U.K.'s Prudential to Split Into Two Firms -- WSJ

March 15 2018 - 2:02AM

Dow Jones News

By Philip Georgiadis and Ben Dummett

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (March 15, 2018).

British insurer Prudential PLC has split its European and

international arms into two new companies, the latest example of

wide-ranging restructuring of the European insurance sector.

The 170-year-old firm said Wednesday it will demerge M&G

Prudential, its U.K. and European business, leaving investors with

shares in two separately listed companies with entirely different

business models.

Prudential -- which isn't related to Prudential Financial Inc.,

a U.S. financial-services provider -- will become a solely

international firm, focused on the U.S., Asia and Africa, and will

be led by current Chief Executive Mike Wells.

M&G Prudential will focus on its retirement and savings

business in the U.K. and Europe, and will pursue a less-capital

intensive structure, following new rules that require insurers to

hold higher levels of capital.

Shares in Prudential were up about 6% in London afternoon

trading.

Prudential's transformation comes as the European insurance

sector is being reshaped.

While many European insurers have struggled to expand in their

home markets, Asia and other emerging markets have proved far more

attractive. That has led to an uptick in deal-making.

German insurer Allianz SE has this year expanded its presence in

South Asia, announcing deals in Sri Lanka and Thailand. Zurich

Insurance Group AG on Monday announced a deal expanding its

presence in Latin America.

While Prudential's insurance and asset-management operations in

the U.K. and Europe have increased profit 7% annually over the past

10 years, its Asian operation has seen a 24% annual rise over the

same period.

Prudential expects the region's expanding middle class to

continue to drive that growth by fueling demand for more savings

and life and health insurance coverage. Mr. Wells said the region's

population is "underprotected" and offers an attractive growth

opportunity.

Prudential's Jackson operation in the U.S., which sells

annuities in the world's largest market for retirement savings, is

also growing at a faster clip than the U.K. and European business.

The division's profit has gained 17% annually over the past 10

years.

As part of the demerger, Prudential announced GBP12 billion sale

of M&G Prudential's U.K. annuity portfolio to insurer Rothesay

Life.

Prudential's changes follow French company AXA SA's decision to

sell its U.S. life-insurance business via a coming initial public

offering, and focus on property and casualty insurance via the

$15.3 billion acquisition of XL Group Ltd.

Analysts said a spinoff had looked a possibility since

Prudential combined two if its U.K. businesses last August, but the

move had come about quicker than some expected.

"In an organization as complex and diverse as Pru, a split makes

sense," said Nicholas Hyett, an equity analyst at Hargreaves

Lansdown. "The two businesses that emerge will be distinctive -- a

high-growth emerging market play and a capital-light dividend

machine."

Prudential announced the moves alongside its annual results for

2017, recording a 10% rise in operating profit to GBP4.69

billion.

Write to Philip Georgiadis at philip.georgiadis@wsj.com and Ben

Dummett at ben.dummett@wsj.com

(END) Dow Jones Newswires

March 15, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

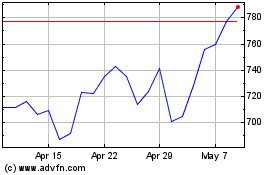

Prudential (LSE:PRU)

Historical Stock Chart

From Jan 2025 to Feb 2025

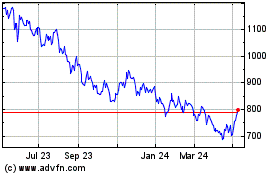

Prudential (LSE:PRU)

Historical Stock Chart

From Feb 2024 to Feb 2025