TIDMBILB

RNS Number : 4038X

Bilby PLC

19 December 2019

19 December 2019

Bilby plc

("Bilby" or the "Company")

Interim Results

Bilby Plc (AIM:BILB), a leading gas heating, electrical and

building services provider, announces its interim results for the

six months ended 30 September 2019.

Financial Overview

Unaudited Unaudited Audited 12

6 months 6 months months to

to to 31 March

30 September 30 September 2019

2019 2018 GBP 000

Group results GBP 000 GBP 000

-------------------------------------- -------------- -------------- -----------

Revenue(1) 29,778 36,359 66,528

Gross profit(1) 7,819 8,261 9,483

Underlying EBITDA(2) 2,062 2,678 3,164

Underlying operating profit 1,917 2,546 2,789

Underlying profit before taxation(3) 1,702 2,428 2,501

Profit/(loss) after taxation 542 1,133 (8,596)

Basis EPS 1.34 2.81 (21.29)

Basic EPS adjusted(4) 3.78 5.40 6.38

Dividend per share 0.00 2.00 2.50

Net Debt(5) 11,068 7,891 10,858

-------------------------------------- -------------- -------------- -----------

1. Underlying Revenue and Gross profit for the 12 months ended

31 March 2019 were GBP69.588 million and GBP15.131 million

respectively. There are no adjustments to Revenue or Gross Profit

for the 6 months ended 30 September 2018 or 30 September 2019.

2. Underlying EBITDA is earnings before interest, tax,

depreciation and non-underlying items as set out in note 3.

3. Underlying profit before taxation is stated after interest

and before charging non-underlying items.

4. Basic EPS adjusted is the profit before deducting

non-underlying after tax divided by the weighted average number of

ordinary shares.

5. Net debt comprises overdraft, term loans, mortgage and other

loans less cash

Summary

-- Robust performance from the underlying Group delivers an

underlying EBITDA of GBP2.1 million (2018: GBP2.7 million) in a

business that is historically weighted to the second-half

-- The Group resolved its legacy issues and completed the restructuring of P&R

-- Strong cash generation of GBP2.4m from underlying operations

but impacted by GBP1.8m relating to P&R losses from year ending

March 2019 and related restructuring, resulting in net cash

generation from operating activities of GBP0.629m

-- Appointment of David Bullen as Chief Executive Officer who

accelerated the operational and financial review of the business

which led to several conclusive actions:

o The closure of P&R's gas division

o P&R's profitable building services contracts transferred

to management responsibility of Purdy

o Integration and alignment of R Dunham into Group

o Standardisation and centralisation of operating systems,

policies and controls to improve transparency, efficiency and

profitability within the Group, remains ongoing

o Appointment of an interim Group HR Director - a permanent

position for this role will be confirmed in due course

-- Significant operational progress securing new large scale

contracts with no major contracts up for renewal in the financial

year

o Purdy won a contract with Enfield Council with a value of

GBP1.2 million

o DCB secured an extended contract with Port of Dover for GBP1.5

million

o DCB secured a contract with Newlon Housing for GBP1.2

million

o Spokemead secured additional work with its largest customer,

Southwark Council

Post period end & outlook

o Fundraise of GBP2 million to provide additional resources to

improve the working capital position

o Conclusion and closure of the resolution proceedings relating

to the two severely loss-making contracts with Carillion Amey and

East Kent Housing with nil settlement to all parties

o Strengthening of Board with the appointment of David Guest as

Non-Executive Director and Chair of the Audit Committee

o Board remain confident of at least maintaining underlying

revenues of GBP59 million with an underlying EBITDA of not less

than GBP4.5 million for the full year

Commenting on the results, David Bullen, Chief Executive of

Bilby plc said:

"This has been a period of restructuring for the Group in which

we finally resolved the legacy issues relating to P&R and

continued the operational and financial review that collectively

has achieved a positive reset for the Group. We have taken the

positive steps to improve our levels of transparency and

efficiency, as well as engaging staff at all levels to shape the

future of the organisation. This will ensure that each subsidiary

benefits from being part of a wider Group and will accelerate the

trajectory of our future growth path. I am confident that the

actions we have taken, and continue to undertake, will ensure that

Bilby is best placed to capitalise on opportunities moving

forward."

Enquiries

Bilby plc

Sangita Shah, Chairman +44 (0)20 7796 4133

David Bullen, Chief Executive Officer (via Hudson Sandler)

Canaccord Genuity Limited (Nominated Adviser

and Sole Broker) +44 (0)20 7523 8000

Corporate Broking:

Bobbie Hilliam

Andrew Potts

Georgina McCooke

Sales:

Jonathan Barr

Hudson Sandler (Financial PR) +44 (0)20 7796 4133

Charlie Jack

Bertie Berger

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) 596/2014.

Chair's statement

The first half of 2019 ("the Period") saw significant conclusive

structural and reorganisational changes within the Group, in

addition to a much needed strengthening of the Board. These actions

were a necessity, and all arose from the vital need to fully

address the legacy issues resulting from one poorly managed

subsidiary and re-establish the Group on a robust platform for

future growth.

Following an extensive search process, I was delighted to

welcome David Bullen to the Group as Chief Executive in April 2019.

David joined Bilby from Boleyn International Ltd, a strategic

management consultancy he founded in 2016. He brings an impressive

track record in turnaround situations and creating shareholder

value as well as strong plc experience. On arrival, David

immediately accelerated the operational and financial review the

Board had implemented and will spearhead this until completion. His

appointment has already made a huge impact: the Group has

stabilised and we are now forging our strategy to return the

business to solid calibrated growth.

As previously announced, the Group faced several challenges that

had driven the poor financial outrun for the year ended 31 March

2019. These challenges were limited to one subsidiary, P&R. The

poor financial performance of this subsidiary was driven by

operational failings that resulted from governance failings at the

subsidiary. Decisive action was undertaken, including restructuring

P&R, which is now complete. Concurrently, under the aegis of

David Bullen, an intensive operational review across the Group was

instigated to ensure that the enormous challenges from a failing

subsidiary are mitigated and fully addressed proactively. This

operational and financial review of the business is ongoing and has

resulted in the implementation of an investment programme that will

ensure robust systems and governance across the Group.

Despite these challenges, the underlying health of the business

is robust, and we are pleased to deliver underlying Group EBITDA of

GBP2.1 million for the Period (2018: GBP2.7 million) in a business

that is historically stronger in the second-half. As a result of

this progress, in addition to securing new contracts and benefiting

from the centralised functions, Bilby is pleased to report that we

have visible revenues of GBP180.8 million to 2021 (2019: GBP162.3

million).

The net debt position was higher than in previous years as a

result of the material losses on the exit of contracts within the

gas division of P&R and the associated restructuring costs.

These amounted to GBP1.8 million during the Period and

significantly impacted the working capital of the Group.

Post Period end, in November 2019, the Group raised GBP2 million

from existing shareholders and certain Directors and senior

management to provide additional resources to improve the working

capital position. We continue to regularly engage with our banking

partners, HSBC, who remain supportive of the Board and the ongoing

operational and financial review.

In addition, post Period end, we were delighted to augment our

Board with the addition of a new Non-Executive Director, David

Guest. David is currently the senior audit partner at UHY Hacker

Young in Brighton and is Chair of the Audit Committee. We are

seeking to further enhance the non-executive board in the near

future.

Outlook

For the full year, the Board remains confident of at least

maintaining underlying revenues of GBP59 million with an underlying

EBITDA of not less than GBP4.5 million.

While the operational and financial review of the business is

ongoing, the Group has now conclusively resolved its legacy issues

relating to P&R and the underlying business remains solid. With

our bolstered management team, spearheaded by a CEO who is dogged

and impressive, I am confident Bilby can return to the rate of

growth of previous years.

Chief Executive's statement

During the Period, Group underlying revenue decreased 18% to

GBP29.8 million (2018: GBP36.4 million) with underlying EBITDA

decreasing by 23% to GBP2.1 million (2018: GBP2.7 million) and

adjusted earnings per share down to 3.78 pence (2018: 5.40 pence).

The decrease in the underlying EBITDA was primarily driven by the

negative impact P&R had on the Group and the discontinuation of

certain elements of that subsidiary.

Despite these challenges, the Group has performed commendably,

making significant operational progress securing new contracts and

completing substantial work during the Period.

Update on the operational and financial review

The Period saw the completion of the restructuring of the

P&R business that was the primary reason for the Group's

underperformance for the year ended 31 March 2019. Since my

arrival, I have focused on working with the Executive management

team and Board to listen, understand and identify the underlying

issues within the business and address them robustly with urgency.

We have implemented relevant systems and processes to ensure that

our effectiveness, our efficiencies and our offer are all of the

highest standards.

A key outcome of the review established the need for providing

consistency amongst all the subsidiaries, specifically on the

internal reporting and controls, aligning accounting and

performance procedures across the Group through the same

centralised operating systems. These systems include providing

vital end-to-end data on engineering time and identifying

opportunities for improvement that enables all employees to manage,

measure and meet the same high standards through the transparency

and accountability of performance; job by job, contract by

contract. The implementation of this programme is already showing

positive results and delivering efficiencies, with each subsidiary

benefitting as a result.

In parallel and additionally, this improved transparency and

accountability will facilitate the opportunity for the Group to

initiate and implement a Group-wide incentive programme to suitably

reward and recognise, on a personal level, the significance of the

value each of our employees contributes to the success of the

business.

As previously announced, as part of the P&R restructuring,

all profitable building services contracts were transferred to the

management responsibility of Purdy and its centralised systems and

are already benefitting from the consolidation and cohesion that

this has delivered. Importantly, the remaining building services

employees have both welcomed and embraced the change to align

itself with the rest of the Group, contributing to a strengthened

morale within the subsidiary.

People

Immediately following my arrival, the Board strengthened the

Group HR function by instilling an interim HR Director with an

expectation to fulfil this role on a permanent basis. In

conjunction, I have pro-actively sought to engage with employees at

all levels across the subsidiaries with other Members of the Board

and Senior Management, also having detailed consultations with our

stakeholders.

The review and continuing turnaround of the Group could not have

happened without the engaged involvement of all key stakeholders

and we are hugely appreciative of their feedback and dedication. As

part of this process, the Board is committed to ensuring employees

are receiving optimum personal and professional development and

training to maximise their potential. The Board is also committed

to ensuring all our employees have the opportunity to share the

success of the Group. It is vital they are all adequately rewarded

and recognised for their individual contributions to the best in

class service Bilby offers its companies. This will ensure our

profitable growth is sustainable.

Operational review of subsidiaries

Purdy

Purdy has continued the strong momentum it delivered in 2019 by

successfully securing new contracts and undertaking ongoing work

for existing customers. Purdy strengthened its relationship with

Hackney Council by conducting electrical works on some of its

housing stock, with anticipated revenue of GBP0.4 million. The

subsidiary also secured a contract with Enfield Council for

rewiring work and boiler installations with a total value of GBP1.1

million. In addition, it won a GBP0.5 million contract with Tower

Hamlets Community Housing for kitchen and bathroom maintenance

work. The robustness of Purdy's performance during the Period has

been excellent and is a testament to the quality of the business,

the strength of relationships with their client base and the

resolve of the staff.

DCB

DCB's progress has been sluggish during the Period, as deferred

starts and deferred contracts on projects limited the opportunities

for the business. However, these projects have now begun to gather

pace post Period end and will continue to accelerate to the end of

the financial year. DCB built on its relationship with the Port of

Dover by securing a GBP1.5 million contract for Fire Risk

Assessment upgrades to 140 buildings in the area. The contract DCB

held with the Tunbridge Wells Borough Council for the last seven

years to conduct corporate maintenance was extended for an

additional five years. In addition, DCB signed a new contract with

Newlon Housing for GBP1.3 million and a GBP1.2 million contract

with NHS Health Living Centres for remodelling and refurbishment

work.

Spokemead

Despite the reduction in contracted work, following their tender

win last year with Southwark Council, Spokemead continues to

progress positively and has recently secured some new emergency

lighting instalments which will commence in the final quarter of

the year.

R Dunham

Following the acquisition of R Dunham, a significant amount of

work has been undertaken during the Period to align the subsidiary

with the rest of the Group. Historically the subsidiary was

entirely paper-based. It has now been integrated on the centralised

operating systems and will benefit significantly from the

efficiencies this will deliver. The former owner and son have now

left the business. Lee Venables, Bilby COO will undertake overall

responsibility of the subsidiary whilst we assess the potential for

further consolidation within the Group. The opportunity for

strengthening inter-company synergies have already been clearly

demonstrated between R Dunham and Purdy, where they have

successfully coordinated key services relating to Hackney Council,

a Purdy customer.

Summary

During the Period, there has been a great deal of focus on the

operational and financial review of the Group. However, despite the

challenges inherited as a result of P&R, the commitment of our

exceptional workforce has ensured the subsidiaries have performed

and gained further momentum by securing new contracts. We have

continued to deliver a high-quality service to our customers

throughout. Importantly, no major contracts are up for renewal in

the current financial year.

There is still work to be done but the turnaround of the Group

is well on track. Our actions during the period and the recent fund

raise post-Period has stabilised our operations, enabling the Group

to focus on achieving growth. As a result, the Board has confidence

in meeting its expectations for the full year.

Financial Review

The Board are satisfied with the performance of the Group in the

6 months to 30 September 2019 considering the significant

challenges that were faced in the Period.

Revenues of GBP29.8 million and underlying EBITDA of GBP2.1

million in the Period compares to underlying revenues of GBP33.2

million and underlying EBITDA of GBP0.486 million in the second

half of the year ended 31 March 2019, reflecting the consolidation

of the business and elimination of loss making activities.

Underlying revenues in the six month period to 30 September 2018

were GBP36.4 million and underlying EBITDA GBP2.7 million. The

reduction in revenues primarily relates to the exit from the

P&R gas division and lower activity in DCB due to some delays

in the start of contracted projects which are now starting to

progress.

The exit from loss making gas contracts in P&R and transfer

of the other day-to-day operations of P&R is complete and the

claim proceedings with East Kent Housing were resolved post the

Period end with nil settlement to either party. Good progress has

been made on the investment in operational and finance systems,

processes and structures for the Group.

Underlying cash generated of GBP2.4 million demonstrates a

positive cash conversion in the period. Net cash generated from

operating activities was GBP0.629 million after absorbing

non-underlying cash payments of approximately GBP1.8 million

relating to the loss on exit from onerous contracts, the closure of

the gas division of P&R and restructuring costs, which had an

impact on the working capital position of the Group. Operating cash

outflow in the year ended 31 March 2019 was GBP2 million.

Total borrowings increased in the period by GBP0.2 million to

GBP11.1 million, with the cash generated by operating activities

absorbed mainly by the payment of the deferred consideration of

GBP0.476 million for the acquisition of R Dunham and finance costs

relating to interest payable on term loans, mortgage loans and

overdraft. Net debt for covenant purposes was GBP13.7 million at 30

September 2019 and GBP12.6 million at 30 November 2019, with total

facilities of GBP13.9 million.

Post the Period end, in November 2019, the Group undertook a

successful share placing raising GBP2 million (GBP1.8 million net

of costs). The net proceeds were used to improve the Group's

working capital position, with GBP1.2m reducing trade creditors and

the balance improving working capital. We expect to further reduce

the stretch in our trade creditors by up to c.GBP1 million in the

coming months. The Group has been granted temporary amendments to

its financial covenants with HSBC until June 2020 which will

provide additional time and flexibility to agree new debt

facilities with rebased financial covenants. The Bank remains

supportive and discussions are already underway to agree new

facilities.

The Board remains confident in achieving revenues of GBP59

million for the year ending 31 March 2020 with underlying EBITDA of

not less than GBP4.5 million.

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the six month period ended 30 September 2019

Unaudited Unaudited Audited

6 months 6 months Year ended

to to 31 March

30 September 30 September 2019

2019 2018

GBP'000 GBP'000 GBP'000

Underlying revenue 29,778 36,359 69,588

Non-underlying revenue - - (3,060)

Total revenue 29,778 36,359 66,528

Underlying cost of sales (21,959) (28,098) (54,457)

Non-underlying cost of sales - - (2,618)

------------- ------------- -----------

Gross Profit 7,819 8,261 9,453

Other operating expenses (5,902) (5,715) (12,342)

------------- ------------- -----------

Operating profit before non-underlying

items 1,917 2,546 (2,889)

Non-underlying operating expenses

Amortisation of customer relationships (963) (896) (1,836)

Impairment of customer relationships - - (1,802)

Share based payment charge (28) (64) (128)

Acquisition costs - - (120)

Restructuring costs - (82) (975)

Loss on exit from onerous contracts

and gas division of P&R - - (2,350)

------------- ------------- -----------

Total non-underlying operating expenses (991) (1,042) (7,211)

Operating profit/(loss) 926 1,504 (10,100)

Finance costs (215) (118) (288)

Profit/(loss) before taxation 711 1,386 (10,388)

Income tax (expense)/credit (169) (253) 1,792

Total profit/(loss) for the period

attributable to the equity holders

of the parent company 542 1,133 (8,596)

Other comprehensive income - - -

Total comprehensive income/(loss) for

the period attributable to the equity

holders of the parent company 542 1,133 (8,596)

============= ============= ===========

Earnings per share (note 5)

Basic (pence) 1.34 2.81 (21.29)

Diluted (pence) 1.34 2.76 (21.29)

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

At 30 September 2019

Unaudited Unaudited Audited

6 months 6 months Year ended

to to 31 March

30 September 30 September 2019

2019 2018

GBP'000 GBP'000 GBP'000

Assets

Non-current assets

Intangible fixed assets 10,930 13,122 11,750

Property plant and equipment 1,684 1,606 1,661

Total non-current assets 12,614 14,728 13,411

Current assets

Inventories 3,425 4,445 3,134

Trade and other receivables 17,555 20,488 18,548

Cash and cash equivalents 11 161 21

Total current assets 20,991 25,094 21,703

Total assets 33,605 39,822 35,114

============= ============= ===========

Issued share capital and reserves

Share capital 4,054 4,029 4,054

Share premium 8,609 8,391 8,609

Share based payment reserve 855 763 827

Merger reserve (248) (248) (248)

Retained earnings (5,312) 4,080 (5,854)

Total equity attributable to the equity

of the group 7,958 17,015 7,388

Non-current liabilities

Borrowings 212 2,200 236

Obligations under finance leases 47 1 -

Deferred tax liabilities 599 1,722 431

858 3,923 667

Current liabilities

Overdraft 6,303 4,354 5,219

Borrowings 4,564 1,498 5,424

Obligations under finance leases 16 28 10

Current income tax liabilities - 1,481 -

Deferred consideration - 500 476

Trade and other payables 13,906 11,023 15,930

24,789 18,884 27,059

Total equity and liabilities 33,605 39,822 35,114

============= ============= ===========

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

For the six month period ended 30 September 2019

Unaudited Unaudited Audited

6 months 6 months Year ended

to to 31 March

30 September 30 September 2019

2019 2018

GBP'000 GBP'000 GBP'000

Net cash generated from/(used in) operating

activities 629 (1,005) (2,026)

------------- ------------- -----------

Cash flow from investing activities

Acquisition of subsidiaries (476) (500) (1,750)

Net cash acquired on acquisition - - 79

Purchases of property, plant and equipment (85) (80) (158)

Purchase of intangible assets (54) (2) (9)

Proceeds on disposal of property, plant

and equipment - - 9

------------- ------------- -----------

Net cash used in investing activities (615) (582) (1,829)

------------- ------------- -----------

Cash flow from financing activities

Proceeds from borrowings - - 6,100

Repayment of borrowings (883) (749) (5,193)

Interest paid (215) (118) (288)

Capital element of finance lease payments (10) (52) (71)

Dividends paid - (805) (1,009)

Net cash used in financing activities (1,108) (1,724) (461)

------------- ------------- -----------

Net decrease in cash and cash equivalents (1,094) (3,311) (4,316)

Cash and cash equivalents at beginning

of period/year (5,198) (882) (882)

Cash and cash equivalents at end of

period/year (6,292) (4,193) (5,198)

============= ============= ===========

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the six month period ended 30 September 2019 (unaudited)

Share based

Issued Share payment Merger Retained Total

share capital premium reserve reserve earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 April

2019 4,054 8,609 827 (248) (5,854) 7,388

Profit and total comprehensive

income for the period - - - - 542 542

Share-based payment

charge - - 28 - - 28

Dividends paid - - - - - -

Balance at 30 September

2019 4,054 8,609 855 (248) (5,312) 7,958

============== ======== =========== ======== ========= =======

For the six month period ended 30 September 2018 (unaudited)

Balance at 1 April

2018 4,029 8,392 699 (248) 3,751 16,623

Profit and total comprehensive

income for the period - - - - 1,133 1,133

Share-based payment

charge - - 64 - - 64

Dividends paid - - - - (805) (805)

Balance at 30 September

2018 4,029 8,392 763 (248) 4,079 17,015

============== ======== =========== ======== ========= =======

For the year ended 31 March 2019

Balance at 1 April

2018 4,029 8,392 699 (248) 3,751 16,623

Loss and total comprehensive

income for the period - - - - (8,596) (8,596)

Issue of share capital 25 217 - - - 242

Share-based payment

charge - - 128 - - 128

Dividends paid - - - - (1,009) (1,009)

Balance at 31 March

2019 4,054 8,609 827 (248) (5,854) 7,388

============== ======== =========== ======== ========= =======

NOTES TO THE INTERIM STATEMENT

1. Basis of preparation

Bilby Plc and its subsidiaries (together 'the Group') operate in

the gas heating, electrical and general building services

industries. The Group is a public company operating on the AIM

Market of the London Stock Exchange and is incorporated and

domiciled in England and Wales (registered number 09095860). The

address of its registered office is 201 Temple Chambers, 3-7 Temple

Avenue, London EC4Y 0DT.

These interim financial statements of the Group have been

prepared on a going concern basis under the historical cost

convention, and in accordance with International Financial

Reporting Standards ("IFRSs") as adopted by the European Union, the

International Financial Reporting Interpretations Committee

("IFRIC") interpretations issued by the International Accounting

Standards Boards ("IASB") that are effective or issued and early

adopted as at the time of preparing these financial statements and

in accordance with the provisions of the Companies Act 2006. The

Group has adopted all of the new and revised standards and

interpretations issued by the IASB and the International Financial

Reporting Interpretations Committee ("IFRIC") of the IASB, as they

have been adopted by the European Union, that are relevant to its

operations and effective for accounting periods beginning on 1

April 2019.

The interim financial information does not include all the

information and disclosures required in the annual financial

statements and should be read in conjunction with the Group's

annual financial statements, being the statutory financial

statements for Bilby Plc as at 31 March 2019, which have been

prepared in accordance with IFRS as adopted by the European

Union.

The interim financial information for the six months ended 30

September 2019 do not comprise statutory accounts within the

meaning of Section 434 of the Companies Act 2006. The interim

financial information has not been audited.

Significant accounting policies

The accounting policies adopted in the preparation of the

interim financial information is consistent with those expected to

be adopted in the preparation of the Group's annual financial

statements for the year ending 31 March 2020.

Going concern

The Directors have prepared detailed financial forecasts and

cash flows looking beyond twelve months from the date of these

consolidated financial statements. In developing these forecasts

the Directors have made assumptions based upon their view of the

current and future economic conditions that will prevail over the

forecast period.

On the basis of the return to profitability in the period and

the above projections, the successful share placing in November

2019 and the constructive discussion with HSBC as set out below,

the Directors are confident that the Group has sufficient working

capital to honour all of its obligations to creditors as and when

they fall due. Accordingly, the Directors continue to adopt the

going concern basis in preparing these consolidated financial

statements.

Publication of non-statutory financial statements

The results for the six months ended 30 September 2019 and 30

September 2018 are unaudited and have not been reviewed by the

auditor. Statutory accounts for the year ended 31 March 2019, on

which the auditors gave an audit report which included a material

uncertainty related to going concern and did not contain a

statement under section 498(2) or (3) of the Companies Act 2006,

have been filed with the Registrar of Companies. In November 2019,

the Group undertook a successful share placing raising GBP2 million

(GBP1.8 million net of costs). The net proceeds were used to

improve the Group's working capital position. The Group has been

granted temporary amendments to its financial covenants with HSBC

until June 2020 which will provide additional time and flexibility

to agree new debt facilities with rebased financial covenants.

The interim financial information has been prepared on the basis

of the same accounting policies as published in the audited

financial statements for the year ended 31 March 2019.The annual

financial statements of the Group are prepared in accordance with

International Financial Reporting Standards and International

Financial Reporting Interpretations Committee ("IFRIC")

pronouncements as adopted by the European Union. Comparative

figures for the year ended 31 March 2019 have been extracted from

the statutory financial statements for that period.

2. Corporate governance, principal risks and uncertainties

The Corporate Governance Report included with our Annual Report

and Financial Statements for 2019 detailed how we embrace

governance. The Bilby Board recognise the importance of sound

corporate governance commensurate with the size and nature of the

Company and the interests of its shareholders.

The Quoted Companies Alliance has published a corporate

governance code for small and mid-sized quoted companies, which

includes a standard of minimum best practice for AIM companies, and

recommendations for reporting corporate governance matters (the

"QCA Code"). Bilby has adopted the QCA Code.

The nature of the principal risks and uncertainties faced by the

Group have not changed significantly from those set out within the

Bilby Plc annual report and accounts for the year ended 31 March

2019. The main points are listed below:

-- Profitable growth - the growth of our Group is dependent on

its ability to win new business and increase the amount of work we

do for our existing customers. It also relies on our ability to

successfully bid, mobilise, operate and manage contracts

profitably.

-- Reputational management - maintaining our reputation is vital

to the success of our business and a loss of confidence from our

customers and the residents we serve will affect our ability to

retain and win business. This in turn can adversely affect our

financial performance and growth prospects.

-- Financial controls - ensuring we have strong financial

controls, access to funding and effective cash conversion is

essential to our ability to deliver our contracts and grow our

business.

-- Compliance and regulation - delivering on our contractual

obligations and meeting and reporting against agreed service levels

directly affect our ability to retain and win business. In order to

conduct our business we need to work to regulatory frameworks and

comply with legal requirements.

-- Significant health, safety or environmental incident - due to

our diverse operational portfolio, the potential to cause

significant harm to our employees, our business partners or members

of the public, or to damage the environment will always exist. We

are committed to safeguarding our people and protecting the

environment wherever we operate.

-- IT - as a business we are reliant on our IT infrastructure to

be able to conduct our work. IT provides the platform for our

contract management and business support activities. We are reliant

on these systems to improve our operational efficiency and they

provide the foundation for our administrative functions and

financial reporting.

-- Attracting and retaining skilled people - attracting and

retaining the best skilled people at all levels of the business is

critical to the success of our performance. This is particularly

the case in ensuring we have access to a diverse range of views and

experience and in attracting expertise at both managerial and

operational levels where the market may be highly competitive. We

need to maintain good relations with our staff, invest in their

training and the development of their careers.

3. Non-underlying items

Operating profit/(loss) includes the following items which are

considered by the Board to be exceptional, one off in nature,

non-cash expenses or necessary elements of expenditure to derive

future benefits for the Group which have not been capitalised on

the Consolidated Statement of Financial Position.

Unaudited Unaudited Audited

6 months 6 months Year ended

to to 31 March

30 September 30 September 2019

Note 2019 2018

GBP'000 GBP'000 GBP'000

Amortisation of customer relationships (a) 963 896 1,836

Impairment of customer relationships (a) - - 1,802

Share based payment charge (b) 28 64 128

Acquisition costs (c) - - 120

Restructuring costs (d) - 82 975

Loss on exit from onerous contracts

and gas division of P&R (e) - - 7,604

Impairment of accrued income (f) - - 424

991 1,042 12,889

============= ============= ===========

All non-underlying items have been charged to other operating

expenses except that in the year ended 31 March 2019 GBP2.636

million and GBP2.618 million of the loss on exit from onerous

contracts and gas division of P&R were charged to revenues and

cost of sales respectively and the impairment of accrued income was

charged to revenues.

(a) Amortisation and impairment of customer relationships

Amortisation of acquisition intangibles was GBP0.963 million for

the period (H1 2018: GBP0.896 million) and relates to amortisation

of the customer relationships identified by the Directors on the

acquisition of Purdy, DCB, Spokemead and R. Dunham. Impairment of

customer relationships of GBP1.802 million in the year ended 31

March 2019 related to Spokemead.

(b) Share based payment charge

A group share option scheme is in place during the period. The

share based payment charge has been separately identified as it is

a non-cash expense.

(c) Acquisition costs

Acquisition costs comprise legal, professional and other

expenditure in relation to the acquisition of R. Dunham in the year

ended 31 March 2019.

(d) Restructuring costs

Comprise redundancy costs, compromise agreements, legal and

professional fees and other related costs and were one off and

non-recurring.

(e) Loss on exit from onerous contracts and gas division of P&R

Comprise trading losses, legal and professional fees, impairment

of financial assets and inventory and provisions for claims in

relation to the exit of two contracts in P&R and the exit from

the gas division of P&R.

(f) Impairment of accrued income

Relates to one off adjustment to accrued income on a building

services contract following detailed review undertaken by the

Directors.

4. Cash flows from operating activities

Unaudited Unaudited Audited

6 months 6 months Year ended

to to 31 March

30 September 30 September 2019

2019 2018

GBP'000 GBP'000 GBP'000

Profit/(loss) before income tax 711 1,386 (10,388)

Adjusted for:

Finance costs 215 118 288

Loss on disposal of property, plant

and equipment 12 - 75

Depreciation 122 112 256

Amortisation of intangible assets 973 916 1,880

Impairment of intangible assets - - 1,802

Share based payments 28 64 128

Fair value adjustment (100) - -

Movement in receivables 993 73 2,980

Movement in payables (2,033) (2,375) 1,870

Movement in inventories (292) (1,292) 186

Tax paid - (7) (1,103)

Net cash from/(used in) operating

activities 629 (1,005) (2,026)

============= ============= ===========

5. Earnings per share

The calculation of basic and diluted earnings per share is based

on the result attributable to shareholders divided by the weighted

average number of ordinary shares in issue during the year. Basic

earnings per share amounts are calculated by dividing net profit

for the year or period attributable to ordinary equity holders of

the parent by the weighted average number of ordinary shares

outstanding during the year.

Basic and diluted earnings per share is calculated as

follows:

Unaudited Unaudited Audited

6 months 6 months Year ended

to to 31 March

30 September 30 September 2019

2019 2018

GBP'000 GBP'000 GBP'000

Profit/(loss) used in calculating

basic and diluted earnings

per share 542 1,133 (8,596)

Weighted average number of shares

for the purpose of basic earnings

per share 40,540,027 40,290,027 40,373,589

Weighted average number of shares

for the purpose of diluted earnings

per share 40,540,027 41,121,286 40,373,589

Basic earnings per share (pence) 1.34 2.81 (21.29)

Diluted earnings per share (pence) 1.34 2.76 (21.29)

Adjusted earnings per share

Profit after tax is stated after deducting non-underlying items

totalling GBP0.991 million. Non-underlying items are either

exceptional or one-off in nature, non-cash expenses or necessary

elements of expenditure to derive future benefits for the Group

which have not been capitalised in the Consolidated Statement of

Financial Position. These are shown separately on the face of the

Consolidated Statement of Comprehensive Income.

The calculation of adjusted basic and adjusted diluted earnings

per share is based on the result attributable to shareholders,

adjusted for exceptional items, divided by the weighted average

number of ordinary shares in issue during the year.

Unaudited Unaudited Audited

6 months 6 months Year ended

to to 31 March

30 September 30 September 2019

2019 2018

GBP'000 GBP'000 GBP'000

Adjusted Earnings Per Share

Profit after tax 542 1,133 (8,596)

Add back:

Restructuring costs - 82 975

Loss on exit from onerous contracts

and gas division of P&R - - 7,604

Impairment of accrued income - - 424

Amortisation of acquisition intangible

assets 963 896 1,836

Impairment of customer relationships - - 1,802

Share based payment charge 28 64 128

Acquisition costs - - 120

Impact of above adjustments on corporation

tax - - (1,716)

------------- ------------------ ----------------------------

1,533 2,175 2,577

------------- ------------------ ----------------------------

Weighted average number of shares

for the purpose of basic adjusted

earnings per share 40,540,027 40,290,027 40,373,589

Weighted average number of shares

for the purpose of diluted adjusted

earnings per share 40,540,027 41,121,286 40,509,079

Basic adjusted earnings per share

(pence) 3.78 5.40 6.38

Diluted adjusted earnings per share

(pence) 3.78 5.29 6.36

6. Share capital

Ordinary shares of GBP0.10 each Unaudited

6 months

to

30 September

2019

GBP'000

At the beginning of the period 4,054

Issued in the period -

--------------------

At the end of the period 4,054

Number of shares Unaudited

6 months

to

30 September

2019

At the beginning of the period 40,540,027

Issued in the period -

--------------------

At the end of the period 40,540,027

7. Dividends

The Board do not recommend an interim dividend for the year

ending 31 March 2020 due to the overall level of indebtedness that

resulted from the loss for the year ended 31 March 2019.

8. Taxation

The income tax charge for the six months ended 30 September 2019

is calculated based upon the effective tax rates expected to apply

to the Group for the full year of 19% (2018: 19%). Differences

between the estimated effective rate and the statutory rate of 19%

are due to non-deductible expenses.

9. Forward-Looking statements

This report contains certain forward-looking statements with

respect to the financial condition of Bilby Plc. These statements

involve risk and uncertainty because they relate to events and

depend on circumstances that will occur in the future. There could

be a number of factors which influence the actual results and

developments. These could impact on the forward-looking statements

included in this report.

10. Events after the balance sheet date

In November 2019, the Group undertook a successful share placing

raising GBP2 million (GBP1.8 million net of costs). The net

proceeds were used to improve the Group's working capital position.

The Group has been granted temporary amendments to its financial

covenants with HSBC until June 2020 which will provide additional

time and flexibility to agree new debt facilities with rebased

financial covenants.

In December 2019 the Group formally resolved claim proceedings

with East Kent Housing with nil settlement to either party.

11. Interim Report

Copies of this Interim Report will be available to download from

the investor relations section on the Group's website

www.bilbyplc.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR LFFSLFSLTLIA

(END) Dow Jones Newswires

December 19, 2019 02:00 ET (07:00 GMT)

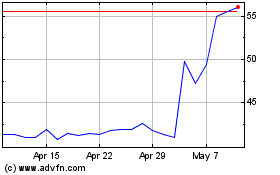

Kinovo (LSE:KINO)

Historical Stock Chart

From Jun 2024 to Jul 2024

Kinovo (LSE:KINO)

Historical Stock Chart

From Jul 2023 to Jul 2024