TIDMPEG

RNS Number : 6709Q

Petards Group PLC

03 September 2014

3 September 2014

PETARDS GROUP PLC

INTERIM RESULTS ANNOUNCEMENT

Petards Group plc ('Petards'), the AIM quoted developer of

advanced security and surveillance systems, reports its interim

results for the six months to 30 June 2014.

Key points:

-- Operational

o Order book remains in excess of GBP20 million giving strong

position for the second half 2014 and future years.

-- Approximately one third of order book is scheduled for

delivery in the second half of 2014

-- Orders secured in first half of 2014 included;

-- Over GBP1.5 million for Petards eyeTrain CCTV systems from

Siemens for new super high-speed trains it is building for the

Turkish State Railway. This was the first order placed under a

framework agreement signed with Siemens in June 2014 for thesupply

ofPetards train related products and services.

-- Over GBP4.5 million for modification programme relating to

countermeasures equipment for the MOD.

-- Financial

o Results for the six months to 30 June 2014

-- Revenues up 101% to GBP7.2 million (2013: GBP3.6 million)

-- Gross margin 27% (2013: 40%), a reflection of higher defence

equipment supplies

-- EBITDA GBP441,000 profit (2013: GBP158,000 loss before

exceptionals)

-- Operating profit GBP346,000 (2013: GBP299,000 loss)

-- Profit after tax GBP273,000 (2013: GBP338,000 loss)

o Finance

-- Cash inflow from operating activities GBP181,000 (2013:

GBP1,029,000 outflow)

-- Cash at 30 June 2014 GBP1.5 million (31 Dec 2013: GBP1.4

million) and no bank debt

-- Basic EPS of 0.79p per share (2013: 3.11p loss per share)

-- Diluted EPS of 0.62p per share (2013: 3.11p loss per

share)

Commenting on the current outlook, Raschid Abdullah, Chairman,

said:

"The second half of 2014 has started well and the Group

continues to trade profitably. The Group's overall order book is in

excess of GBP20 million of which over one third is expected to be

delivered before the end of the current year.

There continues to be opportunities for development and growth

in all of our current product areas and we expect customers to be

placing orders on a number of projects in the coming months which

we believe we are well placed to secure.

The Board is confident about the Group's prospects for the

second half and beyond as whilst there is still work to be done

this year in closing out new business, the present order book

already provides a strong base going forward into 2015."

Contacts:

Petards Group plc www.petards.com

Raschid Abdullah, Chairman Mb: 07768 905004

Andy Wonnacott, Finance Director Tel: 0191 420 3000

WH Ireland Limited, Nomad and www.wh-ireland.co.uk

Joint Broker

Mike Coe, Ed Allsopp Tel: 0117 945 3470

Hybridan LLP, Joint Broker www.hybridan.com

Claire Louise Noyce Tel: 020 3713 4581

claire.noyce@hybridan.com

Chairman's Statement

Corporate Overview

I am pleased to report that having entered the year with a

strong order book the Group has produced a much improved trading

performance in the six months ended 30 June 2014. Revenues totalled

GBP7.2 million and the pre-tax profit was GBP273,000. In addition

the Group has secured a number of significant contracts within both

the rail and defence industries and has a strong order book.

The financing transactions completed in the latter part of 2013

coupled with positive cash flows on the larger projects currently

flowing through the business have put the Company in a much

stronger position with no bank debt and cash balances of GBP1.5

million as at 30 June 2014.

Operating Review

The Group continued to make progress on a number of fronts with

the award of some key projects during the period.

Petards' strategic position within the new train build market

was strengthened with a five year framework agreement being entered

into with Siemens' rail vehicle business to supply Petards train

related products and services. The first order under that agreement

was placed to supply Petards eyeTrain on-board digital CCTV systems

for the new super high-speed Velaro type trains that Siemens are

building for the Turkish State Railway.

The project is currently worth in excess of GBP1.5 million and

has the potential to increase in size over time providing that

Siemens is successful in winning additional train orders from the

Turkish State Railway which has announced plans to procure up to a

further 90 high speed trains.

The UK rail market offers a number of near term order

opportunities for Petards eyeTrain systems for fitment onto new

build trains for rolling stock for which orders have been placed on

train builders already and for rolling stock for which orders are

expected to be placed soon. Also as previously anticipated, enquiry

levels for retrofit applications are increasing as a result of the

letting of new franchises to UK train operators.

The contract awarded at the end of June, worth over GBP4.5

million, by the Ministry of Defence ("MOD") to modify

countermeasures equipment fitted to many of its aircraft will

contribute to revenues in 2014 and the two following years. This

programme will replace obsolete components within ALE-47 Threat

Adaptive Countermeasure Dispensing System (TACDS) Programmers which

form part of the integrated Defensive Aids Suite installed on a

variety of aircraft. We are hopeful that some other smaller

countermeasures projects will be approved in the second half of the

year.

Petards has been the long standing operator of an MOD enabling

contract to supply it with private mobile radio equipment,

ancillaries and engineering services and the Group's expertise in

this field was recognised when it was awarded the GBP7 million

Secure Management Radio Equipment ("SMRE") project in 2013. We were

therefore extremely pleased to have learned yesterday that Petards

has been awarded, subject to contract, the new enabling contract

that commences later this month. Revenues from this new two year

contract are estimated to be similar to those under the previous

contract which were in excess of GBP0.5 million per annum and the

MOD have the option to extend the contract by up to a further two

years.

Trading in our Emergency Services products remained similar to

that for the equivalent period in 2013 and continues to make a

small but positive contribution to the Group's profitability.

Consideration is presently being given to how the Group's business

in this area could be enhanced through product development.

Our 'Fit 4 Growth' programme is on-going and is now focused on

the continuous improvement and development of our businesses. To

support this programme and our current business levels of activity,

additional resources have been recruited but operating costs will

continue to be closely monitored to ensure they remain in step with

both revenues and margins.

Overview of the Results

Group revenues for the six months ended 30 June 2014 of GBP7.2

million were double the GBP3.6 million achieved in the equivalent

period last year and were almost 15% higher than the total revenues

for the prior year (2013: GBP6.3 million). Equipment deliveries for

the SMRE project accounted for a substantial proportion of this

growth, although revenues from both equipment and one-off

engineering services provided to Bombardier, Siemens and Hyundai

Rotem were also notable contributors.

In line with our expectations, gross margins were down to 27%

(June 2013: 40%). While margins on our different product lines were

generally maintained, the main cause of the reduction in the margin

percentage was the mix of business compared with that of 2013. In

particular, the SMRE project had a significant effect due to its

high material cost content as did some of the one-off rail

engineering services which were competitively priced in order to

gain market position for potential future equipment orders from

those customers.

Administrative expenses totalled GBP1.6 million (June 2013:

GBP1.7 million) and after net financial expenses of GBP73,000 (June

2013: GBP39,000) and no tax charge, the Group recorded a profit

after tax of GBP273,000 (June 2013: GBP338,000 loss).

Despite working capital increasing in the six months by

approximately GBP0.2 million due to higher revenues, net cash

inflow from operating activities was GBP0.2 million which compared

favourably with a net cash outflow of GBP1.0 million in the same

period last year. Cash balances at 30 June 2014 were GBP1.5 million

and were similar to those at 31 December 2013 (GBP1.4 million).

Board changes

I am pleased to announce that Paul Negus was appointed as a

director of the Company on 3 September 2014. Paul has

responsibility for business development for the Group's rail

products and brings considerable commercial experience having spent

eight years as Managing Director of PIPS Technology Limited, a

developer of automatic number plate recognition and CCTV systems

first under private ownership and latterly under the ownership of

Federal Signal Inc.

During the implementation of the 'Fit 4 Growth' programme, Osman

Abdullah assumed an interim role chairing the board of the

Company's main operating subsidiary, Petards Joyce-Loebl. In

recognition that this role is likely to continue for the

foreseeable future the Board considers that the nature of his

contribution will be as an executive director of the Company.

Outlook

The second half of 2014 has started well and the Group continues

to trade profitably. The Board anticipates securing some additional

business during the latter part of this year that is expected to

make a contribution to revenues during the second half year. The

Group's overall order book is in excess of GBP20 million of which

over one third is expected to be delivered before the end of the

current year.

There continue to be opportunities for development and growth in

all of our current product areas and we expect customers to be

placing orders on a number of projects in the coming months which

we believe we are well placed to secure.

The Board is confident about the Group's prospects for the

second half and beyond as whilst there is still work to be done

this year in closing out new business, the present order book

already provides a strong base going forward into 2015.

Raschid Abdullah

3 September 2014

Condensed Consolidated Income Statement

for the six months ended 30 June 2014

Unaudited Unaudited Audited

6 months 6 months year

ended ended ended

30 June 30 June 31 December

Note 2014 2013 2013

GBP000 GBP000 GBP000

Revenue 7,163 3,572 6,259

Cost of sales (5,202) (2,147) (3,733)

Gross profit 1,961 1,425 2,526

Administrative expenses (1,615) (1,724) (3,856)

Operating profit/(loss) 346 (299) (1,330)

------------------------------------ ----- --------- --------- ------------------

Analysed as:

Earnings before interest,

tax, depreciation and amortisation

('EBITDA') 441 (158) (716)

Depreciation and amortisation (95) (69) (308)

Share based payments - - -

Restructuring costs - (72) (306)

346 (299) (1,330)

Financial income 2 15 20

Financial expenses 2 (75) (54) (1,078)

Profit/(loss) before tax 273 (338) (2,388)

Income tax 3 - - 95

Profit/(loss) for the period

attributable to equity

shareholders of the company 273 (338) (2,293)

Basic earnings per share

(pence) 4 0.79 (3.11) (15.87)

Diluted earnings per share

(pence) 4 0.62 (3.11) (15.87)

The above results are derived from continuing operations.

Condensed Consolidated Statement of Comprehensive Income

for the six month period ended 30 June 2014

Unaudited Unaudited Audited

6 months 6 months year

ended ended ended

30 June 30 June 31 December

2014 2013 2013

GBP000 GBP000 GBP000

Profit/(loss) for period 273 (338) (2,293)

Other comprehensive income

Currency translation on foreign

currency net investments - (13) (13)

Total comprehensive income for

the period 273 (351) (2,306)

Condensed Consolidated Statement of Changes in Equity

for the six month period ended 30 June 2014

Currency

Share Share Merger Equity Retained translation Total

capital premium reserve reserve earnings differences equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Balance at 1 January

2013 (audited) 6,412 24,152 - - (28,849) (198) 1,517

Loss for the period - - - - (338) - (338)

Other comprehensive

income - - - - - (13) (13)

Total comprehensive

income for the

period - - - - (338) (13) (351)

Balance at 30 June

2013 (unaudited) 6,412 24,152 - - (29,187) (211) 1,166

Balance at 1 January

2013 (audited) 6,412 24,152 - - (28,849) (198) 1,517

Loss for the year - - - - (2,293) - (2,293)

Other comprehensive

income - - - - - (13) (13)

Total comprehensive

income for the

year - - - - (2,293) (13) (2,306)

Purchase of own shares (592) - - - - - (592)

Sale of own shares 592 - - - 3 - 595

Water Hall transaction

(note 2) 110 - 1,112 213 - - 1,435

Share issue: placing 115 1,035 - - - - 1,150

Expenses of share

issue - (87) (37) - - - (124)

Conversion of convertible

loan

notes 8 53 - (7) 7 - 61

Balance at 31 December

2013 (audited) 6,645 25,153 1,075 206 (31,132) (211) 1,736

Balance at 1 January

2014 (audited) 6,645 25,153 1,075 206 (31,132) (211) 1,736

Profit for the period - - - - 273 - 273

Other comprehensive - - - - - - -

income

Total comprehensive

income for the

period - - - - 273 - 273

Conversion of convertible

loan

notes 3 17 - (1) 1 - 20

Balance at 30 June

2014 (unaudited) 6,648 25,170 1,075 205 (30,858) (211) 2,029

Condensed Consolidated Balance Sheet

at 30 June 2014

Unaudited Unaudited Audited

30 June 30 June 31 December

2014 2013 2013

ASSETS GBP000 GBP000 GBP000

Non-current assets

Property, plant and equipment 170 182 165

Goodwill 401 401 401

Development costs 618 488 640

Deferred tax assets 647 587 653

1,836 1,658 1,859

Current assets

Inventories 1,900 1,924 1,779

Trade and other receivables 2,283 1,311 983

Cash and cash equivalents -

escrow deposits 35 - -

Cash and cash equivalents 1,508 256 1,440

5,726 3,491 4,202

Total assets 7,562 5,149 6,061

EQUITY AND LIABILITIES

Equity attributable to equity

holders of the parent

Share capital 6,648 6,412 6,645

Share premium 25,170 24,152 25,153

Equity reserve 205 - 206

Merger reserve 1,075 - 1,075

Currency translation reserve (211) (211) (211)

Retained earnings deficit (30,858) (29,187) (31,132)

Total equity 2,029 1,166 1,736

Non-current liabilities

Interest-bearing loans and

borrowings 1,515 - 1,518

Deferred tax liabilities 124 122 128

1,639 122 1,646

Current liabilities

Interest-bearing loans and

borrowings - 1,334 -

Trade and other payables 3,894 2,527 2,679

3,894 3,861 2,679

Total liabilities 5,533 3,983 4,325

Total equity and liabilities 7,562 5,149 6,061

Condensed Consolidated Statement of Cash Flows

for the six month period ended 30 June 2014

Unaudited Unaudited Audited

6 months 6 months year

ended ended ended

30 June 30 June 31 December

2014 2013 2013

GBP000 GBP000 GBP000

Cash flows from operating activities

Profit/(loss) for the period 273 (338) (2,293)

Adjustments for:

Depreciation 24 24 47

Amortisation of intangible assets 71 45 261

Financial income (2) (15) (20)

Financial expense 75 54 1,078

Income tax charge - - (95)

Exchange differences - (13) (13)

Operating cash flows before movement in

working capital 441 (243) (1,035)

Change in trade and other receivables (1,336) 217 647

Change in inventories (121) (713) (568)

Change in trade and other payables 1,206 (251) (267)

Cash generated from operations 190 (990) (1,223)

Interest received 2 - 20

Interest paid (49) (39) (60)

Income tax received 38 - -

Net cash from operating activities 181 (1,029) (1,263)

Cash flows from investing activities

Acquisition of property, plant and equipment (29) (34) (40)

Capitalised development expenditure (49) (3) (371)

Cash deposits held in escrow (35) 77 77

Net cash (outflow)/inflow from investing

activities (113) 40 (334)

Cash flows from financing activities

Proceeds from share issue - - 1,150

Expenses of share issue - - (87)

Water Hall transaction (note 2) - - (83)

Proceeds from sale of own shares - - 595

New short term borrowings - 1,334 -

Repayment of bank borrowings - (42) (42)

Net cash inflow from financing activities - 1,292 1,533

Net increase/(decrease) in cash and cash

equivalents 68 303 (64)

Water Hall transaction: Settlement of

working capital facility (note 2) - - 1,551

Total movement in cash and cash equivalents

in the period 68 303 1,487

Cash and cash equivalents at start of

period 1,440 (47) (47)

Cash and cash equivalents at end of period 1,508 256 1,440

Cash and cash equivalents comprise:

Cash and cash equivalents per balance

sheet 1,508 256 1,440

Notes

1 Basis of preparation

The interim financial information set out in this statement for

the six months ended 30 June 2014 and the comparative figures for

the six months ended 30 June 2013 are unaudited. This financial

information does not constitute statutory accounts as defined in

Section 435 of the Companies Act 2006.

The comparative figures for the financial year ended 31 December

2013 are not the Company's statutory accounts for that financial

year. Those accounts have been reported on by the Company's

auditors and delivered to the Registrar of Companies. The report of

the auditors was (i) unqualified, (ii) did not include a reference

to any matters to which the auditor drew attention by way of

emphasis without qualifying their report, and (iii) did not contain

a statement under section 498 (2) or (3) of the Companies Act

2006.

This interim statement, which is neither audited nor reviewed,

has been prepared in accordance with the measurement and

recognition criteria of Adopted IFRSs. It does not include all the

information required for the full annual financial statements, and

should be read in conjunction with the financial statements of the

Group as at and for the year ended 31 December 2013. It does not

comply with IAS 34 'Interim Financial Reporting' as is permissible

under the rules of the AIM Market ("AIM").

The accounting policies applied in preparing these interim

financial statements are the same as those applied in the

preparation of the annual financial statements for the year ended

31 December 2013, as described in those financial statements other

than standards, amendments and interpretations which became

effective after 1 January 2014 and were adopted by the Group. These

have had no significant impact on the Group's profit for the period

or equity. The Board approved these interim financial statements on

2 September 2014.

Copies of this interim statement will be available on the

Company's website (www.petards.com) and from the Company's

registered office at 390 Princesway, Team Valley, Gateshead, Tyne

and Wear, NE11 0TU.

2 Financial expenses

Unaudited Unaudited Audited

6 months ended 6 months year ended

30 June ended 31 December

2014 30 June 2013

GBP000 2013 GBP000

GBP000

Interest expense on financial liabilities

at amortised cost:

* Convertible loan notes at 7% p.a. (cash) 59 - 34

15 - 9

- 52 54

* Convertible loan notes amortisation (non-cash) 1 2 3

* Bank finance (cash)

* Other (cash)

Net foreign exchange loss - - -

Water Hall transaction (see below) - - 978

Financial expenses 75 54 1,078

On 29 August 2013 the Group completed a debt for equity swap

with Water Hall Group plc ('the Water Hall transaction'). Under the

terms of the arrangement, the Group issued equity, share options,

and convertible loan notes with a combined fair value of

GBP2,975,000 to:

(i) settle its working capital facility of GBP1,551,000

(ii) purchase its own shares to the value of GBP592,000 and

(iii) acquire the remaining net assets of Water Hall Group plc

which comprised cash of GBP72,000 and net liabilities of GBP68,000

relating to trade and other payables net of VAT receivables.

The loss on this transaction of GBP860,000 was included in total

exceptional finance costs for the year ended 31 December 2013 of

GBP978,000; the balance included transaction expenses of

GBP118,000. The net cash effect of this transaction was an outflow

of GBP83,000. In addition the Group's overdraft of GBP1,551,000 was

settled. The debt for equity swap resulted in the Group obtaining

control of the Water Hall Group plc legal entity with the result

that, from 29 August 2013, Water Hall Group plc has been

consolidated into the accounts.

3 Taxation

No provision for taxation has been made in the Condensed

Consolidated Income Statement for the six months to 30 June 2014

based on the estimated tax provision required for the year ending

31 December 2014. No provision was required in the six months to 30

June 2013.

4 Earnings per share

Basic earnings per share

Basic earnings per share is calculated by dividing the profit

for the period attributable to the shareholders by the weighted

average number of shares in issue.

The calculation of earnings per share is based on the profit for

the period and on the weighted average number of ordinary shares

outstanding in the period.

Unaudited Unaudited Audited

6 months 6 months year

ended ended ended

30 June 30 June 31 December

2014 2013 2013

Earnings

Profit/(loss) for the period (GBP000) 273 (338) (2,293)

Number of shares

Weighted average number of ordinary shares

('000) 34,347 10,866 14,456

Diluted earnings per share

Diluted earnings per share assumes conversion of all potentially

dilutive ordinary shares, which arise from both convertible loan

notes and share options, and is calculated by dividing the adjusted

profit for the period attributable to the shareholders by the

assumed weighted average number of shares in issue. The adjusted

profit for the period comprises the profit for the period

attributable to the shareholders after adding back the interest on

convertible loan notes for the period.

Unaudited Unaudited Audited

6 months 6 months year

ended ended ended

30 June 30 June 31 December

2014 2013 2013

Adjusted earnings

Profit/(loss) for the period (GBP000) 347 (338) (2,293)

Number of shares

Weighted average number of ordinary shares

('000) 55,983 10,866 14,456

At 30 June 2013 and 31 December 2013 diluted earnings per share

was identical to the basic earnings per share as the Group was loss

making.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR QLLFBZKFLBBX

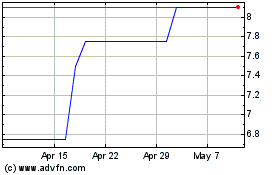

Petards (LSE:PEG)

Historical Stock Chart

From Jun 2024 to Jul 2024

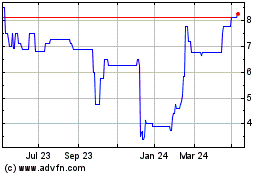

Petards (LSE:PEG)

Historical Stock Chart

From Jul 2023 to Jul 2024