TIDMPEG

RNS Number : 0745T

Petards Group PLC

22 September 2010

PETARDS GROUP PLC

INTERIM RESULTS ANNOUNCEMENT

Petards Group plc ('Petards'), the AIM quoted developer of advanced security and

surveillance systems, reports its interim results for the six months to 30 June

2010.

Financial Highlights

· Revenues of GBP5.3m (2009: GBP6.6m)

· Gross margins increased to 41.1% (2009: 36.5%)

· Profit before tax of GBP115,000 (2009: GBP242,000)

· Basic and diluted earnings per share of 0.02p (2009: 0.04p)

· Net cash outflow from operating activities of GBP0.9m (2009: GBP0.6m

inflow) - due to early receipt of over GBP1m in H2 '09 for which related cash

outflows occurred in early 2010

· Net debt of GBP1.9m (2009: GBP1.8m)

Operational Highlights

· Overseas revenues up to GBP1.4m (2009: GBP0.8m) due to increased eyeTrain

sales

· Revenues for emergency services and defence products lower than in 2009

· Delivery of on-board CCTV on East Coast Trains accounts for c. 20% of

revenues

· New win customer with Spanish train builder, Vossloh

· Pipeline of opportunities for rail business is strong

Commenting on the current outlook, Tim Wightman, Chairman, said:

"We expect results for the second half to be slightly weaker than in the first

half. Although revenue should be higher, margins are expected to be lower.

However, we do anticipate a significant order intake in the balance of the year

which will provide a good base from which to build for 2011."

Contacts:

+------------------------------+---------------------------------------+

| Petards Group plc | www.petards.com |

+------------------------------+---------------------------------------+

| Andy Wonnacott, Finance | +44 (0) 191 420 3000 |

| Director | |

+------------------------------+---------------------------------------+

| | |

+------------------------------+---------------------------------------+

| WH Ireland Limited | www.wh-ireland.co.uk |

+------------------------------+---------------------------------------+

| Mike Coe / Marc Davies | +44 (0) 117 945 3470 |

+------------------------------+---------------------------------------+

| | |

+------------------------------+---------------------------------------+

| Walbrook PR Limited | www.walbrookpr.com |

+------------------------------+---------------------------------------+

| Paul McManus | Tel: +44 (0) 20 7933 8787 |

+------------------------------+---------------------------------------+

| | Mob: +44 (0) 7980 541 893 |

+------------------------------+---------------------------------------+

| | paul.mcmanus@walbrookpr.com |

+------------------------------+---------------------------------------+

Chairman's Statement

Overview of the Results

In the first half of 2010 the Group performed broadly in line with our

expectations although on lower than expected revenues.

Profit before tax for the six months ended 30 June 2010 was GBP115,000 (2009:

GBP242,000) despite revenues of GBP5.3m being almost 20% lower than the same

period last year (2009: GBP6.6m). An improvement in margins aided the first

half result and helped offset the impact of lower revenues. The profit after

tax was GBP115,000 (2009: GBP251,000) resulting in basic and diluted earnings

per share of 0.02p (2009: 0.04p).

Government spending restrictions resulted in revenues for both our defence and

emergency services (ProVida) products being lower, with defence product revenues

from electronic countermeasures and ruggedised electronics control systems for

armoured vehicles being particularly affected. However, revenues from eyeTrain

products were up significantly reflecting the commencement of delivery of some

of the large orders we secured in 2009.

Margins in the period were 41.1% as compared with 36.5% for the first half of

last year. These reflected better than expected final margins on some projects

started in 2009 and completed during the period and also the fact that some of

the reduction in revenues related to products with lower than average margins.

We expect margins for the full year will be slightly below those achieved in

2009.

Cash Flow and Balance Sheet

As I reported in April, we achieved an exceptional operating cash inflow during

the second half of 2009 which was aided by early receipt of over GBP1m for which

the related cash outflows took place in the early part of 2010. Net cash flows

for the first half of 2010 were therefore reduced by this same amount resulting

in a net cash outflow from operating activities for the six months ended 30 June

2010 of GBP0.9m (2009: GBP0.6m inflow).

The Group's net debt at 30 June 2010 was GBP1.9m (30 June 2009: GBP1.8m). Net

debt has increased during the six months principally due to two main factors:

the first being due to the exceptional cash performance in 2009 referred to

above. Secondly, contract work-in-progress relating to eyeTrain products had

also temporarily increased as a consequence of significant orders received

during 2009 and stocking levels of emergency services products that had been

held in anticipation of projects that have been delayed were also higher. This

stock is standard product and is being utilised on other projects and is

expected to be utilised during the second half year.

The Group's total equity position continued to improve and at 30 June 2010 it

showed a deficit of GBP0.25m compared with a deficit of GBP1.14m as at 30 June

2009 and GBP0.29m at 31 December 2009.

Operating Review

The Company's operational performance has improved markedly over recent years.

However, the present economic climate and the uncertainty pending the outcome of

the UK government's public spending review this Autumn has meant that the rate

at which those improvements are now being made has slowed markedly over the

course of the past few months. The impact of these factors is by no means

universal, although all the industry sectors in which we operate are being

affected to some degree or other. Programmes involving new platforms in

particular are being affected although we believe this is likely to present

opportunities for refurbishment/life extension projects for existing equipment.

Examples of this are the well publicised deferral of UK new train programmes

such as Intercity Express and Thameslink, the loss of which we would hope to

offset from our strong position in supplying to the train refurbishment market.

A pleasing feature of the first half year was the increased contribution of

overseas revenues. These accounted for GBP1.4m of total revenues, up from

GBP0.8m in the same period in 2009. Revenues from eyeTrain accounted for this

increase and more than offset the lower level of ProVida product sales achieved

compared with 2009. However, while for the full year overseas revenues from

eyeTrain products will exceed the levels achieved in 2009, we expect our overall

overseas revenues will be lower due to weaker demand for ProVida products and

delays in the placement of expected orders from overseas customers.

As mentioned above, overall revenues for our emergency services and defence

products in the six months were lower than in 2009. While revenues from

products for the defence industry were expected to be lower, the lower demand

for emergency services products both at home and overseas was both unexpected

and disappointing. Orders for these products tend to have a sales cycle

measured in weeks rather than months and there is no sign of any significant

upturn in the short term and so we remain cautious on revenues for the balance

of the year.

Deliveries of on-board CCTV systems under our contract with East Coast Trains

continued and accounted for nearly 20% of revenues during the period.

Deliveries will continue throughout 2010 and the contract is expected to be

substantially complete by the year end. During the period we secured orders to

supply equipment to another refurbishment programme being undertaken by Northern

Rail in conjunction with the train owners, Angel Trains and Porterbrook Leasing.

We were also pleased to add Vossloh, a Spanish train builder to our list of

European customers when they selected our on-board CCTV and Automatic Passenger

Counting Systems for use on their new train-tram series. The first eyeTrain

systems were supplied during the first half year for use on Mallorca's tram and

train network between Manacor and Artácan.

Our pipeline of opportunities for future rail business in the UK and overseas is

strong although as previously reported, the majority of current overseas

opportunities are for new build trains through train builders and the sales

cycle for these runs into many months or in some cases years and so the benefits

of the business development activities we have been undertaking will not be

immediately apparent.

Research and Development

During the period the Group invested GBP0.3m (2009: GBP0.2m) in product

development of which GBP0.2m (2009: GBP0.2m) was capitalised. Net of

amortisation, capitalised development expenditure increased by GBP0.1m (2009:

GBP0.2m).

Products whose development phase was completed during the period included our

ProVida 4000 in-car speed detection and video evidence system, ProVida 4000

radar system and the new ProVida DVR. We anticipate taking our first orders for

these new products by the end of the year and are optimistic that these, along

with other products currently under development, will help generate additional

sales.

In addition, we have continued to develop the capabilities of our eyeTrain

system and have also been undertaking the engineering work to create the

interfaces to enable it to be integrated onto an increasing number of train

variants.

Strategy

The Board's overall objective remains to achieve attractive and sustainable

rates of growth and returns in the more sophisticated or high-end of the

security, surveillance and ruggedized electronics market. Our strategy to

achieve this objective is:

· to focus upon our core products which are used in the rail transport,

emergency services and defence industries;

· to continue to invest in developing our technologies through our product

roadmap;

· to increase sales both organically and, when appropriate, by acquisition;

· to increase sales outside of the UK; and

· to improve operating margins through cost management.

Our progress during the period has not been helped by the current market

conditions. However, as reported above we have moved forward with our product

development and overall sales outside of the UK and margins were up on the same

period last year.

Outlook

The concern that I expressed in my report to you in April is proving to be well

founded and the uncertainty over available programme budgets faced by our

customers in the emergency services and defence industries in particular is

resulting in delays in the placement of orders and in some cases programme

cancellations. Some significant orders which we were expecting to secure in the

second and third quarters have been delayed and are now unlikely to contribute

significantly to the 2010 results.

However, we expect that despite the likely significant nature of government

expenditure cuts to be implemented in October, once those decisions have been

taken this should enable customers to plan ahead with some certainty and release

orders for those programmes that will be proceeding.

We expect results for the second half to be slightly weaker than in the first

half. Although revenue should be higher, margins are expected to be lower.

However, we do anticipate a significant order intake in the balance of the year

which will provide a good base from which to build for 2011.

Tim Wightman

21 September 2010

Condensed Consolidated Income Statement

for the six months ended 30 June 2010

+--------------------+---+---+---+------+-----+-----------+-----------+----------+

| | | | |Note | | Unaudited | Unaudited | Audited |

| | | | | | | 6 months | 6 months | Year |

| | | | | | | ended | ended | ended |

| | | | | | | 30 June | 30 June | 31 |

| | | | | | | 2010 | 2009 | December |

| | | | | | | | | 2009 |

+--------------------+---+---+---+------+-----+-----------+-----------+----------+

| | | | | | | GBP000 | GBP000 | GBP000 |

+--------------------+---+---+---+------+-----+-----------+-----------+----------+

| | | | | | | | | |

+--------------------+---+---+---+------+-----+-----------+-----------+----------+

| Revenue | | | | | | 5,311 | 6,589 | 15,946 |

+--------------------+---+---+---+------+-----+-----------+-----------+----------+

| Cost of sales | | | | | | (3,130) | (4,182) | (9,908) |

+--------------------+---+---+---+------+-----+-----------+-----------+----------+

| | | | | | | | | |

+--------------------+---+---+---+------+-----+-----------+-----------+----------+

| Gross profit | | | | | | 2,181 | 2,407 | 6,038 |

+--------------------+---+---+---+------+-----+-----------+-----------+----------+

| | | | | | | | | |

+--------------------+---+---+---+------+-----+-----------+-----------+----------+

| Administrative | | | | | | (2,077) | (2,099) | (4,770) |

| expenses | | | | | | | | |

+--------------------+---+---+---+------+-----+-----------+-----------+----------+

| | | | | | | | | |

+--------------------+---+---+---+------+-----+-----------+-----------+----------+

| Operating profit | | | | | | 104 | 308 | 1,268 |

+--------------------+---+---+---+------+-----+-----------+-----------+----------+

| Financial income | | | | | | 42 | 10 | 14 |

+--------------------+---+---+---+------+-----+-----------+-----------+----------+

| Financial expenses | | | | | | (31) | (76) | (262) |

+--------------------+---+---+---+------+-----+-----------+-----------+----------+

| | | | | | | | | |

+--------------------+---+---+---+------+-----+-----------+-----------+----------+

| Profit before | | | | | | 115 | 242 | 1,020 |

| income tax | | | | | | | | |

+--------------------+---+---+---+------+-----+-----------+-----------+----------+

| Income tax | | | | 3 | | - | 9 | 88 |

+--------------------+---+---+---+------+-----+-----------+-----------+----------+

| | | | | | | | | |

+--------------------+---+---+---+------+-----+-----------+-----------+----------+

| Profit for the period | | | | | | |

| attributable to equity | | | | 115 | 251 | 1,108 |

| holders of the company | | | | | | |

+----------------------------+---+------+-----+-----------+-----------+----------+

| | | | | | | | | |

+--------------------+---+---+---+------+-----+-----------+-----------+----------+

| Earnings per share | | | | | | | | |

+--------------------+---+---+---+------+-----+-----------+-----------+----------+

| Basic and diluted | | | | 4 | | 0.02p | 0.04p | 0.17p |

+--------------------+---+---+---+------+-----+-----------+-----------+----------+

| | | | | | | | | |

+--------------------+---+---+---+------+-----+-----------+-----------+----------+

The above results are derived from continuing operations.

Condensed Consolidated Statement of Comprehensive Income

for the six month period ended 30 June 2010

+--------------------------------+-----------+-----------+-----------+

| | Unaudited | Unaudited | Audited |

| | 6 months | 6 months | Year |

| | ended | ended | ended |

| | 30 June | 30 June | 31 |

| | 2010 | 2009 | December |

| | | | 2009 |

+--------------------------------+-----------+-----------+-----------+

| | GBP000 | GBP000 | GBP000 |

+--------------------------------+-----------+-----------+-----------+

| | | | |

+--------------------------------+-----------+-----------+-----------+

| Profit for period | 115 | 251 | 1,108 |

+--------------------------------+-----------+-----------+-----------+

| | | | |

+--------------------------------+-----------+-----------+-----------+

| Other comprehensive income | | | |

+--------------------------------+-----------+-----------+-----------+

| Currency translation on | (83) | 149 | 127 |

| foreign currency net | | | |

| investments | | | |

+--------------------------------+-----------+-----------+-----------+

| | | | |

+--------------------------------+-----------+-----------+-----------+

| Total comprehensive income for | 32 | 400 | 1,235 |

| the period | | | |

+--------------------------------+-----------+-----------+-----------+

| | | | |

+--------------------------------+-----------+-----------+-----------+

Condensed Consolidated Statement of Changes in Equity

for the six month period ended 30 June 2010

+--------------------------+---------+---------+----------+-------------+---------+

| | | | | Currency | |

| | Share | Share | Retained | translation | Total |

| | capital | premium | earnings | differences | equity |

+--------------------------+---------+---------+----------+-------------+---------+

| | GBP000 | GBP000 | GBP000 | GBP000 | GBP000 |

+--------------------------+---------+---------+----------+-------------+---------+

| | | | | | |

+--------------------------+---------+---------+----------+-------------+---------+

| Balance at 1 January | 6,367 | 23,255 | (30,866) | (317) | (1,561) |

| 2009 (audited) | | | | | |

+--------------------------+---------+---------+----------+-------------+---------+

| | | | | | |

+--------------------------+---------+---------+----------+-------------+---------+

| Profit for the period | - | - | 251 | - | 251 |

+--------------------------+---------+---------+----------+-------------+---------+

| Other comprehensive | - | - | - | 149 | 149 |

| income | | | | | |

+--------------------------+---------+---------+----------+-------------+---------+

| | | | | | |

+--------------------------+---------+---------+----------+-------------+---------+

| Total comprehensive | - | - | 251 | 149 | 400 |

| income for the period | | | | | |

+--------------------------+---------+---------+----------+-------------+---------+

| Equity-settled share | - | - | 18 | - | 18 |

| based payments | | | | | |

+--------------------------+---------+---------+----------+-------------+---------+

| | | | | | |

+--------------------------+---------+---------+----------+-------------+---------+

| Balance at 30 June 2009 | 6,367 | 23,255 | (30,597) | (168) | (1,143) |

| (unaudited) | | | | | |

+--------------------------+---------+---------+----------+-------------+---------+

| | | | | | |

+--------------------------+---------+---------+----------+-------------+---------+

| Balance at 1 January | 6,367 | 23,255 | (30,866) | (317) | (1,561) |

| 2009 (audited) | | | | | |

+--------------------------+---------+---------+----------+-------------+---------+

| Profit for the year | - | - | 1,108 | - | 1,108 |

+--------------------------+---------+---------+----------+-------------+---------+

| Other comprehensive | - | - | - | 127 | 127 |

| income | | | | | |

+--------------------------+---------+---------+----------+-------------+---------+

| | | | | | |

+--------------------------+---------+---------+----------+-------------+---------+

| Total comprehensive | - | - | 1,108 | 127 | 1,235 |

| income for the year | | | | | |

+--------------------------+---------+---------+----------+-------------+---------+

| Equity-settled share | - | - | 34 | - | 34 |

| based payments | | | | | |

+--------------------------+---------+---------+----------+-------------+---------+

| | | | | | |

+--------------------------+---------+---------+----------+-------------+---------+

| Balance at 31 December | 6,367 | 23,255 | (29,724) | (190) | (292) |

| 2009 (audited) | | | | | |

+--------------------------+---------+---------+----------+-------------+---------+

| | | | | | |

+--------------------------+---------+---------+----------+-------------+---------+

| | | | | | |

+--------------------------+---------+---------+----------+-------------+---------+

| Balance at 1 January | 6,367 | 23,255 | (29,724) | (190) | (292) |

| 2010 (audited) | | | | | |

+--------------------------+---------+---------+----------+-------------+---------+

| Profit for the period | - | - | 115 | - | 115 |

+--------------------------+---------+---------+----------+-------------+---------+

| Other comprehensive | - | - | - | (83) | (83) |

| income | | | | | |

+--------------------------+---------+---------+----------+-------------+---------+

| | | | | | |

+--------------------------+---------+---------+----------+-------------+---------+

| Total comprehensive | - | - | 115 | (83) | 32 |

| income for the period | | | | | |

+--------------------------+---------+---------+----------+-------------+---------+

| Equity-settled share | - | - | 9 | - | 9 |

| based payments | | | | | |

+--------------------------+---------+---------+----------+-------------+---------+

| | | | | | |

+--------------------------+---------+---------+----------+-------------+---------+

| Balance at 30 June 2010 | 6,367 | 23,255 | (29,600) | (273) | (251) |

| (unaudited) | | | | | |

+--------------------------+---------+---------+----------+-------------+---------+

| | | | | | |

+--------------------------+---------+---------+----------+-------------+---------+

Condensed Consolidated Balance Sheet

at 30 June 2010

+---------------------------+---------+-----------+-----------+----------+

| | | Unaudited | Unaudited | Audited |

| | | 30 June | 30 June | 31 |

| | | 2010 | 2009 | December |

| | | | | 2009 |

+---------------------------+---------+-----------+-----------+----------+

| ASSETS | | GBP000 | GBP000 | GBP000 |

+---------------------------+---------+-----------+-----------+----------+

| Non-current assets | | | | |

+---------------------------+---------+-----------+-----------+----------+

| Property, plant and | | 237 | 316 | 267 |

| equipment | | | | |

+---------------------------+---------+-----------+-----------+----------+

| Goodwill | | 401 | 401 | 401 |

+---------------------------+---------+-----------+-----------+----------+

| Development costs | | 720 | 536 | 621 |

+---------------------------+---------+-----------+-----------+----------+

| Deferred tax assets | | 356 | 310 | 356 |

+---------------------------+---------+-----------+-----------+----------+

| | | | | |

+---------------------------+---------+-----------+-----------+----------+

| | | 1,714 | 1,563 | 1,645 |

+---------------------------+---------+-----------+-----------+----------+

| | | | | |

+---------------------------+---------+-----------+-----------+----------+

| Current assets | | | | |

+---------------------------+---------+-----------+-----------+----------+

| Inventories | | 1,706 | 856 | 941 |

+---------------------------+---------+-----------+-----------+----------+

| Trade and other | | 1,859 | 1,828 | 3,450 |

| receivables | | | | |

+---------------------------+---------+-----------+-----------+----------+

| Cash and cash equivalents | | 21 | 267 | 701 |

| | | | | |

+---------------------------+---------+-----------+-----------+----------+

| | | | | |

+---------------------------+---------+-----------+-----------+----------+

| | | 3,586 | 2,951 | 5,092 |

+---------------------------+---------+-----------+-----------+----------+

| | | | | |

+---------------------------+---------+-----------+-----------+----------+

| Total assets | | 5,300 | 4,514 | 6,737 |

+---------------------------+---------+-----------+-----------+----------+

| | | | | |

+---------------------------+---------+-----------+-----------+----------+

| EQUITY AND LIABILITIES | | | | |

+---------------------------+---------+-----------+-----------+----------+

| Equity attributable to | | | | |

| equity holders of the | | | | |

| parent | | | | |

+---------------------------+---------+-----------+-----------+----------+

| Share capital | | 6,367 | 6,367 | 6,367 |

+---------------------------+---------+-----------+-----------+----------+

| Share premium | | 23,255 | 23,255 | 23,255 |

+---------------------------+---------+-----------+-----------+----------+

| Currency translation | | (273) | (168) | (190) |

| reserve | | | | |

+---------------------------+---------+-----------+-----------+----------+

| Retained earnings deficit | | (29,600) | (30,597) | (29,724) |

+---------------------------+---------+-----------+-----------+----------+

| | | | | |

+---------------------------+---------+-----------+-----------+----------+

| Total equity | | (251) | (1,143) | (292) |

+---------------------------+---------+-----------+-----------+----------+

| | | | | |

+---------------------------+---------+-----------+-----------+----------+

| Non-current liabilities | | | | |

+---------------------------+---------+-----------+-----------+----------+

| Interest-bearing loans | | 799 | 700 | 1,050 |

| and borrowings | | | | |

+---------------------------+---------+-----------+-----------+----------+

| Deferred tax liabilities | | 66 | - | 66 |

+---------------------------+---------+-----------+-----------+----------+

| | | | | |

+---------------------------+---------+-----------+-----------+----------+

| | | 865 | 700 | 1,116 |

+---------------------------+---------+-----------+-----------+----------+

| | | | | |

+---------------------------+---------+-----------+-----------+----------+

| Current liabilities | | | | |

+---------------------------+---------+-----------+-----------+----------+

| Bank overdraft | | 669 | - | - |

+---------------------------+---------+-----------+-----------+----------+

| Other | | 450 | 1,375 | 400 |

| interest-bearing loans | | | | |

| and borrowings | | | | |

+---------------------------+---------+-----------+-----------+----------+

| Trade and other | | 3,567 | 3,582 | 5,513 |

| payables | | | | |

+---------------------------+---------+-----------+-----------+----------+

| | | | | |

+---------------------------+---------+-----------+-----------+----------+

| | | 4,686 | 4,957 | 5,913 |

+---------------------------+---------+-----------+-----------+----------+

| | | | | |

+---------------------------+---------+-----------+-----------+----------+

| Total liabilities | | 5,551 | 5,657 | 7,029 |

+---------------------------+---------+-----------+-----------+----------+

| | | | | |

+---------------------------+---------+-----------+-----------+----------+

| Total equity and | | 5,300 | 4,514 | 6,737 |

| liabilities | | | | |

+---------------------------+---------+-----------+-----------+----------+

| | | | | |

+---------------------------+---------+-----------+-----------+----------+

Condensed Consolidated Statement of Cash Flows

for the six month period ended 30 June 2010

+--------------------------------------------+----+-----------+-----------+----------+

| | | Unaudited | Unaudited | Audited |

| | | 6 months | 6 months | Year |

| | | ended | ended | ended |

| | | 30 June | 30 June | 31 |

| | | 2010 | 2009 | December |

| | | | | 2009 |

+--------------------------------------------+----+-----------+-----------+----------+

| | | GBP000 | GBP000 | GBP000 |

+--------------------------------------------+----+-----------+-----------+----------+

| Cash flows from operating activities | | | | |

+--------------------------------------------+----+-----------+-----------+----------+

| Profit for the period | | 115 | 251 | 1,108 |

+--------------------------------------------+----+-----------+-----------+----------+

| Adjustments for: | | | | |

+--------------------------------------------+----+-----------+-----------+----------+

| Depreciation | | 61 | 74 | 180 |

+--------------------------------------------+----+-----------+-----------+----------+

| Amortisation of intangible assets | | 120 | 23 | 206 |

+--------------------------------------------+----+-----------+-----------+----------+

| Financial income | | (42) | (10) | (14) |

+--------------------------------------------+----+-----------+-----------+----------+

| Financial expense | | 31 | 76 | 262 |

+--------------------------------------------+----+-----------+-----------+----------+

| Equity settled share-based payment | | 9 | 18 | 34 |

| expenses | | | | |

+--------------------------------------------+----+-----------+-----------+----------+

| Income tax credit | | - | (9) | (88) |

+--------------------------------------------+----+-----------+-----------+----------+

| | | | | |

+--------------------------------------------+----+-----------+-----------+----------+

| | | 294 | 423 | 1,688 |

+--------------------------------------------+----+-----------+-----------+----------+

| Change in trade and other receivables | | 1,591 | 823 | (822) |

+--------------------------------------------+----+-----------+-----------+----------+

| Change in inventories | | (765) | 517 | 432 |

+--------------------------------------------+----+-----------+-----------+----------+

| Change in trade and other payables | | (2,044) | (1,134) | 800 |

+--------------------------------------------+----+-----------+-----------+----------+

| | | | | |

+--------------------------------------------+----+-----------+-----------+----------+

| Cash (outflow)/inflow from operations | | (924) | 629 | 2,098 |

+--------------------------------------------+----+-----------+-----------+----------+

| Interest received | | 42 | 10 | 14 |

+--------------------------------------------+----+-----------+-----------+----------+

| Interest paid | | (31) | (93) | (287) |

+--------------------------------------------+----+-----------+-----------+----------+

| Income tax received | | 9 | 90 | 205 |

+--------------------------------------------+----+-----------+-----------+----------+

| | | | | |

+--------------------------------------------+----+-----------+-----------+----------+

| Net cash (outflow)/inflow from operating | | (904) | 636 | 2,030 |

| activities | | | | |

+--------------------------------------------+----+-----------+-----------+----------+

| | | | | |

+--------------------------------------------+----+-----------+-----------+----------+

| Cash flows from investing activities | | | | |

+--------------------------------------------+----+-----------+-----------+----------+

| Capitalised development expenditure | | (219) | (214) | (482) |

+--------------------------------------------+----+-----------+-----------+----------+

| Acquisition of property, plant and | | (31) | (53) | (110) |

| equipment | | | | |

+--------------------------------------------+----+-----------+-----------+----------+

| | | | | |

+--------------------------------------------+----+-----------+-----------+----------+

| Net cash outflow from investing activities | | (250) | (267) | (592) |

+--------------------------------------------+----+-----------+-----------+----------+

| | | | | |

+--------------------------------------------+----+-----------+-----------+----------+

| Cash flows from financing activities | | | | |

+--------------------------------------------+----+-----------+-----------+----------+

| Decrease in committed overdraft facility | | - | (356) | (356) |

+--------------------------------------------+----+-----------+-----------+----------+

| Repayment of bank borrowings | | (201) | - | (625) |

+--------------------------------------------+----+-----------+-----------+----------+

| | | | | |

+--------------------------------------------+----+-----------+-----------+----------+

| Net cash outflow from financing activities | | (201) | (356) | (981) |

+--------------------------------------------+----+-----------+-----------+----------+

| | | | | |

+--------------------------------------------+----+-----------+-----------+----------+

| Net (decrease)/increase in cash and cash | | (1,355) | 13 | 457 |

| equivalents | | | | |

+--------------------------------------------+----+-----------+-----------+----------+

| Cash and cash equivalents at start of | | 701 | 268 | 268 |

| period | | | | |

+--------------------------------------------+----+-----------+-----------+----------+

| Effect of exchange rate fluctuations on | | 6 | (14) | (24) |

| cash held | | | | |

+--------------------------------------------+----+-----------+-----------+----------+

| | | | | |

+--------------------------------------------+----+-----------+-----------+----------+

| Cash and cash equivalents at end of period | | (648) | 267 | 701 |

+--------------------------------------------+----+-----------+-----------+----------+

| | | | | |

+--------------------------------------------+----+-----------+-----------+----------+

| Cash and cash equivalents comprise: | | | | |

+--------------------------------------------+----+-----------+-----------+----------+

| Cash and cash equivalents | | 21 | 267 | 701 |

+--------------------------------------------+----+-----------+-----------+----------+

| Bank overdraft | | (669) | - | - |

+--------------------------------------------+----+-----------+-----------+----------+

| | | | | |

+--------------------------------------------+----+-----------+-----------+----------+

| | | (648) | 267 | 701 |

+--------------------------------------------+----+-----------+-----------+----------+

| | | | | |

+--------------------------------------------+----+-----------+-----------+----------+

Notes

(forming part of the financial statements)

1 General

The interim financial information set out in this statement for the six months

ended 30 June 2010 and the comparative figures for the six months ended 30 June

2009 are unaudited. This financial information does not constitute statutory

accounts as defined in Section 435 of the Companies Act 2006.

The comparative figures for the financial year ended 31 December 2009 are not

the company's statutory financial statements for that financial year. Those

accounts have been reported on by the company's auditors and delivered to the

Registrar of Companies. The report of the auditors was (i) unqualified, (ii) did

not include a reference to any matters to which the auditors drew attention by

way of emphasis without qualifying their report, and (iii) did not contain a

statement under section 498(2) or (3) of the Companies Act 2006.

Copies of this interim statement will be sent to shareholders and will be

available on the Company's website (www.petards.com) and from the Company's

registered office at 390 Princesway, Team Valley, Gateshead, Tyne and Wear, NE11

0TU.

2 Basis of preparation

This interim statement, which is neither audited nor reviewed, has been prepared

in accordance with the measurement and recognition criteria of Adopted IFRSs.

They do not include all the information required for the full annual financial

statements, and should be read in conjunction with the financial statements of

the Group as at and for the year ended 31 December 2009. It does not comply with

IAS 34 'Interim Financial Reporting' as is permissible under the rules of the

AIM Market ("AIM").

The accounting policies applied in preparing these interim financial statements,

other than those noted below, are the same as those applied in the preparation

of the annual financial statements for the year ended 31 December 2009, as

described in those financial statements. The Board approved these interim

financial statements on 21 September 2010.

From 1 January 2010 the following standards, amendments and interpretations

endorsed by the EU became effective and were adopted by the Group:

· Revised IFRS 3 Business Combinations;

· Amendments to IAS 27 Consolidated and Separate Financial Statements

· Embedded Derivatives (Amendments to IFRIC 9 and IAS 39);

· Eligible Hedged Items (Amendments to IAS 39 Financial Instruments:

Recognition and Measurement).

The adoption of the above has not had a significant impact on the Group's

interim financial statements.

3 Taxation

No provision for taxation has been made in the profit and loss account for the

six months to 30 June 2010 based on the estimated tax provision required for the

year ending 31 December 2010. No provision was required in the six months to 30

June 2009. An adjustment in respect of prior years of GBP9,000 arose in the six

months to 30 June 2009 in respect of research and development tax credits.

4 Earnings per share

Basic earnings per share is calculated by dividing the profit for the period

attributable to the shareholders by the weighted average number of shares in

issue. The calculation of diluted earnings per share assumes conversion of all

potentially dilutive ordinary shares, all of which arise from share options.

The calculation of earnings per share is based on the profit for the period and

on the weighted average number of ordinary shares outstanding in the period.

+-----------------------------------------+-----------+-----------+----------+

| | Unaudited | Unaudited | Audited |

| | 6 months | 6 months | Year |

| | ended | ended | ended |

| | 30 June | 30 June | 31 |

| | 2010 | 2009 | December |

| | | | 2009 |

+-----------------------------------------+-----------+-----------+----------+

| Earnings | | | |

+-----------------------------------------+-----------+-----------+----------+

| Profit for the period (GBP000) | 115 | 251 | 1,108 |

+-----------------------------------------+-----------+-----------+----------+

| | | | |

+-----------------------------------------+-----------+-----------+----------+

| Number of shares | | | |

+-----------------------------------------+-----------+-----------+----------+

| Weighted average number of ordinary | 636,707 | 636,706 | 636,706 |

| shares ('000) | | | |

+-----------------------------------------+-----------+-----------+----------+

| | | | |

+-----------------------------------------+-----------+-----------+----------+

Diluted earnings per share is identical to the basic earnings per share. None

of the share options are dilutive as the exercise prices are higher than the

average market price of the shares.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR QFLFLBKFZBBB

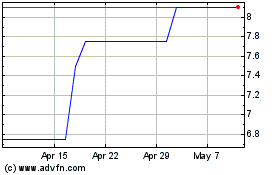

Petards (LSE:PEG)

Historical Stock Chart

From Jun 2024 to Jul 2024

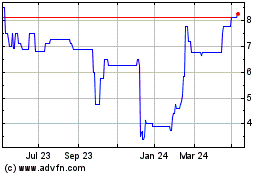

Petards (LSE:PEG)

Historical Stock Chart

From Jul 2023 to Jul 2024