Statement re Successful Extension of Debt Maturities

February 29 2012 - 1:00AM

UK Regulatory

TIDMSKG

SKG successfully extends its debt maturities

Dublin, London, 29 February, 2012: Further to its press release

of 8 February 2012, Smurfit Kappa Group plc ("SKG") is pleased to

announce a very successful result to the planned extension of its

debt maturities. Today, the Group confirmed that it had received

consents in excess of 95% to the proposed amendments to its Senior

Credit Facility. The minimum required level of consents is

66.66%.

Lenders holding in excess of 85% of Term Loans B & C and 70%

of the Revolving Credit Facilities have elected to extend their

commitments, as requested in the Amendment Letter of 8

February.

Smurfit Kappa Group's Chief Financial Officer, Mr Ian Curley,

commented: "As part of our ongoing capital structure management, we

are pleased to report a very successful result to the amendment of

our Senior Credit Facility. Our net debt reduction of EUR358

million to EUR2.75bn in the full year 2011 combined with the

extension of our debt maturity profile provides us with

significantly enhanced financial flexibility."

About Smurfit Kappa Group

Smurfit Kappa Group is a world leader in paper-based packaging

with operations in Europe and Latin America. Smurfit Kappa Group

operates in 21 countries in Europe and is the European leader in

containerboard, solidboard, corrugated and solidboard packaging and

has a key position in several other packaging and paper segments.

Smurfit Kappa Group also has a growing base in Eastern Europe and

operates in 9 countries in Latin America where it is the only

pan-regional operator.

Contacts

Bertrand Paulet FTI Consulting

Smurfit Kappa Group

Tel: +353 1 202 71 80 Tel: +353 1 663 36 80

E-mail: ir@smurfitkappa.com E-mail: smurfitkappa@fticonsulting.com

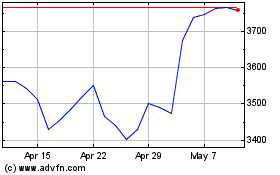

Smurfit Kappa (LSE:SKG)

Historical Stock Chart

From Jun 2024 to Jul 2024

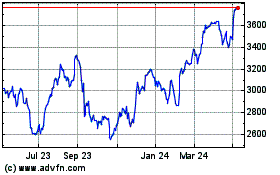

Smurfit Kappa (LSE:SKG)

Historical Stock Chart

From Jul 2023 to Jul 2024