International Cons Airlines Group Statement on possible cash offer for Aer Lingus (2137D)

January 27 2015 - 1:00AM

UK Regulatory

TIDMIAG

RNS Number : 2137D

International Cons Airlines Group

27 January 2015

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN PART

IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A

VIOLATION OF THE RELEVANT LAWS OR REGULATIONS OF THAT JURISDICTION.

THIS ANNOUNCEMENT IS NOT AN ANNOUNCEMENT OF A FIRM INTENTION TO

MAKE AN OFFER UNDER RULE 2.5 OF THE IRISH TAKEOVER PANEL ACT, 1997,

TAKEOVER RULES 2013 ("IRISH TAKEOVER RULES") AND THERE CAN BE NO

CERTAINTY THAT AN OFFER WILL BE MADE, NOR AS TO THE TERMS ON WHICH

ANY OFFER WILL BE MADE.

STATEMENT ON POSSIBLE CASH OFFER FOR AER LINGUS GROUP PLC ("AER

LINGUS")

International Consolidated Airlines Group, SA ("IAG") confirms

it has submitted an improved proposal to make an offer for Aer

Lingus. The proposal consists of an offer of EUR2.55 per share,

structured as a cash payment of EUR2.50 per share, payable upon

completion, in addition to an ordinary dividend of EUR0.05 per

share. The proposal is subject to certain pre-conditions.

The Board of Aer Lingus has indicated to IAG that the financial

terms of the proposal are at a level at which it would be willing

to recommend to Aer Lingus shareholders, subject to being satisfied

with the manner in which IAG proposes to address the interests of

relevant parties. Accordingly the Board of Aer Lingus has granted

IAG access to perform a limited period of confirmatory due

diligence.

It is IAG's intention that under its ownership, Aer Lingus

would:

-- operate as a separate business with its own brand, management

and operations, continuing to provide connectivity to Ireland,

while benefitting from the scale of being part of the larger IAG

group;

-- join the oneworld alliance, of which British Airways and

Iberia are key members; and

-- join the joint business that IAG operates over the North

Atlantic with American Airlines, leveraging the natural traffic

flows between Ireland and the US and the advantageous geographical

position of Dublin for serving connecting flows.

IAG believes that the proposal would secure and strengthen Aer

Lingus's brand and long term future within a successful and

profitable European airline group, offering significant benefits to

both Aer Lingus and its customers.

IAG recognises the importance of direct air services and air

route connectivity for investment and tourism in Ireland and

intends to engage with the Irish Government in order to secure its

support for the transaction.

A further statement will be made if and when appropriate.

IAG Investor Relations

27 January 2015

The Directors of IAG accept responsibility for the information

contained in this announcement. To the best of their knowledge and

belief (having taken all reasonable care to ensure that such is the

case), the information contained in this announcement for which

they accept responsibility is in accordance with the facts and does

not omit anything likely to affect the import of such information.

This announcement does not constitute an announcement of a firm

intention to make an offer under Rule 2.5 of the Irish Takeover

Panel Act, 1997, Takeover Rules 2013 (Irish Takeover Rules). A

person interested in (as defined in the Irish Takeover Rules) 1% or

more of any class of relevant securities of Aer Lingus may have

disclosure obligations under Rule 8.3 of the Irish Takeover Rules,

effective from the date of this announcement.

A copy of this announcement will be available on the IAG website

at www.iagshares.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCFMGZMVNLGKZG

International Consolidat... (LSE:IAG)

Historical Stock Chart

From Feb 2025 to Mar 2025

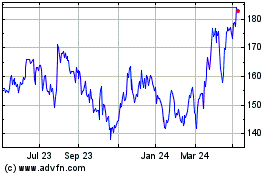

International Consolidat... (LSE:IAG)

Historical Stock Chart

From Mar 2024 to Mar 2025