RNS Number:6615M

Dart Group PLC

22 June 2000

PRELIMINARY RESULTS FOR THE YEAR ENDED 31 March 2000

Dart Group plc, the distribution and aviation services group,

announces results for the year ended 31 March 2000

Chairman's Statement

I am pleased to report another year of good progress for the

Group. Profit before tax and after goodwill amortisation for

the year to 31 March 2000 has risen to #7.3m (1999 - #6.1m) on

turnover of #131.5m (1999 - #105.7m). Earnings per share were

14.69p (1999 - 12.91p). The Company follows a progressive

dividend policy and accordingly the Board is pleased to

recommend a final dividend of 3.46p (1999 - 3.0p) making a total

dividend of 4.92p for the year (1999 - 4.27p), an increase of

15%. The dividend will be payable on 25 August 2000 to

shareholders on the register on 7 July 2000.

On 30 November 1999 the Group acquired the entire issued share

capital of Coolchain Group Limited for a total consideration of

#14.6m. Coolchain is the leading distributor of fruit grown in

and imported through Kent and provides an excellent geographical

fit with the existing Dart Group distribution businesses. The

net assets of Coolchain have been consolidated in the Group's

balance sheet at the year end and the Group's consolidated

profit and loss reflects the results of Coolchain since the date

of acquisition. The continuing performance of that company is

encouraging.

In September 1999, #2.9m was raised by means of a placing of

1,622,150 new ordinary shares and in January 2000 an Airbus

A300B4 was sold for #8.8m net of expenses. As a result of

these actions net debt at 31 March 2000 stood at #10.0m (1999:

#7.1m). Year end gearing was 39% (1999: 36%), with interest

being covered 11 times.

The Group has two operating divisions - Distribution and

Aviation Services.

DISTRIBUTION DIVISION

The Distribution Division is now the UK's leading consolidator

and distributor of fresh produce, having distribution

arrangements with each of the major supermarket groups and with

many of their suppliers.

The companies within this division, Fowler Welch, Coolchain and

Channel Express (CI), specialise in the temperature-controlled

distribution of fresh produce and horticultural products to

supermarkets and wholesale markets throughout the UK, and are

developing services to continental Europe.

During the year substantial new distribution business has been

won, whilst the division's geographical coverage and market

position have been enhanced by the acquisition of Coolchain,

which has operating centres in Paddock Wood and Teynham in Kent.

The division's businesses now have key coverage and strengths in

the prime produce areas of Lincolnshire, Kent, and the Solent

region of Hampshire and West Sussex.

We are particularly pleased to welcome the strong and

experienced Coolchain management team to the Group. The

handling and efficient distribution of highly perishable produce

on behalf of demanding suppliers, wholesalers and supermarkets,

requires experienced and dedicated management and staff.

Fowler Welch, Coolchain and Channel Express (CI) have all proved

to be successful at developing their facilities and services to

meet their customers' expectations.

Whilst the management of each company will continue to run their

individual businesses, maximising the benefits of their local

trading relationships, synergies will be gained both from the

pooling of the distribution vehicle fleets to form a national

network and the enhancement of IT and information systems in

close co-operation with our customers. We are confident that

an increasingly efficient and cost-effective network will result

and that the division is well positioned to expand the range of

services it offers and thereby profitably grow its shared-user

distribution business.

The Group is committed to on-going investment in this division

to enable continuing organic growth and to facilitate strategic

acquisitions.

AVIATION SERVICES DIVISION

The two companies in the Aviation Division are Channel Express

(Air Services), our cargo airline, and Benair Freight

International, our freight management and forwarding company.

The companies serve two different markets. Channel Express

(Air Services) operates cargo aircraft on behalf of express

parcel companies, postal authorities, forwarders and other

airlines, whilst Benair manages worldwide freight movements for

manufacturers and shippers. The air cargo market is currently

growing at a rate of nearly 6% per year and provides

considerable opportunities for the development of these

businesses.

Channel Express (Air Services) operates 8 six tonne capacity

Fokker F27s, 4 fifteen tonne capacity Lockheed Electras and 3

forty-five tonne capacity Airbus A300B4 'Eurofreighters' on

contract services within Europe and to the Middle East. The

A300B4-100, which was sold in January 2000, was replaced by a

leased, longer range, A300B4-200. Channel Express (Air Services)

specialises in providing the express parcels industry with cost-

effective, reliable cargo aircraft. The range of payloads

offered allows the company to match its customers' needs as

their routes develop. It is forecast that there will be an

increasing need for cargo aircraft as global trade increases,

together with the associated expectation of time-definite

delivery.

In order to build the company's operations and profits, it is

likely that the aircraft fleet will be increased over the coming

year, both by the selective acquisition of further aircraft and

by leasing in additional capacity. We believe that we are

well placed in our specialist market to expand our operations

and services.

Over the past year Channel Express (Air Services) has also

successfully developed its aircraft parts trading activities,

supporting both its own aircraft and similar types operated by

other airlines. I am pleased to say that this business, which

fits so well with our existing operations, shows every sign of

becoming a useful contributor to the Group.

Benair has continued to grow its business in a competitive

market. The company gives a personal and efficient service in

an industry dominated by large multi-national operators. To

succeed in this market, Benair concentrates on its niche

businesses - the importation and distribution of ornamental fish

and the management of freight on its chosen key routes,

particularly to the USA and the Far East. This continues to be

a successful strategy enabling Benair to maintain its

contribution to the Group.

The activities of each of the companies in both divisions is

more fully detailed in the Review of Operations which follows

this statement.

I am extremely encouraged at the progress the Group has made in

the past year and am pleased to say that the current year's

trading has commenced satisfactorily. None of this could be

achieved without the hard work and commitment of all our staff

and I am very grateful to them for their continued enthusiasm

and support.

PHILIP MEESON

CHAIRMAN

22 June 2000

REVIEW OF OPERATIONS

DISTRIBUTION

The Group's Distribution Division comprises, Fowler Welch,

Channel Express (CI) and, since 30 November 1999, the Coolchain

Group. In the period since Coolchain's acquisition by Dart

Group, good progress has been made in integrating its operations

within the division and the business is making a valuable

contribution to the continuing development of the division's

national temperature-controlled fresh produce distribution

network. It is especially pleasing to record the positive way

in which the management and staff of Coolchain have embraced the

change of ownership and this has greatly helped to make a

seamless transition possible.

In order to continue to build upon their important existing

trading relationships, Fowler Welch, Coolchain and Channel

Express (CI) will each retain their individual trading

identities, with their business activities controlled by their

respective Managing Directors, reporting directly to the

Divisional Chief Executive. However, as sister companies

within the Distribution Division, they will also work in

partnership to realise the cost efficiencies and operational

synergies to be gained through the pooling of their vehicle

fleets, common practices and from other benefits of scale.

The division made further substantial progress during the year

in its specialist market sector. In the UK, Fowler Welch and

Coolchain have continued to win important new supermarket

distribution business as a result of the development of the

shared-user distribution network. The European business,

operating to and from The Netherlands, has also successfully

expanded and Channel Express (CI), which serves Guernsey and

Jersey, has seen improvements in its performance mainly as a

result of operational efficiencies achieved in the mainland

distribution network.

Fowler Welch has fresh produce consolidation centres situated at

Spalding, Lincolnshire, and Portsmouth, Hampshire, and secondary

facilities at Earith and Yaxley in Cambridgeshire and Selby in

North Yorkshire. From these sites, the business has continued to

grow with more than 600 trailer loads per day of locally grown

and imported fresh produce now being managed and distributed to

supermarket regional distribution centres. During 1999, Fowler

Welch BV, a Dutch registered company, was formed to manage the

division's international business and to enable the division to

benefit from the many operational cost advantages available to

operators within the EC.

Coolchain provides a broadly similar distribution service to

that of Fowler Welch, operating from two consolidation centres

at Teynham and Paddock Wood in Kent and a secondary facility at

Haydock on Merseyside. The company deals almost exclusively

with supermarkets and their suppliers and distributes a wide

variety of fruit and other fresh produce to regional

distribution centres. Coolchain's Paddock Wood centre serves

the West Kent region, whilst the Teynham facility provides a

full range of consolidation and distribution services to East

Kent growers and importers. The company offers its customers

additional value-added services such as sorting, grading,

packing and labelling as well as the medium-term storage of

products under controlled ripening conditions, prior to

delivery.

Together, Fowler Welch, Coolchain and Channel Express (CI)

employ nearly 1,000 staff, utilise over 450,000 sq ft of purpose-

built warehousing and operate a large combined fleet of modern

temperature-controlled road vehicles. Managing the complex and

time-critical operation is a workforce of dedicated management

and staff with many years' industry experience at their

disposal.

To strengthen the senior management structure and support the

Divisional Chief Executive, an experienced Divisional Finance

Director has recently been appointed. There has also been a

realignment of executive responsibilities within Coolchain, with

all its UK operations now under the control of that company's

Managing Director. A separate role of Commercial Director has

also been created to bring added focus to Coolchain's business

development. To provide continuity and maintain the depth of

industry expertise, one of the company's former senior

executives has been appointed a non-executive director of the

new Coolchain board.

The division's IT capabilities are currently under review prior

to the development of a single operating platform. Much work

has already taken place, including detailed discussions with

retailers and their major suppliers regarding the specification

for a new system. It is clearly important that this offers a

common interface with our customers' systems as well as meeting

the needs of the division's emerging single distribution

network. This will be a major catalyst for achieving synergies.

Fowler Welch has maintained its pace of development over the

past year, winning a number of important supermarket

distribution initiatives which are expected to lead to new and

exciting opportunities as the company moves forward.

In February 2000, Fowler Welch was awarded the Tesco national

horticulture distribution business. Phase 1 of this process

involves the consolidation at Spalding of cut flowers and pot

plants prior to delivery to Tesco's regional distribution

centres. The next stage, due to commence in Spring 2001, will

see a further refinement of Tesco's supply chain requirements to

meet their 'just in time' store delivery programmes. This new

process will require the 'continuous replenishment' of

horticultural products and is being pioneered by Tesco in

partnership with Fowler Welch. The intention is to extend this

to a wide range of short shelf-life perishable goods and we

believe that each of our distribution companies is well

positioned to play an increasing role in this programme as it

gains momentum.

To deal effectively with the increased distribution business, a

new two storey modular office block has been erected within the

Spalding complex, and a further extension of the warehouse is

planned for the coming year.

The new Fowler Welch, Portsmouth, consolidation centre is now

fully commissioned and has completed its first full year of

operations. The centre recently attracted its first supermarket

initiative, winning Tesco's distribution for Solent and West

Sussex fresh produce suppliers. New contracts with a number of

major growers and importers supplying retailers nationally from

the same region have also commenced resulting in a significant

increase in throughput. The secondary sites at Earith and

Yaxley, which feed products into the shared-user distribution

network have also experienced further growth. The Selby

operation, established last year, has made its first full year

contribution.

Fowler Welch has also successfully expanded its range of

distribution services with the introduction of a groupage

service for horticultural products from Europe to the UK which

are fed into the division's UK distribution network.

Since acquisition, Coolchain has continued to successfully

expand its operations, winning new produce packing, storage and

distribution business from supermarkets and their suppliers.

A significant development for the division since the acquisition

of Coolchain has been the award to that company by Asda of its

Kent fresh produce distribution business which commenced in

February 2000. Following the successful commencement of the

service for Asda, this important win led to a subsequent

decision by Asda also to award Fowler Welch the major portion of

their remaining national fresh produce distribution, which

commenced in May 2000.

Channel Express (CI)'s prime business continues to be supplying

the Channel Islands of Guernsey and Jersey with a vital air and

sea link to the UK - the company is a leading freight carrier on

these routes.

The air service, operated jointly by Channel Express (CI) and

Channel Express (Air Services) from Bournemouth International

Airport, provides an important link between the Channel Islands

and the UK mainland for urgent freight. Cut flowers, pot

plants and fresh produce comprise the main exports by air and

sea from the Islands with chilled foods, mail, national

newspapers and a wide range of consumer goods making up

consignments for the return journeys.

The new Portsmouth distribution centre has enabled the

consolidation of the division's long-established UK-wide flower

distribution service from a multi-site operation into a more

cost-effective single site, whilst at the same time offering

Channel Islands growers the opportunity to take advantage of

improved facilities for the handling and distribution of their

high-quality flower exports. This, together with the increased

volumes now being handled from many South Coast and Continental

sources through Portsmouth, has allowed the division to continue

to build its cost-effective horticultural distribution service

to wholesale markets, packers and supermarkets.

Channel Express (CI) has also experienced significant growth in

the transport of chilled foodstuffs from the UK to the Channel

Islands, particularly into Guernsey where the company has

invested in extended coldstore facilities as well as additional

and improved local delivery vehicles.

The division is now the market leader in its specialist

temperature-controlled distribution sector having secured fresh

produce and horticulture distribution business from all four

major multiple retailers, together with other leading

supermarkets and their suppliers. The Group will continue to

invest in the IT systems and infrastructure necessary to support

the division's growth and to facilitate its strategic

development in this rapidly evolving market place.

The Distribution Division's companies are well positioned to

take advantage of the considerable opportunities that are

believed to lie ahead, including the distribution of a wider

range of temperature-controlled products and the development of

'just in time' store delivery techniques. The Group believes

that there will be continuing important business opportunities

resulting from the fulfilment of the supermarkets' and their

suppliers' evolving supply chain needs.

AVIATION SERVICES

Channel Express (Air Services) is one of Europe's leading

operators of cargo aircraft, flying on behalf of express parcel

companies, postal authorities, freight forwarders and other

airlines. The Company's fleet of eight Fokker F27s, four

Lockheed Electras and three Airbus A300s fly throughout Europe

and to the Middle East on long-term contract services. This

business is supplemented by ad hoc' charters. Typically,

these charters are operated at short notice to meet the need for

'just in time' stock replenishment by such customers as vehicle

manufacturers and their suppliers who may be facing disruption

in their supply chains.

MergeGlobal, a specialist airfreight management consultancy

firm, estimates that world air freight volumes will average 5.8%

annual growth to 2004. It is separately reported that the air

express industry continues to grow at rates in excess of twice

this figure. The air express market is served by integrated

carriers offering time-definite package collection and delivery

services for an increasingly global client base and utilising

continually expanding airfreight networks. Industry leaders

are Fedex, UPS, DHL and TNT all of whom are long-standing

customers of Channel Express (Air Services). These well-

established and very successful 'integrators' are now being

challenged by leading forwarding and logistics companies and

national post offices, which will also need cargo aircraft.

The company, therefore, expects a continuing demand for its

services and believes that, with its 20 years experience in this

market, Channel Express (Air Services) is well placed to expand

its operations over the foreseeable future.

In order to help its customers develop their air cargo routes,

the company's 3 aircraft types offer payloads of 6, 15 and 45

tonnes. Each of the aircraft types meets Chapter 3 noise

regulations making them welcome at noise-sensitive European

airports at night when the majority of customers' air freight

and sorting operations take place.

The choice of aircraft is obviously crucial to the company's

success. Although each of the company's fleets is normally

contracted to a customer's route, often flying services from a

European city to the customer's central sorting hub nightly,

utilisation is relatively low and, whilst this may well be

boosted with additional charter work, it is unlikely that any

aircraft will exceed 1,500 hours flying per year. Cost of

ownership, therefore, plays a significant role in the aircraft

acquisition decision. Each of the Company's three aircraft

types has previously been in service with passenger airlines

before being replaced with newer models, offering more

attractive, direct operating costs - a major consideration for

higher utilisation daytime passenger operations. Specialist

cargo airlines such as Channel Express (Air Services) have

traditionally acquired these ex-passenger aircraft and converted

them into freighters.

To operate these aircraft successfully, Channel Express (Air

Services) relies on the excellent teamwork of all its

operational, engineering and administrative staff and this has

enabled the company to achieve a technical on-time despatch

reliability of 99% over the past year. Whilst obviously price

is important to our customers, the delay of an aircraft's

arrival at a hub with parcels destined for multiple destinations

can cause havoc to their operations. Our company, therefore,

spends much time and effort in reviewing and developing its

aircraft support and operating systems to improve its services

to its customers.

Whilst the Group prefers to purchase aircraft to obtain the long-

term benefits of ownership, additional capacity is leased in to

meet demand. The Group has replaced an owned A300B4-100 with a

leased in, longer range, A300B4-200, and further supplemented

its fleet with a leased Electra and two leased Fokker F27s.

Each of the aircraft are integrated into the fleet and are

supported, engineered and operated by Channel Express (Air

Services)' staff in order to achieve the same level of

reliability and service as the owned aircraft.

In 1996, Channel Express (Air Services) pioneered the conversion

of 300+ seat passenger Airbus A300B4s into 45 tonne capacity

freighters, placing the first order for such a conversion with

BAE Systems Aviation Services Ltd at Filton, England. The

introduction of the type into the company's service has also

given it the opportunity to develop an international aircraft

parts support business. Called Channel Express Parts Trading,

this operation has grown over the past year and has gained

important contracts to support other Airbus aircraft. In order

to cost-effectively build its stocks of Airbus parts, the Group

has now purchased and dismantled 4 early model A300s. As well

as enabling Channel Express Parts Trading to supply its

customers, the parts from these aircraft have also, of course,

given the company valuable resource for its own fleet, further

enhancing its own service standards. The Group's aim is to

develop the parts trading activities in line with the

development of the company's aircraft fleet.

Channel Express (Air Services) expects to expand its aircraft

fleet as its customers' requirements grow. Potential fleet

opportunities are continually being assessed - the company

believes that its future growth is likely to be organic rather

than by the acquisition of other businesses.

Benair trades in a competitive market place that predominantly

offers opportunities either to global companies or niche

operators. Benair is fortunate to have two important niche

businesses - the importation of ornamental, tropical and cold

water fish and air and sea freight management on key routes to

and from USA and the Far East.

The business has offices at London Heathrow, Manchester, East

Midlands and Newcastle airports, a subsidiary in Singapore and

associates and agents in other key central trade centres. A

personal service is offered to customers with the company's

reputation for the careful handling of live fish being used as a

benchmark for the standards of the operation as a whole.

In order to develop its business, Benair has a very strong

commitment to the development of its staff which has been

recognised during the year through the successful attainment of

Investor in People status, and the development of its

information technology capabilities.

The company believes that there are considerable opportunities

to expand in both of its niche areas. The distribution of

fish is fragmented in the UK and there are probably

opportunities for consolidation and to take advantage of the

consequent benefits of scale. At the same time, the company

will continue to strengthen its focus on its specialist freight

routes with additional sales and operational resources being

deployed to maximise performance.

Benair contributes operationally and financially to the Group's

results - we look forward to continuing to develop and build the

company over the coming years.

For further information contact:

DART GROUP PLC Tel: 01202 597676

Philip Meeson, Group Chairman and Chief Executive

Mobile: 07785 258666

Michael Forder, Group Chief Financial Officer

Mobile: 07721 865850

CONSOLIDATED PROFIT AND LOSS ACCOUNT

for the year ended 31 March 2000

2000 1999

Notes #'000 #'000

TURNOVER

Existing operations 120,176 105,730

Acquisitions 11,274 -

______ ______

Continuing operations 1 131,450 105,730

_______ _______

Net operating expenses,

excluding amortisation of goodwill (123,680) (98,920)

Amortisation of goodwill (165) -

Net operating expenses (123,845) (98,920)

OPERATING PROFIT

Existing operations 7,223 6,810

Acquisitions 382 -

______ ______

Continuing operations 7,605 6,810

______ ______

Surplus on disposal of fixed assets 358 299

Net interest payable (702) (1,004)

______ _____

PROFIT ON ORDINARY ACTIVITIES

BEFORE TAXATION 7,261 6,105

Taxation (2,376) (1,936)

______ _____

PROFIT ON ORDINARY ACTIVITIES

AFTER TAXATION 4,885 4,169

Dividends (1,676) (1,380)

______ _____

RETAINED PROFIT FOR THE YEAR 3,209 2,789

______ _____

EARNINGS PER SHARE

- basic 4 14.69p 12.91p

- basic, excluding the

amortisation of goodwill 4 15.19p 12.91p

- diluted 4 14.57p 12.78p

______ ______

STATEMENT OF TOTAL

RECOGNISED GAINS AND LOSSES

2000 1999

#'000 #'000

Profit on ordinary activities

after taxation 4,885 4,169

Exchange gain/(loss) on foreign

equity investment 8 (15)

______ _____

4,893 4,154

______ _____

BALANCE SHEETS

at 31 March 2000

Group Company

Notes 2000 1999 2000 1999

#'000 #'000 #'000 #'000

FIXED ASSETS

Intangible assets 9,768 - - -

Tangible assets 32,686 38,820 22,232 31,211

Investments 59 106 18,279 3,725

______ ______ ______ ______

42,513 38,926 40,511 34,936

CURRENT ASSETS

Stock 1,773 1,435 - -

Debtors 25,189 14,122 4,812 4,890

Cash at bank and in hand 7,655 9,147 3,010 5,025

______ ______ _____ _____

34,617 24,704 7,822 9,915

CURRENT LIABILITIES

CREDITORS: amounts falling due

within one year (34,868)(25,867)(24,217) (22,393)

______ ______ ______ _______

NET CURRENT LIABILITIES (251)(1,163)(16,395) (12,478)

______ ______ ______ ______

TOTAL ASSETS LESS CURRENT

LIABILITIES 42,262 37,763 24,116 22,458

CREDITORS: amounts falling due after

more than one year (13,485)(14,942)(10,956) (11,812)

PROVISION FOR LIABILITIES AND

CHARGES (3,029)(3,251) (3,449) (2,949)

______ ______ ______ ______

(16,514)(18,193)(14,405) (14,761)

______ ______ ______ ______

25,748 19,570 9,711 7,697

______ ______ ______ ______

CAPITAL AND RESERVES

Called up share capital 1,704 1,617 1,704 1,617

Share premium account 7,438 4,564 7,438 4,564

Profit and loss account 16,606 13,389 569 1,516

______ ______ _____ _____

SHAREHOLDERS FUNDS -

equity interests 2 25,748 19,570 9,711 7,697

______ _____ _____ _____

CONSOLIDATED CASH FLOW STATEMENT

for the year ended 31 March 2000

2000 1999

Notes #'000 #'000

NET CASH INFLOW FROM

OPERATING ACTIVITIES 3 16,619 24,480

RETURNS ON INVESTMENT AND

SERVICING OF FINANCE (702) (1,004)

TAXATION (1,790) (512)

CAPITAL EXPENDITURE AND

FINANCIAL INVESTMENT (2,789) (15,091)

ACQUISITIONS (14,283) -

EQUITY DIVIDENDS PAID (1,467) (1,217)

_____ _____

CASH (OUTFLOW)/INFLOW BEFORE

MANAGEMENT OF LIQUID RESOURCES

AND FINANCING (4,412) 6,656

MANAGEMENT OF LIQUID RESOURCES 4,549 (4,549)

FINANCING 2,920

(4,106)

_____ _____

INCREASE/(DECREASE) IN CASH

IN THE YEAR 3,057 (1,999)

_____ _____

RECONCILIATION OF NET CASH FLOW TO

MOVEMENT IN NET DEBT

2000 1999

#'000 #'000

Increase/(decrease) in cash in the year 3,057 (1,999)

Cash (inflow)/outflow from short

term deposits (4,549) 4,549

Cash outflow from decrease in net

debt in the year 41 4,143

Debt acquired with acquisition

of subsidiary undertaking (1,476) -

_____ ______

Change in net debt in the year (2,927) 6,693

Net debt at 1 April (7,072) (13,765)

_____ _____

Net debt at 31 March (9,999) (7,072)

_____ _____

NOTES

1. Turnover

2000 1999

#'000 #'000

Distribution 70,164 44,942

Aviation Services 61,286 60,788

_______ ______

131,450 105,730

_______ ______

Turnover arising within:

The United Kingdom and the

Channel Islands 129,515 104,663

Mainland Europe 663 -

The Far East 1,272 1,067

_______ ______

131,450 105,730

_____________

2. Reconciliation Of Movements In Shareholders Funds

Group Company

2000 1999 2000 1999

#'000 #'000 #'000 #'000

Profit for the year 4,885 4,169 729 1,137

Dividends (1,676)(1,380) (1,676) (1,380)

_____ _____ _____ _____

3,209 2,789 (947) (243)

Currency translation

differences 8 (15) - -

Issue of shares under

share option schemes 84 37 84 37

Issue of shares under

placing 2,877 - 2,877 -

_____ _____ _____ _____

Net addition/(reduction)

to shareholders'

funds 6,178 2,811 2,014 (206)

Opening shareholders'

funds 19,570 16,759 7,697 7,903

______ ______ _____ _____

Closing shareholders'

funds 25,748 19,570 9,711 7,697

______ ______ _____ _____

3. Reconciliation of Operating Profit

to Net Cash Flow from Operating Activities

2000 1999

#'000 #'000

Operating Profit 7,605 6,810

Depreciation 11,455 15,315

Amortisation of goodwill 165 -

(Increase)/Decrease in stock (251) 43

Increase in debtors (5,806) (1,689)

Increase in creditors 3,443 4,016

Exchange differences 8 (15)

______ ______

Net cash inflow from

operating activities

16,619 24,480

______ ______

4. Earnings Per Share

The calculation of basic earnings per share is based on

earnings for the year ended 31 March 2000 of #4,885,000

(1999 - #4,169,000) and on 33,250,926 shares (1999 -

32,299,341) being the weighted average number of shares in

issue for the year.

The calculation of basic earnings per share, excluding the

amortisation of goodwill, is based on earnings of

#5,050,000, as calculated below, for the year ended 31

March 2000 (1999: #4,169,000) and on 33,250,926 shares

(1999: 32,299,341) being the weighted average number of

shares in issue for the year.

2000 1999

#'000 #'000

Profit on ordinary activities

after taxation 4,885 4,169

Amortisation of goodwill 165 -

_____ _____

5,050 4,169

_____ _____

The diluted earnings per share is based on earnings for the

year ended 31 March 2000 of #4,885,000 (1999 -

#4,169,000), and on 33,521,700 ordinary shares (1999 -

32,622,517) calculated as follows:

2000 1999

000's 000's

Basic weighted average number of shares 33,251 32,299

Dilutive potential ordinary share:

Employee share options 271 324

_______ ______

33,522 32,623

_______ ______

5. The financial information for the years ended 31 March 1999

and 2000 do not constitute statutory accounts, as defined

in Section 240 of the Companies Act 1985, but are based on

the statutory accounts for the years then ended. Statutory

accounts for the year ended 31 March 1999, on which the

auditors issued an unqualified opinion pursuant to Section

235 of the Companies Act 1985, have been filed with the

Registrar of Companies. Statutory accounts for the year

ended 31 March 2000, on which the auditors issued an

unqualified opinion pursuant to Section 235 of the

Companies Act 1985, will be filed with the Registrar of

Companies in due course.

6. The proposed final dividend of 3.46 pence per share will,

if approved, be payable on 25 August 2000 to shareholders

on the Company's register at the close of business on 7

July 2000.

7. The 2000 Annual Report and Accounts (together with the

Auditors Report) will be posted to shareholders on 7 July

2000. The Annual General Meeting will be held on 3 August

2000.

END

FR ZGGZVRMVGGZM

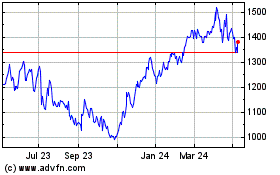

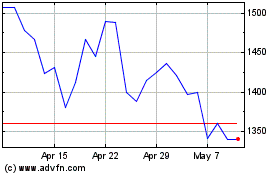

Jet2 (LSE:JET2)

Historical Stock Chart

From Jun 2024 to Jul 2024

Jet2 (LSE:JET2)

Historical Stock Chart

From Jul 2023 to Jul 2024