TIDMHZM

RNS Number : 8804Q

Horizonte Minerals PLC

23 October 2023

NEWS RELEASE

23 October 2023

HORIZONTE MINERALS PROVIDES Q3-2023 CONSTRUCTION UPDATE

HIGHLIGHTS

-- Construction progress continues to be made at Araguaia

o Strong safety performance, no lost time injuries with close to

5.1 million hours worked

o Rotary Kiln sections have been installed on the support

piers

o The furnace shell is complete with roof installation

underway

o All critical equipment packages have been contracted and are

either on site or en route to site

o As of 30 September, 138,000 tonnes of ore averaging 1.92% Ni

has been stockpiled

o Commissioning of the 126 km (230kV) power transmission line

underway

-- US$429 million has been spent at Araguaia as of 30 September 2023

-- As stated on 2 October 2023, Reta Engenharia has been

retained to complete a detailed capital cost and schedule analysis

which is expected to be completed by mid Q4-2023

-- The Company is continuing to progress construction activities

while advancing financing discussions with its cornerstone

shareholders and lenders

-- Araguaia Nickel Project Line 2 Feasibility Study ("FS"),

which aims to double nickel production from 14,500 tonnes per annum

to 29,000 tonnes per annum, to be published in mid Q4-2023

Horizonte Minerals Plc (AIM/TSX: HZM) ("Horizonte" or the

"Company"), the nickel company developing two Tier 1 assets in

Brazil, reports that construction activities continue to progress

well at its Araguaia Nickel Project ("Araguaia" or "the Project").

As of 30 September 2023, US$429 million has been spent on Araguaia

with progress made across key work fronts and no interruptions to

date on construction activities.

As stated in the press release dated 2 October 2023, a number of

factors arising from the completion of the detailed engineering

work has led to an increase in material and quantities, scope

changes, increased costs around the main electromechanical erection

contract and increased duration on delivery schedule. These changes

require additional financing resulting in an expected increase in

the overall Project capital requirement by at least 35% (from the

current capex budget of US$537m) and delay of first production to

Q3-2024. Reta Engenharia is expected to complete its capital cost

and schedule analysis report, following which an independent

technical advisor, nominated by Senior Lenders will review the

updated costs with targeted completion by mid Q4-2023.

Jeremy Martin, CEO of Horizonte, commented: "Despite the current

challenges, I am pleased to report that construction activities at

the Araguaia Project continue to progress well, with a strong

safety performance to date.

"Notwithstanding the expected increase in capital, the Araguaia

project remains a Tier 1 nickel project with lower quartile C1 cash

costs, and a long mine life of 28 years producing a high grade, low

impurity FeNi product. Discussions with the Company's major

shareholders and lenders to fund the project to completion are

progressing."

CAPITAL COST REVIEW PROCESS

Reta Engenharia's detailed capital cost and schedule analysis is

on-going, with the updated estimate being assessed to meet the

requirements of AACEI Class 1, improved from the estimate utilised

in September 2022.

Principal capital changes are linked to the following:

-- Civil works: the development of engineering maturity and

identification of new scopes to the project resulted in increases

in civil quantities (concrete, rebar and formwork) and the

corresponding rise in the installation costs. These changes relate

to the water storage reservoir, the water abstraction pipeline,

selected major equipment packages and equipment interfaces.

-- Electromechanical (EM) assembly: increased equipment and

materials quantities have resulted from the completion of the

critical detailed engineering, and the shift of more EM activities

into the wet season given the expected delay to 3Q-2024. This

represents a significant percentage of the cost increase given the

lower productivity in the wet season and increased quantities.

-- Refractory: the cost to install 4.3 kt of refractory was significantly underestimated.

-- Vendor delays: one of the vendors have not been able to

deliver key packages in line with the project timeline leading to

termination of the contract and the sourcing of alternatives at

higher prices.

-- Schedule extension: given the above and the expected schedule

delay of around six months, there is an associated increase in

costs and working capital linked to the increased schedule

duration.

More detailed information will be given once the final

engineering study is complete by mid Q4-2023.

PROJECT FINANCING ACTIVITIES

As of 30 September 2023, a total of US$429 million has been

spent on construction at Araguaia.

As of 30 September 2023, US$215 million has been drawn down from

the senior secured project finance debt facility of US$346 million

(the "Senior Debt Facility"). As of 30 September 2023, the Company

had total liquidity sources of US$253 million comprised of US$131

million undrawn on the Senior Debt Facility and a Group cash

position of US$122 million. Of the Group cash position, US$93m

relates to the project to cover current construction activity and

working capital which includes the full draw down on the Cost

Overrun Facility of US$25m as well as US$5m cost over run equity.

The cash balance is committed to near term capital expenditures.

US$16m of the Group cash position is segregated for the development

of Vermelho with the balance of US$13m spread amongst other

entities for the ongoing running of the Group.

The remainder of the undrawn Senior Debt Facility of US$131

million is intended to be used to fund current project capital

costs, and in order to draw down on the Senior Debt Facility, all

conditions precedents must be satisfied including a cost to

complete analysis. With the estimated increase in overall Project

capital, the Company is working closely with its senior lenders and

its cornerstone shareholders on a financing solution to solve the

funding gap. The Company's objective is to put in place a financing

solution which will satisfy the cost to complete requirements and

thereby allow the Company to continue to access its Senior Debt

Facility.

The senior lenders and the independent technical engineers were

on-site on 4 October 2023 undertaking a review of construction

progress to date.

Management discusses the Araguaia Water Storage Reservoir with

Senior Lenders and the independent technical engineers.

ARAGUAIA NICKEL PROJECT STATUS UPDATE

Health, Safety & Wellbeing

The lost-time injury frequency rate ("LTIFR") for Araguaia as of

30 September 2023 was 0.00 and the total recordable injury

frequency rate ("TRIFR") was 0.70 per million hours worked,

comparing favourably to a TRIFR of 2.1 for the same period last

year. As of 30 September 2023, more than five million hours of work

had occurred directly on the Araguaia construction project, without

a lost time injury.

Horizonte continues to focus its safety programmes on critical

risk controls, safe behaviours and risk management. During the

Project's life to date, over 7,600 internal safety audits have been

conducted and more than 11,000 safety plan observations have been

completed. To increase engagement and participation by our

contracting partners in our safety systems and processes, we

continue to monitor and report on individual partner company

performance on a range of indicators and undertake interventions as

necessary to ensure zero harm.

Construction activities

An overview of the Araguaia Nickel process plant site.

The ore homogenisation building has all the structural steelwork

in place with the cladding of the roof underway. The framework for

the overhead tripper conveyor that runs the full length of the shed

has been installed and once commissioned, will feed crushed ore

onto the two blended stockpiles. Each stockpile will be 90m long,

30m wide and around 13m in height, with a combined capacity of

36,000 wet tonnes of ore. Completion of the mechanical construction

of the homogenisation building is planned for early February 2024

when commissioning is expected to begin. Ahead of this, the belt

conveyor, cables and piping will be installed.

All the structural steelwork is in place on the ore

homogenisation building, with the cladding of the roof

underway.

The 42m long Rotary Dryer has been lifted onto its support piers

for final alignment and completion ahead of internal and external

welding. Commissioning of the Rotary Dryer mechanical assembly is

scheduled to begin by year end. Steelwork is currently being

erected and will support auxiliary equipment including the

electrostatic precipitator, dry ore feed bins, dry ore discharge

and tertiary crusher. Other key parts currently being erected

include the gear assembly, installation of the driver and

lubrication system.

The Rotary Dryer (foreground) is scheduled for commissioning by

year end.

All eleven sections of the FLSmidth Rotary Kiln have now been

lifted onto the support piers and the bearing guide rings have been

installed, ahead of final alignment and welding. Measuring 110m

long and 5.5m wide, the Rotary Kiln will produce calcine that is

transferred to the Electric Arc Furnace at a rate of around 115 dry

tonnes per hour at an exit temperature of around 800(o) C.

Equipment that is due to be installed over the next two months

includes the gear assembly, the shell driver and lubrication

system. Preparation for the refractory lining and the installation

will commence in December 2023.

The Rotary Kiln installed on the support piers with main roller

bearing guide rings visible.

The Electric Arc Furnace shell is complete, and the roof

sections are on site with erection underway. The electrical

transformer has been positioned within the furnace building and the

nine calcine feed bins have been installed. As of 30 September

2023, around 2,500t of steel has been erected in the furnace

building, with the fifth and final level in place. The next phase

of work underway are the installation of the calcine feed bin

covers and the electrodes. Refractory installation is expected to

commence in Q1-2024, starting around the feed pipes before focusing

on the internal lining of the circular 18m by 7.25m furnace.

The Electric Arc Furnace building in the centre with the

electrical transformer being positioned on the second level, to the

left of the image is the refinery building.

Following the granting of Araguaia's mining authorisation in

mid-2023, mining has progressed well with around 138,000 tonnes of

ore stockpiled and categorised on the run-of-mine (ROM) pad as of

30 September 2023, averaging 1.92% Ni. By year end, the Company

anticipates having stockpiled around 250,000 tonnes, at an average

grade of 1.90% Ni, in line with the target for the year.

Mining at the Pequizeiro pit showing the excavators currently in

the high-grade transition zone. The processing plant is shown in

the background approximately 500m from the mine.

Around 138,000 tonnes of ore stockpiled and categorised on the

ROM pad as of 30 September 2023.

Power infrastructure

All 260 transmission line towers have been erected and the

entire 126km of conductor cable installation has been completed.

Commissioning of the 230kV power transmission line from the

Xinguara Bay substation to the Araguaia project has begun and is

due to be concluded by February 2024.

Out of a total of 260 transmission towers:

-- 260 foundations have been poured (100% complete)

-- 260 towers have been erected (100% complete)

-- 126km of conductor cable installation has been completed

(100% complete)

The Araguaia sub-station with both of the main 230kV/34.5kV

transformers installed.

At the Xinguara Bay substation:

-- Engineering is complete

-- Procurement and civil works well advanced

-- Electromechanical erection is advancing, targeting completion

by year end.

A technical inspection was undertaken by the Pará State

Secretariat for Environment and Sustainability ("SEMAS") in late

August 2023 in anticipation of the powerline commissioning and the

issuance of the Operating Licence.

Water storage reservoir

The Water Storage Reservoir (WSR) continues to advance with

Cofferdam construction now completed. Construction of the principal

embankment is underway with jet grouting expected to be concluded

mid-November. A delay in completion has been driven by the

requirement for additional jet grouting to address geotechnical

conditions. The Company is targeting year end to commission the

WSR, and once complete, the WSR will provide a constant source of

cooling water to the process plant and act as a heat sink for the

furnace.

Water Storage Reservoir where the Cofferdam is now completed and

construction of the principal embankment is underway.

Contracts & Procurement

All critical equipment packages have been contracted and are

either on site or en route to site with around 90% of procurement

now complete. Over three quarters of the smaller, non-critical

auxiliary packages have been contracted, with items such as

consumables and workshop equipment under tender. All remaining

packages are expected to be finalised by year end following which

the Contract and Procurement teams focus will be on ensuring all

materials and equipment are delivered safely to site, in line with

the updated project schedule.

Engineering

As of September 2023, engineering had reached 99.8% for first

issue of drawings and 93% for issue for construction (IFC).

Engineering still to complete relates to utilities for the

Nitrogen, Oxygen, LPG and Diesel Fuel EPC supplier packages which

are not on the critical path.

Environmental activities

Within the quarter, the Company completed the sealing of roads

adjacent to five small rural villages and additionally implemented

enhanced dust suppression in localities proximal to residential

areas. Horizonte has remained actively engaged with these rural

communities and results of automatic air quality monitoring

stations and, importantly, feedback from these communities, now

indicates that dust management protocols are effectively addressing

construction related increases in road traffic.

Beyond Horizonte's investment of over BRL 50m in state and

municipal road upgrades in 2022 - including widening, capping,

safety controls and bridge upgrades, making what were previously

poor quality roads safe for increased levels of activity - and the

BRL 3.9m spent on surfacing near rural villages, the Company made a

further commitment to support the Municipality in its commitment to

seal 2 km of state road at the outskirts of the Conceição do

Araguaia urban area. The Company has now completed tendering and

expect these works to commence in Q4 2023.

In other environmental management activities, Horizonte

concluded a major programme of impact avoidance in the period,

confirming the re-design of the Pequizeiro stockpile to avoid 49 ha

of native vegetation. This important project enhancement means that

in terms of overall Araguaia land take, almost three quarters of

the land disturbance will be restricted to highly modified

pastureland. In line with biodiversity commitments, Horizonte

continues to explore further opportunities to avoid biodiversity

impacts. Also in the period, the primary flora and fauna rescue

activities, conducted by specialist botanists and zoologists

associated with the Araguaia development were completed. These

highly successful programmes have, since construction commencement,

resulted in the registration of over 1,200 animals, as well as

collection of over 19kg of seed from 43 species for mine site

reclamation and farm afforestation.

Social management

In conjunction with the management of construction related

impacts, several programmes continued in the quarter to enhance the

benefits that can be realised by host communities from the

long-term presence of Horizonte in the area. In July 2023 the first

group of local companies participating in our Supplier Development

Programme concluded their formal training and mentoring phase of

the programme. The second group of local companies commenced

training in August 2023 and included smaller rural communities of

Chapéu de Palha and Vila Joncon. The objectives of this programme

are to increase participation by local companies in the Horizonte

supply chain, to maximise retention of value by host communities

and stimulate market growth and economic diversity.

In relation to the Araguaia Resettlement Action Plan, as at the

end of the quarter, five project affected households had been

successfully resettled to their new homes. Families involved in the

resettlement programme commenced the first phase of agroecology

focussed training covering topics including rural property

management, sustainable farm management and soil preparation.

The Company Health Promotion and Prevention Programme during the

period included training for school students on relevant social and

health issues including mental health, child protection and rights,

and teen pregnancy. These educational activities supported formal

curriculum aligned education on youth multipliers in health.

Permitting

September 2023 saw the submission of numerous reports to the

environmental regulator ("SEMAS") illustrating compliance with

various Installation Licence (construction) conditions. In Brazil,

environmental licencing follows a three-stage process: i)

preliminary licence (LP) issued following assessment and

acceptability of the project proposal and impact assessment; ii)

installation licence (LI) allowing construction and other

preliminary development, such as pre-stripping; and iii)

operational licence (LO), allowing the use and operation of the

constructed/developed infrastructure. The submission of documents

demonstrating compliance with an Installation Licence is a

regulatory predecessor for issuance of the related Operational

Licence. Key submissions related to: the Arraias River water

pipeline (that will transmit water for the filling of the water

storage reservoir); the 230kV transmission line (operational

electricity supply); and temporary fuel station (fleet fuelling and

process plant commissioning).

Horizonte has received all required project approvals relevant

to this phase of the Araguaia project and does not anticipate any

issues in relation to issuance of operational licences. In the

reporting period Horizonte also submitted compliance documentation

in relation to the mining authorisation awarded to the Company in

Q2-2023, allowing the commencement of mining and stockpiling of

ore.

ARAGUAIA LINE 2: FEASIBILITY STUDY EXPECTED IN Q4 2023

The results from the Feasibility Study on Araguaia Line 2 remain

on track to be published in mid Q4-2023. The combined production of

Araguaia Line 1 and 2 is expected to be 29,000 tonnes per

annum.

VERMELHO NICKEL-COBALT PROJECT

The FS for Horizonte's 100% owned Vermelho project in Brazil is

currently on-going. Vermelho has a high-grade scalable resource

with a long mine life. Given Vermelho's geological characteristics,

the ore has the ability to be processed either through

High-Pressure Acid Leach ("HPAL") or Rotary Kiln Electric Furnace

("RKEF") technologies. As part of the study and driven by the

evolving market dynamics, Horizonte is evaluating the optimal final

nickel product that will supply the critical metals market.

For further information, visit www.horizonteminerals.com or

contact:

Horizonte Minerals plc info@horizonteminerals.com

Jeremy Martin (CEO) +44 (0) 203 356 2901

Simon Retter (CFO)

Patrick Chambers (Head of IR)

Peel Hunt LLP (Nominated Adviser & Joint

Broker)

Ross Allister

David McKeown

Bhavesh Patel +44 (0)20 7418 8900

BMO (Joint Broker)

Thomas Rider

Pascal Lussier Duquette

Andrew Cameron +44 (0) 20 7236 1010

Barclays (Joint Broker)

Philip Lindop

Richard Bassingthwaighte +44 (0)20 7623 2323

Tavistock (Financial PR)

Jos Simson

Cath Drummond +44 (0) 20 7920 3150

ABOUT HORIZONTE MINERALS

Horizonte Minerals Plc (AIM/TSX: HZM) is developing two

100%-owned, Tier 1 projects in Pará state, Brazil - the Araguaia

Nickel Project and the Vermelho Nickel-Cobalt Project. Both

projects are high-grade, low-cost, with low carbon emission

intensities and are scalable. Araguaia is under construction and

when fully ramped up with both Line 1 and Line 2, is forecast to

produce 29,000 tonnes of nickel per year. Vermelho is at

feasibility study stage and is expected to supply nickel to the

critical metals market. Horizonte's combined production profile of

over 60,000 tonnes of nickel per year positions the Company as a

globally significant nickel producer. Horizonte's top three

shareholders are La Mancha Investments S.à r.l., Glencore Plc and

Orion Resource Partners LLP.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

Except for statements of historical fact relating to the

Company, certain information contained in this press release

constitutes "forward-looking information" under Canadian securities

legislation. Forward-looking information includes, but is not

limited to, the ability of the Company to complete any planned

acquisition of equipment, statements with respect to the potential

of the Company's current or future property mineral projects; the

ability of the Company to complete a positive feasibility study

regarding the second RKEF line at Araguaia on time, or at all, the

ability of the Company to complete a positive feasibility study

regarding the Vermelho Project on time, or at all, the success of

exploration and mining activities; cost and timing of future

exploration, production and development; the costs and timing for

delivery of the equipment to be purchased, the estimation of

mineral resources and reserves and the ability of the Company to

achieve its goals in respect of growing its mineral resources; the

realization of mineral resource and reserve estimates and achieving

production in accordance with the Company's potential production

profile or at all. Generally, forward-looking information can be

identified by the use of forward-looking terminology such as

"plans", "expects" or "does not expect", "is expected", "budget",

"scheduled", "estimates", "forecasts", "intends", "anticipates" or

"does not anticipate", or "believes", or variations of such words

and phrases or statements that certain actions, events or results

"may", "could", "would", "might" or "will be taken", "occur" or "be

achieved". Forward-looking information is based on the reasonable

assumptions, estimates, analysis and opinions of management made in

light of its experience and its perception of trends, current

conditions and expected developments, as well as other factors that

management believes to be relevant and reasonable in the

circumstances at the date that such statements are made, and are

inherently subject to known and unknown risks, uncertainties and

other factors that may cause the actual results, level of activity,

performance or achievements of the Company to be materially

different from those expressed or implied by such forward-looking

information, including but not limited to risks related to: the

inability of the Company to complete any planned acquisition of

equipment on time or at all, the ability of the Company to complete

a positive feasibility study regarding the implementation of a

second RKEF line at Araguaia on the timeline contemplated or at

all, the ability of the Company to complete a positive feasibility

study regarding the Vermelho Project on the timeline contemplated

or at all, exploration and mining risks, competition from

competitors with greater capital; the Company's lack of experience

with respect to development-stage mining operations; fluctuations

in metal prices; uninsured risks; environmental and other

regulatory requirements; exploration, mining and other licences;

the Company's future payment obligations; potential disputes with

respect to the Company's title to, and the area of, its mining

concessions; the Company's dependence on its ability to obtain

sufficient financing in the future; the Company's dependence on its

relationships with third parties; the Company's joint ventures; the

potential of currency fluctuations and political or economic

instability in countries in which the Company operates; currency

exchange fluctuations; the Company's ability to manage its growth

effectively; the trading market for the ordinary shares of the

Company; uncertainty with respect to the Company's plans to

continue to develop its operations and new projects; the Company's

dependence on key personnel; possible conflicts of interest of

directors and officers of the Company, and various risks associated

with the legal and regulatory framework within which the Company

operates, together with the risks identified and disclosed in the

Company's disclosure record available on the Company's profile on

SEDAR at www.sedar.com, including without limitation, the annual

information form of the Company for the year ended December 31,

2022, and the Araguaia and Vermelho Technical Reports available on

the Company's website https://horizonteminerals.com/. Although

management of the Company has attempted to identify important

factors that could cause actual results to differ materially from

those contained in forward-looking information, there may be other

factors that cause results not to be as anticipated, estimated or

intended. There can be no assurance that such statements will prove

to be accurate, as actual results and future events could differ

materially from those anticipated in such statements.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DRLQFLFLXBLZFBQ

(END) Dow Jones Newswires

October 23, 2023 02:04 ET (06:04 GMT)

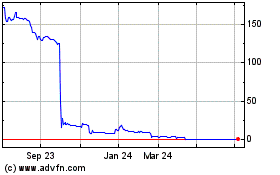

Horizonte Minerals (LSE:HZM)

Historical Stock Chart

From Dec 2024 to Jan 2025

Horizonte Minerals (LSE:HZM)

Historical Stock Chart

From Jan 2024 to Jan 2025