UPDATE:National Grid:To Restructure US Business, Cut 1,200 Jobs

January 31 2011 - 9:59AM

Dow Jones News

U.K. gas and electricity network operator National Grid PLC

(NG.LN) Monday announced a major restructuring of its U.S. business

in a plan that targets a reduction in operating costs by $200

million a year, primarily to be achieved through the reduction of

around 1,200 jobs in the U.S.

The restructuring, which also includes the appointment of Tom

King as U.S. executive director and president and the creation of

several regional presidents in the states where the company

operates, comes after the regulator in New York granted the company

a smaller-than-expected increase in electricity distribution and

transmission rates on Jan. 21.

National Grid CEO Steve Holliday said the restructuring of the

U.S. business hadn't been forced upon the company by the series of

disappointing regulatory decisions on rates the company can charge

in the U.S.

He said the restructure was planned and the company had been

waiting to complete the full cycle of regulatory filings before it

could make the announcement.

"It's not a knee jerk, it has been thought through for some

time," Holliday told reporters on a conference call.

"We're hitting more and more of our performance targets every

year, but we are not earning adequate returns thus far in all of

our U.S. regulatory jurisdictions so despite an increase in

revenues, operating costs in the U.S. are still higher than we are

recovering through today's rates," Holliday told reporters on a

conference call.

In a separate announcement, the company also said it expects

operating profit for 2010/2011 to be "significantly" ahead of last

year.

"The strong momentum seen in the first half has continued and

has further improved, driven by cold winter weather following the

hot weather in the U.S. in the summer," the company said in a

statement.

National Grid is to recommend an 8% increase in its full-year

dividend, in line with policy.

The majority of National Grid's business in the U.S is regulated

and is mostly in electricity and gas distribution. The company

operates in New York, Rhode Island and Massachusetts.

At 1508 GMT, National Grid shares were up 2% at 557 pence,

outperforming the U.K. power utility sector and the broader FTSE

index of which it is a component.

-By Selina Williams, Dow Jones Newswires +44 207 842 9262l;

selina.williams@dowjones.com (Jana Weigand contributed to this

story.)

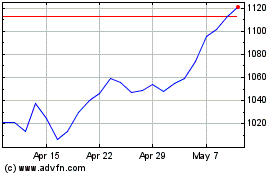

National Grid (LSE:NG.)

Historical Stock Chart

From Jan 2025 to Feb 2025

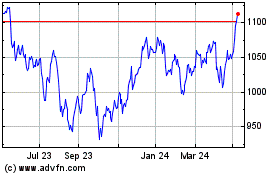

National Grid (LSE:NG.)

Historical Stock Chart

From Feb 2024 to Feb 2025