Half Yearly Report

November 19 2009 - 1:00AM

UK Regulatory

TIDMDTG

RNS Number : 7395C

Dart Group PLC

19 November 2009

DART GROUP PLC

Interim Results

Dart Group PLC (the "Group"), the aviation and distribution group, announces its

interim results for the half year ended 30 September 2009. These results are

presented under International Financial Reporting Standards (IFRS).

Highlights

* Turnover maintained at GBP272.7m (2008: GBP272.8m)

* Pre-tax profits down 23% to GBP28.1m (2008: GBP36.3m)

* Underlying pre-tax profits down 23% to GBP25.7m (2008: GBP33.5m)

* Aviation load factors increased to 81% (2008: 80%)

* GBP12.2m net cash generated from operating activities (2008: GBP20.3m)

* Interim dividend declared at 0.36p per share (2008: nil)

Chairman's Statement

I am pleased to report on the Group's trading for the six months ended 30

September 2009. The Group delivered a profit before tax of GBP28.1m, a decrease

of 23% on last year (2008: GBP36.3m).

On an underlying basis (excluding the specific IAS39 mark to market

adjustments), profit before tax amounted to GBP25.7m (2008: GBP33.5m). This

trading performance was in line with expectations and reflects the tougher

trading environment we are experiencing in the aviation business. Jet2.com, the

Group's leisure airline, was successful in maintaining load factors, but in part

at the expense of yields. Underlying EBITDA decreased by 23% to GBP40.0m (2008:

GBP51.6m).

Net cash flow from operations of GBP12.2m was generated in the period (2008:

GBP20.3m). Total capital expenditure in the first half amounted to GBP6.5m

(2008: GBP9.5m), primarily relating to the overhaul of the Group's aircraft

engines, in addition to a small acquisition by Fowler Welch-Coolchain.Net cash

amounted to GBP16.1m at the end of the period, a GBP23.3m improvement on the

previous year.

The Board has decided to pay an interim dividend of 0.36p per share, in

recognition of the Group's trading performance in the period. The dividend will

be paid on 29 January 2010 to shareholders on the register at 11 December 2009.

Jet2.com

Jet2.com has continued to focus on its core leisure routes from its bases in the

North (Belfast, Blackpool, Edinburgh, Leeds Bradford, Manchester and Newcastle),

whilst increasing its services to Eastern Mediterranean destinations. The

company operates 31 aircraft of which 29 (21 Boeing 737-300s and 8 Boeing

757-200s) are owned by the Group. The 235 seat Boeing 757-200 enables us to

serve popular Eastern Mediterranean, Red Sea and Canary Island destinations very

cost effectively whilst still offering competitive economics to traditional

Western Mediterranean resorts. It is also an ideal aircraft for our important

passenger charter market.

We flew 2.2m scheduled passengers in the six months to 30 September 2009 (2008:

2.3m) with the total number of routes served from all bases rising to 94 (2008:

75). We were able to increase load factors, partly at the expense of yields, by

focusing on flying popular routes at departure times convenient to our

customers.

Ancillary revenues are continually being developed with gross revenue per

passenger increasing to GBP20.70 during this half year (2008: GBP15.17). This

increase is principally driven by sales made possible by our proprietary

reservation system. Pre-ordered meals and advanced seat assignment have been

particularly successful on some of our longer routes. Further enhancements

continue to be introduced by our commercial and IT teams, including on-going

development of our travel trade interfaces which allow easy access to Jet2.com's

seat inventory for travel agents and tour operators. Jet2.com was recently

honoured at the Northern Ireland Travel and Tourism Awards, winning the award

for the Best Travel Internet Booking System.

After a very strong performance in the previous year, our freight and passenger

charter business experienced reduced revenues, reflecting a weaker market for

charter services. In total, charter revenues were down 18% in the first

half. Pleasingly, however, on 29 October 2009 Jet2.com was voted Passenger

Airline of the Year by the Baltic Air Charter Association.

Whilst the management of costs has been a particular focus, a significant

proportion of the airline's cost base is foreign currency based and has suffered

from the weakness of Sterling. Our fuel efficiency programme continues to

deliver improved fuel utilisation; two of our Boeing 757 aircraft are now

equipped with aero-dynamically efficient winglets with two more aircraft to be

fitted this winter. In June 2009, the first Boeing 737 flight took place with

Pratt & Whitney manufactured parts fitted to its CFM engines. Jet2.com is the

lead customer for this programme, which delivers significant savings relative to

the cost of OEM components.

For Winter 09/10, Jet2.com has slightly reduced its overall scheduled capacity,

reflecting a prudent approach in the current economic environment. For next

summer we will be operating new scheduled services to seven sun destinations

from East Midlands Airport (which are also available as package holidays with

Jet2holidays.com). We have also expanded our operations from both Newcastle and

Manchester Airports and now operate more scheduled leisure routes than any other

airline at Manchester Airport. Overall, we have planned a 2% increase in

scheduled seat capacity for Summer 2010, with a higher proportion of Eastern

Mediterranean destinations. New destinations for next summer include Bergerac,

Gran Canaria, Kos, Madeira, Reus and Tunisia, and we have increased capacity to

Egypt, Greece and Turkey.

We continue to invest in the development of Jet2holidays.com, our ATOL protected

tour operator, which delivered over 47,000 package holidays in the half year to

September 2009, an 80% increase over the same period last year. It is expected

that Jet2holidays.com will make an increasingly significant contribution to the

airline's passenger numbers in the coming year. We believe that it will become

increasingly successful through offering our leisure customers good value

package holidays from their local airports, flying with Jet2.com.

Fowler Welch-Coolchain

The Group's logistics company, Fowler Welch-Coolchain, provides an integrated

supply chain solution for retailers, food manufacturers, growers and importers.

Services provided from its distribution centres in Spalding (Lincs), Teynham

(Kent), Washington (Tyne & Wear), Stockport (Cheshire) and Portsmouth

(Hampshire) include both chilled and ambient storage and distribution, together

with value adding pick-to-order warehousing operations. The company also has

port operations in Sheerness and Southampton and provides transport services for

imported container traffic entering the UK through the East Coast Port network.

There have been significant new business wins during the period and further

additional business wins from existing customers. Our Washington distribution

centre has seen increased Tesco Express deliveries, whilst our ambient

consolidation centre at Stockport has increased its volumes into Asda stores,

including the commencement of Asda George distribution. Like-for-like sales

have increased by 8% year on year although fuel surcharges levied have reduced

as a result of lower oil prices.

Operating margins have improved during the first six months of the year across

the business.Our own vehicle performance has benefited from a combination of

increased utilisation, more loaded miles and better networking of the combined

fleet, in part driven by a reduction in the ambient fleet.We have continued to

invest in driver training and have committed to introduce more 'best in class'

fuel efficient vehicles as part of our continuing fleet replacement programme.

This, together with a further expansion of our double-decker trailer fleet, will

not only generate fuel savings and additional operating efficiencies, but also

further reduce our carbon footprint. The Manhattan warehouse management system

implemented at Spalding is also now generating substantial operating

efficiencies and will be rolled out through all other chilled distribution

centres during the remainder of the financial year.

We continue to develop our container transport operations, which not only

enhances our ability to provide an end-to-end service to customers but also

reduces traditional periods of vehicle downtime in our chilled network. The

company increased its presence in this sector through the acquisition on 1

September 2009 of Bawdsey Haulage Limited, a company specialising in the

distribution of containers from its depot at the Port of Felixstowe. This

operation is expected to generate revenues of approximately GBP6m per annum. In

addition to this acquisition, an operation has commenced at Teesport to further

develop the container business.

Fowler Welch-Coolchain continues to exploit considerable growth opportunities

across all its core activities and is in a good position to capitalise on

further market consolidation.

Outlook

On an underlying basis, we expect full year trading to be in line with market

expectations. Jet2.com forward booking levels are encouraging and Fowler

Welch-Coolchain continues to perform strongly. However, we expect the current

challenging trading environment to remain for some time and we will continue to

manage the business prudently, whilst continuing to take advantage of market

opportunities.

Philip Meeson,

Chairman 19 November 2009

www.dartgroup.co.uk

Enquiries:

+-----------------------------------------+-----------------------------------------+

| Philip Meeson, Chairman | Mobile: 07785 258666 |

+-----------------------------------------+-----------------------------------------+

| Andrew Merrick, Group Finance Director | Mobile: 07788 565358 |

| | |

+-----------------------------------------+-----------------------------------------+

| Andy Pedrette, Smith & Williamson | 020 7131 4000 |

| Corporate Finance Limited | |

+-----------------------------------------+-----------------------------------------+

Consolidated Group Income Statement (unaudited)

For the half year ended 30 September 2009

+----------------------------+------+-------------+-------------+---------+-------------+-------------+---------+-------------+-------------+---------+

| | | Half year ended 30 | Half year ended 30 | Year ended 31 March 2009 - |

| | | September 2009 | September 2008 | Audited |

+----------------------------+------+-------------------------------------+-------------------------------------+-------------------------------------+

| | | Before | Specific | IFRS | Before | Specific | IFRS | Before | Specific | IFRS |

| | | Specific | IAS 39 | | Specific | IAS 39 | | Specific | IAS 39 | |

| | | IAS 39 | mark to | | IAS 39 | mark to | | IAS 39 | mark to | |

| | | mark to | market | | mark to | market | | mark to | market | |

| | | market | adjustments | | market | adjustments | | market | adjustments | |

| | | adjustments | | | adjustments | | | adjustments | | |

+----------------------------+------+-------------+-------------+---------+-------------+-------------+---------+-------------+-------------+---------+

| |Note | GBPm | GBPm | GBPm | GBPm | GBPm | GBPm | GBPm | GBPm | GBPm |

+----------------------------+------+-------------+-------------+---------+-------------+-------------+---------+-------------+-------------+---------+

| | | | | | | | | | | |

+----------------------------+------+-------------+-------------+---------+-------------+-------------+---------+-------------+-------------+---------+

| Turnover | 3 | 272.7 | - | 272.7 | 272.8 | - | 272.8 | 439.3 | - | 439.3 |

+----------------------------+------+-------------+-------------+---------+-------------+-------------+---------+-------------+-------------+---------+

| | | | | | | | | | | |

+----------------------------+------+-------------+-------------+---------+-------------+-------------+---------+-------------+-------------+---------+

| Net operating expenses | | (247.4) | 2.4 | (245.0) | (237.9) | 2.8 | (235.1) | (405.3) | 4.7 | (400.6) |

+----------------------------+------+-------------+-------------+---------+-------------+-------------+---------+-------------+-------------+---------+

| Other operating income | | - | - | - | 1.0 | - | 1.0 | 1.2 | - | 1.2 |

+----------------------------+------+-------------+-------------+---------+-------------+-------------+---------+-------------+-------------+---------+

| | | | | | | | | | | |

+----------------------------+------+-------------+-------------+---------+-------------+-------------+---------+-------------+-------------+---------+

| Operating profit | | 25.3 | 2.4 | 27.7 | 35.9 | 2.8 | 38.7 | 35.2 | 4.7 | 39.9 |

+----------------------------+------+-------------+-------------+---------+-------------+-------------+---------+-------------+-------------+---------+

| | | | | | | | | | | |

+----------------------------+------+-------------+-------------+---------+-------------+-------------+---------+-------------+-------------+---------+

| Finance income | | 2.2 | - | 2.2 | 2.4 | - | 2.4 | 0.9 | - | 0.9 |

+----------------------------+------+-------------+-------------+---------+-------------+-------------+---------+-------------+-------------+---------+

| Finance costs | | (1.8) | - | (1.8) | (4.8) | - | (4.8) | (7.3) | - | (7.3) |

+----------------------------+------+-------------+-------------+---------+-------------+-------------+---------+-------------+-------------+---------+

| Net financing costs | | 0.4 | - | 0.4 | (2.4) | - | (2.4) | (6.4) | - | (6.4) |

+----------------------------+------+-------------+-------------+---------+-------------+-------------+---------+-------------+-------------+---------+

| | | | | | | | | | | |

+----------------------------+------+-------------+-------------+---------+-------------+-------------+---------+-------------+-------------+---------+

| | | | | | | | | | | |

+----------------------------+------+-------------+-------------+---------+-------------+-------------+---------+-------------+-------------+---------+

| | | | | | | | | | | |

+----------------------------+------+-------------+-------------+---------+-------------+-------------+---------+-------------+-------------+---------+

| Profit on ordinary activities | 25.7 | 2.4 | 28.1 | 33.5 | 2.8 | 36.3 | 28.8 | 4.7 | 33.5 |

| before taxation | | | | | | | | | |

+-----------------------------------+-------------+-------------+---------+-------------+-------------+---------+-------------+-------------+---------+

| | | | | | | | | | | |

+----------------------------+------+-------------+-------------+---------+-------------+-------------+---------+-------------+-------------+---------+

| Taxation | 6 | (7.2) | (0.7) | (7.9) | (10.3) | (0.8) | (11.1) | (5.1) | (1.3) | (6.4) |

+----------------------------+------+-------------+-------------+---------+-------------+-------------+---------+-------------+-------------+---------+

| | | | | | | | | | | |

+----------------------------+------+-------------+-------------+---------+-------------+-------------+---------+-------------+-------------+---------+

| Profit for the period (all | | 18.5 | 1.7 | 20.2 | 23.2 | 2.0 | 25.2 | 23.7 | 3.4 | 27.1 |

| attributable to equity | | | | | | | | | | |

| shareholders of the | | | | | | | | | | |

| parent) | | | | | | | | | | |

+----------------------------+------+-------------+-------------+---------+-------------+-------------+---------+-------------+-------------+---------+

| | | | | | | | | | | |

+----------------------------+------+-------------+-------------+---------+-------------+-------------+---------+-------------+-------------+---------+

| | | | | | | | | | | |

+----------------------------+------+-------------+-------------+---------+-------------+-------------+---------+-------------+-------------+---------+

| Earnings per share - total | 4 | | | | | | | | | |

+----------------------------+------+-------------+-------------+---------+-------------+-------------+---------+-------------+-------------+---------+

| - basic | | 13.10p | | 14.31p | 16.39p | | 17.81p | 16.87p | | 19.27p |

+----------------------------+------+-------------+-------------+---------+-------------+-------------+---------+-------------+-------------+---------+

| - diluted | | 12.67p | | 13.83p | 16.39p | | 17.81p | 16.46p | | 18.80p |

+----------------------------+------+-------------+-------------+---------+-------------+-------------+---------+-------------+-------------+---------+

| | | | | | | | | | | |

+----------------------------+------+-------------+-------------+---------+-------------+-------------+---------+-------------+-------------+---------+

| Earnings per share - continuing | | | | | | | | | |

| operations | | | | | | | | | |

+-----------------------------------+-------------+-------------+---------+-------------+-------------+---------+-------------+-------------+---------+

| - basic | | 13.10p | | 14.31p | 16.39p | | 17.81p | 16.87p | | 19.27p |

+----------------------------+------+-------------+-------------+---------+-------------+-------------+---------+-------------+-------------+---------+

| - diluted | | 12.67p | | 13.83p | 16.39p | | 17.81p | 16.46p | | 18.80p |

+----------------------------+------+-------------+-------------+---------+-------------+-------------+---------+-------------+-------------+---------+

| | | | | | | | | | | |

+----------------------------+------+-------------+-------------+---------+-------------+-------------+---------+-------------+-------------+---------+

Consolidated Group Statement of Comprehensive Income (unaudited)

For the half year ended 30 September 2009

+----------------------------------+------+---------------+--+--------------+--+------------+

| | | Half year | | Half year | | Year ended |

| | | ended 30 | | ended 30 | | 31 March |

| | | September | | September | | 2009 |

| | | 2009 | | 2008 | | Audited |

| | | GBPm | | GBPm | | GBPm |

+----------------------------------+------+---------------+--+--------------+--+------------+

| | | | | | | |

+----------------------------------+------+---------------+--+--------------+--+------------+

| Profit for the period | | 20.2 | | 25.2 | | 27.1 |

+----------------------------------+------+---------------+--+--------------+--+------------+

| | | | | | | |

+----------------------------------+------+---------------+--+--------------+--+------------+

| Exchange differences on | | - | | (0.1) | | (0.2) |

| translating foreign operations | | | | | | |

+----------------------------------+------+---------------+--+--------------+--+------------+

| Effective portion of changes in | | (0.5) | | (1.9) | | (11.8) |

| fair value of cash flow hedges | | | | | | |

+----------------------------------+------+---------------+--+--------------+--+------------+

| Taxation on components of other | | 0.1 | | 0.5 | | 3.7 |

| comprehensive income | | | | | | |

+----------------------------------+------+---------------+--+--------------+--+------------+

| Other comprehensive income & | | (0.4) | | (1.5) | | (8.3) |

| expense for the period, net of | | | | | | |

| taxation | | | | | | |

+----------------------------------+------+---------------+--+--------------+--+------------+

| | | | | | | |

+----------------------------------+------+---------------+--+--------------+--+------------+

| Total comprehensive income for | | 19.8 | | 23.7 | | 18.8 |

| the period all attributable to | | | | | | |

| owners of the parent | | | | | | |

+----------------------------------+------+---------------+--+--------------+--+------------+

| | | | | | | |

+----------------------------------+------+---------------+--+--------------+--+------------+

Consolidated Group Balance Sheet (unaudited)

As at 30 September 2009

+----------------------------------+------+---------------+--+--------------+--+------------+

| | | 30 September | | 30 September | | 31 March |

| | | 2009 | | 2008 | | 2009 |

| | | GBPm | | GBPm | | Audited |

| | | | | | | |

| | | | | | | GBPm |

+----------------------------------+------+---------------+--+--------------+--+------------+

| Non-current assets | | | | | | |

+----------------------------------+------+---------------+--+--------------+--+------------+

| Goodwill | | 7.0 | | 6.8 | | 6.8 |

+----------------------------------+------+---------------+--+--------------+--+------------+

| Property, plant and | | 183.4 | | 186.3 | | 190.5 |

| equipment | | | | | | |

+----------------------------------+------+---------------+--+--------------+--+------------+

| Derivative | | 5.0 | | 6.0 | | 2.4 |

| financial | | | | | | |

| instruments | | | | | | |

+----------------------------------+------+---------------+--+--------------+--+------------+

| | | 195.4 | | 199.1 | | 199.7 |

+----------------------------------+------+---------------+--+--------------+--+------------+

| | | | | | | |

+----------------------------------+------+---------------+--+--------------+--+------------+

| Current assets | | | | | | |

+----------------------------------+------+---------------+--+--------------+--+------------+

| Inventories | | 1.0 | | 0.3 | | 0.4 |

+----------------------------------+------+---------------+--+--------------+--+------------+

| Trade and other | | 45.4 | | 47.9 | | 45.1 |

| receivables | | | | | | |

+----------------------------------+------+---------------+--+--------------+--+------------+

| Derivative | | 6.3 | | 6.6 | | 32.7 |

| financial | | | | | | |

| instruments | | | | | | |

+----------------------------------+------+---------------+--+--------------+--+------------+

| Cash and cash | | 16.5 | | 0.4 | | 11.8 |

| equivalents | | | | | | |

+----------------------------------+------+---------------+--+--------------+--+------------+

| | | 69.2 | | 55.2 | | 90.0 |

+----------------------------------+------+---------------+--+--------------+--+------------+

| | | | | | | |

+----------------------------------+------+---------------+--+--------------+--+------------+

| Total assets | | 264.6 | | 254.3 | | 289.7 |

+----------------------------------+------+---------------+--+--------------+--+------------+

| | | | | | | |

+----------------------------------+------+---------------+--+--------------+--+------------+

| Current liabilities | | | | | | |

+----------------------------------+------+---------------+--+--------------+--+------------+

| Trade and other | | 114.5 | | 118.6 | | 139.9 |

| payables | | | | | | |

+----------------------------------+------+---------------+--+--------------+--+------------+

| Borrowings | | 0.4 | | 7.6 | | - |

+----------------------------------+------+---------------+--+--------------+--+------------+

| Derivative | | 2.0 | | 2.1 | | 30.8 |

| financial | | | | | | |

| instruments | | | | | | |

+----------------------------------+------+---------------+--+--------------+--+------------+

| | | 116.9 | | 128.3 | | 170.7 |

+----------------------------------+------+---------------+--+--------------+--+------------+

| | | | | | | |

+----------------------------------+------+---------------+--+--------------+--+------------+

| Non-current liabilities | | | | | | |

+----------------------------------+------+---------------+--+--------------+--+------------+

| Other non current | | 6.1 | | 6.2 | | 6.4 |

| liabilities | | | | | | |

+----------------------------------+------+---------------+--+--------------+--+------------+

| Derivative | | 7.3 | | 4.1 | | 0.2 |

| financial | | | | | | |

| instruments | | | | | | |

+----------------------------------+------+---------------+--+--------------+--+------------+

| Deferred tax | | 20.9 | | 17.5 | | 19.0 |

+----------------------------------+------+---------------+--+--------------+--+------------+

| | | 34.3 | | 27.8 | | 25.6 |

+----------------------------------+------+---------------+--+--------------+--+------------+

| | | | | | | |

+----------------------------------+------+---------------+--+--------------+--+------------+

| Total liabilities | | 151.2 | | 156.1 | | 196.3 |

+----------------------------------+------+---------------+--+--------------+--+------------+

| | | | | | | |

+----------------------------------+------+---------------+--+--------------+--+------------+

| Net assets | | 113.4 | | 98.2 | | 93.4 |

+----------------------------------+------+---------------+--+--------------+--+------------+

| | | | | | | |

+----------------------------------+------+---------------+--+--------------+--+------------+

| | | | | | | |

+----------------------------------+------+---------------+--+--------------+--+------------+

| Capital and reserves | | | | | | |

+----------------------------------+------+---------------+--+--------------+--+------------+

| | | | | | | |

+----------------------------------+------+---------------+--+--------------+--+------------+

| Called up share | | 1.8 | | 1.8 | | 1.8 |

| capital | | | | | | |

+----------------------------------+------+---------------+--+--------------+--+------------+

| Share premium | | 9.3 | | 9.3 | | 9.3 |

| account | | | | | | |

+----------------------------------+------+---------------+--+--------------+--+------------+

| Cash flow hedging | | 1.5 | | 8.6 | | 1.9 |

| reserve | | | | | | |

+----------------------------------+------+---------------+--+--------------+--+------------+

| Profit and loss | | 100.8 | | 78.4 | | 80.4 |

| account | | | | | | |

+----------------------------------+------+---------------+--+--------------+--+------------+

| Other reserves | | - | | 0.1 | | - |

+----------------------------------+------+---------------+--+--------------+--+------------+

| Total shareholders' equity | | 113.4 | | 98.2 | | 93.4 |

+----------------------------------+------+---------------+--+--------------+--+------------+

Consolidated Group Cash Flow Statement (unaudited)

For the half year ended 30 September 2009

+----------------------------------+------+------------+--+-----------+--+----------+

| | | Half year ended 30 | | Year |

| | | September | | ended 31 |

| | | | | March |

+----------------------------------+------+---------------------------+--+----------+

| | | 2009 | | 2008 | | 2009 |

| | | GBPm | | GBPm | | Audited |

| | | | | | | GBPm |

+----------------------------------+------+------------+--+-----------+--+----------+

| | | | | | | |

+----------------------------------+------+------------+--+-----------+--+----------+

| Cash flows from operating | | | | | | |

| activities | | | | | | |

+----------------------------------+------+------------+--+-----------+--+----------+

| Profit before taxation from continuing | 28.1 | | 36.3 | | 33.5 |

| operations | | | | | |

+-----------------------------------------+------------+--+-----------+--+----------+

| | | | | | | |

+----------------------------------+------+------------+--+-----------+--+----------+

| Adjustments for: | | | | | | |

+----------------------------------+------+------------+--+-----------+--+----------+

| Finance income | | (2.2) | | (2.4) | | (0.9) |

+----------------------------------+------+------------+--+-----------+--+----------+

| Finance costs | | 1.8 | | 4.8 | | 7.3 |

+----------------------------------+------+------------+--+-----------+--+----------+

| Depreciation | | 14.7 | | 16.6 | | 30.7 |

+----------------------------------+------+------------+--+-----------+--+----------+

| Financial | | 7.4 | | - | | - |

| derivative close | | | | | | |

| out costs | | | | | | |

+----------------------------------+------+------------+--+-----------+--+----------+

| Equity settled | | - | | 0.1 | | 0.2 |

| share based | | | | | | |

| payments | | | | | | |

+----------------------------------+------+------------+--+-----------+--+----------+

| Fair value | | (2.4) | | (2.6) | | (4.7) |

| adjustments | | | | | | |

+----------------------------------+------+------------+--+-----------+--+----------+

| Operating cash flows before | | 47.4 | | 52.8 | | 66.1 |

| movements in working capital | | | | | | |

+----------------------------------+------+------------+--+-----------+--+----------+

| | | | | | | |

+----------------------------------+------+------------+--+-----------+--+----------+

| (Increase) in | | (0.6) | | - | | (0.1) |

| inventories | | | | | | |

+----------------------------------+------+------------+--+-----------+--+----------+

| Decrease / (increase) in | 0.6 | | 2.3 | | (5.3) |

| trade and other | | | | | |

| receivables | | | | | |

+-----------------------------------------+------------+--+-----------+--+----------+

| (Decrease) / increase in | (33.4) | | (33.9) | | 7.3 |

| trade and other payables | | | | | |

+-----------------------------------------+------------+--+-----------+--+----------+

| Financial derivative close | - | | - | | (6.5) |

| out costs | | | | | |

+-----------------------------------------+------------+--+-----------+--+----------+

| | | | | | | |

+----------------------------------+------+------------+--+-----------+--+----------+

| Cash generated from operations | | 14.0 | | 21.2 | | 61.5 |

+----------------------------------+------+------------+--+-----------+--+----------+

| | | | | | | |

+----------------------------------+------+------------+--+-----------+--+----------+

| Interest received | | - | | 1.0 | | 0.1 |

+----------------------------------+------+------------+--+-----------+--+----------+

| Interest paid | | (1.8) | | (2.3) | | (2.8) |

+----------------------------------+------+------------+--+-----------+--+----------+

| Tax received / | | - | | 0.4 | | (0.4) |

| (paid) | | | | | | |

+----------------------------------+------+------------+--+-----------+--+----------+

| | | | | | | |

+----------------------------------+------+------------+--+-----------+--+----------+

| Net cash generated from operating | 12.2 | | 20.3 | | 58.4 |

| activities | | | | | |

+-----------------------------------------+------------+--+-----------+--+----------+

| | | | | | | |

+----------------------------------+------+------------+--+-----------+--+----------+

| Cash flows from investing | | | | | | |

| activities | | | | | | |

+----------------------------------+------+------------+--+-----------+--+----------+

| Proceeds from sale of | - | | - | | 0.1 |

| property, plant and | | | | | |

| equipment | | | | | |

+-----------------------------------------+------------+--+-----------+--+----------+

| Business | | (0.7) | | - | | - |

| acquisition | | | | | | |

+----------------------------------+------+------------+--+-----------+--+----------+

| Purchase of | | (5.8) | | (9.5) | | (27.9) |

| property, plant and | | | | | | |

| equipment | | | | | | |

+----------------------------------+------+------------+--+-----------+--+----------+

| | | | | | | |

+----------------------------------+------+------------+--+-----------+--+----------+

| Net cash used in investing | | (6.5) | | (9.5) | | (27.8) |

| activities | | | | | | |

+----------------------------------+------+------------+--+-----------+--+----------+

| | | | | | | |

+----------------------------------+------+------------+--+-----------+--+----------+

| Cash flows from financing | | | | | | |

| activities | | | | | | |

+----------------------------------+------+------------+--+-----------+--+----------+

| Net repayments of proceeds | - | | (22.0) | | (22.0) |

| from borrowings | | | | | |

+-----------------------------------------+------------+--+-----------+--+----------+

| Interim dividend | | (1.0) | | - | | - |

| paid | | | | | | |

+----------------------------------+------+------------+--+-----------+--+----------+

| Transaction costs | | - | | - | | (0.9) |

| paid | | | | | | |

+----------------------------------+------+------------+--+-----------+--+----------+

| | | | | | | |

+----------------------------------+------+------------+--+-----------+--+----------+

| Net cash used in financing activities | (1.0) | | (22.0) | | (22.9) |

+-----------------------------------------+------------+--+-----------+--+----------+

| | | | | | | |

+----------------------------------+------+------------+--+-----------+--+----------+

| Effects of exchange | | - | | - | | 0.1 |

| rate changes | | | | | | |

+----------------------------------+------+------------+--+-----------+--+----------+

| | | | | | | |

+----------------------------------+------+------------+--+-----------+--+----------+

| | | | | | | |

+----------------------------------+------+------------+--+-----------+--+----------+

| Net increase / (decrease) in cash and | 4.7 | | (11.2) | | 7.8 |

| cash equivalents | | | | | |

+-----------------------------------------+------------+--+-----------+--+----------+

| | | | | | | |

+----------------------------------+------+------------+--+-----------+--+----------+

| Cash and cash equivalents at beginning | 11.8 | | 4.0 | | 4.0 |

| of period | | | | | |

+-----------------------------------------+------------+--+-----------+--+----------+

| | | | | | | |

+----------------------------------+------+------------+--+-----------+--+----------+

| Cash and cash equivalents at end | | 16.5 | | (7.2) | | 11.8 |

| of period | | | | | | |

+----------------------------------+------+------------+--+-----------+--+----------+

Consolidated Group Statement of Changes in Equity (unaudited)

For the half year ended 30 September 2009

+-------------------------------+--------------+------------+--------------+-------------+-------------+----------+

| | Share | Share | Cash Flow | Retained | Other | Total |

| | Capital | Premium | Hedging | Earnings | Reserves | Reserves |

| | | | Reserve | | | |

+-------------------------------+--------------+------------+--------------+-------------+-------------+----------+

| | GBPm | GBPm | GBPm | GBPm | GBPm | GBPm |

+-------------------------------+--------------+------------+--------------+-------------+-------------+----------+

| | | | | | | |

+-------------------------------+--------------+------------+--------------+-------------+-------------+----------+

| Balance at 1 April 2008 | 1.8 | 9.3 | 10.0 | 53.1 | 0.2 | 74.4 |

+-------------------------------+--------------+------------+--------------+-------------+-------------+----------+

| | | | | | | |

+-------------------------------+--------------+------------+--------------+-------------+-------------+----------+

| Total comprehensive income | - | - | (1.4) | 25.2 | (0.1) | 23.7 |

| for the period | | | | | | |

+-------------------------------+--------------+------------+--------------+-------------+-------------+----------+

| Share based payments | - | - | - | 0.1 | - | 0.1 |

+-------------------------------+--------------+------------+--------------+-------------+-------------+----------+

| | | | | | | |

+-------------------------------+--------------+------------+--------------+-------------+-------------+----------+

| Balance at 30 September 2008 | 1.8 | 9.3 | 8.6 | 78.4 | 0.1 | 98.2 |

+-------------------------------+--------------+------------+--------------+-------------+-------------+----------+

| | | | | | | |

+-------------------------------+--------------+------------+--------------+-------------+-------------+----------+

| Total comprehensive income | - | - | (6.7) | 1.9 | (0.1) | (4.9) |

| for the period | | | | | | |

+-------------------------------+--------------+------------+--------------+-------------+-------------+----------+

| Share based payments | - | - | - | 0.1 | - | 0.1 |

+-------------------------------+--------------+------------+--------------+-------------+-------------+----------+

| | | | | | | |

+-------------------------------+--------------+------------+--------------+-------------+-------------+----------+

| Balance at 31 March 2009 | 1.8 | 9.3 | 1.9 | 80.4 | - | 93.4 |

+-------------------------------+--------------+------------+--------------+-------------+-------------+----------+

| | | | | | | |

+-------------------------------+--------------+------------+--------------+-------------+-------------+----------+

| Total comprehensive income | - | - | (0.4) | 20.2 | - | 19.8 |

| for the period | | | | | | |

+-------------------------------+--------------+------------+--------------+-------------+-------------+----------+

| Share based payments | - | - | - | 0.2 | - | 0.2 |

+-------------------------------+--------------+------------+--------------+-------------+-------------+----------+

| | | | | | | |

+-------------------------------+--------------+------------+--------------+-------------+-------------+----------+

| Balance at 30 September 2009 | 1.8 | 9.3 | 1.5 | 100.8 | - | 113.4 |

+-------------------------------+--------------+------------+--------------+-------------+-------------+----------+

Notes to the consolidated financial statements

For the half year ended 30 September 2009 (unaudited)

1. General information

The accounts for Dart Group PLC (the "Group") have been prepared and approved by

the Directors in accordance with International Financial Reporting Standards

("IFRS") as adopted by the European Union ("Adopted IFRS"). The Group's accounts

consolidate the accounts of Dart Group PLC and its subsidiaries.

The interim report for the six months ended 30 September 2009 was approved by

the Board of Directors on 18 November 2009.

2. Accounting policies

Basis of preparation

The accounts have been prepared under the historical cost convention, except for

all derivative financial instruments which have been measured at fair value. In

addition this interim financial report does not comply with IAS 34, Interim

Financial Reporting, which is not currently required to be applied under AIM

rules.

Except as described below the accounting policies, presentation and methods of

computation are consistent with those described in the Group's accounts for the

year ended 31 March 2009.

The following new standards and amendments to standards are mandatory for the

first time for the financial year beginning 1 April 2009:

* IAS1 (revised), "Presentation of Financial Statements" requires a statement of

comprehensive income setting out all items of income and expense relating to

non-owner changes in equity. There is a choice between presenting comprehensive

income in one statement or two statements comprising an income statement and a

separate statement of comprehensive income. The Group has elected to present two

statements. In addition IAS1 (revised) requires the statement of changes in

shareholders' equity to be presented as a primary statement. The other revisions

to IAS1 have not had a significant impact on the presentation of the Group's

financial information.

* Amendment to IFRS2 (Share Based Payments) clarifies, amongst other matters, the

treatment of cancelled options. The impact is insignificant.

* IFRS8, "Operating Segments" replaces IAS14, "Segment Reporting" and requires the

disclosure of segment information on the same basis as the management

information provided to the Chief Operating decision maker. The adoption of this

standard has not resulted in a change in the Group's reportable segments, being

aviation services and distribution.

* IAS23 (revised) requires an entity to capitalise borrowing costs directly

attributable to the acquisition, construction and production of a qualifying

asset, as part of the cost of that asset. A qualifying asset is one that takes a

substantial period of time to get ready for use or sale. The impact is not

expected to be material to the Group.

The interim financial information for the 6 months ended 30 September 2009 has

not been audited or reviewed by the auditors. The comparative figures for the

financial year ended 31 March 2009 are not the Group's statutory accounts for

that financial year. Those accounts, which were prepared under IFRS, have been

reported on by the Company's auditors and delivered to the Registrar of

Companies. The report of the auditors was (i) unqualified, (ii) did not include

a reference to any matters to which the auditors drew attention by way of

emphasis without qualifying their report, and (iii) did not contain a statement

under section 237(2) or (3) of the Companies Act 1985.

The Group's accounts are presented in pounds sterling and all values are rounded

to the nearest GBP100,000 except where indicated otherwise.

3. Segmental information

For management purposes the Group is divided into two main segments, Aviation

Services and Distribution. These divisions are the basis on which the Group

reports its primary segmental information in the day-to-day management of the

business. The following is an analysis of the Group's revenue by operating

segment. All of the segmental revenue reported is from external customers.

+---------------------------------+------------+--+------------+--+------------+

| Segmental Revenues | Half year | | Half year | | Year to |

| | to | | to | | 31 March |

| | 30 | | 30 | | 2009 |

| | September | | September | | Audited |

| | 2009 | | 2008 | | GBPm |

| | GBPm | | GBPm | | |

+---------------------------------+------------+--+------------+--+------------+

| | | | | | |

+---------------------------------+------------+--+------------+--+------------+

| Aviation services | 215.4 | | 215.6 | | 326.4 |

+---------------------------------+------------+--+------------+--+------------+

| Distribution | 57.3 | | 57.2 | | 112.9 |

+---------------------------------+------------+--+------------+--+------------+

| | 272.7 | | 272.8 | | 439.3 |

+---------------------------------+------------+--+------------+--+------------+

4. Earnings per share

The calculation of earnings per share is based on the following:

+----------------------------------+-------------+--+-------------+--+-------------+

| | Half year | | Half year | | Year to |

| | to | | to | | 31 March |

| | 30 | | 30 | | 2009 |

| | September | | September | | Audited |

| | 2009 | | 2008 | | |

| | | | | | |

+----------------------------------+-------------+--+-------------+--+-------------+

| | | | | | |

+----------------------------------+-------------+--+-------------+--+-------------+

| Profit for the period (GBPm) | 20.2 | | 25.2 | | 27.2 |

+----------------------------------+-------------+--+-------------+--+-------------+

| | | | | | |

+----------------------------------+-------------+--+-------------+--+-------------+

| Weighted average number of | 141,089,854 | | 141,065,694 | | 141,065,694 |

| ordinary shares in issue during | | | | | |

| the period used to calculate | | | | | |

| basic earnings per share | | | | | |

+----------------------------------+-------------+--+-------------+--+-------------+

| | | | | | |

+----------------------------------+-------------+--+-------------+--+-------------+

| Weighted average number of | 145,906,222 | | 141,065,694 | | 144,590,658 |

| ordinary shares in issue during | | | | | |

| the period used to calculate | | | | | |

| diluted earnings per share | | | | | |

+----------------------------------+-------------+--+-------------+--+-------------+

5. Dividends

An interim dividend has been proposed during the six month period to 30

September 2009 of 0.36p per share (2008: nil).

6. Taxation

The tax charge for the period of GBP7.9 million is calculated by applying an

estimated effective tax rate of 28% for the year to 31 March 2010 to the profit

for the period (2008: 30.6%).

7. Reconciliation of net cash flow to movement in net cash / (debt)

+---------------------------------+-------------+--+------------+--+----------+

| | Half year | | Half year | | Year to |

| | to | | to | | 31 March |

| | 30 | | 30 | | 2009 |

| | September | | September | | Audited |

| | 2009 | | 2008 | | GBPm |

| | GBPm | | GBPm | | |

+---------------------------------+-------------+--+------------+--+----------+

| | | | | | |

+---------------------------------+-------------+--+------------+--+----------+

| Increase / (decrease) in cash | 4.7 | | (11.2) | | 7.9 |

| in the period | | | | | |

+---------------------------------+-------------+--+------------+--+----------+

| Movement in net debt in the | (0.4) | | 22.0 | | 21.2 |

| period | | | | | |

+---------------------------------+-------------+--+------------+--+----------+

| Change in net debt resulting | 4.3 | | 10.8 | | 29.1 |

| from cash flows in the period | | | | | |

+---------------------------------+-------------+--+------------+--+----------+

| Other non cash changes | - | | (0.8) | | (0.1) |

+---------------------------------+-------------+--+------------+--+----------+

| Net cash / (debt) at beginning | 11.8 | | (17.2) | | (17.2) |

| of period | | | | | |

+---------------------------------+-------------+--+------------+--+----------+

| | | | | | |

+---------------------------------+-------------+--+------------+--+----------+

| Net cash / (debt) at end of | 16.1 | | (7.2) | | 11.8 |

| period | | | | | |

+---------------------------------+-------------+--+------------+--+----------+

8. Contingent liabilities

The Group is in litigation in the US against Sutra Inc and Novak Niketic, who

provided use of the reservation system operated by Jet2.com until February 2008,

in relation to the termination of the use of this system. An unspecified

counterclaim has been lodged which is being vigorously defended by the Group in

respect of which the Directors estimate approximately $2.5m liability in the

unlikely event that the counterclaim is successful.

9. Other matters

This report will be posted on the Company's website, www.dartgroup.co.uk and

copies are available from the Company Secretary at the registered office of the

Company, Low Fare Finder House, Leeds Bradford International Airport, Leeds LS19

7TU.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR CKFKBCBDDADD

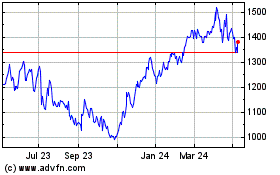

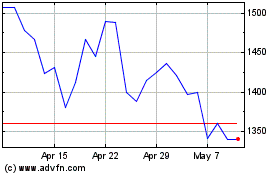

Jet2 (LSE:JET2)

Historical Stock Chart

From Jun 2024 to Jul 2024

Jet2 (LSE:JET2)

Historical Stock Chart

From Jul 2023 to Jul 2024