TIDMSKG

Smurfit Kappa Group plc

2012 First Quarter Results

4 May 2012: Smurfit Kappa Group plc ("SKG" or the "Group"), one

of the world's largest integrated manufacturers of paper-based

packaging products, with operations in Europe and Latin America,

today announced results for the three months ending 31 March

2012.

2012 First Quarter

| Key Financial

Performance Measures

EUR m Q1 2012 Q1 2011 Change Q4 2011 Change

Revenue EUR1,823 EUR1,803 1% EUR1,819 0%

EBITDA before EUR246 EUR243 1% EUR245 1%

Exceptional

Items andShare-based

Payment Expense (1)

EBITDA Margin 13.5% 13.5% - 13.4% -

Operating Profit EUR177 EUR147 20% EUR149 19%

Basic EPS (cent) 27.1 15.6 74% 39.4 (31%)

Pre-exceptional 15.3 16.0 (4%) 30.4 (50%)

EPS (cent)

Free Cash Flow(2) (EUR16) EUR12 - EUR199 -

Net Debt EUR2,775 EUR3,061 (9%) EUR2,752 1%

Net Debt to EBITDA 2.7x 3.2x - 2.7x -

(LTM)

(1) EBITDA before exceptional items and share-based payment expense is denoted by EBITDA throughout the remainder of themanagement commentary for ease of reference. A reconciliation of profit for the period to EBITDA before exceptional items andshare-based payment expense is set out on page 25.

(2) Free cash flow is set out on page 8. The IFRS cash flow is set out on page 15.

Highlights

-- Strong EBITDA of EUR246 million despite significant cost pressures

during the quarter

-- Performance reflects the strength and efficiency of SKG's integrated

system

-- Net debt/EBITDA of 2.7x stable versus year-end 2011 despite increased

working capital

-- High input costs and positive supply environment underpin continued

pricing progress

-- Expect full year 2012 EBITDA performance broadly similar to that

achieved in 2011

Performance Review and Outlook

Gary McGann, Smurfit Kappa Group CEO, commented: "We are pleased

to report a relatively strong EBITDA of EUR246 million for the

first quarter. Despite significant increases in input costs and

downward pressure on box prices in the period, our EBITDA margin of

13.5% reflects the efficiency of our integrated system in Europe.

Our Latin American businesses also continued to perform well,

contributing to 23% of the Group's overall EBITDA in the

quarter.

Basic EPS is 74% up compared to last year, primarily as a result

of exceptional gains. Sequentially, both our basic and

pre-exceptional EPS declined, largely as a result of a tax credit

in the fourth quarter of 2011.

Notwithstanding increased working capital levels in the quarter,

our net debt to EBITDA ratio was unchanged at 2.7x at the end of

March, and well within our objective of remaining below 3.0x

through the cycle. In the first quarter, we successfully completed

amendments to our Senior Credit Facility, providing us with

increased financial flexibility and extended debt maturities to

2016 and 2017.

During quarter one, 2012, box demand in Europe was stable

compared to the fourth quarter, 2011 levels, and industry

inventories reduced. This market backdrop combined with rising

input costs allowed SKG to implement price increases for testliner

and kraftliner during the first quarter and into April 2012 which

should underpin some box price recovery during the second half of

the year.

For the full year 2012, subject to macro-economic volatility and

normal business risk, we expect to deliver an EBITDA performance

broadly similar to that achieved in 2011. This will in turn support

good free cash flow generation and further de-leveraging, thereby

continuing to expand our available range of strategic and financial

options.

This strong performance expectation is underpinned by our

leadership position in packaging innovation and sustainability, our

efficient integrated operating system, and our continued financial

discipline at all levels of the company."

About Smurfit Kappa Group

Smurfit Kappa Group is a world leader in paper-based packaging

with operations in Europe and Latin America. Smurfit Kappa Group

operates in 21 countries in Europe and is the European leader in

containerboard, solidboard, corrugated and solidboard packaging and

has a key position in several other packaging and paper segments.

Smurfit Kappa Group also has a growing base in Eastern Europe and

operates in 9 countries in Latin America where it is the only

pan-regional operator.

Forward Looking Statements

Some statements in this announcement are forward-looking. They

represent expectations for the Group's business, and involve risks

and uncertainties. These forward-looking statements are based on

current expectations and projections about future events. The Group

believes that current expectations and assumptions with respect to

these forward-looking statements are reasonable. However, because

they involve known and unknown risks, uncertainties and other

factors, which are in some cases beyond the Group's control, actual

results or performance may differ materially from those expressed

or implied by such forward-looking statements.

Contacts

Smurfit Kappa GroupBertrand Paulet, +353 1 202 71

80ir@smurfitkappa.comorFTI Consulting+353 1 663 36

80smurfitkappa@fticonsulting.com

2012 First Quarter | Performance Overview

Compared to the fourth quarter of 2011, demand for SKG's

packaging solutions in the first quarter was 3% higher on an

absolute basis. However, when adjusted for a lower number of

working days in the fourth quarter, demand in the first quarter was

flat. Compared to the first quarter of 2011, SKG's total corrugated

volumes were approximately 1% lower.

Despite a sequential increase in input costs and a 2% average

reduction in box prices in the first quarter, SKG's EBITDA margin

of 13.5% was in line with the fourth quarter 2011. In a challenging

operating environment, this outcome highlights SKG's particular

ability to generate consistently strong margins and returns through

the cycle, underpinned by a differentiated commercial offering, and

a cost competitive, well invested, integrated system.

SKG's relatively strong first quarter performance also reflects

an ongoing focus on cost efficiency, with a further EUR30 million

of cost take-out benefits delivered across its system in the

period. SKG is benefiting from the increasing efficiency of its

paper mills, as returns from the ongoing capital investment

programme are being achieved. Recent investments included

significant rebuilds in its Swedish kraftliner mill and in two of

its German recycled mills, together with the closure of a higher

cost recycled mill in France.

From an industry perspective, following widespread downtime at

the end of 2011 and into 2012, inventories progressively reduced

during the first quarter, despite the start-up of a new recycled

machine by a competitor in the UK. The medium term supply outlook

remains favourable, as limited availability and higher cost of

fibre are increasing barriers to entry for new capacity. Currently,

only one new machine is expected to be built in Europe over the

next two years.

The supply outlook for kraftliner is also expected to remain

tight in the near to medium term, reflecting the reduction in US

imports since the end of 2011 and the recent bankruptcy of a

European producer, which will remove approximately 7% of the

relevant industry capacity. As the clear kraftliner market leader

in Europe, and a net seller of approximately 500,000 tonnes per

annum, SKG should strongly benefit from the resulting more

consolidated market for that grade.

The sudden rise in input costs since the beginning of 2012,

combined with a satisfactory market balance, has generated

broad-based support for paper price increases in Europe. Overall,

between February and April 2012, SKG has implemented price

increases of EUR80 per tonne for recycled containerboard and EUR30

per tonne for kraftliner. Further kraftliner pricing progress is

expected in quarter two. In line with the usual three to six months

lag, higher paper prices should underpin in some box price recovery

in the second half of 2012.

The Group's Latin American EBITDA of EUR55 million in the first

quarter was 11% higher year-on-year, primarily reflecting the

absence of the maintenance downtime in SKG's Colombian mill system

that occurred in March 2011. While EBITDA in Colombia was higher

year-on-year, Venezuela was broadly stable and Mexico and Argentina

were lower.

Working capital increased by EUR88 million in the first quarter

of 2012, broadly in line with the prior year outflow. Despite

higher working capital levels, the Group's net debt increased by

only EUR23 million in the period. Compared with the end of March

2011, SKG's net debt has reduced by EUR286 million, which

demonstrates the strong cash flow generation capability of the

business.

The marginal increase in net debt in the first quarter, combined

with a strong EBITDA performance contributed to an unchanged net

debt to EBITDA ratio of 2.7x at the end of March compared to the

year-end 2011 level. The Group expects good cash flow generation

and further de-leveraging in 2012.

2012 First Quarter | Financial Performance

At EUR1,823 million for the first quarter of 2012, sales revenue

was EUR20 million higher than in the first quarter of 2011, the

equivalent of 1%. However, allowing for the positive impact of

currency and hyperinflation accounting of EUR10 million, and for

the positive impact of acquisitions net of disposals of EUR8

million, the underlying sales revenue was broadly stable

year-on-year. Compared to the fourth quarter of 2011, sales revenue

in the first quarter of 2012 was marginally higher.

At EUR246 million, EBITDA in the first quarter of 2012 was EUR3

million higher than the first quarter of 2011. Currency,

acquisitions and disposals had a marginally positive impact.

Compared to the fourth quarter of 2011, EBITDA increased by EUR1

million.

Exceptional gains of EUR28 million were included in the first

quarter's 2012 operating profit. This included EUR10 million

primarily relating to the sale of land at SKG's former Valladolid

mill in Spain (operation closed in 2008), together with EUR18

million relating to the disposal of a company in Slovakia. The gain

primarily relates to the reclassification (under IFRS) of the

cumulative translation differences within equity from reserves to

retained earnings through the Income Statement. In the first

quarter of 2011, exceptional charges of EUR1 million related to the

on-going rationalisation of the European corrugated operations.

SKG's basic EPS increased from 15.6 cent in the first quarter of

2011 to 27.1 cent in the first quarter of 2012, primarily as a

result of the exceptional gains. On a pre-exceptional basis, EPS

was slightly lower year on year at 15.3 cent compared to 16.0 cent.

Compared with the fourth quarter of 2011 both SKG's basic and

pre-exceptional EPS declined, largely driven by a tax credit in the

fourth quarter of 2011 (as a result of the recognition of deferred

tax assets) compared to a tax expense in the first quarter of

2012.

2012 First Quarter | Free Cash Flow

Compared to a net inflow of EUR12 million in the first quarter

of 2011, the Group reported a net outflow of EUR16 million in the

first quarter of 2012. While EBITDA was 1% higher, the lower free

cash flow primarily resulted from higher capital expenditure and

cash tax outflows year-on-year.

Capital expenditure of EUR63 million in the first quarter of

2012 equated to 74% of depreciation, compared to 62% in the first

quarter of 2011. For the full year 2012, SKG expects to maintain

its capital expenditure at its normalised level of around 90% of

depreciation.

Compared to an EUR86 million increase in the first quarter of

2011, working capital increased by EUR88 million in the first

quarter of 2012. Higher absolute levels of working capital at the

end of the first quarter primarily resulted from a rise in debtors

and somewhat higher inventory values.

However, at 8.7% of annualised sales revenue, SKG's working

capital to sales ratio at the end of March 2012 actually improved

compared to the 9.2% reported at March 2011, thereby demonstrating

the Group's continuing focus on tight working capital

management.

Cash interest of EUR61 million in the first quarter of 2012 was

the same as the first quarter of 2011. Following on from the

successful amendments to its Senior Credit Facility in the first

quarter of 2012, and subsequent use of cash on balance sheet to

make early debt repayments of EUR330 million by the end of the

second quarter, SKG expects its cash interest in 2012 to be

slightly lower than in 2011.

Tax payments of EUR14 million in the first quarter of 2012 were

EUR4 million higher than in 2011.

In 2012, subject to normal economic and business risks, the

Group expects to deliver good free cash flow generation and further

de-leveraging, supported by an anticipated strong EBITDA

performance, continued discipline in capital expenditure and

slightly lower cash interest year-on-year, somewhat offset by

higher cash tax payments.

2012 First Quarter | Capital Structure

The Group's net debt increased by EUR23 million to EUR2,775

million during the first quarter, primarily reflecting the negative

free cash flow of EUR16 million, combined with a EUR13 million

outflow in respect of the purchase of own shares for the Group's

Deferred Annual Bonus Plan, and a EUR6 million outlay for the

acquisition of a bag-in-box operation in Argentina. These were

somewhat offset by positive currency impacts of EUR11 million,

mainly reflecting the relative strengthening of the euro against

the US dollar towards the end of the first quarter.

Despite a slightly higher net debt, the Group's net debt to

EBITDA ratio of 2.7x at the end of March 2012 was unchanged

compared to the 2011 year-end level. Through the cycle, the Group's

clear objective is to maintain its net debt to EBITDA ratio below

3.0x.

Compared with March 2011, SKG's net debt at the end of March

2012 was EUR286 million lower, the equivalent of a 9% reduction.

This positive outcome re-confirms SKG's track record of delivering

strong free cash flow generation through the cycle.

In line with its proactive approach to capital structure

management, in the first quarter the Group successfully completed

amendments to its Senior Credit Facility ('SCF'), providing it with

extended debt maturities and significantly enhanced financial

flexibility.

Lenders comprising 98% of the SCF consented to the proposed

amendments, while lenders holding 90% of Term Loans B & C and

77% of the Revolving Credit Facilities elected to extend their

commitments to 2016 and 2017. The amendments became effective on 1

March 2012.

By the end of the second quarter of 2012, SKG will have prepaid

EUR330 million of its SCF debt at par, funded from cash on balance

sheet. This prepayment will effectively remove all of the Group's

remaining SCF maturities in 2012, 2013 and 2014.

As a result of the amendment and subsequent cash prepayment, the

Group has no SCF maturities before 2016, and has increased

flexibility to raise longer-dated capital, at a time of its

choosing, to refinance its SCF in the future and/or its Senior

Subordinated Notes due in 2015.

The Group's average debt maturity profile at the end of March

2012 has increased from 4.4 years to 5.1 years (5.4 years pro-forma

the cash prepayment). The Group's liquidity remains strong, with

EUR820 million of cash on its balance sheet at the end of March

2012, together with committed undrawn credit facilities of

approximately EUR525 million.

2012 First Quarter | Operating efficiency

Commercial offering and innovation

In the first quarter of 2012, SKG's business with pan-European

customers continued to outperform, growing by 4.9% year-on-year in

a generally flat market. This demonstrates the attractiveness of

SKG's offering in an increasingly international customer world.

With approximately 90% of its pan-European business contracted from

one to six years, SKG is building long-term sustainable

partnerships with its customers.

Using the skills and experience acquired in servicing the

increasing demands of international customers, SKG has continued to

pay special attention to the recruitment and retention of local

customers who benefit from the best international standards of the

Group's businesses.

SKG's continuing commercial success is underpinned by its

long-standing business positioning as a paper packaging

"one-stop-shop", characterised by a broad and expanding geographic

footprint, a diversified product range, and unrivalled design and

innovation capabilities.

During the first quarter, SKG showcased its "one-stop-shop" and

extensive range of sustainable and innovative packaging offerings

at its third innovation and sustainability conference held in the

Netherlands. Approximately 150 of SKG's key customers attended the

event, recognising SKG's critical role in adding value to their

supply chain in an increasingly demanding market place.

A selection of these customers participated as part of the

judging panel to choose the projects, products and employees to be

awarded for producing SKG's most innovative packaging solutions and

sustainability ideas for the past year, among 200 pre-selected

initiatives. A similar event will be organised in Latin America in

the near future.

As witnessed at the awards ceremony, an increasing competitive

advantage for SKG is its drive in the area of sustainability, with

a stated objective to be the first European company to guarantee

that all of its packaging solutions are coming from sustainable

sources. The Group's fourth annual sustainable development report

will be published in June 2012 and will elaborate extensively on

progress against SKG's stated targets and on its work in the wider

area of Corporate Social Responsibility.

Since the beginning of 2012, SKG received further independent

testimony of its leadership position in innovation, sustainability

and design. These included the development, for Philips, of an

environmentally friendly paper-based packaging solution to replace

the historical plastic package for the transport and handling of

delicate electronic devices through its supply chain.

In February SKG was chosen by Danone Spain as its "Best Supplier

for 2011" in the Raw Materials & Packaging Category. This award

reflects SKG's strong performance in all of the appraised areas,

including "product quality and service", "most innovative idea" and

"best sustainable development idea". For more than 11 years, Danone

has placed its trust in SKG to develop innovative solutions to

package its products.

In April 2012, one of SKG's innovative designs, called "Care

bottle packaging" won a Gold award in Germany. The Care bottle

packaging is a patent protected design, and has been approved by

DHL for shipping wine bottles, amongst other products.

Cost take-out programme

In 2011, SKG commenced a new two year cost take-out initiative,

with a target to generate EUR150 million of savings by the end of

2012. This programme is based on a detailed bottom-up approach and

is subject to a formal reporting system. SKG generated EUR100

million of cost take-out benefits in 2011.

A further EUR30 million of cost take-out was delivered in the

first quarter of 2012, partially mitigating the impact of

significant increases in input costs during the period, thereby

contributing to the delivery of the Group's relatively strong

EBITDA margin of 13.5%.

Having reviewed its cost base, SKG is satisfied that it can

upscale its original two year (2011/12) cost take-out target from

EUR150 million to over EUR200 million, implying an upscaled 2012

cost take-out objective of over EUR100 million.

2012 First Quarter | Performance Review

Europe

SKG's total corrugated shipments in the first quarter of 2012

were 1% lower than in the first quarter of 2011. Within that

number, SKG's box volumes were generally flat, while sheet volumes,

a more commoditised product offering, reduced by 8% as a result of

SKG's strong stance on pricing.

Following the decline in paper prices in the second half of

2011, renewed input cost pressure in December and into the new year

generated significant margin compression for non-integrated

producers. As a result, sizeable amounts of market-related downtime

were announced at 2011 year-end and into 2012 which, combined with

higher paper exports overseas, led to a progressive reduction in

industry inventories during the first quarter.

On the cost side, OCC prices increased by approximately EUR35

per tonne through the first quarter, reflecting renewed Chinese

demand. Energy and distribution costs also increased. Lower

inventories combined with a steep rise in input costs generated

broad-based support for paper price increases.

As a result, European recycled containerboard prices have

increased by approximately EUR80 per tonne between February and

April, the equivalent of a 20% increase. Despite that increase, in

April the spread between OCC and testliner prices remained

approximately EUR60 per tonne lower than at the 2007 peak, thereby

clearly highlighting the challenges faced by less efficient

capacity in the industry. In that context, the closure of three

small recycled containerboard mills was announced in Europe since

the beginning of 2012 (representing a combined 185,000 tonnes of

capacity).

In the case of SKG, following the permanent closure of 10 less

efficient containerboard mills since 2005, and in light of the

significant ongoing investments in its "champion" mills, the Group

is equipped with an efficient and fully integrated recycled

containerboard system. As can be seen from the relatively strong

EBITDA margin delivered in the quarter by the European operations,

SKG's system should deliver a strong performance in any operating

environment.

On the kraftliner side, US imports into Europe were 22% lower

year-on-year in the fourth quarter of 2011. Imports remained

measured into 2012, which contributed to maintain an appropriate

balance in the market through the first quarter. In April, one of

the Group's long-standing competitors announced the permanent

closure of its 290,000 tonnes kraftliner mill in Norway,

representing approximately 7% of the relevant industry capacity.

This event is expected to further tighten the supply for that grade

over the near to medium term, with SKG well positioned to benefit

from it.

In the quarter SKG announced a kraftliner price increase of

EUR60 per tonne, of which EUR30 per tonne has been implemented to

the end of April. The Group currently expects to implement the

remainder of this necessary kraftliner price increase during the

second quarter.

On the corrugated side, as expected, prices came under downward

pressure in the first quarter, reflecting the weaker paper prices

that prevailed in the second half of 2011. On average, SKG's

European corrugated prices were 2% lower in the first quarter than

in the fourth quarter of 2011. Into the second quarter, corrugated

prices are expected to remain generally stable.

Latin America

In the first quarter, Latin American EBITDA of EUR55 million was

11% higher year-on-year, and represented 23% of the Group's total

EBITDA. The region delivered an EBITDA margin of 16.6% in the

quarter, broadly in line with the prior year performance.

While SKG's corrugated volumes in Colombia were 2% higher

year-on-year, pricing was relatively stable, highlighting moderate

inflation in the country. The country's EBITDA was significantly

higher year-on-year, primarily reflecting the absence of the

planned maintenance downtime of its Cali mill that occurred in

March 2011, combined with the benefits of SKG's ongoing cost

take-out efforts.

In the challenging Venezuelan market, demand declined in the

first quarter of 2012. Continuing high inflation in the country was

offset by the Group's operating efficiency actions, as well as some

necessary price recovery. SKG is planning downtime in its

Venezuelan mill system during the second quarter of 2012.

Higher demand and 3% higher box prices in Mexico were not

sufficient to fully offset the significant fibre and energy cost

inflation, resulting in lower EBITDA in the first quarter on a

year-on-year basis. The first quarter result was also negatively

impacted by the planned downtime to upgrade the Group's main

containerboard machine in Mexico city.

The volumes and profitability of the Argentinian operation in

the first quarter were negatively impacted by a prolonged strike in

one of its packaging plants. Negotiations are continuing in an

effort to resolve the dispute. Paper and box prices were

significantly higher year-on-year, somewhat compensating for the

high inflation level prevailing in the country.

Despite some country-specific challenges from time to time, the

Group believes that the geographic diversity of its business in the

Latin American region, together with the proven ability of its

local management to drive the business forward, will allow it to

continue to deliver a strong performance through the cycle. Latin

America remains a key target region for SKG's future growth.

Summary Cash Flow(1)

Summary cash flows for the first quarter are set out in the following table.

3 months to31-Mar-12 3 months to31-Mar-11

EURm EURm

Pre-exceptional EBITDA 246 243

Cash interest expense (61) (61)

Working capital change (88) (86)

Current provisions (4) (3)

Capital expenditure (63) (54)

Change in capital creditors (27) (6)

Tax paid (14) (10)

Sale of fixed assets 8 1

Other (13) (12)

Free cash flow (16) 12

Share issues 4 7

Ordinary shares purchased - own shares (13) -

Sale of businesses and investments 1 4

Purchase of investments (6) (1)

Dividends (1) -

Derivative termination receipts 1 -

Net cash (outflow)/inflow (30) 22

Deferred debt issue costs amortised (4) (4)

Currency translation adjustments 11 31

(Increase)/decrease in net debt (23) 49

(1) The summary cash flow is prepared on a different basis to the

cash flow statement under IFRS. The principal difference

is that thesummary cash flow details movements in net debt

while the IFRS cash flow details movements in cash and

cash equivalents. Inaddition, the IFRS cash flow has different

sub-headings to those used in the summary cash flow.

A reconciliation of the free cashflow to cash generated

from operations in the IFRS cash flow is set out below.

3 months to31-Mar-12 3 months to31-Mar-11

EURm EURm

Free cash flow (16) 12

Add back: Cash interest 61 61

Capital expenditure (net of change in capital creditors) 90 60

Tax payments 14 10

Less: Sale of fixed assets (8) (1)

Profit on sale of assets and businesses - non exceptional (3) (5)

Non-cash financing activities (5) -

Cash generated from operations 133 137

Capital Resources

The Group's primary sources of liquidity are cash flow from

operations and borrowings under the revolving credit facility. The

Group's primary uses of cash are for debt service and capital

expenditure.

At 31 March 2012 Smurfit Kappa Funding plc had outstanding

EUR217.5 million 7.75% senior subordinated notes due 2015 and

US$200 million 7.75% senior subordinated notes due 2015. In

addition Smurfit Kappa Treasury Funding Limited had outstanding

US$292.3 million 7.50% senior debentures due 2025 and the Group had

outstanding EUR207 million variable funding notes issued under the

new EUR250 million accounts receivable securitisation program

maturing in November 2015.

Smurfit Kappa Acquisitions had outstanding EUR500 million 7.25%

senior secured notes due 2017 and EUR500 million 7.75% senior

secured notes due 2019. Smurfit Kappa Acquisitions and certain

subsidiaries are also party to a senior credit facility. The senior

credit facility comprises a EUR94 million amortising Tranche A

maturing in 2012, a EUR95 million Tranche B maturing in 2013, a

EUR719 million Tranche B4 maturing in 2016, a EUR77 million Tranche

C maturing in 2014 and a EUR727 million Tranche C4 maturing in

2017. In addition, as at 31 March 2012, the facility includes a

EUR525 million revolving credit facility of which there were no

drawings under facilities supported by letters of credit.

The following table provides the range of interest rates as of

31 March 2012 for each of the drawings under the various senior

credit facility term loans.

BORROWING ARRANGEMENT CURRENCY INTEREST RATE

Term Loan A EUR 3.049%

Term Loan B EUR 3.551% - 4.444%

USD 3.708%

Term Loan B4 EUR 4.051% - 4.944%

USD 4.208%

Term Loan C EUR 3.801% - 4.694%

USD 3.958%

Term Loan C4 EUR 4.301% - 5.194%

USD 4.458%

Borrowings under the revolving credit facility are available to

fund the Group's working capital requirements, capital expenditures

and other general corporate purposes.

Market Risk and Risk Management Policies

The Group is exposed to the impact of interest rate changes and

foreign currency fluctuations due to its investing and funding

activities and its operations in different foreign currencies.

Interest rate risk exposure is managed by achieving an appropriate

balance of fixed and variable rate funding. At 31 March 2012 the

Group had fixed an average of 72% of its interest cost on

borrowings over the following twelve months.

Our fixed rate debt comprised mainly EUR500 million 7.25% senior

secured notes due 2017, EUR500 million 7.75% senior secured notes

due 2019, EUR217.5 million 7.75% senior subordinated notes due

2015, US$200 million 7.75% senior subordinated notes due 2015 and

US$292.3 million 7.50% senior debentures due 2025. In addition the

Group also has EUR1,110 million in interest rate swaps with

maturity dates ranging from April 2012 to July 2014.

Our earnings are affected by changes in short-term interest

rates as a result of our floating rate borrowings. If LIBOR

interest rates for these borrowings increase by one percent, our

interest expense would increase, and income before taxes would

decrease, by approximately EUR11 million over the following twelve

months. Interest income on our cash balances would increase by

approximately EUR8 million assuming a one percent increase in

interest rates earned on such balances over the following twelve

months.

The Group uses foreign currency borrowings, currency swaps,

options and forward contracts in the management of its foreign

currency exposures.

Group Income

Statement

- First Quarter

Unaudited Unaudited

3 months to 31-Mar-12 3 months to 31-Mar-11

Pre-exceptional2012 Exceptional2012 Total2012 Pre-exceptional2011 Exceptional2011 Total2011

EURm EURm EURm EURm EURm EURm

Revenue 1,823 - 1,823 1,803 - 1,803

Cost of sales (1,296) - (1,296) (1,296) - (1,296)

Gross profit 527 - 527 507 - 507

Distribution costs (143) - (143) (139) - (139)

Administrative (235) - (235) (220) - (220)

expenses

Other operating - 28 28 - - -

income

Other operating - - - - (1) (1)

expenses

Operating profit 149 28 177 148 (1) 147

Finance costs (106) - (106) (114) - (114)

Finance income 34 - 34 43 - 43

Profit on disposal - - - 2 - 2

ofassociate

Profit before 77 28 105 79 (1) 78

income tax

Income tax expense (42) (49)

Profit for the 63 29

financial

period

Attributable to:

Owners of the Parent 60 34

Non-controlling 3 (5)

interests

Profit for the 63 29

financial

period

Earnings per share

Basic earnings per 27.1 15.6

share - cent

Diluted earnings 26.5 15.3

per share - cent

Group Statement

of

Comprehensive

Income

Unaudited Unaudited

3 months to31-Mar-12 3 months to31-Mar-11

EURm EURm

Profit for the 63 29

financial

period

Other

comprehensive

income:

Foreign 35 (47)

currency

translation

adjustments

Defined benefit

pension plans

including

payroll

tax:

- Actuarial (31) (24)

loss

- Movement in 3 3

deferred tax

Effective portion

of

changes in fair

value of cash

flow hedges:

- Movement out 6 6

of reserve

- New fair (4) 21

value

adjustments

into reserve

- Movement in - (3)

deferred tax

Total 9 (44)

other

comprehensive

income/(expense)

Total 72 (15)

comprehensive

income/(expense)

for

the financial

period

Attributable

to:

Owners of the 64 (2)

Parent

Non-controlling 8 (13)

interests

72 (15)

Group Balance Sheet

Unaudited Unaudited Audited

31-Mar-12 31-Mar-11 31-Dec-11

EURm EURm EURm

ASSETS

Non-current assets

Property, plant 2,976 2,956 2,973

and equipment

Goodwill and 2,231 2,193 2,210

intangible

assets

Available-for-sale 32 32 32

financial assets

Investment in 14 14 14

associates

Biological assets 120 85 114

Trade and other 4 4 5

receivables

Derivative financial 3 - 6

instruments

Deferred income 164 125 177

tax assets

5,544 5,409 5,531

Current assets

Inventories 704 685 690

Biological assets 9 7 10

Trade and other 1,430 1,399 1,326

receivables

Derivative financial 4 5 7

instruments

Restricted cash 9 12 12

Cash and cash 811 541 845

equivalents

2,967 2,649 2,890

Total assets 8,511 8,058 8,421

EQUITY

Capital and reserves

attributable

to the owners of

the Parent

Equity share capital - - -

Capital and other 2,350 2,308 2,336

reserves

Retained earnings (296) (524) (341)

Total equity 2,054 1,784 1,995

attributable

to

the owners of

the Parent

Non-controlling 200 162 191

interests

Total equity 2,254 1,946 2,186

LIABILITIES

Non-current

liabilities

Borrowings 3,410 3,459 3,450

Employee benefits 680 606 655

Derivative financial 55 104 54

instruments

Deferred income tax 209 198 210

liabilities

Non-current income 13 9 10

tax liabilities

Provisions for 60 47 55

liabilities

and charges

Capital grants 13 14 13

Other payables 7 7 10

4,447 4,444 4,457

Current liabilities

Borrowings 185 155 159

Trade and other 1,502 1,427 1,504

payables

Current income tax 47 42 36

liabilities

Derivative financial 60 18 59

instruments

Provisions for 16 26 20

liabilities

and charges

1,810 1,668 1,778

Total liabilities 6,257 6,112 6,235

Total equity and 8,511 8,058 8,421

liabilities

Group Statement of Changes in Equity

Capital and other reserves

Equitysharecapital Sharepremium Ownshares Reverseacquisitionreserve Cash flowhedgingreserve Foreigncurrencytranslationreserve Share-basedpaymentreserve Retainedearnings Totalequityattributableto theowners ofthe Parent Non-controllinginterests Totalequity

Unaudited EURm EURm EURm EURm EURm EURm EURm EURm EURm EURm EURm

At 1 January 2012 - 1,945 - 575 (35) (228) 79 (341) 1,995 191 2,186

Profit for the financial period - - - - - - - 60 60 3 63

Other comprehensive income:

Foreign currency translationadjustments - - - - - 30 - - 30 5 35

Defined benefit pension plansincluding - - - - - - - (28) (28) - (28)

payroll tax

Effective portion of changes in - - - - 2 - - - 2 - 2

fairvalue of cash flow hedges

Total comprehensive income forthe period - - - - 2 30 - 32 64 8 72

Shares issued - 4 - - - - - - 4 - 4

Shares acquired by DeferredShare Awards Trust - - (13) - - - - - (13) - (13)

Hyperinflation adjustment - - - - - - - 13 13 2 15

Dividends paid to non-controllinginterests - - - - - - - - - (1) (1)

Recycling of cumulative foreignexchange - - - - - (17) - - (17) - (17)

reserve on disposal

Share-based payment - - - - - - 8 - 8 - 8

At 31 March 2012 - 1,949 (13) 575 (33) (215) 87 (296) 2,054 200 2,254

Group Statement of Changes

in Equity (continued)

Capital and other reserves

Equitysharecapital Sharepremium Reverseacquisitionreserve Cash flowhedgingreserve Foreigncurrencytranslation reserve Share-basedpaymentreserve Retainedearnings Total equityattributableto theowners ofthe Parent Non-controllinginterests Totalequity

Unaudited EURm EURm EURm EURm EURm EURm EURm EURm EURm EURm

At 1 January 2011 - 1,937 575 (45) (216) 64 (552) 1,763 173 1,936

Profit for the financial period - - - - - - 34 34 (5) 29

Other comprehensive income:

Foreign currency translationadjustments - - - - (39) - - (39) (8) (47)

Defined benefit pension plansincluding - - - - - - (21) (21) - (21)

payroll tax

Effective portion of changes in - - - 24 - - - 24 - 24

fairvalue of cash flow hedges

Total comprehensiveincome/(expense) - - - 24 (39) - 13 (2) (13) (15)

for the period

Shares issued - 7 - - - - - 7 - 7

Hyperinflation adjustment - - - - - - 15 15 2 17

Share-based payment - - - - - 1 - 1 - 1

At 31 March 2011 - 1,944 575 (21) (255) 65 (524) 1,784 162 1,946

Group Cash Flow

Statement

Unaudited Unaudited

3 months to31-Mar-12 3 months to31-Mar-11

EURm EURm

Cash flows from

operating

activities

Profit for the 63 29

financial

period

Adjustment for

Income tax expense 42 49

Profit on sale (28) (2)

of assets

and businesses

Amortisation of (1) -

capital grants

Equity settled 8 1

share-based

payment expense

Amortisation of 5 7

intangible

assets

Profit on disposal - (2)

of associates

Depreciation charge 80 82

Net finance costs 72 71

Change in inventories (8) (55)

Change in biological 4 5

assets

Change in trade and (92) (131)

other receivables

Change in trade and 8 97

other payables

Change in provisions (9) (3)

Change in employee (12) (14)

benefits

Foreign currency - 1

translation

adjustments

Other 1 2

Cash generated from 133 137

operations

Interest paid (47) (46)

Income taxes paid:

Overseas corporation (14) (10)

tax (net

of tax refunds) paid

Net cash inflow from 72 81

operating activities

Cash flows from

investing

activities

Interest received 2 1

Purchase of property, (88) (60)

plant and equipment

and biological assets

Purchase of intangible (2) -

assets

Decrease/(increase) 3 (5)

in restricted cash

Disposal of property, 11 6

plant and equipment

Disposal of associates - 4

Purchase of subsidiaries (11) -

and

non-controlling

interests

Deferred consideration 6 (1)

Net cash outflow from (79) (55)

investing activities

Cash flows from

financing

activities

Proceeds from issue of 4 7

new ordinary shares

Ordinary shares (13) -

purchased

- own shares

(Decrease)/increase in (10) 20

interest-bearing

borrowings

Repayment of finance (2) (2)

lease liabilities

Derivative termination 1 -

receipts

Deferred debt (10) -

issue costs

Dividends paid to (1) -

non-controlling

interests

Net (31) 25

cash (outflow)/inflow

from

financing activities

(Decrease)/increase (38) 51

in cash

and cash equivalents

Reconciliation

of opening

to closing

cash and cash

equivalents

Cash and cash 825 481

equivalents

at 1 January

Currency translation 2 (4)

adjustment

(Decrease)/increase (38) 51

in cash

and cash equivalents

Cash and cash 789 528

equivalents

at 31 March

1.General Information

Smurfit Kappa Group plc ('SKG plc') ('the Company') ('the

Parent') and its subsidiaries (together the 'Group') manufacture,

distribute and sell containerboard, corrugated containers and other

paper-based packaging products such as solidboard and graphicboard.

The Company is a public limited company whose shares are publicly

traded. It is incorporated and tax resident in Ireland. The address

of its registered office is Beech Hill, Clonskeagh, Dublin 4,

Ireland.

2.Basis of Preparation

The annual consolidated financial statements of SKG plc are

prepared in accordance with International Financial Reporting

Standards ('IFRS') issued by the International Accounting Standards

Board ('IASB') and adopted by the European Union ('EU'); and, in

accordance with Irish law.

The financial information presented in this report has been

prepared to comply with the requirement to publish an 'Interim

management statement' for the first quarter, in accordance with the

Transparency Regulations. The Transparency Regulations do not

require Interim management statements to be prepared in accordance

with International Accounting Standard 34 - 'Interim Financial

Information' ('IAS 34'). Accordingly the Group has not prepared

this financial information in accordance with IAS 34.

The financial information has been prepared in accordance with

the Group's accounting policies. Full details of the accounting

policies adopted by the Group are contained in the financial

statements included in the Group's Annual Report for the year ended

31 December 2011 which is available on the Group's website

www.smurfitkappa.com. The accounting policies and methods of

computation and presentation adopted in the preparation of the

Group financial information are consistent with those described and

applied in the Annual Report for the financial year ended 31

December 2011. No new standards, amendments or interpretations

which became effective in 2012 will have an effect on the Group

financial statements.

The condensed interim Group financial information includes all

adjustments that management considers necessary for a fair

presentation of such financial information. All such adjustments

are of a normal recurring nature. Some tables in this interim

statement may not add correctly due to rounding.

The condensed interim Group financial information presented does

not constitute full group accounts within the meaning of Regulation

40(1) of the European Communities (Companies: Group Accounts)

Regulations, 1992 of Ireland insofar as such group accounts would

have to comply with all of the disclosure and other requirements of

those Regulations. Full Group accounts for the year ended 31

December 2011 will be filed with the Irish Registrar of Companies

in due course. The audit report on those Group accounts was

unqualified.

3.Segmental Analyses

With effect from 1 September, 2011 the Group reorganised the way

in which its European businesses are managed. As part of this

reorganisation for commercial reasons, the businesses which

previously formed part of the Specialties segment were

operationally merged with the Europe segment (formally known as

Packaging Europe) and are now managed on a combined basis to make

decisions about the allocation of resources and in assessing

performance. After this date, the Group ceased to produce financial

information for Specialties as the financial information of all of

its plants is now combined with the other Europe segment

plants.

As a result, the Group has now two segments on the basis of

which performance is assessed and resources are allocated: 1)

Europe and 2) Latin America and segmental information is presented

below on this basis. Prior year segmental information has been

restated to conform to the current year segment presentation.

The Europe segment is highly integrated. It includes a system of

mills and plants that produces a full line of containerboard that

is converted into corrugated containers. It also includes the

bag-in-box and solidboard businesses. The Latin America segment

comprises all forestry, paper, corrugated and folding carton

activities in a number of Latin American countries. Inter segment

revenue is not material. No operating segments have been aggregated

for disclosure purposes.

Segment disclosures are based on operating segments identified

under IFRS 8. Segment profit is measured based on earnings before

interest, tax, depreciation, amortisation, exceptional items and

share-based payment expense ('EBITDA before exceptional items').

Segmental assets consist primarily of property, plant and

equipment, biological assets, goodwill and intangible assets,

inventories, trade and other receivables, deferred income tax

assets and cash and cash equivalents.

3 months to 31-Mar-12 3 months to 31-Mar-11

Europe LatinAmerica Total Europe LatinAmerica Total

EURm EURm EURm EURm EURm EURm

Revenue

and

Results

Revenue 1,490 333 1,823 1,507 296 1,803

EBITDA 200 55 255 201 50 251

before

exceptional

items

Segment 28 - 28 (1) - (1)

exceptional

items

EBITDA 228 55 283 200 50 250

after

exceptional

items

Unallocated (9) (8)

centre

costs

Share-based (8) (1)

payment

expense

Depreciation (84) (87)

and

depletion

(net)

Amortisation (5) (7)

Finance (106) (114)

costs

Finance 34 43

income

Profit - 2

on

disposal

of

associate

Profit 105 78

before

income

tax

Income (42) (49)

tax

expense

Profit 63 29

for

the

financial

period

Assets

Segment 6,209 1,554 7,763 6,280 1,264 7,544

assets

Investment 1 13 14 1 13 14

in

associates

Group 734 500

centre

assets

Total 8,511 8,058

assets

4.Exceptional Items

The following items 3 months to31-Mar-12 3 months to31-Mar-11

are regarded

as exceptional

in nature:

EURm EURm

Reorganisation and - (1)

restructuring

costs

Disposal of assets 28 -

and operations

Exceptional items 28 (1)

included

in operating profit

Exceptional gains of EUR28 million were included in the first

quarter's 2012 operating profit.

This included EUR10 million primarily relating to the sale of

land at SKG's former Valladolid mill in Spain (operation closed in

2008), together with EUR18 million relating to the disposal of a

company in Slovakia. The gain primarily relates to the

reclassification (under IFRS) of the cumulative translation

differences within equity from reserves to retained earnings

through the Income Statement.

In the first quarter of 2011, exceptional charges of EUR1

million related to the on-going rationalisation of the European

corrugated operations.

5.Finance Costs

and Income

3 months to31-Mar-12 3 months to31-Mar-11

EURm EURm

Finance costs:

Interest 33 33

payable

on bank

loans

and overdrafts

Interest payable - 1

on

finance leases

and hire

purchase

contracts

Interest payable 33 33

on

other

borrowings

Foreign 2 3

currency

translation

loss on debt

Fair value loss 10 18

on derivatives

not designated

as hedges

Interest cost 25 25

on employee

benefit plan

liabilities

Net monetary 3 1

loss

-

hyperinflation

Total finance 106 114

costs

Finance income:

Other interest (2) (1)

receivable

Foreign (11) (19)

currency

translation

gain on debt

Fair value gain (2) (4)

on derivatives

not designated

as hedges

Expected return (19) (19)

on employee

benefit plan

assets

Total finance (34) (43)

income

Net finance 72 71

costs

6. Income Tax

Expense

Income tax

expense

recognised in

the Group

Income

Statement

3 months to31-Mar-12 3 months to31-Mar-11

EURm EURm

Current

taxation:

Europe 17 15

Latin America 11 32

28 47

Deferred 14 2

taxation

Income tax 42 49

expense

Current tax is

analysed

as follows:

Ireland 1 1

Foreign 27 46

28 47

Income tax

recognised

in the Group

Statement

of

Comprehensive

Income

3 months to31-Mar-12 3 months to31-Mar-11

EURm EURm

Arising on (3) (3)

actuarial

gains/losses

on defined

benefit plans

including

payroll tax

Arising on - 3

qualifying

derivative

cash flow

hedges

(3) -

7. Employee

Post

Retirement

Schemes

- Defined

Benefit

Expense

The table below

sets out

the components

of the

defined benefit

expense

for

the quarter:

3 months to31-Mar-12 3 months to31-Mar-11

EURm EURm

Current service 7 7

cost

Expected return (19) (19)

on plan assets

Interest 25 25

cost on

plan

liabilities

Net financial 6 6

expense

Defined benefit 13 13

expense

Included in cost of sales, distribution costs and administrative

expenses is a defined benefit expense of EUR7 million for the

quarter (2011: EUR7 million). Expected return on plan assets of

EUR19 million (2011: EUR19 million) is included in finance income

and interest cost on plan liabilities of EUR25 million (2011: EUR25

million) is included in finance costs in the Group Income

Statement.

The amounts recognised in the Group Balance Sheet were as

follows:

31-Mar-12 31-Dec-11

EURm EURm

Present value of funded or partially (1,751) (1,715)

funded obligations

Fair value of plan assets 1,518 1,486

Deficit in funded or partially (233) (229)

funded plans

Present value of wholly (447) (426)

unfunded obligations

Net employee benefit liabilities (680) (655)

The employee benefits provision has increased from EUR655

million at 31 December 2011 to EUR680 million at March 2012. The

main reason for this is the increase in liabilities due to the

lower Eurozone AA Corporate bond yields was not fully offset by

plan assets return.

8.Earnings Per Share

Basic

Basic earnings per share is calculated by dividing the profit

attributable to the owners of the Parent by the weighted average

number of ordinary shares in issue during the period.

3 months to31-Mar-12 3 months to31-Mar-11

Profit attributable 60 34

to the owners

of the Parent

(EUR million)

Weighted average 222 221

number

of ordinary

shares in issue

(million)

Basic earnings per 27.1 15.6

share - cent

Diluted

Diluted earnings per share is calculated by adjusting the

weighted average number of ordinary shares outstanding to assume

conversion of all dilutive potential ordinary shares which comprise

convertible shares issued under the management equity plans and

matching shares issued under the Deferred Annual Bonus Plan.

3 months to31-Mar-12 3 months to31-Mar-11

Profit attributable 60 34

to the owners

of the Parent

(EUR million)

Weighted average 222 221

number

of ordinary

shares in issue

(million)

Potential dilutive 5 5

ordinary

shares assumed

(million)

Diluted weighted 227 226

average ordinary

shares (million)

Diluted earnings 26.5 15.3

per share - cent

9.Property, Plant and Equipment

Land andbuildings Plant andequipment Total

EURm EURm EURm

Three months

ended

31 March 2012

Opening net 1,115 1,858 2,973

book

amount

Reclassification 2 (3) (1)

Additions 10 47 57

Acquisitions 1 1 2

Depreciation (12) (68) (80)

charge

for the

period

Hyperinflation 3 3 6

adjustment

Foreign 7 12 19

currency

translation

adjustment

At 31 March 1,126 1,850 2,976

2012

Year ended 31

December

2011

Opening net 1,128 1,880 3,008

book

amount

Reclassification 19 (25) (6)

Additions 4 282 286

Acquisitions 2 7 9

Depreciation (50) (296) (346)

charge

for the year

Impairments (5) (10) (15)

Retirements (2) (1) (3)

and

disposals

Hyperinflation 21 23 44

adjustment

Foreign (2) (2) (4)

currency

translation

adjustment

At 1,115 1,858 2,973

31 December

2011

10.Analysis of Net Debt

31-Mar-12 31-Dec-11

EURm EURm

Senior credit facility

Revolving credit facility(1) - interest (9) (6)

at relevant interbank

rate + 2.5% on RCF1,+2.75% on

RCF2 and +3.25% on RCF3(8)

Tranche A term loan(2a)- interest at 94 94

relevant interbank rate + 2.5%(8)

Tranche B term loan(2b)- interest at 95 822

relevant interbank rate + 3.125%(8)

Tranche B4 term loan(2c)- interest at 719 -

relevant interbank rate + 3.625%(8)

Tranche C term loan(2d)- interest at 77 819

relevant interbank rate + 3.375%(8)

Tranche C4 term loan(2e)- interest at 727 -

relevant interbank rate + 3.875%(8)

US Yankee bonds (including accrued interest)(3) 223 226

Bank loans and overdrafts 78 71

Cash (820) (857)

2015 receivables securitisation 204 206

variable funding notes(4)

2015 cash pay subordinated notes 364 376

(including accrued interest)(5)

2017 senior secured notes (including 500 490

accrued interest)(6)

2019 senior secured notes (including 502 492

accrued interest)(7)

Net debt before finance leases 2,754 2,733

Finance leases 12 13

Net debt including leases 2,766 2,746

Balance of revolving credit facility 9 6

reclassified to debtors

Net debt after reclassification 2,775 2,752

(1) Revolving credit facility ('RCF') of EUR525 million split into RCF1, RCF2 and RCF3 of EUR60 million, EUR62 million and EUR403 million(available under the senior credit facility) to be repaid in full in 2012, 2013 and 2016 respectively. (Revolver loans - nil, drawnunder ancillary facilities and facilities supported by letters of credit - nil)

(2a) Tranche A term loan due to be repaid in certain instalments in 2012

(2b) Tranche B term loan due to be repaid in full in 2013

(2c) Tranche B4 term loan due to be repaid in full in 2016

(2d) Tranche C term loan due to be repaid in full in 2014

(2e) Tranche C4 term loan due to be repaid in full in 2017

(3) US$292.3 million 7.50% senior debentures due 2025

(4) Receivables securitisation variable funding notes due 2015

(5) EUR217.5 million 7.75% senior subordinated notes due 2015 and US$200 million 7.75% senior subordinated notes due 2015

(6) EUR500 million 7.25% senior secured notes due 2017

(7) EUR500 million 7.75% senior secured notes due 2019

(8) The margins applicable to the senior credit facility are determined as follows:

Net debt/EBITDA ratio Tranche Aand RCF1 Tranche B Tranche C RCF2 RCF3 Tranche B4 Tranche C4

Greater than 4.0 : 1 3.250% 3.375% 3.625% 3.500% 4.000% 3.875% 4.125%

4.0 : 1 or less but morethan 3.5 : 1 3.000% 3.125% 3.375% 3.250% 3.750% 3.625% 3.875%

3.5 : 1 or less but morethan 3.0 : 1 2.750% 3.125% 3.375% 3.000% 3.500% 3.625% 3.875%

3.0 : 1 or less but morethan 2.5 : 1 2.500% 3.125% 3.375% 2.750% 3.250% 3.625% 3.875%

2.5 : 1 or less 2.500% 3.125% 3.375% 2.750% 3.125% 3.500% 3.750%

11.Venezuela

Hyperinflation

As discussed more fully in the 2011 annual report, Venezuela

became hyperinflationary during 2009 when its cumulative inflation

rate for the past three years exceeded 100%. As a result, the Group

applied the hyperinflationary accounting requirements of IAS 29 to

its Venezuelan operations at 31 December 2009 and for all

subsequent accounting periods.

The index used to reflect current values is derived from a

combination of Banco Central de Venezuela's National Consumer Price

Index from its initial publication in December 2007 and the

Consumer Price Index for the metropolitan area of Caracas for

earlier periods. The level of and movement in the price index at

March 2012 and 2011 are as follows:

31-Mar-12 31-Mar-11

Index at period end 275.0 220.7

Movement in period 3.5% 6.0%

As a result of the entries recorded in respect of

hyperinflationary accounting under IFRS, the Group Income Statement

is impacted as follows: Revenue EUR1 million decrease (2011: EUR2

million decrease), pre-exceptional EBITDA EUR2 million decrease

(2011: EUR2 million decrease) and profit after taxation EUR10

million decrease (2011: EUR8 million decrease). In 2012, a net

monetary loss of EUR3 million (2011: EUR1 million loss) was

recorded in the Group Income Statement. The impact on our net

assets and our total equity is an increase of EUR5 million (2011:

EUR9 million increase).

Supplemental Financial Information

EBITDA before exceptional items and share-based payment expense

is denoted by EBITDA in the following schedules for ease of

reference.

Reconciliation of

Profit to EBITDA

3 months to31-Mar-12 3 months to31-Mar-11

EURm EURm

Profit for the 63 29

financial

period

Income tax 42 49

expense

Reorganisation - 1

and

restructuring

costs

Disposal of (28) -

assets

and operations

Profit on - (2)

disposal

of associate

Net finance costs 72 71

Share-based 8 1

payment

expense

Depreciation, 89 94

depletion

(net)

and amortisation

EBITDA 246 243

Supplemental

Historical

Financial

Information

EURm Q1, 2011 Q2, 2011 Q3, 2011 Q4, 2011 FY, 2011 Q1, 2012

Group 2,956 3,124 3,109 2,919 12,108 2,950

and

third

party

revenue

Third 1,803 1,867 1,868 1,819 7,357 1,823

party

revenue

EBITDA 243 264 264 245 1,015 246

EBITDA 13.5% 14.2% 14.1% 13.4% 13.8% 13.5%

margin

Operating 147 132 162 149 590 177

profit

Profit 78 58 85 77 299 105

before

tax

Free 12 66 117 199 394 (16)

cash

flow

Basic 15.6 15.7 22.2 39.4 93.0 27.1

earnings

per

share -

cent

Weighted 221 222 222 222 222 222

average

number

of

sharesused

in

EPS

calculation

(million)

Net 3,061 3,003 2,921 2,752 2,752 2,775

debt

Net 3.18 2.98 2.84 2.71 2.70 2.73

debt

to

EBITDA

(LTM)

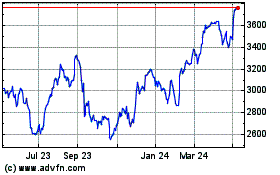

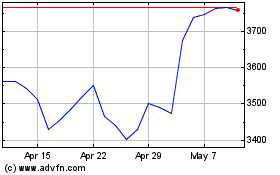

Smurfit Kappa (LSE:SKG)

Historical Stock Chart

From Jul 2024 to Aug 2024

Smurfit Kappa (LSE:SKG)

Historical Stock Chart

From Aug 2023 to Aug 2024