Acquisition

August 16 2010 - 1:00AM

UK Regulatory

TIDMPALM

RNS Number : 0970R

Asian Plantations Limited

16 August 2010

16 August 2010

Asian Plantations Limited

("APL" or the "Company")

Subscription,

Proposed acquisition of Fortune Plantations

and

Holding in Company

Subscription

Asian Plantations Limited (LSE: PALM), a palm oil plantation company with

operations in Malaysia, is pleased to announce that the Company has entered into

subscription agreements with a number of institutional investors for a total of

3,868,083 new ordinary shares of no par value ("Ordinary Shares") of the Company

(the "Subscription Shares") at a subscription price of 110 pence per share (the

"Subscription"). The Subscription will raise GBP4.25 million (circa. US$6.6

million), gross of expenses. The Subscription price represents a 46.7 per cent.

premium to the Company's placing price of 75 pence per share at admission to

trading on AIM on 30 November 2009.

The Company intends to use the proceeds from the Subscription to complete the

conditional acquisition of Fortune Plantation Sdn. Bhd ("Fortune"), which is

described in detail below, and for general working capital purposes.

The Subscription Shares will rank pari passu with all existing Ordinary Shares,

and application will be made for the Subscription Shares to be admitted to

trading on AIM ("Admission"). Admission is expected to take place on 19 August

2010, following which the enlarged issued share capital of the Company will

total 33,444,752 Ordinary Shares. The Company does not hold any shares in

treasury.

Proposed acquisition of Fortune Plantation

The Company is pleased to further announce that it has entered into a

conditional agreement to acquire the entire issued share capital of Fortune (the

"Proposed Acquisition"), which owns a partly developed palm oil plantation

totalling approximately 5,000 hectares in Sarawak, Malaysia (the "Fortune

Estate").

The total consideration for the Proposed Acquisition, which is subject to a

number of conditions, is RM38.7 million (circa. US$12.2 million) and is payable

in two tranches. The initial non-refundable tranche of RM3.9 million (circa.

US$1.2 million) is payable immediately and a further tranche of RM34.8 million

(circa. US$11.0 million) is to be paid within 90 days. The total gross purchase

price per hectare is approximately RM7,737 (circa. US$2,440). Adjusted for land

development works already completed on the Fortune Estate, which effectively

reduce future development capital expenditures, the purchase price per hectare

is approximately RM6,249 (circa. US$1,971).

It is anticipated that the Proposed Acquisition will be completed within a

period of 90 days and the consideration is to be funded with RM24.7 million

(circa. US$7.8 million) from a new nine year debt facility, provided by a local

bank in Malaysia, and RM13.9 million (circa. US$4.4 million) from the net

proceeds of the Subscription. The directors of APL (the "Board") are confident

that all conditions associated with the Proposed Acquisition will be satisfied

but, in the unlikely event that the Proposed Acquisition does not complete, the

net proceeds of the Subscription will be used for general working capital

purposes.

Information on Fortune

The Fortune Estate is less than five kilometres from APL's existing palm oil

plantations and consists of 5,000 hectares of agriculturally titled land. Over

1,000 hectares of this land bank has been cleared and prepared for planting

thereby reducing the Company's required development spend in 2011. Nursery

operations are expected to commence in October 2010, thereby enabling

in-the-ground planting to begin in the final quarter of 2011. The Company

expects, subject to the availability of sufficient working capital, to fully

complete all the in-the-ground planting by the end of 2013.

The audited accounts of Fortune for the year ended 30 June 2009, which have been

prepared under Malaysian GAAP, showed revenues of RM16,010 (circa. US$5,049) and

net losses of RM469,973 (circa. US$148,204). Gross assets as at 30 June 2009

totalled RM17.8 million (circa. US$5.6 million).

The Board believes that the Proposed Acquisition offers numerous strategic

benefits to APL, including, inter alia, the following:

· increasing the scale of the Company's existing operations to

approximately 15,645 hectares of plantation land, which is in line with the

Company's stated objective of exceeding 20,000 hectares within two years of

admission to trading on AIM; and

· providing the Company with the additional scale needed to seek to

meaningfully increase the size of its milling complex, currently under planning

development, to an initial 90 tonnes per hour and upgradeable to 120 tonnes per

hour. A larger milling operation enables improved economies of scale and allows

for better competitive positioning for the processing of third party crop.

In addition, the Board believes that the Company has secured an attractive

valuation of the Fortune Estate, relative to other publicly announced land

transactions in East Malaysia, at a time of increasing scarcity of agricultural

land in Malaysia.

Holding in Company

Steadfast Financial L.P. ("Steadfast") is participating in the Subscription by

subscribing for 2,860,000 Subscription Shares. Following Admission, Steadfast,

through its investment funds, will collectively hold 7,660,000 Ordinary Shares,

representing 22.9 per cent. of the enlarged issued share capital of the Company.

Due to the size of Steadfast's existing shareholding in the Company of 16.2 per

cent., the participation of Steadfast in the Subscription is considered to be a

related party transaction under the AIM Rules for Companies. Accordingly, the

Board considers, having consulted with Strand Hanson Limited, that the terms of

the Subscription are fair and reasonable insofar as the Company's shareholders

are concerned.

Graeme Brown, APL's Joint Chief Executive Officer, commenting on the Proposed

Acquisition, said:

"The acquisition of the Fortune Estate is a transformational development for the

Company. We now have a projected fresh fruit bunch ("FFB") output which

justifies a significant increase to the scale of our milling complex to 90

tonnes per hour, upgradeable to 120 tonnes per hour. We expect our mill to be

operational in 2012. It will incorporate proven vertical sterilizer technology

and environmentally friendly processing technologies, such as methane recapture.

In addition, our combined estates are now larger than that of several

long-standing plantation companies that are publicly traded in Malaysia and

Singapore. We are on track to fully complete the plantings of our first 4,795

hectare estate by year-end 2011 and remain confident that we can achieve the

Company's stated objective of owning in excess of 20,000 hectares within two

years of listing."

Dennis Melka, APL's Joint Chief Executive Officer, commenting on the Proposed

Acquisition, said:

"We are delighted to have received such significant demand for our Subscription

from existing and new institutional shareholders. The new funds raised further

strengthen the Company as it continues its strategy of consolidating scarce

agriculturally-titled land parcels in Malaysia.

The Fortune Estate was acquired in a non-competitive process, driven by the

Board's local relationships, and at an attractive valuation per hectare, being

within 5 per cent. of the value the Company paid for its original estate

acquisition in 2007. Particularly given the numerous recent announcements by

global and regional oilseed processing players seeking upward, vertical

integration into the Southeast Asian plantation sector, we are of the opinion

that the Board's strategy to create a leading Malaysian focused plantation

company has and will continue to create shareholder value.

The next 12 months are an exciting time for the Company, as we initiate

harvesting on our fields planted in 2009 and continue our land consolidation

strategy. We are also confident that we will be in a position to complete the

vast majority of our plantings over the next 18 months and we wish to thank all

our shareholders for their continued support as we work towards bringing our

estates to full maturity."

For further information contact:

+---------------------------------+---------------------------+

| Asian Plantations Limited | |

| Dennis Melka, Joint Chief | |

| Executive Officer | Tel: +65 9878 4171 |

| Graeme Brown, Joint Chief | |

| Executive Officer | Tel: +60 19 8660221 |

| | |

+---------------------------------+---------------------------+

| Strand Hanson Limited | |

| James Harris | Tel: +44 (0)20 7409 3494 |

| Paul Cocker | |

| Liam Buswell | |

| | |

+---------------------------------+---------------------------+

| Mirabaud Securities LLP | |

| Rory Scott | Tel: +44 (0)20 7878 3360 |

| | |

+---------------------------------+---------------------------+

| Bankside Consultants | |

| Simon Rothschild | Tel: +44 (0)20 7367 8871 |

| Louise Mason | Tel: +44 (0)20 7367 8872 |

| | |

+---------------------------------+---------------------------+

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACQKMGMRLKVGGZM

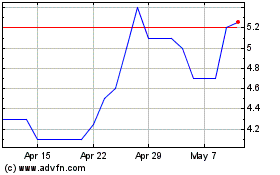

Panther Metals (LSE:PALM)

Historical Stock Chart

From Jun 2024 to Jul 2024

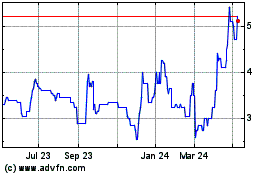

Panther Metals (LSE:PALM)

Historical Stock Chart

From Jul 2023 to Jul 2024