, there may be other

factors that cause results not to be as anticipated, estimated or

intended. There can be no assurance that such statements will prove

to be accurate, as actual results and future events could differ

materially from those anticipated in such statements.

This information is provided by Reach, the non-regulatory press

release distribution service of RNS, part of the London Stock

Exchange. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NRAPPUUARUPWGWW

(END) Dow Jones Newswires

August 24, 2023 02:00 ET (06:00 GMT)

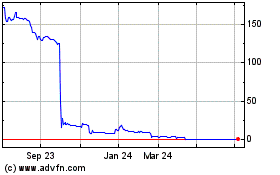

Horizonte Minerals (LSE:HZM)

Historical Stock Chart

From Dec 2024 to Jan 2025

Horizonte Minerals (LSE:HZM)

Historical Stock Chart

From Jan 2024 to Jan 2025