Final Results

Octopus AIM VCT plc

Final Results

Octopus AIM VCT plc today announces the final

results for the year ended 29 February 2024.

Octopus AIM VCT plc (the ‘Company’) is a venture

capital trust (VCT) which aims to provide shareholders with

attractive tax-free dividends and long-term capital growth by

investing in a diverse portfolio of predominantly AIM-traded

companies. The Company is managed by Octopus Investments Limited

(‘Octopus’ or the ‘Investment Manager’).

Financial summary

|

|

Year to 29 February 2024 |

Year to 28 February 2023 |

| Net assets (£’000) |

129,109 |

141,222 |

| (Loss) after tax (£’000) |

(17,734) |

(33,414) |

| Net asset value (NAV) per share

(p) |

63.3 |

78.5 |

| Dividends per share paid in year

(p) |

5.0 |

5.5 |

| Total return (%)1 |

(13.0) |

(19.8) |

| Special dividend proposed

(p)2 |

4.9 |

- |

| Final dividend proposed

(p)2 |

2.5 |

2.5 |

|

Ongoing charges (%)3 |

2.1 |

2.1 |

1 Total return is an alternative

performance measure calculated as movement in NAV per share in the

period plus dividends paid in the period, divided by the NAV per

share at the beginning of the period.

2The proposed final dividend and proposed special

dividend will be paid on 15 August 2024 to shareholders on the

register on 26 July 2024.

3Ongoing charges is an alternative performance measure

calculated using the AIC recommended methodology.

Chair’s statement

Introduction

Firstly, I would like to welcome all new shareholders who have

joined us in the past year.

The year to 29 February 2024 was another

extremely challenging period for investors in smaller companies.

Appetite for risk was affected by persistent inflation which

resulted in interest rates rising further and remaining at their

peak for longer than had originally been expected, prolonging the

pain for the share prices of companies exposed to growth sectors.

Against this background the Alternative Investment Market (AIM)

index was once again the worst performing UK index and the NAV gave

up further ground and finished the year 13.0% down on a total

return basis.

The AIM market raised £1.7 billion for new and

existing companies in the year under review, a decrease on the £2.1

billion raised in the previous year. It was the second year that

the majority of fundraisings in the year under review were for

existing AIM companies seeking further capital as new issues stood

back in response to volatile market conditions. Your Investment

Manager was, however, able to make some investments in existing AIM

companies at attractive valuations, with a total of £7.7 million

invested in qualifying companies in the period, up from the £4.9

million invested in the previous year. Although significant

geo-political risks remain, market sentiment has improved more

recently, with market commentators and economists taking a more

optimistic stance on inflation and interest rates in 2024. The

Investment Manager expects the pipeline of potential new issues to

strengthen later this year, supplementing existing companies

seeking further finance.

Performance

The NAV on 29 February 2024 was 63.3p per share, a significant

decrease on the NAV of 78.5p per share reported at 28 February

2023. Adding back the 5p of dividends paid in the year gives a

total negative return of 13.0%. In the same year, the FTSE AIM

All-Share Index fell by 12.6%, the FTSE SmallCap (excluding

investment companies) Index rose by 0.5% and the FTSE All-Share

Index rose by 0.6%, all on a total return basis. AIM was the worst

performing UK Index by some margin, highlighting the trend for

investors to seek value in more traditional sectors which has now

been the case for the past two years.

Once again stock specific factors had an impact

on our performance, both positive and negative, and these are

covered in more detail in the Investment Manager’s review. In

addition, economic concerns played a significant part in the

valuations of shares during the year. The year started as inflation

levels were still increasing, which encouraged central banks to

raise interest rates to a high point of 5.25% in August 2023. As it

became apparent that inflationary pressures were proving more

stubborn than had been hoped, expected interest rate cuts were

firmly pushed into 2024. This meant that the low appetite for risk

which had been apparent since the end of 2021 persisted, continuing

to impact the share prices of both profitable growth companies as

well as earlier stage companies exposed to the new

economy.

Some companies in the portfolio found themselves

having to raise new capital at a deep discount to previous

valuation levels. The purpose of a VCT is to provide capital for

small growing companies and as a result those companies exposed to

the new economy in the software, technology and healthcare sectors

make up a significant proportion of our investment portfolio. This

worked against us in the year under review.

Dividends

In January 2024 an interim dividend for the year to 29 February

2024 of 2.5p was paid to all shareholders. This was in addition to

the 2.5p final dividend that had been paid in August 2023 and which

related to the previous financial year ended 28 February 2023. The

Board has considered the level of dividend in the context of the

NAV fall during the period and on this occasion is recommending a

final dividend of 2.5p.

In addition, as a result of taking exceptional

profits in a number of long-term holdings during the year, most

notably the full disposal of Ergomed, the Board is proposing a

special dividend of 4.9p which will be paid at the same time as the

final dividend. Including the special dividend, the total dividend

in respect of the year is 9.9p which is a 16.6% yield based on the

share price of 59.5p on 29 February 2024.

It remains the Board’s target to pay an annual

dividend of 5.0p or 5% of the year-end share price, whichever is

greater at the time.

Board changes

Stephen Hazell-Smith, who has been a director of the Company since

1998, will be stepping down from the Board with effect from the

Annual General Meeting on 18 July 2024. I would like to thank

Stephen, on behalf of the Board and the shareholders, for his

extensive contribution to the success of the Company since its

inception. We wish him well for the future.

As announced on 5 June 2024, I am pleased to

report that Louise Nash will be joining the Board as a director

with effect from 1 July 2024. Louise will bring to the Board her

extensive experience as a former fund manager specialising in UK

small and mid-cap companies. In accordance with the Company’s

Articles of Association, a resolution to elect Louise will be put

to the Annual General Meeting on 18 July 2024.

Cancellation of share premium

account

At the last Annual General Meeting, shareholders voted to cancel

share premium to increase the pool of distributable reserves to the

amount of £19.8 million. This is a regular occurrence, and common

practice, to enable the continued payment of dividends and buyback

of shares. A further resolution to cancel share premium is being

proposed at this year’s Annual General Meeting.

Dividend reinvestment

scheme

In common with many other VCTs in the industry, the Company has

established a Dividend Reinvestment Scheme (DRIS). Many

shareholders have already taken advantage of this opportunity. For

investors who do not require income, but value the additional tax

relief on their reinvested dividends, this is an attractive scheme

and I hope more shareholders will find it useful. In the course of

the year 2,781,086 new shares have been issued under this scheme,

returning £1.8 million to the Company. The final dividend referred

to above will be eligible for the DRIS.

Share buybacks

During the year to 29 February 2024 the Company continued to buy

back shares in the market from selling shareholders and purchased

6,351,314 ordinary shares for a total consideration of £4.1

million. We have maintained a discount of approximately 4.5% to NAV

(equating to up to a 5.0% discount to the selling shareholder after

costs), which the Board monitors and intends to retain as a policy

which fairly balances the interests of both remaining and selling

shareholders. Buybacks remain an essential practice for VCTs, as

providing a means of selling is an important part of the initial

investment decision and has enabled the Company to grow. As such, I

hope you will all support the appropriate resolution at the

AGM.

Share issues

On 14 September 2023, a prospectus offer was launched alongside

Octopus AIM VCT 2 plc to raise a combined total of up to £20

million, with a £10 million over-allotment facility. The offer

closed fully subscribed on 21 December 2023. The Company issued

27,555,671 shares under the offer, raising £17.4 million after

costs, net of the DRIS.

VCT status

Shoosmiths LLP were engaged throughout the year to provide the

Board and Investment Manager with advice concerning continuing

compliance with HMRC regulations for VCTs. The Board has been

advised that the Company is in compliance with the conditions laid

down by HMRC for maintaining approval as a VCT. A key requirement

is to maintain at least an 80% qualifying investment level. As at

29 February 2024, 86.0% of the Company’s portfolio was in VCT

qualifying investments.

Last year I reported to you that the Government

had yet to renew the ‘sunset clause’ which provides that income tax

relief for new VCT subscriptions will cease on 5 April 2025. I am

pleased to report that the Government announced in last November’s

Autumn Statement that the sunset clause will be renewed until 2035.

Under EU State Aid regulations, this renewal does require EU

approval which, at the time of writing, is still awaited.

Annual General Meeting

(AGM)

The AGM will take place on 18 July 2024 at 10.30am. The Investment

Manager will also give a live presentation to shareholders on the

day of the AGM. This will enable shareholders to receive an update

from the Investment Manager and provide an opportunity for

questions to the Board and the Investment Manager. Formal notices

will be sent to shareholders by their preferred method (email or

post) and shareholders are encouraged to submit their votes by

proxy. We always welcome questions from our shareholders at the

AGM. Please send any questions via email to

AimAGM@octopusinvestments.com by 5.00pm on 12 July 2024.

Outlook

Although significant geo-political and economic risks remain,

recent strong positive stock market reactions to lower inflation

figures have demonstrated how quickly share prices can turn when

commentators begin to believe that interest rates will start to

fall in response to a more encouraging macro-economic environment.

Interest rate cuts are now expected later this year, particularly

in light of the recent announcement by the UK Prime Minister

calling for an earlier than predicted General Election in the

Summer.

Company results have been robust in the first

results season of the year and forecasts appear to be

conservatively set at this stage. Valuations have not yet recovered

from last year’s falls, leaving many of the larger and faster

growing shares in the portfolio on ratings still well below their

long-term averages, a fact that has been reinforced by the

appearance of significant takeover bid activity in the past few

months. The Investment Manager’s assessment is that the underlying

businesses of these companies remain generally robust, giving good

prospects for uplifts in valuations as overall market sentiment

improves.

The portfolio contains 88 holdings across a

range of sectors with exposure to some exciting new technologies in

the environmental and healthcare sectors in particular. Many of

these companies remain well funded, although the challenge of

raising further capital in the current market environment cannot be

dismissed. The balance of the portfolio towards profitable

companies remains, and the Investment Manager remains confident

that there will continue to be sufficient opportunities to invest

our funds in good companies seeking more growth capital at

attractive valuations.

Neal Ransome

Chair

Investment Manager’s review

Introduction

Amidst a backdrop of continued geopolitical conflict in Europe and

the Middle East, fluctuating inflation indicators, rising interest

rates and a subsequent squeeze in consumer incomes, capital UK

market performance remained lacklustre, and sentiment struggled to

regain a positive stance in the period under review. Investors

continued to be more risk averse, seeking refuge in larger listed

companies in safer sectors as they grappled with the market

uncertainty throughout the year. Consequently, lower appetite for

risk had a negative impact on the share price performance of

earlier stage investments within the portfolio, leading to

de-ratings and a further retreat of AIM growth stocks throughout

2023.

However, the tide of market sentiment began to

turn at the start of 2024 as global macroeconomic data showed more

consistent signs of recovery. The direction of stock market

movements remains closely linked to inflation figures and

expectations of interest rate cuts; with UK inflation data

confirming its continued downward trend, economic analysts are

confident that rate cuts will follow suit and we will likely see

the first fall in the third quarter of 2024. Consensus on the

quantum of the rate cuts is between 0.25% to 0.5% in this calendar

year. This will be dependent on the steady decline of inflation as

wage growth continues to slow down and food prices remain stable.

Interest rate cuts will provide much needed and long-awaited

support for equity markets.

Despite the less favourable background for

smaller growth companies over the period under review, AIM raised

further capital for existing listed companies and the AIM Initial

Public Offering (IPO) market started to gain pace at the beginning

of 2024 and has continued post the period end in line with

improving market confidence. Furthermore, with many UK small

companies trading below their long-term valuation range, there has

been a notable uptick in corporate activity over the last year.

This highlights the size of the stored value within UK smaller

companies, and the opportunity for potential revaluation when stock

markets recover.

The Alternative Investment

Market

Despite the occasional glimmers of optimism, the last couple of

years have tested investors’ resilience. Global markets have

remained fragile, and in the face of persistent global challenges

(both macroeconomic and geopolitical), investor appetite for risk

has stayed subdued. In addition to global headwinds, the spectre of

a looming recession and rising interest rates cast a shadow over

the UK market, and smaller company indices bore the brunt of equity

market de-rating. Over the year to 29 February 2024, the AIM index

declined by 12.6% compared to a FTSE SmallCap index (excluding

investment companies) rise of 0.5% and a FTSE All-Share increase of

0.6% on a total return basis. The performance of AIM was impacted

by its high exposure to growth companies in the technology and

healthcare sectors, highlighting the movement away from growth and

momentum driven shares. While VCTs face additional investment

constraints, the AIM index remains the most relevant broad equity

market index for comparative analysis, given the nature of the

underlying investments. The FTSE SmallCap and FTSE All-Share

indices provide wider context for understanding market

dynamics.

In light of uncertain market conditions, the

pace of initial public offerings (IPOs) and further fundraisings

for existing listed businesses across all UK industries continued

to be slow. There was a total of 17 IPOs on AIM over the period,

compared to 13 the previous financial year. Additionally, AIM saw a

number of exits fairly consistent with historic levels and now

stands at 742 companies as at the end of February, down 8% on the

previous year due to lower IPO activity. We still believe that

equity markets (and VCTs in particular), continue to be a critical

platform for funding smaller companies. This significance was

underscored by the ongoing flow of further fundraisings on AIM

throughout the year, albeit at a slower pace than the previous

year. In the year to 29 February 2024, AIM raised £1.7 billion of

capital for new and existing companies, compared to £2.1 billion in

the previous year.

Performance

Adding back the 5p of dividends paid in the year, the NAV total

return fell by 13.0%. This compares with a fall in the FTSE AIM

All-Share Index of 12.6%, a rise in the FTSE SmallCap (excluding

investment companies) of 0.5% and a rise in the FTSE All-Share

Index of 0.6%, all on a total return basis.

The year to 29 February 2024 was marked by

significant market volatility, driven by both global and local

economic uncertainty. The prevailing themes were rising inflation

and expectations of higher interest rates, which dampened consumer

confidence. The reality of the consumer credit crunch impacted many

in the UK, which was exacerbated by the realisation that the

impending expiration of fixed mortgage rates would add further

uncertainty. Although the fall in energy and food prices provided

somewhat of a soft landing, the squeeze on consumer spending

persisted as interest rate expectations continued to rise more

steeply than anticipated. Between December 2021 and August 2023,

the Bank of England increased interest rates a total of 14 times

from a low of 0.1% to the year-end level of 5.25%. Against this

background, performance in the FTSE AIM All-Share Index was

affected by the momentum away from smaller growth companies and the

move towards lower risk appetite drove the investment in

traditional sectors and larger, well-established companies. This

largely explains the fall in the NAV in the year under review. The

portfolio’s relatively high exposure to small growth companies

(particularly in the healthcare and technology sectors), was

detrimental to performance in a market environment where risk

averse investors have little appetite for earlier stage growth

stocks. Predictably, volatile market dynamics lead to greater

investor focus not just on product and service offering, but on

healthy balance sheets and the ability to access financing.

Some of the larger, profitable holdings in the

portfolio, including GB Group and Brooks MacDonald, were affected

by the poor market sentiment towards AIM growth stocks

generally.

SDI Group, which designs and manufactures

specialist scientific products, was the largest detractor to

performance over the period under review. The company had a couple

of disappointing downgrades over the year due to the end of a

contract with Atik cameras, which had been lucrative over the COVID

period. However, we are encouraged by the recent change in the

management team and the new CEO comes with a wealth of operational

experience in the sector, which has started to feed through

positively over the last few months.

Learning Technologies, a provider of e-learning

services and technologies, was another big detractor to the

performance of the portfolio as trading performance was affected by

the challenging macro environment which impacted both transaction

and project-based work. However, this has prompted a much needed

refocus on profitability and technology redevelopment. Furthermore,

the company recently embarked on a plan to accelerate its support

of higher growth areas of the business that are more aligned with

its core proposition of digital learning and talent management

through the sale of non-core assets, which should enable it to fund

future value-enhancing acquisitions.

Libertine Holdings, which develops linear

generator technologies for use in industry, had a very challenging

year, despite which the company continues to support the

integration of its HEXAGEN™ technology platform with Hyliion

Holdings Corp. and develop its intelliGEN™ technology platform

alongside a number of other commercial projects. However, the need

for further capital to enable the development of its technology

weighs down on the share price performance.

Sosandar, the women’s clothing retailer,

announced its decision to open own-branded retail outlets in the UK

and its move away from being a pure play retail online business

came as a surprise to the market. Though the decision will likely

increase the costs of the business in the short term, the instore

retail offering allows the company to capitalise on the growth of

its brand visibility and popularity in existing major UK retail

stores (both instore and online) which include Sainbury’s Tu, NEXT

and Marks & Spencer. The company’s products serve a fairly

resilient market demographic, and its increasing popularity has

opened up opportunities to expand internationally. Encouragingly,

and despite slowing down its discount strategy, the company had a

strong calendar year-end trading period and has returned to

quarterly profitability.

Feedback, the specialist medical imaging

technology company, has made considerable progress over the last

year. The company announced that it had secured a series of

contracts for a pilot programme with the Community Diagnostic

Centres (CDCs) in the UK and has now received an extension to the

pilot contract with Queen Victoria Hospital (QVH). The pilots will

build on the pilot contract for Sussex ICS with QVH and are also

expected to enable direct GP access into CDC diagnostic services,

further streamlining the patient pathway. Furthermore, the company

continues to focus on the development of its Bleepa product, and

its commercial release should underpin its sales prospects going

forward. Despite the trading progress, concerns regarding well

publicised issues with the NHS and muted investor interest in the

healthcare sector, has impacted the share price negatively.

On the positive side, we have seen many

companies in the portfolio report solid trading performances over

the period which have been reflected in their share prices and

contribute positively to the portfolio performance. This included

construction materials group Breedon, who continued to benefit from

its dynamic pricing strategy and focus on operational excellence

throughout the year, putting them in a strong position despite

macro-economic and industry headwinds. As a result, the company had

a series of revenue and profit upgrades during the year.

Craneware, a provider of data systems to US

healthcare providers, recently posted interim results which

highlighted a return to positive trading and new momentum against a

backdrop of improving market conditions across its market. The

company reported significant increases in sales to both existing

and new customers, with customer retention at an all-time high. The

management team remains committed to growth and is confident in the

short-term and longer-term trading outlook. Craneware is positioned

as a leader in Value Cycle Solutions for the US healthcare market

and remains well placed to benefit from positive market dynamics as

the industry recovers. We believe that the size of the market

opportunity is significant, and the company continues to invest in

R&D and innovation to capitalise on this opportunity.

Ergomed, a pharmaceutical services company,

performed strongly during the first half of the year, recording

strong revenue and profit growth. Later in the year the company was

approached by Permira, a private equity firm, and the bid was duly

accepted, and hence we sold our shares for £9.8 million proceeds,

recognising a profit on disposal of £8.6 million.

In our private company holdings both Popsa and

Hasgrove had their valuations increased over the year; Popsa was

valued upwards during the period due to good trading performance

over the year and Hasgrove has a growing recurring revenue base and

a strong balance sheet. This, coupled with general market weakness

that impacted quoted company share price performance, resulted in

an increased proportion of unquoted investments in the

portfolio.

Portfolio activity

Having made one qualifying investment at a total cost of £0.5

million in the first half of the year, we added one further

qualifying investment of £1.6 million as well as five follow-on

investments totalling £3.7 million in the second half of the year.

This made a total investment of £5.8 million in qualifying

investments for the year, an increase on last year’s £4.9 million.

Post the year end, we have invested a further £0.2 million into one

qualifying investment.

We invested in two new qualifying issues in the

year, Tan Delta Systems plc and Eden Research plc. In the second

half of the year we made follow-on investments into Haydale

Graphene Industries plc, Rosslyn Data Technologies plc, GENinCode

plc, Equipmake Holdings plc and Verici Dx plc. In August 2023, we

made a £0.5 million investment in Tan Delta Systems plc, a global

manufacturer of real-time oil quality monitoring sensors and

systems and a new entrant to AIM. In September 2023, we invested

approximately £1.6 million in Eden Research plc, a company that

develops and supplies biopesticide products and natural

microencapsulation technologies.

During the year we took profits from rising

share prices, selling part of our holdings in nine companies. We

also fully disposed of eight holdings, Adept Telecom plc, Ergomed

plc, Osirium Technologies plc, Itsarm plc, Clean Power Hydrogen

plc, Velocys plc, Polarean Imaging plc and Glantus Holdings plc.

Disposals made a £3.5 million gain over original cost and generated

£14.0 million of cash proceeds. Due to taking exceptional profits

on some of these disposals, most notably the full disposal of

Ergomed, the Board is proposing a special dividend of 4.9p which

will be paid at the same time as the final dividend.

Non-qualifying investments are used to manage

liquidity while awaiting new qualifying investment opportunities.

Although we still hold some existing non-qualifying AIM holdings

where we see the opportunity for further share price progress, we

continued to reduce some of these holdings in the year under

review. During the year we increased our holdings in the FP Octopus

Micro Cap Fund, FP Octopus Multi Cap Income Fund and the FP Octopus

Future Generation Fund, investing a total of £1.7 million over the

period. We also disposed of part of our holding in FP Octopus UK

Multi Cap Income Fund for £2.6 million.

Liquidity

The issue of liquidity within investment funds has remained a topic

of discussion this year. Shareholders may be interested to know

that at the year end 53.8% of the Company’s net assets were held in

individual quoted shares, 7.6% were held in unquoted single company

investments and 37.8% were held in cash or collective investment

funds providing short-term liquidity. Shareholders should be aware

that a proportion of the quoted holdings may have limited liquidity

owing to the size of the investee company and the overall

proportion held by the Company.

VCT regulations

There have been no further changes to the VCT regulations since the

publication of the previous set of audited accounts, however the

sunset clause was extended to 2035 in the Autumn statement. The key

requirements are that 30% of funds raised should be invested in

qualifying holdings within twelve months of the end of the

accounting period in which the shares were issued, and the Company

has to maintain a minimum of 80% of the portfolio (at cost)

invested in qualifying holdings. We remain committed to maintaining

a threshold of quality and to invest where we see the potential for

returns from growth. Over time there has been a gradual change to

the profile of the portfolio towards earlier-stage companies.

However, we continue to hold the larger market capitalisation

companies, in which we invested several years ago as qualifying

companies, or which we bought in the market prior to the rule

changes, where we see the potential for them to continue to

grow.

In order to qualify, companies must:

• have fewer than 250 full-time equivalent employees;

• have less than £15 million of gross assets at the time of

investment and no more than £16 million immediately post

investment;

• be less than seven years old from the date of their first

commercial sale (or ten years if a knowledge intensive company) if

raising State Aided (i.e. VCT) funds for the first time;

• have raised no more than £5 million of State Aided funds in the

previous 12 months and less than the lifetime limit of £12 million

(or £10 million in 12 months and a £20 million lifetime limit if a

knowledge intensive company); and

• produce a business plan to show that the funds are being raised

for growth and development.

Outlook and future

prospects

The portfolio contains 88 holdings with investments across a wide

range of sectors. The balance of holdings in the portfolio is

towards profitable companies and many are still trading in line or

above market expectations. With many small companies trading below

their long-term average, we still see good growth potential when

the market recovers.

Macro-economic dynamics remain a key focus and

the timing of interest rate cuts will be critical. Although the

consensus among economists indicates that interest rates have

peaked, a cut in interest rates sooner rather than later will

likely be a strong catalyst for a much-needed market sentiment

boost. However, the timing of the interest rate cut will likely be

impacted by the Prime Minister’s recent decision to call a general

election on 4 July, earlier than the expected Autumn date.

The Octopus Quoted Companies team

Viability statement

In accordance with provision 4.31 of the UK

Corporate Governance Code 2018, the Directors have assessed the

prospects of the Company over a longer period than the twelve

months required by the ‘going concern’ provision. The Board

conducted this review for a period of five years, which was

considered to be a reasonable time horizon given that the Company

has raised funds under an offer for subscription which closed to new

applications on 21 December 2023 and, under VCT rules, subscribing

investors are required to hold their investment for a five-year

period in order to benefit from the associated tax reliefs. The

Board regularly considers the Company’s strategy, including

investor demand for the Company’s shares, and a five-year period is

considered to be a reasonable time horizon for this.

The Board carried out a robust assessment of the

emerging and principal risks facing the Company and its current

position. This includes the impact of the cost of living crisis,

the unstable economic environment and any other risks which may

adversely impact its business model, future performance, solvency

or liquidity. Particular consideration was given to the Company’s

reliance on, and close working relationship with, the Investment

Manager. The principal risks faced by the Company and the

procedures in place to monitor and mitigate them are set out

below.

The Board has also considered the liquidity of

the underlying investments and the Company’s cash flow projections

considering the material inflows and outflows of the Company

including investment activity, buybacks, dividends and fees and

found these to be realistic and reasonable. The Company’s cash flow

includes cash equivalents which are short-term, highly liquid

investments.

Based on the above assessment the Board confirms

that it has a reasonable expectation that the Company will be able

to continue in operation and meet its liabilities as they fall due

over the five-year period to 28 February 2029.

Risk and risk management

Principal risks, risk management and regulatory

environment

In accordance with the Listing Rules under which the Company

operates, the Board is required to comment on the potential risks

and uncertainties which could have a material impact on the

Company’s performance.

The Board carries out a review of the risk

environment in which the Company operates. The main areas of risk

identified by the Board are as follows:

|

Risk |

Mitigation |

|

Investment performance: The focus of the Company’s

investments is into VCT qualifying companies quoted on AIM and the

AQSE, which by their nature entail a higher level of risk and lower

liquidity than investments in larger quoted companies. |

The Investment Manager has significant experience and a strong track

record of investing in AIM and AQSE companies, and appropriate due

diligence is undertaken on every new investment. The overall risk

in the portfolio is mitigated by maintaining a wide spread of

holdings in terms of financing stage, age, industry sector and

business models. The Board reviews the investment portfolio with

the Investment Manager on a regular basis. |

VCT qualifying status risk: The Company is

required at all times to observe the conditions for the maintenance

of HMRC approved VCT status. The loss of such approval could lead

to the Company and its investors losing access to the tax benefits

associated with VCT status and, in certain circumstances, to

investors being required to repay the initial income tax relief on

their investment.

|

Prior to investment, the Investment Manager seeks assurance from

the Company’s VCT status adviser that the investment will meet the

legislative requirements for VCT investments.

On an ongoing basis, the Investment Manager monitors the Company’s

compliance with VCT regulations on a current and forecast basis to

ensure ongoing compliance with VCT legislation. Regular updates are

provided to the Board throughout the year.

The VCT status adviser formally reviews the Company’s compliance

with VCT regulations on a bi-annual basis and reports their results

to the Board. |

|

Operational risk (reliance on Octopus): The Board

is reliant on the Investment Manager to manage investments

effectively, and manage the services of a number of third parties,

in particular the registrar and tax advisers. A failure of the

systems or controls at the Investment Manager or third-party

providers could lead to an inability to provide accurate reporting

and to ensure adherence to VCT and other regulatory rules. |

The Board reviews the system of internal control, both financial and

non-financial, operated by the Investment Manager (to the extent the

latter are relevant to the Company’s internal controls). These

include controls that are designed to ensure that the Company’s

assets are safeguarded, that proper accounting records are

maintained, and that regulatory reporting requirements are met.

Feedback on other third parties is reported to the Board on at

least an annual basis, including adherence to Service Level

Agreements where relevant. |

|

Information security: A loss of key data could

result in a data breach and fines. The Board is reliant on the

Investment Manager and third parties to take appropriate measures

to prevent a loss of confidential customer information. |

Annual due diligence is conducted on third parties which includes a

review of their controls for information security. The Investment

Manager has a dedicated information security team and a third party

is engaged to provide continual protection in this area. A security

framework is in place to help prevent malicious events. The

Investment Manager reports to the Board on an annual basis to

update them on relevant information security arrangements.

Significant and relevant information security breaches are escalated

to the Board when they occur. |

|

Economic and price risk: Events such as an

economic recession, movement in interest rates, inflation, political

instability and rising living costs could cause volatility in the

market, adversely impacting the valuation of investments. This

could result in a reduction in the value of the Company’s

assets. |

The Company invests in a diverse portfolio of companies across a

range of sectors, which helps to mitigate against the impact of

performance in any one sector. The Company also maintains adequate

liquidity to make sure it can continue to provide follow-on

investment to those portfolio companies which require it and which

is supported by the individual investment case.

The Investment Manager monitors the impact of macroeconomic

conditions on an ongoing basis and provides updates to the Board at

least quarterly. |

Regulatory and reputational risk/legislative: A

change to the VCT regulations could adversely impact the Company by

restricting the companies the Company can invest in under its

current strategy. Similarly, changes to VCT tax reliefs for

investors could make VCTs less attractive and impact the Company’s

ability to raise further funds.

Failure to adhere with other relevant legislation and regulation

could result in reputational damage and/or fines. |

The Investment Manager engages with HM Treasury and industry bodies

to demonstrate the positive benefits of VCTs in terms of growing UK

companies, creating jobs and increasing tax revenue, and to help

shape any change to VCT legislation.

The Investment Manager employs individuals with expertise across

the legislation and regulation relevant to the Company. Individuals

receive ongoing training and external experts are engaged where

required. |

|

Liquidity/cash flow risk: The risk that the

Company’s available cash will not be sufficient to meet its financial

obligations. The Company invests in smaller companies, which are

inherently less liquid than stocks on the main market. Therefore,

these may be difficult to realise for their fair market value at

short notice. |

The Investment Manager prepares cash flow forecasts to make sure

cash levels are maintained in accordance with policies agreed with

the Board. The Company’s overall liquidity levels are monitored on

a quarterly basis by the Board, with close monitoring of available

cash resources. The Company maintains sufficient cash and readily

realisable securities, including money market funds and OEICs,

which can be accessed at short notice. As at 29 February 2024,

27.0% of net assets were held in cash and cash equivalents and

10.8% in OEICs, realisable in seven business days. |

|

Valuation risk: For smaller companies or illiquid

shares, establishing a fair value can be difficult due to the lack of

readily available market data for similar shares, resulting in a

limited number of external reference points. |

Investments in companies traded on AIM and AQSE are valued by the

Investment Manager using closing bid prices as reported on

Bloomberg. Where investments are in unquoted companies or where

there are indicators bid price is not appropriate, alternative

valuation techniques are used in accordance with the International

Private Equity and Venture Capital (IPEV) guidelines.

Valuations of unquoted portfolio companies are performed by

appropriately experienced staff, with detailed knowledge of both the

portfolio company and the market in which it operates. These

valuations are then subject to review and approval by the Octopus

Valuations Committee, comprised of staff who are independent of the

Investment team and with relevant knowledge of unquoted company

valuations. The Board reviews valuations after they have been

agreed by the Octopus Valuations Committee.

Investment in FP Octopus UK Micro Cap Growth Fund, FP Octopus UK

Multi Cap Income Fund and FP Octopus UK Future Generations Fund are

all valued with reference to the daily prices which are published

by Fund Partners, the Authorised Corporate Director. |

Emerging risks

The Board has considered emerging risks. The Board seeks to

mitigate emerging risks and those noted below by setting policy,

regular review of performance and monitoring progress and

compliance. In the mitigation and management of these risks, the

Board applies the principles detailed in the Financial Reporting

Council’s Guidance on Risk Management, Internal Control and Related

Financial and Business Reporting.

The following are some of the potential emerging

risks that the Board and the Investment Manager are currently

monitoring:

• Geo-political protectionism.

• Climate change.

Directors' responsibilities

statement

The Directors are responsible for preparing the annual report and

accounts in accordance with applicable law and regulations.

Company law requires the Directors to prepare

financial statements for each financial year. Under that law the

Directors are required to prepare the financial statements and have

elected to prepare the Company’s financial statements in accordance

with United Kingdom Generally Accepted Accounting Practice (United

Kingdom Accounting Standards and applicable law) including FRS 102

– ‘The Financial Reporting Standard applicable in the UK and

Republic of Ireland’. Under company law the Directors must not

approve the financial statements unless they are satisfied that

they give a true and fair view of the state of affairs of the

Company and of the profit or loss for the Company for that

period.

In preparing these financial statements, the

Directors are required to:

• select suitable accounting policies and then

apply them consistently;

• make judgements and accounting estimates that are reasonable and

prudent;

• state whether applicable UK accounting standards have been

followed, subject to any material departures disclosed and

explained in the financial statements;

• prepare the financial statements on the going concern basis

unless it is inappropriate to presume that the Company will

continue in business; and

• prepare a strategic report, a Director’s report and Director’s

remuneration report which comply with the requirements of the

Companies Act 2006.

The Directors are responsible for keeping

adequate accounting records that are sufficient to show and explain

the Company’s transactions and disclose with reasonable accuracy at

any time the financial position of the Company and enable them to

ensure that the financial statements comply with the Companies Act

2006. They are also responsible for safeguarding the assets of the

Company and hence for taking reasonable steps for the prevention

and detection of fraud and other irregularities.

The Directors are responsible for ensuring that

the annual report and accounts, taken as a whole, are fair,

balanced, understandable and provide the information necessary for

shareholders to assess the Company’s position and performance,

business model and strategy.

Website publication

The Directors are responsible for ensuring the annual report and

the accounts are made available on a website. Financial statements

are published on the Investment Manager’s website in accordance

with legislation in the United Kingdom governing the preparation

and dissemination of financial statements, which may vary from

legislation in other jurisdictions. The maintenance and integrity

of the Company’s website is the responsibility of the Directors.

The Directors’ responsibility also extends to the ongoing integrity

of the financial statements contained therein.

Directors’ responsibilities pursuant to

Disclosure Guidance and Transparency Rule 4 (DTR4)

Neal Ransome (Chair), Andrew Boteler, Stephen

Hazell-Smith and Joanne Parfrey, the Directors, confirm to the best

of their knowledge that:

• the financial statements have been prepared in

accordance with the Financial Reporting Standard applicable in the

United Kingdom and Republic of Ireland (‘FRS 102’) and give a true

and fair view of the assets, liabilities, financial position and

profit and loss of the Company; and

• the annual report includes a fair review of

the development and performance of the business and the financial

position of the Company, together with a description of the

principal risks and uncertainties that it faces.

By Order of the Board

Neal Ransome

Chair

Income statement

|

|

Year to 29 February 2024 |

Year to 28 February 2023 |

|

|

Revenue |

Capital |

Total |

Revenue |

Capital |

Total |

|

|

£'000 |

£’000 |

£’000 |

£'000 |

£’000 |

£’000 |

|

Gain on disposal of fixed asset investments |

- |

813 |

813 |

- |

207 |

207 |

|

Loss on disposal of current asset investments |

- |

(246) |

(246) |

- |

- |

- |

|

Loss on valuation of fixed asset investments |

- |

(16,322) |

(16,322) |

- |

(29,192) |

(29,192) |

|

Loss on valuation of current asset investments |

- |

(1,137) |

(1,137) |

- |

(2,233) |

(2,233) |

|

Investment income |

2,060 |

- |

2,060 |

1,068 |

24 |

1,092 |

|

Investment management fees |

(555) |

(1,666) |

(2,221) |

(650) |

(1,949) |

(2,599) |

|

Other expenses |

(681) |

- |

(681) |

(689) |

- |

(689) |

|

Profit/(loss) before tax |

824 |

(18,558) |

(17,734) |

(271) |

(33,143) |

(33,414) |

|

Tax |

- |

- |

- |

- |

- |

- |

|

Total comprehensive loss after tax |

824 |

(18,558) |

(17,734) |

(271) |

(33,143) |

(33,414) |

|

Earnings per share – basic and diluted |

0.4p |

(10.0p) |

(9.6p) |

(0.2p) |

(20.0p) |

(20.2p) |

• The ‘Total’ column of this statement represents the statutory

income statement of the Company; the supplementary revenue return

and capital return columns have been prepared in accordance with

the AIC Statement of Recommended Practice.

• All revenue and capital items in the above statement derive from

continuing operations.

• The Company has only one class of business and derives its income

from investments made in shares and securities and from bank and

money market funds, as well as OEIC funds.

The Company has no recognised gains or losses other than the

results for the period as set out above. Accordingly, a statement

of comprehensive income is not required.

The accompanying notes are an integral part of the Financial

Statements.

Balance sheet

|

|

As at 29 February 2024 |

As at 28 February 2023 |

|

|

£’000 |

£’000 |

£’000 |

£’000 |

|

Fixed asset investments |

|

80,350 |

|

102,667 |

|

Current assets: |

|

|

|

|

|

Investments |

13,897 |

|

16,188 |

|

|

Money market funds |

33,641 |

|

21,433 |

|

|

Debtors |

666 |

|

354 |

|

|

Applications cash1 |

4 |

|

3 |

|

|

Cash at bank |

1,276 |

|

1,437 |

|

|

|

49,484 |

|

39,415 |

|

|

Creditors: amounts falling due within one year |

(725) |

|

(860) |

|

|

Net current assets |

|

48,759 |

|

38,555 |

|

Total assets less current liabilities |

|

129,109 |

|

141,222 |

|

Called up equity share capital |

|

2,038 |

|

1,798 |

|

Share premium |

|

18,041 |

|

18,924 |

|

Capital redemption reserve |

|

341 |

|

279 |

|

Special distributable reserve |

|

124,213 |

|

118,015 |

|

Capital reserve realised |

|

(24,622) |

|

(23,143) |

|

Capital reserve unrealised |

|

10,470 |

|

27,545 |

|

Revenue reserve |

|

(1,372) |

|

(2,196) |

|

Total equity shareholders’ funds |

|

129,109 |

|

141,222 |

|

NAV per share – basic and diluted |

|

63.3p |

|

78.5p |

1Cash held but not yet allotted

The statements were approved by the Directors and authorised for

issue on 6 June 2024 and are signed on their behalf by:

Neal Ransome

Chair

Company number: 03477519

The accompanying notes are an integral part of

the Financial Statements.

Statement of changes in

equity

| |

Share capital |

Share premium |

Capital redemption reserve |

Special distributable

reserves1 |

Capital reserve

realised1 |

Capital reserve unrealised |

Revenue reserve1 |

Total |

|

|

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

|

As at 1 March 2023 |

1,798 |

18,924 |

279 |

118,015 |

(23,143) |

27,545 |

(2,196) |

141,222 |

|

Comprehensive income for the year: |

|

|

|

|

|

|

|

|

| Management fee allocated as

capital expenditure |

- |

- |

- |

- |

(1,666) |

- |

- |

(1,666) |

| Current period gain on

disposal |

- |

- |

- |

- |

571 |

- |

- |

571 |

| Current period loss on

revaluation of investments |

- |

- |

- |

- |

- |

(17,459) |

- |

(17,459) |

| Capital investment income |

- |

- |

- |

- |

- |

- |

- |

- |

|

Profit after tax |

- |

- |

- |

- |

- |

- |

824 |

824 |

|

Total comprehensive loss for the year |

- |

- |

- |

- |

(1,095) |

(17,459) |

824 |

(17,730) |

Contributions by and

distributions

to owners: |

|

|

|

|

|

|

|

|

| Repurchase and cancellation of

own shares |

(62) |

- |

62 |

(4,083) |

- |

- |

- |

(4,083) |

| Issue of shares |

302 |

20,082 |

- |

- |

- |

- |

- |

20,384 |

| Share issue costs |

- |

(1,158) |

- |

- |

- |

- |

- |

(1,158) |

|

Dividends paid |

- |

- |

- |

(9,526) |

- |

- |

- |

(9,526) |

|

Total contributions by and distributions to

owners: |

240 |

18,924 |

62 |

(13,609) |

- |

- |

- |

5,617 |

| Other

movements |

|

|

|

|

|

|

|

|

| Cancellation of share

premium |

- |

(19,807) |

- |

19,807 |

- |

- |

- |

- |

| Prior years’ holding gains now

realised |

- |

- |

- |

- |

2,871 |

(2,871) |

- |

- |

|

Transfer in reserves |

- |

- |

- |

- |

(3,255) |

3,255 |

- |

- |

|

Total other movements |

- |

(19,807) |

- |

19,807 |

(384) |

384 |

- |

- |

|

Balance as at 29 February 2024 |

2,038 |

18,041 |

341 |

124,213 |

(24,622) |

10,470 |

(1,372) |

129,109 |

| |

Share capital |

Share premium |

Capital redemption reserve |

Special distributable

reserves1 |

Capital reserve

realised1 |

Capital reserve unrealised |

Revenue reserve1 |

Total |

|

|

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

|

As at 1 March 2022 |

1,605 |

25,450 |

236 |

105,258 |

(20,762) |

58,307 |

(1,925) |

168,169 |

|

Comprehensive income for the year: |

|

|

|

|

|

|

|

|

| Management fee allocated as

capital expenditure |

- |

- |

- |

- |

(1,949) |

- |

- |

(1,949) |

| Current period gain on

disposal |

- |

- |

- |

- |

207 |

- |

- |

207 |

| Current period loss on

revaluation of investments |

- |

- |

- |

- |

- |

(31,425) |

- |

(31,425) |

| Capital investment income |

- |

- |

- |

- |

24 |

- |

- |

24 |

|

Loss after tax |

- |

- |

- |

- |

- |

- |

(271) |

(271) |

|

Total comprehensive loss for the year |

- |

- |

- |

- |

(1,718) |

(31,425) |

(271) |

(33,414) |

Contributions by and

distributions

to owners: |

|

|

|

|

|

|

|

|

| Repurchase and cancellation of

own shares |

(43) |

- |

43 |

(3,567) |

- |

- |

- |

(3,567) |

| Issue of shares |

236 |

19,742 |

- |

- |

- |

- |

- |

19,978 |

| Share issue costs |

- |

(668) |

- |

- |

- |

- |

- |

(668) |

|

Dividends paid |

- |

- |

- |

(9,276) |

- |

- |

- |

(9,276) |

|

Total contributions by and distributions to

owners: |

193 |

19,074 |

43 |

(12,843) |

- |

- |

- |

6,467 |

| Other

movements |

|

|

|

|

|

|

|

|

| Cancellation of share

premium |

- |

(25,600) |

- |

25,600 |

- |

- |

- |

- |

|

Prior years’ holding gains now realised |

- |

- |

- |

- |

(663) |

663 |

- |

- |

|

Total other movements |

- |

(25,600) |

- |

25,600 |

(663) |

663 |

- |

- |

|

Balance as at 28 February 2023 |

1,798 |

18,924 |

279 |

118,015 |

(23,143) |

27,545 |

(2,196) |

141,222 |

1Included in these reserves is an amount of

£98,219,000 (2023: £92,676,000) which is considered distributable

to shareholders.

Cash flow statement

| |

Year to 29 February

2024 |

Year to 28 February

2023 |

|

|

£'000 |

£'000 |

Cash flows from operating activities

|

|

|

| |

|

| Loss before tax |

(17,734) |

(33,414) |

| Adjustments for: |

|

|

| Decrease/(increase) in

debtors |

131 |

(25) |

| (Decrease)/increase in

creditors |

(134) |

(794) |

| Gain on disposal of fixed asset

investments |

(813) |

(207) |

| Loss on disposal of current asset

investments |

246 |

– |

| Loss on valuation of fixed asset

investments |

16,322 |

29,192 |

| Loss on valuation of current

asset investments |

1,137 |

2,233 |

|

Non-cash distributions |

– |

(24) |

|

Cash utilised in operations |

(845) |

(3,039) |

| Income

taxes paid |

– |

– |

|

Net cash utilised in operating activities |

(845) |

(3,039) |

| |

|

|

| Cash flows from

investing activities |

|

|

| Purchase of fixed asset

investments |

(7,149) |

(4,880) |

| Proceeds from sale of fixed asset

investments |

13,517 |

2,478 |

| Purchase of current asset

investments |

(1,080) |

(1,878) |

|

Proceeds from sale of current asset investments |

1,988 |

– |

Total cash flows generated from/(utilised in)

investing activities |

7,276 |

(4,280) |

| |

|

|

| Cash flows from

financing activities |

|

|

| Movement in applications

account |

(1) |

243 |

| Purchase of own shares |

(4,083) |

(3,567) |

| Proceeds from share issues |

18,558 |

18,217 |

| Share issue costs |

(1,157) |

(668) |

|

Dividends paid (net of DRIS) |

(7,700) |

(7,515) |

|

Net cash flows from financing activities |

5,617 |

6,710 |

|

Increase/(decrease) in cash and cash

equivalents |

12,048 |

(609) |

|

Opening cash and cash equivalents |

22,873 |

23,482 |

|

Closing cash and cash equivalents |

34,921 |

22,873 |

|

|

|

|

| Cash and cash

equivalents is represented by: |

|

|

| Cash at bank |

1,276 |

1,437 |

| Applications cash |

4 |

3 |

| Money

market funds |

33,641 |

21,433 |

|

Total cash and cash equivalents |

34,921 |

22,873 |

The accompanying notes are an integral part of

the Financial Statements.

Post balance sheet events

The following events occurred between the balance sheet date and

the signing of these financial statements.

• A follow-on

investment totalling £196,000 completed in PCI-Pal plc.

• A follow-on

investment totalling £108,000 completed in FP Octopus UK Future

Generations Fund

• A partial disposal

of 257,924 shares in Spectral AI inc. for total consideration of

£340,000.

• A full disposal of 226,273 shares in

Renalytix plc for total consideration of £123,000.

• A full disposal of 295,600 shares in

LoopUp Group plc for total consideration of £1,000.

• A full disposal of

2,955,131 shares in Cordel Group plc for total consideration of

£97,000.

• A full disposal of

45,376 shares in Cirata plc for total consideration of £22,000.

The following shares have been bought back since

the year end:

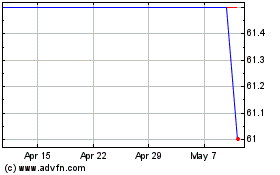

• 21 March 2024:

691,776 shares at a price of 62.1p per share.

• 25 April 2024: 406,159 shares at a

price of 61.2p per share.

• 23 May 2024:

346,056 shares at a price of 63.2p per share.

Notes to the financial

statements

1. Principal accounting

policies

The Company is a Public Limited Company (plc) incorporated in

England and Wales and its registered office is 33 Holborn, London

EC1N 2HT.

The Company’s principal activity is to invest in

a diverse portfolio of predominantly AIM-traded companies with the

aim of providing shareholders with attractive tax-free dividends

and long-term capital growth.

Basis of preparation

The financial statements have been prepared under the historical

cost convention, except for the measurement at fair value of

certain financial instruments, and in accordance with UK Generally

Accepted Accounting Practice (‘GAAP’), including Financial

Reporting Standard 102 – The Financial Reporting Standard

applicable in the United Kingdom and Republic of Ireland’ (‘FRS

102’), and with the Companies Act 2006 and the Statement of

Recommended Practice (‘SORP’) ‘Financial Statements of Investment

Trust Companies and Venture Capital Trusts’ (issued in July

2022).

The principal accounting policies have remained

unchanged from those set out in the Company’s 2023 annual report

and accounts.

2. Income

Accounting policy

Investment income includes interest earned on money market

securities is shown net of income tax withheld at source. Dividend

income is shown net of any related tax credit. Dividends are

allocated to revenue or capital depending on whether the dividend

is of a revenue or capital nature.

Dividends receivable are brought into account

when the Company’s right to receive payment is established and it

is probable that payment will be received. Fixed returns on debt

and money market securities are recognised on a time apportionment

basis so as to reflect the effective yield, provided there is no

reasonable doubt that payment will be received in due course.

Disclosure

|

|

29

February |

28

February |

|

|

2024 |

2023 |

|

|

£’000 |

£’000 |

|

Dividends receivable from fixed asset investments |

866 |

834 |

|

In-specie dividend1 |

– |

24 |

|

Loan note interest receivable |

41 |

45 |

|

Income receivable on money market securities |

1,153 |

189 |

|

|

2,060 |

1,092 |

1In the prior year, the Company

received shares in Verici Dx PLC as a result of an in-specie

dividend from EKF Diagnostics Holdings plc. These have been treated

as capital income.

3. Investment management fees

|

|

29 February 2024 |

28 February 2023 |

|

|

Revenue |

Capital |

Total |

Revenue |

Capital |

Total |

|

|

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

|

Investment management fee |

555 |

1,666 |

2,221 |

650 |

1,949 |

2,599 |

Octopus provides investment management and

accounting and administration services to the Company under a

management agreement which initially ran with Close Investment

Limited from 3 February 1998 and was then novated to Octopus for a

period of five years with effect from 29 July 2008 and may be

terminated at any time thereafter by not less than twelve months’

notice given by either party. No compensation is payable in the

event of terminating the agreement by either party, if the required

notice period is given. The fee payable, should insufficient notice

be given, will be equal to the fee that would have been paid should

continuous service be provided, or the required notice period was

given. The management fee is an annual charge set at 2% of the

Company’s net assets, less deductions outlined below, calculated on

a quarterly basis. The Investment Manager is not entitled to any

annual performance incentive scheme.

During the year Octopus charged gross management

fees of £2,614,000 (2023: £3,067,000). When the various allowances

detailed below are included, the net management fees for the year

are £2,221,000 (2023: £2,599,000). At the year end there was

£499,000 payable to Octopus (2023: £580,000). Octopus received

£243,000 as a result of upfront fees charged on allotments of

Ordinary shares (2023: £282,000).

The Company now pays ongoing adviser charges to

independent financial advisers (‘IFAs’). Ongoing adviser charges

are an ongoing fee of up to 0.5% per annum for a maximum of nine

years paid to advisers who are on an advised and ongoing fee

structure. The Company is rebated for this cost by way of a

reduction in the annual management fee. For the year to 29 February

2024 the rebate received was £140,000 (2023: £183,000).

The Company also facilitates upfront fees to

IFAs where an investor has invested through a financial adviser and

has received upfront advice. Where an investor agrees to an upfront

fee only, the Company can facilitate a payment of an initial

adviser charge of up to 4.5% of the investment amount. If the

investor chooses to pay their intermediary/adviser less than the

maximum initial adviser charge, the remaining amount will be used

for the issue and allotment of additional new shares for the

investor. In these circumstances the Company does not facilitate

ongoing annual payments. To make sure that the Company is not

financially disadvantaged by such payment, a notional ongoing

adviser charge equivalent to 0.5% per annum will be deemed to have

been paid by the Company for a period of nine years. The Company is

rebated for this cost, also by way of a reduction in the annual

management fee. For the year to 29 February 2024 the rebate

received was £171,000 (2023: £202,000).

The Company also receives a reduction in the

management fee for the investments in other Octopus managed funds,

being the Multi Cap, Micro Cap and Future Generations products, to

ensure the Company is not double charged on these products. This

amounted to £80,000 for the year to 29 February 2024 (2023:

£83,000).

The management fee has been allocated 25% to

revenue and 75% to capital, in line with the Board’s expected

long-term return in the form of income and capital gains,

respectively, from the Company’s investment portfolio.

4. Other expenses

Accounting policy

All expenses are accounted for on an accruals basis and are charged

wholly to revenue, apart from management fees which are charged 25%

to revenue and 75% to capital.

The transaction costs incurred when purchasing or selling assets

are written off to the income statement in the period that they

occur.

Disclosure

|

|

29

February |

28

February |

|

|

2024 |

2023 |

|

|

£’000 |

£’000 |

|

IFA charges |

140 |

183 |

|

Directors’ remuneration |

103 |

98 |

|

Registrars’ fees |

69 |

65 |

|

Audit fees |

48 |

43 |

|

Printing and postage |

19 |

23 |

|

VCT monitoring fees |

17 |

13 |

|

Directors’ and officers’ liability insurance |

49 |

50 |

|

Broker’s fees |

6 |

6 |

|

Other administration expenses |

230 |

208 |

|

|

681 |

689 |

The fees payable to the Company’s auditor are

stated net of VAT and the VAT is included within other

administration expenses. No non-audit services were provided by the

Company’s auditor.

The ongoing charges of the Company were 2.1% of

average net assets during the year to 29 February 2024 (2023:

2.1%). Ongoing charges are calculated using the AIC methodology and

exclude exceptional costs and trail commission.

5. Tax

Accounting policy

Corporation tax payable is applied to profits

chargeable to corporation tax, if any, at the current rate. The tax

effect of different items of income/gain and expenditure/loss is

allocated between capital and revenue return on the ‘marginal’

basis as recommended in the SORP.

Deferred tax is recognised on an undiscounted

basis in respect of all timing differences that have originated but

not reversed at the balance sheet date, except as otherwise

indicated.

Deferred tax assets are only recognised to the

extent that it is probable that they will be recovered against the

reversal of deferred tax liabilities or other future taxable

profits.

The corporation tax charge for the year was £nil

(2023: £nil).

Disclosure

|

|

29

February |

28

February |

|

|

2024 |

2023 |

|

Tax reconcilation |

£’000 |

£’000 |

|

Loss before tax |

(17,733) |

(33,414) |

|

Current tax at 24.49% (2023:19.0%) |

(4,329) |

(6,349) |

|

Effects of |

|

|

|

Non-taxable income |

(492) |

(199) |

|

Non-taxbale capital gains |

4,123 |

5,932 |

|

Non-deductible expenses |

(6) |

(4) |

|

Excess management expenses on which deferred tax not

recognised |

704 |

620 |

|

Total tax charge |

- |

- |

Approved VCTs are exempt from tax on capital

gains within the Company. Since the Directors intend that the

Company will continue to conduct its affairs so as to maintain its

approval as a VCT, no deferred tax has been provided in respect of

any capital gains or losses arising on the revaluation or disposal

of investments.

As at 29 February 2024 there is an unrecognised

deferred tax asset of £7,211,000 (2023: £6,551,000) in respect of

accumulated surplus management expenses of £28,844,000 (2023:

£26,204,000), based on a prospective corporation tax rate of 25%

(2023: 25%). This deferred tax asset could in future be used

against taxable profits.

Provided the Company continues to maintain its

current investment profile, it is unlikely that the expenses will

be utilised and that the Company will obtain any benefit from this

asset.

6. Dividends

Accounting policy

Dividends payable are recognised as

distributions in the financial statements when the Company’s

liability to make payment has been established. This liability is

established on the record date, the date on which those

shareholders on the share register are entitled to the

dividend.

Disclosure

|

|

29

February |

28

February |

|

|

2024 |

2023 |

|

|

£’000 |

£’000 |

|

Dividends paid on Ordinary shares during the

year |

|

|

|

Final dividend – 2.5p paid 10 August 2023 (2023: 3.0p) |

4,451 |

4,775 |

|

Interim dividend – 2.5p paid 8 January 2024 (2023: 2.5p) |

5,075 |

4,501 |

|

|

9,526 |

9,276 |

During the year £1,826,000 (2023: £1,761,000) of dividends were

reinvested under the DRIS.

|

|

|

|

|

29

February |

28

February |

|

|

2024 |

2023 |

|

|

£’000 |

£’000 |

|

Dividends paid

and proposed in

respect of the

year |

|

|

|

Interim dividend – 2.5p paid 12 January 2024 (2023: 2.5p) |

5,075 |

4,501 |

|

Special dividend proposed: 4.9p payable 15 August 2024 (2023:

nil) |

9,934 |

- |

|

Final dividend proposed: 2.5p payable 15 August 2024 (2023:

2.5p) |

5,068 |

4,462 |

|

|

20,077 |

8,963 |

Under Section 32 of FRS 102 ‘Events After Balance Sheet Date’,

dividends payable at year end are not recognised as a liability in

the financial statements.

The above proposed final dividend is based on the number of shares

in issue at the date of this report. The actual dividend paid may

differ from this number as the dividend payable will be based on

the number of shares in issue on the record date and will reflect

any changes in the share capital between the year end and the

record date.

|

7. Earnings per share

|

|

29 February 2024 |

28 February 2023 |

|

|

Revenue |

Capital |

Total |

Revenue |

Capital |

Total |

|

Loss attributable to ordinary shareholders (£’000) |

824 |

(18,558) |

(17,734) |

(271) |

(33,143) |

(33,414) |

|

Earnings per ordinary share (p) |

0.4p |

(10.0p) |

(9.6p) |

(0.2p) |

(20.0p) |

(20.2p) |

The earnings per share is based on 185,664,255 Ordinary shares

(2023: 165,688,082, being the weighted average number of shares in

issue during the year), and the loss on ordinary activities after

tax for the year of £17,734,000 (2023: loss £33,414,000).

There are no potentially dilutive capital instruments in issue

and, as such, the basic and diluted earnings per share are

identical.

8. Net asset value per share

|

|

29

February |

28

February |

|

|

2024 |

2023 |

|

Net assets (£’000) |

129,109 |

141,222 |

|

Shares in issue |

203,828,309 |

179,802,084 |

|

NAV per share (p) |

63.3 |

78.5 |

There are no potentially dilutive capital instruments in issue

and, as such, the basic and diluted NAV per share are

identical.

9. Related party

transactions

As at 29 February 2024, Octopus Investments Nominees Limited (OINL)

held 0 shares (2023: 7,598) in the Company as beneficial owner from

shareholders to protect their interests after delays or errors with

shareholder instructions and other similar administrative tasks.

Throughout the period to 29 February 2024 OINL purchased 2,791

shares (2023: 9,875) at a cost of £2,000 (2023: £9,000) and sold

10,389 shares (2023: 3,166) for proceeds of £7,000 (2023: £3,000).

In accordance with the listing rules, this is classed as a related

party transaction as Octopus, the Investment Manager, and OINL are

part of the same group of companies. Any such future transactions,

where OINL takes over the legal and beneficial ownership of Company