TIDMPALM

RNS Number : 2450P

Asian Plantations Limited

30 September 2013

30 September 2013

Asian Plantations Ltd

("APL" or the "Company")

Interim Results for the Six Months ended 30 June 2013

Asian Plantations Limited (LSE: PALM), a palm oil plantation

company with operations in Malaysia, is pleased to announce its

unaudited results for the six month period ended 30 June 2013.

Highlights

-- US$963,000 of revenue reported (2012: US$1,186,000), a

decrease of 18%, based on production and sale of 7,460 tonnes of

fresh fruit bunches ("FFB"), 2012: 6,065 tonnes of FFB. Despite

rising volumes, the decrease in revenue is attributable to: (i)

lower international crude palm oil ("CPO") pricing; (ii)

unfavourable exchange rate movements; and (iii) a delay in issuance

of regulatory approvals to process third party FFB. The necessary

local approvals were subsequently received in June 2013 and the

Company's processing of third party FFB has grown strongly from

7,919 tonnes in July 2013 to 16,271 tonnes PCM in August 2013and

has exceeded 23,000 tonnes for the month of September 2013.

-- Total assets have increased to US$198.9 m.

-- The Company expects to sell in excess of 26,000 tonnes of CPO

and approximately 5,000 tonnes of palm kernel ("PK") in the second

half of 2013.

Post-Balance Sheet Events

-- Issuance of final two tranches of the convertible bond

totaling US$10,000,000 to OCBC Bank on 14 and 23 August 2013. Terms

remain unchanged from those previously announced and the total

US$15,000,000 convertible bond has an effective conversion price of

285 pence per share based on current exchange rates.

-- Completion of the Company's final land acquisition of 3,852

hectares, Grand Performance Sdn Bhd, on 21 August 2013.

-END-

For further information contact:

Asian Plantations Limited

Graeme Brown, Co-Founder & Joint Chief Tel: +65 6325 0970

Executive Officer

Dennis Melka, Co-Founder & Joint Chief

Executive Officer

Strand Hanson Limited

James Harris Tel: +44 (0) 20 7409

James Spinney 3494

Macquarie Capital (Europe) Limited

Steve Baldwin Tel: +44 (0) 203

Dan Iacopetti 037 2000

Panmure Gordon (UK) Limited

Tom Nicholson Tel: +65 6824 8204

Callum Stewart Tel: +44 (0) 20 7459

3600

Bankside Consultants

Simon Rothschild Tel: +44 (0) 20 7367

8871

Unaudited Interim Condensed Consolidated Income Statement

for the six-month period ended 30 June 2013

Note Six Months Six Months

Ended Ended

30.6.2013 30.6.2012

USD'000 USD'000

Unaudited Unaudited

Revenue 6 963 1,186

Cost of sales 7 (3,444) (515)

Gross (loss)/profit (2,481) 671

Other operating income 8 674 279

Administrative expenses 9 (1,774) (2,761)

Other operating expenses 10 (709) (1,009)

Operating loss (4,290) (2,820)

Finance costs 11 (3,622) (1,528)

Loss before tax (7,912) (4,348)

Income tax benefit 12 991 104

Loss for the period (6,921) (4,244)

Attributable to :

Owners of the Company (6,920) (4,244)

Non-controlling interests (1) -*

(6,921) (4,244)

Loss per share attributable

to owners of the Company

(cents per share)

Basic 13 (14.86) (9.18)

Diluted 13 (14.86) (9.18)

* Amount less than USD1,000

Unaudited Interim Condensed Consolidated Statement of

Comprehensive Income

for the six-month period ended 30 June 2013

Six Months Six Months

Ended Ended

30.6.2013 30.6.2012

USD'000 USD'000

Unaudited Unaudited

Loss for the period (6,921) (4,244)

Other comprehensive income

Items that may be reclassified subsequently

to profit or loss:

Foreign currency translation adjustments (2,066) (2)

Total comprehensive income for the

period, net of tax (8,987) (4,246)

Attributable to:

Owners of the Company (8,986) (4,246)

Non-controlling interests (1) -*

(8,987) (4,246)

* Amount less than USD1,000

Unaudited Interim Condensed Consolidated Statement of Financial

Position as at 30 June 2013

Note 30.6.2013 31.12.2012

USD'000 USD'000

Unaudited Audited

ASSETS

Non-current assets

Deferred tax assets 549 178

Property, plant and equipment 14 61,903 53,227

Biological assets 15 59,794 55,287

Land use rights 16 50,988 53,517

Goodwill on consolidation 7,330 7,619

180,564 169,828

Current assets

Inventories 17 2,491 1,724

Trade and other receivables 6,839 6,714

Income tax recoverable 116 99

Prepayments 1,894 2,308

Cash and bank balances 6,997 15,785

18,337 26,630

Total assets 198,901 196,458

EQUITY AND LIABILITIES

Equity

Issued capital 18 89,731 88,594

Accumulated losses (30,565) (23,645)

Other reserves 19 (10,709) (7,916)

Equity attributable to owners

of the Company 48,457 57,033

Non-controlling interests (4) (3)

Total equity 48,453 57,030

Non-current liabilities

Loans and borrowings 20 125,201 102,709

Convertible bonds 21 6,577 1,995

Deferred tax liabilities 5,689 6,556

137,467 111,260

Current liabilities

Trade and other payables 8,412 6,810

Other current financial liabilities 1,096 2,464

Income tax payable 31 -

Loans and borrowings 20 3,331 18,764

Derivative financial instruments 21 111 130

12,981 28,168

Total liabilities 150,448 139,428

Total equity and liabilities 198,901 196,458

Unaudited Interim Condensed Consolidated Statement of Changes in

Equity

for the six-month period ended 30 June 2013

Attributable to the owners

of the Company

-----------------------------------------

Share Other Accumulated Non-controlling

capital reserves losses Total interests Total equity

USD'000 USD'000 USD'000 USD'000 USD'000 USD'000

For the six months ended 30.6.2013

Unaudited

At 1 January 2013 88,594 (7,916) (23,645) 57,033 (3) 57,030

Loss for the period - - (6,920) (6,920) (1) (6,921)

Other comprehensive income

Foreign currency translation adjustments - (2,066) - (2,066) - (2,066)

Total comprehensive income for the period - (2,066) (6,920) (8,986) (1) (8,987)

Issuance of ordinary shares pursuant to

share-based

payment plans 1,137 - - 1,137 - 1,137

Share-based payment transactions (Note 23) - (727) - (727) - (727)

At 30 June 2013 89,731 (10,709) (30,565) 48,457 (4) 48,453

Attributable to the owners

of the Company

-----------------------------------------

Share Other Accumulated Non-controlling

capital reserves losses Total interests Total equity

USD'000 USD'000 USD'000 USD'000 USD'000 USD'000

For the six months ended 30.6.2012

Unaudited

At 1 January 2012 87,321 (11,430) (16,769) 59,122 - 59,122

Loss for the period - - (4,244) (4,244) - (4,244)

Other comprehensive income

Foreign currency translation adjustments - (2) - (2) - (2)

Total comprehensive income for the period - (2) (4,244) (4,246) - (4,246)

Issuance of ordinary shares pursuant to

share-based

payment plans 97 (67) - 30 - 30

Share-based payment transactions (Note 23) - 1,032 - 1,032 - 1,032

Issuance of ordinary shares pursuant to

conversion

of convertible bond 1,176 - - 1,176 - 1,176

Dilution of interest in a subsidiary - - 2 2 (2) -

At 30 June 2012 88,594 (10,467) (21,011) 57,116 (2) 57,114

Unaudited Interim Condensed Consolidated Statement of Cash

Flows

for the six-month period ended 30 June 2013

Six Months Six Months

Ended Ended

30.6.2013 30.6.2012

USD'000 USD'000

Unaudited Unaudited

Operating activities

Loss before tax (7,912) (4,348)

Non-cash adjustment to reconcile loss before

tax to

net cash flows:

Amortisation of land use rights 513 544

Depreciation of property, plant and equipment 539 82

(Gain)/loss on disposal of property, plant and

equipment (6) 1

Gain arising from changes in fair value of convertible

bonds (420) (162)

Interest income (232) (106)

Interest expense 3,622 1,528

Unrealised loss/(gain) on foreign exchange 168 (75)

Share-based payment transaction expense 30 951

Working capital adjustments:

Increase in inventories (832) (282)

Increase in trade and other receivables and prepayments (48) (2,361)

Increase in trade and other payables 585 1,742

(3,993) (2,486)

Income taxes paid, net of refund (20) (8)

Interest received 232 106

Interest paid (3,066) (1,356)

Net cash flows used in operating activities (6,847) (3,744)

Investing activities

Proceeds from disposal of property, plant and

equipment 6 20

Purchase of property, plant and equipment (11,884) (13,012)

Additions to land use rights - (19,784)

Additions to biological assets (5,869) (20,933)

Net cash flows used in investing activities (17,747) (53,709)

Financing activities

Proceeds from issuance of ordinary shares 311 30

Proceeds from issuance of convertible

bond 4,897 -

Issuance expense on liability component

of convertible bond (522) -

Repayment of short term revolving credit (1,888) -

Repayment of term loan (39,705) (3)

Proceeds from term loans 3,557 32,727

Proceeds from Bank Guaranteed Medium

Term Notes Programme 48,192 30,414

Repayment of finance lease liabilities (257) (162)

Short-deposits pledged for a banking

facility and supply of goods 79 (784)

Net cash flows from financing activities 14,664 62,222

Net (decrease)/increase in cash and cash

equivalents (9,930) 4,769

Net foreign exchange difference 8 1,311

Cash and cash equivalents at 1 January 14,188 27,474

Cash and cash equivalents at 30 June

(Note 22) 4,266 33,554

Notes to the Unaudited Interim Condensed Consolidated Financial

Statements - 30 June 2013

1. Corporate information

The interim condensed consolidated financial statements for the

six months ended 30 June 2013 were authorised for issue in

accordance with a resolution of the directors on 30 September

2013.

Asian Plantations Limited (the "Company") is a limited liability

company incorporated and domiciled in the Republic of Singapore and

listed on the Alternative Investment Market ("AIM") of the London

Stock Exchange.

The registered office of the Company is located at No.14 Ann

Siang Road, #02-01, Singapore 069694.

The principal activity of the Company is that of investment

holding. The principal activities of the subsidiaries are

development of oil palm plantation and operating of an oil palm

mill.

2. Basis of preparation and changes to the Group's accounting policies

Basis of preparation

The interim condensed consolidated financial statements for the

six months ended 30 June 2013 have been prepared in accordance with

IAS 34 Interim Financial Reporting.

The interim condensed consolidated financial statements are

unaudited and do not include all the information and disclosures

required in the annual financial statements, and should be read in

conjunction with the Group's annual financial statements as at 31

December 2012.

The financial statements are presented in United States Dollars

("USD") to facilitate the comparison of financial results with

companies in the oil-palm industry and all values are rounded to

the nearest thousand ("USD'000") except when otherwise

indicated.

New standards, interpretations and amendments thereof, adopted

by the Group

The accounting policies adopted in the preparation of the

interim condensed consolidated financial statements are consistent

with those followed in the preparation of the Group's annual

financial statements for the year ended 31 December 2012, except

for the adoption of new standards and interpretations effective as

of 1 January 2013.

The nature and the impact of the new standard/amendment is

described below:

IAS 1 Presentation of Items of Other Comprehensive Income -

Amendments to IAS 1

The amendments to IAS 1 introduce a grouping of items presented

in other comprehensive income (OCI). Items that could be

reclassified (or recycled) to profit or loss at a future point in

time (e.g., net gain on hedge of net investment, exchange

differences on translation of foreign operations, net movement on

cash flow hedges and net loss or gain on available-for sale

financial assets) now have to be presented separately from items

that will never be reclassified (e.g., actuarial gains and losses

on defined benefit plans and revaluation of land and buildings).

The amendment affected presentation only and had no impact on the

Group's financial position or performance.

3. Significant accounting judgements and estimates

The preparation of the consolidated financial statements

requires management to make judgements, estimates and assumptions

that affect the reported amounts of revenues, expenses, assets and

liabilities, and the disclosure of contingent liabilities at the

end of the reporting period. However, uncertainty about these

assumptions and estimates could result in outcomes that could

require a material adjustment to the carrying amount of the asset

or liability affected in the future periods.

3.1 Judgements made in applying accounting policies

In the process of applying the Group's accounting policies,

management has made the following judgements, apart from those

involving estimations, which has the most significant effect on the

amounts recognised in the consolidated financial statements:

Fair value of biological assets (nursery)

The biological assets are stated at fair value. Management made

the judgement that cost approximates fair value of the biological

asset for nursery because little biological transformation has

taken place since its initial cost incurrence. The carrying amount

of nursery as at 30 June 2013 was USD1,729,000 (31 December 2012:

USD1,742,000).

3.2 Estimates and assumptions

The key assumptions concerning the future and other key sources

of estimation uncertainty at the reporting date, that have a

significant risk of causing a material adjustment to the carrying

amounts of assets and liabilities within the next financial year

are discussed below. The Group based its assumptions and estimates

on parameters available when the consolidated financial statements

were prepared. Existing circumstances and assumptions about future

developments, however, may change due to market changes or

circumstances arising beyond the control of the Group. Such changes

are reflected in the assumptions when they occur.

(a) Useful lives of property, plant and equipment

There are no changes to the estimated economic useful life of

property, plant and equipment of within 5 to 60 years.

(b) Impairment of goodwill

An impairment exists when the carrying value of an asset or cash

generating unit exceeds its recoverable amount, which is the higher

of its fair value less costs to sell and its value in use. The

value in use calculation is based on a discounted cash flow model.

The cash flows are derived from projected net cash flows over a

period of 25 productive years of oil palms from financial budgets

approved by management and do not include restructuring activities

that the Group is not yet committed to or significant future

investments that will enhance the asset's performance of the cash

generating unit being tested. Based on management's analysis,

goodwill is not impaired as at 30 June 2013.

3.2 Estimates and assumptions (cont'd)

(c) Taxes

Uncertainties exist with respect to the interpretation of

complex tax regulations, changes in tax laws, and the amount and

timing of future taxable income. Given the wide range of

international business relationships and the long-term nature and

complexity of existing contractual agreements, differences arising

between the actual results and the assumptions made, or future

changes to such assumptions, could necessitate future adjustments

to tax income and expense already recorded. The Group establishes

provisions, based on reasonable estimates, for possible

consequences of audits by the tax authorities of the respective

counties in which it operates. The amount of such provisions is

based on various factors, such as experience of previous tax audits

and differing interpretations of tax regulations by the taxable

entity and the responsible tax authority. Such differences of

interpretation may arise on a wide variety of issues depending on

the conditions prevailing in the respective company's domicile.

The carrying amount of income tax recoverable and income tax

payable at 30 June 2013 was USD116,000 (31 December 2012:

USD99,000) and USD31,000 (31 December 2012: Nil), respectively.

Deferred tax assets are recognised for all unused tax losses,

unabsorbed capital and agricultural allowances to the extent that

it is probable that taxable profit will be available against which

the losses, unabsorbed capital and agricultural allowances can be

utilised. Significant management judgement is required to determine

the amount of deferred tax assets that can be recognised, based

upon the likely timing and the level of future taxable profits

together with future tax planning strategies.

4. Seasonality of operations

The Group's plantation operations are affected by seasonal crop

production, weather conditions and fluctuating commodity prices. As

a result, the comparison of half-year to half-year results may not

be a good indicator of the overall trend of the Group's plantation

operations or of the results for the whole of the financial

period.

5. Segment information

The following tables present revenue and profit information

about the Group's operating segments for the six months ended 30

June 2013 and 2012, respectively:

Oil palm

Six months ended Plantation milling Investment Adjustments

30 June 2013 activities activities holding Total segments and eliminations Consolidated

Unaudited USD'000 USD'000 USD'000 USD'000 USD'000 USD'000

Revenue

External customers 824 139 - 963 - 963

Inter-segment 419 - - 419 (419) -

Total revenue 1,243 139 - 1,382 (419) 963

Results

Segment loss (5,230) (421) (1,222) (6,873) - (6,873)

Inter-segment revenues of USD419,000 are eliminated on

consolidation

Oil palm

Six months ended Plantation milling Investment Adjustments

30 June 2012 activities activities holding Total segments and eliminations Consolidated

Unaudited USD'000 USD'000 USD'000 USD'000 USD'000 USD'000

Revenue

External customers 1,186 - - 1,186 - 1,186

Inter-segment - - - - - -

Total revenue 1,186 - - 1,186 - 1,186

Results

Segment loss (1,196) (199) (1,533) (2,928) - (2,928)

There is no inter-segment revenue to be eliminated.

The following table presents segment assets and liabilities of

the Group's operating segments as at 30 June 2013 and 31 December

2012:

Oil palm Adjustments

Plantation milling Investment Total and

activities activities holding segments eliminations Consolidated

USD'000 USD'000 USD'000 USD'000 USD'000 USD'000

Segment assets

30 June 2103

(Unaudited) 153,098 31,162 74,491 258,751 (67,845) 190,906

31 December 2012

(Audited) 148,734 30,987 75,988 255,709 (67,147) 188,562

Segment

liabilities

30 June 2013

(Unaudited) 127,476 30,061 550 158,087 (67,845) 90,242

31 December 2012

(Audited) 117,777 29,594 1,020 148,391 (67,147) 81,244

Adjustments and eliminations

Interest income, certain finance costs and gain arising from

changes in fair value of embedded derivative of the convertible

bonds are not allocated to individual segments as the underlying

instruments are managed on a group basis.

Current taxes, deferred taxes, share-based payment transaction

expense, goodwill on consolidation and certain liabilities are not

allocated to those segments as they are also managed on a group

basis.

Capital expenditure consists of additions to property, plant and

equipment, biological assets and land use rights.

Inter-segment revenues are eliminated on consolidation.

Six Months Six Months

Ended Ended

30.6.2013 30.6.2012

USD'000 USD'000

Unaudited Unaudited

Reconciliation of loss before tax

Segment loss (6,873) (2,928)

Interest income 232 102

Interest expense (1,689) (734)

Share-based payment transaction (2) (949)

Gain arising from changes in fair

value of embedded derivative of the

convertible bonds 420 161

Group loss (7,912) (4,348)

30.6.2013 31.12.2012

Reconciliation of assets USD'000 USD'000

Segment assets 190,906 188,562

Deferred tax assets 549 178

Goodwill arising on consolidation 7,330 7,619

Income tax recoverable 116 99

Total assets 198,901 196,458

30.6.2013 31.12.2012

USD'000 USD'000

Reconciliation of liabilities Unaudited Audited

Segment liabilities 90,242 81,244

Deferred tax liabilities 5,689 6,556

Loans and borrowings 47,798 49,503

Income tax payable 31 -

Derivative financial instruments 111 130

Convertible bonds 6,577 1,995

Total liabilities 150,448 139,428

6. Revenue

Revenue comprise sale of fresh fruit bunches and crude palm

oil.

7. Cost of sales

Six Months Six Months

Ended Ended

30.6.2013 30.6.2012

USD'000 USD'000

Unaudited Unaudited

Cost of sales for oil palm:

Estates 3,365 515

Mill 79 -

3,444 515

Included in cost of sales is share-based payment transaction

expense of USD27,000 (six months ended 30 June 2012: USD2,000)

related to the Company's share option scheme.

8. Other operating income

Six Months Six Months

Ended Ended

30.6.2013 30.6.2012

USD'000 USD'000

Unaudited Unaudited

Short term deposits interest income 232 106

Sale of seedlings - 11

Gain arising from changes in fair

value of embedded derivative of the

convertible bonds 420 162

Gain on disposal of property, plant

and equipment 6 -

Other income 16 -

674 279

9. Administrative expenses

Included in administrative expenses are audit, tax, legal and

other professional fees amounting to USD542,000 (six months ended

30 June 2012: USD608,000) and share-based payment transaction

expense of USD3,000 (six months ended 30 June 2012: USD949,000)

related to the Company's share option scheme.

10. Other operating expenses

Six Months Six Months

Ended Ended

30.6.2013 30.6.2012

USD'000 USD'000

Unaudited Unaudited

Net foreign exchange loss 113 384

Repair and maintenance 75 73

Amortisation of land use rights 513 544

Cost of seedlings sold 8 8

709 1,009

11. Finance costs

Six Months Six Months

Ended Ended

30.6.2013 30.6.2012

USD'000 USD'000

Unaudited Unaudited

Interest expense on loans and borrowings 3,016 1,318

Interest expense on convertible bonds 88 44

Accretion of interest on convertible

bonds 518 166

3,622 1,528

12. Income tax benefit

The major components of income tax benefit in the interim

consolidated income statement are:

Six Months Six Months

Ended Ended

30.6.2013 30.6.2012

USD'000 USD'000

Unaudited Unaudited

Current income tax expense 32 -

Deferred income tax expense related

to origination and reversal of deferred

taxes (1,095) (156)

Under provision of deferred tax expense

in prior period 72 52

Total income tax benefit (991) (104)

13. Loss per share

Basic loss per share amounts are calculated by dividing loss for

the period, net of tax, attributable to owners of the Company by

the weighted average number of ordinary shares outstanding during

the financial period.

Diluted loss per share amounts are calculated by dividing loss

for the period, net of tax, attributable to owners of the Company

by the weighted average number of ordinary shares outstanding

during the financial period plus the weighted average number of

ordinary shares that would be issued on the conversion of all the

dilutive potential ordinary shares into ordinary shares. There are

no dilutive potential ordinary shares as at period ended 30 June

2013 and 2012.

The following tables reflect the loss and share data used in the

computation of basic loss and diluted per share for the periods

ended 30 June:

Six Months Six Months

Ended Ended

30.6.2013 30.6.2012

USD'000 USD'000

Unaudited Unaudited

Loss, net of tax, attributable to

owners of the Company (6,920) (4,244)

-

============= =============

No. of shares No. of shares

'000 '000

Weighted average number of ordinary

shares for basic and diluted loss

per share computation* 46,564 46,252

-

============= =============

* The weighted average number of ordinary shares takes into

account the weighted average effect of changes in ordinary shares

transactions during the period.

The potential ordinary shares from unsecured convertible bonds

and options granted pursuant to the Company's share option scheme

have not been included in the calculation of diluted loss per share

because they are anti-dilutive.

14. Property, plant and equipment

30.6.2013 31.12.2012

USD'000 USD'000

Unaudited Audited

At 1 January 53,227 15,600

Additions 12,327 38,316

Disposal - (21)

Depreciation (1,365) (1,594)

Exchange differences (2,286) 926

At 30 June / 31 December 61,903 53,227

See Note 25(a) for capital commitments.

Capitalised borrowing costs

The amount of borrowing costs capitalised during the period

ended 30 June 2013 was USD1,133,000 (31 December 2012:

USD1,208,000).

Depreciation capitalised to biological assets

Depreciation of property, plant and equipment of the Group

capitalised to biological assets for the financial period ended 30

June 2013 amounted to USD826,000 (31 December 2012:

USD1,343,000).

Assets under construction

Included in property, plant and equipment are assets under

construction amounted to USD18,095 (31 December 2012: USD25,328).

The construction of the oil palm mill which represented the main

asset under construction as at 31 December 2012 was completed in

early 2013 and has since commenced milling operations.

15. Biological assets

30.6.2013 31.12.2012

USD'000 USD'000

Unaudited Audited

At fair value

At 1 January 55,287 22,811

Additions 6,781 29,405

Gain arising from changes in fair

value - 1,989

Exchange differences (2,274) 1,082

At 30 June / 31 December 59,794 55,287

Represented by:

Mature plantation 26,401 27,442

Immature plantation 31,664 26,103

Nursery 1,729 1,742

At 30 June / 31 December 59,794 55,287

There is no gain or loss arising from changes in fair value less

estimated costs to sell during the financial period ended 30 June

2013 (31 December 2012: USD1,989,000) as the Group has adopted the

practice of determining the fair value of its biological assets on

an annual basis.

30.6.2013 31.12.2012

Hectares Hectares

Planted area:

Mature plantation 4,448 3,559

Immature plantation 5,984 4,591

Total 10,432 8,150

16. Land use rights

30.6.2013 31.12.2012

USD'000 USD'000

Unaudited Audited

At 1 January 53,517 32,158

Additions - 21,044

Amortisation charge (513) (924)

Exchange differences (2,016) 1,239

At 30 June / 31 December 50,988 53,517

Land use rights of the Group are pledged for banking facilities

as disclosed in Note 20.

17. Inventories

30.6.2013 31.12.2012

USD'000 USD'000

Unaudited Audited

Crude palm oil 661 -

Palm kernel 165 -

Consumables 1,665 1,724

2,491 1,724

18. Issued capital

30.6.2013 31.12.2012

No. of No. of

shares shares

'000 USD'000 '000 USD'000

Unaudited Unaudited Audited Audited

At 1 January 2013 / 1 January

2012 46,511 88,594 46,175 87,321

Issuance during the period/year 250 1,137 336 1,273

At 30 June 2013 / 31 December

2012 46,761 89,731 46,511 88,594

- - - -

Issuance of shares

On 17 May 2013, a director exercised 250,000 Initial Options

that were granted in accordance with the Company's share option

scheme and these shares were subsequently listed on AIM on 22 May

2013.

19. Other reserves

The composition of other components of other reserves is as

follows:

30.6.2013 31.12.2012

USD'000 USD'000

Unaudited Audited

Merger reserve (20,256) (20,256)

Foreign currency translation reserve (330) 1,736

Share-based payment transaction reserve 9,877 10,604

(10,709) (7,916)

20. Loans and borrowings

30.6.2013 31.12.2012

USD'000 USD'000

Unaudited Audited

Current

Bank overdraft 1,864 613

Short term revolving credit - 1,962

Term loans 871 15,687

Obligation under finance leases 596 502

3,331 18,764

Non-current

Bank Guaranteed Medium Term Notes

Programme 78,998 31,954

Term loans 44,603 69,134

Obligation under finance leases 1,600 1,621

125,201 102,709

Total loans and borrowings 128,532 121,473

As at 30 June 2013, the Group has drawn down the second (or

final) tranche of the MTN Programme amounting to RM155 million

(approximately USD52 million). Of the total proceeds received,

RM132.2 million (approximately USD44 million) was used in

refinancing of certain loans and borrowings, and the balance for

working capital requirements.

The second tranche of the MTN Programme bear coupon rates

ranging from 3.9% per annum to 4.3% per annum. Tenure of this

tranche is up to 8 years from the date of the first issuance and

repayment is to commence 4 years from date of first issue.

Loans and borrowings of the Group are secured either by a charge

over the leased assets or leasehold land of the Group in which it

has prepaid the rights to use the land as disclosed in Note 16.

21. Convertible bonds - Unsecured

30.6.2012 31.12.2012

Face value Maturity USD'000 USD'000

Unaudited Audited

USD2.1 million 8 August 2015 2,127 1,995

USD5.0 million 14 January 2016 4,450 -

6,577 1,995

On 14 January 2013, the first tranche of the USD15 million

convertible unsecured bonds, amounting to USD5 million, was issued

to OCBC Capital Investment I Pte. Ltd. The remaining two tranches

with balance of USD5 million each was issued on 14 August 2013 and

23 August 2013.

Embedded derivative relating to the conversion option of the

convertible bond is recorded as a "fair value through profit or

loss" financial instrument with a balance of USD111,000 as at 30

June 2013 (31 December 2012: USD130,000).

22. Cash and bank balances

For the purpose of the interim condensed consolidated statement

of cash flows, cash and cash equivalents comprise:

30.6.2013 30.6.2012

USD'000 USD'000

Unaudited Unaudited

Cash and short-term deposits 6,997 35,668

Less: Short-term deposits for the

supply of goods (64) -

Less: Short-term deposits pledged

for a banking facility (803) (784)

6,130 34,884

Bank overdraft (Note 20) (1,864) (1,330)

Cash and cash equivalents 4,266 33,554

23. Share-based payment plans

There has been no cancellation or modification to the Scheme

during the period ended 30 June 2013.

Expense recognised for this equity-settled share-based payment

transaction during the financial period amount to USD101,000 (30

June 2012: USD1,032,000), of which USD71,000 (30 June 2012:

USD83,000 ) has been capitalised to biological assets.

On 17 May 2013, a director exercised 250,000 Initial Options and

the weighted average share price at the date of exercise of this

option was USD3.65.

There was no new share options granted during the financial

period.

24. Fair value of financial instruments

Fair value hierarchy

The Group uses the following hierarchy for determining and

disclosing the fair value of financial instruments by valuation

technique:

Level 1: quoted (unadjusted) prices in active markets for

identical assets or liabilities

Level 2: other techniques for which all inputs that have a

significant effect on the recorded fair value are observable,

either directly or indirectly

Level 3: techniques that use inputs that have a significant

effect on the recorded fair value

that are not based on observable market data

As at 30 June, the Group held the following financial

instruments carried at fair value in the statements of financial

position:

(a) Fair value of financial instruments that are carried at fair value

The Group does not have any financial instruments carried at

fair value other than the derivative component of the unquoted

convertible bonds. Fair value of the derivative component is valued

using a binomial model based on observable data and non-observable

data. The non-observable inputs to the model include assumptions

regarding the future financial performance of the investee, its

risk profile, and economic assumptions regarding the industry and

geographical jurisdiction in which the investee operates.

(b) Fair value of financial instruments by classes that are not

carried at fair value and whose carrying amounts are reasonable

approximation of fair value

Trade and other receivables, Cash and bank balances, Trade and

other payables, Other liabilities and Loans and borrowings

(excluding obligations under finance leases and MTN Programme)

The carrying amounts of these financial assets and liabilities

are reasonable approximation of fair values, either due to their

short-term nature or they are floating rate instruments that are

re-priced to market interest rates on or near the end of the

reporting period.

(c) Fair value of financial instruments by classes that are not

carried at fair value and whose carrying amounts are not reasonable

approximation of fair value

The fair value of financial assets and liabilities by classes

that are not carried at fair value and whose carrying amounts are

not reasonable approximation of fair value are as follows:

Carrying Amount Fair Value

30.6.2013 31.12.2012 30.6.2013 31.12.2012

USD'000 USD'000 USD'000 USD'000

Unaudited Audited Unaudited Audited

Financial liabilities:

- Obligations under

finance leases 2,196 2,123 2,080 2,129

- Convertible bonds 6,577 1,995 * *

- Bank Guaranteed

Medium Term Notes

Programme 78,998 31,954 79,950 31,938

* It is not practicable and cost outweighs benefits to determine

the fair value of the unquoted convertible bonds.

25. Commitments and contingencies

(a) Capital commitments

Capital commitments contracted for at the end of the reporting

period but not recognised in the financial statements are as

follows:

30.6.2013 31.12.2012

USD'000 USD'000

Unaudited Audited

Approved and contracted for:

* property, plant and equipment 9,726 10,434

Approved and not contracted

for:

* property, plant and equipment 11,668 19,970

* biological assets 6,873 10,162

28,267 40,566

(b) Contingencies

The Group does not have contingent liabilities as at 30 June

2013 and 31 December 2012.

(c) Operating lease commitments

As lessee

In addition to the land use rights disclosed in Note 16, the

Group has no other operating leases.

(d) Finance leases

As lessee

The Group has finance leases for certain property, plant and

equipment. These leases have terms of renewal but no purchase

options and escalation clauses. Renewals are at the option of the

specific entity that holds the lease.

Future minimum lease payments under finance leases together with

the present value of the net minimum lease payments are as

follows:

30.6.2013 31.12.2012

Present Present

value of value of

Minimum minimum Minimum minimum

lease payments lease payments lease payments lease payments

USD'000 USD'000 USD'000 USD'000

Unaudited Unaudited Audited Audited

Not later than

one year 690 596 622 502

Later than one

year but not more

than five years 1,775 1,600 1,782 1,621

Total minimum lease

payments 2,465 2,196 2,404 2,123

Less: Amount representing

finance charges (269) - (281) -

Present value of

minimum lease payments 2,196 2,196 2,123 2,123

26. Related party disclosures

The following are the significant transactions between the Group

and related parties (who are not members of the Group) that took

place during the financial period ended 30 June 2013 and 30 June

2012 at the terms agreed between the parties, which are conducted

at mutually agreed terms between the parties.

Six Months Six Months

Ended Ended

30.6.2013 30.6.2012

USD'000 USD'000

Unaudited Unaudited

Transactions with related parties

- Rental expenses 29 14

- Administrative costs charged 88 79

117 93

30.6.2013 31.12.2012

USD'000 USD'000

Unaudited Audited

Amount due from related parties 1 2

Amount due to related parties 150 42

Amount due from/(to) related parties are non-trade related,

unsecured, non-interest bearing and are repayable in cash on

demand.

Related parties represent companies in which certain directors

of the Group have financial interest and are also directors of

these companies.

Compensation of key management personnel

Six Months Six Months

Ended Ended

30.6.2013 30.6.2012

USD'000 USD'000

Unaudited Unaudited

Directors' salaries 241 238

Directors' fees 95 93

Short term employee benefits 174 181

Contribution to defined contribution

plans 22 30

Share-based payment transactions

(Note 23) 38 982

570 1,524

Compensation of key management personnel (cont'd)

Six Months Six Months

Ended Ended

30.6.2013 30.6.2012

USD'000 USD'000

Unaudited Unaudited

Compensation comprise

Amounts paid to:

- Directors of the Company 333 328

- Directors of a subsidiary company 3 3

- Other key management personnel 196 211

532 542

Share-based payment transactions

expense:

- Directors of the Company - 947

- Other key management personnel 38 35

38 982

570 1,524

The amounts disclosed above are the amounts recognised as an

expense during the reporting period related to key management

personnel.

27. Events after the reporting period

On 21 August 2013, the Group completed the acquisition of 100%

equity interest in Grand Performance Sdn. Bhd. at the purchase

price of RM24.7 million (approximately USD7.5 million). This new

subsidiary owns 3,852 hectares of land suitable for oil palm

development.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR URORROUAKOAR

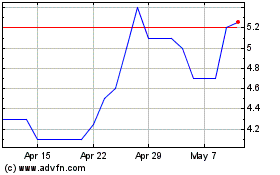

Panther Metals (LSE:PALM)

Historical Stock Chart

From Jun 2024 to Jul 2024

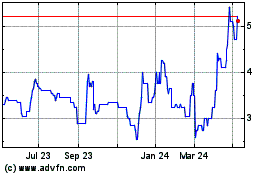

Panther Metals (LSE:PALM)

Historical Stock Chart

From Jul 2023 to Jul 2024