Hardman & Co publication on Real Estate Credit Investments (RECI) - The rise of private credit: threats and opportunities

February 20 2025 - 6:30AM

EQS Non-Regulatory

|

Hardman & Co Research

Hardman & Co publication on Real Estate Credit Investments

(RECI) - The rise of private credit: threats and opportunities

20-Feb-2025 / 12:30 GMT/BST

The issuer is solely responsible for the content of this

announcement.

Hardman & Co Research

on Real Estate Credit Investments (RECI):

The rise of private credit:

threats and opportunities

One of the key trends in

global financing markets has been the rise of private credit. In

this report, we consider the implications for RECI. On the upside,

we note i) the disintermediation of banks reconfirms the drivers to

its business model, ii) this should be positive for sentiment, and

iii) most of RECI’s competitive advantages relative to banks also

apply to private credit funds. On the downside, we note i)

competition will increase, especially for higher-end loans and

staff, although RECI is in a niche position where the biggest funds

are unlikely to be active, and ii) credit losses in large private

credit funds are likely to adversely affect sentiment.

Please click on the link

below for the full report:

https://hardmanandco.com/research/corporate-research/reci-the-rise-of-private-credit-threats-and-opportunities/

If you are interested in

meeting the company, you can register your interest by clicking on

the above link.

|

To contact us:

Hardman & Co

9 Bonhill Street

London

EC2A 4DJ

www.hardmanandco.com

Follow us

on X @HardmanandCo

|

Contact:

Mark Thomas

|

mt@hardmanandco.com

|

Hardman & Co Research

can still be accessed for free after MiFID II. Please click

here to read the

statement.

About Hardman & Co:

Hardman Research Ltd,

trading as Hardman & Co, is an appointed representative of

Capital Markets Strategy Ltd and is authorised and regulated by the

Financial Conduct Authority; our FCA registration number is 600843.

Hardman Research Ltd is registered at Companies House with number

8256259. Attention is drawn to the important disclaimers at the end

of the report.

Dissemination of a CORPORATE NEWS,

transmitted by EQS Group.

The issuer is solely responsible for the content of this

announcement.

|

End of Announcement - EQS News Service

2089257 20-Feb-2025

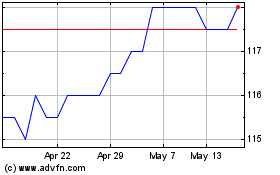

Real Estate Credit Inves... (LSE:RECI)

Historical Stock Chart

From Feb 2025 to Mar 2025

Real Estate Credit Inves... (LSE:RECI)

Historical Stock Chart

From Mar 2024 to Mar 2025