TIDMIRSH

Kenmare Resources plc ("Kenmare" or "the Company")

16 October 2018

Q3 2018 Production Report, Capital Markets Day and Adoption of Dividend

Policy

Kenmare Resources plc (LSE:KMR, ISE:KMR), one of the leading global

producers of titanium minerals and zircon, which operates the Moma

Titanium Minerals Mine (the "Mine" or "Moma") in northern Mozambique, is

pleased to provide a trading update for the third quarter ending 30

September 2018 ("Q3 2018").

Statement from Michael Carvill, Managing Director:

"Kenmare is hosting a Capital Markets Day today to outline the

comprehensive plans we have developed to increase production, expand

margins and begin capital returns to shareholders. I am pleased to

announce our dividend policy, a watershed moment for the company.

Dividends will be based on a minimum of 20% of Profits After Tax and are

expected to commence with an interim dividend for H1 2019.

We believe that industry fundamentals are supportive of higher prices,

and while global growth concerns and normal seasonal weakness have

driven some buying caution, this appears to be lifting. Prices of

ilmenite, our main product, remain at less than 50% of the previous peak

and, in our view, are unlikely to be sufficient to incentivise the

necessary new supply to replace depleting mines and meet continued

demand growth in the medium term."

Overview

-- Ore mined in Q3 2018 increased 8% to 8,411,000 tonnes (Q3 2017: 7,788,000

tonnes), benefitting from increased supplementary dry mining.

-- Heavy Mineral Concentrate ("HMC") production in Q3 2018 increased 3% to

279,900 tonnes (Q3 2017: 272,600 tonnes), however production was impacted

by planned lower grades when compared to Q2 2018.

-- Ilmenite production in Q3 2018 was 233,900 tonnes, down 9% (Q3 2017:

257,500 tonnes).

-- Zircon production in Q3 2018, decreased 10% to 16,200 tonnes (Q3 2017:

18,100 tonnes).

-- Total shipments of finished products in Q3 2018 decreased 5% to 198,900

tonnes (Q3 2017: 208,400 tonnes), in line with previous guidance, due to

the timing of shipments and the weighting of 2018 sales to H1.

-- Chinese ilmenite spot market conditions are improving, following cautious

buying in recent months, while zircon prices continued to advance.

-- Plans to deliver 1.2 million tonnes per annum of ilmenite, plus

associated co-products, by 2021 have been further refined.

-- Dividend policy paying a minimum of 20% of Profit After Tax adopted.

Capital Markets Day

A presentation for analysts and investors will be held at 09:00am BST on

Tuesday, 16 October 2018. A copy of the presentation is available on the

Company website,

https://www.globenewswire.com/Tracker?data=V9B7Akie-Lfw-P6jwS7FlhC2tSoCJXYFxfFQH4kvI6UXtnz2ka_bdoF2rP_8zdTLSccBSVm_FGEHdoJzMdYFg62lpJhmNlZKbkF6LtLMcAw=

www.kenmareresources.com and a replay of the event will be available

shortly afterwards. No new material information or trading update, other

than that contained in this announcement, will be provided at the event.

Production

Production and shipments from the Moma Mine for Q3 2018 was as follows:

Q3-2018 Q3-2017 Variance Q2-2018 Variance

----------- ------------- ------------- ---------- ------------- ----------

tonnes tonnes % tonnes %

----------- ------------- ------------- ---------- ------------- ----------

Excavated

Ore * 8,411,000 7,788,000 8% 8,409,000 0%

-----------

Grade* 3.62% 4.15% -13% 4.68% -23%

-----------

Production

----------- ------------- ------------- ---------- ------------- ----------

HMC 279,900 272,600 3% 377,900 -26%

-----------

Ilmenite 233,900 257,500 -9% 238,500 -2%

-----------

Zircon 16,200 18,100 -10% 16,800 -4%

-----------

of which

primary 10,200 12,000 -15% 11,700 -13%

-----------

of which

secondary 6,000 6,100 -2% 5,100 18%

-----------

Rutile 1,700 2,200 -23% 2,000 -15%

-----------

Shipments 198,900 208,400 -5% 322,000 -38%

-----------

* Excavated Ore and grade are prior to any floor losses.

During Q3 2018, Kenmare mined 8,411,000 tonnes of ore at an average

grade of 3.62% and produced 279,900 tonnes of HMC. Finished product

volumes for the period included 233,900 tonnes of ilmenite and 16,200

tonnes of zircon (including 6,000 tonnes of lower grade secondary

zircon).

Ore mined was in line with the prior quarter but an improvement of 8%

versus Q3 2017 (Q3 2017: 7,788,000 tonnes) as a result of increased

supplementary dry mining capacity installed successfully in H1 2018.

Mining conditions are expected to improve through Q4 2018, enabling

higher tonnages of ore to be processed.

HMC production increased 3% to 279,900 tonnes in Q3 2018 compared with

272,600 tonnes in Q3 2017, principally as a result of the increase in

ore mined, despite lower grades. It is expected that grades will

increase in Q4 2018, and this has been evidenced in the quarter to date,

increasing HMC production for the final quarter.

Production of ilmenite was 233,900 tonnes in Q3 2018, down 9% over the

prior year period (Q3 2017: 257,500 tonnes). Production of ilmenite for

2018 is expected to be within the guidance, though at the mid-low end of

the range.

Zircon production was in line with ilmenite, down 10% to 16,200 tonnes

in Q3 2018, compared with 18,100 tonnes in Q3 2017. Of this, primary

zircon production declined 15% to 10,200 tonnes (Q3 2017: 12,000

tonnes). Secondary zircon volumes were 6,000 tonnes, down 2% (Q3 2017:

6,100 tonnes). Production of zircon for 2018 is expected to be within

the guidance, close to the middle of the guided range.

Power reliability has been greatly improved since the end of 2015 but

through 2018 this stability has been impacted by faulty equipment on the

national grid, which has affected production. Consequently, higher

utilisation of the diesel-powered electric generators has contributed to

higher absolute and unit costs, which are expected to be marginally

beyond the upper end of guidance. The fault has now been identified and

Kenmare has been working with Electricidade de Moçambique, the

state electricity provider, to rectify the issues. This work is expected

to be completed in Q4 2018.

Following very strong H1 2018 sales volumes, as previously outlined,

ilmenite shipments slowed in Q3 2018 due to a seasonal variation and

cautious purchasing behaviour in China. Shipping volumes are still

expected to be lower in aggregate in H2 2018 than H1 2018. Shipment

volumes in Q3 2018 were 198,900 tonnes, 5% lower than Q3 2017 but 38%

lower when compared with Q2 2018 (Q3 2017: 208,400 tonnes, Q2 2018:

322,000 tonnes), primarily reflecting seasonal variation. Sales in Q3

2018 comprised 184,300 tonnes of ilmenite, 12,100 tonnes of zircon and

2,500 of rutile.

Closing stock of HMC at the end of Q3 2018 was 19,100 tonnes, compared

with 52,300 tonnes at the beginning of the quarter. Closing stock of

finished products at 30 September 2018 was 182,500 tonnes (30 June 2018:

129,600 tonnes).

Capital Projects

Raising ilmenite production, by 2021, to 1.2 million tonnes per annum,

plus associated co-products, is a core strategy of the company to help

reduce unit costs and increase margins by fully utilising existing

processing and export facilities at Moma. Preliminary studies in 2016

estimated that the necessary capital expenditure to increase the

capacity of the mining fleet would be up to US$100 million, but

following the completion of Definitive Feasibility Studies, this has

reduced and is now estimated to be approximately US$60 million. Some

further mining capacity increases will be required post 2028.

The first significant capital project to increase capacity was the

upgrade of WCP B, from 2,000 tonnes per hour to 2,400 tonnes per hour.

Kenmare has taken a phased approach to the project to maximise capital

efficiency. Commissioning began in Q3 2018, ahead of schedule, and the

plant has successfully operated at capacity. It is expected that the

final phase of works will be completed in the coming months to ensure

consistent operations at the targeted capacity. Final costs are expected

to be approximately 25% below the guidance of US$16 million.

The Board approved the development of a third dredge mining pond in

August 2018. A 500 tonnes per hour dredge and wet concentrator plant,

WCP C, will be developed in a high-grade area of the Namalope zone,

inaccessible to the existing dredge operations. Resources to support a

20-year life of mine for WCP C have been identified. The project is

expected to cost up to US$45 million (including contingencies) and yield

an IRR of at least 30%. Commissioning is expected before the end of

2019.

Separately, and as previously announced, the Namalope deposit will be

mined until 2020 by WCP B and until 2025 by WCP A. The capital costs

associated with the movement of the mining ponds from Namalope are in

addition to the capital outlined to increase the capacity of the mining

fleet. WCP B will move in H2 2020, increasing production in 2021 to 1.2

million tonnes of ilmenite per annum, plus associated co-products,

through the mining of the higher grade Pilivili deposit. Following the

completion of a PFS (Pre-Feasibility Study), capital costs are estimated

to be approximately US$100 million. A full DFS (Definitive Feasibility

Study) will be completed in Q1 2019. Plans for the movement of WCP A to

Nataka in 2025 remain at an early stage.

Sustaining capital is expected to be within guidance of US$22 million

for 2018 and expected to be in the range of US$20 - 25 million per annum

over the next five years.

Market

Chinese ilmenite purchasing activity slowed over the summer months, as

in previous years, as pigment output reduced due to seasonal demand

factors and some disruptions related to environmental regulation

enforcement in China. Recent announcements of pigment price increases by

Chinese pigment producers points to an improved industry outlook.

Chinese domestic ilmenite prices were stable in Q3 2018, though imported

ilmenite prices were marginally softer, reflecting a weaker Chinese

Renminbi. As we enter Q4 2018, Chinese domestic ilmenite pricing remains

firm, with some upward pressure associated with the improving pigment

market outlook likely in the coming weeks as some large domestic

ilmenite producers have just announced price increases.

Outside of China, ilmenite shipments in Q3 2018 were broadly in line

with expectations, as western pigment plants continued to operate at

high utilisation rates. The high-grade feedstock market continues to be

tight and should afford opportunities for higher consumption of ilmenite

at pigment plants and for upgrading.

Zircon industry fundamentals continued to be favourable in Q3 2018, with

Kenmare agreeing further prices increases in line with general market

levels. Given the strong price recovery since early 2017 to the more

sustainable levels of today, the potential for further significant price

increases appears less likely.

Dividend policy

As part of Kenmare's objective to create and deliver shareholder value,

the Company is pleased to announce its dividend policy. The dividend

policy is to return a minimum of 20% of Profit After Tax. This policy is

subject to prevailing product market conditions and ensuring that the

Company retains a prudent level of cash to fund debt and capital

requirements.

In light of the capital required for development projects as outlined

above, the Company expects to pay modest dividends during the next two

years, starting with an interim dividend based on H1 2019 results,

payable in H2 2019. Following completion of these development projects,

the Company expects to be in a position to make higher capital returns

from 2021.

In order to prepare for payment of the maiden dividend, the Company

intends to eliminate historic losses and undertake a group

rationalisation. Kenmare's Lender Group has agreed to provide the

necessary approvals to enable the Company proceed with these steps.

Elimination of historic losses will also require shareholder approval

and the sanction of the Irish High Court, and the Company intends to

convene an extraordinary general meeting for the approval of the capital

reduction to eliminate historic losses to be held later this year. It

is expected that the various steps to allow the commencement of dividend

payments by the Company will be completed early next year.

For further information, please contact:

Kenmare Resources plc

Michael Carvill, Managing Director

Tel: +353 1 671 0411

Tony McCluskey, Financial Director

Tel: +353 1 671 0411

Jeremy Dibb, Corporate Development and Investor Relations Manager

Tel: +353 1 671 0411

Mob: + 353 87 943 0367

Murray

Joe Heron / Aimee Beale

Tel: +353 1 498 0300

Mob: +353 87 690 9735

Buchanan

Bobby Morse / Chris Judd

Tel: +44 207 466 5000

Forward Looking Statements

This announcement contains some forward-looking statements that

represent Kenmare's expectations for its business, based on current

expectations about future events, which by their nature involve risks

and uncertainties. Kenmare believes that its expectations and

assumptions with respect to these forward-looking statements are

reasonable. However, because they involve risk and uncertainty, which

are in some cases beyond Kenmare's control, actual results or

performance may differ materially from those expressed or implied by

such forward-looking information.

(END) Dow Jones Newswires

October 16, 2018 02:00 ET (06:00 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

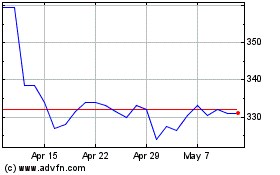

Kenmare Resources (LSE:KMR)

Historical Stock Chart

From Jun 2024 to Jul 2024

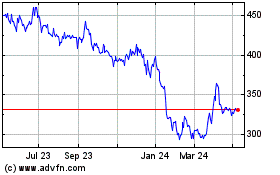

Kenmare Resources (LSE:KMR)

Historical Stock Chart

From Jul 2023 to Jul 2024