Credit Suisse to Launch $6.3 Billion Capital Increase

October 21 2015 - 12:30AM

Dow Jones News

ZURICH—Credit Suisse Group AG revealed details of a planned

overhaul under its new chief executive on Wednesday including

raising roughly 6 billion Swiss francs ($6.3 billion) in new

capital, as the Swiss bank delivered a set of disappointing

third-quarter results.

Incoming CEO Tidjane Thiam took over at Zurich-based Credit

Suisse in July, and has been widely expected to implement changes

at the lender including a downsizing of its relatively expensive,

and relatively high-risk, investment bank unit. Credit Suisse said

on Wednesday it plans to "significantly" reduce the use of capital

at its investment bank.

Credit Suisse said it would raise fresh capital through both a

rights offering and private placement.

Separately, Credit Suisse posted third-quarter results that

included a pretax loss for its investment bank, and a 31% decline

in pretax profit at its private banking and wealth management

unit.

Mr. Thiam, the former CEO of U.K. insurer Prudential PLC, has no

experience running a bank. Some analysts and experts have seen that

as a potential positive, as he faces a series of difficult

decisions about scaling back operations. Credit Suisse is one of a

number of global lenders now in flux, as they respond to stricter

capital rules, difficult market conditions, and disappointed

shareholders.

Write to John Letzing at john.letzing@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 21, 2015 01:15 ET (05:15 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

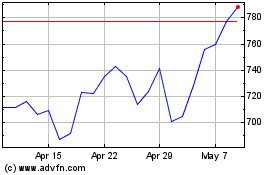

Prudential (LSE:PRU)

Historical Stock Chart

From Jan 2025 to Feb 2025

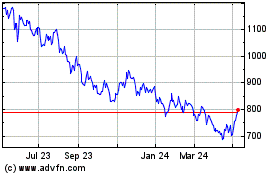

Prudential (LSE:PRU)

Historical Stock Chart

From Feb 2024 to Feb 2025