2001 Chairman's Statement

June 20 2002 - 5:58AM

UK Regulatory

RNS Number:5213X

Kenmare Resources PLC

20 June 2002

Kenmare Resources plc ("Kenmare" or "the Company")

2001 Chairman's Statement

In our last annual report, I outlined Kenmare's focus on converting the Moma

Titanium Minerals Deposit into an operating mine. The main task areas are the

negotiation of sales contracts and the arranging of the necessary funding. I am

delighted to say that we have had considerable success in both these areas.

In May 2002 Kenmare signed an offtake agreement with one of the world's largest

users of TiO2 feedstocks. This contract was signed, despite a generally soft

market following the US economic slowdown. It represents a significant

proportion of the project's ilmenite output and we anticipate it forming the

cornerstone of our evolving offtake arrangements.

In addition to this contract, we have reached outline agreement with consumers

of zircon. The agreements cover our total anticipated zircon output. We are

working with these parties to develop bankable documents. We are also in

discussion with several other major ilmenite and rutile consumers although these

discussions are not at such an advanced stage.

On funding, we appointed N. M. Rothschild & Sons Ltd. as our financial advisor

in June of last year. Working with Rothschild and the Government of Mozambique,

we have finalised our Mineral Licensing Agreement, signed an Implementation

Agreement covering an Industrial Free Zone from which the project benefits, and

agreed a power tariff formula. These activities were completed by the end of

January 2002, allowing us to approach the Development Finance Institutions. I am

pleased to say that these funders reacted positively and, subject to due

diligence, satisfactory completion of the offtake negotiations and raising of

additional equity, have provided expressions of interest to provide senior and/

or mezzanine finance amounting to circa US$280 million. This total exceeds the

Project's likely debt requirement by some US$70 million, providing Kenmare with

increased confidence that these expressions of interest can, in the course of

the next few months, be converted into the required +/-US$210 million of firm

loan commitments. The funding institutions are advancing their interest

concurrently with marketing negotiations.

We have appointed an independent engineering company who will work on behalf of

the lenders to assess the project, and legal counsel who will represent the

lenders on project related legal issues such as the drawing up of documentation.

The inaugural meeting of the lenders committee occurred in June.

In the meantime, Kenmare has completed the largest equity capital raising in its

history. €16.4 million was raised in May 2002 from institutions and private

shareholders. This money will be used principally for the due diligence process,

and for various aspects of final design which are still ongoing. Funds will also

be used for the dismantling of the separator plant purchased from BHP and

payments on that plant. When debt arrangements are complete the residual amount

will be contributed to the project as equity.

The loss for 2001 arises largely from the provision for the remaining value of

the Niassa Gold Mineral Interest. As outlined in the 2001 Interim Report, this

was due to the low gold price and the decision to focus Company resources on the

Moma Project.

During the year Peter McAleer joined the Board. Peter has worked in the resource

industry for 25 years and has been involved with the funding of many successful

mining projects. He has been a great help to the executive as they work to

structure a very complicated funding situation.

In summary, we have signed with a major consumer and are advanced in other

market negotiations; we have raised €16.4 million; we have negotiated the

Minerals Licensing and Implementation Agreements; we have received expressions

of interest from lenders; we have appointed legal counsel and independent

engineer to the lenders, and we have held the inaugural lending meeting. We are

dedicated to continuing to push this project forward with all possible speed.

Charles Carvill, Chairman

For more information:

Tony McCluskey

Financial Director

+353 1 6710411 or +353 87 6740346

Tom Byrne

Murray Consultants

+353 1 6614666 or +353 86 8104224

Tim Blackstone

Blackstone Communications

+44 207 2512544

www.kenmareresources.com

20 June, 2002

This information is provided by RNS

The company news service from the London Stock Exchange

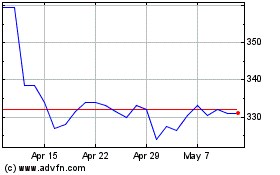

Kenmare Resources (LSE:KMR)

Historical Stock Chart

From Jun 2024 to Jul 2024

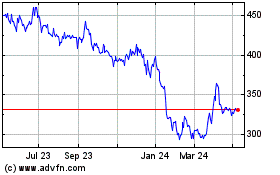

Kenmare Resources (LSE:KMR)

Historical Stock Chart

From Jul 2023 to Jul 2024