Interim Results

December 04 2008 - 2:44AM

UK Regulatory

RNS Number : 5344J

Dart Group PLC

04 December 2008

DART GROUP PLC

Interim Results

Dart Group PLC ("the Group"), the aviation and distribution group, announces its interim results for the half year ended 30 September

2008. These results are presented under International Financial Reporting Standards (IFRS).

Highlights

* Turnover up 8% to �272.8 million (2007: �252.9m)

* Pre-tax profits up 97% to �36.3m (2007: �18.4m)

* Underlying pre-tax profits up 175% to �33.5m (2007: �12.2m)

* Aviation load factors increased to 80.4% (2007:74.0%)

* �20.3m cash generated from operating activities (2007: �0.5m outflow)

Chairman's Statement

I am pleased to report on the Group's trading for the six months ended 30 September 2008. The Group delivered a profit before tax of

�36.3m, an increase of 97% on last year (2007: �18.4m).

On an underlying basis (excluding the Specific IAS39 mark to market adjustments), profit before tax amounted to �33.5m (2007: �12.2m).

This significant improvement in trading performance was principally driven by Jet2.com, the Group's low-cost leisure airline, and reflects

both improved yields and load factor. Underlying EBITDA increased by 77% to �52.7m (2007: �29.9m).

Net cash flow from operating activities of �20.3m was generated in the period (2007: �0.5m outflow), despite the seasonal reduction in

the level of customer advance payments, which peaked in March. Capital expenditure in the first half amounted to �9.5m (2007: �16.0m)

primarily relating to the overhaul of the Group's aircraft engines.

Notwithstanding these strong results, the Board has decided, after careful consideration, not to pay an interim dividend, maintaining a

cautious approach in recognition of current economic conditions.

Jet2.com

Jet2.com has focused on its core leisure routes from its bases in the North (Belfast, Blackpool, Edinburgh, Leeds Bradford, Manchester

and Newcastle). The company operates 30 aircraft of which 29 (21 Boeing 737-300s and 8 Boeing 757-200s) are owned by the Group. The 235

seat Boeing 757-200, with its 3,500 nm range, enables us to serve popular Eastern Mediterranean, Red Sea and Canary Island destinations very

cost effectively whilst still offering competitive economics to traditional Western Mediterranean resorts. The performance of this aircraft

is also demonstrated by the operation of a series of direct flights to New York, the first of which took off from Leeds Bradford

International Airport in early November.

We flew 2.3m scheduled passengers in the 6 months to 30 September 2008 (2007: 2.6m) with the number of routes served being reduced

slightly to 74 (2007: 77). We were able to increase both yields and load factors by focusing on flying popular routes, at departure times

convenient to our customers.

Ancillary revenues are continually being developed with gross revenue per passenger increasing to �15.17 during this half year (2007:

�8.60). The introduction of our new in-house developed reservation system in February has enabled us to make it easier for our customers to

purchase extra services such as seat assignment or Jet2Plus, which gives airport lounge access, priority check-in and a pre-ordered meal.

Further enhancements continue to be introduced by our commercial and IT teams. Additionally, travel trade interfaces have been developed to

build significantly the sales distribution channels available to the airline, in contrast to other low-cost operators. This allows easy

access to Jet2.com's seat inventory for travel agents and tour operators, either directly or via third party integration, and has been well

received by the travel trade. Jet2.com has also introduced a loyalty scheme in November, designed to reward our regular travellers. We see

this as the first stage of a considerable cross marketing opportunity with great potential for future development.

Our freight and passenger charter business continues to thrive, making the most of both the enlarged 757 fleet and the passenger and

freight capabilities of our 737 "Quick Change" aircraft. We continue to build our presence in this important market, with charter revenues

growing by 70% in the first half of the year.

Costs were carefully managed in the period. Our fuel efficiency programme is now achieving a 4% improvement in our fuel utilisation. We

have also started to see the full benefit of the maintenance arrangements entered into with Pratt & Whitney for our Boeing 737 engines.

For the winter season, Jet2.com has managed down its overall scheduled capacity reflecting a prudent approach in the current economic

environment. Popular new destinations, including Croatia, Turkey and the Red Sea, have been added for next summer, with increased flying

from Manchester, whilst overall capacity will be maintained at levels similar to those of summer 2008.

Jet2holidays.com, our ATOL protected tour operator, which offers a complete leisure package, was launched in February 2007. This

operation has sold over 25,000 holidays in the half year to September 2008 and it is expected that it will make an increasingly significant

contribution to the airline's passenger numbers over the coming years. We believe that Jet2holidays.com will become a favoured choice for

our leisure customers by meeting our customers' demand for a package holiday from their local airport on Jet2.com scheduled services.

Fowler Welch-Coolchain

The Group's logistics company, Fowler Welch-Coolchain, provides an integrated supply chain solution to supermarkets and their suppliers,

food manufacturers, growers and importers. Services provided from its distribution centres in Spalding (Lincs), Teynham (Kent), Washington

(Tyne & Wear), Stockport (Cheshire) and Portsmouth (Hampshire) include both chilled and ambient storage and distribution together with value

adding and pick to order warehousing operations. The company also has important port operations in Sheerness and Southampton.

Operating margins have been impacted slightly in the first six months of the year, due to a slight downturn in sales, resulting mainly

from the loss of two accounts, which have been more than replaced by business wins during the period, the most notable of these being both

transport and warehousing services on behalf of Tulip Limited, and the addition of store deliveries on behalf of Tesco from our Washington

distribution centre. A new warehouse management system has now been implemented in Spalding and is delivering operational efficiencies and

improved management information to the benefit of the company and its customers. This project will be rolled out throughout the company's

operations in the coming months.

Continued investment in driver training has resulted in improved year on year fuel efficiency, and will be further enhanced by the

re-introduction of a leading vehicle brand, not part of the fleet in recent years. The expanded use of double-decker trailers gives both

operating efficiencies and a positive impact on our carbon footprint. We have also contributed to a major UK retailer's supply chain

efficiencies by storing and delivering product units designed for direct in-store display, enabling cost savings and environmental

sustainability.

In August 2008, 10 acres of additional land adjacent to the Spalding site were secured. This will facilitate further expansion at this

important site, consistent with the Group's approach to provide for future growth; a similar purchase having been made in Teynham in 2001.

The performance of the ambient business, acquired in April 2006, continues to improve; volumes have increased with both organic and new

business growth, and further opportunities for development exist in this sector. In line with expectations, a positive contribution for the

full year is anticipated from this operation.

Fowler Welch-Coolchain is a successful business with considerable growth prospects in both its chilled and ambient warehousing and

distribution sectors. It is well positioned to exploit opportunities arising from the general economic downturn, with substantially all of

its core activities being based around the food industry. The company is well protected from oil price volatility, applying a variable

weekly surcharge to reflect variations in purchase prices.

Outlook

On an underlying basis, we would expect second half trading to be in line with last year. Jet2.com forward booking levels remain

encouraging for the winter and Fowler Welch-Coolchain continues to perform in line with the Board's expectations. We expect a more

challenging trading environment next year and will continue to manage the business cautiously in the light of current economic conditions.

Philip Meeson,

Chairman 4 December 2008

www.dartgroup.co.uk

Enquiries:

Philip Meeson, Chairman Mobile: 07785 258666

Andrew Merrick, Group Finance Director Mobile: 07788 565358

Andy Pedrette, Smith & Williamson Corporate Finance Limited (Tel: 020 7131 4000)

Consolidated Profit and Loss Account (unaudited)

For the half year ended 30 September 2008

Half year to 30 September 2008 Half year to 30

September 2007 Year to 31 March 2008

Before Specific IAS Specific IAS 39 IFRS Before Specific IAS Specific IAS

39 IFRS Before Specific IAS Specific IAS 39 IFRS

39 mark to market mark to market 39 mark to market mark to

market 39 mark to market mark to market

adjustments adjustments adjustments

adjustments adjustments adjustments

Note �m �m �m �m

�m �m �m �m �m

Turnover 3 272.8 - 272.8 252.9

- 252.9 429.3 - 429.3

Net Operating Expenses (237.9) 2.8 (235.1) (238.9)

6.2 (232.7) (425.7) 7.9 (417.8)

Other operating income 1.0 - 1.0 0.2

- 0.2 2.0 - 2.0

Operating Profit 35.9 2.8 38.7 14.2

6.2 20.4 5.6 7.9 13.5

Finance Income 2.4 - 2.4 1.9

- 1.9 2.7 - 2.7

Finance Costs (4.8) - (4.8) (3.9)

- (3.9) (5.7) - (5.7)

(2.4) - (2.4) (2.0)

- (2.0) (3.0) - (3.0)

Net financing costs - - - -

- - 1.3 - 1.3

Profit on disposal of fixed

assets

33.5 2.8 36.3 12.2

6.2 18.4 3.9 7.9 11.8

Profit on ordinary activities before

taxation

Taxation 6 (10.3) (0.8) (11.1) (3.0)

(1.6) (4.6) (0.8) (2.3) (3.1)

Profit for the period 23.2 2.0 25.2 9.2

4.6 13.8 3.1 5.6 8.7

Earnings per share - total 4

- basic 16.39p 17.81p 6.48p

9.78p 2.15p 6.18p

- diluted 16.39p 17.81p 6.44p

9.72p 2.12p 6.13p

Earnings per share * continuing operations

- basic 16.39p 17.81p 6.48p

9.78p 2.15p 6.18p

- diluted 16.39p 17.81p 6.44p

9.72p 2.12p 6.13p

Consolidated Balance Sheet (unaudited)

As at 30 September 2008

30 September 2008 �m 30 September 2007 �m 31 March 2008 �m

Non-current assets

Goodwill 6.8 6.8 6.8

Property, plant and equipment 186.3 184.9 193.4

Derivative financial 6.0 0.3 1.6

instruments

Deferred tax assets 2.4 6.2 2.8

201.5 198.2 204.6

Current assets

Inventories 0.3 0.2 0.3

Trade and other receivables 47.9 42.4 50.0

Derivative financial 6.6 2.6 13.7

instruments

Cash and cash equivalents 0.4 4.1 4.0

55.2 49.3 68.0

Total Assets 256.7 247.5 272.6

Current liabilities

Trade and other payables 118.6 108.9 147.1

Borrowings 7.6 - -

Derivative financial 2.1 11.5 5.9

instruments

128.3 120.4 153.0

Non-current liabilities

Other non current liabilities 6.2 - 2.9

Borrowings - 36.1 21.2

Derivative financial 4.1 8.2 2.5

instruments

Deferred tax 19.9 16.4 18.6

30.2 60.7 45.2

Total Liabilities 158.5 181.1 198.2

Net Assets 98.2 66.4 74.4

Capital and reserves

Called up share capital 1.8 1.8 1.8

Share premium account 9.3 9.3 9.3

Cash flow hedging reserve 8.6 (3.8) 10.0

Profit and loss account 78.4 59.1 53.1

Other reserves 0.1 - 0.2

Total shareholders* equity 98.2 66.4 74.4

Consolidated Cash Flow Statement (unaudited)

For the half year ended 30 September 2008

Six Months ended 30 September Year ended

2008 �m 2007 �m 31 March 2008�m

Cash flows from operating

activities

Profit before taxation from continuing operations 36.3 18.4 11.8

Adjustments for:

Finance income (2.4) (1.9) (2.7)

Finance costs 4.8 3.9 5.7

Profit on disposal of - - (1.3)

property, plant and equipment

Depreciation 16.6 15.6 30.3

Equity settled share based 0.1 0.2 0.2

payments

Fair value adjustments (2.6) (6.2) (7.9)

Operating cash flows before 52.8 30.0 36.1

movements in working capital

Increase in inventories - - (0.1)

Increase / (decrease) in trade and other receivables 2.3 1.6 (6.5)

(Decrease) / increase in trade and other payables (33.9) (29.5) 12.9

Cash generated from operations 21.2 2.1 42.4

Interest received 1.0 - 0.1

Interest paid (2.3) (1.5) (4.4)

Tax received / (paid) 0.4 (1.1) (0.5)

Net Cash generated / (used) from operating 20.3 (0.5) 37.6

activities

Cash flows from investing

activities

Proceeds from sale of property, plant and equipment - 0.1 -

Purchase of property, plant (9.5) (16.0) (38.5)

and equipment

Proceeds from disposal of discontinued operations - - 1.5

Net Cash used in investing (9.5) (15.9) (37.0)

activities

Cash flows from financing

activities

Net proceeds from issue of - 0.1 0.1

share capital

Net (repayments) of proceeds from borrowings (22.0) 18.1 3.2

Equity dividends paid - (2.0) (2.9)

Net Cash (used) / generated from financing (22.0) 16.2 0.4

activities

Effects of exchange rate - 0.4 (0.9)

changes

Net (decrease) / increase in cash and cash (11.2) 0.2 0.1

equivalents

Cash and cash equivalents at beginning of period 4.0 3.9 3.9

Cash and cash equivalents at (7.2) 4.1 4.0

end of period

Consolidated Statement of Changes in Equity (unaudited)

For the half year ended 30 September 2008

ShareCapital Share Premium Cash Flow Hedging Retained Earnings OtherReserves Total Reserves

Reserve

�m �m �m �m �m �m

Balance at 1 April 2007 1.8 9.2 0.9 47.1 - 59.0

Fair value movements on cash - - (6.5) - - (6.5)

flow hedges

Deferred tax relating to cash - - 1.8 - - 1.8

flow hedges

Issue of shares under share - 0.1 - - - 0.1

option scheme

Share based payments - - - 0.2 - 0.2

Profit for the period - - - 13.8 - 13.8

Dividends paid - - - (2.0) - (2.0)

Balance at 30 September 2007 1.8 9.3 (3.8) 59.1 - 66.4

Fair value movements on cash - - 19.5 - - 19.5

flow hedges

Deferred tax relating to cash - - (5.7) - - (5.7)

flow hedges

Currency translation - - - - 0.2 0.2

differences

Loss for the period - - - (5.1) - (5.1)

Dividends paid - - - (0.9) - (0.9)

Balance at 31 March 2008 1.8 9.3 10.0 53.1 0.2 74.4

Fair value movements on cash - - (1.9) - - (1.9)

flow hedges

Deferred tax relating to cash - - 0.5 - - 0.5

flow hedges

Currency translation - - - - (0.1) (0.1)

differences

Issue of shares under share - - - - - -

option scheme

Share based payments - - - 0.1 - 0.1

Profit for the period - - - 25.2 - 25.2

Balance at 30 September 2008 1.8 9.3 8.6 78.4 0.1 98.2

Notes to the consolidated financial statements (continued)

For the half year ended 30 September 2008 (unaudited)

1. General information

The financial statements for Dart Group Plc (the "Group") have been prepared and approved by the Directors in accordance with

International Financial Reporting Standards ("IFRS") as adopted by the European Union ("Adopted IFRS"). The Group's financial statements

consolidate the financial statements of Dart Group PLC and its subsidiaries.

The interim report for the six months ended 30 September 2008 was approved by the Board of Directors on 3 December 2008.

2. Accounting policies

Basis of preparation

The financial statements have been prepared under the historical cost convention, except for all derivative financial instruments which

have been measured at fair value. In addition this interim financial report does not comply with IAS 34, Interim Financial Reporting, which

is not currently required to be applied under AIM rules.

All accounting policies, presentation and methods of computation are consistent with those described in the Group's financial statements

for the year ended 31 March 2008.

The financial information contained in this statement does not constitute the Company's statutory accounts for the year ended 31 March

2008. Those accounts, which were prepared under IFRS, have been reported on by the Company's auditors and delivered to the Registrar of

Companies. The report of the auditors was (i) unqualified, (ii) did not include a reference to any matters to which the auditors drew

attention by way of emphasis without qualifying their report, and (iii) did not contain a statement under section 237(2) or (3) of the

Companies Act 1985.

The Group's financial statements are presented in pounds sterling and all values are rounded to the nearest �100,000 except where

indicated otherwise.

3. Segmental information

For management purposes the Group is divided into two main segments, Aviation Services and Distribution. These divisions are the basis

on which the Group reports its primary segmental information in the day-to-day management of the business. The following is an analysis of

the Group's revenue by operating segment. All of the segmental revenue reported is from external customers.

Segmental Revenues Half year to30 Half year to30 Year to31 March 2008 �m

September 2008 �m September 2007 �m

Aviation Services 215.6 194.1 308.8

Distribution 57.2 58.8 120.5

272.8 252.9 429.3

4. Earnings per share

The calculation of earnings per share is based on the following:

Half year to30 Half year to30 Year to31 March2008

September2008 September2007

Profit for the period (�m) 25.2 13.8 8.7

Weighted average number of 141,065,694 141,004,913 141,029,664

ordinary shares in issue

during the period used to

calculate basic earnings per

share

Weighted average number of 141,065,694 141,915,649 143,092,396

ordinary shares in issue

during the period used to

calculate diluted earnings per

share

5. Dividends

No dividends have been paid or proposed during the six month period to 30 September 2008 (2007: �2.0m).

6. Taxation

The tax charge for the period of �11.1 million is calculated by applying an estimated effective tax rate for the year to 31 March 2009

to the profit for the period.

7. Reconciliation of net cash flow to movement in net debt

Half year to30 Half year to30 Year to31 March2008

September2008 �m September2007 �m �m

(Decrease) / increase in cash (11.2) (0.2) 0.1

in the period

Cash (inflow) / outflow from 22.0 (18.1) (3.2)

(increase) / decrease in net

debt in the period

Change in net debt resulting 10.8 (18.3) (3.1)

from cash flows in the period

Other non cash changes (0.8) 0.4 0.1

Net debt at beginning of (17.2) (14.1) (14.2)

period

Net debt at end of period (7.2) (32.0) (17.2)

8. Contingent liabilities

The Group is in litigation in the US against Sutra Inc and Novak Niketic, who provided use of the reservation system operated by

Jet2.com until February 2008, in relation to the termination of the use of this system. An unspecified counterclaim has been lodged which is

being vigorously defended by the Group in respect of which the Directors estimate approximately $2.5m liability in the unlikely event that

the counterclaim is successful.

9. Other matters

This report will be posted on the Company's website, www.dartgroup.co.uk and copies are available from the Company Secretary at the

registered office of the Company, Low Fare Finder House, Leeds Bradford International Airport, Leeds LS19 7TU.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR EAPALEFAPFEE

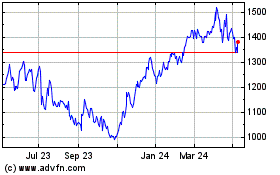

Jet2 (LSE:JET2)

Historical Stock Chart

From Jun 2024 to Jul 2024

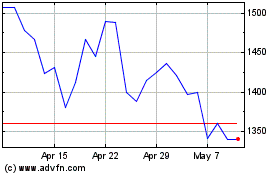

Jet2 (LSE:JET2)

Historical Stock Chart

From Jul 2023 to Jul 2024