As a consequence of brought forward losses from previous years,

there is no tax payable in respect of the Group's profit for the

year (2013 - GBP0.1 million credit) resulting in a profit after tax

of GBP0.6 million (2013: GBP2.3 million loss).

The profits generated in the year served to further strengthen

the balance sheet and shareholders' funds increased to GBP2.4

million (2013: GBP1.7 million). While working capital increased

slightly in the second half year the Group generated an operating

cash inflow for the year of GBP0.8 million (2013: GBP1.3 million

cash outflow). After investing activities, primarily related to

product development, net debt remained at GBP0.1 million (2013:

GBP0.1 million) and comprised convertible loan notes which mature

in September 2018 of GBP1.5 million net of cash balances of GBP1.4

million.

Dividends

The Board is conscious of the value of dividends to investors.

While the return to profitability is encouraging and the balance

sheet is in good shape, the Board would wish to see further

evidence of the Group's recovery before recommending joining the

dividend list. In addition, the Company has a considerable

deficiency on its distributable reserves which in any event

presently prevents the payment of dividends.

In anticipation that the Group's recovery will prove sustainable

during 2015 and beyond, it is the intention of the Board to review

how best to address this matter. Any solution to clear the way for

dividend payments at the appropriate time is likely to require the

consent of both shareholders and the Court.

Product Development

The Board recognises the importance of the Group investing to

develop its portfolio of products and services to both maintain its

competitive position and to grow revenues. Costs for product

development for the year that totalled almost GBP0.75 million, were

predominantly focussed on the development of the Petards eyeTrain

product which the Board believes is an area of the Group's business

that offers significant growth potential. While remaining a key

area of focus for both eyeTrain and Provida, the level of

development expenditure required in 2015 to achieve this is

anticipated to be significantly lower.

Personnel

While directors formulate strategy and set capital allocation,

performance objectives and key management rewards for the Group,

delivery thereon is very much the result of the efforts and

commitment of our people at operational level. Over the past 18

months, Petards Joyce-Loebl, the Company's operational unit located

in Gateshead, has undergone considerable change in operating

structure and personnel with approximately 35% either having moved

on or been replaced and others taking broader roles and more

responsibility coupled with accountability.

On behalf of the Board I welcome those who have joined the

Company during 2014 and thank all our people for their valued

contribution to the delivery of a significant improvement in the

Group's operating performance. The Board looks forward to their

continued support and contribution in 2015 which it believes has

the ingredients to be an exciting period in the Group's

development.

Strategy

The Board believes that Petards operates in growth areas and

that it has the products and services plus available technical and

technological skills to develop new products as well as the sales

and marketing abilities to become a larger and more successful

operator in each of the sectors in which it operates.

The Group's relationships with its predominantly international

'blue chip' and government agency customer base and their strength,

often global, in the sectors which the Company serves gives rise to

the opportunity to develop Petards business through the provision

of good quality professional service in support of its existing and

future product ranges.

While the Board is mindful of economic cycles and the impact

they can have on businesses and business plans, and the risks

associated with over expansion, it believes that in the short to

medium term the current management structure coupled with the

balance sheet and financial stability of the Group, is capable of

continued implementation of the strategy in pursuit of the

achievement of its strategic objectives.

Outlook

Investment in new rail transport rolling stock has continued to

benefit from government initiatives around the world and there is

no obvious sign that this is to likely change in the foreseeable

future. The directors are confident that UK rail operating

franchise renewals over the coming years will result in new

opportunities for Petards' products and services.

Petards position as a long established specialist "value added"

re-seller within the UK defence industry is expected to continue to

provide a platform to develop this area of the Group's business.

While defence budgets remain under scrutiny the areas in which the

Group operates are niche and are not expected to be materially

affected. Further, the Board believes that with additional

management attention and resource being devoted to it, the

Emergency Services will make a larger contribution to Group sales

and profits in 2015.

I am pleased to say for the year to date the Group has traded in

line with expectations and that it remains well placed to add to

the achievements of 2014. The visibility provided by the Group's

current forward order book and its pipeline of order prospects

provides the Board with confidence that further progress will be

made in 2015.

Raschid Abdullah

Chairman

Consolidated Income Statement

for year ended 31 December 2014

Note 2014 2013

GBP000 GBP000

Revenue 2 13,462 6,259

Cost of sales (9,370) (3,733)

Gross profit 4,092 2,526

Administrative expenses (3,323) (3,856)

Operating profit/(loss) 769 (1,330)

------------------------------------- ---- ------- --------

Analysed as:

Earnings before interest,

tax, depreciation and amortisation

('EBITDA') 1,015 (716)

Depreciation and amortisation (246) (308)

Restructuring costs - (306)

769 (1,330)

Financial income 3 3 20

Financial expenses 3 (152) (1,078)

Profit/(loss) before tax 620 (2,388)

Income tax 4 - 95

Profit/(loss) for the year

attributable to equity shareholders

of the parent 620 (2,293)

Earnings per share (pence)

Basic 7 1.80 (15.87)

Diluted 7 1.37 (15.87)

Consolidated Statement of Comprehensive Income

for year ended 31 December 2014

2014 2013

GBP000 GBP000

Profit/(loss) for the

year 620 (2,293)

Other comprehensive

income

Items that may be reclassified

to profit:

Currency translation on foreign

currency net investments - (13)

Total comprehensive

income for the year 620 (2,306)

Statements of Changes in Equity

for year ended 31 December 2014

Share Share Merger Retained Currency Total

capital premium reserve Equity earnings translation equity

reserve differences

Group GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Balance at 1

January 2013 6,412 24,152 - - (28,849) (198) 1,517

Loss for the

year - - - - (2,293) - (2,293)

Other comprehensive

income - - - - - (13) (13)

Total comprehensive

income for the

year - - - - (2,293) (13) (2,306)

Purchase of own

shares (592) - - - - - (592)

Sale of own shares 592 - - - 3 - 595

Water Hall transaction

(note 3) 110 - 1,112 213 - - 1,435

Share issue:

placing 115 1,035 - - - - 1,150

Expenses of share

issue - (87) (37) - - - (124)

Conversion of

convertible loan

notes 8 53 - (7) 7 - 61

Balance at 31

December 2013 6,645 25,153 1,075 206 (31,132) (211) 1,736

Balance at 1

January 2014 6,645 25,153 1,075 206 (31,132) (211) 1,736

Profit for the

year - - - - 620 - 620

Other comprehensive - - - - - - -

income

Total comprehensive

income for the

year - - - - 620 - 620

Conversion of

convertible loan

notes 4 23 - (2) 2 - 27

Exercise of share

options 2 16 - - - - 18

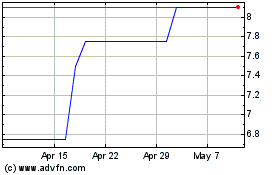

Petards (LSE:PEG)

Historical Stock Chart

From Jun 2024 to Jul 2024

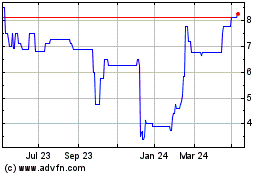

Petards (LSE:PEG)

Historical Stock Chart

From Jul 2023 to Jul 2024