RNS Number:6126B

Kenmare Resources PLC

25 September 2002

KENMARE RESOURCES PLC

REPORTS AND FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED 30 JUNE 2002

Chairman's Statement and Results

for Six Months Ended 30 June, 2002

Dear Shareholder,

We have made considerable progress in advancing towards our first production at

the Moma Project since I last reported to you in June.

On 13 and 14 June, the Inaugural Meeting of the Lender Group for Moma was held

in London. It was attended by representatives of the African Development Bank,

the Development Bank of Southern Africa, ECIC (the South African Export Credit

Agency) and ABSA (the South African commercial bank which proposes to lead the

banks funding with the ECIC guarantee), the European Investment Bank, FMO (the

Dutch development finance institution) and KfW (the German development financing

institution). At this meeting the lenders agreed to appoint a common Independent

Engineer which, on behalf of the Lender Group, would review the previous work

done on the project. This is a normal part of the funding process and marks

seriousness on behalf of the Lender Group. SRK Consulting was appointed to the

role and it has spent the last three months reviewing all technical aspects of

the project, including visiting the plants bought from BHP, and visiting Moma.

SRK has recently released its report, which, I am very pleased to say, has

endorsed the project and Kenmare's general approach to its implementation while

also making several helpful recommendations upon which we are acting.

The Lender Group also appointed an Independent Marketing Analyst to assess the

market opportunity for the products which the Moma mine will produce and Moma's

long term competitiveness. IBMA was given this role and has also recently

released its report, which again is supportive of the project.

Earlier this month, representatives of the Lender Group and their advisors

visited the project site and this was followed by a four day series of meetings

in Mozambique. This process has resulted in the Lender Group agreeing to proceed

with preparation of loan documentation in parallel with completion of their

remaining due diligence and obtaining approvals from their respective

decision-making bodies.

Contracts in respect of a significant proportion of the Moma Project ilmenite

output have been signed and negotiations are ongoing to conclude other off-take

arrangements.

Concurrently with the development of a financing structure and marketing

arrangements, we have to organise the construction of the mine. In conjunction

with Kvaerner (Client Representative Engineer) we have prepared and issued an

Invitation to Bid to contractors. This Invitation to Bid was issued to a short

list of international contractors who have the experience and capability to

deliver the project. The document was issued on 9 September and the bidding

period is three months.

Work has also been undertaken to further refine and provide more detailed

information on certain aspects of the project. In July 2002, GRD Minproc

completed a DFS Addendum Report for the project. This work was commissioned in

order to optimise the waste handling system and integrate Moma into the national

electrical grid of Mozambique from the start of production. The work also

involved increasing the size of the roaster; thus allowing us to sell more

ilmenite into the stronger chloride market. In addition to the DFS Addendum, the

company has a number of other technical programmes underway, ranging from

groundwater pump tests to offshore geotechnical drilling, all aimed at ensuring

that no unwelcome surprises occur.

In line with Kenmare's continuing intent to develop Moma in compliance with best

environmental practices, an Environmental Management Plan (EMP) has been

developed and submitted to Government for approval. A construction EMP is being

developed for inclusion in the construction contract.

Since the Moma project companies' financial statements are denominated in US$,

the Board has decided that we should move to reporting in US$. This move allows

us to reflect the underlying US$ based cash flows with a minimum of accounting

exchange movements. During the six months ended 30 June, we have reported a

profit of US$542,558. This profit arises primarily from foreign exchange gains

and interest earned on the equity capital raised last May, net of Kenmare's

corporate operating costs.

The Directors remain committed to development of the Moma Project, and subject

to finalisation of financing, are confident that the Kenmare Group will be well

positioned to achieve production at Moma according to our targets.

Charles Carvill

Chairman

25 September 2002

INDEPENDENT AUDITORS' REVIEW REPORT

TO THE BOARD OF DIRECTORS OF KENMARE RESOURCES PLC

Interim Financial Information - Six months ended 30 June 2002

Introduction

We have been instructed by the Company to review the financial information for

the six months ended 30 June 2002 which comprises the Consolidated Profit and

Loss Account, the Consolidated Balance Sheet, the Group Cash Flow Statement,

Statement of Total Recognised Gains and Losses and Reconciliation of Movement in

Shareholders' Funds and related notes 1 to 6. We have read the other information

contained in the interim report and considered whether it contains any apparent

misstatements or material inconsistencies with the financial information.

Directors' responsibilities

The interim report, including the financial information contained therein, is

the responsibility of, and has been approved by the Directors. The Listing Rules

of the Irish Stock Exchange and of the UK Listing Authority require that the

accounting policies and presentation applied to the interim figures should be

consistent with those applied in preparing the preceding annual accounts except

where any changes, and the reasons for them, are disclosed.

Review work performed

We conducted our review in accordance with guidance contained in Bulletin 1999/4

issued by the Auditing Practices Board. A review consists principally of making

enquiries of management and applying analytical procedures to the financial

information and underlying financial data and based thereon, assessing whether

the accounting policies and presentation have been consistently applied unless

otherwise disclosed. A review excludes audit procedures such as tests of

controls and verification of assets, liabilities and transactions. It is

substantially less in scope than an audit performed in accordance with Auditing

Standards and therefore provides a lower level of assurance than an audit.

Accordingly we do not express an audit opinion on the financial information.

Review conclusion

On the basis of our review we are not aware of any material modifications that

should be made to the financial information as presented for the six months

ended 30 June 2002.

Deloitte & Touche

Chartered Accountants

and Registered Auditors

Deloitte & Touche House

Earlsfort Terrace

Dublin 2

25 September 2002

CONSOLIDATED PROFIT AND LOSS ACCOUNT

FOR THE SIX MONTHS ENDED 30 JUNE 2002

6 Months 6 Months 12 Months

30/06/02 30/06/01 31/12/01

Unaudited Unaudited Audited

US$ US$ US$

Turnover - - -

Operating Income/(Expenses) 470,825 (875,609) (983,638)

Operating Profit/(Loss) 470,825 (875,609) (983,638)

Interest Receivable 71,733 69,111 110,806

Profit/(Loss) On Ordinary Activities

Before Taxation 542,558 (806,498) (872,832)

Taxation - - -

Profit/(Loss) On Ordinary Activities

After Taxation 542,558 (806,498) (872,832)

Earnings/(Loss) per share: Basic 0.25c (0.43c) (0.47c)

Earnings/(Loss) per share: Diluted 0.22c (0.43c) (0.47c)

CONSOLIDATED BALANCE SHEET

AS AT 30 JUNE 2002

6 Months 6 Months 12 Months

30/06/02 30/06/01 31/12/01

Unaudited Unaudited Audited

US$ US$ US$

Fixed Assets

Mineral Interests 13,317,651 9,728,436 11,137,129

Tangible Assets 41,634,992 41,639,336 41,639,177

54,952,643 51,367,772 52,776,306

Current Assets

Debtors 84,879 95,399 76,826

Cash at Bank and In Hand 12,615,452 2,403,232 1,239,530

12,700,331 2,498,631 1,316,356

Creditors: Amounts falling

due within one year (1,171,149) (1,337,665) (1,484,230)

Net Current Assets/(Liabilities) 11,529,182 1,160,966 (167,874)

Total Assets Less Current Liabilities 66,481,825 52,528,738 52,608,432

Creditors: Amounts falling

due after one year (1,408,720) (1,009,610) (1,379,571)

Provision for liabilities and charges (2,817,500) (1,267,513) (1,275,510)

62,255,605 50,251,615 49,953,351

Capital and Reserves

Called Up Share Capital 24,556,528 20,589,581 20,684,504

Share Premium Account 25,600,044 15,613,682 16,303,622

Profit and Loss Account - (Deficit) (22,438,240) (22,078,747) (22,980,798)

Other Reserve 3,642,080 5,500,419 3,642,080

Revaluation Reserve 30,141,002 30,626,680 31,549,752

Capital Conversion Reserve Fund 754,191 - 754,191

Shareholders' Funds 62,255,605 50,251,615 49,953,351

GROUP CASH FLOW STATEMENT

FOR THE SIX MONTHS ENDED 30 JUNE 2002

6 Months 6 Months 12 Months

30/06/02 30/06/01 31/12/01

Unaudited Unaudited Audited

US$ US$ US$

Net cash inflow/(outflow) from

operating activities 1,316,303 181,943 (63,175)

Returns on investment

and servicing of finance

Interest received 71,733 69,111 110,806

Net cash inflow from returns on

investment & servicing of finance 71,733 69,111 110,806

Capital expenditure

& financial investment

Addition of Mineral Interests (2,180,522) (2,015,352) (3,502,168)

Net cash outflow from capital

expenditure & financial investment (2,180,522) (2,015,352) (3,502,168)

Net cash outflow before use of

liquid resources & financing (792,486) (1,764,298) (3,454,537)

Financing:

Issue of Ordinary Share Capital 14,530,720 5,089,101 5,409,437

Cost of share issue (1,362,274) (378,767) (397,304)

Finance Lease (7,296) - (15,405)

Decrease in debt due within a year (1,027,020) (1,865,457) (2,022,213)

Increase/(Decrease) in

debt due beyond a year 34,278 (20,682) 323,441

Net cash inflow from financing 12,168,408 2,824,195 3,297,956

Increase/(Decrease) in cash 11,375,922 1,059,897 (156,581)

STATEMENT OF TOTAL RECOGNISED GAINS AND LOSSES

FOR THE SIX MONTHS ENDED 30 JUNE 2002

6 Months 6 Months 12 Months

30/06/02 30/06/01 31/12/01

Unaudited Unaudited Audited

US$ US$ US$

Income (Loss) attributable to

Group shareholders 542,558 (806,498) (872,832)

Revaluation of Tangible Fixed Assets (1,408,750) - -

Currency Translation Movement - 5,068,830 2,913,385

Total Recognised Gains and

Losses for the period (866,192) 4,262,332 2,040,553

RECONCILIATION OF MOVEMENT IN SHAREHOLDERS' FUNDS

FOR THE SIX MONTHS ENDED 30 JUNE 2002

6 Months 6 Months 12 Months

30/06/02 30/06/01 31/12/01

Unaudited Unaudited Audited

US$ US$ US$

Total Recognised Gains and Losses -866,192 4,262,332 2,040,553

for the period

Issue of Shares - at par 3,872,024 1,064,764 1,146,812

Share Premium, net of costs 9,296,422 3,645,569 3,865,322

Net Change in Shareholders' funds 12,302,254 8,972,665 7,052,687

Opening Shareholders' funds 49,953,351 41,278,950 42,900,664

Closing Shareholders' funds 62,255,605 50,251,615 49,953,351

NOTES TO THE INTERIM FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED 30 JUNE 2002

1. Basis of Preparation of Interim Financial Statements

The Interim Statement has been prepared applying the accounting policies set out

on page 23 of the 2001 Annual Report and Accounts, save that the financial

statements are prepared in US Dollars from 1 January 2002. The Directors view

the US Dollar as being the functional currency of the group. The comparative

figures are presented in US Dollars using the exchange rate at 1 January 2002.

The unaudited interim financial information in this statement has been reviewed

by the auditors in respect of the six months ended 30th June 2002 only and their

Report to the Directors is set out herein.

2. Earnings and Fully Diluted Earnings per Share

The calculation of the basic earnings per share is based on the profit after

taxation of US$542,558 (2001: Loss US$806,498) and the weighted average number

of shares in issue during the six months ended 30 June 2002 of 214,728,068

shares (2001: 187,201,875 shares).

The calculation of fully diluted earnings per share is based on the profit for

the period after taxation as for basic earnings per share. The number of shares

is adjusted to show the potential dilution if share options and share warrants

are converted into ordinary shares. The weighted average number of shares in

issue is increased to 243,306,384. For the 2001 comparatives, the fully diluted

earnings per share and the basic earnings per share figures are the same, as a

loss was made during each of those periods.

3. Mineral Interests

The recovery of deferred development expenditure is dependent upon the

successful development of economic ore reserves, which in turn depends on the

availability of adequate funding from financial institutions, a joint venture

party or other source.

The Directors are satisfied that deferred expenditure is worth not less than

cost less any amounts written off and that the exploration projects have the

potential to achieve mine production and positive cash flows.

4. Tangible Assets

Tangible Assets are stated at cost or valuation less accumulated depreciation.

GRD Minproc Limited, an independent Australian engineering group, has valued the

Mining and Processing Plant on a depreciated replacement cost basis as at 30

June 2000. The recovery of this amount is dependent upon the successful

development of the Moma Titanium Minerals Project, which in turn depends on the

availability of adequate funding from financial institutions, a joint venture

party or other source. The historical cost net book value of these assets at 30

June 2001 is US$8,118,350. The surplus arising on revaluation amounts to

US$30,141,002.

5. Non-Consolidation of Subsidiary Undertaking

As set out in detail in Note 7 of 2001 Annual Report, Grafites de Ancuabe,

S.A.R.L., a subsidiary company, has been excluded from consolidation from 31

December 1999.

6. Approval of Interim Financial Statements

The interim financial statements were approved by the Board on 25 September

2002.

25 September, 2002

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR BKPKQCBKKACB

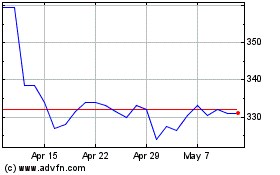

Kenmare Resources (LSE:KMR)

Historical Stock Chart

From Jun 2024 to Jul 2024

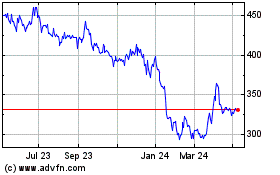

Kenmare Resources (LSE:KMR)

Historical Stock Chart

From Jul 2023 to Jul 2024