TIDMKMR

Kenmare Resources plc ("Kenmare" or "the Company")

Kenmare Resources plc Half-Yearly Results

Six Months Ended 30 June 2013

(LSE/ISE: KMR)

Overview

-- Phase II expansion facilities operational and ramping up production

-- Heavy Mineral Concentrate production up 24% on H1 2012 to 480,000 tonnes

-- Ilmenite production up 9% on H1 2012 to 302,600 tonnes, zircon production

down 19% to 19,100 tonnes

-- Moma Project loan amendment agreed

-- H2 expected to show strong growth over H1 production volumes as expansion

plant ramps up

-- RevenuesUS$79.3 million (H1 2012: US$109.1 million

-- EBITDA US$18.8 million (H1 2012: US$55.5 million)

-- Operating profit US$6.9 million (H1 2012: US$47.0 million)

-- Net loss US$10.2 million (H1 2012: net profit US$38.8 million)

-- Ilmenite market still subdued, zircon market continues to show signs of

recovery

Statement by Michael Carvill, Managing Director:

"With increasing production and the completion of the major investment

phase, management's focus is now on controlling operating costs,

conserving cash and de-risking the business. To this end, a three year

wage agreement has been reached with our unionised workforce, a system

to reduce disruption to electricity supply has been installed and our

capital expenditure programme has been reviewed. Kenmare will be

well-positioned for the global titanium feedstock market's emergence

from this unusually protracted period of subdued demand."

For further information, please contact:

Kenmare Resources plc

Michael Carvill, Managing Director

Tel: +353 1 671 0411

Mob: + 353 87 674 0110

Tony McCluskey, Financial Director

Tel: +353 1 671 0411

Mob: + 353 87 674 0346

Virginia Skroski, Investor Relations Manager

Tel: +353 1 671 0411

Mob: + 353 87 739 1103

Murray Consultants

Joe Heron/Jim Milton

Tel: +353 1 498 0300

Mob: +353 86 255 8400

Tavistock Communications

Mike Bartlett / Jos Simson

Tel: +44 207 920 3150

Mob: +44 7753 949108

INTERIM MANAGEMENT REPORT

Overview

Kenmare recorded an operating profit for the first half of 2013 of

US$6.9 million (2012: US$47.0 million) and EBITDA of US$18.8 million

(2012: US$55.5 million). While production volumes of Heavy Mineral

Concentrate (HMC) and ilmenite increased by 24% and 9% respectively on

the same period last year, revenues decreased to US$79.3 million (2012:

US$109.1 million). This was principally a result of lower average prices,

primarily a reflection of weaker market conditions for the first half of

the year compared with 2012.

Expansion

All main production facilities built as part of the 50% capacity

expansion are substantially complete and operational.

The completed facilities are in ramp-up, with some undergoing debugging

processes and some ancillary systems are still in the last stages of

cold commissioning. No issues have been identified to date which would

have a major effect on the ramp up or the ultimate ability of the

expanded facilities to operate at nameplate capacity.

Operations

Production H1 2013 H1 2012

Heavy Mineral Concentrate (HMC) 480,000 tonnes 386,200 tonnes

Ilmenite 302,600 tonnes 276,600 tonnes

Zircon 19,100 tonnes* 23,600 tonnes*

Shipments H1 2013 H1 2012

Product Shipped 294,100 tonnes 321,500 tonnes

* Includes 7,400 tonnes secondary zircon product (H1 2012: 11,100

tonnes)

Production is consistent with operational updates given in the course of

the year. Production of HMC in H1 2013 was up 24% on H1 2012 despite

January and February being very difficult months for mining operations.

These months were the last part of the transition of Dredge Pond A from

the Namalope Flats area to an elevated dunal plateau where it will

remain for the next 10 years. As a direct consequence of difficult

mining in January and February, ilmenite production was constrained in

these months by a lack of HMC for processing. In addition, there was a

scheduled shutdown of the Mineral Separation Plant (MSP) in June to

facilitate expansion integration works which restricted that month's

ilmenite production to 36,400 tonnes. Nonetheless, ilmenite production

increased 9% in H1 2013 from H1 2012. In July, 80,000 tonnes of

ilmenite were produced, a significant increase compared to previous

months due to the start of contributions from the Auxiliary Ilmenite

Plant constructed as part of the Phase II Expansion. August ilmenite

production was slightly reduced due to planned maintenance. The outlook

for the remainder of the year is that production will increase towards

design capacity as the expansion plants ramp-up.

Zircon production declined by 19% from H1 2012 to H1 2013. This was

mainly due to an expansion-related shutdown of the non-magnetic

production circuits throughout June which resulted in reduced zircon

production of 1,000 tonnes. This shutdown extended through July but is

now over and the expanded non-magnetic circuits are being ramped up.

The Company shipped 294,100 tonnes of products in H1 2013 compared with

321,500 tonnes in H1 2012. In Q1, shipping levels were very low (48,500

tonnes) primarily because stocks had been sold down to a minimum level

at the end of the year, and since production was quite modest in the

first two months of 2013, stocks took some time to replenish. In

contrast, 245,600 tonnes were shipped in Q2.

Now that WCP A is mining in favourable conditions on the dunal plateau,

and disruption of operations to link in expansion facilities has ceased,

output of all final products is expected to increase in H2 2013

reflecting a steadily increasing contribution from the expansion

facilities.

In August, the Company and the union (SINTICIM) which represents the

Mine's unionised workforce reached a long term agreement on remuneration

for the next three years which provides the Company with a stable basis

for cost management of a key component of our operating cost.

Market

Demand for titanium feedstocks to date in 2013 has been subdued due to a

significant destocking cycle by the pigment industry. In 2012, despite

global GDP increasing by 3%, global volumes of traded pigment reduced by

approximately 10%. Given the scale of this contraction and general

expectation of improved economic outlook in 2013, most industry

commentators expected a sustained recovery in demand by mid-year.

However this recovery has not fully taken hold and the destocking cycle

has been longer and deeper than we or most industry participants

expected.

Nonetheless despite a less buoyant spring coating season due to the

extended winter in Europe and North America, pigment demand improved in

the first two quarters compared to the same period in 2012, and steps to

moderate pigment production contributed to a significant drawdown of

pigment inventory. However the process is not complete, and although

some producers have announced a normalisation of their pigment

inventories, others continue to hold some excess volumes and curtail

production. Globally, pigment plant operating rates, although improving,

are still around 80% (and likely lower in China) compared to more

normal levels of around 90%.

This curtailment of pigment production is likely to continue into the

second half of 2013 as pigment producers remain cautious about the pace

of demand recovery in the pigment market. Although US demand continues

to grow due to the improved economic conditions, and in particular the

recovery in the housing market and strong automotive manufacturing,

demand in Europe is sluggish, whilst Asia is more challenging. China in

particular is adjusting to more moderate growth rates as the Government

orients the direction of the economy to a more consumer-driven model and

tries to deflate the property market.

As a consequence of high feedstock inventories at the start of 2013 and

low pigment plant operating rates, demand for feedstocks continues to be

weak in 2013 and downward pricing pressure persists. However, along with

widespread production cuts by major high grade feedstock producers,

there is evidence that ilmenite production is being curtailed in Vietnam

and China as current prices are now below production cost for some

producers. As pigment plant utilisation rates continue to improve during

the second half of 2013, we expect a normalisation of feedstock

purchasing and increased demand.

The outlook in the zircon market continues to improve since prices

bottomed at the end of Q1 2013 following the sharp correction in the

previous eight months. There is evidence that some of the substitution

and thrifting of zircon by the ceramics industry in the past two years,

motivated by previous significant price increases, is being reversed in

response to lower prices. Demand conditions are also looking more

positive in China and Europe, the two principal ceramics producing

regions which experienced a big slowdown in 2012. The zircon market is

expected to continue its slow recovery, and the expected price

environment for the remainder of 2013 is stable to modest upward

pressure.

Financial Review for the six months ended 30 June 2013

Revenues for the period amounted to US$79.3 million (2012: US$109.1

million), arising from the sale of 294,100 tonnes (2012: 321,500 tonnes)

of ilmenite, zircon and rutile. The decrease in revenue was principally

due to lower market prices received as weak market conditions prevailed

during the first half of the year.

Total operating costs, consisting of cost of sales and other operating

costs, amounted to US$72.4 million (2012: US$62.1 million), included

depreciation and amortisation of US$12.0 million (2012: US$8.5 million).

The increase in operating costs was principally from higher labour and

engineering costs, together with additional costs associated with the

continued transition of Wet Concentrator Plant A from the low lying

Namalope Flats zone onto a raised dunal plateau, which was completed

during the first quarter. Included in other operating costs are freight,

demurrage and distribution costs of US$7.0 million (2012: US$5.4

million), administration costs of US$1.8 million (2012: US$1.9 million)

and a share-based payment expense of US$1.4 million (2012: US$0.9

million). Adjusting total operating costs for depreciation of US$12.0

million (2012: US$8.5 million), total Group share-based payments of

US$1.5 million (2012: US$1.4 million), freight reimbursable by customers

of US$1.6 million (2012: US$1.3 million) and mineral product inventory

movements of US$9.3 million (2012: US$0.9m), the cash production cost

for the period amounted to US$66.6 million (2012: US$51.8 million).

The gross profit for the period was US$17.0 million (2012: US$55.2

million) and the operating profit was US$6.9 million (2012: US$47.0

million). The decreases in gross profit and operating profit resulted

from lower revenues and increases in operating costs as noted above.

Earnings before interest, tax, depreciation and amortisation (EBITDA)

for the period amounted to US$18.8 million (2012: US$55.5 million).

Net finance costs amounted to US$17.5 million (2012: US$13.9 million)

and the Group reported a foreign exchange gain of US$1.4 million (2012:

US$5.7 million), mainly based upon retranslation of Euro-denominated

loans. The Group is reporting a net loss of US$10.2 million for the

period (2012: profit US$38.8 million).

During the period, additions to property, plant and equipment were

US$90.8 million (2012: US$191.9 million). Capital expenditure on

existing plant and equipment was US$7.3 million (2012: US$36.2 million),

expansion capital expenditure was US$64.6 million (2012: US$154.5

million) bringing total expansion additions as at 30 June 2013 to

US$395.6 million (2012: US$331.0 million). Of this US$395.6 million

US$18.5 million relates to a claim by an expansion contractor that is

being disputed by Kenmare. In addition, during the period operating

costs of US$5.6 million (2012: nil) associated with the expansion

facilities were capitalised. Final expansion construction costs,

excluding disputed amounts, are now expected to be approximately US$390

million. The mine closure asset has increased by US$13.3 million as a

result of the change in the discount rate used in the calculation of the

mine closure provision. The discount rate used as at 30 June 2013 was 3%

based on a 20 year US Treasury yield rate. This is a change in the

assumption from 9% used as at 31 December 2012 being the average

effective borrowing rate for the Moma Titanium Minerals Mine. The reason

for the change in assumption is to exclude the risk of the Company and

only include risk specific to the liability.

Inventory at the period end amounted to US$34.2 million (2012: US$22.4

million), consisting of mineral products of US$16.0 million (2012:

US$6.6 million) and consumable spares of US$18.2 million (2012: US$15.8

million). The increase in mineral product inventories from 2012 is due

to higher volumes at the period end. The increase in consumable spares

is due to additional spares required to be held for the expanded plant

and equipment. Trade and other receivables amounted to US$20.2 million

(2012: US$35.7 million), of which US$16.9 million (2012: US$29.9

million) are trade receivables from the sale of mineral products and

US$3.3 million (2012: US$5.8 million) is comprised of prepayments and

other miscellaneous debtors. The decrease in trade receivables at the

period end is due to the reduction in revenue. Included in trade and

other payables of US$69.2 million (2012: US$52.8 million) is US$40.6

million (2012: US$27.9 million) relating to expansion capital additions.

Of this US$40.6 million, US$18.5 million is disputed by Kenmare.

Bank loans, comprising the existing Moma project loans and a new

corporate bank loan, amounted to US$358.5 million (2012: US$324.4

million) at the end of the period. On 28 February 2013, Kenmare and Absa

Bank Limited ("Absa") entered into an agreement establishing a corporate

facility of US$40 million. This facility was fully drawn during the

period and matures on 20 March 2014. It is capable of being renewed on

the written agreement of Absa and Kenmare and it will need to be renewed

or refinanced on or before 20 March 2014. The corporate loan facility

bears interest at 1 month LIBOR plus 8% and loan interest of US$0.8

million accrued on this loan during the period.

In relation to the Moma project loans, during the period senior loan

interest and principal of US$16.0 million (2012: US$32.9 million) was

paid, interest of US$13.6 million (2012: US$26.4 million) accrued, and

the Euro-denominated loans decreased by US$2.6 million (2012 increase:

US$3.8 million) as a result of the US Dollar strengthening against the

Euro. The average interest rate on the Group loans at the period end was

8.7%. On 31 July 2013, the Group entered into an amendment to the Moma

project loan agreements with the project lenders. This amendment was

agreed as part of on-going management of the Group's financial resources,

taking into consideration the current product market conditions and

funding of remaining expansion costs. The amendment includes: the

effective postponement of the date on which deferred subordinated debt

is required to be brought current from 1 August 2014 to 1 August 2015;

the deferment of the 1 August 2013 principal instalment of senior debt

of US$13 million to 1 August 2014; and an extension in time and quantum

of the ability of the Project to fund expansion-related capital

expenditures from Project operating cash flows.

Cash and cash equivalents at 30 June 2013 amounted to US$31.0 million

(2012: US$46.1 million).

Health, Safety and Community

The Mine's health and safety record remains positive with a lost time

injury frequency rate of 0.35 for the twelve months to 30 June 2013.

Kenmare remains committed to providing a safe and healthy work

environment for its employees.

The Kenmare Moma Development Association (KMAD) continued to support

local communities during the period through its economic, social and

infrastructure projects.

Outlook

As the expansion ramp-up progresses, the long period of investment in

the facilities at Moma is now complete. The assets that have been

constructed give the Mine the ability to supply a significant proportion

of the world's titanium feedstock requirement and to do so from a low

point on the production cost curve. Titanium feedstocks are critical to

the functioning and development of the global economy. Whilst demand has

been subdued due to de-stocking and to generally reduced growth in many

major markets, as the de-stocking cycle completes and large economies

such as the USA move towards more normal growth patterns, demand will

improve.

Given the largely fixed cost base, the increase in production from the

expanded plant will drive down the unit operating costs. When the market

strengthens and delivers improvements in price, increasing production

will generate significant free cash flow from operations. During current

market weakness, the company will continue to focus on production

ramp-up and cost control to maintain liquidity.

Principal risks and uncertainties

The Group's business may be affected by risks similar to those faced by

many companies in the mining industry. There are a number of potential

risks and uncertainties that could have a material impact on the Group's

performance over the remaining six months of the financial year and

could cause actual results to differ materially from expected results.

These risks are outlined below.

Market risks

The Group's revenue and earnings depend upon the demand for and

prevailing prices of ilmenite, zircon and rutile. Such prices are based

on world supply and demand and are subject to large fluctuations in

response to changes in the demand for such products, whether as a result

of uncertainty or a variety of additional factors beyond the Group's

control. Prices for the Group's products are also impacted by the

available supply of ilmenite, rutile, other titanium pigment feedstocks,

and zircon. The Group's revenue generation, results of operations and

financial condition may be significantly and adversely affected by

declines in the demand for and prices of ilmenite, zircon and rutile.

Concentration and counterparty risk

A small number of customers account for a significant proportion of the

Group's revenue. If any of its major customers ceased dealing with the

Group and the Group was unable to sell the product in the market on

comparable or superior terms, this would have an adverse impact on the

Group's financial condition and results of operations.

Further, the Group's contracts are such that some customers receive

title to the product prior to the due date for payment. If any of the

customers were unable to or failed to pay for such products, this would

have an adverse impact on the Group's revenue generation, result of

operations or financial condition.

Competition risk

The mining industry is competitive. The Group faces strong competition

from other mining companies in the production and sale of titanium

minerals and zircon. Many of these companies have substantially greater

financial resources and a longer operating history than the Group. As a

result, such companies may have a greater capacity to respond to

competitive pressures and market dynamics. There can be no assurance

that the Group could be able to successfully respond to such competitive

pressure or the competitive activities of other producers.

Expansion ramp-up risk

A failure to achieve post-Phase II Expansion production targets on a

timely basis could have a material adverse effect on the Group's

production. Successful commissioning and ramp-up of the Phase II

Expansion is subject to various factors, many of which are not within

the Group's control, including the performance of contractors, suppliers

and consultants, and the performance of installed equipment. There is

no guarantee that the expanded operations will achieve and maintain the

anticipated production volumes on a timely basis, or that the final

expansion capital costs or post-expansion operating costs will be in

line with those anticipated. Failure to implement the Phase II

Expansion as planned may have a material adverse effect on the Group's

financial condition and the results of operations, and the Group may be

unable to capitalise to the maximum extent on any increase in demand or

prices of our products.

Operational risks

The Group's financial condition and results of operations are solely

dependent on the success of our operation of the Mine. Any event that

materially interferes with our ability to conduct operations at the Mine

could have a materially adverse effect on the Group's financial

condition and results of operations.

Mining operations are vulnerable to natural events, including drought,

floods, fire, storms and the possible effects of climate change.

Operating difficulties could be experienced such as a result of

unexpected geological variations. Mineral sands dredge mining involves

considerable berm construction and geotechnical management. An accident

or a breach of operating standards could result in a significant

incident which would affect the Group's reputation, and the costs of its

operations for indeterminate periods.

The Mine requires reliable roads, ports, power sources and power

transmission facilities, and water supplies to conduct its business. The

availability and cost of infrastructure affects capital and operating

costs, production and sales. In particular, the Mine is dependent on the

electricity generation and transmission system in northern Mozambique,

and a single 170 km transmission line to the Moma Mine from the Nampula

substation. Although the Group has invested in equipment to minimise

power interruptions and has been working with the state power

transmission utility, Electricidade de Mocambique (EdM) to improve the

stability of the electricity supply to the Moma Mine, there is no

certainty that it will succeed in minimising or eliminating power

fluctuations and interruptions entirely which could adversely affect

production. If either the power station at Cahora Basa or the power

transmission line to the Moma Mine were to experience prolonged

disruptions, production of ilmenite, rutile and zircon would be reduced,

which would reduce cash flow, may impact customer relationships, and

have an adverse impact on the Group's trading and financial position.

Furthermore, the Mine is reliant on the marine terminal for the shipment

of products. Adverse weather conditions can limit the amount of

shipments. Extreme weather conditions or accident could result in

damage to the marine terminal, rendering the Mine unable to ship its

products pending repair. In these situations, the Mine may be unable to

meet its commitments to customers to a lesser or greater degree,

resulting in reduced revenues, ocean freight penalties and reduced

cashflow, with an adverse impact on customer relationships, results of

operations and trading and financial condition.

In addition, the Group's customers depend upon ocean freight to

transport products purchased from the Group. Disruption of ocean freight

as a result of piracy or other events could temporarily impair the

Group's ability to supply its products to its customers and thus could

adversely affect the Group's results of operations and trading and

financial condition. The Group has developed a policy to manage the

threat of piracy near the marine terminal.

The Group's insurance does not cover every potential risk associated

with its operations. Adequate cover at reasonable rates is not always

obtainable. In addition, the Group's insurance may not fully cover its

liability or the consequences of any business interruption such as

weather events, equipment failure or labour dispute. The occurrence of a

significant event not fully covered by insurance could have an adverse

effect on the Group's business, results of operations and financial

condition.

Financing and refinancing risks

On the 28 February 2013, Kenmare and Absa entered into agreement

establishing a corporate facility of US$40 million maturing on 20 March

2014. This facility was fully drawn in the period. It is capable of

being renewed on the written agreement of both Absa and Kenmare and it

will need to be renewed or refinanced on or before 20 March 2014.

Failure to renew or refinance may result in an event of default under

the corporate facility as well as under the Moma Project Loans.

The development of the Mine has been partly financed by the Moma Project

Loans. The Group's ability to meet its debt service obligations depends

on the cashflow generated from operations. The Mine's cashflow, in turn,

depends primarily on the Mine's ability to achieve production, product

sales volumes and pricing and cost targets. Failure to achieve these

targets could result in insufficient funds to meet scheduled interest

and principal repayments which would result in an event of default.

Senior management monitors achievement of targets and cashflow to ensure

sufficient funds are available to meet scheduled repayments.

Currency risks

The Group's corporate and Moma project loans are denominated in US

Dollars and Euro. At 30 June 2013, the loan balance comprised US$188.1

million denominated in US Dollars and US$170.4 million denominated in

Euro. The outstanding loans are due to be repaid in instalments between

2014 and 2019. All the Group's sales are denominated in US Dollars.

Euro-denominated loans expose the Group to currency fluctuations which

are realised on payment of interest and principal on Euro-denominated

loans.

Senior management regularly monitors and reports to the Board on these

currency risks. The Board has determined that the Group's current policy

of not entering into derivative financial instruments to manage the

loan-related currency risks continues to be appropriate in light of the

length of, and payment profile over, the loan repayment period.

Group operating and capital costs are denominated in US Dollars, South

African Rand, Mozambican Metical, Euro, Sterling, Australian Dollars and

Singapore Dollars. Fluctuations in these currencies will impact on the

Group's financial results. The operating and expansion capital currency

exposure is managed by adjusting the currencies in which the cash used

to fund such expenditure is held.

Interest rate risk

Interest rates on the Group's bank loans are both fixed and variable.

The variable rates are based on one month and six month US Dollar LIBOR.

All the Euro loans are fixed rate. The Group is exposed to movements in

interest rates which affect the amount of interest paid on borrowings.

As at 30 June 2013, 59% of the Group's debt (US$211.6 million) was at

fixed interest rates and 41% (US$146.9 million) was at variable interest

rates. Any increase in the one month and six month US Dollar LIBOR would

increase finance costs and therefore have a negative impact on the

Group's profitability. Senior management regularly monitors and reports

to the Board on these interest rate risks. The Board has determined that

the Group's current policy of not entering into derivative financial

instruments to manage such risks continues to be appropriate in light of

the length of the loan repayment period, the payment profile over this

period and the mix of fixed and variable rate debt.

Health and safety risks

The Group is committed to conducting its business in a manner that

minimises the exposure of its employees, contractors and the general

public to health and safety risks arising from its operations. An

accident or a breach of operating standards could result in a

significant incident which would affect the Group's reputation, and the

costs and viability of its operations for an indeterminate period. The

Group's operations worked 4.4 million hours in the six months to 30 June

2013 (2012: 3.3 million hours), with 7 lost-time injuries to employees

and contractors (2012: 2 lost-time injuries). Malaria is a key risk at

the Mine and the Group continues to develop and implement programmes to

minimise its impact on all personnel at the Mine. The Group will also

continue to ensure that appropriate health and safety standards are

maintained across all its activities.

Human Resources risks

The Group's success depends upon the expertise and continued service of

certain key executives and technical personnel, including the Executive

Directors. The loss of the services of certain key employees, including

to competitors, could have a material adverse effect on the results of

operations and financial condition of the Group. In addition, as the

Group's business develops and expands, the Group's future success will

depend on its ability to attract and retain highly skilled and qualified

personnel, which is not guaranteed. Due to the increased mining activity

in Mozambique in recent years, the Group has encountered increasing

competition in attracting experienced mining professionals. Should key

personnel leave or should the Group be unable to attract and retain

qualified personnel, the Group's business, its results of operations and

financial condition may be adversely affected. Certain Mine employees

are represented by a union under a collective agreement. The Mine may

not be able to satisfactorily renegotiate agreements when they expire

and may face higher wage demands. In addition, existing labour

agreements may not prevent a strike or work stoppage, which could have

an adverse effect on the Group's earnings, financial condition and

reputation.

Litigation risks

The Group may from time to time face the risk of litigation in

connection with its business and/or other activities. Recovery may be

sought against the Group for large and/or indeterminate amounts and the

existence and scope of liabilities may remain unknown for substantial

periods of time. A substantial legal liability and/or an adverse ruling

could have a material adverse effect on the Group's business, results of

operation and/or financial condition.

Political and regulatory risks

The Mine is located in Mozambique, which has been politically stable for

almost two decades. The Group has operated in Mozambique since 1987, and

has executed a Mineral Licensing Contract and an Implementation

Agreement which each contain certain protections against adverse changes

in Mozambican law. Mozambique may, however, become subject to risks

similar to those which are prevalent in many developing countries,

including extensive political or economic instability, changes in fiscal

policy (including increased taxes or royalty rates), nationalisation,

inflation, and currency restrictions. In addition, there may be an

increase in, and tightening of, the regulatory requirements (including,

for example, in relation to employee health and safety, permitting and

licensing, planning and development and environmental compliance). The

occurrence of these events could adversely affect the economics of the

Mine and could have a material adverse effect on the results of

operations and financial condition of the Group.

Related party transactions

There have been no material changes in the related party transactions

affecting the financial position or the performance of the Group in the

period other than those disclosed in Note 10.

Going Concern

As stated in Note 1 to the condensed consolidated financial statements,

based on the Group's forecasts and projections the Directors are

satisfied that the Group has sufficient resources to continue in

operation for the foreseeable future, a period of not less than twelve

months from the date of this report. Accordingly, they continue to adopt

the going concern basis in preparing the condensed consolidated

financial statements.

Events after the balance sheet date

On 31 July 2013, the Group entered into an amendment to the Moma project

loan agreements with the project lenders as detailed above and in Note

7.

In August, the Company and the union (SINTICIM) which represents the

Mine's unionised workforce reached a long term agreement on remuneration

for the next three years.

Forward-looking statements

This report contains certain forward-looking statements. These

statements are made by the Directors in good faith based on the

information available to them up to the time of their approval of this

report and such statements should be treated with caution due to the

inherent uncertainties, including both economic and business risk

factors, underlying any such forward-looking information.

On behalf of the Board,

Managing Director Financial Director

Michael Carvill Tony McCluskey

27 August 2013 27 August 2013

RESPONSIBILITY STATEMENT

The Directors are responsible for preparation of the Half Yearly

Financial Report in accordance with the Transparency (Directive

2004/109/EC) Regulations 2007, the Transparency Rules of the Central

Bank of Ireland, and with IAS 34, Interim Financial Reporting as adopted

by the European Union.

The Directors confirm that, to the best of their knowledge:

-- The Group condensed consolidated financial statements for the half year

ended 30 June 2013 have been prepared in accordance with IAS 34 'Interim

Financial Reporting', as adopted by the European Union;

-- The Interim Management Report includes a fair review of the information

required by Regulation 8(2) of the Transparency (Directive 2004/109/EC)

Regulations 2007, being an indication of important events that have

occurred during the first six months of the financial year and their

impact on the condensed consolidated financial statements; and a

description of the principal risks and uncertainties for the remaining

six months of the year; and

-- The Interim Management Report includes a fair review of the information

required by Regulation 8(3) of the Transparency (Directive 2004/109/EC)

Regulations 2007, being related party transactions that have taken place

in the first six months of the current financial year and that materially

affected the financial position or performance of the entity during that

period; and any changes in the related party transactions described in

the last annual report that could do so.

On behalf of the Board,

Managing Director Financial Director

Michael Carvill Tony McCluskey

27 August 2013 27 August 2013

INDEPENDENT REVIEW REPORT TO THE MEMBERS OF KENMARE RESOURCES PLC

Introduction

We have been engaged by the Company to review the group condensed

consolidated set of financial statements in the Half-Yearly Financial

Report for the six months ended 30 June 2013 which comprises the Group

Condensed Consolidated Statement of Comprehensive Income, the Group

Condensed Consolidated Statement of Financial Position, the Group

Condensed Consolidated Statement of Changes in Equity, the Group

Condensed Consolidated Statement of Cashflows and related notes 1 to 13.

We have read the other information contained in the Half-Yearly

Financial Report and considered whether it contains any apparent

misstatements or material inconsistencies with the information in the

group condensed consolidated set of financial statements.

This report is made solely to the Company's members, as a body, in

accordance with International Standard on Review Engagements (UK and

Ireland) 2410 "Review of Interim Financial Information performed by the

Independent Auditor of the Entity" issued by the Auditing Practices

Board. Our work has been undertaken so that we might state to the

Company's members those matters we are required to state to them in an

independent review report and for no other purpose. To the fullest

extent permitted by law, we do not accept or assume responsibility to

anyone other than the Company and the Company's members as a body, for

our review work, for this report, or for the conclusions we have formed.

Directors' Responsibilities

The Half-Yearly Financial Report is the responsibility of, and has been

approved by, the Directors. The Directors are responsible for preparing

the Half-Yearly Financial Report in accordance with the Transparency

(Directive 2004/109/EC) Regulations 2007 and the Transparency Rules of

the Central Bank of Ireland.

As disclosed in note 1, the annual financial statements of the group are

prepared in accordance with IFRSs as adopted by the European Union. The

group condensed consolidated set of financial statements included in

this Half-Yearly Financial Report has been prepared in accordance with

International Accounting Standard 34 'Interim Financial Reporting,' as

adopted by the European Union.

Our Responsibility

Our responsibility is to express to the Company a conclusion on the

condensed consolidated set of financial statements in the Half-Yearly

Financial Report based on our review.

Scope of Review

We conducted our review in accordance with International Standard on

Review Engagements (UK and Ireland) 2410, "Review of Interim Financial

Information Performed by the Independent Auditor of the Entity" issued

by the Auditing Practices Board for use in Ireland. A review of interim

financial information consists of making inquiries, primarily of persons

responsible for financial and accounting matters, and applying

analytical and other review procedures. A review is substantially less

in scope than an audit conducted in accordance with International

Standards on Auditing (UK and Ireland) and consequently does not enable

us to obtain assurance that we would become aware of all significant

matters that might be identified in an audit. Accordingly, we do not

express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that causes us to

believe that the group condensed consolidated set of financial

statements in the Half-Yearly Financial Report for the six months ended

30 June 2013 is not prepared, in all material respects, in accordance

with International Accounting Standard 34 (IAS 34 -Interim Financial

Reporting) as adopted by the European Union, the Transparency (Directive

2004/109/EC) Regulations 2007, and the Transparency Rules of the Central

Bank of Ireland.

Emphasis of Matter - Going Concern and Recoverability of Property, Plant

and Equipment

In forming our conclusion on the condensed consolidated financial

statements for the six months ended 30 June 2013, which is not modified,

we have considered the adequacy of the disclosures made in note 1 of the

group condensed consolidated financial statements concerning going

concern and in note 5 concerning the recoverability of Property, Plant

and Equipment of US$962.9 million which is dependent on the successful

development of economic ore reserves, successful operation of the Moma

Titanium Minerals Mine ("Mine") including the expansion project and

continued availability of adequate funding for the Mine. The group

condensed financial statements do not include any adjustments relating

to these uncertainties and the ultimate outcome cannot at present be

determined.

Deloitte & Touche

Chartered Accountants

Dublin

27 August 2013

KENMARE RESOURCES PLC

GROUP CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHS ENDED 30 JUNE 2013

Unaudited Unaudited Audited

6 Months 6 Months 12 Months

30 June 30 June 31 Dec

2013 2012 2012

Notes US$'000 US$'000 US$'000

Revenue 2 79,273 109,127 234,638

Cost of sales (62,245) (53,946) (134,472)

Gross profit 17,028 55,181 100,166

Other operating costs (10,152) (8,181) (19,730)

Operating profit 6,876 47,000 80,436

Finance income 210 1,330 1,706

Finance costs (17,689) (15,200) (28,714)

Foreign exchange

gain/(loss) 1,370 5,663 (641)

(Loss)/profit before

tax (9,233) 38,793 52,787

Income tax charge (993) - (3,301)

(Loss)/profit for the

period/year (10,226) 38,793 49,486

Attributable to equity

holders (10,226) 38,793 49,486

Cent per share Cent per share Cent per share

(Loss)/earnings per

share: basic 4 (0.40c) 1.61c 2.01c

(Loss)/earnings per

share: diluted 4 (0.40c) 1.60c 2.00c

The accompanying notes form part of these condensed consolidated

financial statements.

KENMARE RESOURCES PLC

GROUP CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2013

Unaudited Unaudited Audited

30 June 30 June 31 Dec

2013 2012 2012

Notes US$'000 US$'000 US$'000

Assets

Non-current assets

Property, plant and equipment 5 962,919 775,182 887,513

Deferred tax asset 1,182 5,477 2,176

964,101 780,659 889,689

Current assets

Inventories 34,212 27,989 22,422

Trade and other receivables 20,209 44,374 35,746

Cash and cash equivalents 31,008 35,141 46,067

85,429 107,504 104,235

Total assets 1,049,530 888,163 993,924

Equity

Capital and reserves attributable to the Company's

equity holders

Called-up share capital 6 205,205 196,388 205,168

Share premium 6 349,861 301,510 349,780

Retained earnings 19,652 18,799 29,801

Other reserves 22,357 19,059 20,848

Total equity 597,075 535,756 605,597

Liabilities

Non-current liabilities

Bank loans 7 145,537 192,293 177,380

Obligations under finance lease 1,341 1,675 1,508

Provisions 8 22,840 7,668 9,050

169,718 201,636 187,938

Current liabilities

Bank loans 7 212,982 127,059 147,032

Obligations under finance lease 318 253 286

Provisions 8 276 276 276

Trade and other payables 69,161 23,183 52,795

282,737 150,771 200,389

Total liabilities 452,455 352,407 388,327

Total equity and liabilities 1,049,530 888,163 993,924

The accompanying notes form part of these condensed consolidated

financial statements.

KENMARE RESOURCES PLC

GROUP CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHS ENDED 30 JUNE 2013

Called-Up Share Capital Retained Share Total

Share Premium Conversion Earnings Option

Capital Reserve /(Losses) Reserve

Fund

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

Balance at 1

January 2012 196,347 301,391 754 (19,994) 16,856 495,354

Profit for the

period - - - 38,793 - 38,793

Share based

payments - - - - 1,449 1,449

Issue of share

capital 41 119 - - - 160

Balance at 30

June 2012 196,388 301,510 754 18,799 18,305 535,756

Profit for the

period - - - 10,693 - 10,693

Share based

payments - - - 309 1,789 2,098

Issue of share

capital 8,780 48,270 - - - 57,050

Balance at 31

December 2012 205,168 349,780 754 29,801 20,094 605,597

Loss for the

period - - - (10,226) - (10,226)

Share based

payments - - - 77 1,509 1,586

Issue of share

capital 37 81 - - - 118

Balance at 30

June 2013 205,205 349,861 754 19,652 21,603 597,075

The accompanying notes form part of these condensed consolidated

financial statements.

KENMARE RESOURCES PLC

GROUP CONDENSED CONSOLIDATED STATEMENT OF CASHFLOWS

FOR THE SIX MONTHS ENDED 30 JUNE 2013

Unaudited Unaudited Audited

6 Months 6 Months 12 Months

30 June 30 June 31 Dec

2013 2012 2012

US$'000 US$'000 US$'000

Cash flows from operating activities

(Loss)/profit for the period/year (9,233) 38,793 52,787

Adjustment for:

Foreign exchange movement (1,370) (5,663) 641

Share-based payments 1,547 1,512 3,165

Finance income (210) (1,330) (1,706)

Finance costs 14,827 13,693 27,157

Depreciation 11,995 8,476 18,456

Increase in provisions 204 59 1,236

Operating cash inflow 17,760 55,540 101,736

(Increase)/decrease in inventories (11,790) (2,143) 3,424

Decrease/(increase) in trade and other

receivables 15,537 (5,543) 3,100

Increase/(decrease) in trade and other

payables 3,605 (4,611) (4,185)

Cash generated by operations 25,112 43,243 104,075

Interest received 210 1,330 1,706

Interest paid (3,482) (3,669) (7,014)

Net cash from operating activities 21,840 40,904 98,767

Cash flows from investing activities

Additions to property, plant and equipment (61,405) (71,176) (164,251)

Net cash used in investing activities (61,405) (71,176) (164,251)

Cash flows from/(used in) financing

activities

Proceeds on the issue of shares 119 160 57,210

Repayment of borrowings (12,985) (12,966) (25,875)

Drawdown of borrowings 40,000 - -

Fees paid on drawdown of borrowings (802) - -

Decrease in obligations under finance lease (280) (280) (560)

Net cash from/(used in) financing activities 26,052 (13,086) 30,775

Net decrease in cash and cash equivalents (13,513) (43,358) (34,709)

Cash and cash equivalents at the beginning

of period/year 46,067 77,256 77,256

Effect of exchange rate changes on cash and

cash equivalents (1,546) 1,243 3,520

Cash and cash equivalents at end of

period/year 31,008 35,141 46,067

The accompanying notes form part of these condensed consolidated

financial statements.

KENMARE RESOURCES PLC

NOTES TO THE GROUP CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE PERIOD ENDED 30 JUNE 2013

1. BASIS OF PREPARATION AND GOING CONCERN

The annual financial statements of Kenmare Resources plc are prepared in

accordance with IFRSs as adopted by the European Union. The Group

Condensed Consolidated Financial Statements for the six months ended 30

June 2013 have been prepared in accordance with the Transparency

(Directive 2004/109/EC) Regulations 2007, the Transparency Rules of the

Central Bank of Ireland and with IAS 34 'Interim Financial Reporting',

as adopted by the European Union.

The accounting policies and methods of computation adopted in the

preparation of the Group Condensed Consolidated Financial Statements are

the same as those applied in the Annual Report for the financial year

ended 31 December 2012 and are described in the Annual Report.

In the current financial year, the Group has adopted all Standards and

Interpretations which are effective from 1 January 2013. Adoption has

resulted in no material impact on the financial statements.

The financial information presented in this document does not constitute

statutory financial statements. The amounts presented in the Half Yearly

Financial Statements for the six months ended 30 June 2013 and the

corresponding amounts for the six months ended 30 June 2012 have been

reviewed but not audited. The independent auditors' review report is on

pages 11 and 12. The financial information for the year ended 31

December 2012, presented herein, is an abbreviated version of the annual

financial statements for the Group in respect of the year ended 31

December 2012. The Group's financial statements have been filed in the

Companies Registration Office and the independent auditors issued an

unqualified audit report, with an emphasis of matter in the opinion, in

respect of those annual financial statements.

There were no other gains or losses during the six months period ended

30 June 2013 other than those reported in the Condensed Consolidated

Statement of Comprehensive Income.

Based on the Group's forecast, the Directors are satisfied that the

Group has sufficient resources to continue in operation for the

foreseeable future, a period of not less than twelve months from the

date of this report. Accordingly, they continue to adopt the going

concern basis in preparing the condensed consolidated financial

statements.

Key assumptions upon which the forecast is based include a mine plan

covering production using the Namalope and Nataka proved and probable

reserves, forecast sales and the renewal or refinancing of the Absa

corporate loan. The forecast also reflects a revised debt repayment

profile for the Moma Project Loans.

Annual production levels at full capacity pre-expansion are

approximately 800,000 tonnes of ilmenite per annum plus co-products,

rutile and zircon and post-expansion are approximately 1.2 million

tonnes of ilmenite per annum plus co-products, rutile and zircon.

Product sales prices are based on contract prices as stipulated in

marketing agreements with customers, or where contracts are based on

market prices or production is not presently contracted, prices as

forecast. The forecast is developed using Kenmare's industry knowledge

and assumes that the product markets recover from the subdued levels

experienced during the first half of 2013 and that Kenmare will sell

increasing volumes of all products as the expansion production volumes

ramp-up. Operating and capital replacement costs are based on approved

budget costs for 2013 and escalated by 2% per annum thereafter and

reflecting post-expansion costs from 2013 onwards.

On 28 February 2013, Kenmare and Absa Bank Limited ("Absa") entered into

an agreement establishing a corporate facility of US$40 million. This

facility was fully drawn during the period, and matures on 20 March

2014. It is capable of being renewed on the written agreement of Absa

and Kenmare and the forecast assumes it will be renewed or refinanced on

or before 20 March 2014. Absa, a member of Barclays plc, is an existing

lender to the Project Companies.

On 31 July 2013, the Group entered into an amendment to the Moma Project

Loan agreements with the project lenders. This amendment was agreed as

part of on-going management of the Group's financial resources, taking

into consideration the current product market conditions and funding of

remaining expansion costs. The amendment includes: the effective

postponement of the date on which deferred subordinated debt is required

to be brought current from 1 August 2014 to 1 August 2015; the deferment

of the 1 August 2013 principal instalment of senior debt of US$13

million to 1 August 2014; and an extension in time and quantum of the

ability of the Project to fund expansion-related capital expenditures

from Project operating cash flows.

2. SEGMENTAL INFORMATION

Information on the operations of the Moma Titanium Minerals Mine in

Mozambique is reported to the Group's Board for the purposes of resource

allocation and assessment of segment performance. Information regarding

the Group's operating segment is reported below.

Unaudited Unaudited Audited

30 June 13 30 June 12 31 Dec 12

US$'000 US$'000 US$'000

Segment revenues and results

Moma Titanium Minerals Mine

Revenue 79,273 109,127 234,638

Cost of sales (62,245) (53,946) (134,472)

Gross profit 17,028 55,181 100,166

Other operating costs (7,502) (5,855) (14,032)

Segment operating profit 9,526 49,326 86,134

Central operating costs (2,650) (2,326) (5,698)

Group operating profit 6,876 47,000 80,436

Finance income 210 1,330 1,706

Finance expense (17,689) (15,200) (28,714)

Foreign exchange gain/(loss) 1,370 5,663 (641)

(Loss)/profit before tax (9,233) 38,793 52,787

Income tax charge (993) - (3,301)

(Loss)/profit for the period/year (10,226) 38,793 49,486

Segment assets

Moma Titanium Minerals Mine assets 1,024,224 867,750 957,805

Corporate assets 25,306 20,413 36,119

Total assets 1,049,530 888,163 993,924

3. SEASONALITY OF SALE OF MINERAL PRODUCTS

Sales of mineral products are not seasonal in nature.

4. (LOSS)/EARNINGS PER SHARE

The calculation of the basic and diluted (loss)/earnings per share

attributable to the ordinary equity holders of the parent company is

based on the following data:

Unaudited Unaudited Audited

30 June 13 30 June 12 31 Dec 12

US$'000 US$'000 US$'000

(Loss)/profit for the period/year attributable to

equity

holders of the parent (10,226) 38,793 49,486

Unaudited Unaudited Audited

30 June 13 30 June 12 31 Dec 12

Number of Number of Number of

Shares Shares Shares

Weighted average number of issued ordinary shares

for the

purposes of basic (loss)/earnings per share 2,531,367,056 2,410,081,709 2,462,602,902

Effect of dilutive potential ordinary shares

Share options - 16,773,446 9,977,123

Weighted average number of ordinary shares for the

purpose

of diluted (loss)/earnings per share 2,531,367,056 2,426,855,155 2,472,580,025

Cent per Cent per Cent per

share share share

(Loss)/earnings per share: basic (0.40c) 1.61c 2.01c

(Loss)/earnings per share: diluted (0.40c) 1.60c 2.00c

For the six months ended 30 June 2013, the basic loss per share and the

diluted loss per share are the same, as the effect of the outstanding

share options is anti-dilutive.

5. PROPERTY, PLANT AND EQUIPMENT

Plant Other Construction Development Total

& Equipment Assets In Progress Expenditure

US$'000 US$'000 US$'000 US$'000 US$'000

Cost

Balance at 1

January 2012 343,451 16,500 181,439 248,761 790,151

Transfer from

construction in

progress 1,134 2,047 (3,181) - -

Additions during

the period - - 68,551 989 69,540

Balance at 30 June

2012 344,585 18,547 246,809 249,750 859,691

Transfer from

construction in

progress 11,552 11,416 (22,968) - -

Additions during

the period 170 - 121,907 234 122,311

Balance at 31

December 2012 356,307 29,963 345,748 249,984 982,002

Transfer to

consumable spare

inventory - - (3,471) - (3,471)

Transfer from

construction in

progress 15,573 2,118 (17,691) - -

Additions during

the period 14,833 - 76,039 - 90,872

Balance at 30 June

2013 386,713 32,081 400,625 249,984 1,069,403

Accumulated

Depreciation

Balance at 1

January 2012 45,659 10,919 - 19,455 76,033

Charge for the

period 4,940 807 - 2,729 8,476

Balance at 30 June

2012 50,599 11,726 - 22,184 84,509

Charge for the

period 5,528 1,271 - 3,181 9,980

Balance at 31

December 2012 56,127 12,997 - 25,365 94,489

Charge for the

period 6,399 2,081 - 3,515 11,995

Balance at 30 June

2013 62,526 15,078 - 28,880 106,484

Carrying Amount

Balance at 30 June

2013 324,187 17,003 400,625 221,104 962,919

Balance at 30 June

2012 293,986 6,821 246,809 227,566 775,182

Balance at 31

December 2012 300,180 16,966 345,748 224,619 887,513

During the period the Group carried out an impairment review of property,

plant and equipment. The cash generating unit for the purpose of

impairment testing is the Moma Titanium Minerals Mine as this is the

operating segment of the Group. The basis on which the recoverable

amount of the Moma Titanium Minerals Mine is assessed is its

value-in-use. The cash flow forecast employed for the value-in-use

computation is a life-of-mine financial model. The recoverable amount

obtained from the financial model represents the present value of the

future pre-tax and pre-finance cash flows discounted at 10%.

Key assumptions include the following:

-- A mine plan based on the Namalope and Nataka proved and probable

reserves.

-- The cash flows assume ramp-up to expanded production levels during 2013.

Expected annual production levels at full capacity pre-expansion are

approximately 800,000 tonnes of ilmenite per annum plus co-products,

zircon and rutile. Expected annual production levels at full capacity

post-expansion are approximately 1.2 million tonnes of ilmenite per annum

plus co-products, zircon and rutile.

-- Product sales prices are based on contract prices as stipulated in

marketing agreements with customers, or where contracts are based on

market prices or production is not presently contracted, prices as

forecast.

-- Operating and capital replacement costs are based on approved budget

costs for 2013 and escalated by 2% per annum thereafter and reflecting

post-expansion costs from 2013 onwards.

As a result of this review no impairment provision is required. The

discount rate is the significant factor in determining the recoverable

amount and a 1% change in the discount rate results in an 8% change in

the recoverable amount.

Substantially all the property, plant and equipment is or will be

mortgaged, pledged or otherwise encumbered to secure project loans as

detailed in Note 7.

The carrying amount of the Group's plant and equipment includes an

amount of US$1.2 million (2012: US$1.2 million) in respect of assets

held under finance leases.

Included in construction and progress is US$17.4 million (2012: US$29.3

million) relating to capital projects for existing operations and

US$383.2 million (2012: US$316.4 million) relating to expansion capital.

The amount included in payables relating to expansion costs at 30 June

2013 is US$40.6 million (2012: US$27.9 million). Of this US$40.6 million,

US$18.5 million is disputed by Kenmare.

Expansion development costs incurred during the period before the

expansion assets are capable of operating at production levels in a

manner intended by management are deferred and included in property,

plant and equipment.

The recovery of property, plant and equipment is dependent upon the

successful development of economic ore reserves and the successful

operation of the mine including the mine expansion project and continued

availability of adequate funding for the mine. The Directors are

satisfied that at the balance sheet date the recoverable amount of

property, plant and equipment is not less than its carrying amount and

based on the planned mine production levels that the Moma Titanium

Minerals Mine will continue to achieve positive cash flows from

operations.

6. SHARE CAPITAL

Share capital as at 30 June 2013 amounted to US$205.2 million (2012:

US$205.1 million). During the period, 0.5 million ordinary shares in the

Company were issued as a result of the exercise of share options.

US$0.04 million of these issues have been credited to share capital and

US$0.08 million to share premium.

7. BANK LOANS

Unaudited Unaudited Audited

30 June 13 30 June 12 31 Dec 12

US$'000 US$'000 US$'000

Moma Project Loans

Senior Loans 93,357 119,490 106,891

Subordinated Loans 226,028 199,862 217,521

Total Moma Project Loans 319,385 319,352 324,412

Corporate Loan 39,134 - -

Total Bank Loans 358,519 319,352 324,412

Within one year 212,982 127,059 147,032

In the second year 37,606 39,425 39,993

In the third to fifth years 70,871 93,945 86,725

After five years 37,060 58,923 50,662

358,519 319,352 324,412

Less amounts due for settlement within 12

months (212,982) (127,059) (147,032)

Amount due for settlement after 12 months 145,537 192,293 177,380

Bank loans at the period end amounted to US$358.5 million (2012:

US$324.4 million). During the period loan interest and principal

repayments of US$16.2 million (2012: US$32.9 million) were made,

interest of US$14.1 million (2012: US$26.4 million) accrued and

Euro-denominated loans decreased by US$2.6 million (2012: increase of

US$3.8 million) as a result of the US Dollar strengthening against the

Euro during the period. During the period the corporate loan facility of

US$40 million was drawn down in full. Fees incurred in relation to the

corporate loan amounted to US$1.2 million.

Moma Project Loans

Moma Project Loans have been made to the Mozambique branches of Kenmare

Moma Mining (Mauritius) Limited and Kenmare Moma Processing (Mauritius)

Limited (the Project Companies). The Moma Project Loans are secured by

substantially all rights and assets of the Project Companies, and,

amongst other things, the shares in and intercompany loans to the

Project Companies.

Seven Senior Loan credit facilities were made available for financing

the Moma Titanium Minerals Mine. The aggregate maximum available amount

of the Senior Loan credit facilities was US$185 million plus EUR15

million which were fully drawn in 2008. As at 30 June 2013 the remaining

tenors of the Senior Loans range from 2 years to 5 years. Three of the

Senior Loans bear interest at fixed rates and four bear interest at

variable rates.

The Subordinated Loans comprise the original Subordinated Loans, the

Standby Subordinated Loans and the Additional Standby Subordinated

Loans.

The original Subordinated Loan credit facilities (made available under

documentation entered into in June 2004) with original principal amounts

of EUR47.1 million plus US$10 million (excluding capitalised interest)

were fully drawn in 2005. The original Subordinated Loans denominated in

Euro bear interest at a fixed rate of 10% per annum, while the original

Subordinated Loans denominated in US Dollars bear interest at six month

LIBOR plus 8% per annum.

The Standby Subordinated Loan credit facilities (made available under

documentation entered into in June 2005) with original principal amounts

of EUR2.8 million and US$4 million were fully drawn in 2007. Standby

Subordinated Loans bear interest at fixed rates of 10% per annum in

respect of EUR2.8 million and US$1.5 million and at six month LIBOR plus

8% per annum in respect of US$2.5 million.

The Additional Standby Subordinated Loan credit facilities of US$12

million and US$10 million (made available under documentation entered

into in August 2007) were fully drawn in 2008. The Additional Standby

Subordinated Loans bear interest at 6 month LIBOR plus 5%.

Interest and principal on the Subordinated Loans is due to be paid each

year in February and August but if cash is insufficient in the Project

Companies on any scheduled payment date, interest is capitalised and

both interest and principal become payable on the next semi-annual

payment date thereafter, in whole or in part, to the extent of available

cash. Included in loan amounts due within one year is US$145.6 million

(2012: US$118.6 million) in relation to such Subordinated Loans. The

final instalments are due on 1 August 2019.

Standby Subordinated lenders have an option to require that Kenmare

purchase the Standby Subordinated Loans on agreed terms.

Under a Deed of Waiver and Amendment entered into in 2009, interest

margins on Subordinated Loans were increased by 3% per annum until

Technical Completion and by 1% per annum until Completion. This

additional margin is scheduled to be paid after senior loans have been

repaid in full but may be prepaid without penalty.

Moma Project Loan Completion

The Company and Congolone Heavy Minerals Limited have guaranteed the

Moma Project Loans during the period prior to Completion (achievement of

both "Technical Completion" and "Non-Technical Completion"). Upon

Completion, the Company's and Congolone Heavy Mineral Limited's

guarantee of the Moma Project Loans will terminate. Failure to achieve

Completion by the Final Completion Date (subject to extension for force

majeure) would constitute an Event of Default under the Moma Project

Financing.

On 5 September 2011, Technical Completion was achieved. Non-Technical

Completion occurs upon the meeting certain financial, legal and

permitting requirements, including filling of specified reserve accounts

to the required levels as well as certification in respect of the

Project Companies having sufficient funds available to repay deferred

Subordinated Loan amounts on the next scheduled payment date.

Amendments to Moma Project Loans

On 31 July 2013, the Company, Kenmare Moma Mining (Mauritius) Limited

(Mozambique Branch) and Kenmare Moma Processing (Mauritius) Limited

(Mozambique Branch) entered into an Amendment Agreement with Project

Lenders. Among other things, the Amendment Agreement provided as

follows:

-- A deferral by Senior Lenders of senior principal (US$13 million) due on 1

August 2013 until 1 August 2014; and an agreement that no Subordinated

Loans would be paid prior to such date;

-- An extension of the final date for achieving Completion to 28 February

2015 (subject to further extension for any subsequent force majeure

events). As a result, the effective date on which deferred Subordinated

Loan obligations need to be repaid is extended from the 1 August 2014

payment date to the 1 August 2015 payment date;

-- An extension of the ability to apply Project operating cashflows to fund

remaining expansion costs with the effect that up to US$58 million of

available cash flows accruing after 30 June 2013 can be reserved in

specified bank accounts until the earlier of the date on which the

outstanding completion certificates are delivered and 31 December 2014;

and such reserved cash together with the US$5.4 million balance in such

accounts as at 30 June 2013 can be applied to expansion capital costs

until the later of 31 December 2014 and the date on which the outstanding

completion certificates are delivered; this is subject to certain limits

on the amounts that may be so applied on or after 1 July 2013, including,

other than in respect of certain specified costs, the amount that may be

applied in respect of expansion costs shall not exceed US$40.4 million

(including US$5.4 million already reserved as at 30 June 2013); and

-- In consideration of such amendments, payment to Lenders of a

risk/deferral fee in quarterly instalments, in the case of Senior Lenders,

to a total of 1.25%, and in the case of Subordinated Lenders, to a total

of 2.25%, in each case of the principal amount outstanding as at 31 July

2013; as well as work fees totalling US$180,000, legal fees and

out-of-pocket costs incurred by the Project Lenders in negotiating the

amendment, and fees payable in connection with certain political risk and

other guarantees and insurance policies applicable to the Senior Loans.

Other Group bank borrowings

On 28 February 2013, Kenmare and Absa entered into agreement

establishing a corporate facility of US$40 million maturing on 20 March

2014. This facility was fully drawn in the period. It is capable of

being renewed on the written agreement of both Absa and Kenmare and it

will need to be renewed or refinanced on or before 20 March 2014. The

corporate loan facility bears interest at 1 month LIBOR plus 8%. Absa, a

member of Barclays plc, is an existing lender to the Project Companies.

Group borrowings interest and currency risk

Loan facilities arranged at fixed interest rates expose the Group to

fair value interest rate risk. Loan facilities arranged at variable

rates expose the Group to cash flow interest rate risk. Variable rates

are based on six or one month LIBOR. The average effective borrowing

rate at the period end was 8.7%. The interest rate profile of the

Group's loan balances at the period end was as follows:

Unaudited Unaudited Audited

30 June 13 30 June 12 31 Dec 12

US$'000 US$'000 US$'000

Fixed rate debt 211,591 207,392 214,513

Variable rate debt 146,928 111,960 109,899

Total debt 358,519 319,352 324,412

Under the assumption that all other variables remain constant and using

the 6 month LIBOR, a 1% change in LIBOR would result in a US$1.1 million

(2012: US$1.1 million) change in finance costs for the year.

The currency profile of the bank loans is as follows:

Unaudited Unaudited Audited

30 June 13 30 June 12 31 Dec 12

US$'000 US$'000 US$'000

Euro 170,388 151,038 165,709

US Dollars 188,131 168,314 158,703

Total debt 358,519 319,352 324,412

The Euro-denominated loans expose the Group to currency fluctuations.

These currency fluctuations are realised on payment of Euro-denominated

debt principal and interest. Under the assumption that all other

variables remain constant, a 10% strengthening or weakening of Euro

against the US Dollar, would result in a US$1.8 million (2012: US$1.7

million) change in finance costs and a US$17 million (2012: US$16.6

million) change in foreign exchange gain or loss for the year.

The above sensitivity analyses are estimates of the impact of market

risks assuming the specified change occurs. Actual results in the future

may differ materially from these results due to developments in the

global financial markets which may cause fluctuations in interest and

exchange rates to vary from the assumptions made above and therefore

should not be considered a projection of likely future events.

8. PROVISIONS

Unaudited Unaudited Audited

30 June 13 30 June 12 31 Dec 12

US$'000 US$'000 US$'000

Mine closure provision 18,478 4,704 4,907

Mine rehabilitation provision 2,140 1,800 1,973

Legal provision 1,440 1,440 1,444

Executive Directors' bonus

provision 1,058 - 1,002

Total provision 23,116 7,944 9,326

The mine closure provision represents the Directors' best estimate of

the Group's liability for close-down, dismantling and restoration of the

mining and processing site. A corresponding amount equal to the

provision is recognised as part of property, plant and equipment. The

costs are estimated on the basis of a formal closure plan and are

subject to regular review. The costs are estimated based on the net

present value of estimated future cost. Mine closure costs are a normal

consequence of mining, and the majority of close-down and restoration

expenditure is incurred at the end of the life of the mine. The

unwinding of the discount is recognised as a finance cost and US$0.2

million (2012: US$0.2 million) has been recognised in the statement of

comprehensive income.

The main assumptions used in the calculation of the estimated future

costs include:

-- a discount rate of 3% (2012: 9%) based on a 20 year US Treasury yield

rate. This is a change in the assumption from 9% used in the prior year

being the average effective borrowing rate for the Moma Titanium Minerals

Mine. The reason for the change in assumption is to exclude the risk of

the Company and only include risk specific to the liability. The change

in the assumption increases the provision as at 30 June 2013 by US$13.3

million and the mine closure asset was increased by the same amount;

-- an inflation rate of 2% (2012: 2%);

-- an estimated life of mine; and

-- an estimated closure cost of US$20.4 million (2012: US$20.4 million) and

an estimated post-closure monitoring provision of US$1.9 million (US$1.9

million).

The mine rehabilitation provision was increased by US$0.2 million as a

result of additional provision of US$0.4 million for areas disturbed net

of US$0.2 million released for areas rehabilitated during the period.

US$0.3 million (2012: US$0.3 million) of the mine rehabilitation

provision has been included in current liabilities to reflect the

estimated cost of rehabilitation work to be carried out over the next

year.

9. SHARE-BASED PAYMENTS

The Company has a share option scheme for certain Directors, employees

and consultants. Options are exercisable at a price equal to the quoted

market price of the Company's shares on the date of grant. The options

generally vest over a three to five year period, in equal annual

amounts. If options remain unexercised after a period of seven years

from the date of grant, the options expire. The option expiry period may

be extended at the discretion of the Board of Directors.

During the period the Group recognised a share-based payment expense of

US$1.5 million (2012: US$1.5 million). US$0.05 million (2012: US$0.4

million) of the share based payment was capitalised in property, plant

and equipment during the period.

10. RELATED PARTY TRANSACTIONS

Transactions between the Company and its subsidiaries, which are related

parties, have been eliminated on consolidation and are not disclosed in

this note.

Apart from existing remuneration arrangements there were no material

transactions or balances between Kenmare and its key management

personnel or members of their close families.

11. FAIR VALUE

The fair value of the Group borrowings of US$332.8 million (2012: US$291

million) has been calculated by discounting the expected future cash

flows at prevailing interest rates and by applying period end exchange

rates.

The fair value of trade and other receivables, trade and other payables

and the finance lease are equal to their carrying amounts.

12. EVENTS AFTER THE BALANCE SHEET DATE

On 31 July 2013, Kenmare, Congolone Heavy Minerals Limited, Kenmare Moma

Mining (Mauritius) Limited (Mozambique Branch) and Kenmare Moma

Processing (Mauritius) Limited (Mozambique Branch) entered into an

amendment with Project Lenders details of which are set out in Note 7.

In August, the Company and the union (SINTICIM) which represents the

Mine's unionised workforce reached a long term agreement on remuneration

for the next three years.

13. INFORMATION

The Half Yearly Financial report was approved by the Board on 27 August

2013.

Copies are available from the Company's registered office at Chatham

House, Chatham Street, Dublin 2, Ireland. The statement is also

available on the Company's website at www.kenmareresources.com.

This announcement is distributed by Thomson Reuters on behalf of Thomson

Reuters clients.

The owner of this announcement warrants that:

(i) the releases contained herein are protected by copyright and other

applicable laws; and

(ii) they are solely responsible for the content, accuracy and

originality of the

information contained therein.

Source: Kenmare Resources via Thomson Reuters ONE

HUG#1725154

http://www.kenmareresources.com/

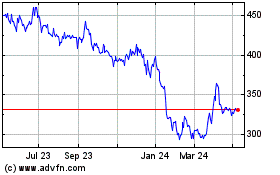

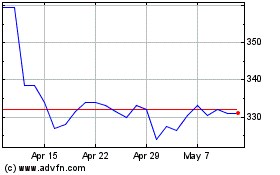

Kenmare Resources (LSE:KMR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Kenmare Resources (LSE:KMR)

Historical Stock Chart

From Jul 2023 to Jul 2024