Cadence Minerals PLC Sonora Lithium Investment Update (4228T)

November 16 2023 - 1:00AM

UK Regulatory

TIDMKDNC

RNS Number : 4228T

Cadence Minerals PLC

16 November 2023

Cadence Minerals Plc

("Cadence Minerals", "Cadence", or "the Company")

Sonora Lithium Investment Update

Request for treaty negotiations with Mexico

Cadence Minerals (AIM/Aquis: KDNC) advises that the Company and

its subsidiary REM Mexico Limited ("REMML") have issued a Request

for Consultations and Negotiations ("Request") to the Government of

Mexico under the United Kingdom-Mexico Bilateral Investment Treaty

("BIT").

The Request concerns the purported revocation of the mining

concessions for the Sonora Lithium Project (the "Project") by the

Mexican General Directorate of Mines as announced by Cadence on 31

August 2023, and related acts and omissions by Mexico. The affected

concessions include those granted to Mexilit S.A. de CV ("Mexilit")

and Minera Megalit S.A. de CV ("Megalit"), these being joint

venture companies in which Cadence holds a 30% stake through

REMML.

In their Request, Cadence and REMML have identified various BIT

obligations that have been breached by Mexico, including Mexico's

obligation not to unlawfully expropriate the investments of UK

investors such as Cadence and REMML and its obligation to treat

such investments fairly and equitably.

In accordance with Article 10 of the BIT, Cadence and REMML have

requested consultations and negotiations with Mexico with a view to

resolving the dispute amicably. The BIT provides for disputes to be

resolved by international arbitration if they cannot be resolved by

consultation and negotiation.

Cadence and REMML have engaged leading international law firm

Clifford Chance as counsel for the BIT process. The Clifford Chance

team representing Cadence and REMML specialise in mining-related

investment treaty arbitration cases.

Cadence CEO Kiran Morzaria commented: "The team at Clifford

Chance have many years of experience in mining-related investment

treaty arbitration, and have successfully resolved similar cases in

the past. With their guidance, we are hopeful that a constructive

solution can be reached through consultations and negotiations with

Mexico under the BIT. "

Background to Cadence Sonora Investments

Cadence holds an interest in the Sonora Lithium Project

("Project") via its 30% stake in each of Mexilit and Megalit.

Mexilit and Megalit form part of the Project. The Project

consists of nine granted concessions. Two of the concessions (La

Ventana and La Ventana 1) are owned 100% by subsidiaries of Ganfeng

Lithium Group Co., Ltd ("Ganfeng"). El Sauz, El Sauz 1, El Sauz 2,

Fleur and Fleur 1 concessions are owned by Mexilit, which is owned

70% by Ganfeng and 30% by Cadence. The Buenavista and San Gabriel

concessions are owned by Megalit, which is owned 70% by Ganfeng and

30% by Cadence.

For further background to Cadence's investments in the Sonora

Lithium Project, see the Company's RNS of 31 August 2023 ("Sonora

Lithium Investment Update") here .

For further information contact:

Cadence Minerals plc +44 (0) 20 3582 6636

Andrew Suckling

Kiran Morzaria

WH Ireland Limited (NOMAD

& Broker) +44 (0) 20 7220 1666

James Joyce

Darshan Patel

Fortified Securities - Joint

Broker +44 (0) 20 3411 7773

Guy Wheatley

Brand Communications +44 (0) 7976 431608

Public & Investor Relations

Alan Green

Cautionary and Forward-Looking Statements

Certain statements in this announcement are or may be deemed to

be forward-looking statements. Forward-looking statements are

identi ed by their use of terms and phrases such as "believe",

"could", "should", "envisage", "estimate", "intend", "may", "plan",

"will", or the negative of those variations or comparable

expressions including references to assumptions. These

forward-looking statements are not based on historical facts but

rather on the Directors' current expectations and assumptions

regarding the company's future growth results of operations

performance , future capital, and other expenditures (including the

amount, nature, and sources of funding thereof) competitive

advantages business prospects and opportunities. Such

forward-looking statements re ect the Directors' current beliefs

and assumptions and are based on information currently available to

the Directors. Many factors could cause actual results to differ

materially from the results discussed in the forward-looking

statements, including risks associated with vulnerability to

general economic and business conditions, competition,

environmental and other regulatory changes actions by governmental

authorities, the availability of capital markets reliance on key

personnel uninsured and underinsured losses and other factors many

of which are beyond the control of the company. Although any

forward-looking statements contained in this announcement are based

upon what the Directors believe to be reasonable assumptions. The

company cannot assure investors that actual results will be

consistent with such forward-looking statements.

The information contained within this announcement is deemed by

the company to constitute Inside Information as stipulated under

the Market Abuse Regulation (E.U.) No. 596/2014, as it forms part

of U.K. domestic law under the European Union (Withdrawal) Act

2018, as amended. Upon the publication of this announcement via a

regulatory information service, this information is considered to

be in the public domain.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCNKQBPBBDDQDD

(END) Dow Jones Newswires

November 16, 2023 02:00 ET (07:00 GMT)

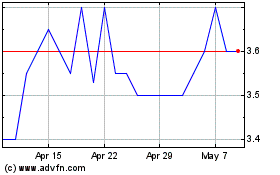

Cadence Minerals (LSE:KDNC)

Historical Stock Chart

From Jan 2025 to Feb 2025

Cadence Minerals (LSE:KDNC)

Historical Stock Chart

From Feb 2024 to Feb 2025