Jangada Mines PLC Study Identifies Export Routes, Vanadium Project (1777T)

November 13 2019 - 1:00AM

UK Regulatory

TIDMJAN

RNS Number : 1777T

Jangada Mines PLC

13 November 2019

Jangada Mines plc / EPIC: JAN.L / Market: AIM / Sector:

Mining

13 November 2019

Jangada Mines plc ('Jangada' or the 'Company')

Logistic Study Identifies Export Routes for Pitombeiras Vanadium

Project

Jangada Mines plc, a natural resources company, is pleased to

announce the positive conclusions from a logistic study

commissioned by the Company to assess possible routes to market for

the products extracted from its Pitombeiras Vanadium Project ('the

Project') located in the state of Ceará, Brazil. To view the

announcement with illustrative maps and diagrams please follow this

link -

http://www.rns-pdf.londonstockexchange.com/rns/1777T_1-2019-11-12.pdf

Overview

-- Three potential routes for ore identified;

o Two to Main Chinese Ports (MCP) - Fortaleza seaport as

embarkation point being the most cost effective with estimated at

US$84.64/wet metric ton (wmt); and

o One to the Brazil-based Companhia Siderurgica de Pecém (CSP)

refinery with an estimated cost at US$36.00/wmt.

-- Study considered an estimated initial production of 300kt of

V(2) O(5) concentrate increasing to 600kt of V(2) O(5)

concentrate.

-- The costs/wmt underlines the competitive nature of high-grade vanadium deposit.

-- The study will form part of a Preliminary Economic Assessment

("PEA"), which the Company is currently in the process of

preparing.

Brian McMaster, Chairman of Jangada, said: "The logistic

analysis has demonstrated that Pitombeiras is well located to reach

overseas markets through both the Pecém and Fortaleza seaports in

Ceará state, which are within the Ceará Free Trade Zone, an

industrial free trade area for exporting companies' facilities.

Importantly, they provide tax and exchange benefits, and simplified

administrative procedures, which positively impact the product's

selling margins and bring additional competitive advantages to

Jangada."

Details

C. Steinweg Handelsveem Latin America S.A. was commissioned by

Jangada to prepare an initial analysis of the most favourable

logistical routes for the vanadium product from the Pitombeiras

Project on the basis of an estimated production of 300kt of V(2)

O(5) concentrate in 2020, increasing to 600kt of V(2) O(5)

concentrate in 2022. The objective of the initial analysis was to

identify competitive logistic alternatives and provide indicative

costs for the logistics Ex- Works ('EXW') from the Project to the

ports of destination ('POD').

The analysis indicated three potential routes for the

Pitombeiras ore, two of them considering the Main Chinese Ports

('MCP') as a final destination and the other the Brazil-based

Companhia Siderurgica de Pecém ('CSP') refinery as a final

destination.

The total indicative costs (ground and ocean costs) to transport

the Pitombeiras ore from the Project to the MCP using the Fortaleza

seaport have been estimated at US$ 84.64/wet metric tonne (wmt).

Using the Pecem seaport as an alternative route, the total

indicative costs have been estimated at US$ 90.02/wmt. The study

demonstrated that the route using the Fortaleza seaport is the

cheapest option, considering the MCP as a final destination.

In addition, the total indicative costs considering the CSP as a

final destination have been estimated at US$ 36.00/wmt, which only

involves ground transportation using trucks.

The map and tables below illustrate the path and distance

utilising federal highways from the Project to the major seaports

in Ceará State, including Pecém and Fortaleza, as well as the

option to transport the ore directly to CPS - located nearby to

Pecém. CPS is a steel company owned by the South Korean companies

Dongkuk Steel, Posco (NYSE: PKX) and Brazilian mining company Vale

(NYSE: VALE).

Figure 1: Pitombeiras Project location in relation to main

seaports at Ceará State. - see PDF

Table 1: Ground transportation distances considered in the

initial analysis.

Route Origin Destination Distance Transport

Mode

----------

A Pitombeiras Pecém 352 km Truck

Project

------ ------------ ------------ --------- ----------

B Pitombeiras Fortaleza 333 km Truck

Project

------ ------------ ------------ --------- ----------

C Pitombeiras CSP 349 km Truck

Project

------ ------------ ------------ --------- ----------

Table 2: Three potential routes for the Pitombeiras vanadium

ore.

Option Potential Routes Truck Transport Details

Pitombeiras Project

-------------------------------

A Pitombeiras Project Bulk Truck to Pecém ->

-> Pecém Storage at the Port ->

Loading into Vessels

-> Ocean Transport to

MCP

------- --------------------- ---------------- -------------------------------

B Pitombeiras Project Bulk Truck to Fortaleza ->

-> Fortaleza Storage at the Port ->

Loading into Vessels

-> Ocean Transport to

MCP

------- --------------------- ---------------- -------------------------------

C Pitombeiras Project Bulk Truck to Companhia Siderurgica

-> CSP de Pecém (CSP)

------- --------------------- ---------------- -------------------------------

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014. Upon the publication of

this announcement, this inside information is now considered to be

in the public domain.

ENDS

For further information please visit www.jangadamines.com or

contact:

Jangada Mines plc Brian McMaster (Chairman) Tel: +44 (0) 20

7317 6629

Strand Hanson Limited James Spinney Tel: +44 (0)20 7409

(Nominated & Financial Ritchie Balmer 3494

Adviser) Jack Botros

Brandon Hill Capital Jonathan Evans Tel: +44 (0)20 3463

(Broker) Oliver Stansfield 5000

St Brides Partners Isabel de Salis Tel: +44 (0)20 7236

Ltd David Penson 1177

(Financial PR)

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

UPDBRBDBDGBBGCD

(END) Dow Jones Newswires

November 13, 2019 02:00 ET (07:00 GMT)

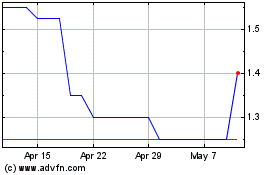

Jangada Mines (LSE:JAN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Jangada Mines (LSE:JAN)

Historical Stock Chart

From Jul 2023 to Jul 2024