RNS Number:4224D

Kenmare Resources PLC

28 September 2004

Kenmare Resources plc ("Kenmare" or "the Company")

Kenmare Interim Results

For the period ended 30th June 2004

Chairman's Statement

Dear Shareholder,

I mentioned at the last Annual General Meeting that we were in discussion with

three separate groups in relation to the final tranche of capital to complete

the Moma Project financing plan. I am now pleased to say that we have signed a

mandate to do so. All the commercial points have been agreed with the Emerging

Africa Infrastructure Fund and while some legal documentation remains to be

processed, every effort is being made to get this completed forthwith.

Completion of these arrangements, under which Stg#6.5 million will be raised by

way of an issue of Ordinary Shares and Warrants on the same terms as under the

original Placing and Open Offer, will mean that 100% of the planned Stg#53

million equity to be raised by Kenmare under the Moma Project financing plan is

achieved.

In the 2003 Annual Report, I stated that Kenmare had signed loan agreements for

US$269 million of loan finance for the Moma Titanium Minerals Project. I also

referred to the successful placing of Stg#30 million of equity with

institutional shareholders and the commencement of an Open Offer to shareholders

on the same terms as those provided to the institutions. This Open Offer was

very well supported by shareholders who contributed Stg#10.1 million, with a

further Stg#6.4 million having been raised by way of a supplementary placing.

The final component of the equity necessary to achieve lenders' minimum equity

requirement was provided by way of commitments from underwriters. These

commitments allowed Kenmare clear the lenders' minimum equity requirement and

gave access to the capital already raised. To facilitate participation by an

important investor such as the Emerging Africa Infrastructure Fund, the

underwriters have extended their existing commitment to 1 November in order to

complete the legal documentation required to execute the signed mandate referred

to above.

In the meantime the contract to build the mine was declared effective on the 5th

of August. Our Project Implementation Director, Ron Williams, and his staff have

now relocated to the office of the contractor in Johannesburg and work has

commenced. At site the first task has been the clearing of a space (servitude)

on either side of our 170km powerline. On completion of this task, the

contractor will assume responsibility for the site, expected late October. While

the main focus of the contractor over the next few months will be on planning,

detailed design, and procurement in Johannesburg, an advance team will also go

to site to open up the quarries and perform initial civil works. As part of the

transformation into a production company we are in the process of appointing a

new Chief Operating Officer, who will assume day-to-day management of

operational issues.

During the six months ended 30th June 2004 we reported a profit of US$71,880.

This profit arises primarily from foreign exchange gains and interest earned,

net of Kenmare's corporate operating costs.

With the last part of our financing agreed we are looking forward to getting on

with building the mine and investigating market possibilities for incremental

sales contracts.

Charles Carvill

Chairman

27th September 2004

For further information:

Kenmare Resources plc

Tony McCluskey

Financial Director

Tel: +353-1-671 0411 or +353-87-6740346

Deirdre Corcoran

Financial Controller

Tel: +353-1-671 0411 or +353-87-6383742

Murray Consultants

Elizabeth Headon

Tel: +353-1-498 0300 or +353-87 989 7234

Conduit plc

Leesa Peters

Tel: +44 (0) 207 936 9095 or + 44 (0) 781 215 9885

www.kenmareresources.com

INDEPENDENT AUDITORS' REVIEW REPORT

TO THE BOARD OF DIRECTORS OF KENMARE RESOURCES PLC

Interim Financial Information - Six months ended 30th June 2004

Introduction

We have been instructed by the Company to review the financial information for

the six months ended 30th June 2004 which comprises the Consolidated Profit and

Loss Account, the Consolidated Balance Sheet, the Group Cash Flow Statement, the

Statement of Total Recognised Gains and Losses and Reconciliation of Movement in

Shareholders' Funds and related notes 1 to 8. We have read the other information

contained in the interim report and considered whether it contains any apparent

misstatements or material inconsistencies with the financial information.

This report is made solely to the company in accordance with the terms of our

engagement to assist the company in meeting the requirements of the Listing

Rules of the Irish Stock Exchange and of the UK Listing Authority. Our review

has been undertaken so that we might state to the company those matters we are

required to state to it in this report and for no other purpose. To the fullest

extent permitted by law, we do not accept or assume responsibility to anyone

other than the company for our review work, for this report or for the

conclusions we have reached.

Directors' responsibilities

The interim report, including the financial information contained therein, is

the responsibility of, and has been approved by, the Directors. The directors

are responsible for preparing the interim report in accordance with the Listing

Rules of the Irish Stock Exchange and of the UK Listing Authority which require

that the accounting policies and presentation applied to the interim figures

should be consistent with those applied in preparing the preceding annual

accounts except where any changes, and the reasons for them, are disclosed.

Review work performed

We conducted our review in accordance with guidance contained in Bulletin 1999/4

issued by the Auditing Practices Board. A review consists principally of making

enquiries of management and applying analytical procedures to the financial

information and underlying financial data and based thereon, assessing whether

the accounting policies and presentation have been consistently applied unless

otherwise disclosed. A review excludes audit procedures such as tests of

controls and verification of assets, liabilities and transactions. It is

substantially less in scope than an audit performed in accordance with Auditing

Standards and therefore provides a lower level of assurance than an audit.

Accordingly we do not express an audit opinion on the financial information.

Review conclusion

On the basis of our review we are not aware of any material modifications that

should be made to the financial information as presented for the six months

ended 30th June 2004.

Deloitte & Touche

Chartered Accountants

and Registered Auditors

Deloitte & Touche House

Earlsfort Terrace

Dublin 2

27th September 2004

CONSOLIDATED PROFIT AND LOSS ACCOUNT

FOR THE SIX MONTHS ENDED 30th JUNE 2004

6 Months 6 Months 12 Months

30/06/2004 30/06/2003 31/12/2003

Unaudited Unaudited Audited

US$ US$ US$

Turnover - - -

Operating Gains/(Expenses) 46,750 (323,647) (42,877)

Operating Profit/(Loss) 46,750 (323,647) (42,877)

Interest Receivable 25,130 101,881 163,428

Profit/(Loss)On Ordinary Activities

Before Taxation 71,880 (221,766) 120,551

Taxation - - -

Profit/(Loss) On Ordinary

Activities

After Taxation 71,880 (221,766) 120,551

Earnings/(Loss) per share: Basic 0.03c (0.85)c 0.05c

Earnings/(Loss) per share: Diluted 0.02c (0.85)c 0.04c

CONSOLIDATED BALANCE SHEET

AS AT 30th JUNE 2004

6 Months 6 Months 12 Months

30/06/2004 30/06/2003 31/12/2003

Unaudited Unaudited Audited

US$ US$ US$

Fixed Assets

Mineral Interests 42,036,267 24,468,280 27,431,163

Tangible Assets 41,618,255 41,626,625 41,622,440

83,654,522 66,094,905 69,053,603

Current Assets

Debtors 751,985 132,400 90,322

Investment in Shares - 158,505 -

Cash at Bank and In Hand 538,203 3,442,389 4,574,490

1,290,188 3,733,294 4,664,812

Creditors: Amounts falling

due within one year (14,479,864) (2,493,995) (3,224,907)

Net Current Assets (13,189,676) 1,239,299 1,439,905

Total Assets Less Current 70,464,846 67,334,204 70,493,508

Liabilities

Creditors: Amounts falling

due after one year (1,502,582) (1,543,551) (1,730,161)

Provision for liabilities and - (3,338,000) -

charges

68,962,264 62,452,653 68,763,347

Capital and Reserves

Called Up Share Capital 26,327,993 24,556,528 26,269,539

Share Premium Account 29,916,845 25,592,896 29,848,262

Profit and Loss Account - (21,819,847) (22,234,044) (21,891,727)

(Deficit)

Revaluation Reserve 30,141,002 30,141,002 30,141,002

Other Reserve 3,642,080 3,642,080 3,642,080

Capital Conversion Reserve 754,191 754,191 754,191

Fund

Shareholders' Funds 68,962,264 62,452,653 68,763,347

GROUP CASH FLOW STATEMENT

FOR THE SIX MONTHS ENDED 30th JUNE 2004

6 Months 6 Months 12 Months

30/06/2004 30/06/2003 31/12/2003

Unaudited Unaudited Audited

US$ US$ US$

Net cash inflow/(outflow) from

operating activities 10,644,229 1,038,113 (1,092,221)

Returns on investment and

servicing of finance

Interest received 25,130 101,881 163,428

Net cash inflow from returns on

investment & servicing of

finance 25,130 101,881 163,428

Capital expenditure & financial

investment

Addition of Mineral Interests (14,605,104) (5,849,971) (8,812,854)

Net cash outflow from capital

expenditure & financial

investment (14,605,104) (5,849,971) (8,812,854)

Net cash outflow before use of

liquid resources & financing (3,935,745) (4,709,977) (9,741,647)

Financing:

Issue of Ordinary Share Capital 127,037 - 6,513,083

Cost of share issue - - (544,706)

Finance Lease - (2,254) (2,254)

Increase in debt due within a

year - 2,221 11,005

(Decrease)/Increase in debt due

beyond a year (227,579) 111,648 298,258

Net cash (outflow)/inflow from

financing (100,542) 111,615 6,275,386

Decrease in cash (4,036,287) (4,598,362) (3,466,261)

STATEMENT OF TOTAL RECOGNISED GAINS AND LOSSES

FOR THE SIX MONTHS ENDED 30th JUNE 2004

6 Months 6 Months 12 Months

30/06/2004 30/06/2003 31/12/2003

Unaudited Unaudited Audited

US$ US$ US$

Profit/(Loss) attributable to

Group shareholders 71,880 (221,766) 120,551

Total Recognised Gains/(Losses) for

the period 71,880 (221,766) 120,551

RECONCILIATION OF MOVEMENT IN SHAREHOLDERS' FUNDS

FOR THE SIX MONTHS ENDED 30th JUNE 2004

6 Months 6 Months 12 Months

30/06/2004 30/06/2003 31/12/2003

Unaudited Unaudited Audited

US$ US$ US$

Total Recognised Gains/(Losses) for

the period 71,880 (221,766) 120,551

Issue of Shares - at par 58,454 - 1,713,011

Share Premium, net of costs 68,583 - 4,255,366

Net Change in Shareholders' funds 198,917 (221,766) 6,088,928

Opening Shareholders' funds 68,763,347 62,674,419 62,674,419

Closing Shareholders' funds 68,962,264 62,452,653 68,763,347

NOTES TO THE INTERIM FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED 30th JUNE 2004

1. Basis of Preparation of Interim Financial Statements

The Interim Statement has been prepared on the going concern basis applying the

accounting policies set out on page 23 of the 2003 Annual Report and Accounts.

The unaudited interim financial information in this statement has been reviewed

by the auditors in respect of the six months ended 30th June 2004 only and

their Report to the Directors is set out on page 4.

2. Earnings and Fully Diluted Earnings per Share

The calculation of the earnings and fully diluted earnings per share is based

on the profit after taxation of US$71,880 (2003: Loss US$221,766) and the

weighted average number of shares in issue during the six months ended 30th

June 2004 of 288,212,873 shares (2003: 262,209,123 shares).

The calculation of fully diluted earnings per share for 2004 is based on the

profit for the period after taxation as for basic earnings per share. The

number of shares is adjusted to show the potential dilution if share options

and share warrants are converted into ordinary shares. This increases the

weighted average number of shares in issue to 316,064,560.

3. Mineral Interests

The recovery of deferred development expenditure is dependent upon the

successful development of economic ore reserves, which in turn depends on the

continued availability of adequate funding.

The Directors are satisfied that deferred expenditure is worth not less than

cost less any amounts written off and that the exploration projects have the

potential to achieve mine production and positive cash flows.

4. Tangible Assets

Tangible Assets are stated at cost or valuation less accumulated depreciation.

GRD Minproc Limited, an independent Australian engineering group, has appraised

the Mining and Processing Plant on a depreciated replacement cost basis of

valuation as at 30th June 2000. An inspection of the Mining and Processing

Plant was carried out by GRD Minproc Limited in March 2002 concluding that no

material alteration to the plants had taken place. Confirmation of the

existence of the Processing Plant and the Mining Plant at 31st December 2003

was provided by Bateman Engineering, an international engineering group.

The recovery of this amount is dependent upon the successful development of the

Moma Titanium Minerals Project, which in turn depends on the availability of

adequate funding from financial institutions, a joint venture party or other

source. The historical cost net book value of these assets at 30th June 2004 is

US$11,473,067. The surplus arising on revaluation amounts to US$30,141,002.

5. Non-Consolidation of Subsidiary Undertaking

As set out in detail in Note 7 of 2003 Annual Report, Grafites de Ancuabe,

S.A.R.L., a subsidiary company, has been excluded from consolidation from 31st

December 1999.

6. Reconciliation of operating profit/(loss) to net cashflow from operating

activities

6 Months 6 Months 12 Months

30/06/2004 30/06/2003 31/12/2003

Unaudited Unaudited Audited

US$ US$ US$

OPERATING ACTIVITIES

Operating Profit/(Loss) 46,750 (323,647) (42,877)

Depreciation 4,185 4,185 8,370

(Increase)/Decrease in Debtors (661,663) (36,927) 5,151

Increase in Investment in Shares - (158,505) -

Increase in operating creditors 11,254,957 1,041,007 1,763,135

Increase/(Decrease) in Provision

for Liabilities & Charges - 512,000 (2,826,000)

Net Cash Flow from Operating

Activities 10,644,229 1,038,113 (1,092,221)

7. Subsequent Events

On 18 June 2004 Kenmare announced details of a Placing and Open offer to raise

up to Stg#53 million, representing the last major step in the financing of

project implementation at Moma. Stg#30 million of this amount was secured

through a placing arranged by the Companies brokers, Canaccord Capital (Europe)

Limited and J&E Davy, Stg#10.1 million was received in response to an open

offer to shareholders with a further Stg#6.4 million raised by way of a

supplementary placing. The final component of the equity necessary to achieve

lenders' minimum equity requirement was provided by way of commitments from

underwriters. These commitments allowed Kenmare clear the lenders' minimum

equity requirement and gave access to the capital already raised. Kenmare has

now signed a mandate with an investor in relation to the balance of the

supplemental placing and the underwriters have extended their existing

commitment to 1 November in order to facilitate this.

8. Approval of Interim Financial Statements

The interim financial statements were approved on 27th September 2004.

28 September, 20

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR QKFKNBBKDDCB

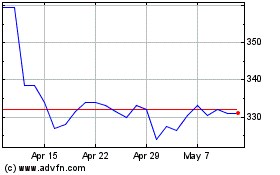

Kenmare Resources (LSE:KMR)

Historical Stock Chart

From Jun 2024 to Jul 2024

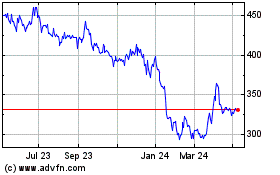

Kenmare Resources (LSE:KMR)

Historical Stock Chart

From Jul 2023 to Jul 2024