EARNINGS PREVIEW: UK Bks Count On Wholesale Banking Revival

April 29 2009 - 5:35AM

Dow Jones News

TAKING THE PULSE: U.K. banks' interim management statements will

show that the reputations of their wholesale banking operations

have been redeemed in the first quarter of 2009.

Seen as the culprit behind write-downs that slashed profits at

nearly every major bank over the past 18 months, wholesale banking

is back with a vengeance, minus the dreaded toxic products that got

them there in first place.

Wholesale banking revenue, such as interest-rate, currency,

money-market and commodities products, is expected to benefit banks

active in these, as has been the case at U.S. and European

peers.

Bread-and-butter lending to retail and particularly commercial

customers is, on the other hand, facing increasing loan losses as

unemployment rises, spending falls and companies fail to honor

payments obligations.

Nomura analyst Robert Law said that considering wholesale

banking's battered image after the write-downs of the past 18

months, investors may understandably be reluctant to value

wholesale banking revenue highly.

Even before the credit crisis, they were considered low-quality

streams. But Law said that, now, they are being boosted by

government funds injected to help stabilize financial markets - and

that assistance will be there until conditions improve in the

broader economy.

Law noted that he doesn't think this revenue will continue to

grow at the pace seen in the first quarter.

NCB Stockbrokers analyst Simon Willis said the worst of

write-downs is over, but said some banks still have a lot of

securities covered by monoline insurers - so-called because their

only business is guaranteeing repayment of bonds and interest if a

borrower defaults. Downgrades of monoline insurers suggests their

ability to actually payout for defaults is diminishing.

Overall, the wholesale banking upside should benefit Barclays

and Standard Chartered PLC (STAN.LN), while Lloyds Banking Group

PLC (LYG), RBS and HSBC Holdings PLC (HBC) are vulnerable to rising

corporate defaults and losses on unsecured personal lending.

Analysts' calls for more capital at U.K. banks have eased off,

for the time being, after more capital hikes at Lloyds, RBS and

HSBC this spring. Standard Chartered is seen as strong after its

cap hike late last year, while Barclays' capital levels received a

stamp of approval from the U.K. Financial Services Authority in

March.

The interim management statements are expected to offer more

insight than usual, but aren't expected to match other European

banks' quarterly reports in terms of detail.

COMPANIES TO WATCH:

Barclays--- (Thursday, May 7)

MAIN FOCUS: At its annual general meeting Barclays said first

quarter profits were "well ahead" of last year. After buying Lehman

Brothers' U.S. investment banking activities Barclays' position in

wholesale banking has improved, and analysts said the market is

likely to accept write-downs as long as revenue covers it and more.

As of December 2008. Barclays had a GBP8.4 billion exposure to

monoline insurers. The loan book is seen as high-quality, and

Barclays has said commercial property lending isn't an issue.

Royal Bank of Scotland--- (Friday, May 8)

MAIN FOCUS: RBS has embarked on a three- to five-year

restructuring plan, which includes halving the size of its global

banking and markets operations, and there still is no clarity on

how much of its distressed assets will be covered by the

government's asset protection scheme. The bank may be well

capitalized for now, the analysts say, but there is little

visibility. The bank is a big lender to corporations in the U.K.,

exposing it to rising defaults.

HSBC--- (Monday, May 11)

MAIN FOCUS: HSBC has stopped writing consumer finance business

in the U.S. but it could take years to run down the current loan

book, meaning continued impairments will be a drag on earnings.

HSBC generates less revenue in wholesale banking so it won't

benefit as much from that market's strength. Overall the bank

benefits from a strong balance sheet and a solid ratio of loans to

deposits.

Standard Chartered--- (bot yet scheduled)

MAIN FOCUS: Wholesale banking contributes three-quarters of

profit, so Standard Chartered should benefit from strong trading

seen at Asian wholesale banks, and from improved macro-economic

news flow around China. The bank is taking market share as major

players withdraw. Standard Chartered is a possible buyer of ABN

Amro Asia assets that RBS plans to divest. In consumer banking,

there are signs that bad debts will spiral, but from a low level.

Standard Chartered's AGM takes place May 7. It hasn't set a date

for its interim management statement.

Lloyds Banking--- (not yet scheduled)

MAIN FOCUS: Lloyds has little wholesale markets revenue. The

bank sits on a troubled commercial lending portfolio, mostly from

HBOS. The government's asset protection scheme should insulate

Lloyds from some losses, especially on the worst loans in HBOS'

portfolio, but in a weak U.K. economy, and as unemployment

increases, analysts expect "meaningful" deterioration in unsecured

personal lending. Lloyds Banking Group's AGM takes place June 5. It

hasn't set a date for its interim management statement.

-By Ragnhild Kjetland; Dow Jones Newswires; +44 207 842 9268;

ragnhild.kjetland@dowjones.com

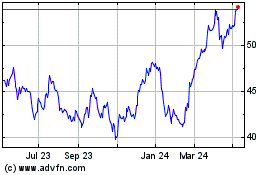

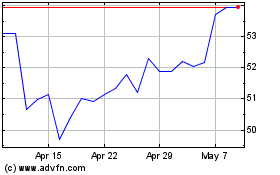

Lloyds Banking (LSE:LLOY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Lloyds Banking (LSE:LLOY)

Historical Stock Chart

From Jul 2023 to Jul 2024