TIDMPEG

RNS Number : 6494Z

Petards Group PLC

25 September 2009

PETARDS GROUP PLC

INTERIM RESULTS ANNOUNCEMENT

Petards Group plc ('Petards'), the AIM quoted developer of advanced security and

surveillance systems, reports its interim results for the six months to 30 June

2009.

Highlights

* Revenues lower at GBP6.6m (2008: GBP10.5m)

* Gross margins increased to 36.5% (2008: 30.4%)

* Profit before tax of GBP242,000 (2008: GBP305,000)

* Basic and diluted earnings per share of 0.04p (2008: 0.05p)

* Strong operating cash GBP0.6m inflow (2008: GBP0.4m outflow)

* Significant reduction in net debt to GBP1.8m (30 June 2008: GBP2.8m)

* Outlook for stronger second half and full year profits in line with market

expectations

Commenting on the current outlook, Tim Wightman, Chairman, said:

"As I reported at our AGM, revenues for 2009 are weighted towards the second

half and we now have secured substantially all of the orders we require to meet

current trading expectations for the year. Due to the timing of the receipt of

orders, the final quarter is expected to be a particularly busy period.

The efforts we have been making to increase customer awareness of our rail

transport and emergency services products in overseas markets appear to be

starting to bear some fruit and despite likely cuts in defence spending, we are

optimistic that orders for our ruggedised electronics expertise will grow over

the coming year."

Contacts:

+------------------------------------+------------------------------------+

| Petards Group plc | www.petards.com |

+------------------------------------+------------------------------------+

| Andy Wonnacott, Finance Director | Tel: 0191 420 3000 |

+------------------------------------+------------------------------------+

| | |

+------------------------------------+------------------------------------+

| Collins Stewart Europe Limited | |

+------------------------------------+------------------------------------+

| Piers Coombs, Stewart Wallace | Tel: 020 7523 8350 |

+------------------------------------+------------------------------------+

| | |

+------------------------------------+------------------------------------+

| Walbrook PR Limited | Tel: 020 7933 8787 |

+------------------------------------+------------------------------------+

| Paul McManus | Mob: 07980 541 893 |

+------------------------------------+------------------------------------+

| | paul.mcmanus@walbrookpr.com |

+------------------------------------+------------------------------------+

Chairman's Statement

Introduction

In the first half of 2009 the Group continued to perform well and while profits

are marginally lower than for the same period in 2008, they are ahead of our

expectations for the period.

The benefits of the actions management have taken in the first half of last year

to further reduce our cost base show through in these results.

We have also continued to maintain the level of increased investment in product

development that we made in 2008 and the products concerned, which are

principally for the Rail Transport and Emergency Services markets are being well

received by existing and new customers in both overseas and UK markets.

Financial Results

During the six months ended 30 June 2009 the Group achieved a profit before tax

of GBP242,000 (2008: GBP305,000) on revenues of GBP6.6m (2008: GBP10.5m).

Profit after tax was GBP251,000 (2008: GBP305,000).

Basic and diluted earnings per share were 0.04p (2008: 0.05p).

The reduction in revenues compared to 2008 was anticipated. The first half of

2008 included GBP0.6m relating to a UVMS order taken prior to the sale of our

software business and customer deliveries for eyeTrain(TM) products were also

substantially higher, influenced by different train refurbishment programme

schedules. Revenues from our defence customers were similar to 2008 although

this year the mix of business was weighted towards products and services with a

higher value added content.

This coupled with some improvements in our other products and services gave rise

to a significant increase in gross margins for the period, up from 30.4% last

year to 36.5% in 2009.

Administrative expenses are almost GBP0.7m lower at GBP2.1m (2008: 2.8m).

Approximately half of these savings arose from the full impact of the overhead

reduction programme implemented in 2008 that we reported in our 2008 results.

The balance relates to the restructuring of our US operations which took place

following the disposal of our UK software products business.

Cash Flow and Balance Sheet

Net cash from operating activities was significantly ahead of the prior year at

GBP0.6m inflow (2008: GBP0.4m outflow).

During the period the Group again reduced its net indebtedness and is operating

well within its available committed bank facilities. Net debt at 30 June 2009

was GBP1.8m (30 June 2008: GBP2.8m and 31 December 2008: GBP2.2m).

Much progress has been made over the past eighteen months in improving the

Group's balance sheet. The Group's total equity position has improved from a

deficit of GBP2.3m at 31 December 2007 to a deficit of GBP1.1m as at 30 June

2009.

Business Review

During the first half of 2009 we have made further progress in the markets on

which our products are focussed.

Our new generation of eyeTrain(TM) digital CCTV systems for the rail market,

launched late last year, opens up a wider market for us, as its modular design

is better suited to the needs of new-build trains as well as the metro,

underground and tram markets. Its predecessors, while fitted on a number of new

trains such as the Pendolino, was designed more to meet the requirements of the

refurbished train market which has dominated UK rail contracts over recent

years. During the period we secured orders for both new build and refurbished

applications including the orders for Hyundai Rotem (GBP0.8m) and a UK train

operator (in excess of GBP3m).

The increased investment in our overseas sales and marketing for rail transport

products has resulted in a substantial increase in the number of opportunities

and bid activity in 2009. We are very much encouraged by the interest that our

rail solutions are attracting with new train builders and hope to report further

progress over the coming months.

We are also widening the markets in which our ProVida(TM) speed detection in-car

video, Automatic Number Plate Recognition (ANPR) systems and cameras are sold.

Year on year revenues are lower, due to the first half of 2008 having benefitted

from a single sizeable order of a GBP1m sale to a North African end-user and

also because a 2009 order worth GBP0.4m from our Italian distributor was

delivered just after 30 June. However, a number of new partners operating in

parts of the Middle East and Asia have projects that we hope will give rise to

some significant orders in due course.

Revenues arising from our defence capabilities remained strong and we have taken

a number of important contracts. As we expected, revenues from the sale of

electronic countermeasures systems were down from their peak in 2008. Whilst at

a lower level, demand for these systems still continues and shortly after the

period end we received a GBP2.5m order from UK MoD, the value added content of

which is higher than that for many similar orders received last year. The award

in August of a three year enabling contract to supply UK MoD Units and

Establishments with private mobile radio equipment, ancillaries and engineering

services will continue to provide us with a revenue stream from our

communications business into the future.

We supply specialist ruggedised electronics systems onto many of the UK's legacy

armoured vehicles and revenues from these were up on 2008. BAE Systems Land

Systems is a key prime contractor to the MoD for such vehicles and during 2009

we have been working closely with them to increase this area of our business.

Dividends

The Board is not recommending the payment of a dividend.

Outlook

As I reported at our AGM, revenues for 2009 are weighted towards the second half

and we now have secured substantially all of the orders we require to meet

current trading expectations for the year. Due to the timing of the receipt of

orders, the final quarter is expected to be a particularly busy period.

The efforts we have been making to increase customer awareness of our rail

transport and emergency services products in overseas markets appear to be

starting to bear some fruit and despite likely cuts in defence spending, we are

optimistic that orders for our ruggedised electronics expertise will grow over

the coming year.

Tim Wightman

25 September 2009

Condensed Consolidated Income Statement

for the six months ended 30 June 2009

+------------------------+----+----+----+------+-------+-----------+-----------+----------+

| | | | |Note | | Unaudited | Unaudited | Audited |

| | | | | | | 6 months | 6 months | Year |

| | | | | | | ended | ended | ended |

| | | | | | | 30 June | 30 June | 31 |

| | | | | | | 2009 | 2008 | December |

| | | | | | | | | 2008 |

+------------------------+----+----+----+------+-------+-----------+-----------+----------+

| | | | | | | GBP000 | GBP000 | GBP000 |

+------------------------+----+----+----+------+-------+-----------+-----------+----------+

| | | | | | | | | |

+------------------------+----+----+----+------+-------+-----------+-----------+----------+

| Revenue | | | | | | 6,589 | 10,460 | 18,862 |

+------------------------+----+----+----+------+-------+-----------+-----------+----------+

| Cost of sales | | | | | | (4,182) | (7,281) | (12,887) |

+------------------------+----+----+----+------+-------+-----------+-----------+----------+

| | | | | | | | | |

+------------------------+----+----+----+------+-------+-----------+-----------+----------+

| Gross profit | | | | | | 2,407 | 3,179 | 5,975 |

+------------------------+----+----+----+------+-------+-----------+-----------+----------+

| | | | | | | | | |

+------------------------+----+----+----+------+-------+-----------+-----------+----------+

| Administrative | | | | | | (2,099) | (2,757) | (5,031) |

| expenses | | | | | | | | |

+------------------------+----+----+----+------+-------+-----------+-----------+----------+

| | | | | | | | | |

+------------------------+----+----+----+------+-------+-----------+-----------+----------+

| Operating profit | | | | | | 308 | 422 | 944 |

+------------------------+----+----+----+------+-------+-----------+-----------+----------+

| Financial income | | | | | | 10 | 3 | 147 |

+------------------------+----+----+----+------+-------+-----------+-----------+----------+

| Financial expenses | | | | | | (76) | (120) | (387) |

+------------------------+----+----+----+------+-------+-----------+-----------+----------+

| | | | | | | | | |

+------------------------+----+----+----+------+-------+-----------+-----------+----------+

| Profit before income | | | | | | 242 | 305 | 704 |

| tax | | | | | | | | |

+------------------------+----+----+----+------+-------+-----------+-----------+----------+

| Income tax | | | | 3 | | 9 | - | 296 |

+------------------------+----+----+----+------+-------+-----------+-----------+----------+

| | | | | | | | | |

+------------------------+----+----+----+------+-------+-----------+-----------+----------+

| Profit for the period | | | | 251 | 305 | 1,000 |

| attributable to equity | | | | | | |

| holders of the company | | | | | | |

+----------------------------------+----+------+-------+-----------+-----------+----------+

| | | | | | | | | |

+------------------------+----+----+----+------+-------+-----------+-----------+----------+

| Earnings per share | | | | | | | | |

+------------------------+----+----+----+------+-------+-----------+-----------+----------+

| Basic and diluted | | | | 4 | | 0.04p | 0.05p | 0.16p |

+------------------------+----+----+----+------+-------+-----------+-----------+----------+

| | | | | | | | | |

+------------------------+----+----+----+------+-------+-----------+-----------+----------+

The above results are derived from continuing operations.

Condensed Consolidated Statement of Comprehensive Income

for the six month period ended 30 June 2009

+-------------------------------------+------------+------------+-------------+

| | Unaudited | Unaudited | Audited |

| | 6 months | 6 months | Year |

| | ended | ended | ended |

| | 30 June | 30 June | 31 December |

| | 2009 | 2008 | 2008 |

+-------------------------------------+------------+------------+-------------+

| | GBP000 | GBP000 | GBP000 |

+-------------------------------------+------------+------------+-------------+

| | | | |

+-------------------------------------+------------+------------+-------------+

| Profit for period | 251 | 305 | 1,000 |

+-------------------------------------+------------+------------+-------------+

| | | | |

+-------------------------------------+------------+------------+-------------+

| Other comprehensive income | | | |

+-------------------------------------+------------+------------+-------------+

| Currency translation on foreign | 149 | (5) | (317) |

| currency net investments | | | |

+-------------------------------------+------------+------------+-------------+

| | | | |

+-------------------------------------+------------+------------+-------------+

| Total comprehensive income for the | 400 | 300 | 683 |

| period | | | |

+-------------------------------------+------------+------------+-------------+

| | | | |

+-------------------------------------+------------+------------+-------------+

Condensed Consolidated Statement of Changes in Equity

for the six month period ended 30 June 2009

+-------------------------------------+------------+------------+-------------+

| | Unaudited | Unaudited | Audited |

| | 6 months | 6 months | Year |

| | ended | ended | ended |

| | 30 June | 30 June | 31 December |

| | 2009 | 2008 | 2008 |

+-------------------------------------+------------+------------+-------------+

| | GBP000 | GBP000 | GBP000 |

+-------------------------------------+------------+------------+-------------+

| | | | |

+-------------------------------------+------------+------------+-------------+

| Balance at start of period | (1,561) | (2,285) | (2,285) |

+-------------------------------------+------------+------------+-------------+

| | | | |

+-------------------------------------+------------+------------+-------------+

| Total comprehensive income for the | 400 | 300 | 683 |

| period | | | |

+-------------------------------------+------------+------------+-------------+

| Equity settled share based payments | 18 | 24 | 41 |

+-------------------------------------+------------+------------+-------------+

| | | | |

+-------------------------------------+------------+------------+-------------+

| Balance at end of period | (1,143) | (1,961) | (1,561) |

+-------------------------------------+------------+------------+-------------+

| | | | |

+-------------------------------------+------------+------------+-------------+

Condensed Consolidated Statement of Financial Position

at 30 June 2009

+------------------------------------+------+-----------+-----------+----------+

| | | Unaudited | Unaudited | Audited |

| | | 30 June | 30 June | 31 |

| | | 2009 | 2008 | December |

| | | | | 2008 |

+------------------------------------+------+-----------+-----------+----------+

| ASSETS | | GBP000 | GBP000 | GBP000 |

+------------------------------------+------+-----------+-----------+----------+

| Non-current assets | | | | |

+------------------------------------+------+-----------+-----------+----------+

| Property, plant and equipment | | 316 | 356 | 339 |

+------------------------------------+------+-----------+-----------+----------+

| Goodwill | | 401 | 401 | 401 |

+------------------------------------+------+-----------+-----------+----------+

| Development costs | | 536 | 131 | 345 |

+------------------------------------+------+-----------+-----------+----------+

| Deferred tax assets | | 310 | 245 | 310 |

+------------------------------------+------+-----------+-----------+----------+

| | | | | |

+------------------------------------+------+-----------+-----------+----------+

| Total non-current assets | | 1,563 | 1,133 | 1,395 |

+------------------------------------+------+-----------+-----------+----------+

| | | | | |

+------------------------------------+------+-----------+-----------+----------+

| Current assets | | | | |

+------------------------------------+------+-----------+-----------+----------+

| Inventories | | 856 | 1,646 | 1,373 |

+------------------------------------+------+-----------+-----------+----------+

| Trade and other receivables | | 1,828 | 3,907 | 2,635 |

+------------------------------------+------+-----------+-----------+----------+

| Cash and cash equivalents | | 267 | 34 | 268 |

+------------------------------------+------+-----------+-----------+----------+

| | | | | |

+------------------------------------+------+-----------+-----------+----------+

| Total current assets | | 2,951 | 5,587 | 4,276 |

+------------------------------------+------+-----------+-----------+----------+

| | | | | |

+------------------------------------+------+-----------+-----------+----------+

| Total assets | | 4,514 | 6,720 | 5,671 |

+------------------------------------+------+-----------+-----------+----------+

| | | | | |

+------------------------------------+------+-----------+-----------+----------+

| EQUITY AND LIABILITIES | | | | |

+------------------------------------+------+-----------+-----------+----------+

| Equity attributable to equity | | | | |

| holders of the parent | | | | |

+------------------------------------+------+-----------+-----------+----------+

| Share capital | | 6,367 | 6,367 | 6,367 |

+------------------------------------+------+-----------+-----------+----------+

| Share premium | | 23,255 | 23,255 | 23,255 |

+------------------------------------+------+-----------+-----------+----------+

| Currency translation reserve | | (168) | (5) | (317) |

+------------------------------------+------+-----------+-----------+----------+

| Retained earnings deficit | | (30,597) | (31,578) | (30,866) |

+------------------------------------+------+-----------+-----------+----------+

| | | | | |

+------------------------------------+------+-----------+-----------+----------+

| Total equity | | (1,143) | (1,961) | (1,561) |

+------------------------------------+------+-----------+-----------+----------+

| | | | | |

+------------------------------------+------+-----------+-----------+----------+

| Non-current liabilities | | | | |

+------------------------------------+------+-----------+-----------+----------+

| Interest-bearing loans and | | 700 | 2,222 | 1,756 |

| borrowings | | | | |

+------------------------------------+------+-----------+-----------+----------+

| | | | | |

+------------------------------------+------+-----------+-----------+----------+

| Current liabilities | | | | |

+------------------------------------+------+-----------+-----------+----------+

| Bank overdraft | | - | 593 | - |

+------------------------------------+------+-----------+-----------+----------+

| Other interest-bearing loans and | | 1,375 | - | 675 |

| borrowings | | | | |

+------------------------------------+------+-----------+-----------+----------+

| Trade and other payables | | 3,582 | 5,862 | 4,801 |

+------------------------------------+------+-----------+-----------+----------+

| Other financial liabilities | | - | 4 | - |

+------------------------------------+------+-----------+-----------+----------+

| | | | | |

+------------------------------------+------+-----------+-----------+----------+

| Total current liabilities | | 4,957 | 6,459 | 5,476 |

+------------------------------------+------+-----------+-----------+----------+

| | | | | |

+------------------------------------+------+-----------+-----------+----------+

| Total liabilities | | 5,657 | 8,681 | 7,232 |

+------------------------------------+------+-----------+-----------+----------+

| | | | | |

+------------------------------------+------+-----------+-----------+----------+

+------------------------------------+------+----------+----------+----------+

| Total equity and liabilities | | 4,514 | 6,720 | 5,671 |

+------------------------------------+------+----------+----------+----------+

| | | | | |

+------------------------------------+------+----------+----------+----------+

Condensed Consolidated Cash Flow Statement

for the six month period ended 30 June 2009

+--------------------------------------------------+------+-----------+-----------+-----------+

| |Note | Unaudited | Unaudited | Audited |

| | | 6 months | 6 months | Year |

| | | ended | ended | ended |

| | | 30 June | 30 June | 31 |

| | | 2009 | 2008 | December |

| | | | | 2008 |

+--------------------------------------------------+------+-----------+-----------+-----------+

| | | GBP000 | GBP000 | GBP000 |

+--------------------------------------------------+------+-----------+-----------+-----------+

| Cash flows from operating activities | | | | |

+--------------------------------------------------+------+-----------+-----------+-----------+

| Profit for the period | | 251 | 305 | 1,000 |

+--------------------------------------------------+------+-----------+-----------+-----------+

| Adjustments for: | | | | |

+--------------------------------------------------+------+-----------+-----------+-----------+

| Depreciation | | 74 | 109 | 208 |

+--------------------------------------------------+------+-----------+-----------+-----------+

| Amortisation of intangible | | 23 | 71 | 73 |

| assets | | | | |

+--------------------------------------------------+------+-----------+-----------+-----------+

| Financial income | | (10) | (3) | (147) |

+--------------------------------------------------+------+-----------+-----------+-----------+

| Financial expense | | 76 | 120 | 387 |

+--------------------------------------------------+------+-----------+-----------+-----------+

| Loss on sale of property, | | - | 7 | 9 |

| plant and equipment | | | | |

+--------------------------------------------------+------+-----------+-----------+-----------+

| Gain on sale of business and | | - | - | - |

| assets | | | | |

+--------------------------------------------------+------+-----------+-----------+-----------+

| Equity settled share-based | | 18 | 24 | 41 |

| payment expenses | | | | |

+--------------------------------------------------+------+-----------+-----------+-----------+

| Income tax credit | | (9) | - | (296) |

+--------------------------------------------------+------+-----------+-----------+-----------+

| | | | | |

+--------------------------------------------------+------+-----------+-----------+-----------+

| | | 423 | 633 | 1,275 |

+--------------------------------------------------+------+-----------+-----------+-----------+

| Change in trade and other | | 823 | (595) | 746 |

| receivables | | | | |

+--------------------------------------------------+------+-----------+-----------+-----------+

| Change in inventories | | 517 | (231) | 46 |

+--------------------------------------------------+------+-----------+-----------+-----------+

| Change in trade and other | | (1,134) | (30) | (1,389) |

| payables | | | | |

+--------------------------------------------------+------+-----------+-----------+-----------+

| Change in provisions | | - | (11) | (11) |

+--------------------------------------------------+------+-----------+-----------+-----------+

| | | | | |

+--------------------------------------------------+------+-----------+-----------+-----------+

| Cash inflow/(outflow) from operations | | 629 | (234) | 667 |

+--------------------------------------------------+------+-----------+-----------+-----------+

| Interest received | | 10 | 3 | 147 |

+--------------------------------------------------+------+-----------+-----------+-----------+

| Interest paid | | (93) | (129) | (407) |

+--------------------------------------------------+------+-----------+-----------+-----------+

| Income tax received | | 90 | - | 56 |

+--------------------------------------------------+------+-----------+-----------+-----------+

| | | | | |

+--------------------------------------------------+------+-----------+-----------+-----------+

| Net cash inflow/(outflow) from | | 636 | (360) | 463 |

| operating activities | | | | |

+--------------------------------------------------+------+-----------+-----------+-----------+

| | | | | |

+--------------------------------------------------+------+-----------+-----------+-----------+

| Cash flows from investing activities | | | | |

+--------------------------------------------------+------+-----------+-----------+-----------+

| Proceeds from sale of | | - | - | 5 |

| property, plant and equipment | | | | |

+--------------------------------------------------+------+-----------+-----------+-----------+

| Capitalised internal | | (214) | (142) | (358) |

| development expenditure | | | | |

+--------------------------------------------------+------+-----------+-----------+-----------+

| Cash previously not available | 5 | - | 2,400 | 2,400 |

| for use following business | | | | |

| disposal in 2007 | | | | |

+--------------------------------------------------+------+-----------+-----------+-----------+

| Acquisition of property, plant | | (53) | (26) | (99) |

| and equipment | | | | |

+--------------------------------------------------+------+-----------+-----------+-----------+

| | | | | |

+--------------------------------------------------+------+-----------+-----------+-----------+

| Net cash (outflow) /inflow from investing | | (267) | 2,232 | 1,948 |

| activities | | | | |

+--------------------------------------------------+------+-----------+-----------+-----------+

| | | | | |

+--------------------------------------------------+------+-----------+-----------+-----------+

| Cash flows from financing activities | | | | |

+--------------------------------------------------+------+-----------+-----------+-----------+

| (Reduction)/increase in | | (356) | - | 356 |

| committed overdraft facility | | | | |

+--------------------------------------------------+------+-----------+-----------+-----------+

| Repayment of borrowings | | - | (1,843) | (1,990) |

+--------------------------------------------------+------+-----------+-----------+-----------+

| Payment of finance lease | | - | (8) | (8) |

| liabilities | | | | |

+--------------------------------------------------+------+-----------+-----------+-----------+

| | | | | |

+--------------------------------------------------+------+-----------+-----------+-----------+

| Net cash outflow from financing activities | | (356) | (1,851) | (1,642) |

+--------------------------------------------------+------+-----------+-----------+-----------+

| | | | | |

+--------------------------------------------------+------+-----------+-----------+-----------+

| Net increase in cash and cash | | 13 | 21 | 769 |

| equivalents | | | | |

+--------------------------------------------------+------+-----------+-----------+-----------+

| Cash and cash equivalents at | | 268 | (580) | (580) |

| start of period | | | | |

+--------------------------------------------------+------+-----------+-----------+-----------+

| Effect of exchange rate | | (14) | - | 79 |

| fluctuations on cash held | | | | |

+--------------------------------------------------+------+-----------+-----------+-----------+

| | | | | |

+--------------------------------------------------+------+-----------+-----------+-----------+

| Cash and cash equivalents at end of period | | 267 | (559) | 268 |

+--------------------------------------------------+------+-----------+-----------+-----------+

| | | | | |

+--------------------------------------------------+------+-----------+-----------+-----------+

| Cash and cash equivalent comprise: | | | | |

+--------------------------------------------------+------+-----------+-----------+-----------+

| Cash and cash equivalents | | 267 | 34 | 268 |

+--------------------------------------------------+------+-----------+-----------+-----------+

| Bank overdraft | | - | (593) | - |

+--------------------------------------------------+------+-----------+-----------+-----------+

| | | | | |

+--------------------------------------------------+------+-----------+-----------+-----------+

| | | 267 | (559) | 268 |

+--------------------------------------------------+------+-----------+-----------+-----------+

Notes

(forming part of the financial statements)

1. General

The interim financial information set out in this statement for the six months

ended 30 June 2009 and the comparative figures for the six months ended 30 June

2008 are unaudited. This financial information does not constitute statutory

accounts as defined in Section 240 of the Companies Act 1985.

The comparative figures for the financial year ended 31 December 2008 are not

the company's statutory financial statements for that financial year. Those

accounts have been reported on by the company's auditors and delivered to the

Registrar of Companies. The report of the auditors was (i) unqualified, (ii) did

not include a reference to any matters to which the auditors drew attention by

way of emphasis without qualifying their report, and (iii) did not contain a

statement under section 237(2) or (3) of the Companies Act 1985.

2. Basis of preparation

This interim statement, which is neither audited nor reviewed, has been prepared

in accordance with the measurement and recognition criteria of Adopted IFRSs.

They do not include all the information required for the full annual financial

statements, and should be read in conjunction with the financial statements of

the Group as at and for the year ended 31 December 2008. It does not comply with

IAS 34 'Interim Financial Reporting' as is permissible under the rules of the

AIM Market ("AIM").

The accounting policies applied in preparing these interim financial statements,

other than those noted below, are the same as those applied in the preparation

of the annual financial statements for the year ended 31 December 2008, as

described in those financial statements. The Board approved these interim

financial statements on 24 September 2009.

From 1 January 2009 the following standards, amendments and interpretations

endorsed by the EU became effective and were adopted by the Group:

* IFRS 8 'Operating Segments';

* IFRIC 11 'IFRS 2 - Group and Treasury Share Transactions';

* Revised IAS 23 'Borrowing Costs';

* Revised IAS 1 'Presentation of Financial Statements';

* Amended IFRS 1 and IAS 27 'Cost of an Investment in a Subsidiary, Jointly

Controlled Entity or Associate';

* Amendments to IFRS 2 'Share based payment - Vesting Conditions and

Cancellations'.

The adoption of the above has not had a significant impact on the Group's

interim financial statements.

3. Taxation

No provision for taxation has been made in the profit and loss account for the

six months to 30 June 2009 based on the estimated tax provision required for the

year ending 31 December 2009. No provision was required in the six months to 30

June 2008. An adjustment in respect of prior years of GBP9,000 arose in the six

months to 30 June 2009 in respect of research and development tax credits.

4. Earnings per share

Basic earnings per share is calculated by dividing the profit for the period

attributable to the shareholders by the weighted average number of shares in

issue. The calculation of diluted earnings per share assumes conversion of all

potentially dilutive ordinary shares, all of which arise from share options.

The calculation of earnings per share is based on the profit for the period and

on the weighted average number of ordinary shares outstanding in the period.

+------------------------------------------------+-----------+-----------+-----------+

| | Unaudited | Unaudited | Audited |

| | 6 months | 6 months | Year |

| | ended | ended | ended |

| | 30 June | 30 June | 31 |

| | 2009 | 2008 | December |

| | | | 2008 |

+------------------------------------------------+-----------+-----------+-----------+

| Earnings | | | |

+------------------------------------------------+-----------+-----------+-----------+

| Profit for the period (GBP000) | 251 | 305 | 1,000 |

+------------------------------------------------+-----------+-----------+-----------+

| | | | |

+------------------------------------------------+-----------+-----------+-----------+

| Number of shares | | | |

+------------------------------------------------+-----------+-----------+-----------+

| Weighted average number of ordinary shares | 636,706 | 636,706 | 636,706 |

| ('000) | | | |

+------------------------------------------------+-----------+-----------+-----------+

| | | | |

+------------------------------------------------+-----------+-----------+-----------+

Diluted earnings per share is identical to the basic earnings per share. None

of the share options are dilutive as the exercise prices are higher than the

average market price of the shares.

5. Cash

Following the disposal of the UK software products business on 21 December 2007

an amount of GBP2,400,000 was held in a separate bank account not available to

use by the Group.

This amount was excluded from cash and cash equivalents as disclosed in the cash

flow statement for the year ended 31 December 2007 on the basis that it was not

available for use at 31 December 2007. In the period ended 30 June 2008

GBP1,875,000 of these proceeds were used to reduce the bank loan. The

GBP2,400,000 was recognised as a cash inflow in the 2008 cash flow statement

when it was released from escrow.

6. Interim results

Copies of this interim statement will be sent to shareholders and will be

available on the Company's website (www.petards.com) and from the Company's

registered office at 390 Princesway, Team Valley, Gateshead, Tyne and Wear, NE11

0TU.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR VZLFLKKBXBBQ

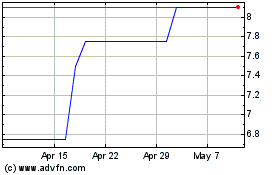

Petards (LSE:PEG)

Historical Stock Chart

From Jun 2024 to Jul 2024

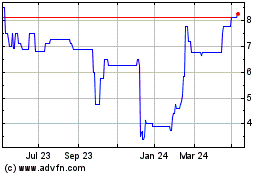

Petards (LSE:PEG)

Historical Stock Chart

From Jul 2023 to Jul 2024