TIDMPXC

RNS Number : 9056N

Phoenix Copper Limited

28 September 2023

Phoenix Copper Limited / Ticker: PXC / Sector: Mining

28 September 2023

Phoenix Copper Limited

("Phoenix" or the "Company", together with subsidiaries the

"Group")

Interim Results

Phoenix Copper Ltd (AIM: PXC, OTCQX ADR: PXCLY), the AIM-quoted

USA-focused base and precious metals emerging producer and

exploration company, is pleased to announce its unaudited interim

results for the six months ended 30 June 2023 (the "Period").

Year-to-date Highlights

Corporate & Financial

- Investment in Empire Mine increased to $35.88 million (2022: $29.73 million)

- Group reports loss of $0.63 million (2022: loss of $1.052 million)

- Period-end net assets of $37.39 million (2022: $38.22 million)

- Company reports a profit of $309,759 (2022: loss of $368,534)

- Company loans to operating subsidiaries increased to $29.63 million (2022: $25.23 million)

- Corporate copper bond documentation being finalised, prior to

listing on The International Stock Exchange in the Channel Islands,

and anticipated closing of an initial tranche of up to $80

million

- Inaugural Sustainability Report published and the Company

scoring an overall 'A' rating on Digbee ESG Platform

Operational

- Continuity of Empire Mine open pit mineralisation further

confirmed, including intercepts of up to 12.8% copper, 269.10

grammes per tonne ("g/t") silver and 0.75 g/t gold

- Metallurgical test work to recover copper, gold and silver via

flotation plus leaching completed and now being optimised

- Further higher-grade base and precious metals mineralisation

encountered at Red Star silver-lead deposit

- 28 holes (3,300 metres) of drilling completed on 60-hole

Navarre Creek gold drilling programme

Chairman's Statement

As we approach the final quarter of 2023, we continue to make

good operational progress at our Empire project in Idaho, both in

terms of the development of the initial open-pit mine and the

exploration of the surrounding mineralised district. It remains our

intention to fund construction of this first mine, which will give

us production and financial autonomy, with minimal additional

dilution to shareholders. With this objective in mind, we are

currently finalising the documentation to create a class of

authorised bonds in a total amount of $300 million, and to admit

them to trading on The International Stock Exchange ("TISE") in the

Channel Islands, as a prelude to closing an initial tranche to

raise up to $80 million. We have been in discussion with a number

of interested parties for some time, and we are hopeful that we can

finally close the book in the near future. We share the frustration

that this apparent delay has caused, but we have to acknowledge

that we are trying to raise multiples of our current market

capitalisation, and that the market remains turbulent, to say the

least. Although there can be no certainty until the bonds have been

issued and settled, we are confident that the issue will close and

that the Company will have access to the relevant construction

funding when required.

Since we last reported, we have made several advances with the

Empire open-pit project. These are described in detail in the CEO's

report. With the success of our metallurgical test work, first

announced in June and updated at the beginning of September, we

have narrowed our focus to three process design options that will

produce the most economic value for shareholders while considering

current metal prices, reagent costs and capital expenditure

requirements. If, as the laboratory tests indicate, we can process

copper, gold and silver on a commercial scale using a

flotation-based process, we will be able to recover the metals

without the use of cyanide, and may be able to build the majority

of our operations on patented (Company-owned) land, which may

simplify the permitting process. In addition to processing the

oxide ore from the open pit, the flotation-based plant may also

enable us to process the higher-grade sulphide ore below the

open-pit, effectively giving us two plants for the price of one. As

we make the final adjustments to our economic model and Plan of

Operations, we look forward to updating you with the feasibility

study in Q4.

I would like to thank our Environmental, Social and Governance

("ESG") team whose hard work enabled Phoenix to gain one of the

highest marks awarded by Digbee ESG, the specialist mining sector

ratings agency, which is used by an increasing number of investors

to source ESG compliant investments. Phoenix scored an overall "A."

This has helped us as several funds considering investing in our

bonds regard this as a crucial part of the decision-making

process.

The other highlight of the summer was the commencement of

drilling at Navarre Creek, our 3,578 acre (14.48 sq km) gold

exploration project, situated some 8 kilometres west-northwest of

the Empire open-pit mine, which followed on from our surface

sampling and field magnetics surveys. We have drilled 28 holes to

date within a permitted 60-hole programme, and we look forward to

sharing the results when they are back from the assay

laboratory.

As always, I would like to thank shareholders for their

continued support and patience, and look forward to updating you

with further progress, both operationally and corporately, in the

4(th) quarter and beyond.

Marcus Edwards-Jones

Chairman

Chief Executive Officer's Report

The Company started the year with fresh analytical data from the

2022 metallurgical core drilling program and with the contracting

of RDI Laboratories (now Forte Dynamics) in Colorado, USA to

complete final metallurgical test work and a final process design

for recovering copper, gold and silver at our Empire Open-Pit Mine.

At the same time as we were evaluating the 2022 drilling results,

the last of which arrived in March 2023, we were preparing for the

summer arrival of a reverse-circulation drill rig to begin

subsurface exploration at our Navarre Creek gold claim block. Assay

results from the 2022 Red Star drilling campaign were also

delivered and reported in April 2023. The drilling results were

consistent with previous results and continued to indicate robust

metal grades, in particular gold, silver, and lead. The Company's

ESG program continued strong forward momentum after receiving an

overall score of "A" on Digbee ESG, a disclosure platform for the

mining industry that simplifies peer reporting and rewards

management action, and the publication of the Company's inaugural

Sustainability Report. The Company purchased and moved all of the

laboratory assets from the former AuRIC Metallurgical Laboratories

in Salt Lake City to Mackay, Idaho, for use in the future mine's

onsite assay laboratory. As we move through the second half of the

year, the U.S. Department of Energy has announced that it is

upgrading copper to the "near critical" classification for clean

energy technologies.

This new classification, coupled with last year's US Defense

Production Act announcement providing for an increase in the

domestic production of metals for national defense, electric

vehicle technologies, and electrical transmission and storage,

further sets the stage for long-term stability in the global copper

market.

2023 Metallurgical Testing Program

In 2022, 3,502 feet (1,067 metres) of core were drilled at the

Empire copper deposit for the purpose of collecting samples

3-dimensionally representative of the oxide portion of the deposit

for copper, gold and silver recovery testing. Initially, the

metallurgical work was intended to further develop a commercial

leaching design using only ammonium thiosulfate ("ATS") as the

primary reagent for recovering copper, gold and silver. Following

the initial test work, our metallurgists determined that adding a

flotation step upstream of the leaching circuit and generating a

saleable concentrate stream containing all of the metals could

provide an immediate revenue stream with less concern over reagent

pricing and product supply, as well as reducing the total volume of

ore entering the downstream leaching circuit. If the

flotation-followed-by-leaching process proves to be commercially

viable, it has the potential of reducing overall capital and

operating costs as well as the potential of sizing down the

operational footprint and allowing a greater portion of the

operation to reside on the Company's patented mining claims.

Another possible advantage of the flotation circuit design is in

the flotation milling equipment. Similar flotation technologies are

widely used in the processing of sulphide ores, similar to the

deeper sulphide mineralization at Empire, and at least part or all

of the flotation circuit constructed for the open-pit processing

could be employed for processing sulphide material in the future.

The initial flotation and leaching results are shown in Table 1

below, and are based on "open-cycle" testing.

Table 1: Flotation and Leaching Results

Process flowsheet Cu Recovery Au Recovery Ag Recovery Gross Revenue

option (USD/metric

tonne)

Flotation Only 37.3% 48.8% 44.6% 35.54

------------ ------------ ------------ --------------

Flotation plus ATS

Leach of Flot Tails 66.5% 92.7% 73.0% 64.42

------------ ------------ ------------ --------------

Flotation plus Acid

Leach of Flot Tails 87.8% 48.8% 44.6% 57.80

------------ ------------ ------------ --------------

Note: Revenue based on $1,875 / oz gold, $4/lb copper, and

$18.75 / oz silver

The test work completed to date is currently being optimized

through "locked-cycle" testing, which mimics the characteristics of

an operating mill by recirculating material and process fluids. It

is not uncommon to see recovery improvements resulting from locked

cycle testing. Once fully optimized, the final process design will

be completed and capital and operating costs, as well as the costs

for mining and general construction, will be finalized and an

updated project economic model generated. This will enable the Plan

of Operations to be updated and submitted to the regulatory

authorities in order to complete the permitting process.

2023 Navarre Creek Drilling Program

Reverse-circulation drilling commenced on the Company's Navarre

Creek gold project in July. Up to 60 drill holes located at four

primary target areas within the 14.48 sq km (3,578 acres) property

have been planned. The drilling program plan was approved by the US

Forest Service in August 2022 and allows for holes to be drilled

from 30 drill pads through July 2024. 28 holes have been completed

to date, totalling 10,830 feet (3,300 metres). Initial assay

results for the drilling are anticipated from late Q3 this year.

Drill hole targets at Navarre Creek were selected based on the

results of the past several years of surface geochemistry results

as well as geophysical anomalies identified from a total field

magnetics survey and hyperspectral mineral survey conducted in

2021.

While there is no guarantee that the Navarre Creek exploratory

drilling program will result in the discovery of a viable ore

deposit, the geology, mineralogy, and geochemistry of Navarre Creek

fits all the criteria necessary for a potentially significant gold

bearing system. The geological characteristics of the Navarre Creek

rocks evident on the surface are also evident in many of the drill

cuttings logged since drilling commenced in July, and the pending

assays will be the determining factor of mineralization in the four

initial target areas.

Red Star Drilling Results

In 2022, 875 feet of reverse-circulation drilling was completed

that tested the magnetic anomalies identified during the ground

magnetics survey. Assay results from the 2022 drilling program were

received in Q2 2023. The assay values for copper, silver, lead, and

zinc were consistent with previous drilling programs. Of particular

interest are the results from drill hole RS22-02, which tested the

western margin of a strong magnetic anomaly, assaying 7.62 metres

of 142.7 grammes/tonne ("g/t") silver, 2.94% lead, and 1.54% zinc.

Additionally, drill hole RS22-04 assayed 9.15 metres of 1.56 g/t

gold and 0.62% copper, including 1.52 metres averaging 7.59 g/t

gold and 0.58% copper. While our primary focus is on the

engineering and development of the Empire Open-Pit Mine, a plan is

being constructed for follow-up drilling at Red Star in 2024.

Other Business

The Company purchased all of the laboratory assets from AuRIC

Metallurgical Laboratories following its closure this spring,

including the analytical equipment and supplies necessary for the

onsite laboratory that will service the Empire Mine once it is in

operation. The purchase of these laboratory assets will prove most

cost effective, saving up to three times as much as the purchase of

new equipment, which is significant in light of the current

laboratory equipment market.

Empire Mineral Resources

Polymetallic Open Pit Mine

An updated NI 43-101 compliant resource was completed by

Hardrock Consulting in October 2020 and reported for the

polymetallic Empire Mine open pit oxide deposit. The updated

resource showed a 51% increase in the Measured and Indicated

category from the previous year's resource. Including the Inferred

resources, the Empire open-pit oxide deposit now contains 129,641

tonnes of copper, 58,440 tonnes of zinc, 10,133,772 ounces of

silver and 355,523 ounces of gold.

Table 2: Mineral Resource Statement for Empire Mine, after

Hard Rock Consulting October 2020

------------------------------------------------------------------------------------------------------

CLASS Tonnes Cu Average Grade Metal Content

Equiv

%

----------- ----------- ------- --------------------------- ------------------------------------------------

Cu Zn Ag Au Cu Zn Ag Au Cu

Equiv

----------- ----------- -------

% % g/t g/t Tonnes tonnes Ozs ozs Tonnes

----------- ----------- -------

Measured 8,289,719 0.81 0.42 0.22 11.4 0.327 34,655 18,160 3,031,791 87,036 67,013

----------- ----------- ----- ----- ------- ----------

Indicated 14,619,340 0.72 0.36 0.18 9.7 0.322 52,888 25,711 4,563,407 151,370 105,899

M+I 22,909,059 0.75 0.38 0.19 10.3 0.324 87,543 43,871 7,595,198 238,406 172,912

----------- ----- ----- ------- ----------

Inferred 10,612,556 0.75 0.4 0.14 7.4 0.343 42,098 14,569 2,538,574 117,117 79,296

----------- ----------- ----- ----- ------- ---------- --------

Red Star - High-grade Silver

Red Star is a high-angle silver-lead vein system hosted in

andradite-magnetite and located 330-metres north-northwest of the

Empire oxide pit. Red Star was identified from a 20-metre wide

surface outcrop across a skarn structure. In early May 2019, the

Company announced a small maiden Inferred sulphide resource of

103,500 tonnes, containing 577,000 ounces of silver, 3,988 tonnes

of lead, 957 tonnes of zinc, 338 tonnes of copper, and 2,800 ounces

of gold.

Table 3: Maiden Inferred Resource Statement for Red Star, May

2019

Class Tons Ag Ag Au Au Pb Pb Zn Zn Cu Cu

(x1000) g/t oz g/t oz % lb % Lb % lb

-------- ------ -------- ------ -------- ----- --------- ----- --------- ----- --------

(x1000) (x1000) (x1000) (x1000) (x1000) % (x1000)

-------- ------ -------- ------ -------- ----- --------- ----- --------- ----- --------

Inferred 114.13 173.4 577.3 0.851 2.8 3.85 8,791.20 0.92 2,108.80 0.33 745

-------- ------ -------- ------ -------- ----- --------- ----- --------- ----- --------

Outlook

Over the past six months, the copper price has been less

volatile than in 2022, ranging between $3.50 and $4.00/pound. Gold

and silver have followed suit and settled in at $1,900 and

$23/ounce, respectively. The cost of the materials and supplies

necessary for the construction and operation of our Empire open pit

project have also appeared to stabilize, although generally at

higher levels than in the days before Covid-19 and the war in

Ukraine. While the cost of lumber and concrete have been

consistently decreasing, structural steel and diesel fuel remain

elevated. Diesel fuel in Idaho is over $4.00/gallon, nearly twice

the per gallon pre-Covid price. Labor costs have also increased, as

the current working generation demands more compensation for hours

worked. This is understandable as inflation has driven the cost of

living to all-time highs. As a result, it is our job to engineer

the most efficient mining and processing technologies available to

ensure that our operations can withstand the additional burdens on

production.

In July of this year, the U.S. Department of Energy announced

that it is upgrading the criticality of copper for clean energy

technologies as part of the agency's Critical Materials Assessment.

The purpose of the research and conclusions in the assessment is to

enable the Department of Energy to set priorities for investment to

secure domestic critical mineral and material supply chains,

support the clean energy transition, and promote sustainable

solutions to meet current and future needs. The assessment found

that copper is a material that serves a critical function in

electrification as many nations aim to reduce carbon emissions,

with some setting goals to achieve net zero by 2050. The report

notes that these efforts will increase the demand for clean energy

technologies and the materials they rely on. Copper, a key metal in

electric vehicles, wind turbines, and other green technologies, is

set to move from a 'noncritical' classification in the short term

to a 'near critical' classification in the medium term. Between

2025 and 2030, copper is expected to land on a level 3 out of 4 in

terms of its importance to energy on the agency's criticality

matrix. As mentioned, this new classification, coupled with last

year's US Defense Production Act announcement, further sets the

stage for long-term stability in the global copper market.

Copper remains in the top three of the most consumed metals in

the world, trailing only behind iron and aluminum. The heavy focus

on green energy metals for power generation, transmission, and

transportation will only increase the demand. Clean energy

initiatives in the United States, Canada, and Europe have already

begun to drive demand for copper, cobalt and lithium. As other

countries develop similar initiatives, demand will outweigh global

supply.

Our Idaho projects host both EV metals and precious metals. Our

current metallurgical test work, which is focused on developing the

most efficient and economical methods of recovering copper, gold,

and silver, will be designed to deliver crucial metals to the

numerous infrastructure and green energy projects in the global

pipeline at the lowest cost possible to the consumer and the

highest margin possible for us.

Our story becomes even stronger with the realization that these

resources are all located in known mining districts in the

geopolitically stable, pro-mining jurisdiction of Idaho, USA.

Conclusion

As the demand for metals increases globally, the Company is in

an ideal position to deliver copper, gold, and silver into a market

with increasing demands. Our team of highly-experienced engineers,

metallurgists, and geologists are continuing the work necessary to

position ourselves as future metal producers contributing to the

global transportation, manufacturing and energy sectors that are so

vital to our livelihoods.

I would like to thank all our professional staff, consultants

and advisors, all of whom continue to work tirelessly to accomplish

our common goal of putting the Empire Mine into production and

exploring and developing our other projects for inclusion in a

pipeline of future producing mines. I look forward to reporting

further positive news as we continue our exploration and

development programs during the remainder of 2023.

Ryan McDermott

Chief Executive Officer

ESG & Sustainability Committee Chairman's Report

It is a great pleasure to provide an update on the ESG &

Sustainability ("ESG&S") activities since our last report in

May 2023.

Following the publication of our inaugural Sustainability Report

in Q2 2023, we continue to work with the KCAT (Konnex Community

Advisory Team) to ensure that our stakeholders remain informed

about our progress as we continue through the development and

permitting stages. We are keen to continue sharing our knowledge of

the industry within the community in which we will be operating,

including at the elementary and middle school levels, as well as

providing general mining and Company operations updates for the

immediate community. Community involvement is a cornerstone of our

ESG philosophy.

The tone of the national conversation about copper is changing.

The USA is looking at ways to become more mineral independent, and

PXC is exploring various ways to collaborate with Federal and State

governments to assist in this process. In particular, the ESG&S

team has been exploring government programmes and grants for mine

exploration process development.

We are also currently exploring ways to reduce our operational

footprint and operate as much as possible on our existing patented

(private) land. Minimizing our footprint, without adversely

affecting the mining process, is the right decision both

operationally and environmentally.

In addition, the ESG&S team is currently initiating

discussions with several other mining companies in order to

formulate a dispute resolution process ahead of hiring a large

workforce. We are aiming to provide a clear process for employees

of the Company, as well as for our stakeholders.

We are excited to have identified a community education

opportunity partner who is willing to provide a highly practical

eight-month mechanical training course targeted predominantly at

recent and future graduates in the local high schools, and who is

able to offer the course at 1/8(th) of the usual price. We are very

keen to publicise this locally. In the first place, it is a

fantastic opportunity for our youth, but also because when we move

to production, we will be hiring individuals with mechanical

qualifications, and it will be an absolute priority for us to hire

locally whenever possible. All anecdotal evidence and research

shows that local hires tend to show greater loyalty, and remain in

employment for longer than out-of-area hires.

We currently have two openings in our KCAT team which we will

publicise shortly in order to find individuals with suitable

experience who can assist in acting as liaisons between the Company

and the community.

In association with the KCAT, we are in the process of

finalising a Konnex Vendor Handbook, which sets out the

requirements and expectations we have of external contractors and

suppliers who conduct business with, or wish to conduct business

with, the Company. We have also drafted a Konnex Employee Handbook,

which sets out the Company's core values and goals, as well as a

detailed set of requirements of employee expectations.

We are looking forward to updating you further in the future. In

the meantime, we would be delighted to receive feedback and

suggestions at esg@phoenixcopper.com .

Catherine Evans

Non-Executive Director

Financial Overview

The Group reports a loss for the Period of $0.63 million (2022:

loss of $1.052 million). This includes a non-cash foreign exchange

gain on sterling denominated assets of $96,172 (2022: foreign

exchange loss of $503,593), and a charge of $18,992 (2022: $36,623)

relating to non-cash share-based payments attributable to warrants

or options extended or granted during the Period, and which amount

is simultaneously credited back to the retained deficit. Net assets

at 30 June 2023 totalled $37.39 million (2022: $38.22 million),

including $35.88 million (2022: $29.73 million) relating to the

Empire Mine, and $2.75 million (2022: $9.05 million) in cash.

The Company reports a profit for the Period of $309,759 (2022:

loss of $368,534), and net assets of $41.81 million (2022: $40.88

million). During the Period, the Company charged its operating

subsidiaries $450,000 (2022: $465,000) in respect of management

services provided, and $837,108 (2022: $610,653) in respect of

interest at 6% per annum on its inter-company loans, the latter

eliminating on consolidation. At 30 June 2023, the Company's loan

to Konnex Resources Inc ("Konnex"), owner of the Empire Mine, stood

at $27.03 million (2022: $22.95 million). This loan will be repaid

from Konnex's operating cash flow in due course and is intended,

together with royalties receivable from Konnex, to form a platform

for a future proposed dividend policy to return money to

shareholders.

The Company has also advanced $2.60 million (2022: $nil) to KPX

Holdings Inc ("KPX"), its Idaho registered intermediate holding

company, into which the Company's investment in Konnex, and

investments in and related loans to Borah Resources Inc, Lost River

Resources Inc and Salmon Canyon Resources Inc, totalling $4.42

million, were transferred on 31 December 2022 in return for 100% of

the equity of KPX.

During the Period, the Company issued 50,000 ordinary shares of

no par value ("Ordinary Shares") pursuant to the exercise of

warrants. Since the Period-end a further 2,250,000 Ordinary Shares

have been issued pursuant to the exercise of warrants. The

outstanding share capital of the Company is currently 124,928,622

Ordinary Shares.

In September 2023 the board approved the creation of a class of

corporate copper bonds to a total authorised amount of $300

million, as a prelude to the anticipated closing of an initial

tranche to raise up to $80 million (before expenses) for the

development and construction of the Empire open pit mine, plus

operational working capital. The bonds will pay a floating rate

coupon subject to a minimum of 8.5% per annum and a maximum of 20%.

The floating rate coupon will be calculated as to the higher of a

copper price coupon linked to the copper price on the London Metal

Exchange, or an interest rate coupon linked to the US Federal

Discount Rate. The bonds will be secured on the Group's patented

open pit mining claims, will be listed on The International Stock

Exchange in the Channel Islands, and will have a ten-year life with

bondholder option to request redemption at nominal value after six

years and the Company's option to offer redemption at a 10% premium

to nominal value after five years. M&G Trustee Company are

acting as Security Trustee and Escrow Agent, and The Bank of New

York Mellon ("BNYM") as Custodian and Transfer, Paying and

Settlement Agent.

On 24 March 2023 the Company announced a short-term, unsecured

$2,000,000 loan facility (the "Loan Facility"), for which the

initial three month term was extended for a further three months on

23 June 2023, at a fixed 4% coupon. The Company has extended the

initial term of the Loan Facility for a further two months until 22

November 2023 at a fixed 2% coupon. At the Company's option, the

Loan Facility may be extended to 22 March 2024, at an interest rate

of 1% per month.

The Company's shares are listed on AIM, operated by the London

Stock Exchange under the ticker PXC, and are also admitted to

trading on New York's OTCQX Market under the ticker PXCLF, and in

the form of American Depositary Receipts ("ADRs") under the ticker

PXCLY, with each ADR comprising 10 Ordinary Shares. BNYM sponsored

the ADR Program and act as ADR depositary, custodian and

registrar.

The Directors recognise the importance of sound corporate

governance and have applied the Quoted Companies Alliance's

Corporate Governance Code 2018. The Company's Corporate Governance

Statement dated 24 May 2023, and the Company's 2022 Sustainability

Report, can be viewed on the Company's website at

https://phoenixcopperlimited.com.

Richard Wilkins

Chief Financial Officer

Condensed consolidated income

statement Unaudited Unaudited Audited

6 months 6 months 12 months

to to to

30 June 30 June 31 December

2023 2022 2022

Note $ $ $

Continuing operations

Revenue 3 - - -

Exploration and evaluation

expenditure (28,839) - -

---------- ------------ -------------

Gross loss (28,839) - -

Administrative expenses 4 (617,788) (1,057,717) (1,568,475)

Other operating expenses 9 - - (37,777)

Loss from operations (646,627) (1,057,717) (1,606,252)

Finance income 21,258 6,107 32,104

Loss before taxation (625,369) (1,051,610) (1,574,148)

Taxation - - -

---------- ------------ -------------

Loss for the period (625,369) (1,051,610) (1,574,148)

---------- ------------ -------------

Loss attributable to:

* Owners of the parent company (612,262) (1,038,033) (1,546,827)

* Non-controlling interests (13,107) (13,577) (27,321)

---------- ------------ -------------

(625,369) (1,051,610) (1,574,148)

---------- ------------ -------------

Basic and diluted loss per

share - US cents 5 (0.50) (0.86) (1.27)

---------- ------------ -------------

The revenue, expenditures and operating result for each period

is derived from acquired and continuing operations in North America

and the United Kingdom.

Condensed consolidated statement

of comprehensive income Unaudited Unaudited Audited

6 months 6 months 12 months

to to to

30 June 30 June 31 December

2023 2022 2022

$ $ $

---------- ------------ -------------

Loss for the period and total comprehensive

income for the period (625,369) (1,051,610) (1,574,148)

---------- ------------ -------------

Total comprehensive income for

the period attributable to:

Owners of the parent company (612,262) (1,038,033) (1,546,827)

Non-controlling interests (13,107) (13,577) (27,321)

---------- ------------ -------------

(625,369) (1,051,610) (1,574,148)

---------- ------------ -------------

Condensed consolidated statement

of

financial position Unaudited Unaudited Audited

30 June 30 June 31 December

Note 2023 2022 2022

$ $ $

------------ ------------ ------------

Non-current assets

Property, plant and equipment

- mining property 6 35,876,914 29,731,139 33,104,230

Intangible assets 7 347,000 345,844 347,000

------------

Total non-current assets 36,223,914 30,076,983 33,451,230

------------ ------------ ------------

Current assets

Trade and other receivables 8 1,433,783 780,299 1,534,507

Finance assets 9 18,563 56,340 18,563

Cash and cash equivalents 2,749,407 9,045,669 4,664,233

------------

Total current assets 4,201,753 9,882,308 6,217,303

------------ ------------ ------------

Total assets 40,425,667 39,959,291 39,668,533

------------ ------------ ------------

Current liabilities

Trade and other payables 10 35,321 478,302 572,470

Other liabilities 11 2,240,000 250,000 500,000

------------

Total current liabilities 2,275,321 728,302 1,072,470

------------ ------------ ------------

Non-current liabilities

Other liabilities 11 - 250,000 -

Provisions 12 757,702 757,702 757,702

------------ ------------ ------------

Total non-current liabilities 757,702 1,007,702 757,702

------------ ------------ ------------

Total liabilities 3,033,023 1,736,004 1,830,172

Net assets 37,392,644 38,223,287 37,838,361

------------ ------------

Equity

13

Share capital 10 - - -

Share premium account 44,889,817 44,848,384 44,878,927

Retained deficit (7,529,980) (6,684,755) (7,086,480)

Translation reserve (18,588) (18,588) (18,588)

Capital and reserves attributable

to the owners of the parent company 37,341,249 38,145,041 37,773,859

Non-controlling interests 51,395 78,246 64,502

Total equity 37,392,644 38,223,287 37,838,361

------------ ------------ ------------

Condensed consolidated statement of changes in equity

Share premium Retained Translation Total Non-controlling Total

deficit reserve interests Equity

$ $ $ $ $ $

Balance at 1 January 2022 43,460,747 (5,751,359) (18,588) 37,690,800 91,823 37,782,623

-------------- ------------ ------------ ------------ ---------------- ------------

Loss for the period - (1,038,033) - (1,038,033) (13,577) (1,051,610)

------------ ------------ ------------ ---------------- ------------

Total comprehensive income

for

the period - (1,038,033) - (1,038,033) (13,577) (1,051,610)

-------------- ------------ ---------------- ------------

Shares issued in the period 1,387,637 - - 1,387,637 - 1,387,637

Share issue expenses - - - - - -

Share-based payments - 104,637 - 104,637 - 104,637

Total contribution by

owners 1,387,637 104,637 - 1,492,274 - 1,492,274

-------------- ------------ ------------ ------------ ---------------- ------------

Balance at 30 June 2022 44,848,384 (6,684,755) (18,588) 38,145,041 78,246 38,223,287

-------------- ------------ ------------ ------------ ---------------- ------------

Loss for the period - (508,794) - (508,794) (13,744) (522,538)

Total comprehensive income

for

the period - (508,794) - (508,794) (13,744) (522,538)

-------------- ------------ ------------ ------------ ---------------- ------------

Shares issued in the period 30,543 - - 30,543 - 30,543

Share-based payments - 107,069 - 107,069 - 107,069

-------------- ------------ ------------ ------------ ---------------- ------------

Total contribution by

owners 30,543 107,069 - 137,612 - 137,612

-------------- ------------ ------------ ------------ ---------------- ------------

Balance at 31 December 2022 44,878,927 (7,086,480) (18,588) 37,773,859 64,502 37,838,361

-------------- ------------ ------------ ------------ ---------------- ------------

Loss for the period - (612,262) - (612,262) (13,107) (625,369)

------------ ------------ ------------ ---------------- ------------

Total comprehensive income

for

the period - (612,262) - (612,262) (13,107) (625,369)

-------------- ------------ ---------------- ------------

Shares issued in the period 10,890 - - 10,890 - 10,890

Share-based payments - 168,762 - 168,762 - 168,762

Total contribution by

owners 10,890 168,762 - 179,652 - 179,652

-------------- ------------ ------------ ------------ ---------------- ------------

Balance at 30 June 2023 44,889,817 (7,529,980) (18,588) 37,341,249 51,395 37,392,644

-------------- ------------ ------------ ------------ ---------------- ------------

Condensed consolidated statement

of cash flows Unaudited Unaudited Audited

6 months 6 months 12 months

to to to 31 December

30 June 30 June 2022

2023 2022

$ $ $

------------ ------------ ----------------

Loss before taxation (625,369) (1,051,610) (1,574,148)

Adjustments for:

Depreciation

Share-based payments 18,992 36,623 67,818

Fair value adjustment to financial

asset - - 37,777

(606,377) (1,014,987) (1,468,553)

Changes in working capital

Decrease/(increase) in trade and other

receivables 172,175 49,896 (58,563)

(Decrease) in trade and other payables (537,149) (404,894) (310,726)

------------ ------------ ----------------

Cash (used in)/generated from operating

activities (971,351) (1,369,985) (1,837,842)

------------ ------------ ----------------

Investing activities

Purchase of intangible assets - (15,000) (16,156)

Purchase of property, plant and equipment (2,622,914) (3,539,095) (6,836,312)

Net cash outflow from investing activities (2,622,914) (3,554,095) (6,852,468)

------------ ------------

Cash flows from financing activities

Proceeds from the issuance of ordinary

shares 10,890 1,387,637 1,418,180

Preliminary bond-issue expenses (71,451) (464,417) (1,110,166)

Proceeds from new short-term loans 2,000,000 - -

Repayment of deferred consideration (260,000) - -

Net cash inflow from financing activities 1,679,439 923,220 308,014

------------ ------------ ----------------

Net (decrease)/increase in cash and

cash equivalents (1,914,826) (4,000,860) (8,382,296)

Cash and cash equivalents at the beginning

of the period 4,664,233 13,046,529 13,046,529

Cash and cash equivalents at the

end of the period 2,749,407 9,045,669 4,664,233

------------ ------------ ----------------

An amount of $149,770, (30 June 2022: $68,014, 31 December 2022:

$143,888) in respect of the charge for share-based payments was

capitalised into mining property.

1. Basis of preparation and principal accounting policies

This condensed consolidated interim financial information was

approved for issue by the Board on 27 September 2023.

This condensed consolidated interim financial information has

not been audited and does not include all of the information

required for full annual financial statements. While the financial

figures included within this interim report have been computed in

accordance with IFRS applicable to interim periods, this report

does not contain sufficient information to constitute an interim

financial report as set out in International Accounting Standard

34: Interim Financial Reporting.

Basis of consolidation

Principles of consolidation

Subsidiaries are all entities (including structured entities)

over which the Group has control. The Group controls an entity when

the Group is exposed to, or has rights to, variable returns from

its involvement with the entity and has the ability to affect those

returns through its power to direct the activities of the entity.

Subsidiaries are fully consolidated on the date on which control is

transferred to the Group. They are deconsolidated from the date

that control ceases.

The acquisition method of accounting is used to account for

business combinations by the Group.

Intercompany transactions, balances and unrealised gains of

transactions between Group companies are eliminated. Unrealised

losses are also eliminated unless the transaction provides evidence

of an impairment to the transferred asset.

Accounting policies of subsidiaries have been changed where

necessary to ensure consistency with the policies adopted by the

Group.

Non-controlling interests in the results and equity of

subsidiaries are shown separately in the consolidated income

statement, consolidated statement of comprehensive income,

statement of changes in equity and consolidated statement of

financial position respectively.

2. Information on the Group

Phoenix Copper Limited (the "Company") and its subsidiary

undertakings (the "Group") are engaged in exploration and mining

activities, primarily precious and base metals, primarily in North

America. The Company is domiciled and incorporated in the British

Virgin Islands on 19 September 2013 (registered number 1791533).

The address of its registered office is OMC Chambers, Wickhams Cay

1, Road Town, Tortola VG1110, British Virgin Islands. The Company

is quoted on London's AIM (ticker: PXC) and trades on New York's

OTCQX Market (ticker: PXCLF; ADR ticker PXCLY).

3. Revenue

The Group is not yet producing revenues from its mineral

exploration and mining activities. During the period the Company

charged its subsidiary entities $450,000 (30 June 2022: $465,000;

31 December 2022: $930,000) in respect of management services

provided.

4. Administrative expenses

Administrative expenses include $96,172 of foreign exchange

gains (30 June 2022: foreign exchange losses of $503,593; 31

December 2022: foreign exchange losses of $564,353).

Administrative expenses also include share-based payments of

$18,992 (30 June 2022: $36,623; 31 December 2022: $67,818). The

related credits to equity are taken to the retained deficit.

5. Loss per share Unaudited Unaudited Audited

6 months 6 months 12 months

to to to 31 December

30 June 30 June 2022

2023 2022

$ $ $

------------------- ------------------- -----------------

Loss for the period attributable

to equity holders of the parent

company (612,262) (1,038,033) (1,546,827)

------------------- ------------------- -----------------

Number Number Number

Weighted average number of ordinary

shares for the purposes of basic

and diluted loss per share 122,668,401 121,105,350 121,794,101

------------------- ------------------- -----------------

Loss per share - basic and diluted

(US cents) (0.50) (0.86) (1.27)

------------------- ------------------- -----------------

Non-current assets

6. Property, plant and equipment - mining Mining

property Property

$

----- -------------------------

Cost or valuation

At 1 January 2022 26,124,030

Additions 3,607,109

-------------------------

At 30 June 2022 29,731,139

Additions 3,373,091

At 31 December 2022 33,104,230

Additions 2,772,684

At 30 June 2023 35,876,914

-------------------------

Depreciation

At 30 June 2022, 31 December 2022 and 30 June -

2023

----- -------------------------

Net book value:

30 June 2022 29,731,139

-------------------------

31 December 2022 33,104,230

30 June 2023 35,876,914

-------------------------

Mining property assets relate to the past producing Empire Mine

copper - gold - silver - zinc project in Idaho, USA. The Empire

Mine has not yet recommenced production and no depreciation has

been charged in the statement of comprehensive income. There has

been no impairment charged in any period due to the early stage in

the Group's project to reactivate the mine.

7. Intangible assets

Exploration

and evaluation

expenditure

$

---- ----------------

Cost or valuation

At 1 January 2022 330,844

Additions 15,000

----------------

At 30 June 2022 345,844

Additions 1,156

----------------

At 31 December 2022 347,000

Additions -

---- ----------------

At 30 June 2023 347,000

----------------

Net book value:

30 June 2022 345,844

--------

31 December 2022 347,000

30 June 2023 347,000

--------

Exploration and evaluation expenditure relates to the Bighorn

and Redcastle properties on the Idaho Cobalt Belt in Idaho, USA.

The Bighorn property is owned by Salmon Canyon Resources Inc. The

Redcastle property is owned by Borah Resources Inc. Both companies

are wholly owned subsidiaries of KPX Holdings Inc, a wholly owned

subsidiary of the parent entity, and each of which are registered

and domiciled in Idaho. The Redcastle property is subject to an

Earn-In Agreement with First Cobalt Idaho, a wholly owned

subsidiary of Electra Battery Materials Corporation of Toronto,

Canada.

8. Trade and other receivables Unaudited Unaudited Audited

30 June 30 June 31 December

2023 2022 2022

$ $ $

---------- ---------- ------------

Other receivables 193,952 206,918 181,072

Preliminary bond issue expenses 1,181,617 464,417 1,110,166

Prepaid expenses 58,214 108,964 243,269

---------- ---------- ------------

1,433,783 780,299 1,534,507

---------- ---------- ------------

The preliminary bond issue expenses relate to the Company's

corporate copper bonds. These expenses will be deducted from the

proceeds of the bonds when issued and amortised over the expected

life of the bonds.

9. Financial assets Unaudited Unaudited Audited

6 months 6 months 12 months

to to to 31 December

30 June 30 June 2022

2023 2022

$ $ $

Quoted investments 18,563 56,340 18,563

---------- ---------- ----------------

In May 2021 the Group entered into an earn-in agreement with

First Cobalt Idaho, a wholly-owned subsidiary of Toronto-based

Electra Battery Materials Corporation ("Electra"), in respect of

the Group's Redcastle cobalt property on the Idaho Cobalt Belt. The

Group received consideration of $50,000 and 11,111 shares (as

consolidated) in Electra valued at $56,340, a total initial

consideration of $106,340.

The shares were valued at market price as at 31 December 2022

and a fair value adjustment of $37,777 has been charged to other

operating expenses as at 31 December 2022.

10. Trade and other payables Unaudited Unaudited Audited

30 June 30 June 31 December

2023 2022 2022

$ $ $

----------- ----------- ------------

Trade payables 19,175 478,302 569,864

Other payables

Need 16,146 - 2,606

35,321 478,302 572,470

----------- ----------- ------------

11. Other liabilities Unaudited Unaudited Audited

30 June 30 June 31 December

2023 2022 2022

$ $ $

----------- ----------- ------------

Current liabilities

Short-term loan 2,000,000 - -

Deferred consideration 240,000 250,000 500,000

----------- ----------- ------------

2,240,000 250,000 500,000

----------- ----------- ------------

Non-current liabilities

Deferred consideration - 250,000 -

----------- ----------- ------------

In April 2021, the Group entered into an agreement with Mackay

LLC to acquire 1% of the 2.5% net smelter royalty payable on mining

leases on the Empire Mine in Idaho, USA. Total consideration

payable to Mackay LLC is $800,000, of which $560,000 has been paid.

Deferred consideration comprises one further payment of $240,000

due on 31 December 2023.

The $2,000,000 short-term loan facility is unsecured, carries an

effective interest rate of 12% per annum, and is repayable on or

before 22 November 2023, unless extended at the Company's option to

22 March 2024.

12. Provisions Unaudited Unaudited Audited

30 June 30 June 31 December

2023 2022 2022

$ $ $

---------- ---------- ------------

Decommissioning provision 100,000 100,000 100,000

Royalties payable 657,702 657,702 657,702

---------- ---------- ------------

757,702 757,702 757,702

---------- ---------- ------------

There has been no change to provisions in the period ended 30

June 2023 and the year ended 31 December 2022.

The provision of $100,000 for decommissioning the Empire Mine is

based on the directors' estimate after taking into account

appropriate professional advice, and is included within mining

property.

The other provision of $657,702 arises from a business

combination in 2017 and comprises potential royalties payable in

respect of future production at the Empire Mine. This liability

will only be payable if the Empire Mine is successfully restored to

production and will be deducted from the royalties payable.

13. Share capital Unaudited Unaudited Audited

30 June 30 June 31 December

2023 2022 2022

Number Number Number

------------ ------------ ------------

Allotted and issued

Ordinary shares with no par value 122,678,622 122,471,622 122,628,622

------------ ------------ ------------

The Ordinary Shares rank pari passu.

During the period the Company issued 50,000 Ordinary Shares

pursuant to the exercise of warrants raising $10,890 with an

average issue cost of 21.8 US cents.

Since the period end a further 2,250,000 Ordinary Shares have

been issued pursuant to the exercise of warrants raising $500,400

with an average issue cost of 22.2 US cents.

14. Events after the reporting date

In September 2023 the board approved the creation of a class

of corporate copper bonds to a total authorised amount of $300

million, as a prelude to the anticipated closing of an initial

tranche to raise up to $80 million (before expenses) for the

development and construction of the Empire open pit mine, plus

operational working capital. The bonds will pay a floating rate

coupon subject to a minimum of 8.5% per annum and a maximum of

20%. The floating rate coupon will be calculated as to the higher

of a copper price coupon linked to the copper price on the London

Metal Exchange, or an interest rate coupon linked to the US Federal

Discount Rate. The bonds will be secured on the Group's patented

open pit mining claims, will be listed on The International Stock

Exchange in the Channel Islands, and will have a ten-year life

with bondholder option to request redemption at nominal value

after six years and the Company's option to offer redemption

at a 10% premium to nominal value after five years. M&G Trustee

Company are acting as Security Trustee and Escrow Agent, and

The Bank of New York Mellon ("BNYM") as Custodian and Transfer,

Paying and Settlement Agent.

Market Abuse Regulation (MAR) Disclosure

The Company deems the information contained within this

announcement to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014, which has been

incorporated into UK law by the European Union (Withdrawal) Act

2018. Upon the publication of this announcement via Regulatory

Information Service, this inside information is now considered to

be in the public domain.

Contacts

For further information please visit

www.phoenixcopperlimited.com or contact:

Phoenix Copper Limited Ryan McDermott Tel: +1 208 954

Brittany Lock 7039

Richard Wilkins Tel: +1 208 794

8033

Tel: +44 7590

216 657

SP Angel Corporate David Hignell / Kasia Brzozowska Tel: +44 20 3470

Finance LLP (Nominated 0470

Adviser)

------------------------------------ -----------------

Tavira Financial Jonathan Evans / Oliver Stansfield Tel: +44 20 7100

Limited (Joint Broker) 5100

------------------------------------ -----------------

WH Ireland (Joint Harry Ansell / Katy Mitchell Tel: +44 207

Broker) 2201666

------------------------------------ -----------------

Panmure Gordon (UK) John Prior / Hugh Rich / Ailsa Tel: +44 20 7886

Limited (Joint Broker) Macmaster 2500

------------------------------------ -----------------

EAS Advisors (US Matt Bonner / Rogier de la Rambelje Tel: +1 (646)

Corporate Adviser) 495-2225

------------------------------------ -----------------

BlytheRay Tim Blythe / Megan Ray Tel: +44 20 7138

(Financial PR) 3204

------------------------------------ -----------------

Notes

Phoenix Copper Limited is a USA focused, base and precious

metals emerging producer and exploration company, initially

targeting copper, gold and silver production from an open pit

mine.

Phoenix's primary operations are focused near Mackay, Idaho in

the Alder Creek mining district, at the 80% owned Empire Mine

property, which historically produced copper at grades of up to 8%,

as well as gold, silver, zinc and tungsten, from an underground

mine.

Since 2017, Phoenix has carried out extensive drill programmes

which have defined a NI 43-101 completed PEA (preliminary economic

assessment) for an open pit heap leach solvent extraction and

electrowinning ("SX-EW") mine, which was updated in October 2020.

From the 2020 PEA, the measured and indicated resource is:

22,909,059 tonnes at an average grade of 0.38% copper, 0.324

grammes per tonne ("g/t") gold, 10.3 g/t silver, and 0.19% zinc.

The contained metal for the measured and indicated resource is

87,543 tonnes of copper, 238,406 ounces of gold, 7,595,198 ounces

of silver and 43,871 tonnes of zinc.

In addition to Empire, the district includes the historic

Horseshoe, White Knob and Blue Bird Mines, past producers of

copper, gold, silver, zinc, lead and tungsten from underground

mines. A new discovery at Red Star, 330 metres northwest of the

Empire Mine proposed open pit, has revealed high grade silver /

lead sulphide ore, and from three shallow exploration drill holes a

maiden inferred resource of 103,000 tonnes containing 173.4 g/t

silver, 0.85 g/t gold and 3.85% lead (1.6 million ounces silver

equivalent) was reported in an NI 43-101 technical report published

in May 2019. Additionally, the district includes Navarre Creek, a

volcanic-hosted precious metals target in a 14.48 sq km area. The

Company's total land package at Empire comprises 8,034 acres (32.51

sq kms).

At Empire, it is estimated that less than 1% of the potential

ore system has been explored to date and, accordingly, there is

significant opportunity to increase the resource through phased

exploration. The stated aim of the Company is to fund this phased

exploration through free cashflow generated by its initial mine. A

Plan of Operations in respect of the initial open pit mine was

filed with the relevant regulatory authorities in June 2021.

Phoenix also has two wholly owned cobalt properties on the Idaho

Cobalt Belt to the north of Empire. An Earn-In Agreement has been

signed with Electra Battery Materials, Toronto, in respect of one

of those properties.

Phoenix is listed on London's AIM (PXC), and trades on New

York's OTCQX Market (PXCLF and PXCLY (ADRs)). More details on the

Company, its assets and its objectives can be found on PXC's

website at https://phoenixcopperlimited.com/

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFVDARIDFIV

(END) Dow Jones Newswires

September 28, 2023 02:00 ET (06:00 GMT)

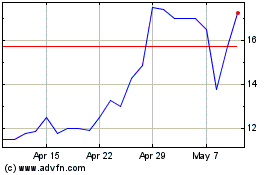

Phoenix Copper (LSE:PXC)

Historical Stock Chart

From Feb 2025 to Mar 2025

Phoenix Copper (LSE:PXC)

Historical Stock Chart

From Mar 2024 to Mar 2025