TIDMHZM

RNS Number : 3803T

Horizonte Minerals PLC

14 November 2023

NEWS RELEASE

14 November 2023

ARAGUAIA PROJECT UPDATE

Horizonte Minerals Plc (AIM/TSX: HZM) ("Horizonte" or the

"Company") the nickel development company, announces that it is

continuing to work closely with its senior lenders and its

cornerstone shareholders on a financing solution for its Araguaia

Nickel Project ("Araguaia" or "the Project"), as announced on 2

October 2023, in parallel to progressing the capital cost and

schedule analysis.

To manage resources and funds whilst undertaking discussions

with the Company's cornerstone shareholders and lenders, the

Company intends to reduce construction activities at Araguaia,

advancing only critical work streams while maintaining a strong

focus on safety.

As of 10 November 2023, the Araguaia Project had total liquidity

sources of US$169 million comprised of US$131 million undrawn on

the Senior Debt Facility ( subject to satisfying drawdown

conditions ) and a cash position of US$38 million which should

provide sufficient working capital to around mid-December 2023

unless there are positive outcomes from conversations with

suppliers, other cash preserving measures, or other financing

solutions, which if successful should provide sufficient working

capital until late Q1 24 .

The Company has hosted a series of site visits during the last 7

days with key shareholders and lenders representatives. These

groups are undertaking their respective due diligence as part of a

funding plan and expect to finalise their respective internal

diligence processes in early Q1 2024 with funding completion

targeted for late Q1 2024. It remains the Company's objective to

put in place a financing solution which will satisfy the cost to

complete requirements and thereby allow the Company to continue to

access its Senior Debt Facility.

CEO Jeremy Martin said, "Discussions with the Company's major

shareholders and lenders on funding the Project to completion are

progressing. While work on the funding solution continues, we have

elected to focus capital and human resources on the critical work

packages. This work is planned is to ensure that we are

well-positioned to resume full construction activities post receipt

of the funding to benefit stakeholders and our community alike.

Notwithstanding the expected increase in capital, the Araguaia

project remains a Tier 1 nickel project that will produce a high

grade, low cost, low impurity FeNi product over a 28-year mine

life."

First production at Araguaia will be contingent on the result of

the various funding discussions and the Company will continue to

provide updates on its financing progress as required.

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014, as retained in the UK

pursuant to the European Union (Withdrawal) Act 2018.

For further information, visit www.horizonteminerals.com or

contact:

Horizonte Minerals plc info@horizonteminerals.com

Jeremy Martin (CEO) +44 (0) 203 356 2901

Simon Retter (CFO)

Patrick Chambers (Head of IR)

Peel Hunt LLP (Nominated Adviser & Joint

Broker)

Ross Allister

David McKeown

Bhavesh Patel +44 (0)20 7418 8900

---------------------------

BMO (Joint Broker)

Thomas Rider

Pascal Lussier Duquette

Andrew Cameron +44 (0) 20 7236 1010

---------------------------

Barclays (Joint Broker)

Philip Lindop

Richard Bassingthwaighte +44 (0)20 7623 2323

---------------------------

Tavistock (Financial PR)

Jos Simson

Cath Drummond +44 (0) 20 7920 3150

---------------------------

ABOUT HORIZONTE MINERALS

Horizonte Minerals Plc (AIM/TSX: HZM) is developing two

100%-owned, Tier 1 projects in Pará state, Brazil - the Araguaia

Nickel Project and the Vermelho Nickel-Cobalt Project. Both

projects are high-grade, low-cost, with low carbon emission

intensities and are scalable. Araguaia is under construction and

when fully ramped up with both Line 1 and Line 2, is forecast to

produce 29,000 tonnes of nickel per year. Vermelho is at

feasibility study stage and is expected to supply nickel to the

critical metals market. Horizonte's combined production profile of

over 60,000 tonnes of nickel per year positions the Company as a

globally significant nickel producer. Horizonte's top three

shareholders are La Mancha Investments S.à r.l., Glencore Plc and

Orion Resource Partners LLP.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

Except for statements of historical fact relating to the

Company, certain information contained in this press release

constitutes "forward-looking information" under Canadian securities

legislation. Forward-looking information includes, but is not

limited to, the ability of the Company to complete any planned

acquisition of equipment, statements with respect to the potential

of the Company's current or future property mineral projects; the

ability of the Company to complete a positive feasibility study

regarding the second RKEF line at Araguaia on time, or at all, the

ability of the Company to complete a positive feasibility study

regarding the Vermelho Project on time, or at all, the success of

exploration and mining activities; cost and timing of future

exploration, production and development; the costs and timing for

delivery of the equipment to be purchased, the estimation of

mineral resources and reserves and the ability of the Company to

achieve its goals in respect of growing its mineral resources; the

realization of mineral resource and reserve estimates and achieving

production in accordance with the Company's potential production

profile or at all. Generally, forward-looking information can be

identified by the use of forward-looking terminology such as

"plans", "expects" or "does not expect", "is expected", "budget",

"scheduled", "estimates", "forecasts", "intends", "anticipates" or

"does not anticipate", or "believes", or variations of such words

and phrases or statements that certain actions, events or results

"may", "could", "would", "might" or "will be taken", "occur" or "be

achieved". Forward-looking information is based on the reasonable

assumptions, estimates, analysis and opinions of management made in

light of its experience and its perception of trends, current

conditions and expected developments, as well as other factors that

management believes to be relevant and reasonable in the

circumstances at the date that such statements are made, and are

inherently subject to known and unknown risks, uncertainties and

other factors that may cause the actual results, level of activity,

performance or achievements of the Company to be materially

different from those expressed or implied by such forward-looking

information, including but not limited to risks related to: the

inability of the Company to complete any planned acquisition of

equipment on time or at all, the ability of the Company to complete

a positive feasibility study regarding the implementation of a

second RKEF line at Araguaia on the timeline contemplated or at

all, the ability of the Company to complete a positive feasibility

study regarding the Vermelho Project on the timeline contemplated

or at all, exploration and mining risks, competition from

competitors with greater capital; the Company's lack of experience

with respect to development-stage mining operations; fluctuations

in metal prices; uninsured risks; environmental and other

regulatory requirements; exploration, mining and other licences;

the Company's future payment obligations; potential disputes with

respect to the Company's title to, and the area of, its mining

concessions; the Company's dependence on its ability to obtain

sufficient financing in the future; the Company's dependence on its

relationships with third parties; the Company's joint ventures; the

potential of currency fluctuations and political or economic

instability in countries in which the Company operates; currency

exchange fluctuations; the Company's ability to manage its growth

effectively; the trading market for the ordinary shares of the

Company; uncertainty with respect to the Company's plans to

continue to develop its operations and new projects; the Company's

dependence on key personnel; possible conflicts of interest of

directors and officers of the Company, and various risks associated

with the legal and regulatory framework within which the Company

operates, together with the risks identified and disclosed in the

Company's disclosure record available on the Company's profile on

SEDAR at www.sedar.com, including without limitation, the annual

information form of the Company for the year ended December 31,

2022, and the Araguaia and Vermelho Technical Reports available on

the Company's website https://horizonteminerals.com/. Although

management of the Company has attempted to identify important

factors that could cause actual results to differ materially from

those contained in forward-looking information, there may be other

factors that cause results not to be as anticipated, estimated or

intended. There can be no assurance that such statements will prove

to be accurate, as actual results and future events could differ

materially from those anticipated in such statements.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCUSVBROWUAARA

(END) Dow Jones Newswires

November 14, 2023 03:02 ET (08:02 GMT)

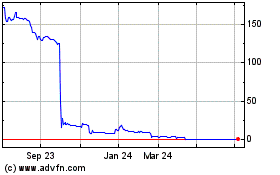

Horizonte Minerals (LSE:HZM)

Historical Stock Chart

From Dec 2024 to Jan 2025

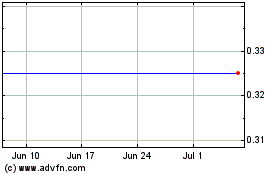

Horizonte Minerals (LSE:HZM)

Historical Stock Chart

From Jan 2024 to Jan 2025