TIDMKMR

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN

OR INTO, THE UNITED STATES OF AMERICA, CANADA, JAPAN, AUSTRALIA, SOUTH

AFRICA, HONG KONG OR SWITZERLAND OR ANY JURISDICTION WHERE TO DO SO

MIGHT CONSTITUTE A VIOLATION OF APPLICABLE LAW OR REGULATION.

This announcement is not an offer of securities for sale, or an offer to

buy or subscribe for, directly or indirectly, securities to any person

in the United States, Canada, Japan, Australia, South Africa, Hong Kong

or Switzerland or any other jurisdiction in which such offer or

solicitation is unlawful. This announcement is an advertisement and not

a prospectus (or prospectus equivalent document). Any offer to acquire

shares pursuant to the Capital Restructuring will be made, and investors

should only subscribe for or purchase any shares referred to in this

announcement and should make any investment decision, solely on the

basis of information contained in the prospectus (the "Prospectus") to

be published by Kenmare Resources plc ("Kenmare" or the "Company and,

together with its subsidiaries, the "Group") in connection with the

admission of the new ordinary shares in the Company ("New Ordinary

Shares") to be issued under the Capital Restructuring to listing on the

secondary listing segment of the Official List of the Irish Stock

Exchange and the premium listing segment of the Official List of the

Financial Conduct Authority ("FCA") and to trading on the respective

main market for listed securities of the Irish Stock Exchange and the

London Stock Exchange (the "Admission") and in connection with the

making of the Open Offer to the public in Ireland and the United

Kingdom.

30 June, 2016

Kenmare Resources plc

US$275 million of equity commitments secured, enabling the Capital

Restructuring and Open Offer to proceed

Highlights

-- New equity commitments of US$275 million have been secured, enabling the

Capital Restructuring and Open Offer to proceed. This comprises US$100

million in the Cornerstone Placing, US$145.7 million cash commitments

under the Firm Placing, and US$29.3 million under the Lender

Underwriting. The Issue Price is US$3.132 per New Ordinary Share,

equivalent to US1.566c before the impact of the proposed 1 for 200

Consolidation and Stg 1.16p based on the US$:Stg exchange rate as of the

Latest Practicable Date.

-- An Open Offer of up to US$122.7 million (approximately StgGBP90.8

million) will proceed at the same price as all other funds raised

(equivalent to Stg 1.16p before the Consolidation), full subscription

under which would reduce gross debt to nil. The Open Offer will have a

ratio of 1 New Ordinary Share for every 71 Existing Ordinary Shares held

on the Record Date. Subscription under the Open Offer will be in Sterling

(StgGBP2.317 per New Ordinary Share) or Euro (EUR2.818 per New Ordinary

Share), being the Issue Price converted at the exchange rates as of the

Latest Practicable Date.

-- Based on the agreed terms of the Debt Restructuring announced on 20 June,

2016, completion of the Capital Raise will reduce debt by not less than

US$292.5 million to no more than US$100 million and provide the Company

with US$75 million for working capital and to cover expenses. All funds

raised in the Open Offer in excess of US$29.3 million will discharge US$4

of debt for every US$3 raised. The Lender Underwriting will be eliminated

if at least US$29.3 million is raised in the Open Offer.

-- A Prospectus and Notice of Extraordinary General Meeting and Annual

General Meeting are expected to be issued on 1 July, 2016 with the

Extraordinary General Meeting and Annual General Meeting to be held on 25

July, 2016. Closing date for subscriptions under the Open Offer will be

22 July, 2016.

Commenting on the outcome of the Firm Placing, Michael Carvill, Managing

Director of Kenmare stated:

"The Capital Raise and Capital Restructuring provides Kenmare with an

excellent platform to deliver strong returns to its shareholders. The

strengthening of the balance sheet, allied to falling cash costs and

vastly increased power stability, allows Kenmare to benefit from the

strong improvement in the titanium feedstock market we are currently

experiencing."

Details of the Firm Placing and Open Offer

Kenmare Resources plc (LSE:KMR, ISE:KMR), one of the leading global

producers of titanium minerals and zircon, which operates the Moma

Titanium Minerals Mine in northern Mozambique, is pleased to announce

that commitments have been secured in respect of 46,519,505 New Ordinary

Shares to be issued under the Firm Placing and up to 9,355,335 New

Ordinary Shares to be issued under the Lender Underwriting at the Issue

Price of US$3.132 per New Ordinary Share (being equivalent to US1.566c

before the impact of the proposed 1 for 200 Consolidation). Total

commitments under the Firm Placing, Lender Underwriting and the

previously announced Cornerstone Placing with the State General Reserve

Fund of the Sultanate of Oman (SGRF), are therefore in respect of US$275

million. Pursuant to the Debt Equitisation, Lenders may be issued with

an aggregate maximum of 7,609,371 New Ordinary Shares representing 6.9%

of the then Enlarged Issued Share Capital.

Completion of the Capital Raise will achieve the minimum US$275 million

necessary to effect the Capital Restructuring on the terms previously

announced. This achieves a reduction of the existing debt to US$100

million and provides the Company with US$75 million for working capital

and to cover expenses. All funds raised in the Open Offer in excess of

US$29.3 million will discharge US$4 of debt for every US$3 raised.

Completion of the Capital Raise is conditional, inter alia, on

shareholder approval, as more fully described below.

New Ordinary Shares to be issued pursuant to the Cornerstone Placing and

the Firm Placing will, when issued and fully paid, rank pari passu in

all respects with the Ordinary Shares, including the right to receive

all dividends and other distributions (if any) declared, made or paid by

Kenmare after the date of issue of the New Ordinary Shares.

The Company also announces that the proposed Open Offer will be in

respect of up to 39,181,767 New Ordinary Shares at an Issue Price of

StgGBP2.317 or EUR2.818 (subject to the terms of the Open Offer) (being

the Issue Price converted to sterling and euro at the exchanges rates on

29 June, 2016 ("the Latest Practicable Date")). Total maximum proceeds

under the Open Offer (if the Open Offer is subscribed in full) would be

approximately US$122.7 million (approximately StgGBP90.8 million). Open

Offer Shares will be available to Qualifying Shareholders on the

following basis:

1 Open Offer Share (reflecting the Capital Reorganisation) for every 71

Existing Ordinary Shares

registered in their name at the Record Date and so in proportion for any

other number of Existing Ordinary Shares then held. Fractions of New

Ordinary Shares will not be allotted and each Qualifying Shareholder's

entitlement under the Open Offer will be rounded down to the nearest

whole number of New Ordinary Shares.

Qualifying Shareholders (including those with a nil Basic Entitlement)

may however apply for any whole number of New Ordinary Shares under the

Open Offer. The Excess Application Facility will enable Qualifying

Shareholders to apply for any whole number of New Ordinary Shares in

excess of, equal to or less than their Basic Entitlement which, in the

case of Qualifying Non-CREST Shareholders, is equal to the number of

Open Offer Entitlements as shown on their Application Form or, in the

case of Qualifying CREST Shareholders, is equal to the number of Open

Offer Entitlements standing to the credit of their stock account in

CREST. Qualifying Shareholders with holdings of Existing Ordinary Shares

in both certificated and uncertificated form will be treated as having

separate holdings for the purpose of calculating their Basic

Entitlements under the Open Offer.

Excess applications will be satisfied only to the extent that

corresponding applications by other Qualifying Shareholders are not made

or are made for less than their Basic Entitlements. If there is an

over-subscription resulting from excess applications, allocations in

respect of such excess applications will be made pro rata to the number

of excess New Ordinary Shares applied for.

Application has been made for the Open Offer Entitlements to be admitted

to CREST. It is expected that the Open Offer Entitlements will be

admitted to CREST at 8.00 a.m. on 4 July, 2016. The Open Offer

Entitlements will also be enabled for settlement in CREST at 8.00 a.m.

on 4 July, 2016.

Shareholders should note that the Open Offer is not a rights issue.

Qualifying CREST Shareholders should note that, although the Open Offer

Entitlements will be admitted to CREST and be enabled for settlement,

applications in respect of entitlements under the Open Offer may only be

made by the Qualifying Shareholder originally entitled or by a person

entitled by virtue of a bona fide market claim raised by Euroclear's

Claims Processing Unit. Qualifying non-CREST Shareholders should note

that the Application Form is not a negotiable document and cannot be

traded. Qualifying Shareholders should be aware that in the Open Offer,

unlike in a rights issue, any Open Offer Shares not applied for will not

be sold in the market or placed for the benefit of Qualifying

Shareholders who do not apply under the Open Offer.

The New Ordinary Shares to be issued pursuant to the Open Offer will,

when issued and fully paid, rank pari passu in all respects with the

Ordinary Shares, including the right to receive all dividends and other

distributions (if any) declared, made or paid by Kenmare after the date

of issue of the New Ordinary Shares to be issued pursuant to the Open

Offer.

The Open Offer is not underwritten and there are no commitments in place

in respect of participation in the Open Offer, save in the case of M&G

which has committed to subscribe for such number of Open Offer Shares as

would, when added to its holding of its Existing Ordinary Shares and the

Firm Placed Shares for which it is subscribing mean that its holding on

completion of the Capital Restructuring would represent 19.97% of the

then Enlarged Issued Share Capital.

Use of Proceeds

The following table summarises the sources and uses of proceeds of the

Capital Raise on the basis of the US$275 million commitments under the

Cornerstone Placing, Firm Placing and Lender Underwriting:

Sources Uses

Capital Raise Maximum of US$367.9 million Applied to repay and discharge debt US$200 million (1)

(US$275 million under the Cornerstone Placing, Firm Minimum of US$275 million

Placing and Lender Underwriting and up to US$122.7

million under the Open Offer)

Working capital and expenses of the issue (2) US$75 million (2)

Maximum additional amount applied to repay and discharge US$93.4 million(3)

debt US$0 million

Minimum additional amount applied to repay and discharge

debt

Gross Total Raised Maximum of US$367.9 million Total maximum amount applied to repay and discharge US$293.4 million

Minimum of US$275 million debt US$200 million

Total minimum amount applied to repay and discharge US$75 million

debt

Total gross proceeds retained by the Company

1. US$200 million (by cash subscription and, to the extent necessary, the

Lender Underwriting of up to US$29.3 million) will repay and discharge

US$269 million in debt (including Accrued Interest) under the terms of

the Amendment, Repayment and Equitisation Agreement.

2. Expenses of the issue are estimated at US$13.4 million.

3. US$122.72 million (cash proceeds additional to the US$245.7 million of

cash proceeds of the Cornerstone Placing and Firm Placing) will replace

US$29.3 million of Lender Underwriting and the balance of US$93.4 million

will repay and discharge any residual debt under the terms of the

Amendment, Repayment and Equitisation Agreement.

Conditions of the Capital Raise

The Cornerstone Placing, the Firm Placing, the Lender Underwriting and

the Open Offer are conditional, inter alia, upon:

1. the passing of all of the Capital Restructuring Resolutions;

2. Admission of the New Ordinary Shares to be issued under the Cornerstone

Placing, the Firm Placing and the Open Offer becoming effective by not

later than 8.00 a.m. on 15 August, 2016 (or such later time and/or date

as the Company, the Cornerstone Investor, the Lenders and the Sponsor may

agree);

3. the Cornerstone Subscription Agreement having become unconditional in all

respects and not having been terminated in accordance with its terms;

4. the placing commitment provided by M&G (see below) in respect of their

participation in the Firm Placing, being in respect of 18,712,664 New

Ordinary Shares ("Placing Commitment") having become unconditional in

all respects and not having been terminated in accordance with its terms.

5. the Placing and Open Offer Agreement having become unconditional in all

respects and not having been terminated in accordance with its terms; and

6. those conditions to the Admission Effective Date under the Amendment,

Repayment and Equitisation Agreement that fall to be satisfied or waived

prior to Admission of the New Ordinary Shares to be issued under the

Cornerstone Placing, Firm Placing and Open Offer having been satisfied or

waived and the Amendment, Repayment and Equitisation Agreement not having

been terminated in accordance with its terms.

M&G is a related party of the Company for the purposes of the Listing

Rules of the FCA because it is a substantial shareholder in the Company.

M&G, as at the Latest Practicable Date, is interested in 555,468,527

Existing Ordinary Shares, representing approximately 19.97% of the

Existing Issued Ordinary Share Capital of the Company. Accordingly, the

participation by M&G in the Firm Placing requires the approval of

Independent Shareholders by way of a simple majority in general meeting.

Such approval will be sought at the Extraordinary General Meeting. M&G

has also committed to subscribe for such number of Open Offer Shares as

would, when added to its holding of its Existing Ordinary Shares and its

Placing Commitment, mean that its holding on completion of the Capital

Restructuring would represent 19.97% of the then Enlarged Issued Share

Capital of the Company.

Prospectus and Notice of Extraordinary General Meeting

The Prospectus is expected to be published on or around 1 July, 2016

containing full details of how Shareholders can participate in the Open

Offer and also containing Notice of an Extraordinary General Meeting

expected to be held at 10.15 a.m. (or, if later, immediately following

the conclusion of the Annual General Meeting convened to be held at

10.00 a.m. on the same day and at the same location) on 25 July 2016.

Completion of the Capital Raise is conditional, inter alia, upon the

passing of the Capital Restructuring Resolutions set out in the Notice

of the Extraordinary General Meeting.

Copies of the Prospectus will be available from the registered office of

Kenmare Resources plc at Chatham House, Chatham Street, Dublin 2, D02

VP46, Ireland during normal business hours on any weekday (except

Saturdays, Sundays and public holidays) from the date of its publication

until Admission. The Prospectus will also be available on the Company's

website, www.kenmareresources.com.

Expected Timetable of Events

The following are the expected date in relation to events under the

Capital Restructuring.

Event Time and/or Date

Record Date for entitlements under the Open Offer 5.00 p.m. on 29 June,

2016

Ex-entitlement date for the Open Offer 1 July, 2016

Publication of the Prospectus, Application Forms and 1 July, 2016

Forms of Proxy

Open Offer Entitlements credited to stock accounts 8.00 a.m. on 4 July, 2016

in CREST of Qualifying

CREST Shareholders

Latest recommended time and date for requesting withdrawal 4.30 p.m. on 18 July,

of Open Offer Entitlements from CREST 2016

Latest recommended time and date for depositing Open 3.00 p.m. on 19 July,

Offer Entitlements into CREST 2016

Latest time and date for splitting Application Forms 3.00 p.m. on 20 July,

(to satisfy bona fide market claims) 2016

Latest time and date for receipt of completed Application 11.00 a.m. on 22 July,

Forms and payment in full under the Open Offer or 2016

settlement of relevant CREST instruction (as appropriate)

Latest time and date for receipt of Forms of Proxy 10.00 a.m. on 23 July

in respect of the Annual General Meeting 2016

Latest time and date for receipt of Forms of Proxy 10.15 a.m.* on 23 July

in respect of the 2016

Extraordinary General Meeting

Results of the Open Offer announced through an RIS 7.00 a.m. on 25 July 2016

Annual General Meeting 10.00 a.m. on 25 July

2016

Extraordinary General Meeting 10.15 a.m.* on 25 July

2016

Capital Reorganisation Record Date 6.00 p.m. on 25 July 2016

Capital Reorganisation Effective Date 8.00 a.m. on 26 July 2016

Issue of the New Ordinary Shares pursuant to the Cornerstone 8.00 a.m. on 26 July 2016

Placing and Firm Placing and Open Offer and Admission

and commencement of dealings in all such New Ordinary

Shares

CREST stock accounts expected to be credited for the 26 July 2016

New Ordinary Shares issued pursuant to the Cornerstone

Placing and Firm Placing and Open Offer

Issue and Admission of the New Ordinary Shares issued 28 July 2016

on the Debt Equitisation (if any) and under the Lender

Underwriting Equitisation (if any)

Restructuring Effective Date 28 July 2016

Shares certificates for New Ordinary Shares issued 5 August 2016

pursuant to the Cornerstone Placing and Firm Placing

and Open Offer expected to be dispatched

*or, if later, immediately following the conclusion

of the Annual General Meeting convened to be held

at 10.00 a.m. on the same day and at the same location

Notes:

1. The times and dates set out in the expected timetable of principal events

above and mentioned throughout this Announcement are Dublin times and may

be adjusted by the Company in consultation with the Sponsor, in which

event details of the new times and dates will be notified to the Irish

Stock Exchange, the FCA, the London Stock Exchange, and, where

appropriate, the revised time and/or date will be notified by

announcement to Shareholders through a Regulatory Information Service.

Capitalised terms used in this announcement and not otherwise defined

shall have the meaning given to them in the announcement issued by

Kenmare dated 20 June, 2016.

In this Announcement, US Dollar amounts have been converted to euro and

sterling respectively at rates of US$1: EUR1.1115 and US$1: StgGBP1.352,

being the rates prevailing as of 29 June, 2016, being the Latest

Practicable Date.

For further information, please contact:

Kenmare Resources plc Davy

Michael Carvill, Managing Director Eugenée Mulhern, Anthony Farrell, Daragh O'Reilly

Tel: +353 1 671 0411 Tel: + 353 1 679 6363

Mob: + 353 87 674 0110

Tony McCluskey, Financial Director Canaccord Genuity Limited

Tel: +353 1 671 0411 Martin Davidson, Nilesh Patel, Joe Dorey

Mob: + 353 87 674 0346 Tel: +44 207 523 4689

Jeremy Dibb, Corporate Development and Investor Relations Mirabaud Securities

Manager Rory Scott

Tel: +353 1 671 0411 Tel: + 44 207 878 3360

Mob: + 353 87 943 0367

Murray Consultants NM Rothschild & Sons Ltd

Joe Heron Andrew Webb

Tel: +353 1 498 0300 Tel: + 44 207 280 5000

Mob: +353 87 690 9735

Buchanan Hannam & Partners (Advisory) LLP

Bobby Morse Andrew Chubb, Ingo Hofmaier, Giles Fitzpatrick

Tel: +44 207 466 5000 Tel: +44 207 907 8500

This announcement is not for release, publication or distribution, in

whole or in part, directly or indirectly, in, into or from the United

States, Canada, Japan, Australia, South Africa, Hong Kong or Switzerland

or any other jurisdiction where to do so would constitute a violation of

the relevant securities laws (the "Excluded Territories"). This

announcement is for information purposes only and shall not constitute

or form part of any offer to buy, sell, issue or subscribe for, or the

solicitation of an offer to buy, sell, issue, or subscribe for, any

securities mentioned herein (the "Securities") in the United States

(including its territories and possessions, any State of the United

States and the District of Columbia) or any other Excluded Territory.

The Securities have not been and will not be registered under the US

Securities Act of 1933, as amended (the "Securities Act"), and may not

be offered or sold in the United States, except pursuant to an exemption

from, or in a transaction not subject to, the registration requirements

of the Securities Act. No public offering of the Securities is being

made in the United States.

This announcement has been issued by, and is the sole responsibility of,

Kenmare. None of Canaccord Genuity Ltd, J&E Davy and Mirabaud Securities

(the "Joint Bookrunners") or any of their respective directors, officers,

employees, advisers or agents accepts any responsibility or liability

whatsoever and makes no representation or warranty, express or implied,

in relation to the contents of this announcement, including its truth,

accuracy, completeness or verification (or whether any information has

been omitted from this announcement) or for any other statement made or

purported to be made by it, or on its behalf, in connection with Kenmare,

the Securities, the Capital Raise or the Debt Restructuring, whether

written, oral or in a visual or electronic form, and howsoever

transmitted or made available. Each of the Joint Bookrunners accordingly

disclaims, to the fullest extent permitted by law, all and any liability

whether arising in tort, contract or otherwise (save as referred to

above) which it might otherwise have in respect of any loss howsoever

arising from any use of this announcement, its contents or any such

statement or otherwise arising in connection therewith.

Each of NM Rothschild & Sons Ltd, Hannam & Partners (Advisory) LLP,

Canaccord Genuity Ltd and Mirabaud Securities (each of whom is

authorised and regulated in the United Kingdom by the FCA) and J&E Davy

(who is regulated in Ireland by the Central Bank) are acting exclusively

for Kenmare and no one else in connection with the Capital Raise. They

will not regard any other person (whether or not a recipient of this

announcement) as a client in relation to the Capital Raise and will not

be responsible to anyone other than Kenmare for providing the

protections afforded to their respective clients nor for giving advice

in relation to the Capital Raise or any transaction or arrangement

referred to in this announcement and accordingly disclaim all and any

liability whether arising in tort, contract or otherwise which they

might have in respect of this announcement or any such statement.

This announcement includes statements that are, or may be deemed to be,

forward-looking statements. These forward looking statements can be

identified by the use of forward looking terminology, including the

terms "anticipates", "believes", "estimates", "expects", "intends",

"may", "plans", "projects", "should" or "will", or, in each case, their

negative or other variations or comparable terminology, or by

discussions of strategy, plans, objectives, goals, future events or

intentions. These forward-looking statements include all matters that

are not historical facts. They appear in a number of places throughout

this announcement and include, but are not limited to, statements

regarding Kenmare's intentions, beliefs or current expectations

concerning, amongst other things, Kenmare's results of operations,

financial position, liquidity, prospects, growth, strategies and

expectations for its Mine and the titanium mining industry.

By their nature, forward looking statements involve risk and uncertainty

because they relate to future events and circumstances. Forward-looking

statements are not guarantees of future performance and the actual

results of Kenmare's operations, financial position and liquidity, and

the development of the markets and the industry in which Kenmare

operates may differ materially from those described in, or suggested by,

the forward-looking statements contained in this announcement.

Forward-looking statements may, and often do, differ materially from

actual results. Any forward-looking statements in this announcement

reflect Kenmare's current view with respect to future events and are

subject to risks relating to future events and other risks,

uncertainties and assumptions relating to Kenmare's operations, results

of operations, financial position and growth strategy.

This announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the information

contained therein.

Source: Kenmare Resources via Globenewswire

HUG#2024404

http://www.kenmareresources.com/

(END) Dow Jones Newswires

June 30, 2016 12:16 ET (16:16 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

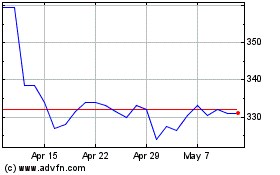

Kenmare Resources (LSE:KMR)

Historical Stock Chart

From Jun 2024 to Jul 2024

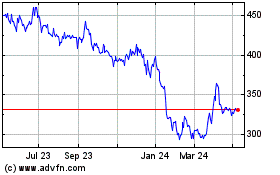

Kenmare Resources (LSE:KMR)

Historical Stock Chart

From Jul 2023 to Jul 2024