Petra Diamonds Ltd - Director Share Vesting

September 27 2024 - 1:01AM

UK Regulatory

Petra Diamonds Ltd - Director Share

Vesting

PR Newswire

LONDON, United Kingdom, September 27

|

27

September 2024

LSE:PDL

|

|

Petra

Diamonds Limited

(Petra

or

the Company)

Director

Share Vesting

Petra

announces the approval of the vesting of certain shares in respect

of share awards originally granted on 12

January 2022 to Petra’s Executive Directors under the 2021

PSP in respect of the period 1 July

2021 to 30 June

2024.

For Mr

Duffy, the vested awards are subject to a 2-year post-vesting

holding period and for Mr Breytenbach, the vested awards are

subject to a 2-year post-termination holding period following his

resignation effective 30 September

2024. Upon release at the end of the holding period, the

vested awards may be settled using newly issued shares, shares held

in treasury, shares purchased in the market or in cash, at the

Company's discretion. The number

of vested shares in each case is set out below. Details of the

vesting level is further disclosed in the Directors' Remuneration

Report within the Company's 2024 Annual Report.

|

Director

|

Position

|

2022

PSP

Number

of ordinary shares vested1

|

2022

PSP

Number

of ordinary shares lapsed1

|

|

Richard

Duffy

|

Chief

Executive Officer

|

167,976

|

585,279

|

|

Jacques

Breytenbach

|

Chief

Finance Officer

|

111,984

|

390,186

|

Note:

-

All

awards under the 2021 PSP were granted as conditional awards over

ordinary shares in Petra of 0.05p each; no consideration was

payable for the grant of the awards.

Further

details regarding the share awards are set out within the

Directors' Remuneration Report within the Company's 2024 Annual

Report. This announcement is made in accordance with Article 19 of

the EU Market Abuse Regulation.

~

Ends ~

FURTHER

INFORMATION

Petra

Diamonds, London +44

(0)784 192 0021

Patrick Pittaway investorrelations@petradiamonds.com

Kelsey Traynor

ABOUT

PETRA DIAMONDS

Petra Diamonds is a

leading independent diamond mining group and a supplier of gem

quality rough diamonds to the international market. The Company’s

portfolio incorporates interests in three underground mines in

South Africa (Cullinan Mine,

Finsch and Koffiefontein) and one open pit mine in Tanzania (Williamson). The Koffiefontein mine

is currently on care and maintenance in preparation for a possible

sale following the execution of a definitive sales agreement as

announced on 8 April

2024.

Petra's strategy is to

focus on value rather than volume production by optimising

recoveries from its high-quality asset base in order to maximise

their efficiency and profitability. The Group has a significant

resource base which supports the potential for long-life

operations.

Petra strives to conduct

all operations according to the highest ethical standards and only

operates in countries which are members of the Kimberley Process.

The Company aims to generate tangible value for each of its

stakeholders, thereby contributing to the socio-economic

development of its host countries and supporting long-term

sustainable operations to the benefit of its employees, partners

and communities.

Petra is quoted with a

premium listing on the Main Market of the London Stock Exchange

under the ticker 'PDL'. The Company’s loan notes due in 2026 are

listed on the Irish Stock Exchange and admitted to trading on the

Global Exchange Market. For more information, visit

www.petradiamonds.com.

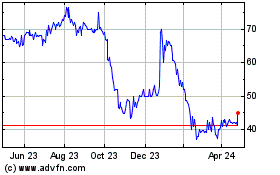

4043539_0.jpeg |

Petra Diamonds (LSE:PDL)

Historical Stock Chart

From Dec 2024 to Jan 2025

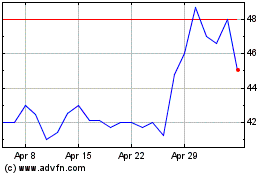

Petra Diamonds (LSE:PDL)

Historical Stock Chart

From Jan 2024 to Jan 2025