At the balance sheet date the interest rate profile of the

Group's interest--bearing financial instruments was:

2014 2013

Notes GBP000 GBP000

-------------------------- ----- -------- --------

Fixed rate instruments

Financial liabilities (24,757) (29,442)

Variable rate instruments

Financial assets 8,111 2,301

Financial liabilities (15,865) (13,773)

Loan arrangement fees 253 553

Finance leases (4,689) (1,777)

-------------------------- ----- -------- --------

Net debt 16 (36,947) (42,138)

-------------------------- ----- -------- --------

The fixed rate borrowings above are shown after taking account

of an interest rate swap (see note 17 for details).

A change of 50 basis points (0.5%) in interest rates at the

balance sheet date would have decreased equity and profit or loss

by the amounts shown below. This calculation assumes that the

change occurred at the balance sheet date and had been applied to

risk exposures existing at that date.

This analysis assumes that all other variables, in particular

foreign currency rates, remain constant and considers the effect on

financial instruments with variable interest rates, financial

instruments at fair value through profit or loss. The analysis is

performed on the same basis for 31 March 2013.

2014 2013

Sensitivity analysis GBP000 GBP000

--------------------- ------ ------

Equity

Increase - -

Decrease 68 38

Profit or loss

Increase - -

Decrease 68 38

--------------------- ------ ------

f) Capital management

The Board's policy is to maintain a strong capital base so as to

maintain investor, creditor and market confidence and to sustain

future development of the business. The Group is dependent on the

continuing support of its bankers for working capital facilities

and so the Board's major objective is to keep borrowings within

these facilities.

The Board manages as capital its trading capital, which it

defines as its net assets plus net debt. Net debt is calculated as

total debt (bank overdrafts, loans and borrowing as shown in the

balance sheet), less cash and cash equivalents. The banking

facilities with our principal bank have covenants relating to

interest cover, cash flow cover and leverage, and our articles

currently permit borrowings (including letter of credit facilities)

to a maximum of four times equity.

Equity

--------------

2014 2013

Notes GBP000 GBP000

---------------------------------- ----- ------ ------

Net assets attributable to owners

of the Parent Company 53,512 51,888

Net debt 16 36,947 42,138

---------------------------------- ----- ------ ------

Trading capital 90,459 94,026

---------------------------------- ----- ------ ------

The main areas of capital management revolve around the

management of the components of working capital including

monitoring inventory turn, and months' production or cost of sales

outstanding, age of inventory, age of trade receivables, balance

sheet reforecasting, monthly profit and loss, weekly cash flow

forecasts and daily cash balances. Major investment decisions are

based on reviewing the expected future cash flows and all major

capital expenditure requires sign off by the Group Chief Executive

Officer and Group Chief Financial Officer. There were no major

changes in the Group's approach to capital management during the

year. A particular focus of the Group is leverage measured as the

ratio of net debt to pre-exceptional EBITDA which is measured on a

monthly basis.

27 Operating leases

Non-cancellable operating lease rentals are payable as

follows:

2014 2013

GBP000 GBP000

--------------------- ------ ------

Less than one year 3,921 4,340

Between one and five

years 8,737 9,844

More than five years 9,178 10,163

--------------------- ------ ------

21,836 24,347

--------------------- ------ ------

The Group leases a number of warehouse and factory facilities as

well as vehicles and office equipment under operating leases. The

leases of warehouse and factory facilities typically have an option

to renew at the end of the lease term and lease payments are

subject to five-yearly rent reviews.

One of the leased properties has been sublet by the Group. The

sub-lease has a period to run of more than five years. Sub-lease

payments of GBP303,000 (2013: GBP303,000) are expected to be

received during the financial year.

During the year GBP4,307,000 was recognised as an expense in the

income statement in respect of operating leases (2013:

GBP3,887,000).

28 Capital commitments

At 31 March 2014, the Group had outstanding authorised capital

commitments to purchase plant and equipment for GBP1,076,000 (2013:

GBP94,000).

29 Related parties

2014 2013

GBP000 GBP000

----------------------------- ------ ------

Sale of goods

AB Alrick - Hedlund 413 394

Hedlunds Pappers Industri AB 62 35

Festive Productions Ltd 57 56

Hedlund Import AB 8,186 7,915

----------------------------- ------ ------

8,718 8,400

----------------------------- ------ ------

Purchase of goods

AB Alrick - Hedlund 706 -

Hedlund Import AB 173 2,455

Festive Productions Ltd - 31

----------------------------- ------ ------

879 2,486

----------------------------- ------ ------

Receivables:

AB Alrick - Hedlund 11 -

Hedlunds Pappers Industri AB 1 17

Festive Productions Ltd - 36

----------------------------- ------ ------

Balance at 31 March 12 53

----------------------------- ------ ------

Payables:

Hedlund Import AB (436) (475)

----------------------------- ------ ------

Balance at 31 March (436) (475)

----------------------------- ------ ------

Identity of related parties and trading

Hedlund Import AB and AB Alrick - Hedlund are under the ultimate

control of the Hedlund family. Anders Hedlund is a Director of

Hedlunds Pappers Industri AB which is under the ultimate control of

the Hedlund family. Festive Productions Ltd is a subsidiary

undertaking of Malios AG, a company under the ultimate control of

the Hedlund family.

Phil Dutton, Non-Executive Director, is married to Judith

McKenna who was Executive Vice President of Strategy and

International Development at Walmart International and is now

Executive Vice President, Chief Development Officer of Walmart US.

Walmart are significant customers of the Group.

The above trading takes place in the ordinary course of business

and on normal commercial terms.

Other related party transactions

Directors of the Company and their immediate relatives have an

interest in 50% (2013: 50%) of the voting shares of the Company.

The shareholdings of Directors are shown in the Directors' report.

No other shares were issued to Directors during the year (2013:

nil).

Directors' remuneration

2014 2013

GBP000 GBP000

------------------------------------------- ------ ------

Remuneration 1,941 946

Pension contributions 71 59

Share-based payments relating to Directors

- LTIP 82 -

Employer national insurance contributions

on the above remuneration 242 130

------------------------------------------- ------ ------

2,336 1,135

------------------------------------------- ------ ------

30 Post balance sheet events

On 5 June 2014 the Company announced that through its business

in Europe ("IG Europe"), it has signed a contract to acquire the

trade and certain of the assets of Enper Giftwrap BV for

approximately EUR1.9 million with the majority of the purchase

price representing usable fixed assets and stock. Enper is a

gift-wrap manufacturer in the Netherlands servicing northern Europe

with sales of EUR5 million and this acquisition will allow IG

Europe to widen its customer base and further strengthen its market

position in a core product category.

Completion is expected to take place at the end of June

2014.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR UGUWPMUPCGQG

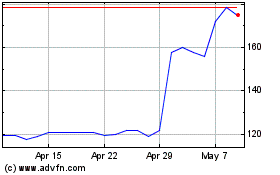

Ig Design (LSE:IGR)

Historical Stock Chart

From Jun 2024 to Jul 2024

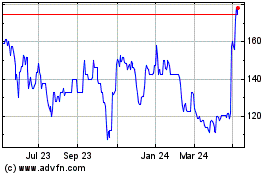

Ig Design (LSE:IGR)

Historical Stock Chart

From Jul 2023 to Jul 2024