RNS No 4113e

DART GROUP PLC

25th June 1998

Dart Group PLC ("Dart Group" or "the Group")

Preliminary statement of results

for the year ended 31 March 1998

CHAIRMANS STATEMENT

I am pleased to report a year of good progress for the Group.

Profit before tax for the year to 31 March 1998 has risen to

#5.13m (1997 - #4.64m) on turnover of #87.8m (1997 -

#72.1m). Earnings per share were 22.4p (1997 - 19.3p). Our

policy is to increase dividends in proportion to the growth in

earnings per share. Having reviewed the projected capital

expenditure requirements of the business the Board is pleased

to recommend a final dividend of 5.0p (1997 - 4.4p) making a

total dividend of 17.3p for the year (1997 - 6.5p). The

dividend will be payable on 27 August 1998 to shareholders on

the register on 10 July 1998.

During the year the Group purchased two further Airbus A300B4s

for conversion, from passenger aircraft into freighters, by

Daimler-Benz Aerospace Airbus (DASA) in Dresden, Germany.

The first of these aircraft was delivered to us on completion

of the conversion on 27 April 1998. This aircraft, and our

first A300 were financed by aircraft mortgages over a five

year term, providing #6.6 million cash at 31 March 1998, to

enable the Group to take advantage of future commercial

opportunities. Net gearing at the year end was 82% with

interest covered 8 times.

The Group has two operating divisions - Distribution and

Aviation Services.

Distribution Division

The divisions primary business is the operation of a high

quality distribution system for fresh produce and flowers to

supermarkets and wholesale markets throughout the UK mainland

and to Northern Ireland and the Channel Islands.

The two companies in this division, Fowler Welch and Channel

Express (CI), based respectively in Spalding, Lincolnshire,

and the Channel Islands, have benefited from the long-term

continuity of experienced management under whose guidance they

have expanded, both organically and by acquisition. The

distribution of fresh produce and flowers is an attractive

sector in which major transportation groups are also keen to

compete. However, the level of organisation and "hands on"

management required to meet the demanding standards of our

supermarket, grower and wholesaler customers is not easily

attained. It is pleasing to note our customers appreciation

of the intricate planning and operation needed to keep a

continuous flow of time sensitive temperature-controlled

produce delivered into their distribution centres in

accordance with their stringent quality requirements.

The division has, therefore, confidently expanded its network

through the acquisition of producer-owned distribution fleets

in Cambridgeshire and has agreed to lease a purpose designed

distribution centre at Portsmouth to serve its Channel Islands

and southern England customers and to handle growing volumes

of imported produce. This 40,000 sq.ft. temperature

controlled facility is scheduled for completion by the end of

1998 and will bring the temperature controlled facilities

operated by the division to over 300,000 sq.ft.

Aviation Services Division

The companies in the Aviation Services Division are our cargo

airline, Channel Express (Air Services), and Benair Freight

International, which manages and forwards freight

internationally by air, sea and road. The world air cargo

market is expected to more than triple over the next 20 years.

It has grown at an average rate of 7.2% per year from 1986 to

1997 and the annual average forecast growth to 2017 is 6.5%.

We are determined that our two specialist cargo companies will

take advantage of the excellent opportunities in this market.

Channel Express (Air Services) operates a fleet of 15 cargo

aircraft which fly throughout Europe on behalf of express

parcel companies, postal authorities, forwarders and other

airlines. In 1996 the company was the first to recognise

the potential for converting the many "parked up" Airbus

A300B4 passenger aircraft into freighters and is now operating

two converted A300s, which have been named "Eurofreighters",

with a third due for delivery in July of this year.

Since introducing the Eurofreighter into service, the company

has experienced considerable demand for the type with each of

its aircraft fully committed to operations. To take further

advantage of the potential in this market, therefore, the

Group is presently negotiating the purchase of a further A300

which it expects to deliver to DASA for conversion into a

freighter with re-delivery in the Spring of 1999. We are

confident that the Eurofreighter represents an excellent long-

term investment for the Group.

Our freight management and forwarding company, Benair, has now

completed the recent expansion of its UK office and warehouse

infrastructure and is well positioned for further growth. To

develop the companys full potential a Chief Executive has

been appointed for the first time. The strengthened

management team is concentrating on the opportunities afforded

by Benairs well-established and strong links with the Far

East and North America and its highly specialised business of

importing and distributing tropical and cold water fish

throughout the UK, whilst developing further niche

opportunities afforded by the Groups connections.

I hope, as you read my statement and the following Review of

Operations, you share my confidence in the Group and in its

future. This confidence is very much a reflection of my

appreciation of, and trust in, my management colleagues and

staff. We are fortunate indeed to have experience and

loyalty at all levels in the Group.

Philip Meeson, Chairman

25 June 1998

REVIEW OF OPERATIONS

DISTRIBUTION

Fowler Welch

The benefits from the merger of the Groups UK distribution

companies, Channel Express and Fowler Welch, are being

realised and the past year has seen the business develop and

the distribution network expand under the Fowler Welch name.

The company has been successful in winning additional business

and has developed new, competitive services to existing and

new customers.

Fowler Welchs primary business is the distribution of fresh

produce and flowers on behalf of supermarkets, wholesalers and

growers throughout the UK and the Channel Islands. These

products are delivered into the companys consolidation

centres or are collected from a wide range of leading

suppliers dealing in both home grown and imported produce and

flowers. Loads are then assembled to customer order by

warehouse teams who form an important part of the distribution

process. Nationwide delivery by the experienced force of over

200 drivers is made within hours to supermarkets and wholesale

outlets, ensuring that these highly perishable consignments

are ready for sale in peak condition.

This 24 hours a day, 7 days a week operation is planned and

carried out by a strong, dedicated team of management and

staff who have many years practical experience. Constant

monitoring of the distribution chain is needed in order to

meet critical delivery deadlines and, to facilitate this, all

vehicles are equipped with the latest in-cab communications

systems. A sophisticated IT system, which is presently being

further enhanced to incorporate closer links with customers

on-line networks, supports the operation.

The principal Fowler Welch consolidation centre is situated at

Spalding, Lincolnshire, where a new 55,000 sq.ft. cold store

was opened in October. This brings the amount of temperature-

controlled facilities at this centre to 155,000 sq.ft. Plans

to extend the 20 acre site are under consideration to cater

for further growth.

In the south, the company has agreed to lease a new, purpose-

designed distribution centre on a 4= acre site at Portsmouth,

Hampshire. This is scheduled for completion by 1 January 1999

and will comprise 20 loading bays within 40,000 sq.ft. of

compartmentalised, fully temperature-controlled warehousing

together with 8,000 sq.ft. of offices. When completed, this

distribution centre will, together with the companys existing

facilities at Bournemouth, present opportunities for

substantial business growth in the south, particularly in the

important growing area of West Sussex. It will also be

ideally situated to handle imports of produce arriving through

the ports of Southampton and Portsmouth.

The new Portsmouth distribution centre will bring the amount

of temperature-controlled storage available throughout the

division to over 300,000 sq.ft.

Fowler Welch works very closely with its customers to ensure

that they receive an efficient, cost effective service in this

competitive market. Through its national distribution network,

the company offers its customers a service that meets their

own particular needs and, at the same time, allows them to

benefit from the economies achieved through the consolidation

of consignments in a "shared-user" environment. Features of

this service can include collection from customers premises,

consolidation at one of the companys distribution centres,

rapid cooling of the product, provision of pre-packing

facilities, storage and delivery to any of the UKs multiple

retailers regional distribution centres or some 40 individual

wholesale markets.

Although delivery into regional distribution centres

continues to be Fowler Welchs prime business, increasingly

this is being taken a stage further by re-loading from these

centres with deliveries destined for individual supermarkets.

Linking these "primary" and "secondary" processes optimises

distribution efficiencies and lowers costs for both parties.

It also reduces the number of large vehicles on the roads and

helps the industry meet Government targets for protecting the

environment.

The companys enlarged national distribution network offers

other opportunities to attract return loads on behalf of its

wide customer base, thus maximising revenue earning miles.

In July 1997 and May 1998 respectively, Fowler Welch expanded

its operational base in eastern England when it took over the

distribution work and vehicle fleets of C. Minaar Ltd and

Russell Burgess Ltd. These two Cambridgeshire-based

companies specialise in the pre-packing of locally grown and

imported produce and Fowler Welch has consolidated their

transport operations into its existing network.

Cambridgeshire is one of the countrys most important produce

growing areas and is strategically significant as it gives the

company access to a further source of supply, both locally

grown and imported from the Benelux countries, through the

eastern ports of Harwich and Felixstowe, and worldwide via

Stansted Airport.

To support the expansion of its business, Fowler Welch has

strengthened its operational management giving the

organisation added momentum and providing the necessary

expertise to capitalise on future opportunities in the sector.

Fowler Welch has been an accredited "Investor in People" for

several years and has seen the benefits this brings in

attracting and retaining high calibre staff at all levels. The

company has developed and implemented in-house training

programmes covering a wide variety of skills tailored to the

specific needs of the business and staff performance is

appraised at regular intervals. Quality plays a key role in

providing customer satisfaction and Fowler Welch has for many

years held the ISO9002 quality standard. Supplementary to

this, supermarket customers have their own stringent codes of

high quality practice to which Fowler Welch adheres.

Channel Express (CI)

The Groups Channel Islands based company, Channel Express

(CI), serves the divisions important markets in Guernsey and

Jersey, with its vehicles delivering fresh produce and

flowers to the UK for distribution by Fowler Welch, returning

with a wide range of chilled, frozen and non-perishable

foodstuffs as well as mail, newspapers and general freight.

The two depots on each island are managed by local staff with

many years experience of Channel Islands needs. Channel

Express (CI) is very much an integral part of the Islands

transport infrastructure, both by air, in co-operation with

Channel Express (Air Services), and by sea.

The new Fowler Welch Portsmouth facility will provide a focal

point for the Channel Islands distribution operation.

Produce and flowers will be consolidated under fully

temperature-controlled conditions and consignments will enter

the Fowler Welch distribution chain more quickly for earlier

delivery to all UK destinations. This will allow the company

to improve the service provided to Channel Island growers

whilst, at the same time, the centres proximity to the port

of entry will ensure the operations cost effectiveness.

It is the intention of the distribution division to continue

to build upon its expanding infrastructure, developing

relationships with both the major multiple retailers and its

other customers through the expansion of its national

distribution network. It is expected that new commercial

opportunities will take the division into other strategic

locations during the coming year but, in particular, it is

believed that the new southern facility will offer

considerable potential for future growth.

AVIATION SERVICES

Channel Express (Air Services)

The Groups cargo airline, Channel Express (Air Services),

operates 15 aircraft on behalf of express parcel companies,

postal authorities, freight forwarders and other airlines.

Additionally the company operates many ad hoc charter flights

that are often arranged at short notice to meet the needs of

customers facing delays in their supply chains. The fleet

currently consists of eight Fokker F27s, four Lockheed

Electras, two Airbus A300 "Eurofreighters" and the remaining

Dart Herald which is due for retirement in March 1999.

All aircraft are owned by the Group except for one Fokker F27

and one Lockheed Electra, which are leased from other

operators. There are no plans to increase the number of F27s

or Electras owned by the Group.

The Groups aircraft offer a range of payloads: 6 tonnes

(Herald and F27s); 15 tonnes (Electras) and 45 tonnes

(Eurofreighters) enabling Channel Express (Air Services) to

offer increasing capacity to meet its customers requirements

as their businesses grow. Typically aircraft are contracted

by customers for periods of between one and three years and

fly scheduled feeder services between major cities and their

distribution centres. Contracts are often renewed for

further periods, for example, an Electra has operated for an

express parcel company on the Shannon-Dublin-Cologne route for

the past five years.

The companys contracts with its customers normally allow it

to pass on increases in third party costs such as fuel, air

traffic and landing fees, thus minimising these areas of risk.

Channel Express (Air Services) customers demand high

standards of service and reliability as it is essential that

aircraft arrive at the customers hubs within a tight time

frame so that cargoes may be sorted rapidly for redistribution

and thereafter continue their journeys to meet delivery

deadlines.

Customers contract Channel Express (Air Services) to operate

on their behalf either because they have decided not to

operate aircraft themselves or because regulatory restrictions

preclude, or restrict, them from operating aircraft in

Europe.

Channel Express (Air Services) frequently operates aircraft

that have been converted into freighters following their

retirement from passenger service. The high aircraft

utilisation of passenger operations dictates that direct

operating costs (such as fuel and maintenance) are kept under

constant review. Competitive operating costs are often

achieved by these airlines upgrading their fleets with newer

generation aircraft. The lower utilisation of intra European

cargo operations places a greater emphasis on fixed costs

(such as depreciation and finance charges) often leading to

the selection of aircraft that have been succeeded in

passenger airline fleets but which are suitable for

conversion into freighters.

Capital cost, suitability for cargo operation and

environmental considerations are all important factors in

Channel Express (Air Services) selection of aircraft types

for passenger to freighter conversion. Noise considerations

are particularly important as many of the companys operations

take place at night.

Apart from European legislation, which requires all aircraft

not meeting its noise requirements to be phased out of service

by 2002, individual airports also increasingly limit the types

of aircraft they are willing to accept at night - often

following pressure from local residents. With the exception

of the one remaining Dart Herald, all of the companys

aircraft have International Civil Aircraft Organisation

Chapter Three noise compliance certificates and are expected

to be acceptable for the foreseeable future for night-time

operations at European airports.

In view of the growth being experienced in the air cargo

market, in February 1996, after considerable research, the

Group purchased a 45 tonne capacity Airbus A300B4 aircraft,

which had been retired from passenger service, and placed the

first contract of its type for the A300s conversion into a

freighter. "The Eurofreighter" entered revenue service on 1

August 1997, flying during the day for a European freight

forwarder, at night for an express parcel company and at the

weekend for British Airways World Cargo from Stansted to Tel

Aviv. Following the operational and commercial success of

this first conversion, during the second and third quarters of

1997, the Group purchased two further A300B4s, the first of

these which entered revenue service, following its conversion,

in May 1998 and the second is due for re-delivery in July

1998.

Each of the companys Eurofreighters has been contracted to

operate European cargo services and it is a significant

reflection of the Groups skills that the types entry into

commercial service has been so successfully completed. Key to

this success has been the contribution of Channel Express

(Air Services) Commercial, Administration, Operations and

Engineering Departments. In order to operate the new type

over 48 aircrew and 20 engineers have been internally promoted

or recruited, and trained over the past 20 months. The

companys policy is to promote from within wherever possible

and 65% of the Eurofreighters operational appointments came

from internal applicants.

To support future Eurofreighter operations, in January of this

year, the Group purchased two A300B2s, an earlier version of

the aircraft having commonality of engines and many major

components. These aircraft were purchased to provide spare

parts and engines for the Eurofreighter fleet and, following

their dismantling, the company is in an extremely strong

position to support the operation of both its own aircraft

and those of other companies which are also now purchasing

A300s and contracting their conversions.

The Group plans to purchase and convert further A300B4s in the

future. It is expected that the F27s and Electras will

operate for a further five to ten years thus giving Channel

Express (Air Services) both continuity of operations and

growth in future capacity.

Benair Freight International

Benair, the Groups freight forwarder, manages and arranges

the transportation of its customers freight by air, sea and

road from its modern office and warehouse facilities at

Heathrow, Manchester and East Midlands Airports. The companys

wholly-owned subsidiary in Singapore and strong relationship

in Hong Kong, together with strategically located overseas

agents and partners, enable Benair to provide a high quality

freight management service to its customers.

During the year a review was undertaken of the companys

operations and development plans with the aim of defining the

main areas for growth in the medium term in order to make the

company a more significant contributor to the Groups revenues

and profits. This review is nearing completion by the newly

appointed Chief Executive who has previous experience of

business development in niche areas with two major forwarders.

In addition to its general freight forwarding activities,

Benair already has a significant niche business that requires

specialist knowledge and handling - the importation of cold

water and tropical fish for distribution to UK wholesalers.

This is a particular expertise that the company has developed

over several years and, despite its strong position in this

specialist market, it is believed that there are further

opportunities for growth.

Benairs business complements the Groups other operations and

provides it with further opportunities to exploit the rapidly

growing cargo market both through its own development

programmes and by exploiting intra Group opportunities. The

company will be given every possible backing to build it into

a substantial business.

CONSOLIDATED PROFIT AND LOSS ACCOUNT

for the year ended 31 March 1998

1998 1997

(audited) (audited)

#000 #000

TURNOVER 87,809 72,119

Net operating expenses (82,174) (67,585)

_______ ______

OPERATING PROFIT 5,635 4,534

Profit on sale of fixed assets 57 64

Net interest (payable)/receivable (567) 40

_______ _____

PROFIT ON ORDINARY ACTIVITIES

BEFORE TAXATION 5,125 4,638

Taxation (1,522) (1,540)

_______ _____

PROFIT ON ORDINARY ACTIVITIES

AFTER TAXATION 3,603 3,098

Dividends (1,178) (1,045)

_______ _____

RETAINED PROFIT FOR THE YEAR 2,425 2,053

_______ _____

EARNINGS PER SHARE (Note 2) 22.4p 19.3p

_____ ____

STATEMENT OF TOTAL

RECOGNISED GAINS AND LOSSES

1998 1997

#000 #000

Profit on ordinary activities after

taxation 3,603 3,098

Foreign exchange loss on foreign equity

investment

(57) (44)

_______ _____

3,546 3,054

_______ ______

CONSOLIDATED BALANCE SHEET

at 31 March 1998

1998 1997

(audited) (audited)

#000 #000 #000 #000

FIXED ASSETS

Tangible assets 38,959 21,686

Investments 106 106

_______ _____

39,065 21,792

CURRENT ASSETS

Stock 1,478 777

Debtors 12,433 12,447

Cash at bank and in hand 6,597 3,320

_______ _____

20,508 16,544

CURRENT LIABILITIES

CREDITORS: amounts falling due

within one year (19,281) (16,212)

_______ ______

NET CURRENT ASSETS 1,227 332

_______ _____

TOTAL ASSETS LESS CURRENT

LIABILITIES 40,292 22,124

CREDITORS: amounts falling due

after more than one year (18,277) (4,013)

PROVISION FOR LIABILITIES AND

CHARGES (5,256) (3,777)

_______ _____

(23,533) (7,790)

_______ _____

16,759 14,334

_______ __ ___

CAPITAL AND RESERVES

Called up share capital 1,614 1,608

Share premium account 4,530 4,479

Profit and loss account 10,615 8,247

_______ _____

SHAREHOLDERS FUNDS -

equity interests 16,759 14,334

_______ __ ___

CONSOLIDATED CASH FLOW STATEMENT

for the year ended 31 March 1998

1998 1997

(audited) (audited)

#000 #000 #000 #000

NET CASH INFLOW FROM OPERATING

ACTIVITIES 9,360 6,338

RETURNS ON INVESTMENT AND

SERVICING OF FINANCE

Interest paid: bank and other

loans (651) (138)

Interest element of finance

lease rental payments (74) (74)

Interest received: bank 158 252

____ ____

(567) 40

TAXATION

Corporation and advance

corporation tax paid (1,037) (1,400)

CAPITAL EXPENDITURE AND FINANCIAL

INVESTMENT

Purchase of tangible fixed

assets (17,894) (8,484)

Disposal of tangible fixed

assets 160 136

______ _____

(17,734) (8,348)

EQUITY DIVIDENDS PAID (1,078) (978)

______ ______

CASH OUTFLOW BEFORE FINANCING (11,056) (4,348)

FINANCING

Ordinary share capital issued 57 38

Other loans repaid (401) (273)

Bank loans repaid (284) (921)

Other loans advanced 14,250 2,083

Bank loans advanced 1,000 2,400

Capital elements of finance

lease rental payments (289) (373)

_______ _______

14,333 2,954

_______ _______

INCREASE/DECREASE IN 3,277 (1,394)

CASH IN THE YEAR _______ _______

NOTES

1. The financial information for the years ended 31 March 1997

and 1998 do not constitute statutory accounts, as defined in

Section 240 of the Companies Act 1985, but are based on the

statutory accounts for the years then ended. Statutory

accounts for the year ended 31 March 1997, on which the

auditors issued an unqualified opinion pursuant to Section 235

of the Companies Act 1985, have been filed with the Registrar

of Companies. Statutory accounts for the year ended 31 March

1998, on which the auditors issued an unqualified opinion

pursuant to Section 235 of the Companies Act 1985, will be

filed with the Registrar of Companies in due course.

2. Earnings per share are calculated on the profit on ordinary

activities after taxation for the financial year and on

16,101,240 (1997: 16,049,066) shares, being the weighted

average number of shares in issue during the year. The

potential dilution of earnings per share from the exercise of

the share options is not material.

3. The proposed final dividend of 5.0 pence (net) per share

will, if approved, be payable on 27 August 1998 to

shareholders on the Companys register at the close of

business on 10 July 1998.

4. The 1998 Annual Report and Accounts (together with the

Auditors Report) will be posted to shareholders by 14 July

1998.

_______________________________

END

FR MLGZVLDMLRMM

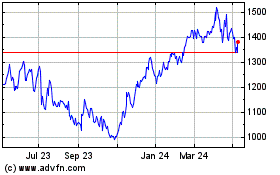

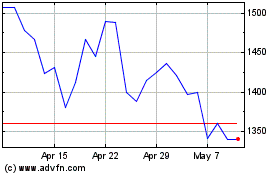

Jet2 (LSE:JET2)

Historical Stock Chart

From Jun 2024 to Jul 2024

Jet2 (LSE:JET2)

Historical Stock Chart

From Jul 2023 to Jul 2024