TIDMKDNC

RNS Number : 0093M

Cadence Minerals PLC

11 September 2023

Cadence Minerals Plc

("Cadence Minerals", "Cadence", or "the Company")

Amapá Iron Ore Project Update

Cadence Minerals (AIM/AQX: KDNC; OTC: KDNCY) is pleased to

provide a progress update for its flagship Amapá Iron Ore Project

("Amapá Project"), including an expedited operational licensing and

re-rating of our tailings storage facility.

Highlights:

-- The expected licensing timeline for the mine, railway and

port at the Amapá Project team has been shortened to12 to 16 months

compared to a typical timeline of up to 36 months.

-- The revised timeline is expected to result in the grant of

mine Installation Licenses ("LI") over the wholly owned port,

railway, beneficiation plant and mine during the course of 2024,

followed by an operational license ("LO") after construction is

completed .

-- The Amapá Tailing Project ("TSF") is approaching the lowest

operational risk rating to date as a result of maintenance,

reporting, drilling, and compliance work carried out since 2019

-- Following the management team's recent visit to Amapá, CEO

Kiran Morzaria will present the most recent developments at a

Shares Magazine investor evening on Wednesday, 13 September.

-- Executive Summary of Pre-Feasibility Study Released and available here

CEO Kiran Morzaria commented: "We are delighted with the

progress we saw first-hand in our recent visit to Amapá. Agreeing a

shortened route to the operational licence is key to getting the

Amapá Project back into production in the shortest time

possible."

"I look forward to presenting the latest developments at the

upcoming Shares Magazine investor evening and reporting to the

markets with further progress after that."

Licensing Update

While the Amapá Project was operating, it held all the necessary

permissions to mine, process, transport and ship some six million

tonnes of iron ore annually. However, many of these licenses lapsed

after it ceased operations in 2014. Cadence has been working

alongside the team at the Amapá Project to obtain these licenses

and permissions. To date, we have reinstated and extended the

railway concession to 2046 (completed in December 2019) and been

granted a change of control over the wholly owned port in November

2021, which ensured the federal licenses could be maintained.

The Amapá Project owns the required Mining Concessions; however,

it must obtain a Mine Extraction and Processing Permit ("Mining

Permit") to begin operation. To obtain this permit, the Amapá

Project must obtain an LI and, when constructed, an Operational

License LO from the Amapá State Environmental Agency.

Before the suspension of mining, the Project had numerous LOs

across the mining, rail, and port operations. These LOs expired

between 2013 and 2018. In 2022, the Amapá Project began

regularising the expired environmental permits and started

consultation with the Amapá State Environmental Agency and the

relevant state authorities. The Amapá Project requested that the

requirement for a full environmental impact study be waived. This

request for a waiver was on the basis that the previous LOs were

granted on an operation that is substantially the same as is

currently planned and remains applicable to future operations.

As a result of the discussions between the various state

authorities and the Amapá Project, we are pleased to announce that

Amapá Project will be able to shorten the licensing timeline

substantially. We have agreed with Amapá State Environmental Agency

that on the mine and railway, we will be able to submit an

Environmental Control Plan - "PCA" (Plano de Controle Ambiental)

and an Environmental Control Report - "RCA" (Relatório de Controle

Ambiental). However, on the port, we will need to complete a full

environmental assessment, but given that the Amapá Project has

already begun some of the background studies, we also anticipate

that the timeline for the grant of the port LI will be

shortened.

The fieldwork for the LI's will begin as soon as possible with

current expectations that we will be able to submit the required

reports for the mine and rail in the second quarter of 2024 and the

reports for the port in the second quarter of 2024. The Amapá State

Environmental Agency will then review the application for the LI's,

and we anticipate that these licenses will be granted in 2024.

This timeline is substantially shorter than expected on a

greenfield site, where the impact study and associated approval can

typically take between 24 and 36 months, while the Amapá Project

could achieve this in 12 to 16 months.

Tailings Storage Facility

One of Cadence's initial investment criteria into the Amapá

Project was the safety and stability of the TSF. As such, before

entering into the investment agreement with our joint venture

partners, we carried out a TSF review by an internationally

recognised consultant group and were satisfied with the structure

and stability of the TS. Nonetheless, given the lack of reporting

and maintenance from 2014 onwards, the TSF at the Amapá Project was

considered a high risk. The work carried out since 2019, including

maintenance, reporting, drilling and compliance, has meant that the

Amapá Project TSF is approaching the lowest risk rating for

operating TSF. The intent is that the TSF will continue to improve

its risk rating. This will be achieved by completing a dam break

study, installing video monitoring on the TSF, and ongoing

inspection and remediation of various TSF-associated

infrastructure.

Shares Magazine Investor Evening

CEO Kiran Morzaria will present at the Shares and AJ Bell 'LIVE'

investor evening in London on 13 September 2023.

The presentation will contain information about the Company's

flagship Amapa Iron Ore Project in Brazil following a recent visit

by the management team.

The Shares and AJ Bell Media, investor evening event is an

opportunity for senior board directors to make a presentation about

their company and update existing and potential investors on their

business plans.

Investors will have the chance to discover investment

opportunities and get to know the companies better by asking

questions 'live' in person after the presentation over drinks and

buffet food .

Shareholders and potential investors can register to join us

LIVE at the Novotel, Tower Hill, for free via this link:

https://www.sharesmagazine.co.uk/events/event/shares-investor-evening-london-live-event-130923

Pre-Feasibility Executive Summary

As part of the ongoing engagement with potential investors, we

have also released an executive summary of the previously announced

PFS, which is available here .

For further information

contact:

Cadence Minerals plc +44 (0) 20 3582 6636

Andrew Suckling

Kiran Morzaria

WH Ireland Limited (NOMAD

& Broker) +44 (0) 207 220 1666

James Joyce

Darshan Patel

Brand Communications +44 (0) 7976 431608

Public & Investor Relations

Alan Green

Qualified Person

Kiran Morzaria B.Eng. (ACSM), MBA, has reviewed and approved the

information contained in this announcement. Kiran holds a Bachelor

of Engineering (Industrial Geology) from the Camborne School of

Mines and an MBA (Finance) from CASS Business School.

Cautionary and Forward-Looking Statements

Certain statements in this announcement are or may be deemed to

be forward-looking statements. Forward-looking statements are

identi ed by their use of terms and phrases such as "believe",

"could", "should", "envisage", "estimate", "intend", "may", "plan",

"will", or the negative of those variations or comparable

expressions including references to assumptions. These

forward-looking statements are not based on historical facts but

rather on the Directors' current expectations and assumptions

regarding the company's future growth results of operations

performance , future capital, and other expenditures (including the

amount, nature, and sources of funding thereof) competitive

advantages business prospects and opportunities. Such

forward-looking statements re ect the Directors' current beliefs

and assumptions and are based on information currently available to

the Directors. Many factors could cause actual results to differ

materially from the results discussed in the forward-looking

statements, including risks associated with vulnerability to

general economic and business conditions, competition,

environmental and other regulatory changes actions by governmental

authorities, the availability of capital markets reliance on key

personnel uninsured and underinsured losses and other factors many

of which are beyond the control of the company. Although any

forward-looking statements contained in this announcement are based

upon what the Directors believe to be reasonable assumptions. The

company cannot assure investors that actual results will be

consistent with such forward-looking statements.

The information contained within this announcement is deemed by

the company to constitute Inside Information as stipulated under

the Market Abuse Regulation (E.U.) No. 596/2014, as it forms part

of U.K. domestic law under the European Union (Withdrawal) Act

2018, as amended. Upon the publication of this announcement via a

regulatory information service, this information is considered to

be in the public domain.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDLBMPTMTIBMJJ

(END) Dow Jones Newswires

September 11, 2023 04:44 ET (08:44 GMT)

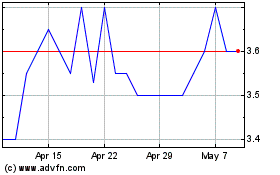

Cadence Minerals (LSE:KDNC)

Historical Stock Chart

From Jan 2025 to Feb 2025

Cadence Minerals (LSE:KDNC)

Historical Stock Chart

From Feb 2024 to Feb 2025