Directors, employees and consultants of the Group receive

remuneration in the form of share-based payment transactions,

whereby the directors, employees and consultants render services as

consideration for equity instruments (equity-settled

transactions).

The cost of equity-settled transactions is determined by the

fair value at the date when the grant is made using an appropriate

valuation model.

That cost is recognised, together with a corresponding increase

in other capital reserves in equity, over the period in which the

performance and/or service conditions are fulfilled in employee

benefits expense (Note 12). The cumulative expense recognised for

equity-settled transactions at each reporting date until the

vesting date reflects the extent to which the vesting period has

expired and the Group's best estimate of the number of equity

instruments that will ultimately vest. The statement of profit or

loss expense or credit for a period represents the movement in

cumulative expense recognised as at the beginning and end of that

period and is recognised, depending on the type of services

rendered, in employee benefits expense (Note 12), as part of

professional fees and if related to the development of biological

assets, the expense are allocated proportionately based on the area

of mature and immature plantations.

No expense is recognised for awards that do not ultimately vest,

except for equity-settled transaction for which vesting is

conditional upon a market or non-vesting condition. These are

treated as vesting irrespective of whether or not the market or

non-vesting condition is satisfied, provided that all other

performance and/or service conditions are satisfied.

When the terms of an equity-settled transaction award are

modified, the minimum expense recognised is the expense had the

terms had not been modified, if the original terms of the award are

met. An additional expense is recognised for any modification that

increases the total fair value of the share-based payment

transaction, or is otherwise beneficial to the employee as measured

at the date of modification.

The dilutive effect of outstanding options is reflected as

additional share dilution in the computation of diluted earnings

per share (further details are given in Note 14).

o) Foreign currency

Each entity in the Group determines its own functional currency

and items included in the financial statements of each entity are

measured using that functional currency. Management determines the

functional currency based on the the primary economic environment

in which the individual entity operates. The Company's functional

currency is Singapore Dollars (SGD) while the functional currency

of the Group's principal subsidiaries is Ringgit Malaysia (RM). The

Group has elected to recycle the gain or loss that arises from the

direct method of consolidation, which is the method the Group uses

to complete its consolidation.

i) Transactions and balances

Transactions in foreign currencies are initially recorded by the

Group entities at their respective functional currency spot rates

at the date the transaction first qualifies for recognition.

Monetary assets and liabilities denominated in foreign

currencies are retranslated at the functional currency spot rate of

exchange at the reporting date.

Differences arising on settlement or translation of monetary

items are recognised in profit or loss with the exception of

monetary items that are designated as part of the hedge of the

Group's net investment of a foreign operation. These are recognised

in other comprehensive income until the net investment is disposed

of, at which time, the cumulative amount is reclassified to profit

or loss. Tax charges and credits attributable to exchange

differences on those monetary items are also recorded in other

comprehensive income.

Non-monetary items that are measured in terms of historical cost

in a foreign currency are translated using the exchange rates at

the dates of the initial transactions. Non-monetary items measured

at fair value in a foreign currency are translated using the

exchange rates at the date when the fair value is determined. The

gain or loss arising on retranslation of non-monetary items

measured at fair value is treated in line with the recognition of

gain or loss on change in fair value of the item (i.e., translation

differences on items whose fair value gain or loss is recognised in

other comprehensive income or profit or loss is also recognised in

other comprehensive income or profit or loss, respectively).

ii) Group companies

On consolidation the assets and liabilities of foreign

operations are translated into USD at the rate of exchange

prevailing at the reporting date and their income statements are

translated at exchange rates prevailing at the dates of the

transactions. The exchange differences arising on translation for

consolidation are recognised in other comprehensive income. On

disposal of a foreign operation, the component of other

comprehensive income relating to that particular foreign operation

is recognised in profit or loss.

Any goodwill arising on the acquisition of foreign operation and

any fair value adjustments to the carrying amounts of assets and

liabilities arising on the acquisition are treated as assets and

liabilities of the foreign operation and translated at the spot

rate of exchange at the reporting date.

In the case of a partial disposal without loss of control of a

subsidiary that includes a foreign operation, the proportionate

share of the cumulative amount of the exchange differences are

re-attributed to non-controlling interest and are not recognised in

profit or loss.

p) Leases

The determination of whether an arrangement is, or contains, a

lease is based on the substance of the arrangement at inception

date. The arrangement is assessed for whether fulfillment of the

arrangement is dependent on the use of a specific asset or assets

or the arrangement conveys a right to use the asset or assets, even

if that right is not explicitly specified in an arrangement.

Group as a lessee

Finance leases that transfer substantially all the risks and

benefits incidental to ownership of the leased item to the Group,

are capitalised at the commencement of the lease at the fair value

of the leased asset or, if lower, at the present value of the

minimum lease payments. Any initial direct costs are also added to

the amount capitalised. Lease payments are apportioned between the

finance charges and reduction of the lease liability so as to

achieve a constant rate of interest on the remaining balance of the

liability. Finance charges are recognised in finance costs in

profit or loss. Contingent rents, if any, are charged as expenses

in the period in which they are incurred.

A leased asset is depreciated over the useful life of the asset.

However, if there is no reasonable certainty that the Group will

obtain ownership by the end of the lease term, the asset is

depreciated over the shorter of the estimated useful life of the

asset and the lease term.

Operating lease payments are recognised as an operating expense

in profit or loss on a straight-line basis over the lease term. The

aggregate benefit of incentives provided by the lessor is

recognised as a reduction of rental expense over the lease term on

a straight-line basis.

q) Borrowing costs

Borrowing costs are capitalised as part of the cost of a

qualifying asset if they are directly attributable to the

acquisition, construction or production of that asset.

Capitalisation of borrowing costs commences when the activities to

prepare the asset for its intended use or sale are in progress and

the expenditures and borrowing costs are incurred. Borrowing costs

are capitalised until the assets are substantially completed for

their intended use or sale. All other borrowing costs are expensed

in the period they occur. Borrowing costs consist of interest and

other costs that an entity incurs in connection with the borrowing

of funds.

r) Convertible bonds and embedded derivatives

When convertible bonds are issued, the total proceeds are

allocated to the liability component and conversion option, which

are separately presented on the statements of financial position.

The conversion option is recognised initially at its fair value and

is accounted for as a derivative liability. The difference between

the total proceeds and the conversion option is allocated to the

liability component. The liability component is subsequently

carried at amortised cost using EIR method until the liability is

extinguished on conversion or redemption of the bonds.

Derivative financial instruments are initially recognised at

fair value on the date on which a derivative contract is entered

into and are subsequently remeasured at fair value. Derivative

financial instruments are carried as assets when the fair value is

positive and as liabilities when the fair value is negative. Any

gain or losses arising from changes in fair value on derivative

financial instruments are taken to profit or loss for the financial

year.

s) Biological assets

Biological assets, which include mature and immature oil palm

plantations, are stated at fair value less estimated costs to sell.

Gains or losses arising on initial recognition of plantations at

fair value less estimated costs to sell and from the changes in

fair value less estimated costs to sell of plantations at each

reporting date are included in profit or loss for the period in

which they arise.

Oil palm trees have an average life of 28 years; with the first

three years as immature and the remaining as mature. Oil palm

plantation is classified as mature when 60% of oil palm per block

is bearing fruits with an average weight of 3 kilograms or more per

bunch. Biological assets also include land preparation costs which

is the cost incurred to clear the land and to ensure that the

plantations are in a state ready for the planting of seedlings.

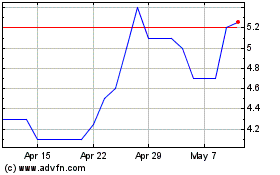

Panther Metals (LSE:PALM)

Historical Stock Chart

From Jun 2024 to Jul 2024

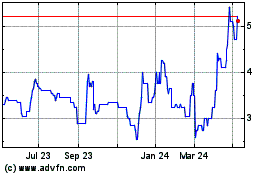

Panther Metals (LSE:PALM)

Historical Stock Chart

From Jul 2023 to Jul 2024