TIDMPEG

RNS Number : 2474P

Petards Group PLC

30 September 2011

PETARDS GROUP PLC

INTERIM RESULTS ANNOUNCEMENT

Petards Group plc ('Petards'), the AIM quoted developer of

advanced security and surveillance systems, reports its interim

results for the six months to 30 June 2011.

Highlights

-- Revenues of GBP5.2m (2010: GBP5.3m)

-- Gross margins 40.5% (2010: 41.1%)

-- Profit before tax of GBP5,000 (2010: GBP115,000)

-- Basic and diluted earnings per share of 0.08p (2010 as

restated: 1.81p)

-- Net cash inflow from operating activities of GBP0.4m (2010:

GBP0.9m outflow)

-- Net debt of GBP1.8m (31 December 2010: GBP2.0m)

Commenting on the current outlook, Tim Wightman, Chairman,

said:

"Our order prospects remain encouraging with a number of large

UK programmes in both the rail and defence markets having now

obtained Government approval. However, the indicated delivery

schedules of trains on the prospective large rail projects mean

that those would be unlikely to have any material impact on

revenues until 2013.

In the shorter term, the increasing global economic uncertainty

over recent weeks leads us to be cautious over the timing of

customer order placement for our products although we believe those

orders will be secured. Despite this we expect year-on-year revenue

growth in 2011, although that growth will be lower than previously

expected."

Contacts:

Petards Group plc www.petards.com

Andy Wonnacott, Finance Director +44 (0) 191 420 3000

WH Ireland Limited www.wh-ireland.co.uk

Mike Coe / Marc Davies +44 (0) 117 945 3470

Chairman's Statement

Overview of the Results

The financial information contained within this interim report

is based upon the Group's unaudited results

for the six months to 30 June 2011.

In the first six months of 2011 the Group performed ahead of our

expectations albeit on lower than expected revenues. Profit before

tax for the period was GBP5,000 (2010: GBP115,000) on revenues of

GBP5.2m which remained at a similar level to those achieved for the

same period last year (2010: GBP5.3m). The profit after tax was

GBP5,000 (2010: GBP115,000) and both basic and diluted earnings per

share were 0.08p (2010 as restated: 1.81p).

Our revenues in June were approximately GBP0.3m lower than

expected due to a major fire at the end of May at one of our key

suppliers which impacted upon deliveries of our Transport products.

Alternative suppliers have been brought on stream and shipments of

product have now re-commenced. This interruption of supply has

necessitated some amendment to customers' build schedules which

will have some effect on our full year revenues of Transport

products.

Overall gross margins were 40.5% and while slightly lower than

those achieved in the same period last year (2010: 41.1%), were

higher than in the second half of 2010 and were ahead of our

expectations.

Cash generated from operations resulted in a GBP0.4m inflow in

the period (2010: GBP0.9m outflow) and the Group's net debt at 30

June 2011 was GBP1.8m (31 December 2010: GBP2.0m).

Operating Review

During the period we completed deliveries of the eyeTrain

equipment that is installed on the Electrostar EMU trains that

Bombardier are supplying to National Express East Anglia and the

first of those trains entered into service on Stansted Express

services. Initial deliveries were also made to Transys Projects and

Bombardier for the vehicle upgrades they are undertaking for

Southeastern Trains' fleet. Revenues from eyeTrain products were

slightly lower than the first six months of 2010 due to the impact

of the fire referred to above.

At this stage last year I commented upon the well publicised

deferral of the Intercity Express and Thameslink new train

programmes arising from the UK governments Comprehensive Spending

Review. We are pleased that during the first half of 2011 the

Department of Transport has given approval for both of those

programmes and confirmed Hitachi and Siemens as the preferred

bidders as these are important projects in which we would hope to

be involved.

Revenues from Provida products were similar to those experienced

in the first half of 2010 and continue to be affected by

significant budgetary pressures faced by UK police forces. Outside

of the UK we have been pleased to receive additional orders from

new partners we established last year and have identified a number

of strong prospects for the future.

While the overall defence market remains challenging, revenues

were up on the same period last year. Another positive was that in

June we received our first order for electronic countermeasures

systems since the Strategic Defence and Security Review was

undertaken. The upgrade forms part of the Puma helicopter life

extension programme and will integrate existing systems to

significantly improve the Defensive Aids Suite on the aircraft. We

are also encouraged by the announcement in July of the Government's

commitment to provide increased funding for the MoD's equipment

budget, as two of the programmes benefiting from this are the

upgrades to Warrior armoured vehicles and the acquisition of

Chinook helicopters, which are platforms to which we have

previously supplied equipment.

Research and Development

A key element of the Group's growth strategy is its commitment

to its product development programme and capitalised development

expenditure in the first six months of 2011 was GBP0.1m (2010:

GBP0.2m). We continue to invest in our products with the resources

available to us.

Capital Reorganisation

At the General Meeting held on 30 June 2011 a special resolution

was passed by shareholders to undertake a capital reorganisation,

details of which are set out in note 4 of this Interim Results

Statement.

Outlook

Our order prospects remain encouraging with a number of large UK

programmes in both the rail and defence markets having now obtained

Government approval. However, the indicated delivery schedules of

trains on the prospective large rail projects mean that those would

be unlikely to have any material impact on revenues until 2013.

In the shorter term, the increasing global economic uncertainty

over recent weeks leads us to be cautious over the timing of

customer order placement for our products although we believe those

orders will be secured. Despite this we expect year-on-year revenue

growth in 2011, although that growth will be lower than previously

expected.

Tim Wightman

29 September 2011

Condensed Consolidated Income Statement

for the six months ended 30 June 2011

Unaudited Unaudited Audited

6 months 6 months Year

ended ended ended

30 June 30 June 31 December

Note 2011 2010 2010

GBP000 GBP000 GBP000

Revenue 5,229 5,311 11,392

Cost of sales (3,112) (3,130) (7,069)

Gross profit 2,117 2,181 4,323

Administrative expenses (2,073) (2,077) (4,238)

Operating profit 44 104 85

Financial income 27 42 53

Financial expenses (66) (31) (85)

Profit before income

tax 5 115 53

Income tax 3 - - 311

Profit for the period attributable

to equity

holders of the company 5 115 364

Earnings per share

Basic and diluted (2010 5 0.08p 1.81p 5.72p

as restated)

The above results are derived from continuing operations.

Condensed Consolidated Statement of Comprehensive Income

for the six month period ended 30 June 2011

Unaudited Unaudited Audited

6 months 6 months Year

ended ended ended

30 June 30 June 31 December

2011 2010 2010

GBP000 GBP000 GBP000

Profit for period 5 115 364

Other comprehensive income

Currency translation on foreign

currency net investments 27 (83) (34)

Total comprehensive income for

the period 32 32 330

Condensed Consolidated Statement of Changes in Equity

for the six month period ended 30 June 2011

Currency

Share Share Retained translation Total

capital premium earnings differences equity

GBP000 GBP000 GBP000 GBP000 GBP000

Balance at 1 January

2010 (audited) 6,367 23,255 (29,724) (190) (292)

Profit for the period - - 115 - 115

Other comprehensive

income - - - (83) (83)

Total comprehensive

income for the

period - - 115 (83) 32

Equity-settled share

based payments - - 9 - 9

Balance at 30 June

2010 (unaudited) 6,367 23,255 (29,600) (273) (251)

Balance at 1 January

2010 (audited) 6,367 23,255 (29,724) (190) (292)

Profit for the year - - 364 - 364

Other comprehensive

income - - - (34) (34)

Total comprehensive

income for the year - - 364 (34) 330

Equity-settled share

based payments - - 18 - 18

Balance at 31

December 2010

(audited) 6,367 23,255 (29,342) (224) 56

Balance at 1 January

2011 (audited) 6,367 23,255 (29,342) (224) 56

Profit for the period - - 5 - 5

Other comprehensive

income - - - 27 27

Total comprehensive

income for the

period - - 5 27 32

Equity-settled share

based payments - - 7 - 7

Capital reorganisation

costs - (25) - - (25)

Balance at 30 June

2011 (unaudited) 6,367 23,230 (29,330) (197) 70

Condensed Consolidated Balance Sheet

at 30 June 2011

Unaudited Unaudited Audited

30 June 30 June 31 December

Note 2011 2010 2010

ASSETS GBP000 GBP000 GBP000

Non-current assets

Property, plant and equipment 149 237 182

Goodwill 401 401 401

Development costs 651 720 701

Deferred tax assets 790 356 790

1,991 1,714 2,074

Current assets

Inventories 1,030 1,706 911

Trade and other receivables 2,542 1,859 2,408

Cash and cash equivalents 3 21 -

3,575 3,586 3,319

Total assets 5,566 5,300 5,393

EQUITY AND LIABILITIES

Equity attributable to equity

holders of the parent

Share capital 4 6,367 6,367 6,367

Share premium 23,230 23,255 23,255

Currency translation reserve (197) (273) (224)

Retained earnings deficit (29,330) (29,600) (29,342)

Total equity 70 (251) 56

Non-current liabilities

Interest-bearing loans and

borrowings 295 799 550

Deferred tax liabilities 189 66 189

484 865 739

Current liabilities

Interest-bearing loans and

borrowings 1,471 1,119 1,453

Trade and other payables 3,541 3,567 3,145

5,012 4,686 4,598

Total liabilities 5,496 5,551 5,337

Total equity and liabilities 5,566 5,300 5,393

Condensed Consolidated Statement of Cash Flows

for the six month period ended 30 June 2011

Unaudited Unaudited Audited

6 months 6 months Year

ended ended ended

30 June 30 June 31 December

2011 2010 2010

GBP000 GBP000 GBP000

Cash flows from operating activities

Profit for the period 5 115 364

Adjustments for:

Depreciation 45 61 138

Amortisation of intangible assets 155 120 250

Financial income (27) (42) (53)

Financial expense 66 31 85

Profit on sale of property, plant

and equipment - - (4)

Equity settled share-based payment

expenses 7 9 18

Income tax credit - - (311)

Operating cash flows before movement in

working capital 251 294 487

Change in trade and other

receivables (134) 1,591 1,042

Change in inventories (119) (765) 30

Change in trade and other payables 450 (2,044) (2,408)

Cash generated from operations 448 (924) (849)

Interest received - 42 53

Interest paid (66) (31) (83)

Income tax received - 9 -

Net cash from operating activities 382 (904) (879)

Cash flows from investing activities

Sale of property, plant and

equipment - - 4

Acquisition of property, plant and

equipment (12) (31) (53)

Capitalised development expenditure (105) (219) (330)

Net cash outflow from investing activities (117) (250) (379)

Cash flows from financing activities

Repayment of bank borrowings (250) (201) (400)

Capital reorganisation expenses (25) - -

Net cash outflow from financing activities (275) (201) (400)

Net decrease in cash and cash

equivalents (10) (1,355) (1,658)

Cash and cash equivalents at start

of period (953) 701 701

Effect of exchange rate fluctuations

on cash held - 6 4

Cash and cash equivalents at end of period (963) (648) (953)

Cash and cash equivalents comprise:

Cash and cash equivalents 3 21 -

Overdraft (966) (669) (953)

(963) (648) (953)

Notes

1 General

The interim financial information set out in this statement for

the six months ended 30 June 2011 and the comparative figures for

the six months ended 30 June 2010 are unaudited. This financial

information does not constitute statutory accounts as defined in

Section 435 of the Companies Act 2006.

The comparative figures for the financial year ended 31 December

2010 are not the Company's statutory accounts for that financial

year. Those accounts have been reported on by the Company's

auditors and delivered to the Registrar of Companies. The report of

the auditors was (i) unqualified, (ii) did not include a reference

to any matters to which the auditors drew attention by way of

emphasis without qualifying their report, and (iii) did not contain

a statement under section 498(2) or (3) of the Companies Act

2006.

Copies of this interim statement will be available on the

Company's website (www.petards.com) and from the Company's

registered office at 390 Princesway, Team Valley, Gateshead, Tyne

and Wear, NE11 0TU.

2 Basis of preparation

This interim statement, which is neither audited nor reviewed,

has been prepared in accordance with the measurement and

recognition criteria of Adopted IFRSs. It does not include all the

information required for the full annual financial statements, and

should be read in conjunction with the financial statements of the

Group as at and for the year ended 31 December 2010. It does not

comply with IAS 34 'Interim Financial Reporting' as is permissible

under the rules of the AIM Market ("AIM").

The accounting policies applied in preparing these interim

financial statements are the same as those applied in the

preparation of the annual financial statements for the year ended

31 December 2010, as described in those financial statements other

than standards, amendments and interpretations which became

effective after 1 January 2011 and were adopted by the Group. These

have had no significant impact on the Group's profit for the period

or equity. The Board approved these interim financial statements on

29 September 2011.

3 Taxation

No provision for taxation has been made in the Condensed

Consolidated Income Statement for the six months to 30 June 2011

based on the estimated tax provision required for the year ending

31 December 2011. No provision was required in the six months to 30

June 2010.

4 Share capital

At 30 June At 30 June At 31 December

2011 2010 2010

No. No. No.

Number of shares in issue

- allotted, called up and

fully paid

New Ordinary Shares of 1p

each 6,367,100 - -

Deferred Shares of 1p each 630,342,900 - -

Ordinary Shares of 1p each - 636,710,000 636,710,000

636,710,000 636,710,000 636,710,000

GBP000 GBP000 GBP000

Number of shares in issue

- allotted, called up and

fully paid

New Ordinary Shares of 1p

each 64 - -

Deferred Shares of 1p each 6,303 - -

Ordinary Shares of 1p each - 6,367 6,367

6,367 6,367 6,367

On 30 June 2011 shareholders passed a resolution to reorganise

the Company's share capital. Under this reorganisation, the

Existing Ordinary Shares of 1p each were consolidated into New

Consolidated Ordinary Shares of GBP100 each on the basis of one New

Consolidated Ordinary Share for each 10,000 Existing Ordinary

Shares. Each New Consolidated Ordinary Share was then sub-divided

into 100 New Ordinary Shares of 1p each and 9,900 Deferred Shares

of 1p each.

Following the reorganisation, the Company's issued share capital

comprises 6,367,100 Ordinary Shares of 1p each and 630,342,900

Deferred Shares of 1p each. The Ordinary Shares have equal voting

rights. The Deferred Shares have no voting rights and are not

entitled to any dividends and have no other right or participation

in the profits of the Company.

5 Earnings per share

Basic earnings per share is calculated by dividing the profit

for the period attributable to the shareholders by the weighted

average number of shares in issue. The calculation of diluted

earnings per share assumes conversion of all potentially dilutive

ordinary shares, all of which arise from share options.

The calculation of earnings per share is based on the profit for

the period and on the weighted average number of ordinary shares

outstanding in the period.

The weighted average number of ordinary shares for the 6 months

ended 30 June 2010 and the year ended 31 December 2010 have been

restated to reflect the reorganisation of the Company's share

capital on 30 June 2011 described in note 4.

Unaudited Unaudited Audited

6 months 6 months Year

ended ended ended

30 June 30 June 31 December

2011 2010 2010

Earnings

Profit for the period (GBP000) 5 115 364

Number of shares

Weighted average number of ordinary

shares ('000) as restated 6,367 6,367 6,367

Weighted average number of ordinary

shares ('000) as originally stated 636,707 636,708

Earnings per share

Basic and diluted as originally stated

(pence) 0.02 0.06

Diluted earnings per share is identical to the basic earnings

per share. None of the share options are dilutive as the exercise

prices are higher than the average market price of the shares.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR VKLFLFKFLBBZ

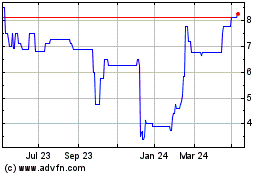

Petards (LSE:PEG)

Historical Stock Chart

From Jun 2024 to Jul 2024

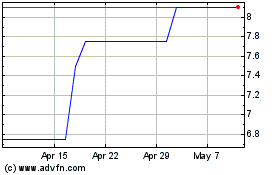

Petards (LSE:PEG)

Historical Stock Chart

From Jul 2023 to Jul 2024