Credit Suisse Pays New CEO Thiam $4.7 Million for 2015

March 24 2016 - 3:10AM

Dow Jones News

ZURICH—Credit Suisse Group AG Chief Executive Tidjane Thiam

received 4.57 million Swiss francs ($4.7 million) in total pay for

2015, a year in which he launched an ambitious bid to restructure

the troubled Swiss bank.

The overall bonus pool at Zurich-based Credit Suisse declined

11% for the year, compared with 2014, as anticipated, according to

a report published on Thursday. Employees in the beleaguered

investment bank saw their bonuses decline by more than 30%, Credit

Suisse said, adding that 31% of the investment bank employees saw

their bonuses cut by more than half.

Mr. Thiam, who assumed the CEO role in July, had requested a 40%

cut to his 2015 bonus compared with what he might have otherwise

received. He has said publicly that this was a gesture of

"solidarity" with employees seeing their own bonuses reduced.

Credit Suisse said Thursday that its board accepted Mr. Thiam's

request, and gave him an award of 2.86 million francs—40% of which

was paid in cash. In addition, Mr. Thiam received a so-called

replacement award paid in stock, designed to compensate him for

remuneration left behind at his former employer Prudential PLC.

That award was valued at 9.6 million francs as of March 17, Credit

Suisse said.

Shares of Credit Suisse have tumbled more than 40% since Mr.

Thiam's tenure began, as the bank has endeavored to revamp in a

period of volatile markets.

The pay for Credit Suisse's top executive and employees

contrasts with that for rival Swiss bank UBS Group AG, which

increased its bonus pool for 2015 by 14% compared with the year

earlier, while UBS CEO Sergio Ermotti received a significant

increase in total pay, to 14.3 million francs.

However, Credit Suisse isn't the only European bank to issue pay

cuts for 2015—Deutsche Bank AG cut its bonus pool for the year by

17%.

Credit Suisse reported a loss of 2.9 billion Swiss francs for

2015, compared with a profit of nearly 1.9 billion francs in the

prior year. The fourth quarter of the year proved to be

particularly painful— Credit Suisse posted a large loss for the

period, as significant problems emerged at its investment bank.

Earlier this week, Mr. Thiam sought to address those problems,

which included a number of large, illiquid positions accumulated by

his trading unit, by announcing an additional 2,000 job cuts at the

investment bank and a sharp reduction in its allocation of risk

weighted assets.

The highest paid member of Credit Suisse's executive board in

2015 is no longer a member of the executive board.

Rob Shafir, who was co-head of Credit Suisse's former Private

Banking and Wealth Management division before Mr. Thiam reshuffled

his executive ranks last October, received 7.88 million francs in

total pay for the year, including a bonus of 6.3 million

francs.

Credit Suisse said its board took into account Mr. Shafir's

contributions in his previous role, as well as his help in

offloading Credit Suisse's private banking business in the U.S. to

Wells Fargo & Co. Mr. Shafir now serves as chairman of the

Americas for the bank.

Write to John Letzing at john.letzing@wsj.com

(END) Dow Jones Newswires

March 24, 2016 03:55 ET (07:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

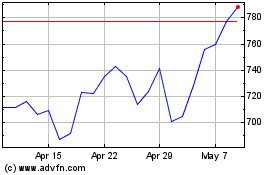

Prudential (LSE:PRU)

Historical Stock Chart

From Jan 2025 to Feb 2025

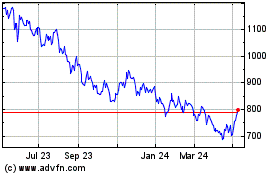

Prudential (LSE:PRU)

Historical Stock Chart

From Feb 2024 to Feb 2025