Manx Financial Group PLC Acquisition of Blue Star Business Solutions Ltd (1538J)

March 28 2018 - 1:00AM

UK Regulatory

TIDMMFX

RNS Number : 1538J

Manx Financial Group PLC

28 March 2018

FOR IMMEDIATE RELEASE 7.00am 28 March 2018

Manx Financial Group PLC (the 'Group')

Acquisition of the entire issued share capital of Blue Star

Business Solutions Limited

Manx Financial Group PLC announces that Bradburn Limited, its

wholly owned subsidiary, has entered into a binding agreement to

acquire the entire issued share capital of Blue Star Business

Solutions Limited ("BBSL") subject only to Financial Conduct

Authority ("FCA") approval of the proposed change of control. An

application to the FCA has been submitted and completion is

expected to occur within 30 days.

BBSL was formed in 2004 and is based in Hampshire and regulated

by the FCA and holds Credit Broking Authorisations. The two

co-founders of BBSL, Marcus Gregory and Mark Hayman, have developed

a niche brokerage which focuses on delivering excellent customer

service to small and medium sized businesses in the UK that require

funding for IT equipment amongst other assets. For its financial

year to the end of March 2018, BBSL will fund in excess of GBP9

million of loan proposals and as at 31 March 2017 reported an

unaudited profit of GBP101,252 after tax. Post-acquisition the

Group will invest in BBSL to allow it to grow profitably by gaining

market share and through its banking subsidiary, Conister Bank

Limited, write the majority of its funding requests.

The board of directors of BBSL will be strengthened by the

appointment of Douglas Grant, the Group's Finance Director, and

Denham Eke, the Group's Chief Executive Officer.

The main terms of the transaction are as follows:

-- An initial payment of GBP1,500,000 in cash at completion;

-- 50% of the enlarged earnings before interest, tax,

depreciation and amortisation ("EBITDA") in BBSL for 3 years post

completion arising from ongoing trading of the BBSL following

completion of the acquisition; together with

-- 50% of the incremental net profit that the Bank realises as a

result of it taking up BBSL loan proposals post completion until

the third anniversary of the transaction. This will be paid

annually with a final payment in year 4 for the unrealised

discounted tail of the portion;

-- The maximum aggregate consideration payable by Bradburn

(including earn-out consideration) is capped at GBP4,000,000.

* net profit is defined as the amount of income earned (less

costs) realised by the Bank arising from new lending which has been

originated by BBSL

This acquisition is part of the Group's strategy to increase its

distribution in the UK broker market.

Douglas Grant, Group Finance Director, commented: "The asset

backed finance market in the UK recorded its seventh year of

successive growth last year, led by the broker finance market which

grew 14% year on year. This is a market Conister Bank is active

within and indeed wrote more than GBP16 million of business last

year. This acquisition will bolster our presence in this attractive

market sector and act as a catalyst for future growth. Both Marcus

and Mark have great experience in the UK broker market and are keen

to grow the business with our assistance and I am equally keen to

work with them to achieve this goal."

For further information: -

Manx Financial Group - http://www.mfg.im/

Blue Star Business Solutions Limited -

http://www.bluestarleasing.com/

Contacts:

Manx Financial Group PLC

Denham Eke, Chief Executive

Tel: +44 (0) 1624 694694

Beaumont Cornish Limited

Roland Cornish/James Biddle

Tel: +44 (0) 20 7628 3396

Britton Financial PR

Tim Blackstone

Tel +44 (0) 7957 140416

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACQFMGZFNNMGRZM

(END) Dow Jones Newswires

March 28, 2018 02:00 ET (06:00 GMT)

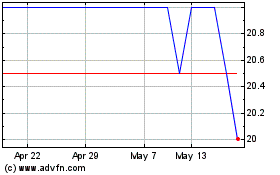

Manx Financial (LSE:MFX)

Historical Stock Chart

From Jun 2024 to Jul 2024

Manx Financial (LSE:MFX)

Historical Stock Chart

From Jul 2023 to Jul 2024